Official Deed Document

When transferring property ownership, the deed form plays a crucial role, functioning as the legal document that facilitates this process. It not only conveys the grantor's (the seller's) interest in the property to the grantee (the buyer) but also guarantees the buyer is receiving the title to the property free from any claims, such as mortgages or liens. There are several types of deeds, each suited to different circumstances and offering varying levels of protection to the buyer. For instance, the Warranty Deed provides the buyer with the highest level of protection, including guarantees against any claims on the property, whereas the Quitclaim Deed offers no such assurances, simply transferring whatever interest the grantor has in the property. Furthermore, the deed form must meet specific legal requirements to be valid, including the correct identification of the parties involved, a legal description of the property, the grantor's signature, and, in many jurisdictions, a witness or notarization. The precise rules can vary significantly from one location to another, underlining the importance of understanding local regulations and possibly consulting a legal advisor to ensure the deed form is properly executed.

Form Example

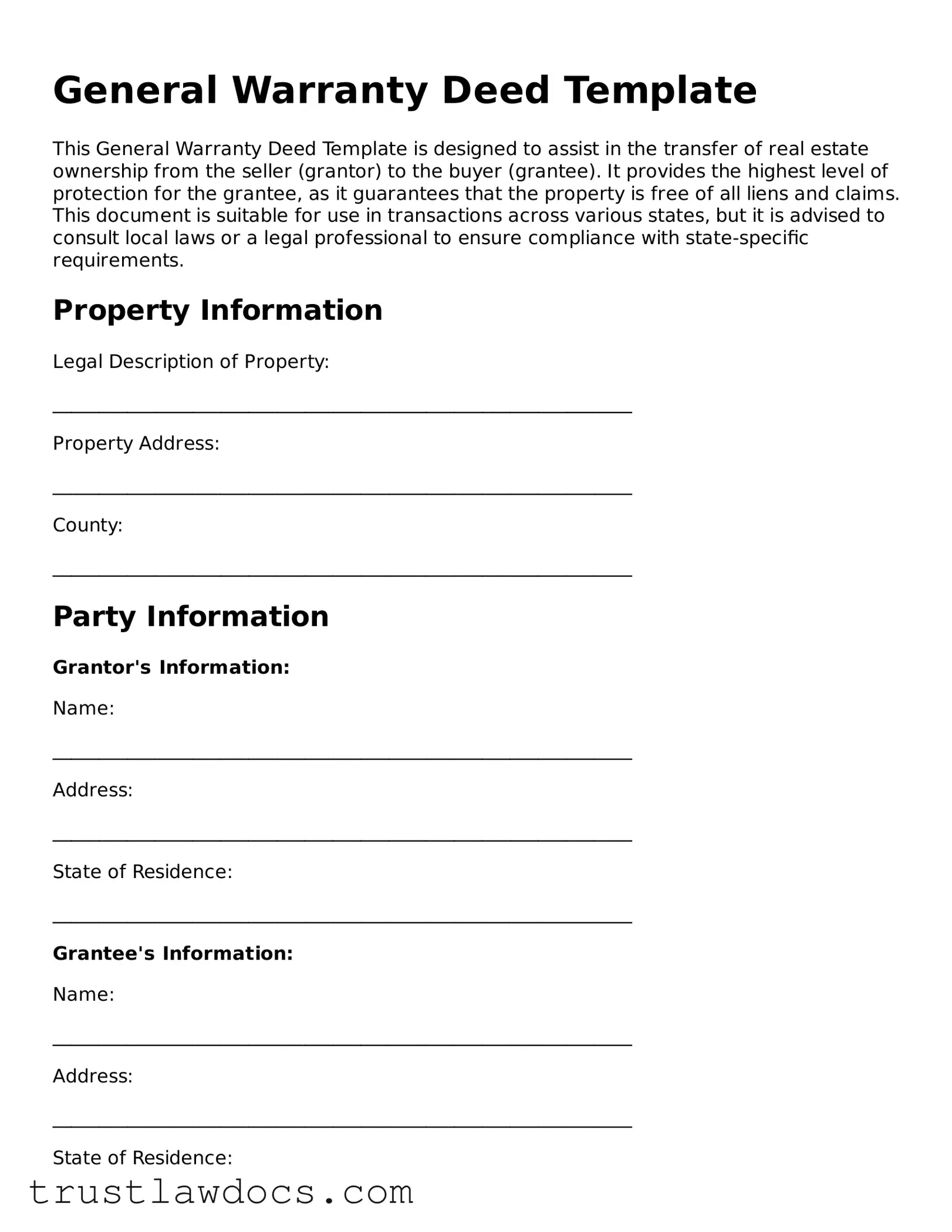

General Warranty Deed Template

This General Warranty Deed Template is designed to assist in the transfer of real estate ownership from the seller (grantor) to the buyer (grantee). It provides the highest level of protection for the grantee, as it guarantees that the property is free of all liens and claims. This document is suitable for use in transactions across various states, but it is advised to consult local laws or a legal professional to ensure compliance with state-specific requirements.

Property Information

Legal Description of Property:

______________________________________________________________

Property Address:

______________________________________________________________

County:

______________________________________________________________

Party Information

Grantor's Information:

Name:

______________________________________________________________

Address:

______________________________________________________________

State of Residence:

______________________________________________________________

Grantee's Information:

Name:

______________________________________________________________

Address:

______________________________________________________________

State of Residence:

______________________________________________________________

Conveyance Terms

The Grantor(s) hereby conveys to the Grantee(s), their heirs, successors, and assigns, the described property, with all rights, privileges, and appurtenances, free and clear of all encumbrances, except as specifically noted herein. This conveyance is made with the Covenant of General Warranty. The Grantor(s) will defend the title to the property against the lawful claims and demands of all persons.

