Free Deed Form for Florida

In the complex world of real estate transactions, the Florida Deed form plays a critical role in the transference of property ownership. This document, though seemingly straightforward, encompasses a variety of legal requirements and subtleties that require careful attention. It serves not only as a testament to the sale and transfer of real estate but also as a safeguard for both the buyer and seller, ensuring that the rights and responsibilities of each party are clearly defined and protected. The form itself must adhere to specific state regulations, including the type of deed being executed—whether it’s a warranty, special warranty, or quitclaim deed—each offering different levels of protection and guarantees concerning the property title. Furthermore, the deed must accurately describe the property, include the names of all parties involved, and comply with Florida's signing and notarization requirements to be considered valid. These facets of the Florida Deed form underscore its importance in property transactions, serving not only as a formal record of sale but also as a critical legal instrument that impacts the parties involved in profound and lasting ways.

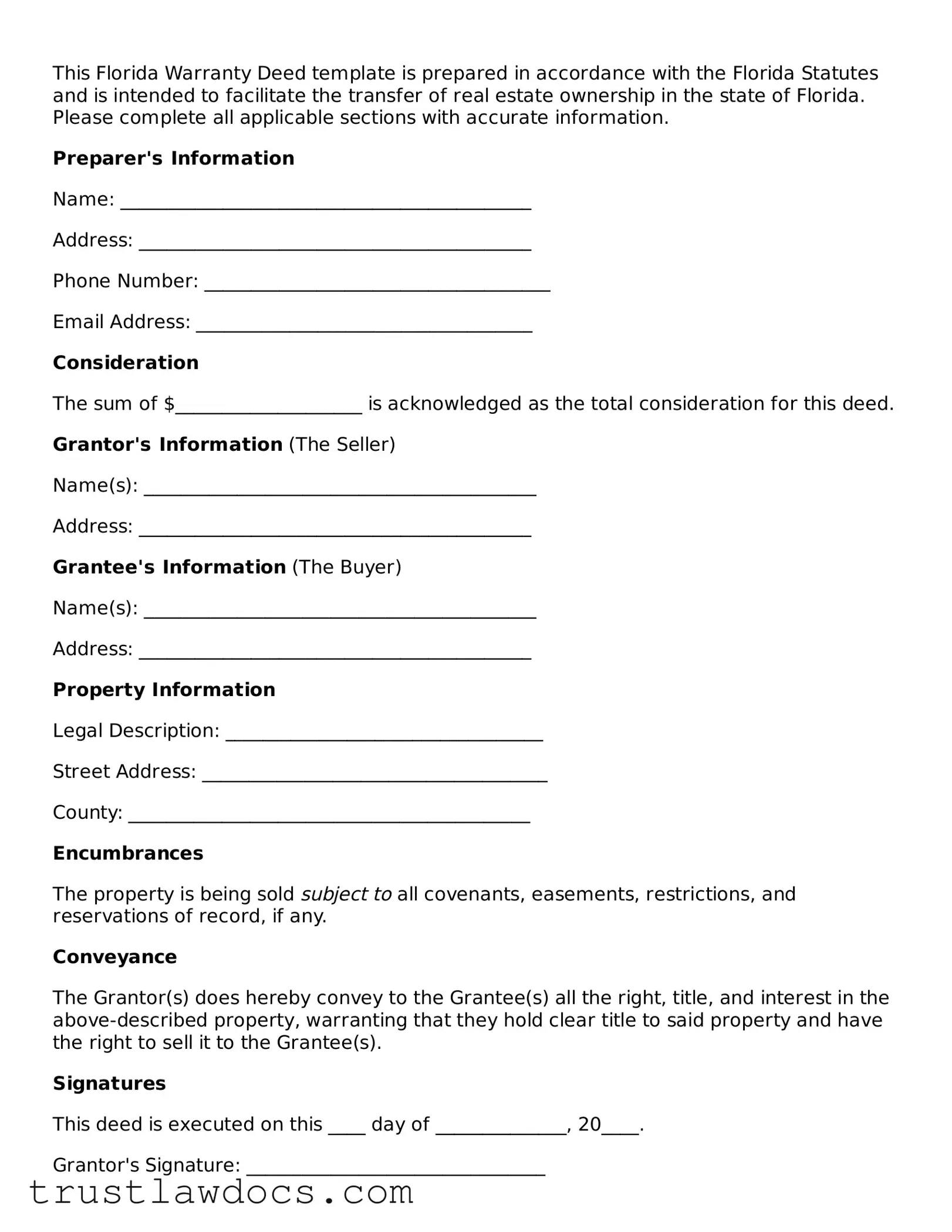

Form Example

This Florida Warranty Deed template is prepared in accordance with the Florida Statutes and is intended to facilitate the transfer of real estate ownership in the state of Florida. Please complete all applicable sections with accurate information.

