Official Business Purchase and Sale Agreement Document

When an individual or entity decides to buy or sell a business, a critical step in the process involves the use of a Business Purchase and Sale Agreement form. This document serves as a comprehensive blueprint for the transaction, outlining the terms, conditions, and mutual obligations of both parties involved. Major aspects covered by this form include the identification of the business being sold, the purchase price, payment arrangements, and any representations and warranties made by the seller regarding the state of the business. Additionally, the form addresses the allocation of assets and liabilities, conditions precedent to the sale, covenants regarding the operation of the business prior to sale, and the provisions for handling any disputes that may arise. The agreement is crucial for ensuring that both the buyer and the seller have a clear understanding of their rights and responsibilities, securing a smooth transition of ownership, and providing legal protection for all parties involved. This document acts not only as a record of the sale but also as a guide through the complex process of transferring business ownership.

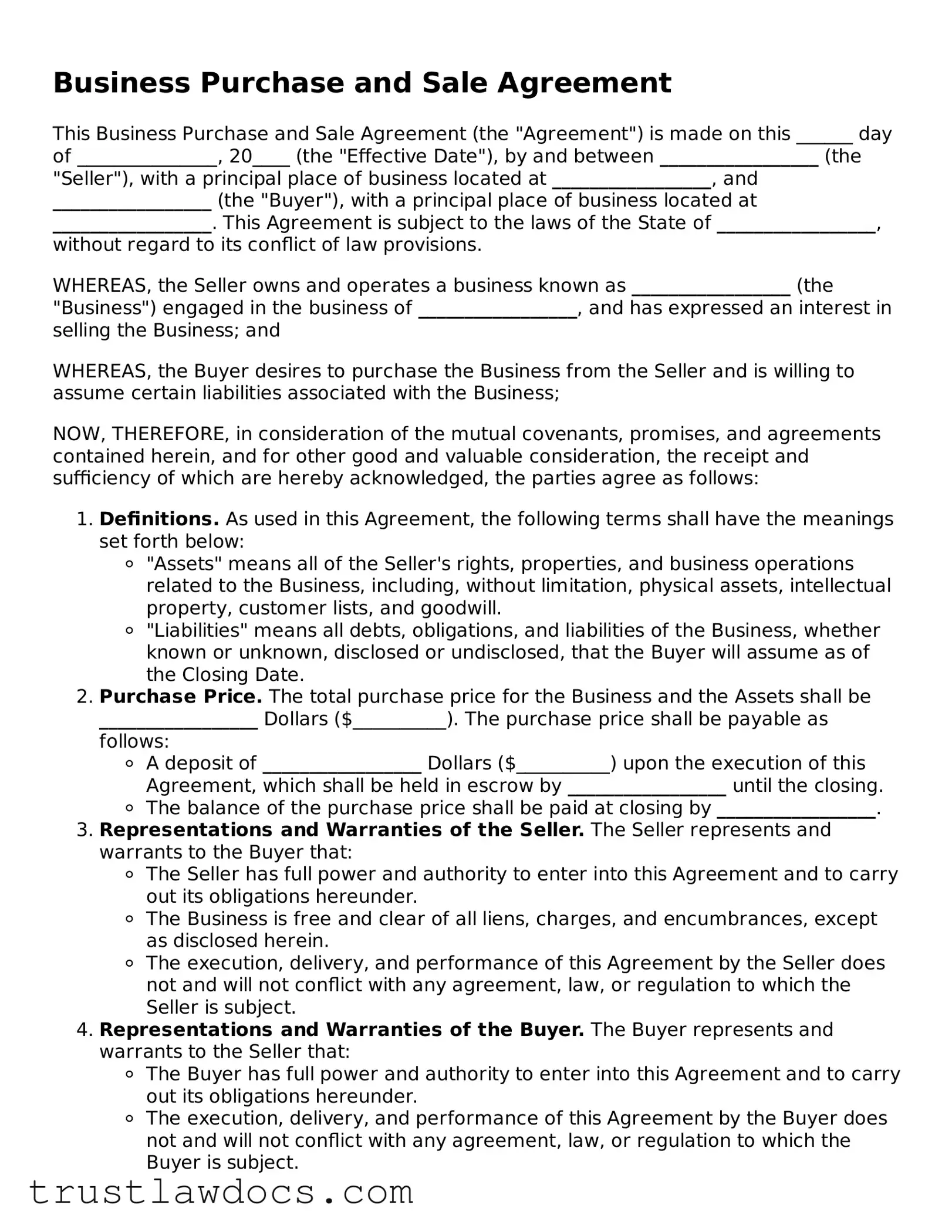

Form Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (the "Agreement") is made on this ______ day of _______________, 20____ (the "Effective Date"), by and between _________________ (the "Seller"), with a principal place of business located at _________________, and _________________ (the "Buyer"), with a principal place of business located at _________________. This Agreement is subject to the laws of the State of _________________, without regard to its conflict of law provisions.

WHEREAS, the Seller owns and operates a business known as _________________ (the "Business") engaged in the business of _________________, and has expressed an interest in selling the Business; and

WHEREAS, the Buyer desires to purchase the Business from the Seller and is willing to assume certain liabilities associated with the Business;

NOW, THEREFORE, in consideration of the mutual covenants, promises, and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Definitions. As used in this Agreement, the following terms shall have the meanings set forth below:

- "Assets" means all of the Seller's rights, properties, and business operations related to the Business, including, without limitation, physical assets, intellectual property, customer lists, and goodwill.

- "Liabilities" means all debts, obligations, and liabilities of the Business, whether known or unknown, disclosed or undisclosed, that the Buyer will assume as of the Closing Date.

- Purchase Price. The total purchase price for the Business and the Assets shall be _________________ Dollars ($__________). The purchase price shall be payable as follows:

- A deposit of _________________ Dollars ($__________) upon the execution of this Agreement, which shall be held in escrow by _________________ until the closing.

- The balance of the purchase price shall be paid at closing by _________________.

- Representations and Warranties of the Seller. The Seller represents and warrants to the Buyer that:

- The Seller has full power and authority to enter into this Agreement and to carry out its obligations hereunder.

- The Business is free and clear of all liens, charges, and encumbrances, except as disclosed herein.

