Free Lady Bird Deed Form for Florida

The Florida Lady Bird Deed form is an effective tool for estate planning, allowing property owners to retain control over their real estate during their lifetime while ensuring a smooth transfer to designated beneficiaries upon their death. This unique form of deed bypasses the need for probate, a process that can be both time-consuming and costly. Named after Lady Bird Johnson, though not formally tied to her, this deed has gained popularity for its simplicity and efficiency in passing assets directly to heirs. While it allows the property owner full use and control—including the ability to sell or modify the property—the deed automatically transfers ownership to the named beneficiaries without the need for legal intervention after the owner's death. The form is specific to Florida and reflects the state's particular legal requirements and protections for both property owners and their heirs. Understanding the nuances and legalities of the Lady Bird Deed can empower property owners to effectively manage their estate planning, providing peace of mind and financial benefits to their loved ones.

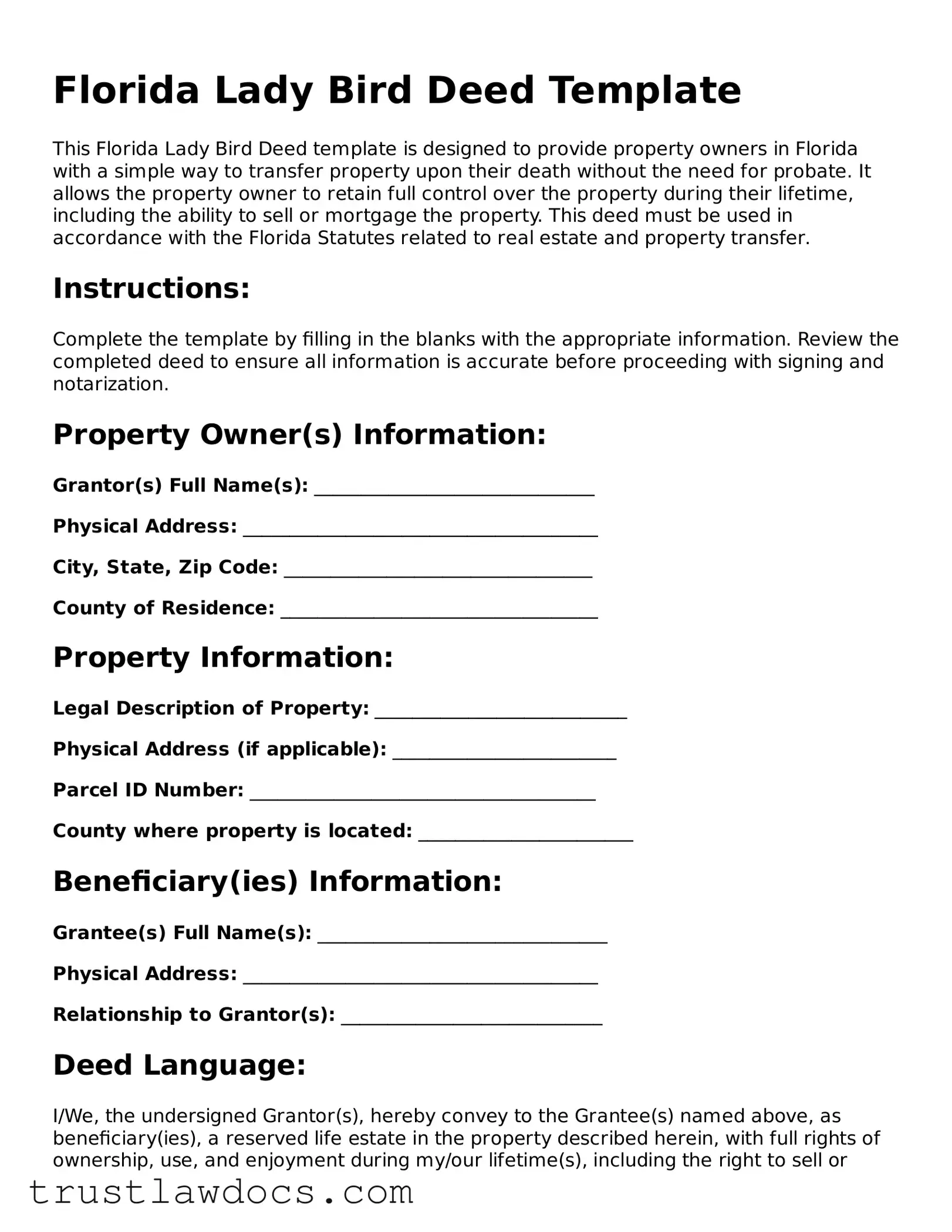

Form Example

Florida Lady Bird Deed Template

This Florida Lady Bird Deed template is designed to provide property owners in Florida with a simple way to transfer property upon their death without the need for probate. It allows the property owner to retain full control over the property during their lifetime, including the ability to sell or mortgage the property. This deed must be used in accordance with the Florida Statutes related to real estate and property transfer.

