Free Gift Deed Form for California

In the sunny state of California, a special document named the California Gift Deed form plays a pivotal role in the act of generosity, where one person decides to gift a piece of real estate to another. This form is not merely a piece of paper but a legally binding agreement that ensures the property is transferred without any exchange of money. Its essence lies in its ability to bypass the typical sales process, making the gesture of giving more heartfelt and immediate. Users of the form will find it particularly useful for its streamlined approach to property transfer, ensuring that the gift is not only given but also received in the eyes of the law. The form outlines necessary details such as the description of the property, the parties involved, and the conditions under which the gift is made, if any. By requiring notarization, the document also adds a layer of legal protection and formality to what might otherwise be considered a simple transfer. Understanding the nuances of this form is essential for anyone considering a generous act involving real estate in California, as it safeguards the interests of both the giver and the receiver, ensuring the process is clear, transparent, and legally sound.

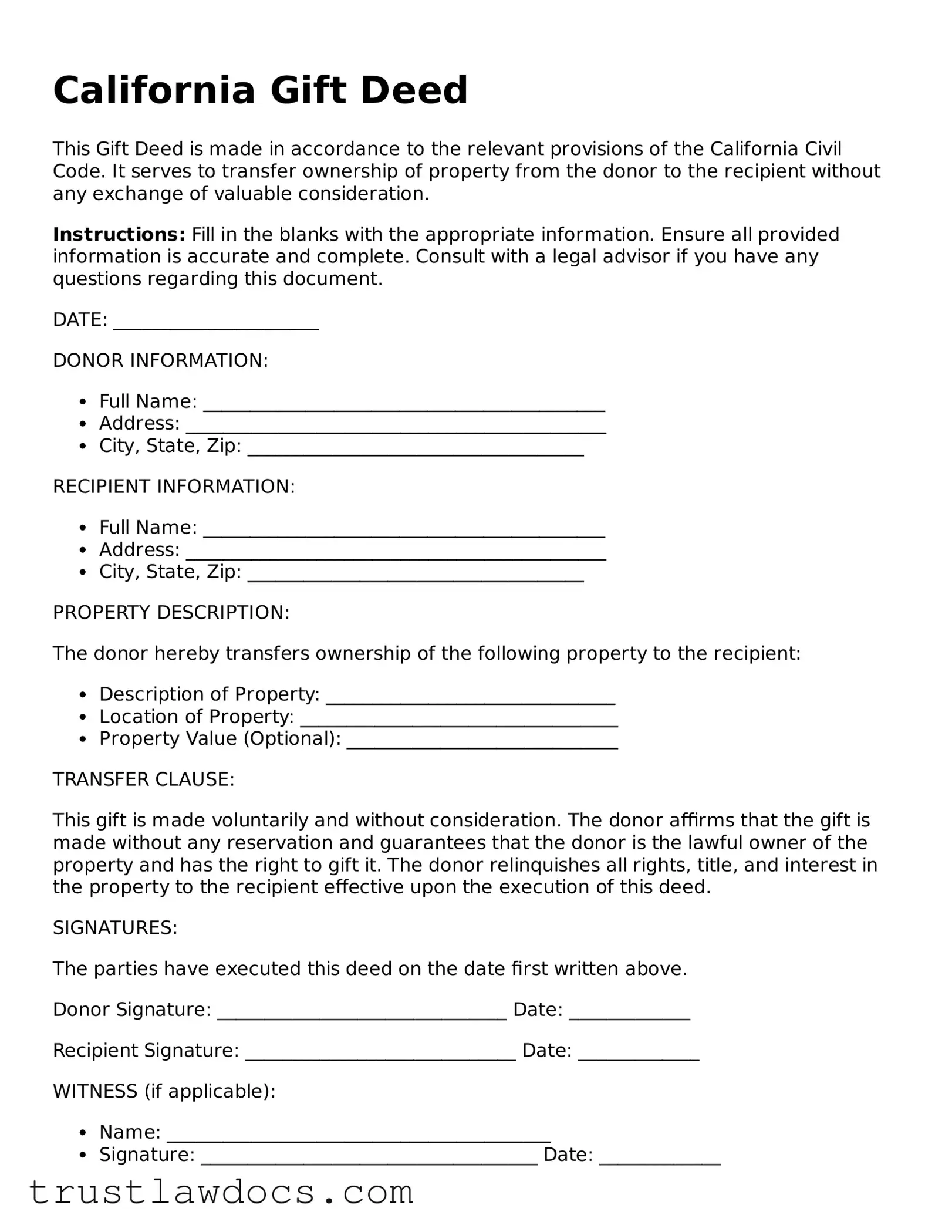

Form Example

California Gift Deed

This Gift Deed is made in accordance to the relevant provisions of the California Civil Code. It serves to transfer ownership of property from the donor to the recipient without any exchange of valuable consideration.

Instructions: Fill in the blanks with the appropriate information. Ensure all provided information is accurate and complete. Consult with a legal advisor if you have any questions regarding this document.

DATE: ______________________

DONOR INFORMATION:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City, State, Zip: ____________________________________

RECIPIENT INFORMATION:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City, State, Zip: ____________________________________

PROPERTY DESCRIPTION:

The donor hereby transfers ownership of the following property to the recipient:

- Description of Property: _______________________________

- Location of Property: __________________________________

- Property Value (Optional): _____________________________

TRANSFER CLAUSE:

This gift is made voluntarily and without consideration. The donor affirms that the gift is made without any reservation and guarantees that the donor is the lawful owner of the property and has the right to gift it. The donor relinquishes all rights, title, and interest in the property to the recipient effective upon the execution of this deed.

SIGNATURES:

The parties have executed this deed on the date first written above.

Donor Signature: _______________________________ Date: _____________

Recipient Signature: _____________________________ Date: _____________

WITNESS (if applicable):

