Free Deed Form for Indiana

In Indiana, transferring property ownership is a process that requires attention to detail and adherence to state laws, making the Indiana Deed form an essential document in these transactions. This legal document not only signifies the transfer of ownership from one party to another but also needs to meet specific state requirements to be considered valid. It encompasses various types of deeds, each catered to different situations and levels of warranty or protection for the buyer. From warranty deeds offering the highest level of buyer protection by guaranteeing clear title, to quitclaim deeds transferring ownership with no guarantees about the title, understanding the nuances of each is critical. Additionally, the form must be properly executed, including necessary signatures and, in most cases, notarization, before being filed with the appropriate county recorder's office to complete the transaction. Navigating through the complexities of property transactions, the Indiana Deed form serves as a pivotal component in ensuring a smooth transfer and providing peace of mind to both parties involved.

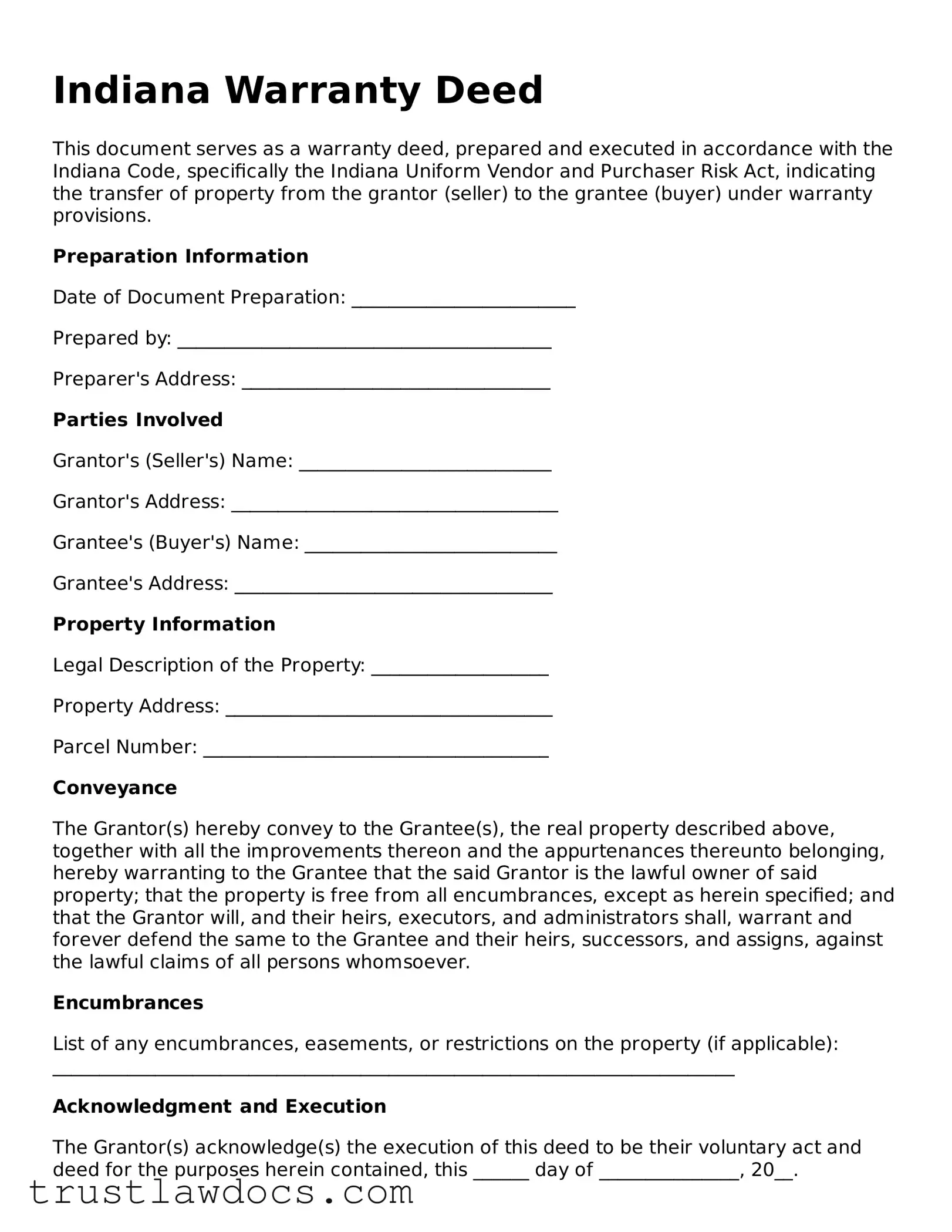

Form Example

Indiana Warranty Deed

This document serves as a warranty deed, prepared and executed in accordance with the Indiana Code, specifically the Indiana Uniform Vendor and Purchaser Risk Act, indicating the transfer of property from the grantor (seller) to the grantee (buyer) under warranty provisions.

