Official Gift Deed Document

When individuals decide to transfer property as a gift, the Gift Deed form becomes an essential document to ensure the process is legally binding and clearly documented. This form outlines the details of the giver and the receiver, specifying the item or property being given without any expectation of payment or compensation. The act of giving through this document serves not only as a heartfelt gesture but also as a significant legal transaction, establishing the transfer of ownership under the law. It is particularly important in preventing future disputes over the property's ownership, making it a crucial step in the conveyance of gifts that carry substantial financial or emotional value. Proper completion and execution of the Gift Deed form can also have implications for tax purposes, both for the giver and the receiver, potentially necessitating further financial planning. Therefore, understanding the components, requirements, and potential consequences associated with this form is vital for anyone considering this generous and meaningful act.

Gift Deed for Specific States

Form Example

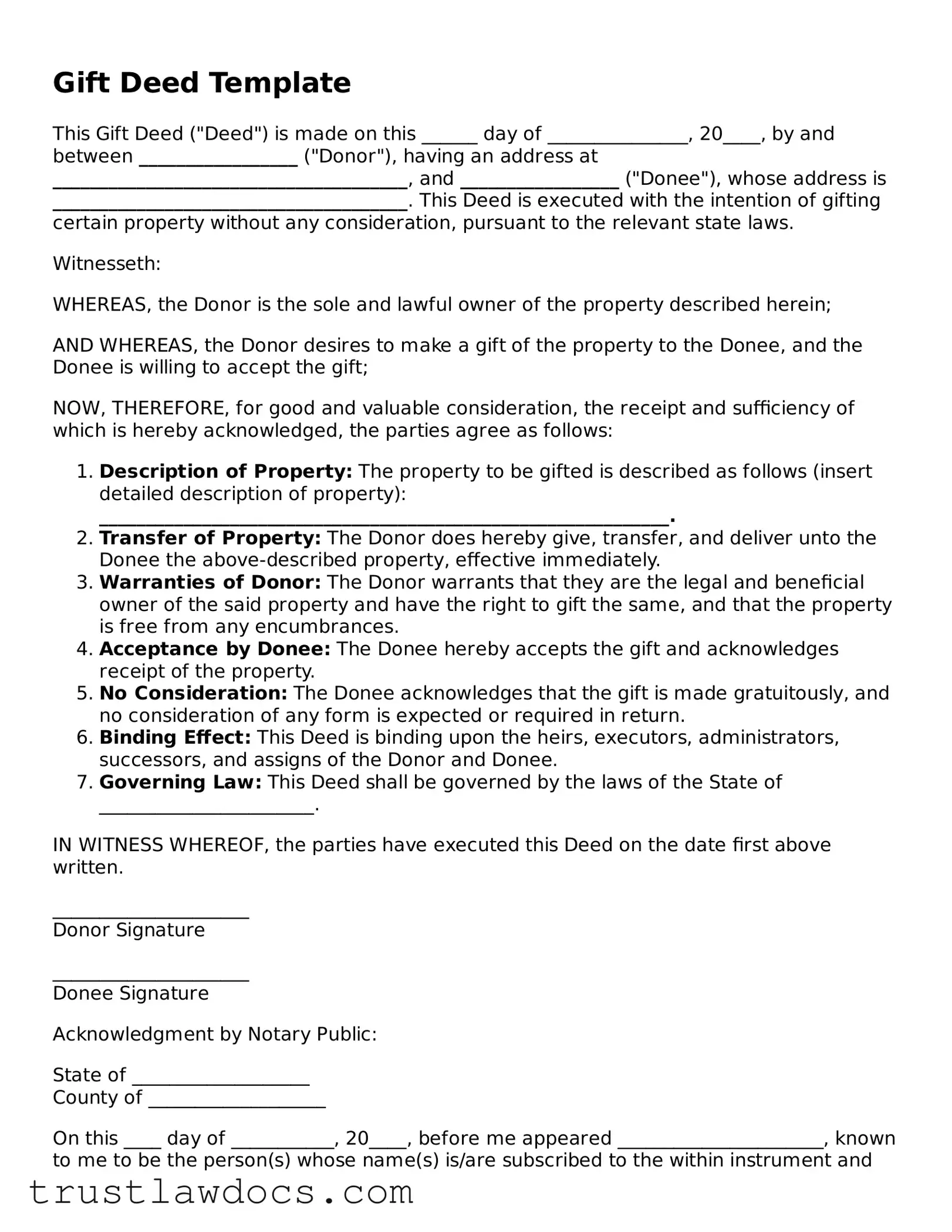

Gift Deed Template

This Gift Deed ("Deed") is made on this ______ day of _______________, 20____, by and between _________________ ("Donor"), having an address at ______________________________________, and _________________ ("Donee"), whose address is ______________________________________. This Deed is executed with the intention of gifting certain property without any consideration, pursuant to the relevant state laws.

Witnesseth:

WHEREAS, the Donor is the sole and lawful owner of the property described herein;

AND WHEREAS, the Donor desires to make a gift of the property to the Donee, and the Donee is willing to accept the gift;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

- Description of Property: The property to be gifted is described as follows (insert detailed description of property):

_____________________________________________________________. - Transfer of Property: The Donor does hereby give, transfer, and deliver unto the Donee the above-described property, effective immediately.

- Warranties of Donor: The Donor warrants that they are the legal and beneficial owner of the said property and have the right to gift the same, and that the property is free from any encumbrances.

- Acceptance by Donee: The Donee hereby accepts the gift and acknowledges receipt of the property.

- No Consideration: The Donee acknowledges that the gift is made gratuitously, and no consideration of any form is expected or required in return.

