Official Credit Check Authorization Document

Understanding the complexity and significance of obtaining consent through a Credit Check Authorization form is crucial for both businesses and individuals. This essential document serves as a formal agreement, allowing one party to perform a credit inquiry on another. The authorization ensures transparency and compliance with legal standards, particularly with respect to privacy laws and financial regulations. It meticulously outlines the purpose of the credit check, the type of information that will be accessed, and how that information will be used, thereby protecting all parties involved. Additionally, the form plays a pivotal role in various scenarios, ranging from employment processes to loan applications and tenancy agreements, making it an indispensable tool in assessing financial reliability and mitigating risks. Its proper use not only fosters trust between parties but also safeguards against potential legal challenges, underscoring the importance of a detailed and correctly executed Credit Check Authorization form.

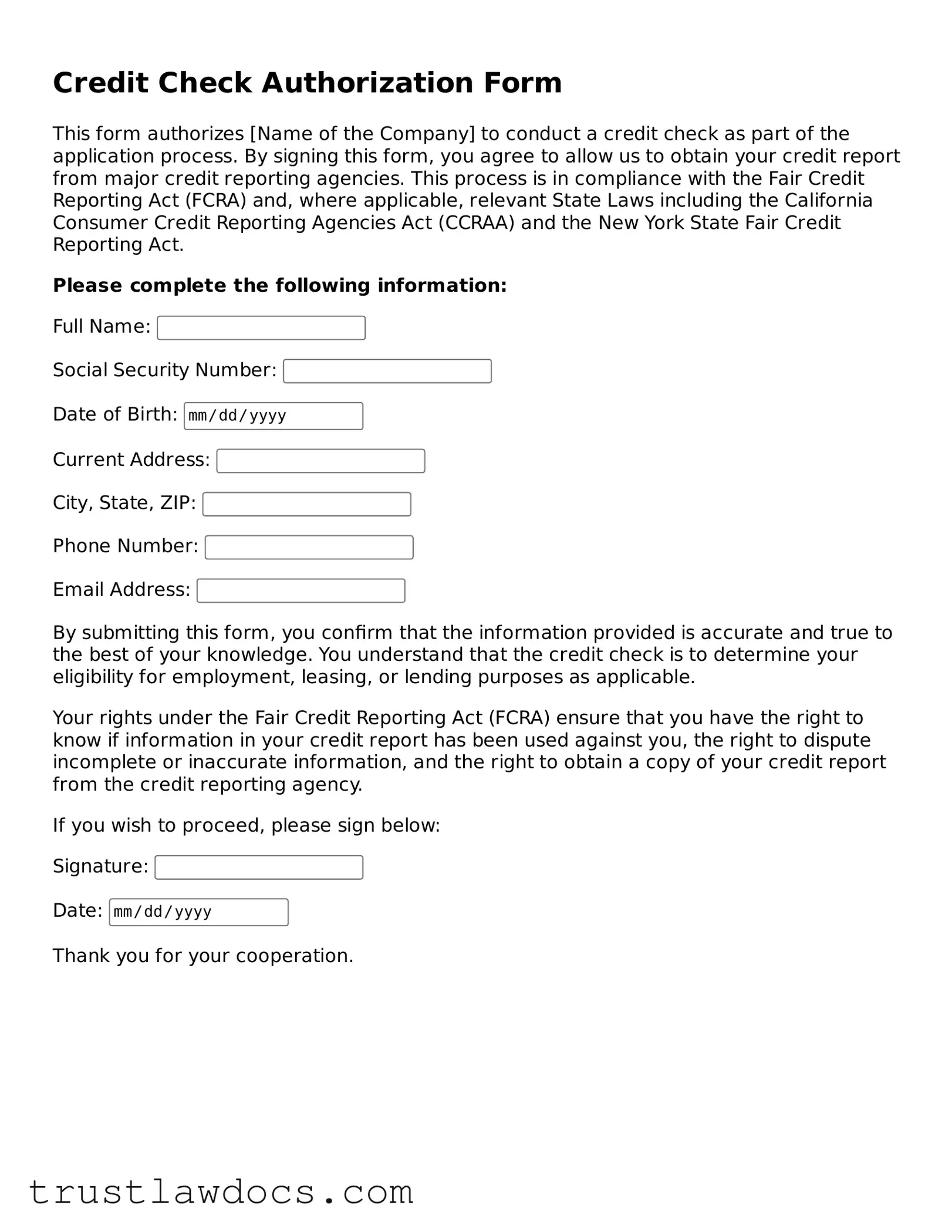

Form Example

Credit Check Authorization Form

This form authorizes [Name of the Company] to conduct a credit check as part of the application process. By signing this form, you agree to allow us to obtain your credit report from major credit reporting agencies. This process is in compliance with the Fair Credit Reporting Act (FCRA) and, where applicable, relevant State Laws including the California Consumer Credit Reporting Agencies Act (CCRAA) and the New York State Fair Credit Reporting Act.

Please complete the following information:

By submitting this form, you confirm that the information provided is accurate and true to the best of your knowledge. You understand that the credit check is to determine your eligibility for employment, leasing, or lending purposes as applicable.

Your rights under the Fair Credit Reporting Act (FCRA) ensure that you have the right to know if information in your credit report has been used against you, the right to dispute incomplete or inaccurate information, and the right to obtain a copy of your credit report from the credit reporting agency.

If you wish to proceed, please sign below:

Thank you for your cooperation.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Credit Check Authorization form is used to grant permission to a landlord, employer, or lender to run a credit check. |

| Required Information | Includes the applicant's full name, address, Social Security Number (SSN), and date of birth. |

| Consent | It acts as evidence that the individual has agreed to have their credit history accessed. |

| Governing Laws | Federal laws such as the Fair Credit Reporting Act (FCRA) govern the use and process of these forms across the US. |

| State-Specific Forms | Some states have specific requirements, and thus, state-specific forms may incorporate additional provisions or disclosures. |

| User Privacy | The form ensures that the person's information is used solely for the purpose of conducting the credit check. |

