Free Deed Form for California

In the state of California, transferring property ownership is a process that necessitates accuracy, clarity, and adherence to specific legal protocols, of which the California Deed form is a crucial element. This document, pivotal in its role, ensures that the transaction between the seller and the buyer is not only officially recorded but also recognized by the legal system. The form is tailored to accommodate various types of property transfers, catering to a broad spectrum of needs, whether it's a sale, a gift, or a transfer through inheritance. It is imperative for both parties involved to understand the significance of this document, as it carefully outlines the details of the transaction, including the identification of the parties, the legal description of the property, and the terms of the transfer. The completion of this form, followed by its filing with the appropriate county recorder's office, marks the final step in the legal transfer of property, highlighting its indispensable nature in the realm of real property transactions in California.

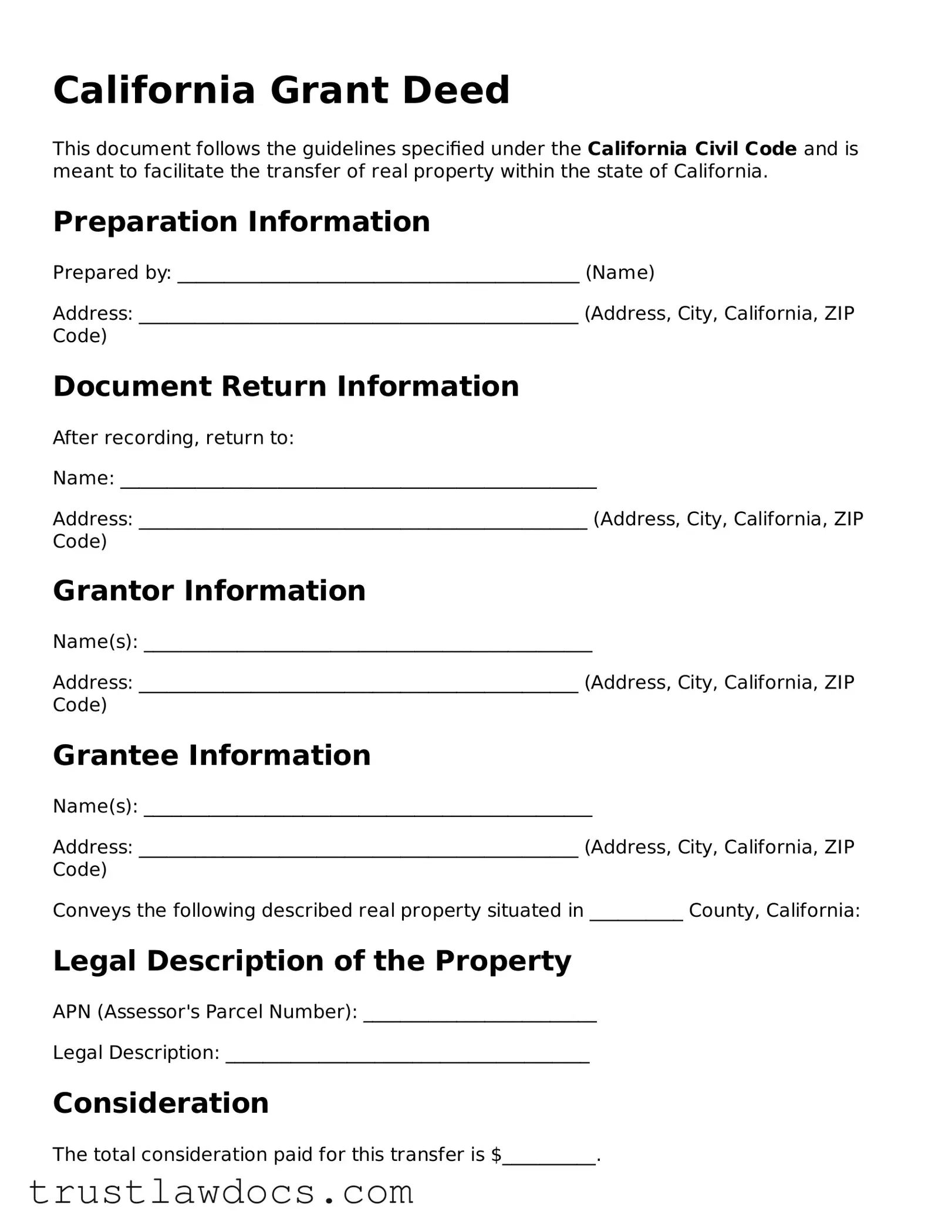

Form Example

California Grant Deed

This document follows the guidelines specified under the California Civil Code and is meant to facilitate the transfer of real property within the state of California.

Preparation Information

Prepared by: ___________________________________________ (Name)

Address: _______________________________________________ (Address, City, California, ZIP Code)

Document Return Information

After recording, return to:

Name: ___________________________________________________

Address: ________________________________________________ (Address, City, California, ZIP Code)

Grantor Information

Name(s): ________________________________________________

Address: _______________________________________________ (Address, City, California, ZIP Code)

Grantee Information

Name(s): ________________________________________________

Address: _______________________________________________ (Address, City, California, ZIP Code)

Conveys the following described real property situated in __________ County, California:

Legal Description of the Property

APN (Assessor's Parcel Number): _________________________

Legal Description: _______________________________________

Consideration

The total consideration paid for this transfer is $__________.

Terms of the Transfer

The Grantor(s) hereby grants to the Grantee(s) all their right, title, and interest in the described property, reserving no interest in the property except as otherwise explicitly stated herein.

Signatures

This deed is executed on the date of __________ (Month, Day, Year).

Grantor's Signature: _______________________________

Grantor's Printed Name: ____________________________

Grantee's Signature: ________________________________

Grantee's Printed Name: ____________________________

Acknowledgment

A California Notary Public must acknowledge this deed.

Recording Requested By

And when recorded, mail to:

Name: ______________________________________________