- Binding Effect: This Deed is binding upon the heirs, executors, administrators, successors, and assigns of the Donor and Donee.

- Governing Law: This Deed shall be governed by the laws of the State of _______________________.

IN WITNESS WHEREOF, the parties have executed this Deed on the date first above written.

_____________________

Donor Signature

_____________________

Donee Signature

Acknowledgment by Notary Public:

State of ___________________

County of ___________________

On this ____ day of ___________, 20____, before me appeared ______________________, known to me to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

________________________________

Notary Public

My Commission Expires: ____________

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| 2 | The donor is the person who gives the gift, and the recipient of the gift is called the donee. |

| 3 | Gift Deeds must be in writing, signed by the donor, and accepted by the donee to be legally effective. |

| 4 | Notarization is often required to authenticate the signing of the Gift Deed and to prevent fraud. |

| 5 | Witnesses may also be required to sign the Gift Deed, depending on state law. |

| 6 | In some states, the Gift Deed needs to be recorded with the local government office that handles property records. |

| 7 | Governing laws vary by state, and it's crucial to ensure that the Gift Deed complies with local regulations. |

| 8 | A Gift Deed cannot be revoked once it has been delivered and accepted, unless under very specific and rare circumstances. |

| 9 | Gift Deeds are commonly used for gifting real estate, vehicles, or other significant assets without the need for money to change hands. |

| 10 | Tangible personal property can also be transferred through a Gift Deed, making it a versatile document for various types of gifts. |

How to Write Gift Deed

When you decide to transfer property to another person without expecting anything in return, a Gift Deed form is a legal document you'll use to formalize the process. It helps to ensure that the transfer is recognized legally and can assist in preventing potential disputes in the future. Completing this form properly is crucial as it contains details about the donor (the person giving the gift), the donee (the person receiving the gift), and the gift itself. Follow these steps carefully to fill out your Gift Deed form accurately.

- Start by entering the date the Gift Deed is being executed at the top of the form. Ensure the date is correct and clearly written.

- Write the full legal name and address of the donor in the section designated for the party giving the gift. Make sure the information is accurate and matches any identification or legal documents.

