Free Deed in Lieu of Foreclosure Form for Texas

In Texas, homeowners facing the daunting prospects of foreclosure have various avenues to consider, one of which is executing a Deed in Lieu of Foreclosure. This legal document represents a consensual agreement between a borrower and lender, where the borrower voluntarily transfers ownership of their property to the lender to satisfy a loan that's in default, thereby avoiding the foreclosure process. It's a critical tool for individuals seeking to mitigate the financial and emotional tolls of foreclosure, offering a path that can ultimately preserve credit scores compared to traditional foreclosure proceedings. The form itself, fundamental for this process, outlines the terms under which this transfer occurs, detailing the relinquishment of the property rights by the homeowner in favor of the mortgagee. It’s imperative for those considering this option to understand not just the immediate benefits but also the potential consequences, including tax implications and the lender’s policies on pursuing any deficiency judgments post-transfer. Given its complexities and the significant legal ramifications, consulting with a legal professional before proceeding is highly advised to navigate the process effectively and ensure all parties' rights are protected.

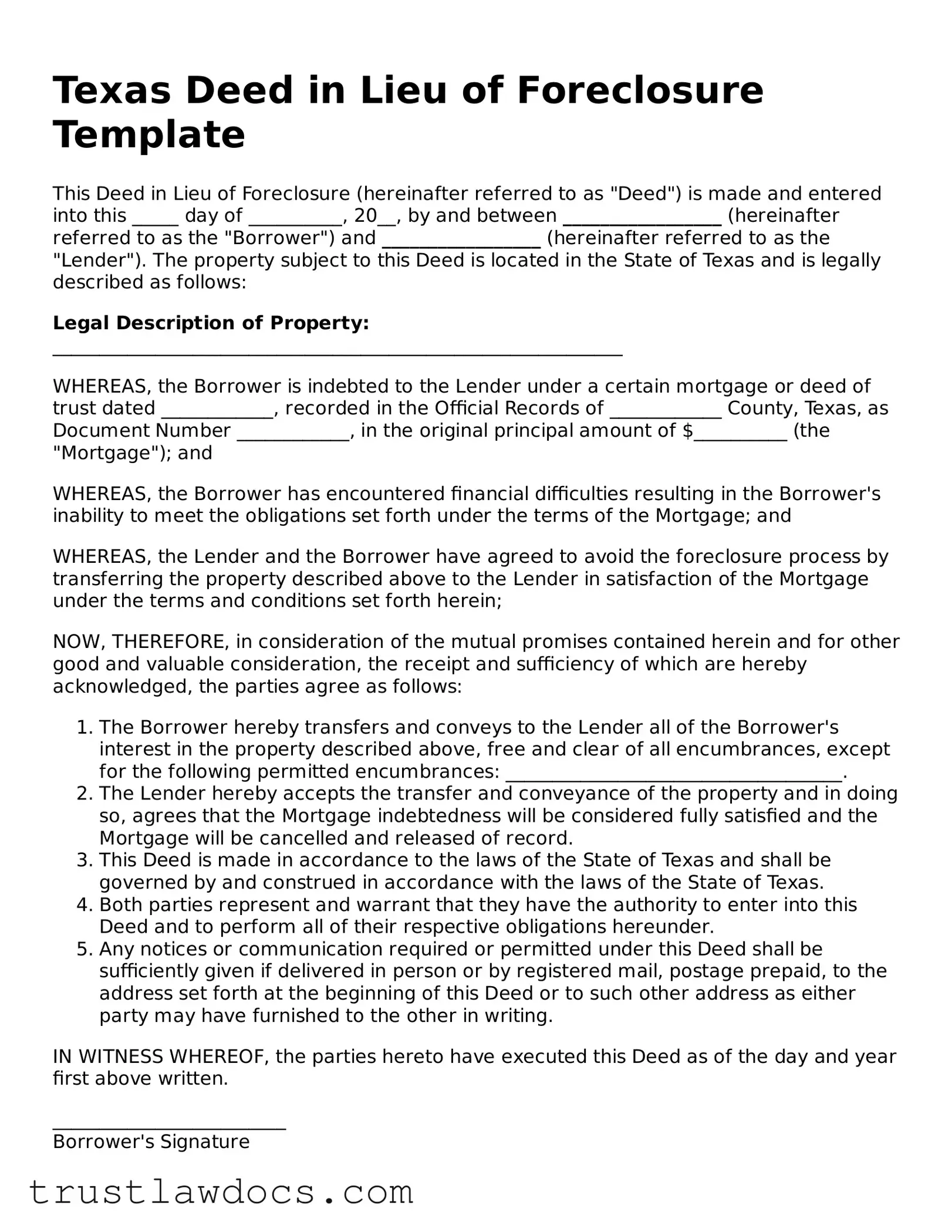

Form Example

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure (hereinafter referred to as "Deed") is made and entered into this _____ day of __________, 20__, by and between _________________ (hereinafter referred to as the "Borrower") and _________________ (hereinafter referred to as the "Lender"). The property subject to this Deed is located in the State of Texas and is legally described as follows:

Legal Description of Property: _____________________________________________________________

WHEREAS, the Borrower is indebted to the Lender under a certain mortgage or deed of trust dated ____________, recorded in the Official Records of ____________ County, Texas, as Document Number ____________, in the original principal amount of $__________ (the "Mortgage"); and

WHEREAS, the Borrower has encountered financial difficulties resulting in the Borrower's inability to meet the obligations set forth under the terms of the Mortgage; and

WHEREAS, the Lender and the Borrower have agreed to avoid the foreclosure process by transferring the property described above to the Lender in satisfaction of the Mortgage under the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- The Borrower hereby transfers and conveys to the Lender all of the Borrower's interest in the property described above, free and clear of all encumbrances, except for the following permitted encumbrances: ____________________________________.

- The Lender hereby accepts the transfer and conveyance of the property and in doing so, agrees that the Mortgage indebtedness will be considered fully satisfied and the Mortgage will be cancelled and released of record.

