Official Deed in Lieu of Foreclosure Document

In exploring options to avoid foreclosure, homeowners and lenders often consider a Deed in Lieu of Foreclosure as a viable alternative. This arrangement allows a homeowner in financial distress to transfer the property title directly to the lender, effectively bypassing the lengthy, and often more damaging, process of foreclosure. Such an agreement not only can provide relief to the homeowner by avoiding the arduous foreclosure process and potentially lessening the impact on their credit score but also benefits the lender by reducing the time and financial costs associated with foreclosure proceedings. However, the process is not without its complexities, involving specific eligibility criteria, negotiations on any remaining mortgage balance, and implications for both parties involved. The form and accompanying paperwork must be meticulously prepared and submitted, requiring clear understanding and accuracy to ensure that the agreement is legally binding and mutually beneficial. The significance of getting this agreement right cannot be understated, given its potential to provide a smoother transition for homeowners facing financial hardship and for lenders needing to resolve non-performing loans. Understanding the major aspects of the Deed in Lieu of Foreclosure form is crucial for anyone considering this path.

Deed in Lieu of Foreclosure for Specific States

Form Example

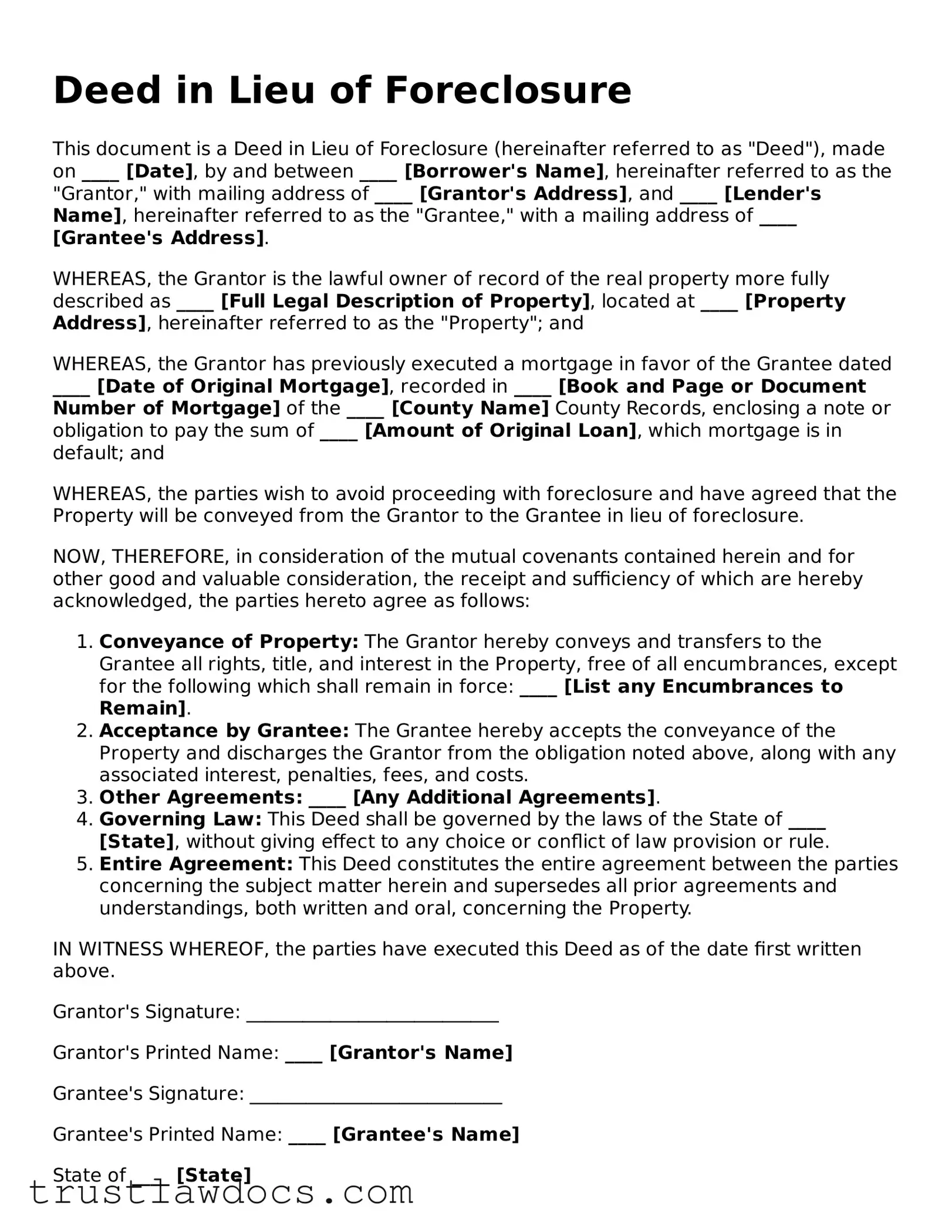

Deed in Lieu of Foreclosure

This document is a Deed in Lieu of Foreclosure (hereinafter referred to as "Deed"), made on ____ [Date], by and between ____ [Borrower's Name], hereinafter referred to as the "Grantor," with mailing address of ____ [Grantor's Address], and ____ [Lender's Name], hereinafter referred to as the "Grantee," with a mailing address of ____ [Grantee's Address].

WHEREAS, the Grantor is the lawful owner of record of the real property more fully described as ____ [Full Legal Description of Property], located at ____ [Property Address], hereinafter referred to as the "Property"; and

WHEREAS, the Grantor has previously executed a mortgage in favor of the Grantee dated ____ [Date of Original Mortgage], recorded in ____ [Book and Page or Document Number of Mortgage] of the ____ [County Name] County Records, enclosing a note or obligation to pay the sum of ____ [Amount of Original Loan], which mortgage is in default; and

WHEREAS, the parties wish to avoid proceeding with foreclosure and have agreed that the Property will be conveyed from the Grantor to the Grantee in lieu of foreclosure.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

- Conveyance of Property: The Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in the Property, free of all encumbrances, except for the following which shall remain in force: ____ [List any Encumbrances to Remain].