Address: ____________________________________________ (Address, City, California, ZIP Code)

Notary Public

State of California

County of ___________

On ______________ (Date), before me, ___________________ (Name of Notary), personally appeared _________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal.

(Seal)

Notary Signature: ________________________________

Notary Printed Name: _____________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Type of Document | California Deed Form |

| Purpose | Used to legally transfer ownership of real property in California |

| Key Components | Includes the grantor and grantee's names, legal description of the property, and signature of the grantor |

| Governing Law(s) | Primarily governed by the California Civil Code |

| Recording Requirement | Must be filed with the county recorder's office where the property is located to be effective |

| Types of Deeds | Includes General Warranty, Grant, and Quitclaim Deeds among others, each serving different purposes |

How to Write California Deed

When the time comes to transfer property ownership in California, filling out a deed form is a critical step. This document officially conveys the property from one party to another and must be completed with care to avoid any legal complications down the road. Whether you’re transferring property to a family member, selling your home, or adding a spouse to the title, knowing how to properly fill out this form is essential. The process can seem daunting at first, but by following these straightforward steps, you'll be able to complete the form accurately and confidently.

- Begin by accessing the most current version of the California deed form. Ensure it's the correct form for your specific situation, whether it’s a grant deed, a quitclaim deed, or another type that suits your needs.

- At the top of the form, write the name and address of the person to whom the county clerk should return the document after recording. This ensures the deed is returned to the correct party once the transfer is officially on record.

- Indicate the Assessor’s Parcel Number (APN) of the property in the designated space. This number is unique to your property and is essential for identification purposes.

- Provide the name of the grantor(s) – the current owner(s) of the property – in the space provided. Make sure to include their full legal names to avoid any ambiguity.

- List the name of the grantee(s) – the new owner(s) – with their full legal names as well. If there's more than one grantee, specify how they will hold title (e.g., as joint tenants, tenants in common).

- Detail the property being transferred. Include the legal description of the property, which may be more detailed than the address and may be found on the current deed or by contacting your local recorder’s office.

- If the deed requires it, state the consideration being exchanged for the property. This could be the purchase price, a statement of relationship (if applicable), or a description of other valuable considerations.

