Official Deed of Trust Document

Embarking on the journey of property ownership often leads one to encounter various legal documents, among which the Deed of Trust form stands out due to its pivotal role in real estate transactions. This form serves as a linchpin in the world of property finance, effectively securing a real estate loan by involving a third party to hold the title until the borrower has repaid the loan in full. It's a fascinating document that not only facilitates the traditional buying and selling of properties but also ensures that all parties involved are safeguarded throughout the process. Understanding the nuances and major aspects of the Deed of Trust is crucial for anyone navigating the complex terrain of real estate investments or transactions. It operates under a tri-party agreement, making it distinct from other forms of property deeds. The intricate interplay between the borrower, lender, and trustee, each with their specific roles and responsibilities, creates a secure environment for property-related transactions. Whether you're a first-time homebuyer, a seasoned investor, or simply keen on understanding how property transactions work, delving into the mechanics of the Deed of Trust form unveils an essential layer of knowledge that adds clarity and confidence to the process.

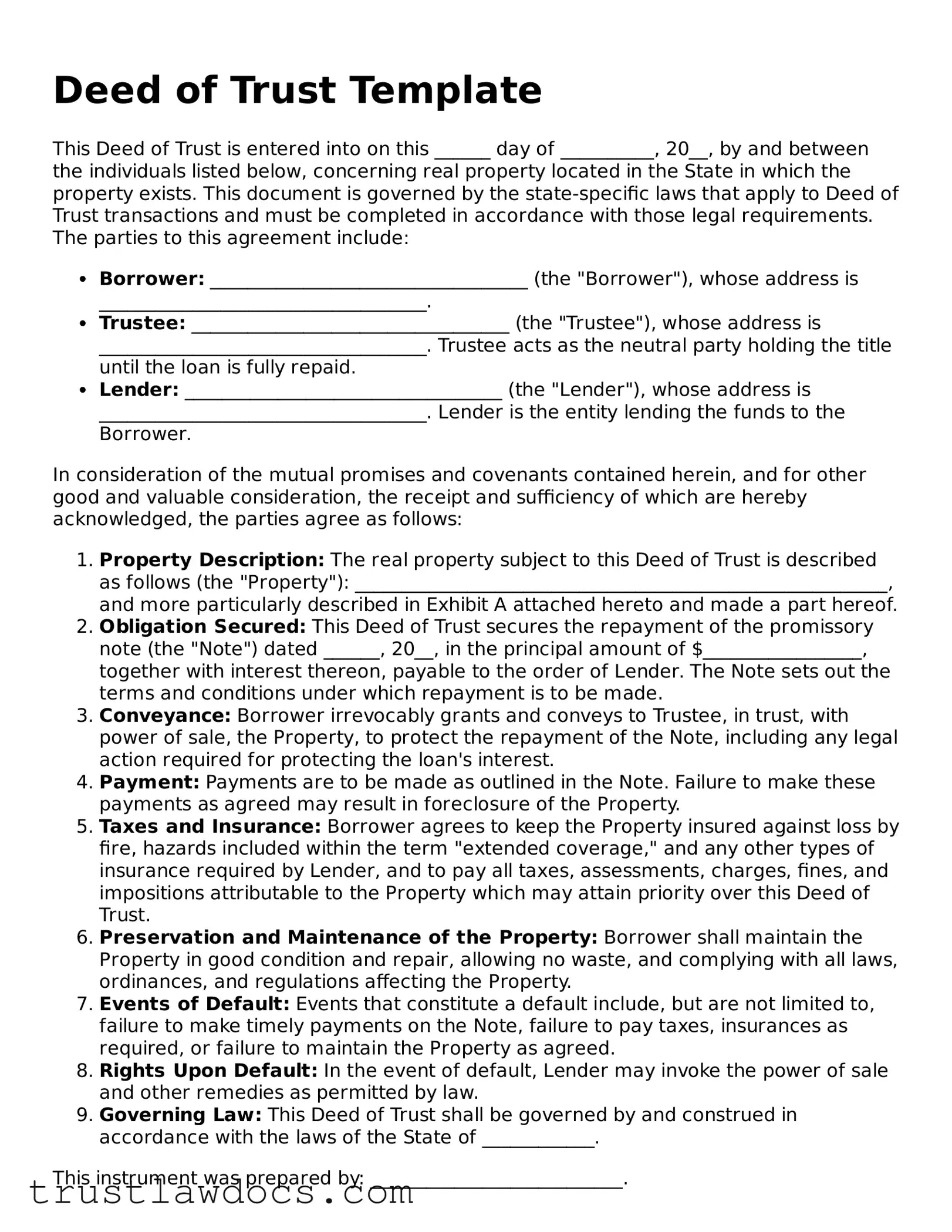

Form Example

Deed of Trust Template

This Deed of Trust is entered into on this ______ day of __________, 20__, by and between the individuals listed below, concerning real property located in the State in which the property exists. This document is governed by the state-specific laws that apply to Deed of Trust transactions and must be completed in accordance with those legal requirements. The parties to this agreement include:

- Borrower: __________________________________ (the "Borrower"), whose address is ___________________________________.