| Record Keeping | Entities conducting the credit check must keep the form on file as proof of consent for a period defined by relevant laws. |

| Withdrawal of Consent | Individuals may have the right to withdraw their consent, but this must usually be done in writing and may affect their application or agreement. |

| Importance of Accuracy | Ensuring the accuracy of the information on the form helps prevent delays in the credit check process or potential legal issues. |

How to Write Credit Check Authorization

Once you're ready to take action, such as applying for a rental property, securing a loan, or making a significant purchase that requires financing, you might be asked to authorize a credit check. This step gives the requester permission to look into your credit history to assess your credibility and financial health. The Credit Check Authorization form is a simple document that formally grants this permission. Completing it accurately is crucial for moving forward with your application or request.

To fill out the Credit Check Authorization form, follow these steps:

- Begin by entering your full legal name, ensuring it matches the name on your government-issued identification documents.

- Provide your current address, including the street name, number, city, state, and ZIP code. If you've lived at your current address for less than two years, be prepared to provide previous addresses.

- Enter your date of birth and Social Security Number (SSN), both of which are typically required for identity verification purposes during the credit check process.

- Specify the type of credit check authorization you are granting. This could be a one-time authorization for a specific purpose or a more general ongoing consent.

- Include any additional information requested by the form, such as your employment history or income details, if applicable.

- Read through the consent and disclosure section carefully. This part explains what the credit check entails and how your information will be used.

- Sign the form and date it to officially give your authorization. Ensure your signature matches the one on your ID to avoid any discrepancies.

- If the form is being submitted electronically, check if an electronic signature is acceptable or if you need to print the form to sign and scan it.

After the Credit Check Authorization form is completed and submitted, the requesting party will proceed with the credit check. The results will play a critical role in their decision-making process related to your application or request. It's essential to provide accurate and truthful information to avoid any potential delays or complications.

Get Answers on Credit Check Authorization

What is a Credit Check Authorization form?

A Credit Check Authorization form is a document that gives a third party the permission to access and review an individual's credit history. This form is often used by landlords, employers, and lenders to evaluate the creditworthiness and reliability of an individual. It ensures that the credit check is conducted legally, with the individual's full consent.