Preparer's Information

Name: ____________________________________________

Address: __________________________________________

Phone Number: _____________________________________

Email Address: ____________________________________

Consideration

The sum of $____________________ is acknowledged as the total consideration for this deed.

Grantor's Information (The Seller)

Name(s): __________________________________________

Address: __________________________________________

Grantee's Information (The Buyer)

Name(s): __________________________________________

Address: __________________________________________

Property Information

Legal Description: __________________________________

Street Address: _____________________________________

County: ___________________________________________

Encumbrances

The property is being sold subject to all covenants, easements, restrictions, and reservations of record, if any.

Conveyance

The Grantor(s) does hereby convey to the Grantee(s) all the right, title, and interest in the above-described property, warranting that they hold clear title to said property and have the right to sell it to the Grantee(s).

Signatures

This deed is executed on this ____ day of ______________, 20____.

Grantor's Signature: ________________________________

Grantor's Printed Name: ____________________________

Grantee's Signature: _______________________________

Grantee's Printed Name: ___________________________

State of Florida

County of ____________________

On this ____ day of _______________, 20____, before me, the undersigned notary public, personally appeared ______________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ____________________________

Printed Name: _____________________________________

Commission Number: ________________________________

Expiration Date: _________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Type of Document | The Florida Deed form is a legal document used to transfer real estate ownership from the seller (grantor) to the buyer (grantee). |

| Governing Law | It is governed by Florida statutes, primarily Chapter 689, which outlines the specifics of conveying property. |

| Witness Requirement | In Florida, a deed must be signed in the presence of two witnesses to be legally valid. |

| Recording Requirement | After execution, the deed must be recorded with the County Recorder's Office in the county where the property is located to establish a public record. |

How to Write Florida Deed

Filling out a Florida deed form is a straightforward process that involves documenting the transfer of property from one party to another. This action is a crucial step in ensuring that your property rights are properly recorded and recognized by the state of Florida. The form requires detailed information about both the grantor (the person selling or transferring the property) and the grantee (the person receiving the property), as well as a precise description of the property being transferred. Following these steps carefully will help you complete the form accurately and efficiently.

- Begin by entering the full legal name(s) of the grantor(s). Ensure that the names are spelled correctly and match the names listed on the property's current deed.

- Input the complete legal name(s) of the grantee(s). As with the grantor(s), double-check the spelling and ensure consistency with any legal documents that list the grantee(s)' name(s).

- Write the mailing address of the grantee(s). This address is where future property tax bills and other important documents related to the property will be sent.

- Detail the consideration paid for the property. This is usually the purchase price or the value of the property being transferred. Even if the property is a gift, a nominal consideration amount, such as $10.00, is typically listed.

- Provide a full and accurate legal description of the property. This information can usually be found on the current deed or by consulting a property survey. It should include lot numbers, subdivision names, and any other details that uniquely identify the property.

- If applicable, mention any specific terms or conditions of the transfer. This part is not always necessary but can be used to outline any agreements or restrictions related to the use of the property.

- Sign and date the form in the presence of a notary public. The grantor(s) must sign the deed form, and their signatures must be notarized to verify authenticity.

- The form should then be submitted to the local county recorder’s office, along with any required filing fee. The recorder’s office will file the deed, making it part of the public record.

After submitting the deed form to the county recorder’s office, it is crucial to store a copy in a safe place. The recorded deed serves as proof of property ownership and is an essential document for future property transactions or legal matters. Should any questions arise during this process, consulting with a legal professional can provide clarity and ensure that everything is completed according to Florida law.

Get Answers on Florida Deed

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real estate in Florida from one person or entity to another. It contains details about the buyer, seller, and the property itself, ensuring the transaction is recorded and legally binding.

