Free Trailer Bill of Sale Form for Texas

When buying or selling a trailer in Texas, an essential document that plays a critical role in the transaction is the Trailer Bill of Sale form. This important paperwork not only acts as a receipt for the purchase but also serves as a legal document that facilitates the transfer of ownership from the seller to the buyer. It contains vital information such as the details of the buyer and seller, the description of the trailer, including make, model, and VIN, and the purchase price. In Texas, this form is particularly important as it may be required for the registration and titling process, ensuring that all legal requirements are met. Furthermore, it provides both parties with proof of the transaction, which can be crucial for tax reporting purposes and as protection in the event of future disputes. The Trailer Bill of Sale form is a straightforward yet powerful tool in the conveyance of trailer ownership, emphasizing the importance of precision and thoroughness in documenting the sale.

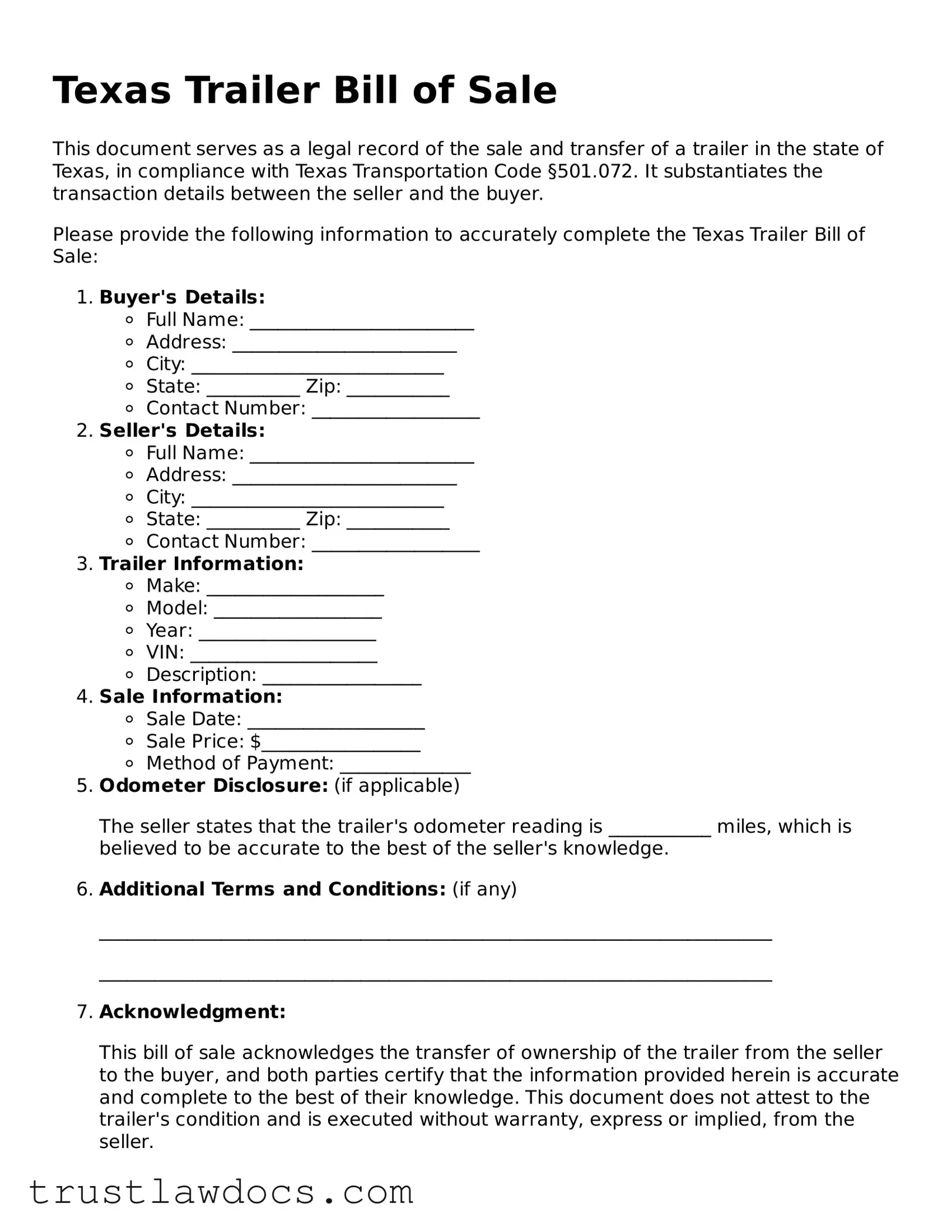

Form Example

Texas Trailer Bill of Sale

This document serves as a legal record of the sale and transfer of a trailer in the state of Texas, in compliance with Texas Transportation Code §501.072. It substantiates the transaction details between the seller and the buyer.

