Free Lady Bird Deed Form for Michigan

In Michigan, the transfer of property upon one's passing often involves significant legal and financial considerations. A tool that has proven both effective and efficient in this regard is the Lady Bird Deed, a unique estate planning document that allows property owners to retain control over their real estate during their lifetime while ensuring a seamless transition to their designated beneficiaries upon their death. This form of deed stands out for several reasons. Firstly, it bypasses the often lengthy and costly probate process, providing a smooth and direct transfer of property. Secondly, it offers the property owner, referred to as the grantor, the flexibility to alter their decisions at any point, granting them unparalleled control and security over their asset. Moreover, the Michigan Lady Bird Deed is recognized for its ability to potentially provide certain tax advantages and protect the property from being claimed to satisfy the grantor's medical bills under specific conditions. Understanding the nuances and legal frameworks that underpin this valuable estate planning tool is key for Michigan residents looking to safeguard their assets and secure their legacies for their loved ones.

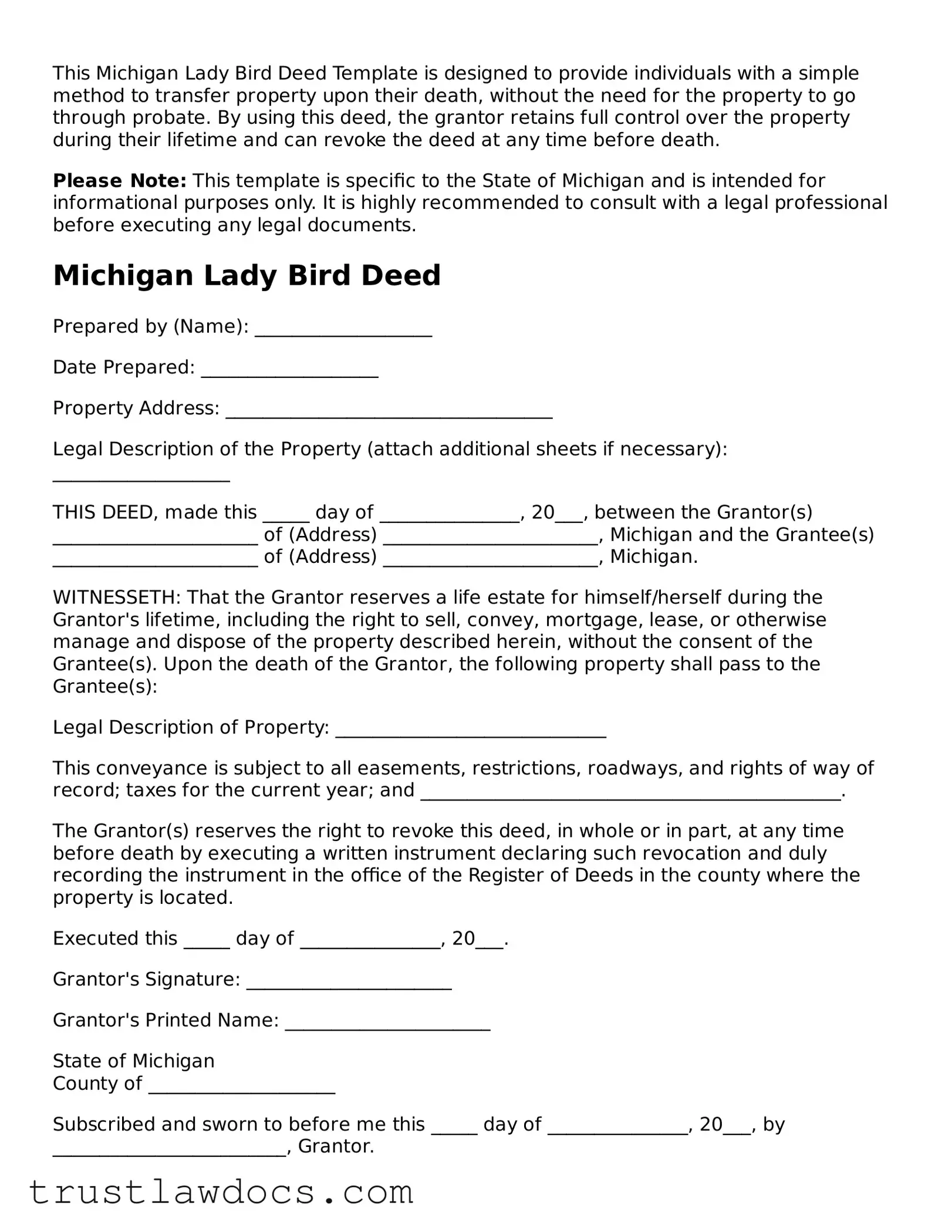

Form Example

This Michigan Lady Bird Deed Template is designed to provide individuals with a simple method to transfer property upon their death, without the need for the property to go through probate. By using this deed, the grantor retains full control over the property during their lifetime and can revoke the deed at any time before death.

Please Note: This template is specific to the State of Michigan and is intended for informational purposes only. It is highly recommended to consult with a legal professional before executing any legal documents.

Michigan Lady Bird Deed

Prepared by (Name): ___________________

Date Prepared: ___________________

Property Address: ___________________________________

Legal Description of the Property (attach additional sheets if necessary): ___________________

THIS DEED, made this _____ day of _______________, 20___, between the Grantor(s) ______________________ of (Address) _______________________, Michigan and the Grantee(s) ______________________ of (Address) _______________________, Michigan.

WITNESSETH: That the Grantor reserves a life estate for himself/herself during the Grantor's lifetime, including the right to sell, convey, mortgage, lease, or otherwise manage and dispose of the property described herein, without the consent of the Grantee(s). Upon the death of the Grantor, the following property shall pass to the Grantee(s):

Legal Description of Property: _____________________________