- In the section following the donor’s information, enter the full legal name and address of the donee. Like with the donor's information, it’s important that this is accurate and matches legal documents.

- Describe the gift in detail in the provided space. Include any identifying details like serial numbers, model numbers, or legal descriptions if the gift is a piece of property. This helps in clearly identifying the gift and its scope.

- If there are any conditions attached to the gift, clearly state these in the specified section. This could include stipulations the donee must meet to receive or retain the gift.

- Both the donor and donee must sign the form in the presence of a witness or notary, depending on the legal requirements in your jurisdiction. Include the date of signing next to or under the signatures.

- Have the witness or notary sign the form and, if applicable, affix their seal. Their official stamp or seal may be required to authenticate the document.

- Finally, check the completed form for accuracy and completeness. Ensure no sections have been missed and that all information is correct.

Once the Gift Deed form is fully completed and signed, it’s recommended that copies are made for both the donor and the donee's records. Depending on the jurisdiction, you might also need to file this document with a local government or registry office to be effective. This final step ensures that the gift is legally recognized and that the transfer of the property is documented officially.

Get Answers on Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that facilitates the process of giving a gift, transferring ownership of property from one person to another without any exchange of money. It solidifies the transfer as a voluntary act, ensuring that the gift is made willingly and received without coercion.

Why do I need a Gift Deed?

Having a Gift Deed is crucial because it creates a legal record of the gift transfer, clarifying the donor's intention to give the property and the donee’s acceptance of the gift. This documentation helps prevent future disputes over ownership and can be critical for tax purposes, as it provides evidence of the transfer for the IRS.

What should be included in a Gift Deed?

A comprehensive Gift Deed should include the full names and addresses of the donor and the donee, a detailed description of the property being gifted, any conditions attached to the gift, the date of the transfer, and signatures from both parties and a notary public. The inclusion of witnesses can also strengthen the document’s validity.

Is a Gift Deed legally binding?

Yes, once signed and notarized, a Gift Deed becomes a legally binding document. It represents a concrete agreement between the donor and the donee, with the full force of law behind the transfer. It is essential, however, that the document meets all state-specific legal requirements to ensure its enforceability.

Can a Gift Deed be revoked?

A Gift Deed, once executed, is generally irrevocable, meaning the donor cannot take back the gift unless specific revocability conditions were included in the deed. It's important to carefully consider the gift since, once transferred, the property belongs to the donee.

What are the tax implications of using a Gift Deed?

The transfer of property through a Gift Deed may have tax implications, including potential liability for gift tax. The IRS allows an annual gift tax exclusion, and amounts above this exclusion may require the donor to file a gift tax return. Always consult with a tax professional to understand the specific implications for your situation.

Do I need a lawyer to create a Gift Deed?

While not strictly necessary, consulting a lawyer when drafting a Gift Deed is highly recommended. Legal expertise can ensure that the deed complies with state laws, addresses all necessary elements, and adequately protects the interests of both parties.

How does a Gift Deed differ from a Will?

A Gift Deed transfers property immediately and irrevocably, with the transfer taking effect during the donor's lifetime. In contrast, a Will is a document that outlines how a person’s property should be distributed after their death. Unlike a Gift Deed, the provisions in a Will do not take effect until after the donor's death.

Common mistakes

Filling out a Gift Deed form is a seemingly straightforward task, yet it's dotted with potential pitfalls that can significantly impact its validity and the intentions behind the gesture. One common mistake is the failure to thoroughly describe the gifted property. Specificity is key; a vague description can lead to disputes or even nullify the deed altogether. This is crucial for both tangible and intangible gifts, as it establishes a clear understanding of what's being transferred.

Another oversight is neglecting to explicitly state that the deed is a gift. A Gift Deed must clearly indicate that no consideration is expected or required in return. This differentiates it from a sale and is vital for the deed to be legally recognized as a gift. Without this clear statement, the deed's purpose and the parties' intentions can be misinterpreted, potentially leading to tax implications or disputes.

