Free Tractor Bill of Sale Form for Texas

When buying or selling a tractor in Texas, a critical document required to formalize the transaction is the Tractor Bill of Sale form. This document serves as a legal record, ensuring both parties agree on the terms of the sale, including details like the sale price and the condition of the tractor. It’s essential for the buyer to secure their new asset, and for the seller to have a record of transferring ownership. Additionally, this form plays a crucial role in the registration process of the vehicle, if applicable, and in resolving any potential disputes over ownership or terms of sale in the future. The Texas Tractor Bill of Sale form embodies more than just a receipt; it's a key player in the agricultural sector's buying and selling process, ensuring transactions are conducted smoothly, legally, and with clear records.

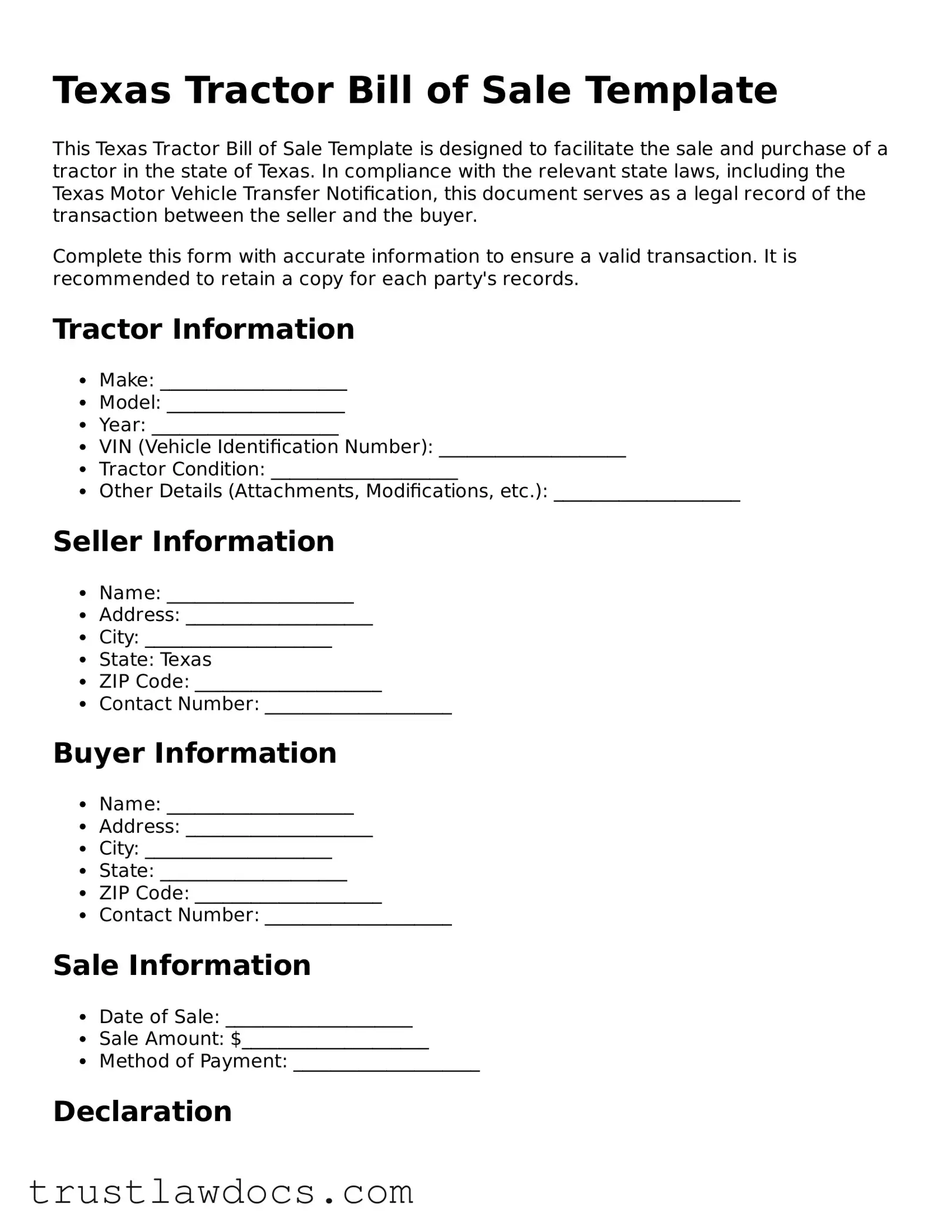

Form Example

Texas Tractor Bill of Sale Template

This Texas Tractor Bill of Sale Template is designed to facilitate the sale and purchase of a tractor in the state of Texas. In compliance with the relevant state laws, including the Texas Motor Vehicle Transfer Notification, this document serves as a legal record of the transaction between the seller and the buyer.