Date of Conveyance:

______________________________________________________________

In witness whereof, the Grantor(s) have set their hand(s) on this day:

______________________________________________________________

Signatures

Grantor's Signature:

______________________________________________________________

Date:

______________________________________________________________

Grantee's Signature:

______________________________________________________________

Date:

______________________________________________________________

Witnesses

(If required by state law)

Witness #1 Name:

______________________________________________________________

Witness #1 Signature:

______________________________________________________________

Date:

______________________________________________________________

Witness #2 Name:

______________________________________________________________

Witness #2 Signature:

______________________________________________________________

Date:

______________________________________________________________

Acknowledgment by Notary Public

State of _________________

County of _______________

On this __________ day of __________, 20____, before me, a Notary Public, personally appeared _______________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature:

______________________________________________________________

Commission Expires:

______________________________________________________________

PDF Form Details

| Fact Name | Detail |

|---|---|

| Definition | A deed is a legal document that transfers ownership of real estate from one party to another. |

| Types | Common types include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Components | Essential components include the grantor and grantee's names, a legal description of the property, and the grantor’s signature. |

| Requirements for Validity | For a deed to be valid, it must be in writing, signed by the grantor, and delivered to the grantee. |

| Recording | Recording a deed with the local government entity is not required for validity but is crucial for protection against claims. |

| Warranty Deeds | Warranty deeds provide the highest level of protection to the grantee, guaranteeing the property is free from all liens and encumbrances. |

| Quitclaim Deeds | Quitclaim deeds transfer only the interest the grantor has in the property, without any warranty of title. |

| Governing Laws | Deed forms and requirements can vary by state, governed by state real estate laws. |

How to Write Deed

After deciding to transfer property, the next step is completing a deed form. This document is pivotal for legally documenting the change in ownership of real estate. The process requires attention to detail to ensure accuracy and legality. By following clear, sequential steps, the individual or parties involved can effectively fill out the deed form, paving the way for a smooth transition. Below are the necessary steps to take when preparing your deed for submission.