Are there different types of Deed forms in Florida?

Yes, Florida recognizes several types of Deeds, each serving different purposes. The most common include the Warranty Deed, which provides the highest level of protection for the buyer, and the Quitclaim Deed, used mainly to transfer property between family members or to clear title issues with less protection for the buyer.

How can I obtain a Florida Deed form?

Florida Deed forms can be obtained from several sources, including local government offices, online legal services, or by consulting with a real estate attorney. Ensure the form complies with Florida state laws to be valid.

What information is required to complete a Deed form in Florida?

To complete a Deed form in Florida, you generally need to provide the legal description of the property, the names and addresses of both the seller (grantor) and the buyer (grantee), and the sale price. The Deed must also be signed by the grantor in the presence of a notary public and, in most cases, a witness.

Is a lawyer needed to transfer property in Florida?

While it is not legally required to have a lawyer to transfer property in Florida, consulting with one is highly recommended. Real estate transactions can be complex, and a lawyer can ensure that the Deed complies with all legal requirements, advise on potential issues, and provide peace of mind.

How is a Florida Deed form recorded?

After the Deed has been properly executed, it must be recorded with the Clerk of the Circuit Court in the county where the property is located. Recording the Deed provides public notice of the property transfer and is necessary for the transaction to be considered complete and legally binding.

Can I transfer property to a family member using a Florida Deed form?

Yes, property can be transferred to a family member using a Florida Deed form. The Quitclaim Deed is often used for this purpose as it is simpler and involves less warranty about the property's title. However, it's important to consider the implications of such a transfer, including potential tax liabilities and how it might affect estate planning.

Do I need to pay taxes when using a Florida Deed to transfer property?

Yes, transferring property using a Deed in Florida may be subject to taxes, including documentary stamp taxes, which are calculated based on the property's sale price or value. Additionally, if the transfer is not exempt, other taxes, such as capital gains tax, may apply. It's advisable to consult with a tax professional to understand all potential tax liabilities.

Common mistakes

When filling out the Florida Deed form, a common mistake made is inaccurately identifying the property. This mistake can have significant implications on the legal transfer of the property. The property description must be detailed and include any and all legal descriptions that are available, such as the lot and block number if the property is in a platted subdivision or a metes and bounds description for unplatted land. A simple address is not sufficient for legal purposes because it does not provide the specificity required to unequivocally identify the property.

Another frequent error is failing to properly execute the deed according to Florida law. This includes ensuring that all people required to sign the deed do so in front of a notary public and, if applicable, witnesses. Florida laws are specific about the execution of deeds, insisting on the presence of two witnesses alongside a notary to confirm the signatory's identity and willingness to sign the document voluntarily. Overlooking this requirement can render the deed void and lead to complications in the official recording of the document.

Incorrectly listing the grantee’s name or failing to provide necessary information about the grantee is yet another mistake. The grantee is the person or entity receiving the property. If a grantee's name is misspelled or incorrectly recorded, it could complicate or delay future transactions involving the property. Additionally, it is crucial to specify the manner in which co-grantees, if there are any, will hold the property. This could be as tenants in common, joint tenants with the right of survivorship, or in some cases, as tenants by the entirety. Not clarifying this can lead to uncertainty or disputes regarding ownership and survivorship rights.

Last but not least, neglecting to record the deed with the Florida county clerk's office is a critical error. Recording acts as a public notice of the transfer of property and protects the grantee's interests. Without recording, the transfer might not be recognized against subsequent purchasers or creditors. Moreover, it is during the recording process that any documentary stamp taxes due on the transfer are calculated and paid. These taxes are based on the sale price or fair market value of the property, and failure to accurately pay them can result in fines and penalties.

Documents used along the form

When transferring property in Florida, the deed form is just one of several important documents that may be needed to ensure a smooth and legally compliant transaction. Beyond the deed itself, which legally transfers ownership from one party to another, there are other forms and documents that play critical roles in the process. Here is a list of up to seven additional forms and documents commonly used alongside the Florida Deed form, each serving a unique purpose in the property transfer process.

- Promissory Note: This document outlines the terms of any loan involved in the property purchase, including the repayment schedule, interest rate, and what happens in the event of a default. It's crucial when the property purchase involves seller financing.