- Trustee: __________________________________ (the "Trustee"), whose address is ___________________________________. Trustee acts as the neutral party holding the title until the loan is fully repaid.

- Lender: __________________________________ (the "Lender"), whose address is ___________________________________. Lender is the entity lending the funds to the Borrower.

In consideration of the mutual promises and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Property Description: The real property subject to this Deed of Trust is described as follows (the "Property"): _________________________________________________________, and more particularly described in Exhibit A attached hereto and made a part hereof.

- Obligation Secured: This Deed of Trust secures the repayment of the promissory note (the "Note") dated ______, 20__, in the principal amount of $_________________, together with interest thereon, payable to the order of Lender. The Note sets out the terms and conditions under which repayment is to be made.

- Conveyance: Borrower irrevocably grants and conveys to Trustee, in trust, with power of sale, the Property, to protect the repayment of the Note, including any legal action required for protecting the loan's interest.

- Payment: Payments are to be made as outlined in the Note. Failure to make these payments as agreed may result in foreclosure of the Property.

- Taxes and Insurance: Borrower agrees to keep the Property insured against loss by fire, hazards included within the term "extended coverage," and any other types of insurance required by Lender, and to pay all taxes, assessments, charges, fines, and impositions attributable to the Property which may attain priority over this Deed of Trust.

- Preservation and Maintenance of the Property: Borrower shall maintain the Property in good condition and repair, allowing no waste, and complying with all laws, ordinances, and regulations affecting the Property.

- Events of Default: Events that constitute a default include, but are not limited to, failure to make timely payments on the Note, failure to pay taxes, insurances as required, or failure to maintain the Property as agreed.

- Rights Upon Default: In the event of default, Lender may invoke the power of sale and other remedies as permitted by law.

- Governing Law: This Deed of Trust shall be governed by and construed in accordance with the laws of the State of ____________.

This instrument was prepared by: ___________________________.

IN WITNESS WHEREOF, the parties have executed this Deed of Trust on the date first written above.

__________________________________

Borrower Signature

__________________________________

Trustee Signature

__________________________________

Lender Signature

State of ________________

County of _______________

On this ______ day of __________, 20__, before me, _____________________, a notary public, personally appeared ____________________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

__________________________________

Notary Public

My Commission Expires: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that essentially serves as security for a loan involving real property. It legally transfers the title of real property to a trustee, who holds it as security for a loan between a borrower and lender. |

| Parties Involved | Three key parties are involved in a Deed of Trust: the Trustor (borrower), the Beneficiary (lender), and the Trustee, who holds the real property's title until the loan is repaid in full. |

| Comparative Instrument | While similar to a mortgage, a Deed of Trust involves an additional party, the Trustee, making it distinct. The Trustee's role is to facilitate the transfer of the property title back to the borrower upon repayment or execute the sale of the property in the event of default. |

| State Specifics | Deeds of Trust are not used in all states. They are more common in western states of the U.S. Each state that does use them has specific governing laws and requirements for their format and execution. |

| Governing Law | For states that utilize Deeds of Trust, the governing law can vary significantly. It's crucial to reference the specific state statutes and regulations that apply to the drafting and execution of a Deed of Trust in the relevant state. |

| Foreclosure Process | In cases of default, a Deed of Trust often allows for a non-judicial foreclosure process. This means the trustee may sell the property without obtaining a court order, making the process quicker and less expensive than judicial foreclosures. |

| Recording Requirement | Like most real estate documents, a Deed of Trust must be recorded with the local county recorder or land registry office. This public recording serves to notify any interested parties of the legal interest in the property. |

How to Write Deed of Trust

After deciding to secure a loan with property, one important step is filling out a Deed of Trust. This document serves as a pledge, stating that the property is being held as security for a loan. It's pivotal to fill out this form meticulously to ensure all details are recorded correctly. This outlines who holds the property and under what conditions it can be sold if the loan is not repaid as agreed. The process may sound daunting, but by breaking it down step by step, it can be straightforward and manageable.

- Gather the Required Information: Before beginning, make sure you have all necessary details such as the legal names of all parties involved (borrower, lender, trustee), the legal description of the property, and the loan amount.