- Gather the necessary information: Before filling out the deed form, ensure you have all relevant information, including the legal description of the property, the current owner's details, and the new owner's details.

- Choose the right type of deed: Based on the nature of the property transfer, select the appropriate deed form such as a Warranty Deed, Quitclaim Deed, or Special Warranty Deed.

- Enter the preparer's information: Fill in the details of the person who is preparing the deed form, typically located at the top of the document.

- Include the considerations: Document the transaction details, including the sale price or gifting information, if applicable.

- Describe the property: Accurately enter the full legal description of the property. This information can usually be found in previous deed documents or a property tax statement.

- Fill in the grantor's information: The grantor is the current owner transferring the property. Input their full name and address as it appears on record.

- Add the grantee's information: The grantee is the new owner receiving the property. Ensure to input their full name and address as it will appear on record.

- Execution by the grantor: The grantor must sign the deed in the presence of a notary public. The presence of witnesses may also be required, depending on state laws.

- Acknowledgment by a notary public: The notary public will verify the identity of the grantor, witness the signing of the deed, and affix their official seal, certifying the authenticity of the document.

- Record the deed: After completion and notarization, the deed must be filed with the local county recorder's office or land registry to make the transfer public record. Filing fees will apply.

Completion of the above steps results in the legal transfer of property ownership. It's important to double-check all entered information for accuracy before submission. For additional peace of mind, consulting with a legal professional can help clarify any doubts and ensure the process is carried out correctly. Remember, the details such as notary and witness requirements may vary by state, so it's advisable to verify these aspects in advance.

Get Answers on Deed

What is a Deed form?

A Deed form is a legal document used to transfer ownership of real property from one party (the grantor) to another (the grantee). It must describe the property, include the names of the old and new owners, and be signed by the person transferring the property. Deeds must be recorded in the county where the property is located to be effective against claims from other parties.

Are there different types of Deed forms?

Yes, there are several types of Deed forms, each serving different purposes and offering varying levels of protection to the buyer. The most common types are:

- Warranty Deed: Provides the highest level of protection to the buyer, guaranteeing that the grantor holds clear title to the property and has the right to sell it.

- Special Warranty Deed: Offers limited protection, stating that the grantor has not done anything to encumber the property during their ownership.

- Quitclaim Deed: Provides no warranties or guarantees about the title of the property, simply transferring whatever interest the grantor has in the property to the grantee.

How do I know which Deed form is right for my situation?

Determining the right Deed form depends on several factors, including the level of protection you desire, the relationship between the buyer and seller, and the requirements of your state. A Warranty Deed is often recommended for sales between strangers, as it provides extensive protection for the buyer. A Quitclaim Deed may be suitable for transfers between family members or to clear up title issues, since it carries no warranties. It's important to consult with a legal professional to understand which type of Deed best suits your specific circumstances.

What are the steps to properly execute and file a Deed?

To properly execute and file a Deed, follow these steps:

- Ensure the Deed form is accurate and complete, including a detailed description of the property.

- Have the grantor(s) sign the Deed in the presence of a notary public to validate the signatures.

- Submit the signed Deed to the county recorder's office (or equivalent) in the county where the property is located. A filing fee will likely be required.

- Check the recorder's office requirements in advance, as some may have additional necessities such as specific forms or witness requirements beyond a notary.

Common mistakes

Filling out a deed form is a crucial step in the process of transferring property ownership. However, people often make mistakes that can lead to complications. One common error is not verifying the exact legal description of the property. This description is more detailed than just an address; it includes boundaries and is usually found in the property's previous deed. If the legal description is incorrect or incomplete, it may invalidate the deed or cause issues with property boundaries in the future.

Another mistake involves misunderstanding the different types of deeds and choosing the wrong one. For instance, a warranty deed offers the buyer the highest level of protection, assuring the property is free from liens and encumbrances, whereas a quitclaim deed transfers only the ownership that the seller has, with no guarantees about encumbrances. Selecting the wrong type of deed can either offer too much risk for the buyer or unnecessary liability for the seller.