- Mortgage: A mortgage document secures the loan on the real property. It grants the lender a lien on the property as security for the loan, which is lifted once the loan is fully repaid.

- Title Insurance Commitment: Before finalizing a property transfer, a title insurance commitment is often required. This document outlines the terms under which a title insurance policy will be issued, protecting the buyer and lender from potential title issues.

- Closing Disclosure: For most residential property sales involving a loan, a closing disclosure is required. It provides detailed financial information about the mortgage loan, including the interest rate, monthly payments, and closing costs.

- Property Appraisal: This document provides an estimate of the property's value. Lenders typically require an appraisal to ensure the property's value supports the loan amount.

- Survey: A property survey shows the boundaries, structures, and improvements on the land. It can reveal potential issues, such as encroachments, that might need to be addressed before the sale is finalized.

- Seller’s Disclosure: This form is provided by the seller and discloses known defects with the property. It is an important document that informs the buyer about the condition of the property, including any known issues or past repairs.

Each of these documents complements the Florida Deed form by addressing different aspects of the property transfer process, from financing and legal protection to the physical condition of the property. Together, they provide a comprehensive framework that helps ensure all parties are informed and protected during the transaction. Whether you are a buyer, seller, or involved in the transaction in another capacity, understanding these documents and their roles can help facilitate a smoother property transfer experience.

Similar forms

The Florida Deed form bears similarity to a Warranty Deed, primarily in its function to legally transfer ownership of real property from one person to another. Both documents serve as binding agreements that assure the buyer receives a clear title, free from liens or other encumbrances. The Warranty Deed goes a step further by providing guarantees from the seller to the buyer against any title claims or issues arising from past ownership periods, offering an extra layer of protection for the buyer.

Comparable to Quitclaim Deeds, the Florida Deed form facilitates the conveyance of real estate interests from the grantor to the grantee. However, Quitclaim Deeds differ in the extent of protection they offer the recipient. These documents do not guarantee a clear title; they simply transfer whatever interest the grantor has in the property, if any. This makes Quitclaim Deeds particularly useful in transactions among familiar parties, such as family members, where trust levels are high and the property history is known.

Akin to a Grant Deed, the Florida Deed form provides a method for transferring property ownership, with the grantor implying certain promises related to the title. These promises include the assertion that the property has not been sold to someone else and that it is free from undisclosed encumbrances during the grantor's period of ownership. This comparison highlights the Grant Deed's role in assuring the grantee of the quality of the title being transferred, aligning it closely with the protection levels offered by the Florida Deed form.

The Florida Deed form is also similar to Trust Deeds in terms of involving property transactions. Trust Deeds are used to secure a real estate property as collateral for a loan, involving three parties: the borrower (trustor), the lender (beneficiary), and the trustee, who holds the property title until the loan is repaid. While Trust Deeds are primarily associated with financing arrangements and involve a temporary transfer of title, both Trust Deeds and the Florida Deed form engage in the legal framework of handling real property titles, shaping the rights and responsibilities of involved parties.

Dos and Don'ts

When filling out a Florida Deed form, ensuring accuracy and thoroughness is crucial. The deed is a legal document that signifies the transfer of property from one party to another. To assist with this process, here are essential dos and don'ts to keep in mind:

Do:- Ensure all names are spelled correctly and match the names on the official property records. Discrepancies in names can lead to complications in the property transfer process.

- Include the correct legal description of the property. This description is typically detailed and should match the one used in previous deeds or the one on file with the county recorder's office.

- Use the correct deed form for the type of transfer you are completing. Florida has different forms for warranty deeds, special warranty deeds, and quitclaim deeds. Each serves a different purpose.

- Have all parties sign the deed in the presence of a notary public. The notarization process is a legal requirement for the deed to be considered valid.

- File the completed deed with the appropriate county office. In Florida, this is usually the Clerk of the Circuit Court in the county where the property is located. Filing the deed is necessary for the transfer to be officially recorded.

- Retain copies of the filed deed for personal records. It's important to have your own copy for reference or in case of disputes in the future.

- Leave any fields blank. Incomplete forms may be rejected or cause legal issues down the line. If a section does not apply, consider marking it as "N/A" (not applicable).