- Name: _________________________________________

- Signature: ____________________________________ Date: _____________

NOTARY (if required):

This document was acknowledged before me on __________________ (date) by __________________ (name of principal).

Name of Notary: _________________________________

Seal:

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer real estate from one person to another without any consideration or payment. |

| Governing Law | It is governed by California Civil Code sections 1146-1149, which outline the requirements and procedures for a valid transfer. |

| Document Requirements | Must be in writing, contain the legal description of the property, and be signed by the grantor. |

| Delivery and Acceptance | The deed must be delivered to and accepted by the grantee to be effective. |

| Witness and Notarization | Though not required, it is recommended to have the deed witnessed and notarized to authenticate the signature. |

| Revocability | A gift deed, once delivered and accepted, is irrevocable without the consent of the grantee. |

| Filing with County Recorder | To finalize the gift and put others on notice, the deed should be filed with the county recorder’s office where the property is located. |

| Tax Implications | The transfer may be subject to federal gift tax and should be reported to the IRS. However, California does not impose a state gift tax. |

| Consideration Clause | The deed must explicitly state that the property is being transferred as a gift to avoid any assumption of a financial transaction. |

| Exemptions | Transfers between family members may be exempt from certain filing fees and taxes, but legal advice should be sought to understand any potential liabilities. |

How to Write California Gift Deed

The process of transferring property in California can be accomplished through various means, one being the execution of a gift deed. A gift deed is a legal instrument that facilitates the giving of property from one person (the donor) to another (the donee) without any exchange of value. Unlike other property deeds, a gift deed denotes that the property is indeed a gift. Completing a gift deed requires attention to detail and an understanding of the required information to ensure it is legally binding and effective. Below are the steps necessary to fill out a California Gift Deed form.

- Identify the Parties: Start by providing the full legal names of the donor (the person giving the gift) and the donee (the person receiving the gift). It's important to also include their complete addresses and state their relationship, if any, to clarify the intent of the transfer.

- Description of the Property: Include a detailed description of the property being gifted. This could be real estate, a vehicle, or other significant assets. For real estate, the legal description of the property as recorded in public records is necessary.