People often overlook the importance of having all the necessary signatures on the deed. Depending on the laws of the state and the type of property being transferred, additional signatures beyond those of the property owner(s) might be required. This includes spouses or business partners who have a legal interest in the property. Failing to secure all necessary signatures can result in the deed being challenged or invalidated.

Notarization is another critical step that is frequently mishandled. Most states require the deed to be notarized to be legally effective. This involves signing the document in front of a notary public. Skipping this step, or not following the specific notarial procedures of your state, can render the deed void and unenforceable.

Incorrectly identifying the parties involved is a common mistake. It is crucial to use full legal names and to accurately distinguish between the grantor (the person transferring the property) and the grantee (the person receiving the property). Ambiguities in identifying parties can lead to disputes about who actually owns the property.

People sometimes forget to file the deed with the local county recorder’s office. After the deed is executed (signed, notarized, and, if required, witnessed), it must be filed, or "recorded," with the appropriate county office to be effective and to put the public on notice of the new owner. Failure to record the deed does not change the ownership legally and may result in significant legal complications.

Another error occurs when individuals do not consider the financial and tax implications of transferring property. Certain transfers can trigger local, state, or federal taxes, and in some cases, might affect the owner’s eligibility for public benefits or financial aid. Without understanding these implications, both the grantor and grantee may find themselves facing unexpected liabilities or consequences.

Finally, many assume that filling out a deed form is a simple task that doesn’t require legal advice. Given the complexity of real estate transactions and the legal requirements involved in transferring property, seeking the assistance of a knowledgeable professional can prevent mistakes. Professionals can offer guidance tailored to your specific situation, ensuring the transfer is conducted properly and legally.

Documents used along the form

When transferring property, a Deed form is just the beginning. There are several other essential forms and documents often used to ensure the process is smooth, legal, and comprehensive. Below is a list of up to eight typical forms and documents that are frequently required alongside the Deed form. These documents serve various purposes, from confirming the property's legal description to ensuring that the property is free of liens and encumbrances.

- Promissory Note: This document outlines the details of a loan between two parties. It's crucial if the property purchase involves seller financing. It specifies the loan amount, interest rate, repayment schedule, and the consequences of non-payment.

- Mortgage or Trust Deed: This document secures the loan on the property. It grants the lender the right to take legal action against the property if the borrower fails to fulfill the terms of the loan.

- Title Insurance Policy: Offers protection to property buyers and lenders against loss or damage arising from liens, encumbrances, or defects in the title to the property.

- Bill of Sale: Used in property transactions to transfer ownership of personal property, such as furniture or appliances, that is sold with the real estate.

- Property Disclosure Statement: The seller provides this document, disclosing any known issues with the property, such as lead paint or asbestos, to inform the buyer and protect the seller from future legal action.

- Survey: A document that shows the property's boundaries, measurements, and any other physical features or improvements. It's critical for understanding exactly what is being purchased.

- Closing Statement: An itemized list of fees and credits, showing the final financial transaction between the buyer and seller. This document summarizes the financial part of the transaction.

- Tax Documents: Documentation to verify that property taxes have been paid and are current. It's essential to ensure that there are no outstanding property taxes that the new owner would be liable for.

Each of these documents plays a vital role in the property transfer process, providing transparency, legal protection, and clarity for all parties involved. The necessity of each document can vary depending on the specific circumstances of the property transaction. Therefore, consulting with a professional to understand which forms are required for your particular situation is always a smart approach. Together, these documents complement the Deed form, ensuring that the property transfer is legal, complete, and in the best interests of both buyer and seller.

Similar forms

The deed form is closely related to a mortgage agreement, as both are fundamental documents in real estate transactions. A mortgage agreement is a contract where a borrower agrees to pledge real estate property as security for a loan, whereas a deed is a legal document that transfers ownership of the property from one party to another. Both documents are recorded in public records and involve detailed legal descriptions of the property to ensure clear transfer and understanding of rights and obligations.