- Enter the Date: Start by entering the date at the top of the form. This records when the agreement was made.

- List the Parties Involved: Fill in the names and addresses of the borrower(s) and lender. If there's a trustee, include their information as well.

- Describe the Property: Provide the full legal description of the property being used as security. This should match the description used in property records to avoid any confusion.

- State the Loan Amount: Clearly write out the amount of money being loaned. This should also include any interest rates or other conditions attached to the loan repayment.

- Include Promissory Note Details: Mention any promissory note related to the loan. Detail the repayment schedule, interest rates, and any other relevant information.

- Define the Trustee's Role: Clarify the trustee's duties and powers. This may include how and when they can sell the property if the loan terms aren't met.

- Sign the Document: All parties involved—the borrower(s), lender, and trustee—must sign the form. Depending on your state, you might also need a witness or notary public to sign.

- Record the Document: After everyone has signed, submit the Deed of Trust to the local county recorder's office. This publically acknowledges the trust deed and secures the interest in the property.

Once the form is completed and recorded, the legal framework for managing the loan with the property as security is in place. It's essential to keep a copy of the Deed of Trust for your records. If you're ever unsure about how to fill out the form correctly, seeking advice from a legal consultant can help ensure everything is done properly.

Get Answers on Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a document that plays a crucial role in the financing of real estate. Essentially, it involves three parties: the borrower (also known as the trustor), the lender (beneficiary), and a neutral third party (trustee). The borrower transfers the property title to the trustee, who holds it as security for the loan provided by the lender. Once the loan is fully repaid, the trustee transfers the title back to the borrower. If the borrower fails to comply with the terms of the loan, the trustee has the authority to sell the property to repay the debt.

How does a Deed of Trust differ from a Mortgage?

Although both a Deed of Trust and a Mortgage serve as security for a loan and involve a borrower and a lender, they have a significant difference in the number of parties involved and the process for handling a default. A mortgage involves only two parties, the borrower and the lender, and in the case of default, the lender must go through the court system to foreclose on the property. On the other hand, a Deed of Trust involves a third party, the trustee, who holds the legal title to the property and can facilitate faster foreclosure outside of court if the borrower defaults.

Who can act as a Trustee in a Deed of Trust?

In a Deed of Trust, the trustee must be a neutral third party. Typically, this could be a title company or a legal professional who is not directly involved in the loan agreement. The primary role of the trustee is to hold the property title as security for the debt and to act on behalf of the beneficiary (lender) should the borrower default on the loan. The trustee has the responsibility of selling the property through a non-judicial foreclosure process, should it become necessary.

What happens when the loan secured by a Deed of Trust is paid off?

When the borrower pays off the loan in full, a critical step is for the trustee to issue a document called a "Reconveyance Deed." This document legally transfers the property title from the trustee back to the borrower, releasing the lien on the property. The process officially confirms that the debt has been satisfied and the borrower owns the property free and clear of the original loan's obligations.

Is it possible to refinance a loan secured by a Deed of Trust?

Yes, refinancing a loan secured by a Deed of Trust is possible. When a borrower decides to refinance, the new loan pays off the existing debt, effectively replacing it. The process involves creating a new Deed of Trust for the new loan, which also means the original loan's trustee must be replaced with a trustee for the new loan. The terms, including the identity of the trustee and any other specifics, may change in accordance with the new loan agreement.

Common mistakes

One common mistake made when filling out the Deed of Trust form is overlooking the accurate legal description of the property. This description goes beyond just the street address; it includes the lot number, subdivision, and other legal identifiers as recorded in public records. Failure to include this precise information can lead to disputes regarding the property covered under the deed.

Another error often seen is not correctly identifying all parties involved. The trust deed should clearly state the names of the trustor (borrower), beneficiary (lender), and trustee (the neutral third party). If any party is mistakenly omitted or misidentified, it could invalidate the agreement or complicate future legal proceedings.

Many individuals mistakenly believe that filling out the form by hand is acceptable. However, most jurisdictions require the deed to be typed to avoid confusion or misinterpretation caused by illegible handwriting. This requirement ensures that all the information on the deed is clear and accessible to all parties and public records officials.

Not securing all necessary signatures is another frequent oversight. The Deed of Trust form must be signed by all parties involved, including witnesses or a notary public, depending on the state laws. Neglecting to have the document properly signed makes the deed legally unenforceable.

Failure to adhere to state-specific requirements can also be a major roadblock. Each state has its own set of rules regarding the execution of a Deed of Trust, including specific disclosures, notarization standards, and even the color of ink used for signing. Ignoring these requirements can result in a deed that is void or unacceptable for recording with the county.