Why do I need to sign a Credit Check Authorization form?

Signing a Credit Check Authorization form is necessary because it protects your personal information. It legally ensures that your credit history can only be accessed with your permission, safeguarding your privacy. For landlords, employers, and lenders, your signature gives them the lawful right to obtain this information, which they need to make informed decisions regarding leasing, employment, or lending.

What information is typically included in a Credit Check Authorization form?

A typical Credit Check Authorization form includes your full name, Social Security Number (SSN), address, and the specific consent allowing the requesting party to obtain your credit report. It may also specify the purpose for which the credit check is being requested and the duration for which the authorization remains valid. Lastly, it will include a place for your signature and the date, evidencing your consent to the credit check.

Is my consent to a Credit Check Authorization form revocable?

Yes, your consent to a Credit Check Authorization form is revocable. If you decide to revoke your consent, you should inform the party who requested your credit report in writing. Keep in mind that revoking your consent may affect your application or agreement with the party requesting the credit check. Therefore, it's advisable to understand the implications of revoking your consent before doing so.

Common mistakes

One common mistake people make when filling out the Credit Check Authorization form is not reviewing their personal information for accuracy. Typos in names, addresses, or social security numbers can lead to delays or incorrect credit reports being pulled. This can affect the credit decision process, leading to potentially unfavorable outcomes for the applicant.

Another error is not specifying the type of credit check authorization they are granting. Without clear consent on whether the authorization is for a soft pull, which doesn’t affect the credit score, or a hard pull, which can, the requester may proceed with a check that the applicant did not intend, possibly impacting their credit score undesirably.

Applicants often neglect to read the fine print that outlines how the information will be used. Failing to understand the scope of authorization could lead to personal data being used in ways or by third parties that the applicant did not expect. Being cautious and aware of these details is crucial in protecting personal information.

Not checking the form for completeness is yet another frequent oversight. Leaving sections of the form blank or failing to initial required areas can result in an incomplete application, causing delays. It's essential to go over the form carefully, ensuring every section is completed as required.

Many people disregard the importance of verifying the legitimacy of the requester. In an era where identity theft is rampant, confirming that the request for a credit check is from a legitimate source is vital. Providing sensitive information to an unverified entity can lead to serious privacy breaches and fraud.

Forgetting to keep a record of the authorization form and its submission details is also a mistake. Should any discrepancies or issues arise regarding the credit inquiry, having a copy of the form along with details of when and to whom it was submitted can provide crucial evidence for resolving such disputes.

Last but certainly not least, applicants sometimes fail to note the expiration of the authorization. Credit check authorizations are not indefinite and understanding when consent needs to be renewed for continuing checks can prevent unexpected or unauthorized credit inquiries.

Documents used along the form

In the complex tapestry of financial transactions and agreements, the Credit Check Authorization form is a crucial document that allows a party to verify the credit history of another. This authorization is often the first step in a series of documentations exchanged or required in various contexts, including employment, leasing, and lending. Alongside it, several other forms and documents typically complete these dealings, ensuring a thorough review of an individual's or entity's financial reliability and compliance with legal standards. Understanding these documents provides a clearer view of the financial verification process.

- Rental Application: This document is used by landlords or property managers to gather information from potential tenants, including their employment history, previous landlords, and personal references. It often accompanies the Credit Check Authorization form in rental agreements.

- Loan Application: Individuals fill out this form when applying for a new loan. It requires detailed information about financial status, employment, income, and existing debts. Credit checks are an integral part of this process.

- Employment Application: Employers use this form to collect information about job applicants. For positions that require financial responsibility, a credit check may be part of the background review process.

- Consent to Background Check: This is a broader authorization form that covers not only credit history checks but also criminal records, driving records, and more, depending on the employer’s or agency's requirements.

- Tenant Screening Authorization: Similar to the Credit Check Authorization form, this document is specific to the rental industry, allowing landlords to conduct a comprehensive background check, which includes credit history, prior evictions, and criminal records.