- Acceptance by Grantee: The Grantee hereby accepts the conveyance of the Property and discharges the Grantor from the obligation noted above, along with any associated interest, penalties, fees, and costs.

- Other Agreements: ____ [Any Additional Agreements].

- Governing Law: This Deed shall be governed by the laws of the State of ____ [State], without giving effect to any choice or conflict of law provision or rule.

- Entire Agreement: This Deed constitutes the entire agreement between the parties concerning the subject matter herein and supersedes all prior agreements and understandings, both written and oral, concerning the Property.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first written above.

Grantor's Signature: ___________________________

Grantor's Printed Name: ____ [Grantor's Name]

Grantee's Signature: ___________________________

Grantee's Printed Name: ____ [Grantee's Name]

State of ____ [State]

County of ____ [County]

This document was acknowledged before me on ____ [Date] by ____ [Names of the Individuals Acknowledged].

Notary Public: ___________________________

My Commission Expires: ____ [Expiration Date]

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| 2 | Executing a Deed in Lieu of Foreclosure typically requires the lender's consent, as it is voluntary and not automatically granted. |

| 3 | This type of deed can provide mutual benefits to both lender and borrower, such as avoiding the lengthy and costly foreclosure process. |

| 4 | It may have a less severe impact on the borrower’s credit history compared to a foreclosure. |

| 5 | The process of a Deed in Lieu of Foreclosure is governed by state law, and the requirements can vary significantly between different jurisdictions. |

| 6 | Some states may have specific forms or filing requirements that need to be completed to properly execute a Deed in Lieu of Foreclosure. |

| 7 | Lenders may not agree to a Deed in Lieu of Foreclosure if there are secondary liens or encumbrances on the property, as it complicates the transfer process. |

| 8 | The agreement may include a clause that the lender will not pursue a deficiency judgment against the borrower for the difference between the sale amount and the remaining debt. |

| 9 | Both parties usually must sign the Deed in Lieu of Foreclosure, and it must be notarized. |

| 10 | After the deed is executed, it must be recorded with the local government office that handles property records to be legally effective. |

How to Write Deed in Lieu of Foreclosure

When facing financial difficulties, homeowners sometimes consider a deed in lieu of foreclosure as a way to avoid the foreclosure process. This option allows the homeowner to transfer the ownership of their property back to the lender voluntarily. It's a significant step that can help avoid the consequences of a foreclosure on a credit report, although it still impacts credit. Understanding how to complete the form correctly is crucial to ensure the process goes smoothly.