Not including the necessary legal language specific to Gift Deeds is a further mistake. Each state has varying requirements, and omitting essential legal terms or failing to comply with state-specific guidelines can render the deed invalid. Given the legal weight of the document, ensuring it meets all jurisdictional requirements is imperative.

A significant error often made is failing to properly execute the Gift Deed according to state laws. This generally involves witnessing and notarization, steps that formalize its authenticity. Skipping or incorrectly handling these formalities can leave the deed open to challenges regarding its legitimacy.

People sometimes forget to consider the tax implications of gifting. While the deed itself is a transfer of property without expectation of payment, there can be tax consequences for both the giver and the receiver. Not understanding or acknowledging these potential implications can lead to unexpected financial burdens.

Assuming that a Gift Deed resolves all matters of inheritance prematurely is an error. A gift made during the lifetime of the donor may reduce the donor’s estate, but without proper estate planning, it may not affect the distribution of the remainder of the estate as intended.

Another common misstep is not addressing the conditions under which the gift is made, if any. While most gifts are unconditional, in cases where conditions are intended, failing to explicitly state them can lead to legal disputes and confusion regarding the enforcement of said conditions.

Omitting the recipient’s acceptance of the gift in the deed is also a mistake. The acceptance is crucial, as it is a key element in the transfer of property. Without acknowledging acceptance within the document, there can be ambiguity regarding the completion of the gift transfer.

Finally, a frequent oversight is not updating the Gift Deed if circumstances change. As with any legal document, changes in the situation of the donor or recipient, the property, or relevant laws require updates to the deed to ensure its validity and relevance. Neglecting to do so can lead to issues in enforcing the deed as initially intended.

Documents used along the form

When you're dealing with the transfer of property through a gift deed, it's often just a part of a larger set of documents required to ensure a seamless and legally sound transfer process. These documents not only corroborate the details within the gift deed but also fulfill various legal requirements and jurisdictions, providing a thorough framework for any property transactions. Identifying and understanding these documents can help parties involved in the transfer process ensure completeness and compliance with legal standards.

- Real Estate Transfer Disclosure Statement: This is a mandatory document in many jurisdictions that provides detailed information about the property being transferred. It outlines any known material facts or defects that could affect the property's value or desirability.

- Title Search Report: Prior to transferring property, a title search is conducted to ensure that the title is clear of any encumbrances or liens. This report details the property’s ownership history, highlighting any potential legal issues that might impede the transfer.

- Property Tax Receipts: It's crucial to have recent property tax receipts when transferring property. These receipts serve as proof that all taxes have been paid up to date, ensuring no outstanding liabilities could affect the new owner.

- Homeowners’ Association (HOA) Documents: If the property is part of a community with a homeowners' association, the relevant HOA documents outlining the association’s rules, regulations, and financial statements must be reviewed and shared with the new owner.

- Proof of Identity: All parties involved in the property transfer must provide valid government-issued identification to prevent fraud and confirm their identities in legal documentation.

- Mortgage Payoff Information: If there's an existing mortgage on the property, detailed information about the mortgage balance and payoff requirements is necessary. This ensures the mortgage can be properly paid off or transferred in accordance with the lender’s conditions.

- Power of Attorney (if applicable): In cases where one of the parties cannot be present or wishes another individual to act on their behalf, a Power of Attorney grants that individual the legal authority to sign documents and make decisions regarding the property transfer.

These documents complement the Gift Deed form, paving the way for a transparent, secure, and legally binding property transfer. Each plays a unique but interconnected role in elaborating on the details of the property, the parties involved, and the terms of the transfer, ensuring that all aspects of the gift are properly documented and legally sound. Handling these documents with care and completeness is key to achieving a hassle-free property transfer process.