Please provide the following information to accurately complete the Texas Trailer Bill of Sale:

- Buyer's Details:

- Full Name: ________________________

- Address: ________________________

- City: ___________________________

- State: __________ Zip: ___________

- Contact Number: __________________

- Seller's Details:

- Full Name: ________________________

- Address: ________________________

- City: ___________________________

- State: __________ Zip: ___________

- Contact Number: __________________

- Trailer Information:

- Make: ___________________

- Model: __________________

- Year: ___________________

- VIN: ____________________

- Description: _________________

- Sale Information:

- Sale Date: ___________________

- Sale Price: $_________________

- Method of Payment: ______________

- Odometer Disclosure: (if applicable)

The seller states that the trailer's odometer reading is ___________ miles, which is believed to be accurate to the best of the seller's knowledge.

- Additional Terms and Conditions: (if any)

________________________________________________________________________

________________________________________________________________________

- Acknowledgment:

This bill of sale acknowledges the transfer of ownership of the trailer from the seller to the buyer, and both parties certify that the information provided herein is accurate and complete to the best of their knowledge. This document does not attest to the trailer's condition and is executed without warranty, express or implied, from the seller.

Seller's Signature: ___________________________ Date: _____________

Buyer's Signature: ___________________________ Date: _____________

Subscribing witness or notary (if required):

Name: _______________________________

Signature: ___________________________ Date: _____________

Note: It is recommended to keep a copy of this bill of sale for both buyer's and seller's records.

PDF Form Details

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose | The Texas Trailer Bill of Sale form is used to document the sale and transfer of ownership of a trailer from the seller to the buyer. |

| 2 | Required by Law | In Texas, a Bill of Sale is not always mandatory for the sale of a trailer, but it is highly recommended for the protection of both parties. |

| 3 | Governing Law | The form is governed by the Texas Transportation Code, which outlines the requirements for the sale and transfer of trailers. |

| 4 | Information Included | The form typically includes details such as the date of sale, parties’ names and addresses, trailer description, sale price, and signatures. |

| 5 | Notarization | Notarization of the Bill of Sale is not required by Texas law but can provide additional legal protection. |

| 6 | Use in Title Transfer | The completed Bill of Sale is used when the buyer applies for a new title in their name at the Texas Department of Motor Vehicles. |

| 7 | Odometer Disclosure | For trailers that are not self-propelled, Texas law does not require an odometer disclosure statement to be included in the Bill of Sale. |

| 8 | Witnesses | While the presence of witnesses is not mandated by Texas laws for the Bill of Sale, having witnesses can add credibility to the document. |

| 9 | Additional Documents | Depending on the trailer type and use, additional documents may be required for registration purposes in Texas. |

How to Write Texas Trailer Bill of Sale

When buying or selling a trailer in Texas, a crucial step involves the completion of the Trailer Bill of Sale form. This form ensures a clear record is kept of the transfer, detailing information about the trailer, the sale price, and the parties involved. Accuracy is key in filling out this document as it provides legal documentation of the sale, which can be important for registration, taxation, and personal record-keeping purposes. The following steps will guide you through the process of accurately completing the form, ensuring a smooth transaction between the buyer and seller.

- Begin by entering the date of the sale at the top of the form. Make sure the date format is correct and clearly legible.

- Next, fill in the seller's full name, address (including city, state, and zip code), and phone number in the space provided. This information should be accurate to ensure proper contact if needed.

- Proceed to fill out the buyer’s information, including their full name, address (city, state, zip code), and phone number. Double-check the correctness of this information for the same reasons as above.

- In the section allocated for the trailer details, enter the make, model, year, Vehicle Identification Number (VIN), and the trailer's license plate number if applicable. This information is critical for identifying the trailer and verifying its legal status.

- Indicate the sale price of the trailer in the space provided. Be sure to write the amount in both words and numerals to avoid any confusion regarding the sale price.

- If there are any additional terms of the sale (such as warranties or specific conditions), clearly list them in the designated section. If there are no additional terms, it is advisable to write "N/A" to signify that the section does not apply.