Complete this form with accurate information to ensure a valid transaction. It is recommended to retain a copy for each party's records.

Tractor Information

- Make: ____________________

- Model: ___________________

- Year: ____________________

- VIN (Vehicle Identification Number): ____________________

- Tractor Condition: ____________________

- Other Details (Attachments, Modifications, etc.): ____________________

Seller Information

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: Texas

- ZIP Code: ____________________

- Contact Number: ____________________

Buyer Information

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: ____________________

- ZIP Code: ____________________

- Contact Number: ____________________

Sale Information

- Date of Sale: ____________________

- Sale Amount: $____________________

- Method of Payment: ____________________

Declaration

The seller declares that the information provided about the tractor is accurate to the best of their knowledge and that the tractor is sold "as is," without any warranties beyond those specified. The buyer accepts the tractor under these terms and conditions, acknowledging receipt of this Bill of Sale as proof of purchase and ownership transfer.

Signatures

Seller's Signature: ____________________ Date: ____________________

Buyer's Signature: ____________________ Date: ____________________

This document is subject to the laws of the State of Texas and may require notarization for additional legal validation.

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Texas Tractor Bill of Sale form is used specifically for the sale of tractors in Texas. |

| 2 | This form serves as a legal document that records the sale of a tractor from a seller to a buyer. |

| 3 | It includes key information, such as the make, model, year, and serial number of the tractor. |

| 4 | Both parties, the buyer and the seller, must provide their names and addresses on the form. |

| 5 | The sale price of the tractor and the date of the sale are required details on the form. |

| 6 | It provides a formal acknowledgement that the seller has transferred all rights of possession and ownership of the tractor to the buyer. |

| 7 | Signatures from both the seller and the buyer are mandatory, making the document a legally binding agreement. |

| 8 | Governing law(s) for this form include the Texas Personal Property Bill of Sale Requirements contained in the Texas Business and Commerce Code. |

| 9 | Completing and retaining a Bill of Sale is strongly recommended for personal records and may be required for tax purposes or registration processes. |

How to Write Texas Tractor Bill of Sale

When it comes time to formalize the sale of a tractor in Texas, the process is streamlined through the use of a Tractor Bill of Sale form. This document, critical for both parties, ensures the transaction is recorded legally, providing a layer of protection and clarity. It outlines the transaction details, including the seller's and buyer's information, the tractor's specifics, and the sale price. Completing this form is straightforward if you follow a step-by-step approach. With attention to detail, you can successfully navigate this essential part of transferring ownership of a tractor.

- Gather information about the tractor, including the make, model, year, identification number, and any additional equipment or details pertinent to the sale.

- Complete the seller’s information section by providing the seller's full name, physical address (including the city, state, and zip code), and contact information.

- Fill in the buyer’s information with the buyer's full name, physical address (including the city, state, and zip code), and contact information.

- Specify the sale details, including the sale date and the total purchase price of the tractor. Ensure this amount is accurate and agreed upon by both the buyer and the seller.

- Detail any additional terms or conditions of the sale that both parties have agreed to. This might include payment plans, warranties, or other specifics relevant to the transaction.

- Both the buyer and the seller should carefully review the completed form to ensure all the information is accurate and reflects the agreement made.

- Have both parties sign and date the form. Depending on local regulations, you may also need to have the form notarized to validate the signatures.

- Prepare two copies of the completed form, ensuring both the buyer and the seller retain a copy for their records. This document will serve as a legal record of the sale and may be needed for future reference, such as registration or tax purposes.

Once the Tractor Bill of Sale form is filled out and signed, the process of transferring ownership is one step closer to completion. It's critical for both parties to keep their copies of the bill of sale, as it not only reinforces the terms of their agreement but also serves as a vital record of the transaction. Remember, this document can be essential for registration, tax purposes, or in the event of a dispute. Therefore, taking the time to fill out the form attentively and accurately is in everyone's best interest.

Get Answers on Texas Tractor Bill of Sale

What is a Texas Tractor Bill of Sale form?