- Declaration of Gift: Clearly state that the transfer of property is intended as a gift. This declaration confirms that the donor expects nothing in return for the transferred property, which distinguishes a gift deed from other types of property transfer documents.

- Signatures: The donor must sign the gift deed in the presence of a notary public. This step is critical as the notarization of the donor's signature validates the document.

- Witnesses (if applicable): While not always required, some situations may call for the presence of witnesses during the signing of the deed. The requirements for witnesses can vary, so it’s wise to check local regulations.

- Recording the Deed: After the gift deed is signed and notarized, it must be filed with the appropriate county recorder’s office. This step is essential for the deed to be recognized as legal and for the donee to claim ownership officially. Recording fees will apply, and these vary by county.

By meticulously following these steps, individuals can successfully complete a California Gift Deed form. This document serves as a permanent record of the property transfer and helps to prevent disputes about ownership in the future. It is advisable for both donors and donees to keep copies of the completed gift deed for their records and for potential use in legal matters that may arise concerning the property.

Get Answers on California Gift Deed

What is a California Gift Deed form?

A California Gift Deed form is a legal document used to transfer ownership of personal property or real estate from one person to another without any exchange of money. The individual giving the gift is known as the "donor," and the person receiving it is the "donee." This form is commonly used to gift property to family members, friends, or charities.

Is a California Gift Deed form legally binding?

Yes, a California Gift Deed form is legally binding once it is properly filled out, signed, and delivered to the donee. It may also need to be notarized and filed with the county recorder's office, especially if it involves the transfer of real estate. The form must comply with California state laws to be considered valid.

Do I need a lawyer to complete a California Gift Deed form?

While it's not legally required to use a lawyer to complete a California Gift Deed form, consulting with one can be very helpful. A lawyer can ensure that the deed is correctly filled out, meets all legal requirements, and genuinely reflects the donor's wishes. This can help avoid any potential legal issues in the future.

Are there any taxes associated with a California Gift Deed?

Gifts of property might be subject to federal gift tax. However, there is a federal gift tax exemption amount that allows individuals to give away a certain value of gifts tax-free throughout their lifetime. For any gift above this exempted amount, a gift tax return might have to be filed. California does not impose a state gift tax, but donors should consult with a tax advisor to understand the federal tax implications fully.

What information is required to complete a California Gift Deed form?

The form typically requires detailed information about the donor and the donee, a legal description of the property being gifted (if it's real estate), and the date of the gift. It may also require signatures from witnesses or a notary acknowledgment to be valid, depending on the nature of the gift and local regulations.

Can a California Gift Deed be revoked?

Once a gift deed has been executed, delivered, and accepted by the donee, it generally cannot be revoked without the donee's consent. This permanence reinforces the necessity of being certain about the decision to gift property before completing the deed.

What is the difference between a Gift Deed and a Will in California?

A Gift Deed transfers property immediately and irrevocably from the donor to the donee, without any payment or consideration. A Will, on the other hand, outlines how a person’s property should be distributed upon their death. Property transferred through a Will may go through probate, a court-supervised process, whereas property transferred by a Gift Deed does not. Each serves different estate planning purposes, and their use will depend on individual circumstances.

Common mistakes

When completing the California Gift Deed form, one common mistake is not providing detailed information about the giver and the recipient. People often forget to include full legal names and addresses, which are crucial for accurately identifying the parties involved in the transfer of property. This oversight can lead to confusion and potential disputes over the deed's validity.

Another error frequently made is failing to describe the gifted property with adequate specificity. A description that is too vague or incomplete can invalidate the deed. It is essential to include all relevant details, such as the property's legal description and parcel number, to ensure there is no ambiguity regarding what is being gifted.

Ignoring the need for witness signatures is also a mistake. The California Gift Deed form requires the presence of witnesses during the signing process to verify the authenticity of the deed. Neglecting this requirement can raise questions about the deed's legitimacy and may result in its rejection by the county recorder's office.

People often overlook the necessity of notarization. A notary public must acknowledge the signing of the Gift Deed for it to be considered valid. This step is crucial for adding an extra layer of verification but is unfortunately missed by many, leading to potential legal challenges.