The process of filling out the Deed in Lieu of Foreclosure form usually involves several key steps. It's important to follow these steps carefully, providing accurate and complete information to avoid potential issues:

- Gather necessary documents: Before you start, make sure you have all relevant documents at hand, such as your mortgage account information, the property title, and any correspondence with the lender regarding the foreclosure.

- Identify the parties: Fill in the full legal names of the homeowner(s) and the lender. Ensure that the names are spelled correctly and match the ones on the mortgage and title documents.

- Describe the property: Accurately describe the property being transferred. This should include the physical address, and may also require the legal description found in your property deed or mortgage agreement.

- State the consideration: In a deed in lieu of foreclosure, the "consideration" is typically the forgiveness of the remaining mortgage balance by the lender. This should be clearly stated in the form.

- Include any agreements: If there are any additional agreements between the homeowner and the lender, such as the homeowner being allowed to stay in the property for a certain period, make sure these are included and clearly described in the form.

- Signatures: The form must be signed by all homeowners listed on the mortgage and the lender. It's important that these signatures are witnessed and notarized, if required by your state's laws.

- File the form: After the form is completed and signed, it needs to be filed with the county recorder's office or the appropriate government agency in your area. This officially transfers the property to the lender and completes the process.

It's essential to consider that laws and requirements can vary by state, so you should check with a local attorney or your lender for specific instructions or requirements in your area. Completing a Deed in Lieu of Foreclosure form is a straightforward process, but attention to detail is crucial to ensure everything is done correctly.

Get Answers on Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal instrument that allows a borrower to transfer all interest in a property to the lender. This action is done to avoid the foreclosure process, effectively cancelling the debt that the borrower owes. It is mutually agreed upon and can be a less damaging option for the borrower's credit history compared to a foreclosure.

Why would someone choose a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can offer several advantages. It can provide a quicker resolution than the lengthy foreclosure process, potentially reduce the financial impact on the borrower, and help avoid the public notoriety of foreclosure. This option also benefits the lender by cutting down the time and expense involved in pursuing a foreclosure.

How does one qualify for a Deed in Lieu of Foreclosure?

Qualification for a Deed in Lieu of Foreclosure often depends on several factors, including the lender's policies, the borrower's financial situation, and whether the property is likely to sell for an amount that covers the outstanding debt. Borrowers typically must prove financial hardship and that they have attempted to sell the property at fair market value without success.

Are there any financial consequences to a Deed in Lieu of Foreclosure?

Yes, there are financial consequences to consider. While a Deed in Lieu of Foreclosure may cancel the outstanding debt, it can still negatively impact the borrower's credit score, albeit typically less severely than a foreclosure. Additionally, borrowers may face tax implications on the debt forgiveness, depending on their individual circumstances.

Can a lender refuse a Deed in Lieu of Foreclosure?

Yes, a lender can refuse a Deed in Lieu of Foreclosure for various reasons. If the lender believes that foreclosure would yield a higher return, or if there are complications such as outstanding liens against the property, they may opt not to proceed with this option. Each lender has its criteria for approval.

What are the steps involved in completing a Deed in Lieu of Foreclosure?

The process typically begins with the borrower contacting the lender to express interest in pursuing a Deed in Lieu of Foreclosure. Necessary paperwork, including a hardship letter, financial documents, and the deed, must be submitted for review. After the lender evaluates the property and the borrower's situation, they may agree to the deed in lieu, at which point legal documents are signed, and the property is transferred to the lender. The exact steps can vary depending on the lender and legal requirements.

Is legal counsel necessary for a Deed in Lieu of Foreclosure?

While not always required, seeking legal counsel when considering a Deed in Lieu of Foreclosure is highly recommended. An attorney can provide valuable guidance on the implications of the deed in lieu, negotiate with the lender on behalf of the borrower, and ensure that all legal documents are correctly prepared and filed. This can help protect the borrower's interests and facilitate a smoother process.