- Both the buyer and the seller should sign and date the form in their respective sections at the bottom. These signatures are vital as they officially confirm the agreement and the transfer of ownership of the trailer.

- Finally, it’s recommended (though not always required) to have the form notarized. If choosing to do so, make sure a licensed notary witnesses the signing and completes the notarization section of the form.

Once completed, both the buyer and seller should keep a copy of the Trailer Bill of Sale for their records. This document serves as proof of purchase and may be needed for registration, insurance, or taxation purposes related to the trailer. Following these steps carefully ensures that the sale is documented correctly, providing peace of mind and legal protection for both parties involved.

Get Answers on Texas Trailer Bill of Sale

What is a Texas Trailer Bill of Sale form?

A Texas Trailer Bill of Sale form is a legal document that records the sale of a trailer from a seller to a buyer within the state of Texas. It includes important information such as the trailer's description, the sale price, and the details of both parties involved in the transaction. This document serves as proof of purchase and is necessary for the buyer to register the trailer under their name.

Why is it important to have a Trailer Bill of Sale in Texas?

Having a Trailer Bill of Sale is crucial in Texas for several reasons. It provides legal proof that the ownership of the trailer has been transferred from the seller to the buyer. This is particularly important for the buyer when registering the trailer with the Texas Department of Motor Vehicles (DMV), as it serves as evidence of ownership. Additionally, it protects both the seller and the buyer in the event of future disputes regarding the trailer's ownership or condition at the time of sale.

What information is required on a Texas Trailer Bill of Sale form?

The Texas Trailer Bill of Sale form requires specific information to be fully effective. This includes the date of the sale, names and addresses of both the seller and the buyer, a detailed description of the trailer (including make, model, year, VIN, and any identifying marks), the sale price, and signatures from both parties involved in the transaction. Optional details might include any warranties or conditions of the sale.

Do I need to notarize the Trailer Bill of Sale in Texas?

In Texas, notarization of a Trailer Bill of Sale is not a legal requirement for the document to be considered valid. However, having the form notarized can add an extra layer of legality and protection for both parties, as it verifies the identity of the signatories and the authenticity of their signatures. While not mandatory, it's an encouraged step, especially for high-value transactions.

How does a buyer register a trailer in Texas with a Bill of Sale?

To register a trailer in Texas using a Bill of Sale, the buyer must take the completed and signed Bill of Sale to their local County Tax Office, along with any other required documents, which may include the trailer's title, a valid form of identification, proof of liability insurance, and the necessary fees. The County Tax Office will then process the registration and issue a new title and license plates for the trailer, officially recording the buyer as the new owner.

Common mistakes

Filling out the Texas Trailer Bill of Sale form can sometimes be a daunting task. One common mistake is not checking for the most current form version. Texas law can change, bringing updates to forms and requirements. Without the most up-to-date form, the validity of the bill of sale can be questioned, potentially complicating future transactions or legal matters related to the trailer.

Another oversight is inaccurately describing the trailer. A precise and thorough description, including make, model, year, and Vehicle Identification Number (VIN), is crucial. This ensures clarity in ownership transfer and can prevent legal issues. An incorrect or vague description might lead to disputes or challenges in establishing the trailer's identity.

Often, individuals omit to verify or mistakenly enter the buyer's and seller's information. Each party's full legal name, address, and contact details should be clearly and correctly written. Misidentification can lead to difficulties in enforcing the agreement or locating parties if issues arise post-sale.

A significant error made during this process is not securing a proper acknowledgment of the payment. Stating the sale price, form of payment, and confirming the transaction’s completion is essential for a clear record of the sale. This mistake can result in disputes over payment or misunderstandings regarding the sale terms.

Not stipulating warranty information is an oversight that can lead to future complications. Whether the trailer is sold "as is" or with a specific warranty should be explicitly mentioned. This clarifies the responsibilities of the seller and the expectations of the buyer, preventing potential legal disputes related to the trailer’s condition after the sale.

Failing to include a lien release, if applicable, is also a major mishap. If the trailer previously had a lien against it, proof of the lien's release must be attached. Selling a trailer without disclosing or properly clearing a lien can create legal and financial headaches for the buyer.

Another common mistake is not obtaining signatures from all relevant parties. Both the buyer and seller should sign the bill of sale, and depending on the situation, witnesses or a notary may also be required. Unsigned or improperly executed documents may not be legally binding.

Overlooking the necessity to check for and comply with county-specific requirements can also be problematic. Some counties may have additional stipulations or forms that need to be completed. Failure to adhere to local regulations can invalidate the bill of sale or delay the registration process.