Similar forms

A gift deed form is closely related to a Will, as both pertain to the transfer of assets. While a gift deed allows an individual to give assets to another person during their lifetime, a Will specifies the distribution of the person’s assets after their death. Both legal documents clearly outline the donor's or testator's intentions regarding their possessions, ensuring a legally binding transfer and helping to prevent disputes among beneficiaries or recipients.

Like a Trust Deed, a gift deed is a mechanism for transferring ownership. A Trust Deed establishes a legal entity to hold property for the benefit of designated individuals, known as beneficiaries. The key similarity lies in the structured transfer of assets, albeit a Trust Deed often involves more complex management and stipulations governing the use and distribution of the assets, guided by the terms set by the grantor.

Power of Attorney (POA) documents share a foundational similarity with gift deeds, as they involve granting someone else the authority to act on your behalf. However, while a POA typically covers a broad range of powers, from financial decisions to healthcare directives, a gift deed focuses exclusively on the transfer of assets as a gift. Both require precision in drafting to ensure the donor’s or principal’s intentions are clear and legally protected.

A Real Estate Deed, much like a gift deed, is involved in the process of transferring property. The primary distinction between them lies in the conditions under which the transfer occurs: a Real Estate Deed is commonly used in the sale and purchase transactions, often involving an exchange of value. Conversely, a gift deed transfers property without consideration, based solely on the donor's wish to gift the property.

Another document similar to a gift deed is the Bill of Sale. Both serve the purpose of transferring ownership of assets from one individual to another. However, the Bill of Sale is predominantly used for the sale of personal property (e.g., vehicles, equipment, personal belongings) and involves a transaction where the buyer provides consideration or payment to the seller, contrasting with the gift deed’s nature of gratuitous transfer.

Finally, a Promissory Note shares traits with a gift deed in terms of documenting an agreement between two parties. A Promissory Note is an agreement for one party to pay another a specific sum, typically related to a loan or debt. While involving transactions, it contrasts with a gift deed’s purpose of transferring assets without the expectation of repayment. Both documents, however, are crucial for recording the terms of an agreement and establishing legal obligations or rights.

Dos and Don'ts

When preparing a Gift Deed, precision and clarity are paramount. Those preparing this document must navigate the process with care to avoid common pitfalls while ensuring the deed is legally sound and reflective of the parties' intentions. Below is a list of recommended do's and don'ts to guide you in completing a Gift Deed form.

- Do carefully review the form before you start entering information. Understanding the entirety of the document ensures you know the required details and can gather necessary information beforehand.

- Do ensure all involved parties are legally competent to participate. This includes verifying that the donor has the capacity to gift and that the recipient is capable of accepting the gift.

- Do accurately describe the property being gifted. A detailed description prevents ambiguity and future disputes over what was intended to be given.

- Do include any conditions or reservations associated with the gift. If the gift comes with certain terms, they must be explicitly stated in the document.

- Do ensure the document is signed in the presence of a notary public. A notarized signature adds a layer of legal legitimacy and authenticity to the deed.

- Don't leave any sections blank. If a section does not apply, it's wise to mark it as "N/A" (not applicable) instead of leaving it empty, to show that it was considered but found to be not relevant.

- Don't use unclear or ambiguous language. The clarity of the deed's language can prevent misunderstandings and enforceability issues in the future.

- Don't forget to check the document for errors before finalizing. Even minor mistakes can lead to major issues in interpreting the deed's intent and validity.

- Don't neglect to retain a copy of the signed and notarized document for personal records. Having your own copy ensures that you have evidence of the gift and its parameters.

Misconceptions

Gift Deeds are an important legal tool used for the transfer of property from one person to another as a gift. Despite their utility, there are several misconceptions regarding Gift Deeds that deserve clarification:

A Gift Deed is not necessary if the property is being given to a family member. This is a common misunderstanding. Regardless of the relationship between the donor (the person giving the gift) and the donee (the person receiving the gift), a formal Gift Deed is often required to legally transfer ownership of property. This document ensures that the transfer is recognized by law and can help prevent future disputes over the property's ownership.