Lastly, an often-overlooked mistake is not recording the deed with the appropriate local government office after completion. For a Deed of Trust to be fully effective and to provide public notice of its existence, it must be recorded in the county where the property is located. Failing to do so can lead to future legal complications, including disputes over property ownership.

Documents used along the form

In the process of securing a real estate transaction, especially when it involves obtaining a loan, a variety of legal forms and documents come into play along with the Deed of Trust. The Deed of Trust is an essential document that signifies the borrower's agreement to put their property as security for a loan. However, it does not exist in isolation. Other forms and documents are crucial for providing comprehensive legal protection and clarity to all parties involved in the transaction. Here is a list of five such documents often used in conjunction with the Deed of Trust:

- Promissory Note: This is a crucial document that complements the Deed of Trust. It outlines the borrower's promise to repay the loan under the agreed terms and conditions, including the loan amount, interest rate, repayment schedule, and actions to be taken in case of default.

- Loan Estimate: This document is provided by the lender to the borrower and outlines the estimated costs associated with the loan. The Loan Estimate includes information regarding interest rates, monthly payments, and the total closing costs for the loan, thus giving borrowers a clear view of their financial commitment.

- Closing Disclosure: This form is a follow-up to the Loan Estimate and is given to the borrower at least three business days before closing on the loan. It details the final transaction costs, ensuring that the borrower is aware of all expenses and terms before the completion of the transaction.

- Title Insurance Policy: To protect against any issues with the property's title, a Title Insurance Policy is crucial. This policy safeguards both the lender and the borrower from potential losses arising from undiscovered defects in the property's title, such as fraud, encumbrances, or liens that were not identified during the initial title search.

- Homeowners Insurance Policy: Lenders require borrowers to obtain a Homeowners Insurance Policy as part of the loan agreement. This policy covers damages to the property, personal liability, and sometimes even living expenses in case the property becomes uninhabitable due to certain covered risks.

Together with the Deed of Trust, these documents form a comprehensive framework that ensures the legal and financial aspects of the real estate transaction are well-documented and clear to all parties involved. By securing these documents, parties can confidently navigate the complexities of property transactions, protecting their interests and adhering to legal requirements.

Similar forms

A Mortgage Agreement is closely related to a Deed of Trust, as both serve to secure a loan using real estate as collateral. The main difference lies in the number of parties involved and the foreclosure process in the event of default. A Mortgage Agreement involves two parties, the borrower and the lender, whereas a Deed of Trust includes an additional party, the trustee, who holds the legal title to the property until the loan is repaid. In a foreclosure situation, a Mortgage typically requires judicial intervention, while a Deed of Trust allows for non-judicial foreclosure, making the process faster and less expensive.

A Promissory Note is another document similar to a Deed of Trust. It outlines the borrower's promise to pay back the loan to the lender but does not by itself secure the loan with real property. Instead, it often accompanies a Deed of Trust or Mortgage Agreement, which serves as the security instrument. The Promissory Note details the loan's terms, such as the interest rate, repayment schedule, and consequences of default, making it a crucial document in the lending process.

A Land Contract shares similarities with a Deed of Trust in that it also involves purchase financing secured by real estate. However, under a Land Contract, the seller finances the buyer's purchase without a traditional lender, and the title remains in the seller's name until the full purchase price is paid. Only then is the deed transferred to the buyer. This contrasts with a Deed of Trust, where the title can be held by a trustee from the beginning of the agreement.

A Security Agreement, comparable to a Deed of Trust, is used to secure a loan with collateral, although it is not limited to real estate and can include other types of assets, such as vehicles or equipment. The borrower grants the lender a security interest in the specified assets as security for the loan. Similar to how a Deed of Trust operates, if the borrower defaults on the loan, the lender may seize the collateral through a specified process. The main difference is in the type of collateral used to secure the loan.

A Lease with Option to Purchase Agreement bears resemblance to a Deed of Trust in terms of involving real estate transactions, but it differs in purpose and structure. This agreement allows a tenant to rent a property with the option to buy it later, typically within a specified period at an agreed-upon price. Like a Deed of Trust, it involves a contractual relationship related to real estate, but while a Deed of Trust secures a loan on the property, a Lease with Option to Purchase facilitates a potential future sale.

Dos and Don'ts

Filling out a Deed of Trust form is a critical step in securing a mortgage or loan against real estate. Ensuring accuracy and completeness in this document is essential for protecting the interests of all parties involved. Below is a guide to what you should and shouldn't do when completing this form:

Do:- Review the form thoroughly before starting to fill it out. Understanding each section can prevent mistakes and oversights.