- The grantor(s) must sign the deed in the presence of a notary public. The signatures legally execute the document, making the transfer official. Ensure that this step is completed accurately, as improper execution can invalidate the deed.

- Lastly, take the completed deed to the county recorder’s office in the county where the property is located. Pay any required recording fees. The office will record the deed, making the transfer of property public record.

After completing the steps above, the transfer process is formally underway. The county recorder’s office will process the deed, after which the document will be officially recorded. This step solidifies the change in ownership and is essential for the grantee’s legal claim to the property. Keep in mind that while these steps provide a general guide, specific requirements may vary by county, so it's wise to reach out to the local recorder’s office with any questions. Paying attention to detail and ensuring each step is completed thoroughly will lead to a smoother transfer process, offering peace of mind to both the grantor and the grantee.

Get Answers on California Deed

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property from one person or entity to another in the state of California. It includes important information such as the names of the buyer and seller, a detailed description of the property, and the signature of the person transferring the property, often referred to as the grantor.

Who needs to sign the California Deed form?

The person or entity transferring the property, known as the grantor, must sign the California Deed form. Depending on the type of deed, witnesses or a notary public may also need to sign the form to validate it.

Are there different types of California Deed forms?

Yes, in California, there are several types of Deed forms including the General Warranty Deed, Grant Deed, and Quitclaim Deed. Each type offers different levels of protection for the buyer regarding the title of the property. A General Warranty Deed provides the most protection, whereas a Quitclaim Deed provides the least.

How do I file a California Deed form?

After the California Deed form is properly filled out and signed, it must be filed with the County Recorder's Office in the county where the property is located. There may be a filing fee, and the form might need to be notarized before filing. It's important to check with the specific county for any additional requirements.

Do I need a lawyer to prepare a California Deed form?

While it's not required by law to have a lawyer prepare a California Deed form, it's highly recommended. Real estate transactions can be complex, and a lawyer can ensure that the deed is prepared correctly and the transfer of property is legally binding.

Can I use a California Deed form to transfer property to a family member?

Yes, a California Deed form can be used to transfer property to a family member. It's a common and legal way to transfer property ownership without involving a sale. However, it's important to choose the right type of deed for your situation and understand any tax implications.

What happens if a California Deed form is not filed?

If a California Deed form is not filed with the County Recorder's Office, the transfer of property may not be legally recognized. This could lead to legal disputes in the future regarding the ownership of the property. Therefore, it's crucial to properly file the deed to ensure transfer of ownership is officially recorded.

Common mistakes

Filling out a California Deed form can seem straightforward, but it's easy to make mistakes if you're not familiar with the process. One of the common errors is not using the correct form for the transaction. California has several types of deed forms such as Grant Deeds, Quitclaim Deeds, and others, each serving different purposes. Selecting the wrong form can lead to unintended legal consequences, potentially invalidating the transfer or failing to provide the expected level of protection for the new owner.

Another frequent mistake is inadequate legal descriptions of the property. The legal description is more than just the address; it includes details that precisely outline the property's boundaries. This information is typically detailed and can be complex. Copying this information incorrectly or incompletely can lead to disputes over property lines and, in extreme cases, can render the deed invalid.

People often forget to have the deed notarized, which is a critical step in the process. In California, a deed is not legally effective unless it is properly acknowledged before a notary public. This not only confirms the identity of the signatories but also their understanding and willingness to execute the deed. Skipping this step can result in the deed being challenged or not recognized in legal proceedings.

A significant yet common oversight is not understanding the difference between joint tenancy and tenancy in common. These terms describe how multiple owners hold title to the property. Choosing the wrong form of ownership could affect the owners' rights to dispose of the property and survivorship rights. This decision should be made with a clear understanding of the implications.

Many also neglect to check for any required additional documentation that might be necessary to accompany the deed upon recording. Depending on the nature of the property transfer and the local jurisdiction's requirements, additional documents such as a Preliminary Change of Ownership Report might be needed. Failing to submit all required documents can delay the recording process or lead to additional fees.