Preparation Information

Date of Document Preparation: ________________________

Prepared by: ________________________________________

Preparer's Address: _________________________________

Parties Involved

Grantor's (Seller's) Name: ___________________________

Grantor's Address: ___________________________________

Grantee's (Buyer's) Name: ___________________________

Grantee's Address: __________________________________

Property Information

Legal Description of the Property: ___________________

Property Address: ___________________________________

Parcel Number: _____________________________________

Conveyance

The Grantor(s) hereby convey to the Grantee(s), the real property described above, together with all the improvements thereon and the appurtenances thereunto belonging, hereby warranting to the Grantee that the said Grantor is the lawful owner of said property; that the property is free from all encumbrances, except as herein specified; and that the Grantor will, and their heirs, executors, and administrators shall, warrant and forever defend the same to the Grantee and their heirs, successors, and assigns, against the lawful claims of all persons whomsoever.

Encumbrances

List of any encumbrances, easements, or restrictions on the property (if applicable): _________________________________________________________________________

Acknowledgment and Execution

The Grantor(s) acknowledge(s) the execution of this deed to be their voluntary act and deed for the purposes herein contained, this ______ day of _______________, 20__.

Grantor's Signature: ________________________________

Grantee's Signature: ________________________________

State of Indiana )

County of ___________ ) SS:

Subscribed and acknowledged before me this ______ day of _______________, 20__, by ____________________________________________________.

Notary Public: _____________________________________

(SEAL)

My commission expires: _____________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Form Type | Indiana Deed Forms are legal documents used to transfer property ownership in the state of Indiana. |

| Governing Law | These forms are governed by Indiana property and real estate law, specifically Indiana Code Title 32. |

| Required Signatures | The deed must be signed by the grantor (seller) in the presence of a notary public to be legally valid. |

| Recording | Once signed and notarized, the deed should be recorded with the county recorder's office in the county where the property is located. |

| Types of Deeds | Common types include Warranty Deeds, which guarantee clear title to the buyer, and Quit Claim Deeds, which transfer ownership without any guarantees. |

How to Write Indiana Deed

When transferring property ownership in Indiana, completing the deed form correctly is crucial. This document serves as a legal confirmation of the transfer, detailing the seller's and buyer's information and the property specifics. Filling out the deed form might seem daunting, but breaking it down into simple steps can make the process more approachable. Correct and thorough completion ensures the smooth progression of the property transfer, preventing any potential legal complications down the line. Below is a step-by-step guide designed to help you fill out the Indiana Deed form accurately.

- Begin by identifying the precise type of deed required for your property transfer. Indiana law recognizes several types, including warranty, quitclaim, and survivorship deeds, each serving different purposes.

- Next, gather all necessary information about the property, including its legal description, parcel number, and current owner details. This information can typically be found in previous deed documents or by contacting your local county recorder's office.

- Enter the full names and addresses of both the grantor (the current owner or seller) and the grantee (the new owner or buyer). Ensure the spelling is accurate to prevent any issues.

- Fill in the legal description of the property as it appears in the current deed or property records. This description includes boundary details, lot numbers, and any other identifiers that outline the property’s specifics.

- Indicate the transfer date and the monetary consideration involved in the transaction, if applicable. This refers to the amount paid by the grantee to the grantor.

- Both the grantor and grantee must sign the deed form in the presence of a notary public. The notary's role is to authenticate the document, verifying the identity of the signatories and their understanding of the deed’s contents.

- After signing, submit the deed form to the local county recorder's office for official filing. This office will record the deed, making the property transfer part of the public record.

- Finally, pay any necessary filing fees associated with the recording of the deed. Fees can vary depending on the county, so it's advisable to contact the recorder's office ahead of time to confirm the amount.

Completing the Indiana Deed form is a significant step in the process of property transfer. By following these instructions carefully, you can ensure the document accurately reflects the details of the transaction. Remember, a properly filled-out deed form not only facilitates a smooth transfer but also serves as a vital record of ownership history. Should you have any doubts or require assistance, consulting with a legal professional familiar with Indiana property laws is recommended.