- The execution, delivery, and performance of this Agreement by the Seller does not and will not conflict with any agreement, law, or regulation to which the Seller is subject.

- Representations and Warranties of the Buyer. The Buyer represents and warrants to the Seller that:

- The Buyer has full power and authority to enter into this Agreement and to carry out its obligations hereunder.

- The execution, delivery, and performance of this Agreement by the Buyer does not and will not conflict with any agreement, law, or regulation to which the Buyer is subject.

- Closing and Transition. The closing of the sale of the Business (the "Closing") shall take place on _________________ at the offices of _________________, or at such other place as the parties may mutually agree. At Closing, the Seller shall deliver to the Buyer all necessary documents to effect the transfer of the Assets and the assumption of the Liabilities.

- Confidentiality. Both parties agree to keep the terms of this Agreement and the circumstances surrounding the sale of the Business confidential, except as required by law or as necessary to enforce this Agreement.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of _________________.

- Entire Agreement. This Agreement contains the entire understanding between the parties and supersedes all prior and contemporaneous agreements and understandings, oral or written, relating to the subject matter hereof.

- Amendment. This Agreement may only be amended by a written document signed by both parties.

- Notices. All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, at the address set forth above, or at such other address as the party may specify in writing.

- Severability. If any term or provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable, the remaining provisions will remain in full force and effect.

- Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the Effective Date first above written.

SELLER: _________________

BUYER: _________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Business Purchase and Sale Agreement form is used to outline the terms and conditions under which a business is sold and purchased, including price, assets, liabilities, and conditions of the sale. |

| Components | This form typically includes details such as identification of the buyer and seller, description of the business being sold, purchase price, payment terms, representations and warranties, and closing details. |

| Governing Law | These agreements are governed by the state laws where the transaction takes place. Each state may have specific requirements regarding the sale of a business, which can affect the contents of the agreement. |

| Due Diligence | Both parties, especially the buyer, usually conduct a due diligence process to verify the financial, legal, and operational status of the business before finalizing the agreement. |

| Customization | Although many templates exist, the Business Purchase and Sale Agreement should be customized to fit the specific circumstances of the sale, ensuring all aspects of the deal are appropriately addressed. |

How to Write Business Purchase and Sale Agreement

Completing a Business Purchase and Sale Agreement is a crucial step in the process of buying or selling a business. This document outlines the terms and conditions of the sale, ensuring both parties are clear on the agreement. It helps protect your interests and facilitates a smoother transaction. The following steps will guide you through filling out this form accurately and thoroughly.