A Texas Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor from the seller to the buyer. It typically includes details like the make, model, year, serial number of the tractor, as well as the names, addresses, and signatures of both parties. This document serves as proof of purchase and can be used for registration, tax collection, and to protect both parties in case of disputes.

Why do I need a Tractor Bill of Sale in Texas?

In Texas, a Tractor Bill of Sale is crucial for several reasons. It not only serves as a receipt for the transaction but also establishes the buyer’s ownership for registration and insurance purposes. Furthermore, it's important for personal record-keeping and can be instrumental in resolving any future disputes over the tractor’s ownership or sale terms.

What information is required on a Texas Tractor Bill of Sale?

The essential information that needs to be included in a Texas Tractor Bill of Sale includes the full names and addresses of both the seller and the buyer, a detailed description of the tractor (make, model, year, serial number), the sale date, the sale price, and the signatures of both parties involved. Including an acknowledgment of the tractor's condition and any warranties or "as-is" status is also advisable.

Does the Texas Tractor Bill of Sale need to be notarized?

While notarization is not a mandatory requirement in Texas for a Tractor Bill of Sale to be legally valid, having the document notarized can add a layer of authenticity and may protect both parties against legal challenges. It's a good practice, especially for high-value transactions.

Can I create my own Texas Tractor Bill of Sale?

Yes, you can create your own Texas Tractor Bill of Sale. However, it must contain all necessary information to be considered valid and effective. It is recommended to use a template or consult a legal professional to ensure that the document meets all legal requirements and adequately protects your interests.

Is a Texas Tractor Bill of Sale the same as a title?

No, a Texas Tractor Bill of Sale is not the same as a title. The Bill of Sale is a document that records the transaction between the buyer and seller, while the title is a document that proves ownership of the tractor. When a tractor is sold, the title should be transferred to the new owner, and the Bill of Sale serves as evidence of the transfer process.

What happens if I lose my Texas Tractor Bill of Sale?

If you lose your Texas Tractor Bill of Sale, it's recommended to contact the party with whom you conducted the transaction and request a duplicate. Keeping digital copies of the document can also prevent such situations. If recreating the document, ensure it contains all original information and is agreed upon by both parties.

Can a Texas Tractor Bill of Sale be used for disputes?

Yes, a Texas Tractor Bill of Sale can be a valuable document in the event of disputes. It serves as a legal proof of the sale and terms agreed upon by the seller and buyer. This can be crucial in settling disputes over ownership, warranties, or the condition of the tractor at the time of sale.

Do both parties receive a copy of the Texas Tractor Bill of Sale?

Yes, both the seller and the buyer should receive a copy of the Texas Tractor Bill of Sale. Each party keeping a copy ensures that both have proof of the transaction’s details, which is important for registration, legal, and personal record-keeping purposes.

Common mistakes

When individuals embark on the task of selling or buying a tractor in Texas, completing a Tractor Bill of Sale form is a critical step. However, numerous mistakes can occur during this process, leading to potential complications down the line. One common error is not thoroughly providing all required details. The form demands specific information about the tractor, such as make, model, year, and serial number. Unfortunately, leaving any of these fields incomplete can cause confusion or disputes in the future.

Another oversight involves neglecting to verify the accuracy of the buyer's and seller's information. This includes names, addresses, and contact details. Ensuring that all personal information is accurate and matches other legal documents is essential. This verification prevents issues related to the ownership and accountability of the tractor, especially vital if any legal issues arise post-sale.

One more prevalent mistake is failing to sign and date the document correctly. The signatures of both the buyer and the seller are mandatory to legitimize the sale in the eyes of the law. The date of the transaction, similarly, is crucial, as it can affect warranty periods, return policies, and other time-sensitive matters. Overlooking these elements can render the bill of sale invalid or contestable, potentially nullifying the sale agreement.

Lastly, individuals often forget the importance of obtaining a witness or notary's signature. While not always a legal requirement in Texas, having an impartial third-party witness the transaction can provide an additional layer of protection against future disputes over the validity of the bill of sale. This simple step can save both parties significant time and effort by bolstering the document's credibility.

Documents used along the form

The Texas Tractor Bill of Sale is a crucial document utilized during the transaction of a tractor, serving as proof of the transfer of ownership from the seller to the buyer. Along with this form, there are several other forms and documents that are frequently used to ensure the legality and smooth processing of the transaction. These additional forms play a vital role in providing a comprehensive legal framework for the sale, offering protection and clarity for both parties involved in the transaction.