There's a common assumption that once a deed is completed and notarized, the process is over. However, a critical step is filing the deed with the county recorder's office. Without recording the deed, the transfer of ownership is not complete. The public record will not reflect the new ownership, affecting the owner's ability to sell or mortgage the property in the future.

Errors in the grantee's name are surprisingly common. Providing an incorrect name or spelling for the grantee can create significant complications down the road, particularly when it's time to sell the property or pass it on to heirs. It’s crucial that the grantee’s name is exactly as it appears on official identification documents.

Sometimes, individuals filling out a deed mistakenly believe they can use it to bypass probate. While certain types of deeds can help in estate planning, simply transferring property through a deed without understanding the broader legal and tax implications can lead to unintended consequences, potentially complicating the probate process instead of simplifying it.

Overlooking the requirement to pay transfer tax or to attach a valid exemption statement can also be a pitfall. The transfer of real property triggers the assessment of a transfer tax unless a valid exemption applies. The deed must either include the amount of transfer tax due or a statement claiming an exemption; failing to do so can lead to penalties and interest.

Finally, a mistake that can easily be avoided yet often isn't, is the failure to retain a copy of the recorded deed for personal records. After the deed is filed with the county recorder's office, it's important to obtain and keep a copy. This document is vital proof of ownership and will be needed for any future transactions or legal actions involving the property.

Attention to detail and a thorough understanding of the process are critical when completing a California Deed form. Mistakes can have lasting implications on property rights and legal standing. When in doubt, seeking advice from a legal professional can help ensure the process is handled correctly.

Documents used along the form

In the process of transferring real estate property in California, the Deed form is critical, but it doesn’t exist in isolation. Several accompanying forms and documents are typically utilized to ensure the transaction is legally binding, accurate, and comprehensive. These additional documents play roles in clarifying the terms of the sale, the property’s condition, and the parties’ obligations.

- Preliminary Change of Ownership Report (PCOR): This document is required by the California Board of Equalization and is used to report the change in ownership to the local assessor’s office. It provides detailed information about the property and the terms of the transfer.

- Notice of Completion: After any construction, alteration, or repair work on the property, this document is recorded to signal the completion of the work. It's important for establishing the start of certain legal time frames related to construction claims.

- Transfer Tax Declarations: When property is transferred, many counties in California require documentation for the calculation of transfer taxes. This form typically details the sale price among other relevant factors that influence the tax amount.

- Title Insurance Policy: This document protects the buyer and the mortgage lender from future claims against the property’s title, ensuring the buyer gains clear ownership. It is based on a thorough examination of public records.

- Natural Hazard Disclosure Statement: Sellers must disclose if properties are within certain hazard areas (e.g., flood zones, fire hazard areas). This requirement provides critical information about potential natural risks associated with the property.

- Homeowners’ Association Documents (HOA Docs): For properties in an HOA, these documents disclose the rules, regulations, and financial health of the association. They are necessary to inform the buyer about the obligations and the community’s condition.

- Escrow Instructions: This document outlines the terms and conditions under which the escrow agent is authorized to distribute funds and transfer title. It's a roadmap for the closing process, detailing what must happen for the transaction to be completed.

- Real Property Transfer Tax Declaration: Similar to Transfer Tax Declarations, this form is used in specific localities to declare the property transfer and calculate the applicable taxes based on the transaction's details.

- Loan Documents: If the purchase is being financed, the buyer will need to sign a series of loan documents, including promissory notes, mortgage or deed of trust, and disclosures about the terms of financing.

- Contingency Removal Forms: These forms are used to document the removal of conditions to the sale proceeding, such as securing financing, the results of home inspections, or the sale of another property.

While the Deed form signifies the transfer of property ownership, the comprehensive nature of real estate transactions necessitates the involvement of additional documents. Each serves its purpose to safeguard the interests of the parties involved and to adhere to California’s legal requirements. Understanding these documents and their roles underscores the complexity of real estate transactions and the importance of meticulous attention to detail throughout the process.

