Free Gift Deed Form for Texas

In the state of Texas, individuals looking to transfer property to a recipient without any exchange of money or valuable consideration can use a legal document known as a Gift Deed form. This tool not only ensures the smooth transition of property ownership but also helps in maintaining clear records for future reference. Unlike conventional sale transactions, a Gift Deed is executed with the intention of gifting the property, thereby exempting the transaction from typical financial scrutiny. The document requires information about the donor (the person giving the gift), the donee (the recipient of the gift), and a detailed description of the property being transferred. To maintain its validity and legal standing, the Gift Deed must be duly signed, witnessed, and notarized, following specific state guidelines. This process solidifies the transfer legally, enabling the donee to assume ownership with full rights. Proper execution of the Gift Deed can also have implications for estate planning and tax considerations, rendering it an essential instrument for benefactors with the foresight to manage their assets wisely.

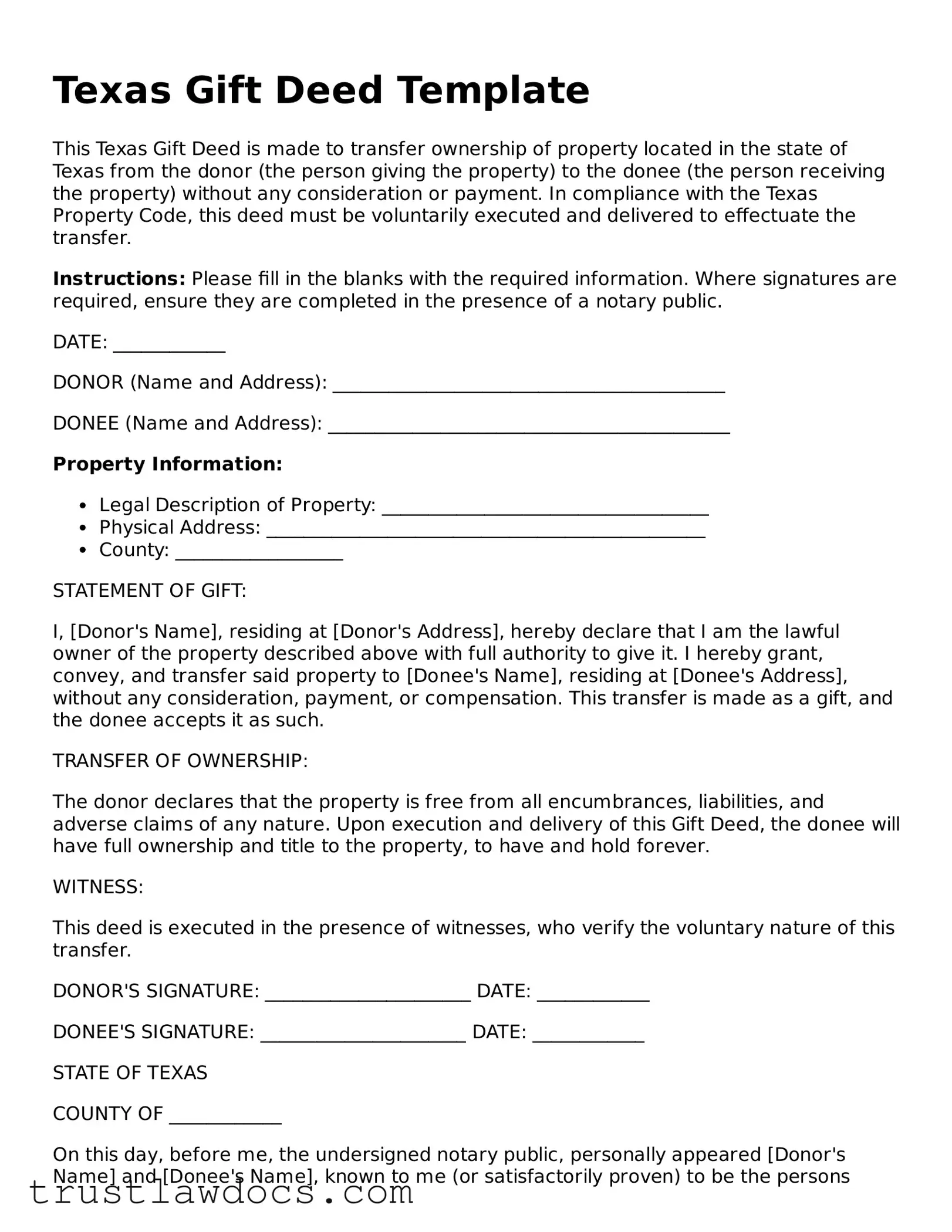

Form Example

Texas Gift Deed Template

This Texas Gift Deed is made to transfer ownership of property located in the state of Texas from the donor (the person giving the property) to the donee (the person receiving the property) without any consideration or payment. In compliance with the Texas Property Code, this deed must be voluntarily executed and delivered to effectuate the transfer.