This conveyance is subject to all easements, restrictions, roadways, and rights of way of record; taxes for the current year; and _____________________________________________.

The Grantor(s) reserves the right to revoke this deed, in whole or in part, at any time before death by executing a written instrument declaring such revocation and duly recording the instrument in the office of the Register of Deeds in the county where the property is located.

Executed this _____ day of _______________, 20___.

Grantor's Signature: ______________________

Grantor's Printed Name: ______________________

State of Michigan

County of ____________________

Subscribed and sworn to before me this _____ day of _______________, 20___, by _________________________, Grantor.

__________________________________

Notary Public, State of Michigan

My Commission Expires: _______________

Instructions for the Recorder: Please record this document in the public records of the Register of Deeds office in the county where the property is located. The recording fee is attached.

PDF Form Details

| Fact Name | Description |

|---|---|

| Avoids Probate | A Michigan Lady Bird Deed allows property to transfer directly to the designated beneficiaries upon the death of the property owner, bypassing the probate process. |

| Retains Control | The property owner retains control over the property during their lifetime, including the ability to sell or mortgage the property. |

| Revocable | This type of deed is revocable, meaning the property owner can change their mind and revoke the deed at any time before their death. |

| Governing Law | The Michigan Compiled Laws (MCL) govern the use and execution of a Lady Bird Deed in Michigan. |

| Not Universally Available | Not all states recognize Lady Bird Deeds, but they are a valid legal document in Michigan for estate planning purposes. |

How to Write Michigan Lady Bird Deed

When preparing to transfer property upon one's death while retaining the right to use the property during one's lifetime, a Michigan Lady Bird Deed can be a useful legal tool. This document allows for a smoother transition without the complexities of probate. The process of filling out the Michigan Lady Bird Deed form requires careful attention to detail to ensure that the deed is executed correctly and effectively. Follow the steps below to fill out the form accurately.

- Begin by entering the date at the top of the document. This should be the current date on which you are preparing the Lady Bird Deed.

- Next, identify the grantor(s) of the property. These are the current owner(s) who are transferring the property upon their death. Include full legal names and addresses.

- Specify the grantee(s) in the designated section. The grantee(s) are the individual(s) who will receive the property upon the grantor's death. Again, full legal names and addresses are required.