- Attempt to alter the deed after it has been notarized. Any changes made post-notarization can void the document or necessitate a complete redo of the process.

- Use informal language or nicknames. Always use the full legal names and descriptions as they appear in official documents related to the property.

- Forget to check local county requirements. Some counties may have additional forms or steps that need to be taken in conjunction with the deed form.

- Overlook the requirement for witness signatures. Florida law often requires the presence of witnesses in addition to the notary public for the deed to be legally binding.

- Ignore tax implications. Transferring property can have tax consequences. It is advisable to consult with a tax professional to understand any potential liabilities.

By following these guidelines, individuals can navigate the complexities of transferring property in Florida with confidence, ensuring that their legal documents are complete, valid, and filed correctly.

Misconceptions

When it comes to transferring property in Florida, the deed form is a crucial document. However, several misconceptions surround its use and requirements. Understanding these misconceptions can help make the property transfer process smoother and more straightforward.

All deed forms in Florida are the same. This is a common misconception. Florida has several types of deeds, including warranty deeds, special warranty deeds, and quitclaim deeds. Each type offers different levels of protection for the buyer, and the choice depends on the specific circumstances of the property transfer.

A notary’s signature is all that's needed to make a Florida deed legally binding. While it's true that a notary's signature is required, it's not the only necessity. The deed also needs to be signed by the grantor (the person transferring the property) and, in some cases, by the grantee (the recipient). Additionally, the deed must be delivered to and accepted by the grantee to be effective.

You can transfer property in Florida using a deed form found online without any legal advice. Although it's possible to find Florida deed forms online, using them without legal guidance can be risky. Property transfers can involve complex legal issues, and a generic form may not cover all specifics or legal requirements of a particular situation. Consulting with a legal professional can help avoid costly mistakes.

Adding someone's name to your property deed is an easy way to ensure they inherit your property. While adding a loved one’s name to your property deed might seem like an easy way to plan for the future, it can have unexpected legal and tax implications. For example, this action could trigger gift tax consequences, affect eligibility for certain types of financial aid, and even expose the property to the added person's creditors. Careful estate planning with a professional is advisable over simple deed modifications.

Key takeaways

Filling out and using the Florida Deed form requires attention to detail and a clear understanding of the document's importance. This legal instrument is pivotal in the process of transferring property ownership, and doing it correctly ensures a smooth transition and secures the rights of the new owner. Here are eight key takeaways to consider:

- Correct Information is Crucial: Ensuring that all details, including the legal names of the buyer and seller (grantor and grantee), the legal description of the property, and the parcel identification number, are accurate is essential. Incorrect information can invalidate the deed.

- Choose the Right Type of Deed: Florida recognizes several types of deeds, including warranty, special warranty, and quitclaim deeds. Each serves different purposes and offers varying levels of protection for the buyer, so selecting the appropriate type is vital.

- Notarization is Mandatory: The signatures of the parties involved must be notarized for the deed to be valid. This step is fundamental in verifying the authenticity of the document.

- Witness Requirements: Florida law requires the presence of two witnesses when signing the deed. This is in addition to the need for a notary public, reinforcing the document's legitimacy.

- Consider the Need for a Lawyer: While it is possible to complete the deed form without legal assistance, consulting with a lawyer can provide valuable insight, especially regarding complex legal descriptions or ensuring that the deed conforms to current laws.

- Recording is Essential: After completing the deed, it must be recorded with the county recorder's office in the county where the property is located. Recording the deed makes it part of the public record and protects the new owner's interests.

- Understand the Tax Implications: Transferring property may have tax implications for both the grantor and grantee. It's important to understand these implications, including potential transfer taxes, to avoid unexpected costs.

- Effect on the Title: Executing and recording a deed changes the title of the property. It's crucial to ensure that the title is clear and that the deed accurately reflects the new ownership to prevent future disputes.

By keeping these key takeaways in mind, individuals involved in the transfer of property in Florida can better navigate the process, ensuring that all legal requirements are met and that the transition of ownership is executed smoothly.

Popular Deed State Forms

Indiana Quit Claim Deed Form - It can specify conditions under which the property is transferred, such as the payment of a certain sale price.

How to Get a Copy of My House Deed - Sometimes a deed form will include warranty clauses that provide guarantees about the property's condition and the validity of the title.