Choosing the wrong form for the type of property being gifted is another common error. California has specific requirements that may vary depending on the property type, such as real estate or personal property. Using the incorrect form can lead to an invalid transfer or additional legal hurdles.

Not understanding the tax implications associated with gifting property is an oversight by many. While the Gift Deed form facilitates the act of gifting, the giver should be aware of any federal or state tax liabilities that may arise. Failure to consider these can result in unexpected tax obligations.

Delaying the recording of the Gift Deed with the appropriate county office is a mistake that can have significant consequences. Timely recording is essential for establishing the document's validity and protecting against claims by third parties. Delayed recording may compromise the recipient's rights to the property.

Some individuals mistakenly believe that a Gift Deed can impose conditions on the use of the gifted property. However, unlike trusts or wills, a Gift Deed transfers ownership without terms or conditions. This misunderstanding can lead to incorrect assumptions about the giver's control over the property after the transfer.

Finally, attempting to use a Gift Deed to evade creditors is a serious misjudgment. If the gift is perceived as an attempt to defraud creditors, it can be overturned. Proper legal advice is necessary to understand the implications of transferring property, especially in complex financial situations.

Documents used along the form

When someone decides to give a piece of property as a gift in California, the Gift Deed form is a key document that officially transfers ownership without any exchange of money. However, using this form typically involves more than simply filling it out and signing it. There are several other forms and documents that are often used alongside the Gift Deed to ensure that the transfer adheres to legal requirements, provides clarity on the gift's specifics, and offers protection to the parties involved. Let's look at some of these additional forms and documents.

- Preliminary Change of Ownership Report (PCOR): This document is filed with the county recorder’s office alongside the Gift Deed. Its purpose is to inform the county assessor about the change in ownership, which helps in updating property tax records.

- Affidavit of Death: In cases where the gift deed is transferring property upon the death of the owner, this document is necessary to prove the death of the property's original owner.

- Quitclaim Deed: This may be used in addition to or in place of a gift deed when the giver does not want to guarantee that they hold clear title to the property. It transfers any interest the giver has in the property without warranties.

- Grant Deed: Similar to a gift deed, a grant deed transfers property with some guarantees from the seller; however, it usually involves a sale rather than a gift.

- Trust Transfer Deed: For individuals transferring property to a trust, this document specifies the property is being moved into the trust and not to a specific person.

- Notarization Acknowledgement Form: Since most deeds must be notarized to be legally valid, this form officially verifies the identity of the parties signing the document and their understanding of what they're signing.

- Warranty Deed: Opposite to a quitclaim deed, this assures the recipient that the property has clear title, ensuring that the giver has the right to transfer the property and that it's free from any encumbrances.

- Transfer Tax Declaration: While not always applicable, some counties require this form to determine if the transfer is subject to transfer taxes, even though most gifts are exempt.

Including these documents with a Gift Deed, when appropriate, ensures a smoother and legally sound transfer of property. Each plays a crucial role in clarifying the specifics of the gift, ensuring all necessary legal steps are followed, and providing security and peace of mind for both the giver and the recipient. Understanding and preparing these additional forms can help prevent future disputes or legal issues, embodying thoroughness and foresight in property transactions.

Similar forms

The California Gift Deed form is similar to a Warranty Deed in that both are used to transfer property. However, where a Warranty Deed provides the recipient (grantee) with certain guarantees about the property's title and protection against any future claims, a Gift Deed, conversely, involves a transfer of real property from one person (the donor) to another (the donee) without any exchange of value and typically without those assurances.

Another document resembling the California Gift Deed form is the Quitclaim Deed. Both documents are used to transfer property interests. The key difference lies in the level of protection offered to the recipient. A Quitclaim Deed transfers the owner’s interest to the recipient with no guarantees regarding the title's quality or if there are any encumbrances. In contrast, a Gift Deed implies the donor holds title to the property but, like the Quitclaim Deed, usually makes no guarantee about the property's encumbrances.