- Start by entering the full legal names and contact information of both the buyer and the seller. Make sure this information is accurate to prevent any confusion or legal issues later on.

- Provide a detailed description of the business being sold. This includes the business name, location, type of business, and any assets included in the sale.

- List the purchase price and the terms of payment. Be specific about the amount, payment schedule, and any conditions for payment adjustments.

- Specify the closing date and location where the final transaction will take place. This is when the ownership of the business will officially change hands.

- Outline any representations and warranties made by the seller. This section covers the condition of the business and any guarantees the seller is making about its status.

- Detail the terms of the non-compete agreement, if applicable. This includes the duration and geographic area where the seller agrees not to compete.

- Include any contingencies that must be fulfilled before the sale can be completed. Common contingencies include obtaining financing and passing inspections.

- State the terms for the termination of the agreement. This includes any circumstances under which the agreement can be legally terminated before the sale is completed.

- List the governing law that will apply to the agreement. This determines which state’s laws will be used to interpret and resolve any disputes that might arise.

- Both parties should sign and date the form. It's also a good idea to have the signatures witnessed or notarized to verify their authenticity.

Once you've completed these steps, the Business Purchase and Sale Agreement will be fully executed and both parties can proceed with the transaction. It’s important to keep a copy of the agreement for your records. Next, you'll move forward with the necessary preparations for closing the sale, ensuring all terms outlined in the agreement are met. This might involve finalizing financing arrangements, conducting final inspections, or completing other closing conditions. Staying organized and maintaining open communication with all involved parties will help ensure a smooth and successful transaction.

Get Answers on Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legally binding document between a seller and a buyer where the terms and conditions of the sale and purchase of a business are detailed. It outlines what is being sold, including assets and liabilities, the purchase price, payment plans if any, closing date, and any conditions that must be met before the deal is closed.

Why do I need a Business Purchase and Sale Agreement?

This agreement serves as a formal record of the transaction and helps protect both parties by ensuring everyone is clear about the terms of the sale, including any responsibilities and obligations. It reduces the risk of misunderstandings and conflicts, providing a clear path for resolving disputes if they arise. Moreover, this agreement is often required by financial institutions and government entities during the transfer process.

What should be included in a Business Purchase and Sale Agreement?

A comprehensive Business Purchase and Sale Agreement should include the names of the buyer and seller, a detailed description of the business being sold, the sale price, payment terms, a list of all included and excluded assets, any assumed liabilities, conditions precedent to the sale, warranties and representations of both parties, and provisions for breach of contract. Additionally, it should specify the closing date and any adjustments to be made to the purchase price at closing.

How do I prepare a Business Purchase and Sale Agreement?

Preparing this agreement typically involves careful negotiation between the buyer and seller to reach mutually acceptable terms. It's advisable to consult with legal and financial professionals to ensure that all critical elements are accurately included and to receive guidance on complex issues like tax implications and regulatory compliance. Once these steps are completed, the final agreement can be drafted, reviewed by both parties, and then signed.

Is a lawyer required to create a Business Purchase and Sale Agreement?

While not strictly required, it's highly recommended to engage a lawyer when creating a Business Purchase and Sale Agreement. Legal professionals can provide invaluable advice on the implications of the terms, ensure the contract complies with state and federal laws, and help navigate any legal complexities related to the transaction. This can prevent costly mistakes and legal issues down the line.

Can I use a template for a Business Purchase and Sale Agreement?

Yes, templates can serve as a starting point, but it's important to customize the document to reflect the specific terms of your transaction and to ensure compliance with local laws and regulations. Given the significant legal and financial implications of buying or selling a business, it's advisable to work with legal counsel to tailor the agreement to your particular needs.

What happens after the Business Purchase and Sale Agreement is signed?