Instructions: Please fill in the blanks with the required information. Where signatures are required, ensure they are completed in the presence of a notary public.

DATE: ____________

DONOR (Name and Address): __________________________________________

DONEE (Name and Address): ___________________________________________

Property Information:

- Legal Description of Property: ___________________________________

- Physical Address: _______________________________________________

- County: __________________

STATEMENT OF GIFT:

I, [Donor's Name], residing at [Donor's Address], hereby declare that I am the lawful owner of the property described above with full authority to give it. I hereby grant, convey, and transfer said property to [Donee's Name], residing at [Donee's Address], without any consideration, payment, or compensation. This transfer is made as a gift, and the donee accepts it as such.

TRANSFER OF OWNERSHIP:

The donor declares that the property is free from all encumbrances, liabilities, and adverse claims of any nature. Upon execution and delivery of this Gift Deed, the donee will have full ownership and title to the property, to have and hold forever.

WITNESS:

This deed is executed in the presence of witnesses, who verify the voluntary nature of this transfer.

DONOR'S SIGNATURE: ______________________ DATE: ____________

DONEE'S SIGNATURE: ______________________ DATE: ____________

STATE OF TEXAS

COUNTY OF ____________

On this day, before me, the undersigned notary public, personally appeared [Donor's Name] and [Donee's Name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

_____________________________

Notary Public

My Commission Expires: ____________

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Texas Gift Deed form is a legal document that allows a person to transfer ownership of property to another as a gift without any consideration or payment. |

| Governing Law | The form is governed by the Texas Property Code, which outlines the requirements for valid gift deeds in the state. |

| Consideration | In a gift deed, the consideration is "love and affection," distinguishing it from other types of property transfer deeds that require financial compensation. |

| Revocability | A gift deed is irrevocable once delivered and accepted by the grantee, meaning it cannot be taken back by the grantor. |

| Delivery and Acceptance | For the deed to be effective, it must be delivered to and accepted by the grantee during the grantor's lifetime. |

| Recording | Although not mandatory, recording the deed with the county clerk's office is strongly recommended for the protection of the grantee's interest. |

| Tax Implications | The transfer of property via a gift deed may have federal tax implications, including the potential requirement to file a gift tax return. |

| Necessary Information | The deed must include the legal description of the property, the names of the grantor and grantee, and be signed by the grantor. |

| Witness and Notarization | While Texas law does not require a gift deed to be witnessed, notarization is necessary for the deed to be recorded and to validate its authenticity. |

How to Write Texas Gift Deed

A Texas Gift Deed form is a document that facilitates the process of giving a gift of real property from one person to another without any consideration (that is, without the recipient paying for it). This legal instrument is quite beneficial for both parties involved, as it formally records the transfer and safeguards the interests of the donor and the donee. It is essential for the donor to fill out the form accurately to ensure that the deed is legally effective and to prevent any potential disputes or misunderstandings in the future. Below are the steps needed to successfully complete the Texas Gift Deed form.

- Gather information about the donor (the person giving the property) and the donee (the person receiving the property), including their full legal names and addresses.

- Identify the property being gifted. This should include a thorough description of the property, such as its address and legal description found in prior deeds or property records.

- Check for any legal requirements specific to the county in Texas where the property is located. Some counties may have unique stipulations or requirements for recording a gift deed.

- Complete the Texas Gift Deed form by entering the required information in the designated sections. This typically involves:

- Entering the date of the gift deed execution.

- Filling in the names and addresses of both the donor and the donee.

- Providing a complete legal description of the gifted property.

- Stating the relationship between the donor and donee, if any, to demonstrate the gift's validity.

- The donor must sign the gift deed in the presence of a notary public. The signature process formalizes the donor's intention to gift the property and helps authenticate the document.

- Have the notary public notarize the deed. This step usually involves the notary public witnessing the donor's signature, then stamping and signing the deed themself.

- File the completed and notarized gift deed with the county clerk's office in the county where the property is located. This step is crucial as recording the deed makes it a part of the public record, providing notice of the ownership transfer.