Similar to the California Gift Deed form, a Transfer-on-Death (TOD) Deed allows property owners to name a beneficiary to whom the property will transfer upon the owner’s death, bypassing the need for the property to go through probate. While both facilitate the transfer of property without financial consideration, a TOD Deed becomes effective only upon the death of the owner, unlike a Gift Deed which takes effect immediately upon execution and delivery.

The Grant Deed is yet another document akin to the California Gift Deed form, as both are used to transfer title to real property. The key difference between them is that a Grant Deed comes with a promise that the property hasn’t been sold to someone else and is free of encumbrances (other than those the buyer is aware of), which is not typically assured in a Gift Deed. Both necessitate the donor’s signature and usually need to be notarized and recorded.

Similar in purpose to the California Gift Deed form, a Deed of Trust involves transferring the title of a property. However, a Deed of Trust is primarily used in financing arrangements, acting as a security for a loan on the property. In this scenario, the property is transferred to a trustee, who holds it as security for the loan between the borrower and lender. Unlike a Gift Deed, a Deed of Trust involves a financial transaction and obligations that the Gift Deed does not entail.

The Life Estate Deed, resembling the California Gift Deed form, facilitates property transfer, allowing the original owner (the grantor) to retain possession during their lifetime and automatically transferring the property to a named remainderman upon their death. While both allow for the transfer of property interests, the Life Estate Deed uniquely provides for the original owner’s use of the property for life before the transfer is fully realized, a feature not present in the conventional Gift Deed.

Lastly, a Power of Attorney (POA) document shares a functional similarity with the California Gift Deed form in terms of allowing an individual to make decisions on another’s behalf. In the context of property transfer, a POA might be used to authorize someone to sign a Gift Deed for the principal. Though their purposes can overlap in this way, a POA is broader, potentially covering a wide range of legal and financial decisions beyond the scope of a simple property transfer.

Dos and Don'ts

When filling out a California Gift Deed form, it's crucial to ensure that the process is completed correctly to avoid potential legal issues down the line. A Gift Deed is a legal document that transfers ownership of real or personal property from one person to another without any consideration, or payment. Whether you're gifting property to a family member or a friend, following these guidelines will help ensure the transfer goes smoothly.

What You Should Do:

- Ensure Accuracy: Double-check all the information you input into the form. This includes the legal description of the property, the donor's details, and the recipient's details. Mistakes here can lead to legal complications or even invalidate the deed.

- Use Precise Language: Legal documents require clarity and preciseness. Use the exact legal terms and descriptions necessary for a Gift Deed. Ambiguities in language can lead to misunderstandings or disputes in the future.

- Sign in the Presence of a Notary: California law requires that Gift Deeds be notarized to be valid. Ensure that all parties sign the deed in the notary's presence. This step is crucial for the document's legal standing.

- File the Deed: After the Gift Deed has been notarized, it must be filed with the county recorder's office where the property is located. Filing the deed makes it a matter of public record, which is essential for the transfer of ownership to be officially recognized.

- Keep Copies: Ensure that both the donor and the recipient keep copies of the notarized and filed Gift Deed for their records. It's important to have this documentation available for future reference.

- Consider Tax Implications: Seek advice on potential tax implications of gifting property. The transfer of property as a gift may have implications for both gift and estate taxes. Consulting with a tax professional can provide clarity on these issues.

What You Shouldn't Do:

- Overlook the Legal Description: Do not use a vague or incorrect description of the property. The legal description is necessary for the deed to be legally binding and for the county recorder's office to accept the filing.

- Forget to Disclose Liens or Encumbrances: Failing to disclose any liens, mortgages, or other encumbrances on the property can lead to legal problems. Be transparent about the property's status to ensure a smooth transfer.

- Ignore Filing Requirements: Do not assume that once the Gift Deed is signed and notarized, the process is complete. The deed must be officially filed with the appropriate county office to effectuate the property transfer.

- Sign Without a Notary: Do not sign the Gift Deed without a notary present. A notary certifies the identity of the signers and validates the document, a step that's legally necessary in California.