After the agreement is signed, both parties must fulfill any conditions specified in the contract before the closing date. This may involve securing financing, obtaining necessary approvals from governmental entities, or completing due diligence tasks. Once all conditions are met, the transaction can proceed to close, where the final exchange of assets and payment will occur.

How can disputes over a Business Purchase and Sale Agreement be resolved?

Disputes are typically resolved through negotiation or mediation as a first step, according to the dispute resolution provisions outlined in the agreement. If these methods fail, litigation may be necessary. It's crucial to have clear dispute resolution procedures in your agreement to guide this process. Consulting with legal counsel during disputes can also help find a resolution that's in the best interest of both parties.

Are there any post-sale responsibilities I should be aware of?

Yes, sellers may have certain obligations even after the sale is completed, such as assisting the buyer during a transition period, respecting non-compete clauses, or fulfilling any warranties or guarantees made in the agreement. Buyers should ensure that all necessary assets have been transferred and begin fulfilling any regulatory or operational requirements related to the newly acquired business. Both parties should review the agreement to fully understand their post-sale responsibilities.

Common mistakes

One common mistake people make when filling out the Business Purchase and Sale Agreement form is not clearly identifying the parties involved. It's crucial to specify the legal names of the buyer and seller, including any co-buyers or co-sellers, and to make sure these are consistent throughout the document. Failing to accurately identify the parties can lead to confusion and might affect the enforceability of the agreement.

Another error is overlooking the importance of a detailed description of what is being sold. This includes not only the physical assets but also any intellectual property, customer lists, or goodwill associated with the business. An incomplete or vague description can lead to disputes post-sale, as there may be differing opinions on what was implied to be included in the sale. It is essential to explicitly list every asset and liability being transferred to avoid misunderstandings and potential legal battles down the line.

A third mistake involves ignoring the representations and warranties section. This part of the agreement is where the seller assures the buyer about the current state of the business and its operations. Often, individuals skim over this section, not realizing its significance. However, inaccuracies or omissions here can lead to severe repercussions. It is crucial to thoroughly understand and accurately represent the financial health, legal standings, and any liabilities of the business. This transparency is key to building trust and can protect both parties if issues arise after the sale.

Finally, many fail to consider the ramifications of the allocation of the purchase price among the various types of assets being sold. The way the purchase price is allocated can have significant tax implications for both the buyer and seller. For instance, certain allocations can lead to a higher tax burden for the seller due to capital gains, or for the buyer in terms of depreciation benefits. It's advisable to consult with a tax professional when completing this section to ensure the allocation is beneficial and compliant with current tax laws.

Documents used along the form

In the complex process of buying or selling a business, the Business Purchase and Sale Agreement is a crucial document. However, this agreement rarely stands alone. Surrounding it, there is a suite of other documents and forms that both support and detail the transaction, ensuring that every aspect of the sale is clear and legally binding. These documents range from preliminary agreements to post-sale agreements, each playing a unique role in the transaction. Let’s explore some of these essential forms and documents.

- Letter of Intent (LOI): Often the starting point of negotiations, this non-binding document outlines the basic terms and conditions of the sale, serving as a foundation for the detailed Business Purchase and Sale Agreement.

- Confidentiality Agreement: Used to protect sensitive information shared during the sale process. Both buyer and seller agree not to disclose confidential details about the business to third parties.

- Due Diligence Checklists: This comprises lists that guide the buyer through a thorough investigation of the business’s financials, legal matters, and other critical areas before finalizing the purchase.

- Bill of Sale: This document transfers ownership of the business's assets from the seller to the buyer, listing what is included in the sale, such as equipment, inventory, and intellectual property.

- Non-Compete Agreement: To protect the buyer, this agreement might be required to prevent the seller from starting a new, competing business within a certain area and time frame after the sale.

- Employment Agreement: If the buyer intends to retain key employees, new employment agreements or contracts may be necessary to outline the terms of their continued employment.

- Consulting Agreement: Sellers often provide support during the transition period. This agreement outlines the terms under which the seller will offer guidance after the sale.

- Lease Agreements: If the business's premises are leased, new lease agreements or assignments of the existing lease to the buyer will be necessary.

- Closing Statement: This document is prepared near the completion of the transaction, detailing the final financial transactions, adjustments, and the distribution of funds between the buyer and seller.