Instructions:

Complete the template by filling in the blanks with the appropriate information. Review the completed deed to ensure all information is accurate before proceeding with signing and notarization.

Property Owner(s) Information:

Grantor(s) Full Name(s): ______________________________

Physical Address: ______________________________________

City, State, Zip Code: _________________________________

County of Residence: __________________________________

Property Information:

Legal Description of Property: ___________________________

Physical Address (if applicable): ________________________

Parcel ID Number: _____________________________________

County where property is located: _______________________

Beneficiary(ies) Information:

Grantee(s) Full Name(s): _______________________________

Physical Address: ______________________________________

Relationship to Grantor(s): ____________________________

Deed Language:

I/We, the undersigned Grantor(s), hereby convey to the Grantee(s) named above, as beneficiary(ies), a reserved life estate in the property described herein, with full rights of ownership, use, and enjoyment during my/our lifetime(s), including the right to sell or mortgage said property without the consent of the Grantee(s). Upon the death of the Grantor(s), the property shall pass to the Grantee(s) as described above, free and clear of any probate process, subject to any encumbrances existing at the time of my/our death.

Execution:

Date: _________________________

Grantor(s) Signature(s): __________________________________

Printed Name(s): _________________________________________

State of Florida, County of _____________________: This document was acknowledged before me on (date) ______________ by (name of Grantor(s)) ________________________, who is personally known to me or who has produced _________________________ as identification and who did not take an oath.

Signature of Notary Public: _______________________________

Printed Name of Notary: ___________________________________

Commission Number: ______________________________________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Florida Lady Bird Deed allows property owners to transfer real estate upon their death without it going through probate. |

| 2 | This deed gives the property owner the right to use and control the property during their lifetime. |

| 3 | It enables the property owner to retain the right to sell or mortgage the property without the beneficiary’s consent. |

| 4 | Upon the property owner's death, the property automatically transfers to the named beneficiary(ies). |

| 5 | No Florida statute explicitly recognizes Lady Bird Deeds, but they are commonly used and accepted due to case law and legal practice within the state. |

| 6 | This type of deed can help avoid the costs and time involved with probate proceedings. |

| 7 | The Lady Bird Deed does not provide the same level of creditor protection as a trust might. |

| 8 | It is essential for the deed to be properly executed, signed, witnessed, and notarized to be valid. |

| 9 | Beneficiaries named in a Lady Bird Deed do not have a present interest in the property until the death of the property owner. |

How to Write Florida Lady Bird Deed

Completing the Florida Lady Bird Deed form requires a focused approach to ensure accuracy, as this document significantly impacts property transfer. The process involves specifying the current property owner, identifying the beneficiary, outlining property details, and securely signing the document. Following these steps methodically is crucial to creating a valid deed that precisely communicates the grantor's intentions.

- Identify the Grantor(s): Begin by listing the full legal name(s) of the current property owner(s) acting as the grantor(s) in the designated section of the form.

- Designate the Beneficiary(ies): Clearly specify the name(s) of the beneficiary(ies) who will receive the property upon the grantor's passing. Ensure exact legal names are used.

- Provide Property Details: Accurately describe the property being transferred. This description should include the physical address, legal description, and any other identifiers necessary to clearly distinguish the property.

- Reserve Life Estate: Clearly state that the grantor(s) retains a life estate in the property. This implies that the grantor(s) will maintain control over the property during their lifetime(s).

- Include Transfer on Death Clause: Explicitly mention that the property will automatically transfer to the named beneficiary(ies) upon the death of the last surviving grantor without needing to go through probate.

- Sign and Notarize: The grantor(s) must sign the deed in the presence of two witnesses and a notary public. The witnesses should also sign, indicating they observed the grantor's signature.