- Describe the property in question with as much detail as possible. Include the legal description of the property, which can be found on the property deed or at the local county recorder's office. This description often includes lot numbers, subdivision name, and measurement details.

- Declare the reservation of life estate. This section is crucial as it outlines the grantor's right to use and profit from the property during their lifetime without the grantee's interference. It's the defining characteristic of the Lady Bird Deed.

- Include any conditions or limitations on the grantee’s future interest in the property, if applicable. These conditions must be clearly stated to avoid any future disputes or confusion.

- The grantor(s) must sign the deed in the presence of a notary public. Ensure that all individuals who are listed as grantors on the deed are present to sign it.

- Have the document notarized. The notary public will verify the identities of the signatories, witness the signing, and then seal the document, making it legally binding.

- Finally, file the completed and notarized Lady Bird Deed with the local county register of deeds. There may be a filing fee, which varies by county.

By carefully following these steps, the Michigan Lady Bird Deed form will be correctly filled out and can then serve its purpose of facilitating a smooth property transfer that bypasses the probate process. It's essential to ensure all information is accurate and complete to avoid any potential legal challenges or misconceptions in the future.

Get Answers on Michigan Lady Bird Deed

What is a Michigan Lady Bird Deed?

A Michigan Lady Bird Deed, also known as an enhanced life estate deed, is a tool for estate planning. It allows a property owner to retain control over their property during their lifetime, including the ability to use and sell the property, and upon their death, the property automatically transfers to a designated beneficiary without the need for probate.

How does a Lady Bird Deed differ from a traditional life estate deed?

The key difference between a Lady Bird Deed and a traditional life estate deed lies in the retained powers of the original property owner. With a Lady Bird Deed, the owner keeps the right to sell, mortgage, or otherwise dispose of the property without needing consent from the remainder beneficiaries. In traditional life estate deeds, these actions would require the agreement of the future beneficiaries.

Who can use a Lady Bird Deed in Michigan?

Any property owner in Michigan can use a Lady Bird Deed as part of their estate planning. It is particularly beneficial for individuals who wish to avoid probate while retaining full control over their property during their lifetime.

What are the benefits of using a Lady Bird Deed?

Benefits include avoiding probate, which can be time-consuming and costly; maintaining the ability to use and modify the property during the owner's life; potentially reducing estate recovery claims by Medicaid; and simplifying the transfer of property to a beneficiary upon the owner's death.

Are there any drawbacks to using a Lady Bird Deed?

While beneficial, there are some considerations. Since this deed is a relatively new and sometimes complex instrument, not all professionals may be familiar with it. Additionally, it may have tax implications for the beneficiary, and it's important to consider how it fits into the overall estate plan.

How is a Lady Bird Deed created?

Creating a Lady Bird Deed involves preparing a deed that meets Michigan's legal requirements, including a clear statement that the owner retains a life estate with the power to convey the property, and naming one or more remainder beneficiaries. It must be signed, witnessed, and notarized, then recorded with the county register of deeds.

Can a Lady Bird Deed be changed or revoked?

Yes, as long as the original property owner is alive and competent, they can change or revoke a Lady Bird Deed. This flexibility is one of the deed's main advantages. A new deed would need to be executed and recorded to make any changes.

How does a Lady Bird Deed impact Medicaid planning?

In Michigan, the use of a Lady Bird Deed is considered a favorable estate planning tool for Medicaid planning. It can help the property owner qualify for Medicaid by not counting the home as part of their assets, and it can potentially protect the home from estate recovery, where the state seeks reimbursement for Medicaid benefits paid on the owner’s behalf after their death.

Do I need a lawyer to create a Lady Bird Deed?

While it's possible to create a Lady Bird Deed on your own, consulting with an experienced estate planning attorney is highly recommended. A lawyer can provide valuable advice, ensure the deed complies with Michigan law, and consider how it fits with your broader estate planning goals.