- This Deed is made in accordance to the laws of the State of Texas and shall be governed by and construed in accordance with the laws of the State of Texas.

- Both parties represent and warrant that they have the authority to enter into this Deed and to perform all of their respective obligations hereunder.

- Any notices or communication required or permitted under this Deed shall be sufficiently given if delivered in person or by registered mail, postage prepaid, to the address set forth at the beginning of this Deed or to such other address as either party may have furnished to the other in writing.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the day and year first above written.

_________________________

Borrower's Signature

_________________________

Borrower's Printed Name

_________________________

Lender's Signature

_________________________

Lender's Printed Name

State of Texas

County of ____________

On this _____ day of ____________, 20__, before me, a notary public, personally appeared ____________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________

Notary Public

My Commission Expires: ____________

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | A Deed in Lieu of Foreclosure is a document in Texas allowing a homeowner to transfer ownership of their property to the lender to avoid the foreclosure process. |

| 2 | This form of voluntary foreclosure may not entirely absolve the borrower's debt unless specifically agreed upon with the lender. |

| 3 | The Texas Property Code generally governs deeds in lieu of foreclosure, along with applicable federal laws and any pertinent local ordinances. |

| 4 | Executing a Deed in Lieu of Foreclosure requires both parties to agree to the terms, which should be clearly stated in the agreement. |

| 5 | It can potentially offer a less damaging impact on the borrower's credit history compared to a traditional foreclosure proceeding. |

| 6 | For the agreement to be legally binding, it must be recorded in the county where the property is located. |

| 7 | Homeowners should consider seeking advice from a lawyer to understand the implications of the deed and negotiate terms that might prevent a deficiency judgment. |

How to Write Texas Deed in Lieu of Foreclosure

When facing financial difficulties, homeowners may seek alternatives to foreclosure. A deed in lieu of foreclosure is one such option, allowing a homeowner to transfer the ownership of their property back to the lender, effectively bypassing the traditional foreclosure process. This process can provide a more graceful exit from a mortgage they can no longer afford, possibly lessening the impact on their credit compared to a foreclosure. Filling out a Texas Deed in Lieu of Foreclosure form is the first step in this legal process. Here's how to complete this form correctly.

