Official Corrective Deed Document

When it comes to real estate transactions, accuracy isn't just important – it's absolutely crucial. Despite the best efforts of all parties involved, mistakes can sneak into deeds, potentially complicating property transfers, clouding titles, and causing significant legal headaches down the line. This is where the Corrective Deed form becomes an invaluable tool. Crafted to rectify errors in previously recorded deeds, it serves as a safety net, ensuring that minor errors such as misspelled names, incorrect property descriptions, or wrong lot numbers don't escalate into major issues. Importantly, it's not a one-size-fits-all solution, but rather a tailored document that addresses and amends specific inaccuracies to clear the path for smooth property transactions and clear titles. Understanding how and when to use this form, along with its limitations and requirements, is essential for anyone involved in the buying, selling, or transfer of real estate.

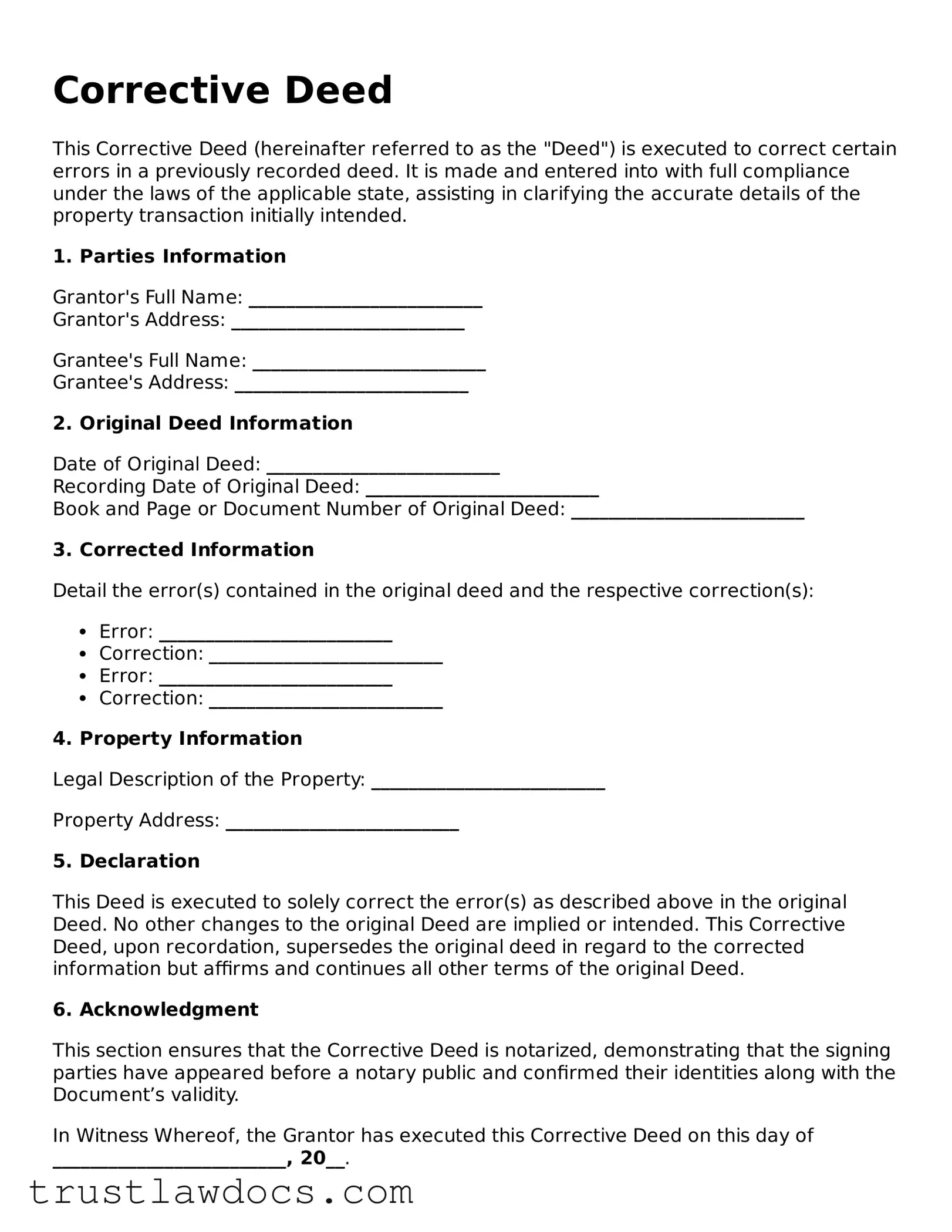

Form Example

Corrective Deed

This Corrective Deed (hereinafter referred to as the "Deed") is executed to correct certain errors in a previously recorded deed. It is made and entered into with full compliance under the laws of the applicable state, assisting in clarifying the accurate details of the property transaction initially intended.

1. Parties Information

Grantor's Full Name: _________________________

Grantor's Address: _________________________

Grantee's Full Name: _________________________

Grantee's Address: _________________________

2. Original Deed Information

Date of Original Deed: _________________________

Recording Date of Original Deed: _________________________

Book and Page or Document Number of Original Deed: _________________________

3. Corrected Information

Detail the error(s) contained in the original deed and the respective correction(s):

- Error: _________________________

- Correction: _________________________

- Error: _________________________

- Correction: _________________________

4. Property Information

Legal Description of the Property: _________________________

Property Address: _________________________

5. Declaration

This Deed is executed to solely correct the error(s) as described above in the original Deed. No other changes to the original Deed are implied or intended. This Corrective Deed, upon recordation, supersedes the original deed in regard to the corrected information but affirms and continues all other terms of the original Deed.

6. Acknowledgment

This section ensures that the Corrective Deed is notarized, demonstrating that the signing parties have appeared before a notary public and confirmed their identities along with the Document’s validity.

In Witness Whereof, the Grantor has executed this Corrective Deed on this day of _________________________, 20__.

Grantor's Signature: _________________________

State of _________________