Common mistakes

One of the most common mistakes people make when filling out the Michigan Lady Bird Deed form is failing to accurately describe the property. Precision in detailing the property's legal description, which includes boundary lines, lot numbers, and other identifiers as recorded in county records, is crucial. Failure to do so can result in disputes or confusion over the property being transferred.

Another frequent oversight is neglecting to check the form for compliance with current Michigan laws. Since laws and regulations regarding property transfer can evolve, using an outdated deed form or not adhering to the latest legal requirements can invalidate the document, preventing the intended transfer of property upon the grantor's death.

Incorrectly identifying the grantor and grantee is also a common error. The grantor is the current property owner, while the grantee is the person designated to receive the property. Mixing up these roles, or inaccurately naming the parties, can lead to legal entanglements that complicate the property's future ownership.

Often, individuals fail to secure the necessary witnesses or notarization for their Lady Bird Deed. Michigan law mandates that such deeds must be signed in the presence of a notary public and, in some cases, require witness signatures. This formal witnessing and notarization process ensures the document's legal validity but is frequently overlooked.

Many incorrectly believe that once a Lady Bird Deed is filled out, no further action is required. However, the deed must be filed with the appropriate county register of deeds office. Failure to record the deed leaves the property transfer incomplete, an error that can lead to significant confusion and legal difficulties after the grantor's death.

Another mistake involves the misunderstanding of how a Lady Bird Deed interacts with existing debts and obligations on the property. Some assume that the deed negates the need to address these issues, but in reality, any outstanding debts or liens on the property can still affect the grantee after the transfer is complete.

Confusion over revocation is another pitfall. A Lady Bird Deed provides the grantor with the right to revoke the deed at any time, but not understanding the proper process for revocation can lead to issues if the grantor’s intentions change. A clear grasp of how to effectively revoke the deed ensures that the grantor's current wishes are always reflected.

Finally, a stark underestimation of the need for professional guidance is a prevalent issue. Many individuals attempt to complete a Lady Bird Deed without consulting a legal professional, leading to mistakes in the form’s preparation and execution. Such oversights can undermine the deed's intent and effectiveness, demonstrating the value of professional advice in ensuring the deed reflects the grantor's wishes and complies with Michigan law.

Documents used along the form

When dealing with the transfer of real estate upon death in Michigan, a Lady Bird Deed (also known as an enhanced life estate deed) is a valuable tool that ensures property is passed to beneficiaries without the need for probate. However, it's rarely the only document required to fully address the legal and financial aspects of estate planning and property transfer. To effectively complement a Lady Bird Deed, several other forms and documents are often used to ensure a comprehensive and secure estate plan is in place.

- Last Will and Testament: This document outlines an individual’s wishes regarding the distribution of their estate after death. Although a Lady Bird Deed specifies beneficiaries for real estate, a will covers the remainder of personal and real property not included in the deed.

- Durable Power of Attorney for Finances: This grants another person the authority to handle financial matters on behalf of an individual, should they become incapacitated. It’s crucial for managing assets not covered under a Lady Bird Deed.

- Medical Power of Attorney: Also known as a healthcare proxy, this designates someone to make medical decisions on one's behalf if they’re unable to do so. While it doesn’t relate directly to property transfer, it’s a key component of a well-rounded estate plan.

- Revocable Living Trust: This allows individuals to manage their assets during their lifetime and specify how they should be distributed upon death. A trust can provide more control over asset distribution than a deed and can include property not addressed by the Lady Bird Deed.

- Beneficiary Designation Forms: Often used with retirement accounts and life insurance policies, these forms name beneficiaries for assets that aren’t typically covered in a will or trust, matching the comprehensive approach of an estate plan that includes a Lady Bird Deed.

Collectively, these documents can build a robust estate plan that addresses a wide range of personal and financial circumstances. When properly executed, they work in harmony with a Lady Bird Deed to ensure an efficient transfer of assets, minimize taxes, and avoid the complications of probate, offering peace of mind to both the property owner and their beneficiaries.