- Record the Deed: After all signatures are gathered, submit the deed to the appropriate county records office for official recording. This may involve a recording fee, and the process will vary by county.

Accurately completing each step and adhering to the requirements ensures the deed's validity. This attention to detail will serve to protect the grantor's interests and ensure a smooth property transfer process to the intended beneficiaries.

Get Answers on Florida Lady Bird Deed

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a legal document used in the state of Florida. It allows property owners to retain control over their property during their lifetime, including the right to sell or mortgage the property, and upon their death, the property automatically transfers to a designated beneficiary, bypassing the probate process.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike a traditional life estate deed, where the life tenant (property owner) needs the consent of the remainderman (beneficiary) to sell or encumber the property, a Lady Bird Deed grants the life tenant more control. The life tenant can sell, mortgage, or otherwise dispose of the property without the beneficiary's permission. This flexibility makes it a preferred estate planning tool.

What are the benefits of using a Lady Bird Deed in Florida?

The Lady Bird Deed offers several benefits: it helps avoid probate, which can save time and money; it preserves the property owner's eligibility for Medicaid as the property is not considered a countable asset; and it offers flexibility to change beneficiaries or sell the property without needing consent from the beneficiaries.

Are there any disadvantages to using a Lady Bird Deed?

While beneficial, there are some drawbacks. Since it's not recognized in all states, it can cause confusion if property laws change or if properties in other states are involved. Additionally, there may be tax implications to consider, especially concerning capital gains for beneficiaries, which should be discussed with a tax professional.

Who should consider using a Lady Bird Deed?

Individuals who own real estate in Florida and wish to avoid probate, while maintaining complete control over their property during their lifetime, may find a Lady Bird Deed especially useful. It is also beneficial for those looking to protect assets while planning for Medicaid eligibility for long-term care.

How can one create a Lady Bird Deed in Florida?

Creating a Lady Bird Deed requires precise legal language and must comply with Florida law. It must be drafted, signed, witnessed by two individuals, and notarized before being recorded with the local county recorder’s office where the property is located. Consulting with an estate planning attorney or a legal expert in Florida real estate law is strongly advised to ensure the document is correctly executed.

Can a Lady Bird Deed be revoked or changed?

Yes, one of the advantages of a Lady Bird Deed is its flexibility. The property owner, while alive, has the right to revoke or amend the deed. This can be done by preparing a new deed that revokes the previous one or changes the terms, following the same execution and recording requirements as the original deed.

Common mistakes

Filling out a Florida Lady Bird Deed can be confusing, and mistakes are easy to make if you're not careful. One common mistake is failing to correctly identify the property. This deed requires a precise legal description, not just an address. It's necessary to copy the description directly from your current deed to avoid any discrepancies that might invalidate the deed.

Another frequent error is not specifying the beneficiary correctly. People often list a beneficiary's name without considering potential changes in circumstances. It's crucial to think about alternates in case the primary beneficiary predeceases the grantor. This foresight can prevent the property from undergoing probate, which is what this deed aims to avoid in the first place.

People also tend to overlook the necessity of stating the retention of life estate explicitly. For a Lady Bird Deed to be effective, the document must clearly state that the grantor retains control over the property during their lifetime, including the right to sell or change the deed without the beneficiary's consent. Without this clear declaration, the deed's validity could be challenged.

Incorrectly signing or notarizing the document is another common pitfall. The grantor must sign the deed in the presence of two witnesses and a notary. Sometimes, individuals either forget one of these requirements or incorrectly execute them, which can lead to the deed being considered invalid.

Some people mistakenly believe that a Lady Bird Deed can protect the property from creditors. However, this deed does not shield the property from valid claims against the grantor's estate. If there are outstanding debts at the time of the grantor's death, creditors may have claims against the property, a crucial consideration when planning your estate.

Another error is not understanding the impact of the deed on tax implications, especially regarding future property tax exemptions. Transferring property can affect homestead exemptions, which in turn can significantly alter the amount of property taxes due.

Not consulting with a legal professional is a significant mistake. The complexities of real estate and estate planning law make it essential to seek advice from someone knowledgeable about the subject. This advice can be invaluable in avoiding errors and ensuring the deed accomplishes what it's intended to do.