County of ________________

Subscribed and sworn to (or affirmed) before me on this day of _________________________, 20__, by _________________________, who is personally known to me or has produced _________________________ as identification.

Notary Public's Signature: _________________________

Printed Name: _________________________

Commission Number: _________________________

My commission expires: _________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose of Corrective Deed | Used to correct errors in a previously recorded deed. These errors can include misspellings, incorrect property descriptions, or missing information. |

| Common Errors Addressed | Typical mistakes include incorrect legal descriptions, names, or notary acknowledgements that need clarification or correction. |

| Acceptance | Must be accepted and recorded by the county recorder or similar local office where the property is located to be legally effective. |

| State-Specific Laws | Requirements vary by state, including the specific form and content of the corrective deed, and the necessary steps to record it. |

| No Title Warranty | Corrective deeds typically do not provide a new warranty of title; they merely aim to correct the prior deed's defects. |

How to Write Corrective Deed

Filling out a Corrective Deed form is a critical step in making amendments to any previously recorded deed that contains errors. It's crucial for ensuring that property titles are correctly transferred and recorded, safeguarding the legal interests of all parties involved. This process requires careful attention to detail. By following a step-by-step guide, you can accurately complete the form, thereby rectifying errors and simplifying future transactions related to the property. Before commencing, it's important to gather all relevant documents, including the original deed, to reference the exact information that needs correction.

- Begin by entering the date at the top of the Corrective Deed form. Ensure this reflects the current date when the correction is being made.

- Fill in the grantor(s) name(s) - the person or entity who initially transferred the property - exactly as it appeared on the original deed.

- Write down the grantee(s) name(s) - the person or entity who received the property in the original transaction.

- Provide the corrected information that the deed intends to amend. This could involve a range of details, from misspelled names to incorrect property descriptions.

- Reference the original deed by including its recording date and the book/page number or document number under which it was filed with the local county recorder’s office.

- Sign and print the name of the grantor(s) at the designated section of the form. Bear in mind that the signature(s) might need to be notarized, depending on state laws and regulations.

- If applicable, ensure the grantee(s) also sign and print their name(s) in the designated section.