- Pay any required filing fees. Fees can vary by county, so it's important to check in advance what the cost will be to record the gift deed.

Filling out and recording a Texas Gift Deed form is a straightforward process that requires attention to detail and adherence to county-specific regulations. By following these steps, individuals can ensure that the gift of real property is legally acknowledged and recorded, paving the way for a smooth and dispute-free transfer of ownership.

Get Answers on Texas Gift Deed

What is a Texas Gift Deed form?

A Texas Gift Deed form is a legal document that allows a person to transfer ownership of property to another person without any payment or consideration. It's a way to give property as a gift, typically used among family members or close friends in Texas. The deed ensures the transfer is legally recognized.

Who can use a Texas Gift Deed form?

Anyone who owns property in Texas and wishes to gift that property to another person can use a Texas Gift Deed form. This includes homeowners, landowners, and even those who own certain personal property that is eligible for transfer by deed.

Is a Texas Gift Deed form revocable?

Once a Texas Gift Deed form has been properly executed and delivered to the recipient, it is typically not revocable. This means that the giver cannot change their mind and take back the property unless the recipient agrees to return it voluntarily.

Are there any taxes associated with a Texas Gift Deed?

While there might not be immediate state taxes associated with gifting property in Texas, the giver should consider federal gift tax implications. There is an annual exemption limit and a lifetime exemption limit to how much property one can gift without incurring federal gift tax. It's best to consult with a tax professional for specific advice.

What information is needed to complete a Texas Gift Deed form?

To complete a Texas Gift Deed form, you'll need detailed information about the giver and the recipient, a legal description of the property being gifted, and any conditions of the gift. The document must also be signed by the giver and notarized.

Does a Texas Gift Deed need to be recorded?

For a Texas Gift Deed to be fully effective and to protect the recipient's interest in the property, it must be recorded with the county clerk in the county where the property is located. Recording fees may apply.

Can you gift only a portion of the property with a Texas Gift Deed?

Yes, it's possible to use a Texas Gift Deed to gift only a portion of your property to someone else. The legal description in the deed must clearly specify the portion being gifted for the deed to be valid.

What are the consequences if a Texas Gift Deed is not properly executed?

If a Texas Gift Deed is not properly executed, which includes not being signed, notarized, or accurately describing the property, it may be considered invalid. This could result in the property not legally transferring to the recipient, leading to potential disputes or legal challenges.

Can a Texas Gift Deed be used to transfer property to a minor?

Yes, a Texas Gift Deed can be used to transfer property to a minor. However, because minors cannot legally manage property, a guardian or a trust may need to be established to handle the property until the minor reaches legal age.

Is legal advice required to complete a Texas Gift Deed?

While it's not a requirement, consulting with a legal professional can help ensure that the Texas Gift Deed is properly executed and that all potential legal and tax implications are considered. This is especially important for complicated transfers or when the property has a high value.

Common mistakes

One common mistake made when filling out the Texas Gift Deed form is neglecting to provide complete and accurate description of the property being gifted. This property description must be precise, often including the legal description used in official records, not just a street address or a simple declaration of the property type. Failure to adequately describe the property can result in legal complications, potentially invalidating the deed or leading to disputes over what was intended to be gifted.

Another error occurs when individuals do not properly witness the deed. Texas law requires the presence of a notary public at the time the deed is signed. The notary must acknowledge that the donor (the person giving the property) signed the deed voluntarily for the purposes detailed within it. Without this notarization, the gift deed may not be considered legally binding. Some people mistakenly believe that a notary's presence is a mere formality, but it is, in fact, a crucial step in validating the document.

Additionally, there is sometimes confusion about the need to file the gift deed with the county clerk's office. Once signed and notarized, the document must be filed in the county where the property is located. Failing to record the deed can lead to issues in establishing the recipient's ownership of the property. This step is vital for the transfer of the property’s title and for the deed to be recognized as legitimate under Texas law.

Finally, individuals often overlook the importance of specifying that the transfer is a gift. This requires a statement within the deed affirming that the property is being transferred without receiving anything in return. Without this declaration, the transfer could be misconstrued as a sale, potentially complicating tax implications and the legal standing of the deed. Ensuring that the deed clearly states the property is a gift helps to avoid these potential pitfalls.

Documents used along the form

When it comes to transferring property in Texas as a gift, the Gift Deed form is just the beginning. This document represents the transferor's intent to give a property without compensation. However, to ensure the process runs smoothly and legally, several other documents often accompany the Gift Deed form. These supplementary forms play critical roles in validating the transfer, recording the deed, and addressing tax implications. Let's take a closer look at some of these essential documents.