Filing the deed with incorrect or incomplete information is yet another error. It's critical to ensure that all information is accurate and complete before filing the deed with the local county office. Any mistakes can cause delays or even nullify the deed's effectiveness.

Lastly, misunderstanding the difference between a Lady Bird Deed and other types of deeds can lead to incorrect assumptions about how property will be transferred upon the grantor's death. It's crucial to understand that this specific deed allows property to bypass probate while still giving the grantor control over the property during their lifetime, distinguishing it from other transfer mechanisms.

Documents used along the form

In estate planning and real estate transactions within Florida, a variety of documents can complement the Lady Bird Deed, a specialized form of property deed that allows property to be automatically transferred upon the death of the owner without the need for probate. This deed is particularly popular due to its efficiency in transferring ownership while retaining the owner's rights to use and profit from the property during their lifetime. Alongside the Lady Bird Deed, several other forms and documents are often utilized to ensure a comprehensive and secure approach to estate planning and property management. These documents can vary in purpose, from designating power of attorney to detailing specific wishes regarding one’s estate after death.

- Warranty Deed – A legal document used to transfer property ownership with a guarantee from the seller that they hold clear title to the property and have the right to sell it.

- Quitclaim Deed – This form is used to transfer any ownership interest in property the grantor may have, without making any guarantees regarding the grantor's interest level or promising that the title is clear.

- Durable Power of Attorney – A form that designates someone as legally permitted to make financial and legal decisions on behalf of the person who fills it out, remaining effective even if that person becomes incapacitated.

- Health Care Surrogate Designation – A document that appoints a representative to make healthcare decisions for someone if they become unable to make those decisions themselves.

Similar forms

The Florida Lady Bird Deed shares similarities with a traditional life estate deed. In both documents, the original owner of a property retains control over the asset during their lifetime. They can use and benefit from the property until their passing. The fundamental difference lies in the enhanced power the Lady Bird Deed grants to the original owner, allowing them to sell, mortgage, or otherwise dispose of the property without the consent of the future beneficiaries. This provides a unique mix of retaining control while also planning for the seamless transition of property upon the owner's death.

Similar to a Transfer on Death (TOD) deed, the Lady Bird Deed facilitates the automatic transfer of property ownership upon the death of the original owner, bypassing the probate process. Both documents enable a smooth transition of assets to a named beneficiary or beneficiaries without the need for court intervention. However, the Lady Bird Deed is specific to certain states, including Florida, whereas TOD deeds have broader applicability in other jurisdictions. This specificity to state laws highlights the importance of understanding local legal frameworks when planning estate matters.

Revocable living trusts share a common goal with Lady Bird Deeds: avoiding probate. Both allow for the direct transfer of assets to beneficiaries upon death. The owner of a revocable living trust maintains the ability to change or dissolve the trust during their lifetime, similar to how a property owner can alter their intentions with a Lady Bird Deed. However, setting up and maintaining a trust can be more complex and costly than executing a Lady Bird Deed, making the latter a more straightforward option for individuals looking to streamline the transfer of their real property.

The joint tenancy with right of survivorship deed is another instrument that, like the Lady Bird Deed, allows property to bypass probate and pass directly to a surviving owner. In both arrangements, upon the death of one owner, the property seamlessly transfers to the surviving owner(s) without the need for court involvement. The Lady Bird Deed differs significantly in that it offers the original owner the unique benefit of complete control over the property during their lifetime, including the right to change beneficiaries, which is not typically possible in a joint tenancy arrangement.

Dos and Don'ts

Filling out the Florida Lady Bird Deed form requires a careful approach to ensure that the property transfer aligns with the grantor's intentions while complying with legal standards. Here are essential dos and don'ts to consider during the process:

Do:

- Verify that the Lady Bird Deed is appropriate for your situation by consulting with a real estate or estate planning attorney. This step ensures the deed aligns with your estate planning goals.

- Clearly identify the property by including its legal description, which is more detailed than just the address and can be found on the current deed or property tax documents.

- List the grantor(s) and grantee(s) with their full legal names to avoid any confusion about the parties involved.

- Ensure the deed is properly recorded with the county recorder’s office where the property is located to make the transfer effective.

Don't:

- Assume the form applies to your situation without professional advice. Laws vary by state, and the Lady Bird Deed is not recognized in all jurisdictions.

- Omit any required signatures, including notarization, as this can invalidate the deed.