Similar forms

The California Deed form shares similarities with the Warranty Deed, primarily because both serve to transfer ownership of property. The Warranty Deed, however, includes guarantees from the seller to the buyer that the title is clear of any defects, which is not a feature inherently incorporated into the basic Deed form. This additional layer of protection for the buyer underscores the primary distinction between these two documents.

Similar to the California Deed form, the Quitclaim Deed facilitates the transfer of property rights from one person to another. The key difference lies in the level of protection offered to the recipient. A Quitclaim Deed does not guarantee that the property title is clear of liens or other encumbrances, effectively passing no warranties to the grantee. This contrast focuses on the breadth of rights being transferred.

The Grant Deed, like the California Deed form, is used to convey real estate ownership. It promises that the property has not been sold to someone else and is free from undisclosed liens or restrictions. While it shares the characteristic of transferring property rights with the Deed form, it uniquely assures the recipient of the non-existence of undisclosed encumbrances.

The Trustee’s Deed is another form similar to the California Deed, used in the context of a property held in a trust. When property is transferred from a trust, this deed assures that the trustee has the authority to sell the property. While both documents serve to transfer property rights, the Trustee's Deed is specifically utilized within the framework of trust administration.

Commonly associated with the mortgage process, the Deed of Trust involves three parties—the borrower, lender, and a trustee—and places the property as collateral against the loan. Like the California Deed form, it involves the transfer of rights in a property, but its purpose is to secure a loan rather than to transfer ownership outright.

The Transfer-on-Death (TOD) Deed, similar to the basic Deed form, facilitates the transfer of property. However, its distinctive feature is that the transfer of property rights is deferred until the death of the owner, bypassing the probate process. This document underscores planning for future transfer without the immediate change in ownership.

Equity Transfer Documents, often used in divorce settlements, bear resemblance to the California Deed form in their function to redistribute property rights between parties. These documents specifically address the division of property equity, acknowledging the change in the legal and financial interests in the property.

The Easement Deed, while also a form of property right transfer like the California Deed, specifically grants the right to use another person's land for a specified purpose. Unlike a full transfer of property ownership, an easement deed only affects the usage rights, which contrasts with the broader scope of rights transferred by a deed.

A Partition Deed is utilized to divide property among co-owners, effectively serving to delineate individual ownership portions within a previously shared property. This type of deed, while facilitating a transfer of property rights similar to the California Deed form, specializes in the segregation and allotment of ownership among multiple parties.

Finally, the Correction Deed is utilized to make corrections to a previously recorded deed. While it serves to amend an existing property rights document rather than transfer rights anew, it is similar in that it affects the legal and recorded status of property ownership, ensuring accuracy and clarity in the public record.

Dos and Don'ts

Filling out a California Deed form correctly is crucial for the legal transfer of property. Errors or omissions can delay the process or result in significant legal issues. Here are essential dos and don'ts to keep in mind:

Do:Double-check the legal description of the property. Ensure it matches the description on the current deed or property tax documents.

Use the correct deed transfer form. California has several types, such as Grant Deeds or Quitclaim Deeds, tailored to different situations.

Clearly print or type all information to prevent any misunderstandings or misinterpretations.

Include all necessary parties on the deed. If the property is owned jointly, for example, all owners must be listed.

Sign the deed in front of a notary public to validate its authenticity.

Keep a copy of the completed deed for your records before filing it with the county recorder's office.

Ensure all filing fees are paid to avoid delays with the county recorder’s office.

Leave any fields blank. If a section does not apply, write “N/A” (not applicable) instead of leaving it empty.

Use white-out or make any alterations on the form after it has been signed. This can void the document.

Forget to verify that the person receiving the deed, known as the grantee, is correctly identified by their full legal name.

Assume standard forms meet your specific needs without consulting a legal professional. Each situation can have unique legal implications.

Overlook the need for additional documents. Sometimes, other forms are required to complete the property transfer process successfully.

Fail to record the deed promptly at the county recorder’s office after it’s completed and notarized. Delays can affect the legal standing of the deed.

Ignore the advice of a legal professional. Real estate transactions can be complex, and professional guidance ensures your interests are protected.