Get Answers on Indiana Deed

What is an Indiana Deed form?

An Indiana Deed form is a legal document used to transfer ownership of real estate from one person (the grantor) to another (the grantee) in the state of Indiana. It must be completed accurately and comply with Indiana state laws to be valid.

Are there different types of Indiana Deed forms?

Yes, in Indiana, there are several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. Each type offers different levels of protection and guarantees regarding the title of the property.

What is required for an Indiana Deed form to be valid?

For an Indiana Deed to be considered valid, it must include the legal description of the property, be signed by the grantor, and be notarized. Additionally, it should be recorded with the county recorder's office in the county where the property is located.

Who can prepare an Indiana Deed form?

While anyone can technically prepare an Indiana Deed form, it is highly recommended that a legal professional such as an attorney experienced in real estate law is consulted. This ensures that the deed meets all legal requirements and accurately reflects the transaction.

How does one record an Indiana Deed?

To record an Indiana Deed, one must submit the completed, signed, and notarized deed to the county recorder's office in the county where the property is located. A recording fee must also be paid. The process ensures the deed becomes part of the public record.

What is the importance of recording a deed in Indiana?

Recording a deed in Indiana is crucial as it protects the grantee's ownership rights to the property, provides public notice of the ownership change, and is often required by law. Failure to record a deed can result in disputes over the property's ownership.

Does an Indiana Deed need to be witnessed?

While Indiana law requires a deed to be notarized, which involves a notary public witnessing the signing of the document, it does not specifically require additional witnesses for the deed to be valid.

Can an Indiana Deed be revoked?

Once an Indiana Deed has been executed, delivered, and recorded, it cannot be revoked unless a subsequent deed is executed or if there was an issue with the initial deed's validity. It's essential to be certain of the transaction before executing the deed.

Common mistakes

When individuals embark on the process of transferring property ownership in Indiana, accurately completing the deed form is paramount. A common mistake is the failure to provide complete and accurate legal descriptions of the property. Legal descriptions are not simply the address; they meticulously outline the property's boundaries and are crucial for identifying the exact piece of land being transferred. An inaccurate or incomplete legal description can lead to disputes over property boundaries or can even void the transfer altogether.

Another error often encountered is neglecting to verify the correct deed type. Indiana recognizes several types of deeds, each with its specific purpose and implications for the grantor (the person transferring the property) and the grantee (the recipient). For example, warranty deeds offer the grantee the highest level of protection, asserting that the grantor has clear title to the property, while quitclaim deeds transfer only the grantor's interest in the property, with no guarantees about title quality. Choosing the wrong type of deed can significantly impact the rights transferred.

People frequently overlook the necessity of having all necessary parties sign the deed. In cases where the property is owned jointly, or there are multiple grantees, each party's signature is required to validate the transfer. Failing to obtain all signatures can render the deed ineffective, leaving the property's ownership status in limbo.

The importance of acknowledging the deed before a notary public is often underestimated. This formal process confirms the identity of the signatories and the voluntary nature of their actions. An unacknowledged deed may not satisfy legal requirements for recording, thereby jeopardizing its legitimacy and the clear transfer of ownership.

Incorrectly or incompletely filling out the transferor and transferee sections is a frequent oversight. This includes not only the names of the parties involved but also their complete and accurate contact information. Ambiguities or errors in identifying the parties can lead to challenges in enforcing the deed and, ultimately, in establishing clear ownership.

Last but not least, failing to properly record the deed with the appropriate Indiana county recorder's office is a critical misstep. Recording the deed provides public notice of the change in property ownership and protects the grantee's interests against claims from third parties. An unrecorded deed can result in complications that may jeopardize the grantee's rightful ownership and possession of the property.

Documents used along the form

When transferring property in Indiana, the Deed form is crucial. However, it often requires additional forms and documents to ensure a legal and smooth transition. These supplementary documents cater to different aspects of the property transfer process, addressing details from tax implications to confirming the property's legal description.

- Real Estate Sales Disclosure Form: This document is essential for most property sales in Indiana. Sellers use it to disclose the property's condition, including any known defects that could affect the property's value. This form helps buyers make informed decisions.

- Title Search Report: A title search report details the property's ownership history, verifying that the seller has the legal right to sell the property. This report also reveals any liens, easements, or other encumbrances on the property.

- Mortgage Pre-approval Letter (if applicable): Buyers often need to provide a mortgage pre-approval letter when making an offer on a property. This document shows sellers that the buyer has the financial backing to make the purchase.