- Affidavit of Consideration for Use by Seller: This document clarifies that the property is being transferred as a gift and not as a sale. It provides proof that the transaction is not a taxable sale.

- General Warranty Deed: Used in some cases alongside or in place of a Gift Deed, this form guarantees that the property is free from any liens or encumbrances and that the grantor has the right to transfer the property.

- Quitclaim Deed: Sometimes used in place of a Gift Deed for a less formal transfer of property. This form transfers any ownership or interest the grantor has in the property without making any guarantees about the title.

- Real Estate Transfer Declaration: This form provides necessary information about the property and the transfer for tax purposes and is often required by the local assessing officers.

- Property Tax Statement: Current documentation of the property's tax status can be required to ensure that there are no outstanding taxes due before the transfer.

- Title Search Report: Before transferring property, a title search is often conducted to ensure there are no undisclosed heirs, liens, or other encumbrances on the property.

- Transfer Tax Declaration: Although gift transfers may be exempt, this form is necessary for recording the transfer with the local tax authority and identifying any applicable exemptions.

- Mortgage Discharge Statement: If the property being gifted is under a mortgage, this document is necessary to confirm that the mortgage has been fully paid off or to make arrangements for its transfer.

- Homestead Exemption Forms: If the property qualifies as a homestead, filing the appropriate exemption forms can reduce property taxes for the recipient.

- Power of Attorney: If one party in the transfer cannot be present, a power of attorney may be used to grant authority to another person to sign documents on their behalf.

Each of these documents serves a unique purpose in the property transfer process, complementing the Gift Deed to ensure a legal and efficient transfer. Whether it's to clarify the nature of the transfer, guarantee the property's clear title, or satisfy tax requirements, these supplementary forms are vital in safeguarding the interests of both the donor and the recipient. Understanding and preparing these documents can make the gift-giving process in Texas both joyful and trouble-free.

Similar forms

A Texas Gift Deed is quite similar to a Warranty Deed in that both are used to transfer property ownership. However, where a Warranty Deed guarantees the buyer that the property is free from any claims or liens, a Gift Deed is typically used between family members or close friends, and no money exchanges hands. Both documents are filed with the county to legalize the change in ownership.

Similar to a Quitclaim Deed, a Gift Deed transfers ownership rights of a property to another person. The primary difference lies in the level of protection offered to the recipient. A Quitclaim Deed offers no guarantees about the property’s title, making it a bit riskier than a Gift Deed, which is often used when the giver is sure of the property's clear title and wants to gift it to a close associate or family member.

Comparable to a Trust, a Texas Gift Deed can also serve to pass property to a beneficiary, but it does so immediately, without involving the complexity or the control that a Trust might allow over when and how the property is distributed. Gift Deeds are straightforward for immediate transfers, while Trusts can govern the distribution of property over time and under specific conditions.

Another document similar to a Texas Gift Deed is a Life Estate Deed, where the owner transfers property but retains the right to use it for their lifetime. Unlike a Life Estate Deed, a Gift Deed transfers complete ownership immediately, not retaining any rights for the giver once the deed is executed and delivered.

Like a Transfer-on-Death (TOD) Deed or Beneficiary Deed, a Gift Deed allows a property owner to name a recipient for their property. However, a TOD Deed becomes effective only after the owner’s death, while a Gift Deed transfers the property rights immediately upon execution and acceptance.

Joint Tenancy Agreements share similarities with a Texas Gift Deed because they can be used to add someone to a property's title, thereby gifting them a share of the property. However, Joint Tenancy comes with the right of survivorship, meaning if one owner dies, the other automatically inherits their share, a feature not inherent in Gift Deeds.

A General Warranty Deed, much like a Gift Deed, is used to transfer real estate ownership. The General Warranty Deed, however, provides the grantee with significant legal protections against any claims to the property, standing in contrast to the simpler, trust-based transfer that characterizes a Gift Deed, which does not inherently guarantee against encumbrances or claims.

Lastly, the Texas Gift Deed bears resemblance to a Promissory Note in one key aspect: the transfer of something of value. While a Promissory Note involves a promise to pay a debt or deliver money under specific terms, a Gift Deed involves a promise to transfer property as a gift, entirely without the expectation of compensation or repayment.