The art of successfully transferring ownership of a business involves navigating these documents with precision and care. Each form and document plays a specific role, collectively ensuring that every aspect of the sale is documented, agreed upon, and legally sound. Together with the Business Purchase and Sale Agreement, they form the backbone of a transaction that respects the interests of both buyer and seller, setting a solid foundation for the future of the business.

Similar forms

The Business Purchase and Sale Agreement is closely related to a Bill of Sale. Both serve as legal documents that confirm the transfer of ownership; however, the Bill of Sale is often more straightforward and used for simpler transactions. It acts as a receipt for personal property sold, like vehicles or office equipment, detailing the item sold, the sale price, and the date of sale. This specificity makes the Bill of Sale a vital proof of purchase and ownership, akin to a scaled-down version of a Business Purchase and Sale Agreement, without the complexities usually involved in transferring a business.

Another document similar to the Business Purchase and Sale Agreement is the Asset Purchase Agreement. This agreement is specifically used when buying or selling a part of a business, such as a company's client list or equipment, rather than the entire entity. It allows for the transfer of ownership of tangible and intangible assets without transferring the business entity itself. The focus on assets rather than the whole business distinguishes it from the broader Business Purchase and Sale Agreement but connects them through their essence of transferring ownership.

The Real Estate Purchase Agreement shares similarities with the Business Purchase and Sale Agreement, particularly in its structure and function. Real Estate Purchase Agreements facilitate the transfer of property ownership, detailing terms, conditions, price, and description of the property. While the Real Estate Purchase Agreement focuses on property, the Business Purchase and Sale Agreement can encompass the sale of a business that may include real estate as part of its assets, linking the two in the broader realm of sales agreements.

Merger and Acquisition (M&A) Agreements also bear resemblance to Business Purchase and Sale Agreements. M&A Agreements are complex documents that outline the terms under which companies will combine or one will acquire another. These documents deal with a vast range of considerations from financial arrangements, warranties, and indemnifications similar to those in Business Purchase and Sale Agreements. However, they are tailored for corporate entities and operations on a larger scale, underlining the corporate restructuring aspect rather than the transfer of a single business ownership.

The Letter of Intent (LOI) is a precursor to documents like the Business Purchase and Sale Agreement. It outlines the terms of a deal before the final agreements are drafted, serving as a non-binding agreement between parties to agree in principle on key terms of the sale. While not a definitive sales agreement, the LOI plays a crucial role in laying the groundwork for the Business Purchase and Sale Agreement by establishing the intent to sell and buy, along with the proposed terms.

Confidentiality Agreements often accompany or precede a Business Purchase and Sale Agreement. They are designed to protect sensitive information that might be shared during the negotiation and due diligence process. By restricting the disclosure of confidential information, these agreements safeguard the interests of both parties involved in a business sale, ensuring that proprietary data, customer lists, or trade secrets are not disclosed to competitors or the public prematurely.

Finally, the Non-Compete Agreement is frequently associated with the Business Purchase and Sale Agreement, especially in transactions where the seller could potentially start a competing business. These agreements limit the seller's ability to start a similar business or work in the same industry for a specified period within a certain geographical area. It helps protect the buyer’s investment in the newly acquired business by reducing the risk of competition from the seller, which could undermine the value of the business and its prospects.

Dos and Don'ts

Completing a Business Purchase and Sale Agreement is a significant step in the transaction process, marking a pivotal point where both parties agree on terms for the transfer of ownership. It is crucial to approach this document with thoroughness and diligence to ensure all details are accurately reflected and both parties' interests are protected. Below are important dos and don'ts to consider when filling out this form.

- Do ensure all information is complete and accurate. Missing or incorrect data can lead to disputes or legal issues down the line.

- Do consult with a legal professional. This agreement has significant legal implications, and professional guidance can help prevent potential pitfalls.

- Do clearly define the assets and liabilities being transferred. Ambiguities here can lead to misunderstandings or financial discrepancies after the sale.

- Do include specific terms regarding payment, including the amount, method, and schedule. This clarity can help avoid conflict concerning financial transactions.

- Don't rush through the process. Careful review and consideration of each clause and how it affects each party are essential for a fair agreement.