- Start by gathering all necessary information about your property, including the legal description, address, and the mortgage loan number.

- Enter the date at the top of the form. Make sure the date is accurate, as it represents when the agreement is made.

- Fill in the full legal names of all property owners as they appear on the property deed. If the property is owned jointly, every owner must be listed.

- Insert the legal description of the property. This can be found on your original mortgage documents or property deed. It includes lot number, subdivision, and any other details that legally describe the property.

- Provide the name of the lender (beneficiary) as it appears on the mortgage agreement.

- Indicate the mortgage loan number. This number is crucial for identifying your mortgage agreement with the lender.

- If applicable, add any specific conditions agreed upon with the lender regarding the deed in lieu of foreclosure. This might include terms related to the forgiveness of any deficiency balance or other important details.

- Review the form carefully to ensure all information is accurate and complete. Mistakes could delay or invalidate the process.

- Sign and date the form in the presence of a notary public. Each property owner listed must sign the form.

- Submit the completed form to your lender, along with any other requested documentation. It's advisable to keep a copy for your records.

After submitting the deed in lieu of foreclosure form, the lender will review your submission to ensure it meets all requirements and conditions. If accepted, the lender will process the deed, and the ownership of the property will be transferred back to the lender, completing the deed in lieu of foreclosure process. It's important to maintain communication with your lender throughout this process and to consult with a legal advisor to understand fully your rights and any potential implications.

Get Answers on Texas Deed in Lieu of Foreclosure

What is a Texas Deed in Lieu of Foreclosure?

A Texas Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the ownership of their property to the lender to avoid the foreclosure process. This agreement is used as an alternative solution when a borrower cannot meet the mortgage payments.

How does a Deed in Lieu of Foreclosure work in Texas?

In Texas, the process involves the borrower and lender agreeing that the transfer of the property's title to the lender will settle the outstanding mortgage debt. Once both parties agree to the terms and sign the deed, the property ownership is transferred, and the borrower is released from their mortgage obligations under the agreed conditions.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Opting for a Deed in Lieu of Foreclosure offers several benefits, including avoiding the public notice of foreclosure, potentially lessening the impact on the borrower's credit score compared to a foreclosure, and providing a more dignified exit from property ownership. It also may offer financial relief in the form of forgiven debt or a possible cash settlement to help with relocation.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are drawbacks, including potential tax implications on forgiven debt, the possibility of the lender not agreeing to forgive all the debt, and the requirement for the property to be marketed for a certain period in some cases. Additionally, it might not be an option for properties with other liens or encumbrances.

Can any property qualify for a Deed in Lieu of Foreclosure in Texas?

Not all properties qualify. Lenders usually require the property to be free of other liens and encumbrances, and the market value should typically be close to the amount owed on the mortgage. The borrower’s financial situation needs to justify the inability to continue making payments.

What steps should be taken before considering a Deed in Lieu of Foreclosure?

Before considering this option, borrowers should explore all alternatives, such as loan modification, refinancing, or selling the property through a short sale. Consulting with a financial advisor or housing counselor is also advisable to understand the impacts fully.

How does a Deed in Lieu of Foreclosure affect credit?

While a Deed in Lieu of Foreclosure may have a less negative impact on a credit score than a foreclosure, it still negatively affects credit reports. The specific impact varies depending on the individual's credit history and the scoring model used by creditors.

Is the borrower responsible for any fees associated with a Deed in Lieu of Foreclosure?