Last but not least, neglecting to keep copies of the signed bill of sale for personal records is a misstep. Both parties should retain a copy for their files. This document serves as a receipt and a legal record of the transaction, which can be crucial for future reference, especially in disputes or for tax purposes.

Documents used along the form

When buying or selling a trailer in Texas, the Trailer Bill of Sale form is crucial for documenting the transaction and protecting both parties' interests. However, to ensure a smooth and legally compliant process, other forms and documents often accompany this bill of sale. These additional documents help to verify the details of the transaction, confirm the identities of the parties involved, and provide evidence of the legal transfer of ownership. Let's explore four of these key documents.

- Certificate of Title: This is an essential document for any trailer transaction. It proves the seller's ownership of the trailer and must be transferred to the buyer upon the sale. The Certificate of Title contains important details about the trailer, such as the make, model, year, and Vehicle Identification Number (VIN).

- Application for Texas Title and/or Registration (Form 130-U): When buying a trailer, the new owner must submit this form to the Texas Department of Motor Vehicles (DMV) to apply for a title and registration in their name. It requires information from both the buyer and the seller, including the sale price and date.

- Release of Lien: If the trailer was previously financed and the lien has been paid off, a Release of Lien document is needed. This document is provided by the lienholder and shows that the trailer is free of any financial encumbrances, making it clear for transfer to the new owner.

- Odometer Disclosure Statement: For trailers that are equipped with odometers, an Odometer Disclosure Statement is often required to document the mileage at the time of sale. This statement helps to ensure transparency about the trailer's use and condition.

Accompanying the Texas Trailer Bill of Sale with these documents can significantly streamline the ownership transfer process, ensure compliance with Texas laws, and provide peace of mind to both the buyer and seller. Always check the most current requirements and seek legal advice if necessary to ensure all paperwork is correctly completed and submitted.

Similar forms

The Texas Trailer Bill of Sale form shares similarities with the Vehicle Bill of Sale document. Both serve as a legal record that documents the sale and transfer of ownership of a piece of property from one individual to another. Specifically, they detail the transaction between seller and buyer, including important information such as the description of the item being sold (a trailer in one case, a vehicle in the other), the sale price, and the date of sale. Both documents act as a receipt for the transaction and may be required for registration or tax purposes.

Similarly, the Boat Bill of Sale form closely resembles the Trailer Bill of Sale in its purpose and content. This document is used to record the sale of a boat, detailing specifics about the boat, the sale price, and the parties involved. Like the Trailer Bill of Sale, the Boat Bill of Sale serves as proof of purchase and may be needed to register the boat or transfer the title. Each ensures that the details of the transaction are recorded officially, providing legal protection and clarity for both buyer and seller.

Another related document is the General Bill of Sale. It is a broad document used for the sale of personal property, ranging from electronics to furniture, and does not necessarily tailor to specific categories like trailers or vehicles. Despite this difference, it functions under the same premise, documenting the details of the sale, including the parties involved, the item sold, and the sale amount. It provides a similar level of legal protection and record-keeping for general sales transactions.

Lastly, the Livestock Bill of Sale document, though specific to the sale of animals, shares foundational similarities with the Trailer Bill of Sale. It records key transaction details such as the description of the livestock being sold, the sale price, and identifies the buyer and seller. Like the Trailer Bill of Sale, it acts as a crucial record that legitimizes the transfer of ownership and can be important for registration, breeding records, and health certifications, guaranteeing a transparent transaction process.

Dos and Don'ts

When filling out the Texas Trailer Bill of Sale form, it's crucial to ensure accuracy and completeness to facilitate a smooth transfer of ownership. Here’s a list of what to do and what not to do to help guide you through the process:

- Do:

- Verify the trailer's information, including make, model, year, and Vehicle Identification Number (VIN), before you start filling out the form.

- Print all information legibly in ink to ensure readability and reduce the risk of errors.

- Include both the seller's and buyer's full legal names, addresses, and signatures to validate the transaction.

- Specify the sale date and the total purchase price to maintain a clear record of the sale’s timing and financial details.

- Check if your county requires notarization of the bill of sale and, if so, ensure it is properly notarized.

- Keep copies of the completed bill of sale for both the buyer and seller to protect your legal rights and for your records.

- Don't:

- Leave any sections of the form blank. Incomplete forms may not be legally binding and can complicate the transfer process.