Similarly, a bill of sale resembles a deed form, primarily in their function of transferring ownership rights. While a deed form is used for real estate transactions, a bill of sale is typically employed for the purchase or sale of personal property, such as vehicles or equipment. Both documents serve as legal evidence of a change in ownership, detail the parties involved, and describe the asset being transferred.

A title is another document akin to a deed, given its role in proving ownership. However, while a title is an abstract concept indicating one’s legal rights to the property, a deed is the physical document that legally transfers those rights from the seller to the buyer. Essentially, the deed is the instrument through which a person’s title to real estate is conveyed or transferred.

Trust deeds share similarities with standard deed forms as well, particularly in their involvement in real estate. A trust deed involves three parties – the borrower, the lender, and the trustee – and serves to secure real estate loans. It transfers the legal title of the property to the trustee, who holds it as security for the loan between the borrower and the lender. Like a deed, it is a recorded document that defines the parties and property involved.

The lease agreement, though distinct in its purpose of granting the use of property rather than transferring ownership, shares several characteristics with a deed form. Both documents outline specific terms and conditions related to the property, including the identification of parties and the legal description of the property. While the deed formalizes the transfer of property ownership, a lease agreement establishes the terms under which one party can occupy or use the property of another.

Warranty deeds and deed forms also share a close relationship, as a warranty deed is a specific type of deed. It guarantees that the grantor holds clear title to a piece of real estate and has the right to sell it to the grantee. The warranty deed assures the buyer of the absence of any liens or claims against the property, offering greater protection than a standard deed, which may not make any guarantees about the property’s title.

Lastly, the quitclaim deed is similar to other deed forms in its basic function of transferring interest in real estate. However, it differs significantly in the level of protection it offers the grantee. Quitclaim deeds transfer whatever interest the grantor has in the property without making any guarantees or promises about the extent of that interest. Both quitclaim deeds and other deed forms play crucial roles in property transactions, facilitating the transfer of rights and interests.

Dos and Don'ts

When filling out a Deed form, it's important to adhere to specific guidelines to ensure the document is completed accurately and effectively. Following are lists of what you should and shouldn't do during this crucial process.

Things You Should Do

- Verify Property Description: Ensure the legal description of the property matches the one in the title documents. This includes lot number, subdivision name, and any other pertinent details.

- Check the Grantee's Name: Confirm the correct spelling and legal name of the person or entity receiving the property. Accuracy here is crucial for the validity of the deed.

- Use the Correct Type of Deed: Understand the differences between warranty, quitclaim, and other types of deeds to use the one that best suits your transaction.

- Sign in the Presence of a Notary: Signatures on the deed must be notarized to be legally valid. This usually means signing the document in front of a notary public.

- Get Witnesses If Required: Some states require deed signing to be witnessed by one or more individuals. Know the requirements for your state.

- Record the Deed: After signing, submit the deed to the local county recorder's office or similar entity to make it official and part of the public record.

Things You Shouldn't Do

- Don't Leave Blank Spaces: All fields on the deed should be filled in to prevent unauthorized alterations. If a section doesn't apply, mark it as "N/A" (not applicable).

- Don't Guess on Facts: Make sure all the facts entered in the deed, like property descriptions and names, are accurate. Guessing can lead to invalidation of the deed.

- Don't Use Correction Fluid: Mistakes should be corrected by preparing a new deed. Using correction fluid or making erasures can question the document's legitimacy.

- Don't Forget to Check Tax Implications: Transferring property can have tax implications. Consult with a tax professional to understand any potential impact.

- Don't Ignore Legal and State Requirements: Different states and localities can have varied requirements for deeds. It's important to familiarize yourself with these to ensure compliance.

- Don't Neglect to Keep a Copy: Always keep a copy of the signed and notarized deed for your records. This will serve as proof of the transaction.