- Certificate of Title: This document is an essential piece of evidence showing the legal ownership of the tractor. It includes important details such as the make, model, year, and identification number of the tractor. When a tractor is sold, the Certificate of Title must be transferred to the new owner to confirm the change in ownership.

- Promissory Note: In transactions where the buyer agrees to pay the selling price over a period, a Promissory Note is often used. This document outlines the terms of repayment, including the amount borrowed, interest rate, repayment schedule, and consequences of non-payment. It secures the seller's right to be paid according to the agreed terms.

- Sales and Use Tax Resale Certificate: This certificate is used when the tractor is purchased for resale or lease. It allows the buyer to purchase the tractor without paying sales tax at the time of purchase, on the condition that sales tax will be collected when the tractor is later sold or leased. The document is crucial for transactions involving retailers or resellers.

- Release of Liability Form: While not always mandatory, a Release of Liability Form can be a vital document in a tractor sale. It serves to protect the seller by transferring responsibility for any accidents, injuries, or damages that occur with the tractor after the sale to the new owner. This form helps in ensuring the seller is not held liable for issues that arise following the completion of the sale.

In conclusion, when conducting a tractor sale in Texas, incorporating these documents with the Texas Tractor Bill of Sale form can significantly enhance the legal security for both the buyer and seller. They provide a clear and documented path for the transaction, ensuring that all aspects of the sale are properly handled and recorded. This comprehensive approach to documentation can help in avoiding potential legal issues and ensuring that the transaction adheres to all relevant laws and regulations.

Similar forms

The Texas Tractor Bill of Sale form shares similarities with the Vehicle Bill of Sale, as both serve as vital records of the transaction between a buyer and a seller for a piece of personal property. In both documents, details such as the make, model, year, and identification numbers of the items being sold are crucial for identification purposes. These forms act as proof of ownership transfer, listing the transaction date and the agreed-upon price, thereby providing legal protection for both parties involved.

Similar to a General Bill of Sale, the Texas Tractor Bill of Sale is used to document the sale of various items, not just vehicles or tractors. A General Bill of Sale typically includes the names and addresses of the buyer and seller, a description of the item being sold, and the sale price. It is versatile and can be used for personal property ranging from electronics to furniture, functioning as a legal receipt that confirms a transaction has occurred.

Another document closely related to the Texas Tractor Bill of Sale is the Equipment Bill of Sale. This document specifically focuses on the sale of equipment, which can include tractors among other types of machinery. It details the condition of the equipment, its sale price, and any warranty information. Both documents ensure that the specifics of the transaction are clearly outlined, providing security and clarity to the transaction of high-value items.

The Livestock Bill of Sale resembles the Texas Tractor Bill of Sale in its function as a transaction record, but it specifically pertains to the sale of animals like cattle, horses, and other farm animals. This document includes essential details such as breed, gender, and health status of the livestock being sold, along with the standard buyer and seller information. Although the focus is on livestock rather than machinery, the underlying purpose of establishing clear ownership and terms of sale remains the same, illustrating the document's importance in agricultural and farming transactions.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it's important to ensure accuracy and completeness to facilitate a smooth transfer of ownership. Here are some dos and don'ts to consider:

Dos:Include detailed information about the tractor, such as make, model, year, and serial number, to ensure clear identification of the machinery involved.

Verify that all the information provided on the form is accurate and mirrors the information on the tractor’s title and any associated documents.

Ensure both the seller and buyer provide their full names, addresses, and signatures to validate the transaction.

Include the sale date and price to maintain a transparent record of the transaction's timing and value.

Retain a copy of the bill of sale for both the buyer and the seller as proof of ownership transfer and for record-keeping.

Don’t leave any fields blank. If a section does not apply, mark it as N/A (not applicable) to indicate that it was considered but not needed.

Don’t guess or estimate the details of the tractor; ensure all facts are accurate to prevent future disputes or legal issues.

Don’t forget to check for and comply with any additional requirements specific to Texas, such as emissions testing or safety inspections, that might affect the sale.

Avoid using abbreviations or unclear terms. Spell out all information clearly to prevent misunderstandings.