- Forget to specify the remainder beneficiaries clearly to prevent any misunderstanding about who inherits the property upon the grantor’s death.

- Overlook the importance of filing the deed with the appropriate local office. Failing to record the deed correctly can result in it not being legally binding.

Misconceptions

The Florida Lady Bird Deed, also known as an enhanced life estate deed, is a popular estate planning tool. However, there are several misconceptions about how it works and its benefits. By clarifying these misconceptions, property owners can make more informed decisions about managing their estate.

- Misconception 1: A Lady Bird Deed avoids probate only for real estate. While it's true that a Lady Bird Deed is primarily used to transfer real estate without probate, it effectively allows the property to bypass the probate process completely, making it equally beneficial for all types of real property.

- Misconception 2: It offers no control over the property during the grantor's lifetime. In fact, a Lady Bird Deed provides the grantor complete control over the property, including the right to sell or mortgage the property without consent from the beneficiaries.

- Misconception 3: The deed significantly complicates taxes for the grantor. The reality is that a Lady Bird Deed does not complicate the grantor’s current tax situation. In most cases, property taxes and income taxes remain unaffected during the grantor's lifetime.

- Misconception 4: It protects the property from Medicaid estate recovery. While a Lady Bird Deed can help the property bypass probate, it does not necessarily protect it from Medicaid's estate recovery in all scenarios. Medicaid may still have a claim on the estate under certain conditions.

- Misconception 5: Beneficiaries cannot be changed once the deed is signed. Unlike an irrevocable trust, the grantor can change beneficiaries on a Lady Bird Deed at any time during their lifetime, offering flexibility in estate planning.

- Misconception 6: It is recognized and works the same in all states. The Lady Bird Deed is not recognized in every state. Its validity and operation are specifically pertinent to states that acknowledge it, like Florida.

- Misconception 7: It guarantees the avoidance of all liens against the property. While the deed can help avoid probate, it does not ensure avoidance of all liens against the property, such as federal tax liens that might still attach to the property.

- Misconception 8: A Lady Bird Deed eliminates the need for a will. While it can be a significant part of estate planning, it does not replace the need for a comprehensive will, especially to address assets other than real estate.

- Misconception 9: The deed can only be used for a primary residence. In reality, a Lady Bird Deed can be used for any real property, not just the grantor’s primary residence. This includes vacation homes, rental properties, and land.

- Misconception 10: It drastically reduces the beneficiary's basis in the property. Actually, the beneficiary typically receives a step-up in basis to the fair market value of the property at the grantor’s death, potentially reducing capital gains taxes if the property is sold.

Understanding these aspects of the Florida Lady Bird Deed can help property owners navigate their estate planning more effectively, ensuring their assets are managed according to their wishes while also taking advantage of specific benefits provided by this form of deed.

Key takeaways

A Lady Bird Deed (also known as an enhanced life estate deed) is a useful document in Florida for managing real estate assets effectively. When you're considering using one, here are six key takeaways to guide you:

- Avoid Probate: One of the primary benefits of a Lady Bird Deed is that it allows the property to pass directly to the beneficiaries upon the death of the owner, avoiding the time-consuming and expensive probate process.

- Retain Control: The original owner maintains control over the property and can decide to sell, use, or even mortgage the property without needing permission from the beneficiaries.

- Tax Advantages: Utilizing a Lady Bird Deed can offer tax benefits, such as avoiding the capital gains tax that beneficiaries might face compared to inheriting property through a will.

- Simple and Flexible: Compared to other estate planning tools, a Lady Bird Deed is straightforward to set up. It also provides flexibility, as the owner can change beneficiaries without seeking their consent.

- Medicaid Considerations: Importantly, a Lady Bird Deed can be structured in a way that the property does not count as an asset for Medicaid eligibility purposes, yet allows the property to pass outside of Medicaid estate recovery.

- Seek Professional Help: While the concept might seem straightforward, the specifics of drafting and filing a Lady Bird Deed can be complex. It's wise to consult with an estate planning attorney to ensure the deed is valid and serves its intended purpose effectively.

Popular Lady Bird Deed State Forms

Texas Transfer on Death Deed Form - It can be a wise choice for older property owners wanting to simplify the passing on of their estate.

Free Lady Bird Deed Form - This type of deed helps in avoiding legal complexities and expenses associated with probate proceedings.