- Forget to check whether additional documentation is required by your local DMV for the registration of the trailer.

- Rush through the process without verifying all the details you’ve entered on the form. Mistakes can lead to legal issues or delays.

Misconceptions

When dealing with the sale of a trailer in Texas, it's essential to understand the details and requirements of the Texas Trailer Bill of Sale form correctly. There are a number of misconceptions that can lead to confusion and potentially legal complications. Here's a list of common misunderstandings about the Texas Trailer Bill of Sale form:

- It's the same as a car bill of sale. While both documents serve to record the transaction between a buyer and a seller, the Texas Trailer Bill of Sale form is specifically designed for the sale of trailers. Trailers have unique identifiers and requirements that are different from cars.

- Any bill of sale form will do. While generic bill of sale forms can sometimes be used for various transactions, using the specific form for trailers in Texas ensures that all legal requirements are met. This includes specific information that might not be required on a generic form.

- It's only required for new trailers. Regardless of whether a trailer is brand new or used, a Bill of Sale form is necessary to record the transaction in Texas. It is an essential document for both the buyer and the seller for ownership and tax purposes.

- You don't need it if you're gifting a trailer. Even if money isn't exchanging hands, a Bill of Sale form is recommended for the gifting of a trailer in Texas. It provides legal documentation of the transfer of ownership.

- It must be notarized to be legal. Notarization is not a mandatory requirement for the Texas Trailer Bill of Sale to be considered legal. However, having it notarized can add an extra layer of legality and protection for both parties.

- The form covers registration of the trailer. Completing a Bill of Sale form does not mean the trailer is automatically registered in the new owner's name. The buyer must take the Bill of Sale to the Texas Department of Motor Vehicles (DMV) or an equivalent authority to get the trailer registered.

- It's only relevant at the time of sale. The Texas Trailer Bill of Sale form is not just important at the time of the sale but also serves as crucial documentation down the line for registration, tax, or legal purposes.

- You don't need a Bill of Sale if there's a title. Even if the trailer has a title, a Bill of Sale is important as it outlines the terms of the sale, including the sale price, which may not be detailed in the title.

- The buyer doesn't need a copy. Both the buyer and seller should keep a copy of the Bill of Sale for their records. It protects both parties if there are disputes or questions about the sale in the future.

Understanding these misconceptions about the Texas Trailer Bill of Sale can make the process of buying or selling a trailer much smoother and ensure that both parties are legally protected.

Key takeaways

When dealing with the transfer of ownership for a trailer in Texas, the Trailer Bill of Sale form plays a crucial role. Here are six key takeaways to guide you through filling out and utilizing this document effectively:

- Accurate Details: Ensure all provided information on the Texas Trailer Bill of Sale form is accurate. This includes the full names and addresses of the buyer and seller, the sale date, and detailed information about the trailer such as make, model, year, VIN, and the purchase price.

- Signature Requirements: Both the buyer and seller must sign the bill of sale. These signatures legally validate the document and the sale, making it a vital step in the process. It’s recommended to sign the document in the presence of a notary, though not mandatory in Texas, to add an extra layer of legal protection.

- Keep Copies: It's important for both the buyer and seller to keep copies of the completed bill of sale. This document serves as a receipt and a written record of the transaction, which could be crucial for both parties in future legal or tax-related situations.

- Legal Aspects: The Texas Trailer Bill of Sale form is a simple yet legally binding document that outlines the details of the trailer’s sale and transfer of ownership. It can protect both parties in legal disputes by providing evidence of the transaction’s terms and conditions.

- Registration: For the buyer, the bill of sale is an essential document for the registration process. The buyer will need to present it at the Texas Department of Motor Vehicles (DMV) as part of the proof of ownership to register the trailer under their name.

- No Title Trailers: If the trailer being sold does not have a title (a common scenario with older or smaller trailers in Texas), the Bill of Sale becomes even more crucial as it may be the primary document proving ownership and the legality of the sale.

By keeping these key points in mind, both the buyer and seller can ensure a smooth and legally sound transaction, protecting their interests and complying with Texas laws regarding trailer sales.

Popular Trailer Bill of Sale State Forms

Ca Dmv Bill of Sale Pdf - This document is an essential step in the process of obtaining a license plate for the trailer, where required.

A Bill of Sale - It's an affordable and effective method to ensure all legal requirements for the sale are met without needing a lawyer.

Selling a Trailer in Michigan - It serves as a vital piece of evidence in disputes or for tax purposes, verifying the details of the transaction.