Misconceptions

The process of buying or selling a tractor in Texas might appear straightforward, but it entails completing critical documentation, particularly the Tractor Bill of Sale form. There are several common misconceptions regarding this form that can lead to confusion or legal issues. It's crucial to identify and correct these fallacies to ensure a smooth transaction for both parties involved.

- Misconception 1: The Texas Tractor Bill of Sale form isn't legally required. This is false. While Texas does not mandate a specific form, a documented Bill of Sale is crucial to protect both the buyer and the seller in case of disputes or for record-keeping purposes.

- Misconception 2: The form must be notarized to be valid. Notarization is not a requirement for the form's validity in Texas. However, having it notarized can add an extra layer of protection by verifying the identity of the parties involved.

- Misconception 3: The Bill of Sale is the only document you need to transfer ownership. This is not entirely true. Although it’s an essential part of the process, a clear title transfer is also necessary to complete the change of ownership officially.

- Misconception 4: Any generic Bill of Sale form will suffice. While a general Bill of Sale form may be legally acceptable, a specialized form that includes specific details about the tractor can provide better protection and clarity for both parties.

- Misconception 5: Only the seller needs to provide information on the Bill of Sale. Both the buyer and the seller should provide their details, including contact information, to ensure that all parties are readily identifiable and that the document is comprehensive.

- Misconception 6: The form doesn’t need to mention the tractor’s condition. Documenting the tractor's condition, including any known issues or warranties, is beneficial for protecting the buyer and seller from future disputes or misunderstandings.

- Misconception 7: A Bill of Sale is instant proof of ownership. The form acts as a receipt and a part of the transfer process, but official ownership is only transferred once the title is legally signed over and registered with the appropriate state authorities.

- Misconception 8: Electronic signatures aren’t legally binding on a Texas Tractor Bill of Sale. Electronic signatures are indeed recognized as valid in Texas, provided they meet certain requirements and standards, ensuring flexibility and convenience in completing the transaction.

Understanding the intricacies of the Texas Tractor Bill of Sale form can help prevent legal pitfalls and facilitate a more secure and transparent transaction. By debunking these misconceptions, both buyers and sellers can approach the sale with confidence and proper knowledge.

Key takeaways

When dealing with the transfer of ownership for a tractor in Texas, the Bill of Sale form plays a crucial role. This document not only certifies the sale but also provides a legal record of the transaction. Understanding the key takeaways about filling out and using this form can help make the process smoother and more effective for both the seller and the buyer.

- Ensuring Accuracy: The Texas Tractor Bill of Sale form requires detailed information to be filled out accurately. This includes the make, model, year, and VIN (Vehicle Identification Number) of the tractor, alongside the names and addresses of both the seller and the buyer. Double-checking these details for accuracy can prevent future disputes or legal issues.

- Verification of Ownership: Before the sale, the seller must verify their ownership of the tractor. This involves presenting any previous titles or deeds associated with the tractor. The Bill of Sale then acts as a receipt for the transaction, transferring ownership from the seller to the buyer.

- Signature Requirements: For the Texas Tractor Bill of Sale form to be legally binding, it must be signed by both parties involved in the transaction. Witness signatures and notarization may also be required, depending on local regulations, to further authenticate the document.

- Importance of a Witness or Notary: While not always mandatory, having a witness or notarizing the Bill of Sale can provide additional legal validation. This step ensures that both parties indeed agreed to the terms and that the signatures are legitimate, offering extra protection against fraud.

- Record Keeping: After completing the Bill of Sale, it is essential for both the seller and the buyer to keep copies of the document. This serves as proof of purchase, a record of the transaction details, and may be necessary for registration or insurance purposes for the new owner.

- Legal Protection: The Texas Tractor Bill of Sale form serves as more than just a receipt; it provides legal protection to both the seller and the buyer. For the seller, it confirms the transfer of ownership and the end of their liability. For the buyer, it secures their new ownership rights and can be crucial in resolving any potential disputes regarding the tractor's condition or ownership history.

Completing the Texas Tractor Bill of Sale with diligence and awareness of these key aspects ensures a transparent, fair, and legally sound transaction. It marks an important step in the process of buying or selling a tractor, safeguarding the interests of both parties involved.

Popular Tractor Bill of Sale State Forms

Tractor Bill of Sale - This legal instrument solidifies the agreement into a tangible record, signifying the completion of the transaction.

Bill of Sale for a Tractor - As part of estate planning or settlement, the Tractor Bill of Sale can prove the transfer of assets to heirs or purchasers.