- Use clear, legible handwriting if filling out the form by hand or ensure typed information is correctly formatted and easy to read.

- Verify the legal description of the property. This should match the description on the title and any other legal documents to avoid discrepancies.

- Include all necessary parties in the agreement. The trust deed involves not just the borrower and the lender but also the trustee.

- Double-check the details. Ensure that names, addresses, loan amounts, and other critical information are accurate.

- Attach any required additional documentation. Sometimes, attachments or exhibits are necessary to fully outline the terms or conditions.

- Consult with a professional if in doubt. A real estate lawyer or a qualified professional can offer invaluable advice and guidance.

- Rush through the form without understanding each section's relevance and necessity.

- Leave blanks on the form. If a section does not apply, mark it with N/A (not applicable) instead of leaving it empty.

- Use informal language or abbreviations that could be misunderstood or unrecognized in a legal context.

- Forget to date and sign the document. Unsigned or undated documents may not be legally binding.

- Overlook the need for notarization. Many deeds of trust require notarization to be considered valid and enforceable.

- Ignore jurisdictional requirements. Some states or counties may have specific rules or formats for deeds of trust that must be followed.

- Assume one size fits all. Deeds of trust can vary significantly based on the type of loan, the property, and the involved parties.

Misconceptions

The Deed of Trust form is often surrounded by various misconceptions, leading individuals to misunderstand its function and requirements. Highlighting some of these misconceptions can help provide clarity and accuracy in how this document is perceived and used.

It's the same as a mortgage. A common misconception is that a Deed of Trust is identical to a mortgage. While both serve as security for a loan on real property, their processes differ significantly. A mortgage involves two parties (the borrower and the lender), while a Deed of Trust includes an additional party, the trustee, who holds the property's title until the loan is paid off.

Only beneficial in certain states. Some believe that a Deed of Trust is only beneficial or applicable in certain states. In reality, whether a Deed of Trust can be used depends on state law, but its benefits, such as potentially faster foreclosure processes, can be advantageous in the states where it's permissible.

It transfers full ownership to the lender. Another misunderstanding is that signing a Deed of Trust transfers full ownership of the property to the lender. However, the legal title is actually held by the trustee until the borrower fulfills the loan obligations, at which point the borrower secures full title to the property. The equitable title, or the right to obtain full ownership, remains with the borrower throughout the loan term.

Changing trustees is a complex process. Changing the trustee named in a Deed of Trust is often thought to be a complex and cumbersome process. Although the procedure can vary by state and the specific terms of the trust deed, it generally involves a formal appointment by the lender and acknowledgment by the borrower, demonstrating that with the proper legal advice and documentation, it can be a straightforward process.

Key takeaways

Working with a Deed of Trust form might seem daunting, but it's a crucial step in securing a real estate transaction. This document not only lays the groundwork for the agreement between a borrower and a lender but also ensures that a neutral third party is involved to manage the property title until the loan is fully paid. Here are some key takeaways to help guide you through the process:

- Understand the Parties: Knowing who's who in the Deed of Trust is fundamental. The 'trustor' is the borrower, the 'beneficiary' is the lender, and the 'trustee' is the neutral third party holding the title in trust.

- Accuracy is Key: Double-check the details. From personal information to the legal description of the property, ensuring every piece of information is accurate cannot be overstated.

- Legal Requirements Vary: Requirements can differ significantly from one jurisdiction to another. It’s important to familiarize yourself with local laws to ensure your Deed of Trust complies.

- Honor Terms and Conditions: The document will spell out the loan amount, interest rate, payment schedule, and other conditions. Familiarize yourself with these terms, as they will govern your obligations and rights.

- Safeguarding the Physical Document: Once signed, the Deed of Trust becomes a critical document. Make sure it is safely filed with the relevant local government office, usually the county recorder, to make it a public record.

- Preparation and Signing: Preparation of the document should be done with care, often requiring professional assistance to ensure legality and completeness. All parties must sign the Deed of Trust for it to be effective.

- Consequences of Default: Understand what happens if the borrower fails to meet their obligations. The Deed of Trust outlines the process, generally allowing the trustee to sell the property to pay off the debt.

- Release Upon Satisfaction: When the loan is fully repaid, the borrower should ensure that a deed of reconveyance is filed, releasing the lien on the property and transferring the title back from the trustee to the trustor (borrower).

Handling a Deed of Trust with the seriousness and precision it demands will help protect the interests of all parties involved and ensure a smoother transaction process.

Consider More Types of Deed of Trust Forms

Correction Deed Form California - Mitigates risk by correcting errors that could potentially void a transaction or cause legal disputes.