Misconceptions

Transferring property in California involves utilizing a deed, a legal document that conveys ownership from one party to another. However, there are common misconceptions about the California Deed form that can complicate this seemingly straightforward process. Understanding these misconceptions can help ensure that property transfers occur smoothly and according to legal requirements.

All deeds are the same. It’s a common belief that all deeds are interchangeable. However, California recognizes several types of deeds, including General Warranty Deeds, Grant Deeds, and Quitclaim Deeds, each serving different purposes and offering varying levels of protection to the buyer. Choosing the correct type of deed is crucial based on the transaction.

Fillable forms are one-size-fits-all. Many people think that a standard fillable California Deed form found online can apply to any property transaction. In reality, the specifics of the transaction, such as the property type and the parties involved, might require a more customized approach. Not all fillable forms cater to the unique aspects of every property transfer.

Signing a deed transfers property immediately. The act of signing a deed is an essential step in transferring property ownership, but it is not the final step. The deed must be delivered to the grantee (the person receiving the property) and, in most cases, officially recorded with the County Recorder’s Office to make the transfer effective and public.

A deed guarantees a free and clear title. Simply having a deed in hand does not mean the property does not have any encumbrances, such as liens or easements. A title search is necessary to uncover any potential issues with the property’s title. Moreover, the level of warranty provided against title defects varies depending on the type of deed used in the transaction.

Legal assistance is not necessary. Completing and filing a deed may seem straightforward, but legal nuances can easily be overlooked. Errors or omissions in a deed can lead to future legal troubles or impact property rights. Getting guidance from a legal professional ensures that the deed complies with California law and accurately reflects the agreement between the parties.

Addressing these misconceptions can pave the way for a more informed approach to handling property transactions in California. Given the legal and financial implications of transferring property, considering professional advice to navigate these complexities can be invaluable.

Key takeaways

When dealing with a California Deed form, it's important to understand the process to ensure that property is transferred correctly and legally. Here are key takeaways to help guide you through filling out and using the California Deed form:

- Understand the Type of Deed: California offers several types of deeds, including warranty, grant, and quitclaim deeds. Each serves a different purpose, so it's crucial to choose the one that fits your situation.

- Accurately Identify the Parties: The grantor (the person transferring the property) and the grantee (the person receiving the property) must be identified clearly by their legal names to avoid any confusion.

- Describe the Property: A precise description of the property being transferred, including its boundary lines and physical address, is essential. This often comes from an existing deed or a property tax bill.

- Signatures are Mandatory: The deed must be signed by the grantor in the presence of a notary public to be valid. Depending on the deed type, witness signatures might also be required.

- Notarization: A notary public must acknowledge the deed to confirm the identity of the signatures. Without notarization, the deed may not be legally binding.

- Consider a Preliminary Change of Ownership Report (PCOR): In California, this form is often filed along with the deed. It provides the county with details about the transaction and might be required for the deed to be recorded.

- Recording the Deed: Once the deed is completed and notarized, it must be filed with the county recorder's office in the county where the property is located. Recording legalizes the change of ownership.

- Be Aware of Fees: Counties charge a fee to record the deed. The cost can vary, so it's important to check with the local recorder's office for the exact amount.

- Seek Professional Advice: Real estate laws can be complex. If you're unsure about any part of the process, consulting with a real estate attorney or a professional legal document preparer can provide clarity and peace of mind.

Filling out and using the California Deed form is a significant step in transferring property ownership. By paying careful attention to these key takeaways, you can help ensure that the process is conducted smoothly and legally.

Popular Deed State Forms

Indiana Quit Claim Deed Form - For commercial property transactions, the deed form may include additional clauses specific to commercial use.

Property Deed Transfer Form - Deed forms also often include consideration, which is the value exchanged for the property, supporting the transaction's validity.

Free Texas Deed Transfer Form - Reviewing a deed form carefully before submission ensures the accuracy and legality of the property transfer.

Transfer Deed Form - Understanding state-specific requirements for deed forms can save parties from legal headaches and ensure a smooth ownership transition.