- Double-check all entries for accuracy, then submit the completed Corrective Deed form to the appropriate county recorder’s office, along with any required filing fee.

Once the Corrective Deed form has been submitted, it will be reviewed for accuracy and compliance with local laws. The recorder's office will then officially amend the original property deed, rectifying any previous errors. This crucial administrative correction solidifies your legal rights in future transactions, affirming the property's correct ownership and details. Remember, the specifics of this procedure can vary slightly depending on your location, so it's advisable to consult local regulations or a legal professional if you have any uncertainties.

Get Answers on Corrective Deed

What is a Corrective Deed?

A Corrective Deed is a legal document used to correct errors in a previously recorded deed. This could involve misspellings of names, incorrect property descriptions, or other inaccuracies that might affect the title to the property. The Corrective Deed is filed to ensure that the public record accurately reflects the details of the property transaction.

When should one use a Corrective Deed?

One should use a Corrective Deed if errors are discovered in a previously executed deed. It is important to correct these errors as soon as they are identified to maintain the accuracy of the public record and to ensure clear title to the property. Issues that often necessitate a Corrective Deed include incorrect legal descriptions of the property, misspelled names, incorrect dates, or erroneous notary acknowledgments.

What information is required to complete a Corrective Deed?

To complete a Corrective Deed, one must provide the correct information to replace what was inaccurately reported in the original deed. This usually includes the correct legal name(s) of the grantor(s) and grantee(s), the correct legal description of the property, the date of the original deed, and the recording information of the original deed. It should also state the specific errors being corrected.

Who needs to sign the Corrective Deed?

The party or parties who executed the original deed, typically the grantor(s), need to sign the Corrective Deed. In some cases, depending on the nature of the errors and state laws, the grantee(s) may also need to sign. The signature(s) must then be notarized to validate the Corrective Deed before it is recorded with the county recorder’s office.

How is a Corrective Deed recorded?

After it is signed and notarized, the Corrective Deed must be recorded with the county recorder's office in the county where the property is located. Recording fees may apply, and the requirements for recording can vary by county. It’s recommended to contact the local recorder’s office for guidance on the specific procedures and fees involved in recording a Corrective Deed.

Common mistakes

When individuals attempt to correct errors on a deed through a Corrective Deed form, several common mistakes can occur. One prevalent error is the failure to clearly specify the correction being made. The purpose of a Corrective Deed is to amend a previously recorded deed where some details were incorrect; however, if the corrective document does not concisely state what is being corrected and why, it may not fulfill its intended purpose.

Another mistake often made is the incorrect identification of parties involved. It is crucial to accurately name all parties as they were listed in the original deed, including the grantor(s) and grantee(s). Any discrepancy in the names, whether through misspelling or omission, can lead to further confusion and may necessitate additional corrective actions.

A third common error involves not attaching the original deed or failing to reference it adequately. For a Corrective Deed to be effective, it must make clear which document it is amending. This typically requires either attaching a copy of the original deed or providing a detailed reference to it, including the date of the original deed and the book and page number where it was recorded. Without this information, establishing the connection between the original deed and the corrective document can be challenging.

Incorrectly executing the document also presents a significant stumbling block. Corrective Deeds must be signed in the presence of a notary public or another official authorized to take oaths. Signatures must be original and comply with state laws regarding notarization. If this formal execution process is not correctly followed, the document may not be accepted for recording, ultimately rendering the correction invalid.

Last but certainly not least, individuals often overlook the need to submit the Corrective Deed for recording with the appropriate government office, typically the county recorder's office where the property is located. Simply completing and signing the corrective form does not finalize the correction; the document must be formally recorded to amend the public record effectively. Failure to do so leaves the original error in place as if the correction was never attempted.

Documents used along the form

In real estate transactions, the Corrective Deed form plays an essential role in rectifying any mistakes made in a previously recorded deed. However, this document does not stand alone. Several other forms and documents are often used in conjunction with the Corrective Deed to ensure the accuracy and legality of the property's title. These documents provide additional information, clarify the intentions of the parties involved, and offer legal assurances to all stakeholders. Below is a list of such documents, each serving a unique purpose in complementing the Corrective Deed.