Common mistakes

One common mistake made when filling out the Deed in Lieu of Foreclosure form is neglecting to review the lender’s specific requirements. Lenders often have unique prerequisites for acceptance of a deed in lieu, and overlooking these can lead to rejection. It's crucial to understand that each lender's process may vary significantly.

Another error involves inaccuracies in personal details. People frequently enter incorrect names, addresses, or loan numbers. Such mistakes, although seemingly minor, can cause significant delays. They can lead to confusion regarding the property's ownership or lead to issues in the legal documents related to the property.

Failure to check for junior liens or additional mortgages on the property is a grave oversight. A deed in lieu of foreclosure arrangement typically requires the property to be free of other liens. If not properly addressed, these can impede the process, as all creditors must agree to the terms.

Many also overlook the importance of submitting a hardship letter along with their application. This letter should outline the circumstances leading to their inability to continue making mortgage payments. Failure to provide a clear and compelling hardship letter can weaken their case for a deed in lieu of foreclosure.

Another common error is not obtaining or understanding the terms regarding the deficiency judgment. Some homeowners mistakenly believe that a deed in lieu automatically absolves them of any financial responsibility beyond the property itself. However, without clear terms, lenders may still pursue a deficiency judgment for the difference.

Ignoring tax implications is also problematic. Transferring a property via a deed in lieu of foreclosure may have significant tax consequences. Without proper planning or consulting with a tax adviser, individuals may find themselves facing unexpected tax liabilities.

Some applicants submit incomplete forms. Leaving sections blank or not providing required documentation can stall the process. Detailed attention to every part of the form is crucial for a successful deed in lieu application.

Failing to negotiate the terms of the deed in lieu is a missed opportunity. Many do not realize they can negotiate terms such as relocation assistance or forgiveness of any deficiency. Engaging in negotiations with the lender may lead to more favorable conditions for the homeowner.

Lastly, neglecting to consult with a legal or financial adviser is a significant misstep. Professional advice can provide clarity on the implications of a deed in lieu, ensuring that individuals fully understand their rights and obligations before proceeding.

Documents used along the form

When navigating the process of transferring property rights without going through foreclosure, several key documents accompany the Deed in Lieu of Foreclosure form. These documents play crucial roles in ensuring the transaction aligns with legal standards and both parties are well-informed about their rights and obligations. Highlighting these documents provides insight into the comprehensive nature of property transfer agreements and underscores the importance of thorough documentation.

- Hardship Letter: This personal letter from the borrower to the lender explains the circumstances that make it impossible for the borrower to continue making payments. Details about financial hardships help the lender understand the situation from the borrower's perspective.

- Loan Payoff Statement: This statement provides a detailed account of the total amount due to fully pay off the current loan. It includes the principal balance, accrued interest, and any fees or penalties applicable. This information is essential for accurately settling the loan in the process.

- Estoppel Affidavit: This legal document outlines the terms of the deed in lieu agreement, such as ensuring that the transfer of the deed is voluntary and not forced. It might also include declarations about the absence of secondary liens and the financial condition of the borrower.

- Financial Statement: To further provide context to the lender about the borrower's inability to continue payments, a detailed financial statement is necessary. It lists all assets, liabilities, income, and expenses, giving a clear picture of the financial hardship being faced.

Together with the Deed in Lieu of Foreclosure form, these documents create a framework that safeguards the interests of both lender and borrower. They ensure transparency, facilitate understanding, and pave the way for a smoother transition of property rights. By comprehensively addressing the financial and legal aspects of the transaction, these forms help both parties navigate the process with a higher degree of clarity and confidence.

Similar forms

A Loan Modification Agreement is one document similar to a Deed in Lieu of Foreclosure form. Both serve as tools to avoid foreclosure and are used when a borrower is facing difficulty in meeting mortgage obligations. A Loan Modification Agreement modifies the original terms of the mortgage loan, such as reducing the interest rate or extending the payment period, to make payments more manageable for the borrower, whereas a Deed in Lieu of Foreclosure involves the borrower transferring the property title back to the lender to satisfy the loan and avoid foreclosure proceedings.