Dos and Don'ts

Completing a Texas Gift Deed form requires careful attention to detail and a clear understanding of what is expected to ensure the transfer of property is legally recognized. Here is a comprehensive list of dos and don'ts to guide you through the process:

- Do ensure that the form complies with all Texas legal requirements. This includes using the correct legal descriptions and terminology specific to Texas law.

- Do verify that both the giver (donor) and the receiver (donee) of the gift are clearly identified with their full legal names and addresses to avoid any confusion or misidentification.

- Do have the Gift Deed form notarized. In Texas, notarization is a crucial step for the document to be legally binding and recognized.

- Do keep a copy of the fully executed and notarized document for both the donor's and donee's records. This ensures that both parties have proof of the transfer.

- Don't leave any sections incomplete. Every question and section provided in the form should be answered to ensure the deed is processed without any delays or legal issues.

- Don't sign the document without a notary present. The presence of a notary public during the signing is essential for the deed to be considered valid and enforceable.

- Don't forget to file the completed deed with the local county clerk's office. Filing is necessary for the gift to be officially recorded and recognized by the state of Texas.

- Don't overlook the need for a clear and detailed description of the property being gifted. This includes the property's physical address and legal description, which ensures there is no ambiguity regarding what is being transferred.

Misconceptions

When it comes to transferring property in Texas, a Gift Deed can be a handy tool. However, there are some common misconceptions about how these forms work and what they entail. Let's clear up a few of those misunderstandings:

It's only for real estate. People often think a Gift Deed is exclusively for transferring real estate, but it can also be used for movable assets like vehicles or shares.

You don't need to report it for tax purposes. Even though it's a gift, the Internal Revenue Service (IRS) requires donors to report gifts over a certain value. Ignoring this can lead to penalties.

It's too complicated to be worth it. Some folks avoid using a Gift Deed assuming it's too complex. However, with clear guidance, it can be straightforward and provide legal clarity and peace of mind.

It's instantly effective. A common assumption is that once a Gift Deed is signed, it immediately transfers ownership. In reality, the deed must be legally delivered and accepted to be effective.

No need for witnesses or notarization. Contrary to this belief, having the deed witnessed and notarized is crucial for validating the document and protecting against disputes.

It overrides a will. People often mistake a Gift Deed for having the power to override existing wills. While it does transfer ownership during a person's lifetime, it doesn't change bequests in a will unless those assets were specifically what was gifted.

There are no consequences for the recipient. It's mistakenly believed that receiving a gift through this deed comes without obligations. Depending on the state laws and the value of the gift, there may be tax implications for the recipient.

All states have the same rules for Gift Deeds. Each state has its own laws governing the use of Gift Deeds, including Texas. Assuming that what applies in one state will apply in another can lead to legal issues.

Understanding these misconceptions about the Texas Gift Deed can help in making informed decisions when considering gifting property. When in doubt, seeking legal advice can provide clarity tailored to your specific situation.

Key takeaways

When considering the transfer of property in Texas without exchange of money, utilizing a Texas Gift Deed form is a common approach. It's a legal document that facilitates the process, ensuring the transfer is recognized officially and recorded properly. There are several critical aspects to understand about filling out and using this form:

- Complete the Form with Accurate Information: It's vital to enter all required details accurately, including the full names of the donor (the person giving the property) and the donee (the person receiving the property), a legal description of the property, and any conditions of the gift. Errors or omissions can lead to complications or disputes about the property's ownership.

- Notarization is Required: For a Texas Gift Deed to be legally valid, it must be signed in the presence of a Notary Public. The notarization process formalizes the document, providing a layer of protection against fraud and confirming the identity of the parties involved.

- File the Deed with the County Clerk: After the Gift Deed is completed and notarized, it must be filed with the County Clerk’s office in the county where the property is located. This step is crucial as it places the deed into the official public record, solidifying the transfer of ownership.

- Consider Tax Implications: While a gift deed transfers property without immediate financial exchange, there may still be tax implications for both the donor and donee. For instance, the donor might be subject to federal gift tax reporting requirements if the value of the gift exceeds the annual exemption limit. The donee, meanwhile, might face different implications, such as property tax reassessments. Consulting with a tax professional is advisable to navigate these considerations adequately.

Effectively utilizing a Texas Gift Deed form involves understanding not only the steps for its completion and filing but also the legal and tax implications that accompany the transfer of property. Attention to detail and adherence to the proper procedures will ensure the process goes smoothly and secures the desired outcome for both parties involved.

Popular Gift Deed State Forms

How to Add Name to House Title in California - It serves as proof of the transfer, helping to clear any ambiguity regarding the ownership of the property.