Similar forms

A Michigan Lady Bird Deed, known for enabling property owners to transfer real estate upon their death without going through probate, shares characteristics with several other legal documents. One of these is a Living Trust. Much like a Lady Bird Deed, a Living Trust allows individuals to manage their assets during their lifetime and specify how these assets are distributed upon their death. Both methods bypass the probate process, facilitating a smoother transition of assets to beneficiaries.

Another document similar to the Michigan Lady Bird Deed is the General Warranty Deed. This document guarantees that the property seller holds clear title to the property and has the right to sell it, offering protection to the buyer against future claims to the property. While it serves a different phase of property transfer than a Lady Bird Deed, it similarly involves detailed statements about property rights and ownership.

The Quitclaim Deed also shares similarities with the Michigan Lady Bird Deed. A Quitclaim Deed is used to transfer any interest in real property the grantor might have to the grantee, without any warranty that the title is clear. It’s often used among family members or to clear a title. Like the Lady Bird Deed, it simplifies the transfer process, albeit in a different context and with less protection for the buyer.

Transfer on Death Deed (TODD) is closely related to the Lady Bird Deed, as it allows property owners to name beneficiaries for their property, so the asset passes directly to them upon the owner's death, avoiding probate. Both documents provide a non-probate method for transferring real estate, although the TODD is irrevocable without the beneficiary's consent.

A Power of Attorney document, while primarily focused on granting someone the authority to make decisions on another's behalf, touches on a key feature of the Lady Bird Deed: control during the grantor's lifetime. However, instead of handling decisions after the grantor's death, it applies while the grantor is alive, especially in cases of incapacity.

The Life Estate Deed is another document with a notable similarity to the Lady Bird Deed. It allows a property owner to transfer their property to beneficiaries immediately upon death, while retaining the right to use and benefit from the property during their lifetime. However, unlike the Lady Bird Deed, the original owner (life tenant) cannot sell or mortgage the property without the beneficiaries' consent.

Similar to a Lady Bird Deed, a Joint Tenancy Agreement facilitates the transfer of property upon death. In joint tenancy, property is owned by two or more people in equal shares. Upon the death of one owner, their share automatically passes to the surviving owner(s), avoiding probate. This resembles the Lady Bird Deed's ability to pass property directly to a designated person without needing probate, albeit through a co-ownership structure.

Lastly, the Beneficiary Deed, similar to the Transfer on Death Deed, allows property owners to designate a beneficiary who will inherit the property upon the owner’s death. Like the Lady Bird Deed, it is a tool to bypass the time-consuming and often costly probate process, though specific characteristics and availability may vary by jurisdiction.

Dos and Don'ts

When filling out the Michigan Lady Bird Deed form, individuals must approach the task with attention to detail and a deep understanding of the implications of the document. To ensure clarity and compliance, here are essential do's and don'ts to consider:

- Do thoroughly review the form and instructions before starting. Understanding each section ensures that all the necessary information is provided accurately.

- Do consult with a legal professional if any part of the form or process is unclear. Lady Bird Deeds can have significant legal and tax implications, and professional guidance is invaluable.

- Do carefully identify and describe the property in question, using the exact legal description found in your property's current deed or tax documents. Precision is key to ensure the deed's validity.

- Do clearly name the grantor(s) and grantee(s), ensuring names are spelled correctly and match those on official IDs and documents. This clarity prevents potential disputes or confusion later on.

- Do sign and date the deed in the presence of a notary public. Notarization is a critical step for the document to be legally binding and recognized.

- Don't leave any sections blank. Every question and field should be filled out to avoid uncertainties or legal challenges regarding the deed's intentions.

- Don't hesitate to amend or re-draft the deed if significant mistakes are made or if life circumstances change before the deed is filed. Ensuring the document reflects the current wishes and facts is crucial.

- Don't forget to file the completed and notarized deed with the appropriate county register of deeds. Until it's filed, the deed has no legal effect on the property’s title.

Filling out the Michigan Lady Bird Deed form with accuracy and deliberation ensures that property is transferred smoothly and according to the grantor's wishes, avoiding unnecessary complications and ensuring peace of mind for all involved parties.