- Co-Signer Agreement: When a primary applicant may not have sufficient credit or income to qualify on their own, a co-signer agreement is used. This form binds another party, the co-signer, to the financial obligations under the agreement.

- Identity Verification Form: This document is designed to verify the identity of the individual undergoing the credit check or other forms of background checks, requiring submission of government-issued ID and possibly other identifiers.

- Consumer Credit Report Request Form: Individuals can use this form to request a copy of their credit report from credit reporting agencies. It’s a tool for personal finance management and error correction in one’s credit history.

- Dispute Form: When inaccuracies or disputable items are identified on a credit report, individuals can file this form with the credit bureau, challenging the incorrect information.

- Permission for Electronic Disclosures: This form is used for obtaining consent to receive legal notices and documents electronically, in compliance with regulations that govern electronic transactions and consent.

These documents collectively support the maintenance of financial integrity and trust across a wide range of interactions and transactions. Each plays a unique role in ensuring that parties are well-informed and protected, as they allow for the assessment of financial behaviors and risks. From establishing eligibility for renting an apartment to securing a loan, these forms facilitate the crucial exchange of financial information between entities, governed by regulatory compliance and a commitment to transparency.

Similar forms

The Rental Application Form is closely related to the Credit Check Authorization form, as it often requires the potential tenant's permission to run a credit check. This document gathers detailed information about the applicant, including their rental history, employment, and income. Like the credit check form, it serves to verify the applicant's reliability and financial stability, making it an essential part of the screening process for landlords and property managers.

An Employment Application Form, while primarily used to collect information about a job candidate's experience, skills, and education, can also include a section that requests permission to conduct a background and credit check. This similarity lies in the need to assess the trustworthiness and financial responsibility of the individual, particularly for positions that involve financial management or sensitive information, demonstrating the form's role in vetting potential employees.

The Loan Application Form shares a significant similarity with the Credit Check Authorization form, as it explicitly requires the applicant's consent to investigate their credit history. This process helps lenders evaluate the risk involved in lending money to the applicant by reviewing their previous credit management, outstanding debts, and payment history, which is crucial for making informed lending decisions.

A Mortgage Application Form also necessitates the applicant's authorization to conduct a credit check, similar to the Credit Check Authorization form. This document is more specific in its purpose, aimed at individuals seeking to borrow money to purchase real estate. The lender uses the information from the credit check to determine the applicant's ability to repay the loan, underlining the form's importance in the home buying process.

The Consent to Background and Reference Check form, while broader in scope, encompasses the authorization to perform credit checks as part of its mandate. Employers or organizations use this form to not only verify credit history but also to check criminal records, driving records, and professional references. The similarity lies in the underlying intent to assess the credibility and reliability of the individual.

A Car Loan Application Form explicitly requires permission from the applicant to perform a credit check, mirroring the Credit Check Authorization form's purpose. This form is specific to individuals seeking financing to purchase a vehicle, and the credit check helps the lender assess the borrower's creditworthiness and the risk of defaulting on the loan, highlighting the form's role in the auto financing process.

The Business Credit Application Form is similar as it also involves obtaining consent from the business owner or principal to run a credit check. This document is used by businesses seeking credit from suppliers or financial institutions. The credit check serves to evaluate the business’s financial stability and credit history, ensuring the supplier or lender is making a sound decision in extending credit.

Lastly, the Cosigner Agreement is akin to the Credit Check Authorization form because it requires the cosigner to agree to a credit check. This agreement is used when an individual with a stronger credit history agrees to take responsibility for a loan if the primary borrower defaults. The credit check ensures the cosigner has the financial capability to fulfill this role, paralleling the authorization form’s purpose of assessing financial responsibility.

Dos and Don'ts

Completing a Credit Check Authorization form is a critical step in various processes such as applying for a loan, renting an apartment, or securing financing for a large purchase. To ensure accuracy and maintain one's financial security, here are guidelines on what should and shouldn't be done when filling out such a form:

Do's:

- Read the form carefully before you start filling it out to ensure you fully understand what information is being requested and why it is needed.