Generally, the lender covers the majority of the legal and administrative fees associated with preparing and recording the deed. However, the borrower might be responsible for certain expenses, such as unpaid homeowner association fees or property taxes up to the transfer date.

Common mistakes

When individuals face financial difficulties, a deed in lieu of foreclosure can offer a way out by transferring property ownership to the lender. However, completing this form in Texas requires attention to detail. One common mistake is not verifying the accuracy of the legal description of the property. This description needs to match the one on the original mortgage or deed of trust to ensure the document is legally binding. A mismatch here can lead to delays or even rejection of the deed in lieu of foreclosure agreement.

Another area where people often stumble is failing to confirm that all parties who hold an interest in the property have signed the document. In Texas, this not only includes the primary borrower but also any co-borrowers or co-owners. If anyone with a legal interest in the property is omitted, it could invalidate the agreement. Ensuring that everyone's signatures are on the document protects against future claims or disputes.

Moreover, neglecting to address junior liens is a critical oversight. A property may have secondary mortgages or liens against it, such as home equity loans or judgments. These don't automatically disappear with a deed in lieu of foreclosure. Without an agreement from these lienholders to release their claims, they can remain attached to the property, complicating the transfer process. It's essential to negotiate these issues beforehand to avoid unexpected obstacles.

Not consulting with a legal professional is often a misstep. While filling out the form might seem straightforward, the implications of a deed in lieu of foreclosure are significant. There could be tax consequences, or it might not fully release the borrower from their mortgage obligation. Professionals can provide critical advice specific to an individual's circumstances, helping to navigate the complex legal and financial landscape.

Lastly, people sometimes skip the step of obtaining a written agreement from the lender that the deed in lieu of foreclosure fully satisfies the mortgage debt. Without this, lenders may claim the difference between the mortgage balance and the property's value, known as a deficiency. Explicitly stating that the transaction settles all debts in full is crucial for peace of mind and avoiding unexpected future liabilities.

Documents used along the form

When a homeowner in Texas is facing foreclosure, one alternative to navigate out of this challenging situation is through a Deed in Lieu of Foreclosure. This document allows the homeowner to transfer the property back to the lender voluntarily, effectively bypassing the traditional and often lengthy foreclosure process. However, this process involves more than just the Deed in Lieu of Foreclosure form. Several other documents are typically required to ensure the transaction is carried out smoothly and in compliance with state laws.

- Hardship Letter: This is a personal letter written by the homeowner to the lender, explaining the circumstances that led to the financial hardship and the inability to continue making mortgage payments. The letter helps the lender understand the borrower's situation and can influence the decision to accept the deed in lieu of foreclosure.

- Loan Payoff Statement: This document provides a detailed breakdown of the remaining mortgage balance, including any accrued interest and penalties. It gives both the homeowner and lender a clear picture of what is owed, ensuring there are no misunderstandings regarding the debt's settlement.

- Warranty Deed: Upon agreement, a warranty deed may be required to transfer the property from the homeowner back to the lender. The warranty deed guarantees that the property is free of liens or other encumbrances, offering a layer of protection to the lender by ensuring the title is clear.

- Estoppel Affidavit: This affidavit is signed by the homeowner and sometimes by the lending institution, affirming that the deed in lieu of foreclosure is being entered into voluntarily and that there are no undisclosed agreements between the homeowner and the lender. The affidavit serves to protect both parties from future claims that the deal was not understood fully or was made under duress.

These documents, when used alongside the Texas Deed in Lieu of Foreclosure form, create a comprehensive package that addresses legal, financial, and personal aspects of this significant transaction. Proper completion and submission of these forms are crucial steps in ensuring that the process is conducted legally and ethically, providing a clear path forward for homeowners seeking relief from the burden of an unmanageable mortgage.