A Short Sale Agreement is another document akin to a Deed in Lieu of Foreclosure. In both cases, the objective is to prevent foreclosure when the homeowner can no longer afford their mortgage payments. A Short Sale Agreement allows the homeowner to sell the property for less than the amount owed on the mortgage with the lender’s approval. Conversely, in a Deed in Lieu of Foreclosure, the homeowner surrenders the property to the lender, sidestepping the sale process altogether.

The Mortgage Release (Deed-in-Lieu of Foreclosure) Agreement also shares similarities with a Deed in Lieu of Foreclosure form. Both documents facilitate the voluntary transfer of property from the borrower to the lender to release the borrower from their mortgage obligations and avoid foreclosure. The core difference is largely terminological, as "Mortgage Release" emphasizes the outcome of the agreement—the release of the mortgage lien on the property.

A Notice of Default is another document related to the process surrounding a Deed in Lieu of Foreclosure. This document is a formal notification from the lender to the borrower that they have failed to meet their mortgage payments as agreed. While a Notice of Default is a preliminary document that may precede a Deed in Lieu of Foreclosure, it indicates the initiation of legal proceedings that can lead to foreclosure, pushing the borrower and lender to consider alternatives such as a Deed in Lieu of Foreclosure.

A Foreclosure Complaint, similarly, has a connection to the Deed in Lieu of Foreclosure form. This legal document is filed by the lender in court to start the foreclosure process when a borrower defaults on their mortgage. The filing of a Foreclosure Complaint can lead to discussions between the lender and borrower about possible foreclosure alternatives, including the negotiation of a Deed in Lieu of Foreclosure, as both seek to avoid the lengthy and costly process of foreclosure.

A Quitclaim Deed is related but distinct from a Deed in Lieu of Foreclosure. This document is used to transfer any ownership interest a person might have in a property without making any warranties or promises about the property’s title. While a Quitclaim Deed can be used for various purposes, a Deed in Lieu of Foreclosure specifically transfers the borrower's property to the lender to satisfy the mortgage debt and avoid foreclosure, making the latter more specific in its intent and implications for the borrower and lender.

Finally, a Bankruptcy Discharge Notice is indirectly related to a Deed in Lieu of Foreclosure, as both can be outcomes of financial distress. A Bankruptcy Discharge Notice officially releases the borrower from personal liability for certain specified debts after a bankruptcy proceeding, preventing creditors from taking collection action on these discharged debts. Though the contexts differ significantly—a Deed in Lieu of Foreclosure averts the foreclosure process through the transfer of property, while a Bankruptcy Discharge Notice is the culmination of bankruptcy proceedings—both documents represent critical junctures in addressing severe financial difficulties.

Dos and Don'ts

Filling out the Deed in Lieu of Foreclosure form accurately is crucial in ensuring a smooth process. Here are eight dos and don'ts to guide you:

- Do thoroughly review the entire form before filling it out to ensure you understand all the requirements.

- Do provide accurate and complete information in every section of the form to avoid delays.

- Do use black ink if the form is to be filled out by hand, as this improves readability and scan quality.

- Do contact a legal professional if you have any questions or uncertainties. Getting legal advice can prevent mistakes.

- Don't leave any fields blank. If a section doesn't apply to you, it's better to mark it as "N/A" (not applicable) than to leave it empty.

- Don't rush through filling out the form. Taking your time can help prevent errors.

- Don't use white-out or correction tape. Mistakes should be cleanly crossed out with a single line, and the correct information should be clearly written next to it.

- Don't sign the form without reviewing it. Once you're confident everything is correct, then sign it. Remember, your signature is a binding agreement that the information provided is accurate and complete.

Misconceptions

When discussing the option of a Deed in Lieu of Foreclosure, it's essential to navigate through the sea of misunderstandings that surround this legal document. This method, considered by property owners as a way to avoid foreclosure, comes with its set of misconceptions. Let's address and clarify some of the most common ones.

It completely absolves debt: Many believe that signing a Deed in Lieu of Foreclosure clears them of their mortgage debt. However, this is not always the case. Depending on the agreement with the lender, there may still be financial obligations that the borrower is responsible for.