- Provide accurate information regarding your personal and financial details. Misrepresenting your financial situation can have legal implications.

- Use a secure and private Wi-Fi network if you are completing the form online to protect your personal information from unauthorized access.

- Keep a copy of the authorization form for your records. It's important to have proof of what you have consented to, including the scope of the credit check.

- Regularly review your credit report after giving authorization to ensure there are no unauthorized inquiries or errors.

Don'ts:

- Don't rush through the process. Taking your time can help you avoid mistakes and omissions that could delay the credit check or impact the associated transaction.

- Don't provide more information than is necessary. Only fill out the sections of the form that are required for the credit inquiry being performed.

- Don't forget to check the privacy policy of the entity requesting the credit check. Understand how your information will be used and protected before submitting the form.

By following these guidelines, you can navigate the process of authorizing a credit check with confidence, knowing that you have taken the right steps to safeguard your personal information and financial integrity.

Misconceptions

When it comes to Credit Check Authorization forms, there are a few common misconceptions that can lead to confusion. Understanding the truth behind these can help individuals and businesses navigate credit inquiries more effectively. Here are five important misconceptions and the facts that dispel them:

- Signing a Credit Check Authorization form will negatively affect your credit score. This is a misconception. In reality, the act of authorizing a credit check is a soft inquiry, which does not impact your credit score. Only hard inquiries, such as those done when applying for a new line of credit, can affect your score.

- Employers can see your credit score when you give them authorization to check your credit. This is not accurate. Typically, when employers conduct a credit check, they receive a modified version of your credit report, which excludes your credit score. This report includes information about your credit history and current credit obligations.

- Once you authorize a credit check, you have no control over who sees your credit information. This is false. When you sign a Credit Check Authorization form, you can specify which organization has your permission to view your credit report. This authorization also usually specifies a timeframe, limiting how long your consent is valid.

- All credit inquiries require a Credit Check Authorization form. This is not true. Soft inquiries, like checking your own credit score or prequalification checks made by credit card issuers before they send you an offer, do not require authorization. Only hard inquiries, which could affect your credit score, require your explicit permission through such a form.

- Credit Check Authorization forms are valid indefinitely. This is a common misconception. Actually, these authorizations often have an expiration date. This ensures that your consent is not used for more credit checks than you agree to and that it isn't applied indefinitely for future checks.

Key takeaways

Understanding the Credit Check Authorization form is crucial for making informed decisions regarding financial transactions and employment processes. This document allows organizations to legally obtain and review an individual's credit report, ensuring transparency and consent in these procedures. Here are five key takeaways:

- Consent is Mandatory: A Credit Check Authorization form must be completed and signed before any credit report can be accessed. This ensures that the individual is aware of and agrees to the credit inquiry.

- Accuracy is Essential: When filling out the form, it's important to provide accurate and complete information. Misinformation can lead to delays or inaccuracies in the credit report, potentially affecting decisions based on this information.

- Privacy Protection: The form serves as a safeguard for personal information, highlighting the measures taken to protect privacy. Organizations are obligated to handle the information securely and only for the authorized purpose.

- Understanding Rights: Individuals should be aware of their rights regarding credit checks, including the right to know if information in their credit report has adversely affected them in any financial transaction or employment decision.

- Limited Scope: Authorization given through this form is typically specific to a particular transaction or purpose. It doesn't provide open-ended access to one's credit information for unrelated matters.

By ensuring clarity and mutual understanding, the Credit Check Authorization form plays a critical role in financial and employment procedures. Individuals and organizations alike must approach this process with the seriousness it deserves, recognizing its implications on privacy, accuracy, and legal compliance.

Other Templates:

How to Address a Judge in Writing - A narrative form that allows a third party to provide a judge with an intimate look into the personal characteristics and ethical qualities of a defendant.

Commercial Real Estate Letter of Intent Template - Can result in a faster closing process since it helps identify and address potential issues early in the negotiation stages.

Cease and Desist Harassment Australia - Empowers you to assert your rights with a well-formulated rebuttal to allegations of wrongdoing pointed out in a cease and desist letter.