- Delay Filing After Notarization: Avoid delaying the filing of the Gift Deed after it has been notarized. Delays can cause complications, especially if the donor's circumstances change.

- Skip Professional Advice: Don't overlook the value of professional advice. Consulting with a legal or tax professional can help navigate the complexities of gifting property and prevent unforeseen consequences.

Misconceptions

When it comes to transferring property in California, many choose to use a gift deed. However, there are several misconceptions about this process. Understanding the truths behind these myths is crucial to effectively managing property transfers.

- A gift deed is the easiest way to transfer property. While it's true that gift deeds can be simpler than other transfer documents, they require careful consideration of tax implications and future consequences. It's not just about signing a paper; it's about understanding the legal and financial impact.

- Gift deeds are only for transferring property to family members. Although often used within families, gift deeds can transfer property to anyone. The relationship between the giver and the recipient doesn't limit the deed's validity.

- Filing a gift deed avoids property taxes. This is a common misunderstanding. While a gift deed might avoid some taxes at the time of transfer, the IRS requires reporting of the gift's value. There may also be implications for estate taxes.

- A gift deed grants immediate ownership. The deed does transfer ownership, but the process isn't instantaneous. The deed must be legally recorded with the appropriate county office, a step that's critical for the transfer to be officially recognized.

- Once given, a gift deed cannot be revoked. Generally, gift deeds are irrevocable, meaning once the property is given, the giver can't take it back. However, exceptions exist, such as if the deed was made under fraud or undue influence. It's not as cut-and-dry as it seems.

- Creating a gift deed is expensive. The cost of creating a gift deed can vary, but it doesn't have to be expensive. While it's wise to consult with a legal expert, especially for high-value property, drafting a gift deed can be relatively straightforward.

- You don't need a lawyer to create a gift deed. Technically true, but misleading. While you can draft a gift deed without legal assistance, understanding the document's implications is crucial. Mistakes can lead to unintended tax liabilities or disputes. It's often worth the investment to seek professional advice.

In summary, while gift deeds can be a useful tool for property transfer in California, it's important to approach them with full knowledge of the nuances involved. Dispelling these misconceptions can help ensure that the process goes smoothly for both the giver and the recipient.

Key takeaways

When considering the transfer of property in California through a gift, utilizing a California Gift Deed form can streamline the process. This legal document, while straightforward, requires attention to detail and clarity regarding its completion and usage. Below are key takeaways to guide you through the process.

The California Gift Deed form is a legal document used to transfer property from one person to another without any exchange of money. The giver is referred to as the "donor," and the recipient is the "donee."

It is crucial to ensure that the deed is completely and accurately filled out to prevent any future legal issues or disputes over the property.

One of the most important aspects of the gift deed is the description of the property being gifted. This description should be precise to ensure clear understanding and avoid ambiguities.

Both the donor and donee must sign the deed for it to be legally binding. In some cases, witness signatures may also be required to further validate the document.

For real estate transactions, the deed must be filed with the county recorder’s office in the county where the property is located. This step is essential for the transfer to be officially recognized and for the property records to be updated.

No monetary exchange is involved in a gift deed transaction, but the donor must still consider the federal gift tax implications. Currently, the Internal Revenue Service (IRS) allows an annual exclusion amount before any gift tax is incurred.

In some situations, the donee might be responsible for paying a transfer tax. It's important to check local regulations and possibly consult with a tax professional to understand any financial responsibilities.

Having a notary public witness the signing of the gift deed can add an extra layer of officiality and help protect against future legal disputes regarding the document’s authenticity.

Using a Gift Deed form in California offers a straightforward way to gift property. However, both parties involved should be well-informed about their rights and obligations. Meticulous attention to the document's completion, adherence to legal requirements, and understanding the tax implications are crucial steps in ensuring a smooth transfer of property.

Popular Gift Deed State Forms

Texas Gift Deed Pdf - This form is particularly useful for high-value items or real estate to establish a clear record of the gift's transfer.