It has no impact on credit scores: Another common misconception is that a Deed in Lieu of Foreclosure won't affect credit scores. While it may be less damaging than a foreclosure, it still negatively impacts credit scores, signaling to future lenders that there was a problem fulfilling mortgage obligations.

It's a quick and easy process: The process is often perceived as quick and hassle-free, but in reality, it involves detailed negotiations and extensive paperwork. Both parties must agree to the terms, which can take time.

It's available to all struggling homeowners: Not all homeowners facing foreclosure qualify for a Deed in Lieu of Foreclosure. Lenders consider various factors, including the homeowner's financial situation and the property's market value, before agreeing to this option.

Lenders prefer foreclosure: There's a belief that lenders would rather go through the foreclosure process than accept a deed in lieu. In truth, many lenders prefer a deed in lieu as it saves them time and the expenses associated with foreclosure proceedings.

It allows homeowners to stay in the home: Some homeowners think that a Deed in Lieu of Foreclosure means they can continue living in their home rent-free until the property is sold. This is rarely the case; typically, the homeowner will need to vacate the property once the deed is transferred to the lender.

Only homeowners can initiate it: While homeowners often initiate the process, lenders can also propose a Deed in Lieu of Foreclosure if they believe it to be the best course of action to mitigate their losses.

All personal property can be taken: There's a fear that by agreeing to a Deed in Lieu of Foreclosure, homeowners will also lose all personal property within the home. Generally, personal property is not part of the agreement, and homeowners can remove their belongings before vacating.

Understanding these misconceptions is crucial for homeowners considering a Deed in Lieu of Foreclosure. It's a complex decision that requires careful evaluation of one's financial situation and thoughtful negotiation with the lender. Seeking advice from a knowledgeable legal consultant can provide clarity and guidance through this challenging process.

Key takeaways

Filling out and utilizing a Deed in Lieu of Foreclosure form represents a significant decision for homeowners facing financial difficulty. This legal document can provide a mutually beneficial resolution for both the borrower and the lender, avoiding the lengthy and costly process of foreclosure. Here are seven key takeaways to remember:

- Understanding the Process: A Deed in Lieu of Foreclosure allows a homeowner to transfer the ownership of their property to the lender as a way to avoid foreclosure. This agreement can often provide a faster resolution to a challenging situation.

- Financial Implications: While this option can relieve the homeowner from the burden of an unsustainable mortgage, it's important to be aware of potential tax implications, as the forgiveness of debt could be considered taxable income under certain conditions.

- Eligibility: Not every homeowner or mortgage qualifies for a Deed in Lieu of Foreclosure. Lenders typically require that the homeowner has explored all other alternatives, the property is on the market for a certain period, and there are no junior liens against the property.

- Negotiation is Key: Terms of a Deed in Lieu of Foreclosure are not set in stone and can be negotiated with the lender. This may include forgiveness of any deficiency balance or requesting that the deed in lieu is reported in a certain way to credit agencies.

- Impact on Credit: A Deed in Lieu of Foreclosure will still have a negative impact on your credit score, though it may be less damaging than a foreclosure. The manner in which it is reported to credit bureaus can affect the extent of this impact.

- Seek Legal Advice: Due to the complexity and potential consequences of submitting a Deed in Lieu of Foreclosure, it's crucial to consult with a legal professional. They can provide guidance tailored to your specific situation and help negotiate terms favorable to you.

- Preparation and Documentation: Accurate and thorough documentation is vital. This includes a hardship letter, financial statements, and possibly a list of attempts to sell the property. Ensuring all documents are accurately prepared can facilitate a smoother process.

In conclusion, a Deed in Lieu of Foreclosure can provide a way out for homeowners unable to meet their mortgage obligations, but it's essential to approach this option with a clear understanding of its ramifications. Careful consideration and professional advice are key to navigating this process successfully.

Consider More Types of Deed in Lieu of Foreclosure Forms

Free Deed of Trust Template - Understanding the distinctions between a Deed of Trust and a mortgage is essential for borrowers in states where both options are available.

Deed of Gift Property - It provides a way for donors to contribute to the financial well-being of loved ones, often helping recipients with significant life events or milestones.