Similar forms

A Deed in Lieu of Foreclosure form in Texas shares similarities with a Mortgage Agreement, as both involve the use of real property to secure a loan. The Mortgage Agreement outlines the borrower's obligations and the lender's rights, including the process for foreclosure in case of default. A Deed in Lieu of Foreclosure, however, is used when the borrower is unable to meet mortgage obligations and wishes to transfer the property title directly to the lender to avoid the foreclosure process.

Comparable to a Quitclaim Deed, the Deed in Lieu of Foreclosure transfers property ownership without making any warranties about the property’s title. The Quitclaim Deed allows one party to transfer its interest in the property to another without stating the nature of the interest or rights being transferred, similar to how a Deed in Lieu transfers property back to the lender with no guarantees regarding other encumbrances or liens on the property.

Similar to a Loan Modification Agreement, a Deed in Lieu of Foreclosure form represents an alternative to foreclosure when a borrower is in default. While a Loan Modification Agreement changes the original terms of the mortgage to make repayment feasible for the borrower, a Deed in Lieu of Foreclosure offers a way to resolve the default by transferring the property to the lender, thereby bypassing the lengthy and costly foreclosure process.

The Forbearance Agreement is another document related to the Deed in Lieu of Foreclosure. It provides borrowers with temporary relief from mortgage payments during financial hardship, potentially avoiding foreclosure. While the Forbearance Agreement seeks to delay the foreclosure process, a Deed in Lieu directly addresses it by surrendering the property to the lender, providing a more definitive resolution to the issue of payment default.

Similarly, a Short Sale Agreement is a foreclosure alternative like the Deed in Lieu of Foreclosure. In a Short Sale, the lender agrees to let the borrower sell the property for less than the amount owed on the mortgage. This agreement prevents foreclosure by allowing the property to be sold, whereas a Deed in Lieu of Foreclosure transfers the property directly to the lender without the sale process, if the borrower is unable to sell the property or prefers a quicker resolution.

A Loan Satisfaction Letter slightly resembles the Deed in Lieu of Foreclosure form since both signal the end of the borrower’s obligation under a mortgage. The Loan Satisfaction Letter is provided by the lender once the mortgage is fully paid off, confirming the borrower is no longer indebted. Conversely, a Deed in Lieu of Foreclosure means the borrower is unable to fulfill their payment obligations, leading to the voluntary transfer of the property to the lender.

Release of Lien documents are akin to Deed in Lieu of Foreclosure forms to the extent that both lead to the release of the lien on the property. A Release of Lien occurs when the borrower has fulfilled the debt obligation, removing the lender's claim on the property. In a Deed in Lieu of Foreclosure, the transfer of property ownership to the lender also results in the removal of the lien, although it stems from an inability to pay rather than the fulfillment of payment.

Finally, an Assumption Agreement has parallels with a Deed in Lieu of Foreclosure because it involves a change in who is responsible for the mortgage. In an Assumption Agreement, a new borrower takes over the mortgage under its existing terms, assuming responsibility for the payments. With a Deed in Lieu of Foreclosure, although there's no new borrower, the lender takes back the property, effectively assuming control and relieving the original borrower from the mortgage's terms due to their inability to continue payments.

Dos and Don'ts

When facing the daunting process of filling out the Texas Deed in Lieu of Foreclosure form, it is critical to proceed with both clarity and caution. This document plays a vital role in managing what can be a very stressful situation, allowing the borrower to transfer their home back to the lender, avoiding the foreclosure process. Below are key dos and don'ts to consider when completing this important form:

- Do carefully review the entire form before adding any information. Understanding each section can help prevent mistakes.

- Do consult with a legal advisor or attorney who specializes in real estate or foreclosure law in Texas. Their expertise can be invaluable in navigating this process.

- Do verify all the details, such as property description and contact information, to ensure they are accurate and match those on your mortgage documents.

- Do contact your lender to discuss the possibility of a deed in lieu of foreclosure. This conversation should ideally take place before you start filling out the form.

- Do keep a copy of the completed form for your records. It is an important document, and having your own copy is essential for future reference.