- Don't overlook any applicable legal requirements or regulations that may apply to the business sale. Compliance with local, state, and federal law is non-negotiable.

- Don't forget to detail any contingencies that must be met before the sale is finalized, such as approval from financing institutions or satisfactory results from due diligence investigations.

- Don't hesitate to negotiate terms that reflect the best interests of both parties. Negotiation is a normal part of the business sale process, and adjustments can often be made to accommodate the needs and concerns of both buyer and seller.

By following these guidelines, those involved in the business purchase and sale can approach the agreement with confidence, knowing they have taken steps to protect their interests and facilitate a smooth transition of ownership.

Misconceptions

When it comes to buying or selling a business, the Business Purchase and Sale Agreement form plays a crucial role. However, there are several misconceptions about this document that can lead to confusion. Understanding these myths can help ensure a smoother transaction process for both parties involved.

All Business Purchase and Sale Agreements are the same: Contrary to popular belief, these agreements are often tailored to the specific transaction. Generic templates might not adequately protect your interests.

Attorneys are not necessary if a template is used: Even when using a template, it's crucial to have legal guidance. Every business sale has unique elements that might require modifications to standard contracts.

The bigger the business, the more complex the agreement: Size doesn’t always dictate complexity. Sometimes, small business sales involve intricate arrangements due to unique assets, debts, or regulatory considerations.

The selling price is the only important detail: While crucial, the selling price is just one aspect. Terms regarding the transition period, asset valuation, employee retention, and non-compete clauses also play significant roles.

Verbal agreements are sufficient: Verbal agreements are risky and often not legally binding in the context of business sales. A written and signed agreement is essential for protecting all parties' interests.

You can easily back out of the agreement once signed: Backing out without facing legal consequences can be challenging. The agreement outlines specific conditions under which parties can terminate the contract.

Confidential information is automatically protected: Without a clear confidentiality clause or a separate non-disclosure agreement, confidential information could be at risk. Explicit protection measures should be included.

Future disputes must be settled in court: Many agreements include clauses for arbitration or mediation as first steps in dispute resolution. These can save time and money compared to court proceedings.

The agreement doesn't need to detail the transition process: Detailing the transition of ownership in the agreement is critical. It helps ensure a smooth changeover and clarifies the responsibilities of each party.

Key takeaways

When it comes to buying or selling a business, the Business Purchase and Sale Agreement form is a critical document that outlines the terms of the deal. This form serves as a binding agreement between the buyer and the seller and covers everything from the sale price to the assets and liabilities being transferred. Understanding how to properly fill out and use this form is crucial for both parties to ensure a smooth transaction. Here are seven key takeaways to keep in mind:

- Thoroughly review all sections before signing: Ensure that every aspect of the agreement is clearly understood by both parties. This review helps avoid potential misunderstandings or disputes in the future.

- Ensure accuracy of the details: The business name, address, and description of assets, among other specifics, need to be accurately represented to avoid any legal complications.

- Clarify payment terms: The agreement should detail the amount to be paid, payment method, and timeline to eliminate any ambiguity regarding financial transactions.

- Detail the assets and liabilities included in the sale: A clear list of what is being bought or sold will prevent disputes regarding what was intended to be included in the transaction.

- Include non-compete and confidentiality clauses if necessary: Protecting the business and its assets is crucial; these clauses can prevent the seller from starting a competing business or disclosing sensitive information.

- Specify dispute resolution methods: The agreement should outline how potential disagreements between the buyer and seller will be resolved, helping to avoid lengthy and costly legal battles.

- Consult with professionals: Engaging legal and financial advisors can provide both parties with the guidance needed to navigate complex issues and ensure that the agreement complies with all applicable laws and regulations.

Filling out and using the Business Purchase and Sale Agreement form is a significant step in the process of buying or selling a business. By paying close attention to these key takeaways, parties can conduct transactions more effectively, safeguard their interests, and pave the way for a successful partnership post-sale.

Other Templates:

Bill of Sale Four Wheeler - As a legally binding document, it establishes a formal agreement between the buyer and seller, outlining the specifics of the ATV sale comprehensively.

Free Bill of Sale Template for Car - Keeping a copy of this form can assist owners with insurance claims, showing proof of ownership and the vehicle's condition at the time of purchase.