- Title Search Report: Before correcting a deed, it's crucial to perform a title search. This report uncovers any encumbrances or issues with the property's title, ensuring that all necessary corrections are identified.

- Affidavit of Title: This legal document is provided by the seller to confirm they have the right to sell the property and that there are no undisclosed encumbrances or liens against it. It might be updated following a corrective deed to reflect changes.

- Warranty Deed: Often used to guarantee that the property title is clear, this document might need to be reissued or amended if the corrective deed changes any information that affects the warranty assurances originally provided.

- Quitclaim Deed: In some cases, a quitclaim deed might accompany a corrective deed if a party is relinquishing any potential interest in the property as part of the correction process.

- Property Survey: A property survey may be commissioned if the corrective deed involves changes to the property's boundaries or legal description. This ensures that all parties have an accurate understanding of the property's layout.

- Mortgage Documents: If the property under correction is subject to a mortgage, the lender may require new or amended documents to reflect the corrected deed’s changes, ensuring that their interest in the property is accurately documented.

- Closing Disclosure: This document, which details the final terms and costs of the mortgage, may need to be revised to reflect any changes in financial arrangements resulting from the corrective deed.

- Settlement Statement: A detailed breakdown of all transactions and fees paid during the closing process. If a corrective deed is issued after the original closing, this document may need to be updated to record any additional expenses or adjustments.

Utilizing these documents in conjunction with a Corrective Deed ensures that all aspects of the property’s title and related transactions are accurately recorded and legally binding. Each document serves to clarify, validate, or legally enforce the corrected details, providing peace of mind to buyers, sellers, lenders, and any other parties with an interest in the property. Navigating the complexities of real estate transactions can be challenging, but understanding the function and importance of these documents can help streamline the process and safeguard against future disputes.

Similar forms

A Quitclaim Deed is similar to a Corrective Deed in that it is typically used to transfer interest in a property quickly and without a warranty. Like a Corrective Deed, a Quitclaim Deed does not guarantee that the title is clear of claims or that the grantor legally owns the property being transferred. Although both documents are used for transfers, a Corrective Deed specifically addresses and rectifies errors in a previously recorded deed, whereas a Quitclaim Deed simply transfers whatever interest the grantor has in the property, without addressing any past errors or warranties.

Warranty Deeds, on the other hand, offer a stark contrast to Corrective Deeds by providing guarantees from the grantor to the grantee that the title to the property is clear of liens or claims. Corrective Deeds do not inherently provide such guarantees but instead serve to correct errors in a previous deed. Warranty Deeds ensure the grantee receives a clear title, protected against future claims, whereas Corrective Deeds ensure the accurate reflection of a previous agreement's terms without providing new warranties on the property's title.

A Grant Deed, similar to a Corrective Deed, is used in property transactions to transfer title from one party to another. However, it also implies certain guarantees not inherently present in a Corrective Deed. Specifically, a Grant Deed guarantees that the property has not been sold to someone else and is free of encumbrances apart from those the seller has disclosed. While both document types convey property interests, a Corrective Deed's primary function is to amend errors in previously filed deeds, without extending additional guarantees about the property's status.

The Special Warranty Deed provides a middle ground between the as-is transfer approach of a Corrective Deed and the full guarantees of a general Warranty Deed. It ensures the grantee that the grantor owns the property and discloses any known issues during their period of ownership, but does not guarantee against defects in title that existed before that time. A Corrective Deed, while similar in its use to clear up issues related to the property's previous conveyance, does not provide such assurances or cover a specific ownership period as the Special Warranty Deed does.

Dos and Don'ts

When completing the Corrective Deed form, it's crucial to follow certain guidelines to ensure the process is done correctly. Here are six do's and don'ts to keep in mind:

Do:- Double-check all names and legal descriptions for accuracy.

- Ensure the document is signed in the presence of a notary public.

- Include the original recording information to reference the deed being corrected.