- Property Tax Statements: Recent property tax statements are usually required to verify that all taxes on the property have been paid up to the date of the sale. It ensures that no outstanding taxes will surprise the buyer after the sale.

- Closing Statement: At the property sale's closure, a closing statement itemizes all costs related to the transaction. Both buyer and seller receive this document to understand the financial details of the sale fully.

Together with the Indiana Deed form, these documents create a comprehensive package that facilitates a transparent, legal, and effective transfer of property. While the Deed form is the cornerstone of property transfers, these additional documents ensure everything is in order, from finances to legalities, making the process secure for all parties involved.

Similar forms

The Indiana Deed form shares similarities with a Warranty Deed, which essentially guarantees the buyer that the property title is clear of any claims or liens. The primary similarity lies in the warranty of title, ensuring that the seller holds a clear title to the property, which is then transferred to the buyer. Both documents serve to legally transfer ownership and protect the buyer from future claims against the property.

Similar to a Quitclaim Deed, the Indiana Deed form also deals with the transfer of property interest. However, unlike a Warranty Deed, a Quitclaim Deed does not guarantee that the property title is clear of claims. The Quitclaim Deed is typically used when transferring property between family members or to clear title issues, focusing on the conveyance of rights without any guarantees.

A Trust Deed is another document that shares similarities with the Indiana Deed form in its function of conveying property. However, a Trust Deed involves a trustee, usually a title company, holding the title for the property until the borrower repays the loan in full. It is used in certain states as part of the financing process, involving three parties instead of the two parties common in a simple deed transaction.

The Grant Deed, another similar document, conveys interest in real property and guarantees that the property has not been sold to someone else and is free from undisclosed encumbrances. Like the Indiana Deed, it transfers ownership from the grantor to the grantee but includes some guarantees about the history of the property, albeit not as comprehensive as a Warranty Deed.

A Land Contract is related but differs as it is a form of seller financing for the purchase of real estate. The buyer makes payments to the seller for a period, with ownership of the property transferred only after the final payment. While the Indiana Deed form transfers ownership upon execution, a land contract is a promise of future transfer, contingent upon the buyer fulfilling payment obligations.

The Executor's Deed pertains specifically to the sale of property from an estate. It allows an executor of an estate to transfer property to a buyer, pursuant to the wishes of the decedent as outlined in their will. Although it facilitates a transfer of property ownership like the Indiana Deed, it is specifically used within the context of settling an estate under probate law.

Lastly, a Sheriff's Deed resembles the Indiana Deed form in its function to convey property. This kind of deed comes into play during a sheriff's sale, where property is sold to satisfy a judgment. Like the Indiana Deed, a Sheriff's Deed transfers ownership; however, it originates from a legal action and typically involves foreclosed properties, making its context and implications different.

Dos and Don'ts

When filling out an Indiana Deed form, it is crucial to follow specific guidelines to ensure the document is legally valid and accurately records a property transfer. Here are nine essential do's and don'ts to consider:

- Do thoroughly review the entire form before starting to fill it out to ensure you understand all requirements.

- Do use black ink or type the information to ensure legibility for official records.

- Do verify all property details, such as the legal description, parcel number, and address, for accuracy against official property records.

- Do ensure that all parties who have a legal interest in the property sign the deed in the presence of a notary public.

- Do obtain a witness’s signature if required by state law, as this can vary.

- Don't leave any required fields blank. If a section does not apply, mark it as "N/A" (not applicable) to show that it was not overlooked.

- Don't use correction fluid or tape. If a mistake is made, it is best to start over on a new form to prevent any questions about the document's integrity.

- Don't forget to file the deed with the local county recorder's office after it is signed and notarized. This step is crucial for the transfer to be officially recorded and recognized.

- Don't hesitate to consult a legal professional if there are any doubts or questions about completing the form or the transfer process. It is better to seek advice than to make a mistake that could impact the validity of the deed.

Misconceptions

When it comes to transferring property ownership in Indiana, deeds are the go-to documents. However, there's a fair share of misconceptions about how the Indiana Deed form works and what it entails. Let’s clear up some of these misunderstandings to ensure property transactions are carried out smoothly and correctly.

All Indiana Deed forms are the same: There are actually several types of deeds used in Indiana, each serving different purposes and offering different levels of warranty. For instance, warranty deeds provide the buyer with the highest level of protection, whereas quitclaim deeds transfer property with no guarantees about the title’s clearness.