Misconceptions

When discussing estate planning in Michigan, Lady Bird Deeds are a topic that frequently comes up. Despite their popularity, there are several misconceptions surrounding their use and benefits. Here, we aim to clarify some of the most common misunderstandings.

- Any property can be transferred with a Lady Bird Deed. This is not entirely accurate. A Lady Bird Deed is specifically designed for real estate. Its applicability to other types of property, like cars or bank accounts, is not supported by its legal structure.

- It offers the same benefits as a trust. Although a Lady Bird Deed can help avoid probate similar to a trust, it doesn't provide the same level of control over the asset or the comprehensive estate planning benefits that trusts do.

- It's recognized in all states. The use of a Lady Bird Deed is not universally accepted across the United States. Its recognition and legality are specifically pertinent to Michigan and a few other states.

- Taxes can be completely avoided with a Lady Bird Deed. While it may help in avoiding certain probate costs, a Lady Bird Deed does not exempt the property from estate taxes or remove the obligation for property taxes to be paid.

- Creating a Lady Bird Deed is complicated and expensive. Compared to other estate planning tools, creating a Lady Bird Deed can be relatively simple and cost-effective, especially with professional assistance.

- Once signed, it cannot be revoked. A key feature of the Lady Bird Deed is that it allows the grantor to retain control over the property during their lifetime, including the ability to revoke the deed.

- A Lady Bird Deed automatically transfers liability along with property. The deed transfers property upon death, but not necessarily the liability associated with it during the grantor's lifetime, such as mortgages or other secured debts.

- It eliminates the need for a will. While a Lady Bird Deed can be part of a well-structured estate plan, it should not be considered a substitute for a will. A comprehensive estate plan often includes both tools for different assets and goals.

- The beneficiary has immediate rights to the property. The beneficiary's interest in the property is contingent and doesn’t come into play until the death of the grantor, meaning the grantor maintains full control and use of the property during their lifetime.

Understanding these misconceptions about Lady Bird Deeds in Michigan is crucial for those looking to effectively manage their estate. Knowing the specific capabilities and limitations of this estate planning tool can help individuals make informed decisions that best suit their needs and goals.

Key takeaways

When it comes to managing your estate in Michigan, a Lady Bird Deed can be a valuable tool. Here are ten key takeaways to remember when filling out and utilizing this form:

- A Lady Bird Deed allows property owners in Michigan to transfer property to beneficiaries upon their death without the need for probate court proceedings.

- This form of deed gives the owner retained control over the property during their life, including the right to use, sell, or mortgage the property.

- The property automatically passes to the designated beneficiaries, often referred to as "remaindermen," upon the death of the property owner, without going through probate.

- To be valid, the Lady Bird Deed must be properly completed, signed in the presence of a notary public, and recorded with the county recorder's office where the property is located.

- It is crucial to clearly identify all the parties involved, including the current property owner(s) and the beneficiary(ies).

- One substantial benefit of a Lady Bird Deed is its ability to help avoid the lengthy and costly probate process.

- Additionally, this deed type may offer potential tax advantages for the beneficiaries, including keeping the property's original basis for capital gains purposes.

- Important to note, the Lady Bird Deed can be revoked or changed at any time during the lifetime of the property owner, provided they are mentally competent.

- This deed does not protect the property from Medicaid estate recovery if the owner received Medicaid benefits for long-term care, under current Michigan law.

- Consulting with an estate planning attorney to ensure the Lady Bird Deed aligns with your overall estate planning goals is highly recommended, as individual circumstances can greatly impact its effectiveness.

In essence, a Lady Bird Deed is a powerful estate planning tool that, if utilized correctly, can simplify the process of transferring your property after your death, while retaining control during your lifetime. Attention to detail and legal guidance are key to making the most of its benefits.

Popular Lady Bird Deed State Forms

Texas Transfer on Death Deed Form - Ensures that a property owner's intentions are honored without the need for court intervention.

Lady Bird Deed Texas Pros and Cons - When properly executed, a Lady Bird Deed constitutes a legally binding document that overrides conflicting terms in wills or trust documents.