Misconceptions

When it comes to understanding deeds, many people find themselves entangled in misconceptions. Deeds are crucial documents in the transfer of property ownership, yet their complexities often lead to confusion.

One ownership document fits all scenarios: This is a common misconception. There are various types of deeds, such as warranty, quitclaim, and special warranty deeds. Each serves different situations and offers varying levels of protection to the buyer.

Signing a deed transfers property ownership immediately: While signing is a critical step, the deed must also be delivered to the grantee (the person receiving the property) and, in most jurisdictions, recorded with the local government to complete the ownership transfer process.

A deed must be notarized to be valid: Notarization is often required to record the deed, but a deed can be legally valid without being notarized. The necessity for notarization can vary based on local laws.

All deeds guarantee clear title: Only a warranty deed provides a guarantee that the title is clear of other claims, such as liens or encumbrances. Other deeds, like a quitclaim deed, transfer only the interest the grantor has, if any, without any guarantees.

Deeds and titles are the same: A deed is a document that transfers ownership, while a title is a legal concept that represents the owner's right to possess and use the property. The deed is evidence of the transfer; the title is the ownership itself.

Deeds are public records, so they reveal everything about the property: While deeds are recorded and accessible, they do not disclose all details about the property, such as its condition or exact size. Other documents and inspections are necessary for a full understanding.

Any errors in the deed make it invalid: Small errors, such as typos, do not necessarily invalidate a deed. However, significant errors affecting the legal description of the property or the identities of the parties involved may require correction.

A deed protects the new owner from future claims: Depending on the type, a deed may not protect the buyer from future claims against the property. Title insurance is often purchased to provide this protection.

Once a deed is signed and recorded, it cannot be changed: Corrections or changes to a deed can be made after it is recorded, but doing so usually requires executing a new deed and going through the recording process again.

Clearing up these misconceptions is essential for anyone involved in the transaction or transfer of property. Properly understanding deeds ensures smoother transactions and helps protect the interests of all parties involved.

Key takeaways

Filling out and using a Deed form correctly is crucial for the legal transfer of property ownership. Understanding its components and implications can ensure a smooth and lawful transaction. Here are key takeaways:

- Before anything else, verify the type of Deed needed for your specific situation. Different types of deeds—such as warranty, quitclaim, or special warranty—offer varying levels of protection and warranties about the property's title.

- Accuracy is non-negotiable. Ensure all names and details on the Deed form are correct and match existing property records and identification documents. Mistakes can lead to legal complications or delays.

- Understand the legal description of the property. This is not just the address; rather, it's a detailed description used in legal documents that defines exactly what's being transferred. It may be necessary to consult a surveyor or look at previous deeds for accuracy.

- All involved parties must sign the Deed in the presence of a notary public. This step is essential for the document to be legally binding and for the transfer of ownership to be recognized by law.

- Be aware of the need for witnesses. Depending on your state's laws, witness signatures might also be required for the Deed to be valid.

- After completing the form, file the Deed with the local county clerk's office or land registry office. This public recording formalizes the change of ownership and is a critical step in the process.

- Finally, consider consulting a legal professional. While filling out a Deed form might seem straightforward, real estate law can be complex. Professional advice can help navigate these complexities, ensuring that your rights are protected and that the transfer complies with all applicable laws.

Handling a Deed form with care and due diligence will pave the way for a legitimate and enforceable transfer of property. Whether you're on the giving or receiving end of a property transaction, understanding these takeaways ensures that you're well-prepared for a successful transfer.

Other Templates:

Free Printable Salon Booth Rental Agreement - Describes the allowed use of salon common areas, such as waiting areas, restrooms, and break rooms.

Ca Dmv Bill of Sale Pdf - This document does more than finalize sales; it fosters trust and accountability in private transactions.

Dnr in Canada - A crucial tool for patients with serious, life-limiting illnesses or conditions, aiming to improve the quality of their remaining life by avoiding potentially distressing treatments.