- Don't rush through the form. Take your time to fill out each field carefully to avoid errors that could complicate the process.

- Don't leave any fields blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Don't hesitate to ask questions. If there's something you don't understand on the form, seek clarification from a legal professional before proceeding.

- Don't sign the form without thoroughly reviewing all the information you have provided. Ensure that everything is accurate and complete.

Misconceptions

The Texas Deed in Lieu of Foreclosure form is often misunderstood, leading to several misconceptions about its use and implications. Understanding these misconceptions is crucial for homeowners and stakeholders to navigate their options effectively during challenging times.

It Completely Clears All Outstanding Debts: Many believe that executing a Deed in Lieu of Foreclosure absolves them from all financial liabilities associated with the property. However, this is not always the case. Depending on the agreement and state laws, borrowers may still be responsible for certain debts or deficiencies after the property transfer.

It’s an Easy and Quick Solution: The assumption that a Deed in Lieu of Foreclosure offers a fast track to resolving financial distress is misleading. In reality, this process involves complex negotiations with the lender, assessments of the property’s value, and careful consideration of the borrower’s financial situation. It’s a structured process that requires time and effort.

It Significantly Damages Your Credit Score: While it's true that a Deed in Lieu of Foreclosure impacts your credit score, the degree of impact is often exaggerated. The effect on your credit score is significant but could be less damaging than a foreclosure. The exact impact varies based on multiple factors, including how the lender reports the transaction to credit bureaus.

It’s Available to All Borrowers Facing Foreclosure: Not all borrowers qualify for a Deed in Lieu of Foreclosure. Lenders typically require the borrower to attempt to sell the property at market value for a certain period before agreeing to this option. Additionally, the lender must agree to accept the deed, which isn’t guaranteed.

It Relieves You of Property Taxes Owed: A common misconception is that transferring ownership through a Deed in Lieu of Foreclosure eliminates any outstanding property taxes owed. In truth, the responsibility for these taxes usually remains with the borrower until the transfer is officially recognized and completed by all relevant parties, including local tax authorities.

Key takeaways

A Deed in Lieu of Foreclosure is a document that can significantly impact homeowners and lenders in Texas. Understanding its uses and implications is crucial for anyone considering this option. Here are key takeaways about filling out and using the Texas Deed in Lieu of Foreclosure form:

- Ensure accuracy in all personal and property information to avoid any disputes or legal issues post-submission.

- Both parties—the lender and the borrower—must mutually agree to the Deed in Lieu of Foreclosure as an alternative to the foreclosure process.

- Consulting with a legal professional is advised to fully understand the rights and obligations being waived or accepted by signing the document.

- Clear title is required; any liens or encumbrances on the property can complicate or invalidate the agreement.

- Recognize that this action is reported to credit agencies and will likely impact the borrower's credit score.

- The document should detail any agreement regarding the borrower's responsibility for the property's deficiency balance, if applicable.

- Filing the completed form with the county clerk's office is necessary to make the transfer of property official and public record.

- Understand that a Deed in Lieu of Foreclosure can provide the borrower relief from mortgage payments and the foreclosure process, but may also result in the loss of the property.

- Review the terms regarding the possibility of receiving any leftover funds if the property is later sold by the lender for more than the remaining mortgage balance.

- It is important to consider any potential tax implications, as forgiven debt may be taxable income under federal law.

By thoroughly understanding and attentively filling out the Texas Deed in Lieu of Foreclosure form, both lenders and borrowers can ensure their interests are safeguarded and make informed decisions during difficult financial times.

Popular Deed in Lieu of Foreclosure State Forms

Foreclosure Deed - This form codifies the agreement between a struggling homeowner and the lender to transfer home ownership, avoiding foreclosure’s repercussions.

California Voluntary Foreclosure Deed - Designed for homeowners in financial distress, it enables a dignified exit from mortgage obligations by transferring ownership to the lender.