A deed and a title are the same thing: This is a common misunderstanding. The 'title' refers to the legal right to own and use the property, while a 'deed' is a physical document that transfers the title of property from one person to another.

Filing a deed with the county automatically updates the public record: While filing the deed with the county is a critical step, it primarily serves as a way to give public notice of the transfer. Property owners often must take additional steps to ensure the public records accurately reflect the new ownership, such as updating the county’s assessor office records.

You can complete and file an Indiana Deed form without a notary’s signature: Indiana law requires that the grantor’s (seller’s) signature on a deed be notarized for the document to be legally valid and recordable.

Once a deed is recorded, it cannot be changed: If there are errors in a recorded deed or if the parties agree to modify the terms, a new deed must be prepared, signed, and recorded to replace the original.

A deed guarantees that the property is free from all liens and encumbrances: Not all deeds provide such guarantees. Only warranty deeds typically include a promise that the property is free from liens and encumbrances; other types of deeds, such as quitclaim deeds, do not.

You need a lawyer to create a valid Indiana Deed: While having a lawyer can ensure that the deed is correctly prepared and conforms to Indiana law, it’s possible to create a valid deed without one. However, seeking legal advice can help avoid costly mistakes.

Electronic deeds are not legal in Indiana: Indiana law permits electronic recording of deeds if they meet specific state and local requirements. This process involves digital signatures and electronic filing with the county recorder's office.

All you need to transfer property is a signed deed: Simply signing a deed does not complete the transfer process. The deed must be delivered to and accepted by the grantee (buyer), and in most cases, recorded with the relevant county recorder's office to be effective.

Indiana Deed forms must be filed in person: Many counties in Indiana now offer electronic recording options, allowing for deeds to be filed online. However, requirements vary by county, with some still requiring in-person or mail submissions.

Having a clear understanding of these common misconceptions can help make the process of transferring property in Indiana less daunting. Ensuring all legal requirements are met is crucial for a smooth and lawful property transaction.

Key takeaways

When it comes to transferring property, a deed is a crucial document, especially in Indiana. It's not just about filling out the form; it's about understanding its implications, legal requirements, and how it reflects on your ownership rights. Here are nine key takeaways for anyone dealing with an Indiana Deed form:

- Know the Type of Deed: Indiana has several types of deeds, including warranty, quitclaim, and survivorship deeds. Each serves a different purpose and offers varying levels of protection for the buyer and obligations for the seller.

- Complete Information is Critical: Every field on the Indiana Deed form must be accurately filled out. This includes full legal names of all parties, the precise address and description of the property, and any other details requested on the form to prevent legal discrepancies.

- Legal Description of Property: Not just any description will do; the legal description of the property, including boundary lines, must be included. This might require consulting a surveyor or property records to ensure accuracy.

- Signatures Must Be Notarized: For the deed to be legally binding, the seller's (and sometimes the buyer's) signature must be notarized. This involves signing the document in front of a notary public who verifies the identity of the signers.

- Consideration Must Be Stated: The deed must reflect the consideration, or value, exchanged for the property. This can be a dollar amount or other expressions of value, but it must be clearly stated.

- Transfer Taxes May Apply: Depending on the specifics of the property transfer, certain taxes may need to be paid. Understanding which taxes apply to your situation is important to ensure compliance with state laws.

- Recording is Essential: After the deed is completed and notarized, it must be recorded with the county recorder's office where the property is located. This public recording formalizes the change in ownership.

- Understand the Implications of the Deed: Whether you’re a buyer or a seller, knowing how the type of deed being used affects your rights and obligations is essential. For example, a warranty deed provides the buyer with more protection than a quitclaim deed.

- Seek Professional Guidance: Given the legal and financial implications of transferring property, consulting with a real estate attorney when filling out or executing an Indiana Deed form is advisable. They can ensure that all legal requirements are met and that your interests are protected.

Handling property transactions requires attention to detail and a deep understanding of the legal framework governing these transfers. By keeping these key takeaways in mind, individuals can navigate the process with greater confidence and ensure a smooth transfer of ownership.

Popular Deed State Forms

Free Texas Deed Transfer Form - A warranty deed guarantees that the property is free from any claims or liens, providing protection to the buyer.

How to Get a Copy of My House Deed - For historical properties, special considerations in the deed form may be required to preserve the property’s historical status and value.

Broward County Property Search by Owner Name - This document outlines the details of a property transfer, including the identities of the old and new owners.

Property Deed Transfer Form - The transfer tax, which may be applicable depending on the location, is typically documented within or alongside the deed form.