Creating a Gift Deed is a complicated and expensive process. Many people believe that drafting a Gift Deed is both time-consuming and costly. However, the process can be relatively straightforward, especially with the assistance of a legal professional experienced in property law. While there may be costs involved, such as recording fees or taxes, the overall process can be less complicated and expensive than perceived, especially when considering the potential legal issues it helps avoid.

Gift Deeds are irrevocable. Another misconception is that once a Gift Deed is executed, it cannot be revoked. In truth, whether a Gift Deed can be revoked depends on the terms set out in the deed itself and the applicable state laws. Some Gift Deeds are created with the possibility of revocation, provided certain conditions are met. Therefore, it's important to understand the terms of the Gift Deed and consult with a legal professional to fully understand its revocability.

Taxes are not applicable on properties transferred via Gift Deeds. The belief that gifted property is exempt from taxes is widespread but incorrect. The tax implications for both the donor and the donee can vary significantly based on the value of the gift and the jurisdiction in which the transfer occurs. In some cases, gift tax may apply to the donor, while the donee may be subject to other taxes. It's crucial to consult with a tax professional to understand the specific tax obligations that may arise from a property transfer via a Gift Deed.

Key takeaways

A Gift Deed form is a legal document that facilitates the process of giving gifts, transferring ownership of property from one person to another without any exchange of money. The form serves as proof of this transfer and has specific requirements and considerations for it to be valid and effective. Here are key takeaways to consider when filling out and using a Gift Deed form:

- Complete Information: Ensure all required fields are accurately filled. This typically includes the full names and addresses of both the donor (the person giving the gift) and the donee (the person receiving the gift), a complete description of the gift, and any conditions attached to the gift.

- Legal Description of Property: If the gift is real estate, a legal description of the property must be included in the deed. This description is more detailed than a simple address and may require professional assistance to prepare.

- No Consideration: A Gift Deed should explicitly state that the donor is not receiving anything in return. In other words, the transfer is made "without consideration" to meet the legal definition of a gift.

- Voluntary Transfer: It must be clear that the transfer is made voluntarily and not under duress or undue influence.

- Signing Requirements: The donor must sign the Gift Deed in the presence of a notary public or other official witness to the signing. Requirements may vary by state, so it's crucial to understand local laws.

- Delivery and Acceptance: For a Gift Deed to be effective, it must be delivered to and accepted by the donee. In most cases, physical delivery of the deed document to the donee or their legal representative is required.

- Witnesses: Some states require the presence of witnesses during the signing of the Gift Deed, in addition to the notarization process.

- Filing with Local Authorities: Depending on the type of gift, especially in the case of real estate, the completed and signed Gift Deed may need to be filed with local government offices to be effective and to facilitate a change in public records.

- Gifting to Minors: If the gift is to a minor, consider establishing a trust or appointing a legal guardian to manage the property until the recipient reaches legal age.

- Revocability: Generally, a Gift Deed is irrevocable once delivered and accepted, meaning the donor cannot take back the gift. However, if the deed specifies conditions under which the gift is revocable, it must be clearly stated.

- Tax Implications: Understand the potential tax implications for both the donor and the donee. Depending on the value of the gift, the donor may be responsible for paying federal gift tax, and filing a gift tax return might be necessary.

Gifting property is a generous act with significant legal implications. A properly executed Gift Deed ensures the gift is legally recognized and protects the interests of both the giver and the receiver. Consulting with a legal professional can provide personalized advice and ensure that all legal requirements are met.

Consider More Types of Gift Deed Forms

Correction Deed Form California - An essential tool for estate planners and real estate professionals to ensure accurate and clear property titles.

Free Deed of Trust Template - In crafting a Deed of Trust, specificity in terms and conditions is crucial for ensuring all parties’ obligations and rights are well-defined.