- Clearly state the nature of the error being corrected.

- Retain a copy of the corrected deed for your records.

- Submit the form to the correct county recorder's office.

- Alter the document without professional legal advice.

- Use correction fluid or tape; instead, complete a new form if a mistake is made.

- Forget to review the corrected deed to ensure all errors have been accurately addressed.

- Overlook obtaining the necessary witnesses or notary public, as required by state law.

- Assume the process is completed once the form is submitted; follow up to confirm recording.

- Ignore the need for an updated title search to ensure no further issues are present.

Misconceptions

When dealing with property transactions, documents like the Corrective Deed form arise to address and rectify errors in previously recorded deeds. However, there are several misconceptions about this form and its uses. Understanding these can clear up confusion and ensure a smooth transaction process.

Corrective Deeds can fix any type of error: This is not true. Corrective Deeds are typically used for minor, non-material mistakes such as typographical errors in names, legal descriptions, or incorrect lot numbers. They are not suitable for significant errors that affect the substance of the original deed, such as changing the grantee after the deed has been executed without their consent.

Issuing a Corrective Deed is always mandatory: Not necessarily. The need for a Corrective Deed depends on the nature of the error and its impact on the title. In some cases, if the error does not affect the legal ownership or understanding of the property, it may not be necessary to issue a new deed.

A Corrective Deed changes the original transaction date: This belief is incorrect. The original deed’s transaction date remains the same. The Corrective Deed only amends the error in the original deed and does not alter the effective date of the original transaction.

Corrective Deeds are complicated and require extensive legal work: While it's crucial to ensure accuracy and compliance with state laws, Corrective Deeds are generally straightforward. They specifically address and rectify the error noted in the original deed. With the proper guidance, drafting a Corrective Deed can be a relatively simple process.

Corrective Deeds can be used to evade taxes or dodge creditors: This is a serious misconception. Corrective Deeds are designed to amend clerical errors and cannot legally be used to avoid financial obligations or legal responsibilities. Attempting to use them in such a manner could result in legal consequences.

There is a standard Corrective Deed form that works in every state: Real estate laws vary significantly from state to state, including those governing the use and format of Corrective Deeds. There is no one-size-fits-all form. Each state may have different requirements for what must be included in a Corrective Deed, making it important to consult local regulations or a legal professional.

Key takeaways

When it comes to dealing with real estate documents, accuracy is crucial. A Corrective Deed form serves as an important tool to rectify any errors that were made in a previously recorded deed. Understanding the correct use and implications of this form can help ensure that property records are accurate, which is essential for property owners and potential buyers. Below are four key takeaways about filling out and using the Corrective Deed form:

- Before preparing the Corrective Deed, it is essential to identify the specific errors in the original deed. Common mistakes include misspelled names, incorrect property descriptions, or typographical errors. Recognizing these errors will determine the necessary corrections to be made in the Corrective Deed.

- The Corrective Deed must clearly reference the original deed it is correcting. This includes mentioning the date of the original deed and the parties involved. By doing so, the Corrective Deed can be properly linked to the original document, ensuring a clear chain of title.

- Both the grantor (the person who is transferring the property) and the grantee (the person who is receiving the property) should sign the Corrective Deed. Depending on the state's requirements, witnesses or a notary public may also need to sign the document to validate its authenticity.

- After completing the Corrective Deed, it must be filed with the county recorder's office or the appropriate local land records office. Filing the Corrective Deed updates the public record, making the necessary corrections official. There might be a filing fee, which varies by jurisdiction.

By carefully addressing errors and ensuring the Corrective Deed is correctly filled out and filed, individuals can avoid potential legal issues related to property ownership and ensure that property records accurately reflect the current status of the deed. It’s always a good practice to seek legal advice or assistance from a professional when dealing with real estate documents to ensure that all requirements are met and procedures are correctly followed.

Consider More Types of Corrective Deed Forms

Does California Have a Transfer on Death Deed - It is a legal tool that lets individuals decide who will receive their property, avoiding the complexity of the court system after their passing.