Free Tractor Bill of Sale Form for Michigan

In the heart of America's agricultural landscape, tractors represent more than just machinery; they are pivotal assets for farmers and agricultural businesses alike. The Michigan Tractor Bill of Sale form is a critical document, designed to facilitate the smooth transfer of ownership of this essential equipment from one party to another. This form serves not only as proof of sale but also acts as a detailed record that includes the terms of the deal, the personal details of both the buyer and the seller, and specific information about the tractor itself, such as make, model, year, and serial number. The importance of this document lies in its ability to provide legal protection for both parties involved, ensuring that the transaction is transparent, binding, and recognized by law. Whether it's for small-scale farmers looking to upgrade their operations or large agricultural entities diversifying their equipment, understanding the nuances of the Michigan Tractor Bill of Sale form is stepping stone towards ensuring that every transaction is executed efficiently and with the utmost integrity.

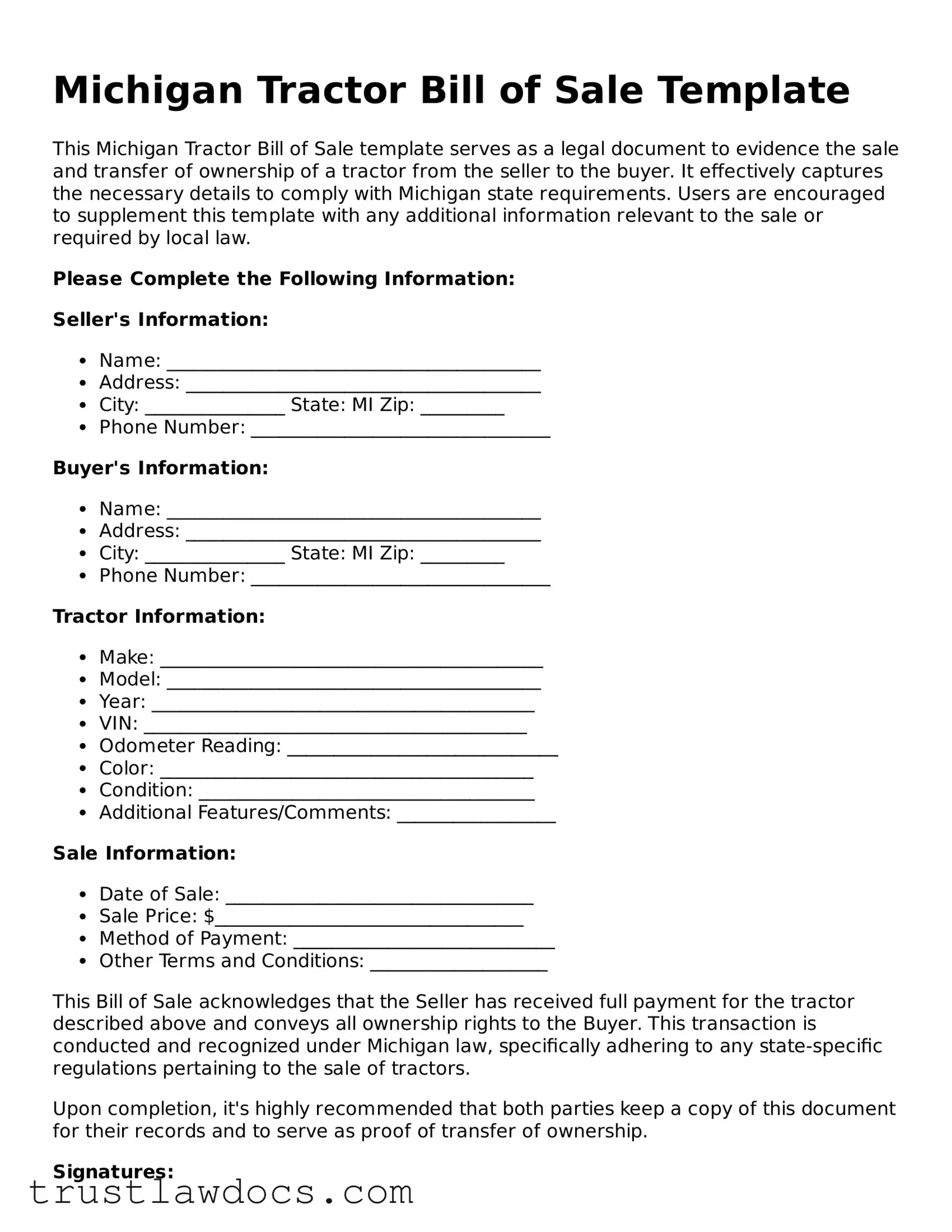

Form Example

Michigan Tractor Bill of Sale Template

This Michigan Tractor Bill of Sale template serves as a legal document to evidence the sale and transfer of ownership of a tractor from the seller to the buyer. It effectively captures the necessary details to comply with Michigan state requirements. Users are encouraged to supplement this template with any additional information relevant to the sale or required by local law.

Please Complete the Following Information:

Seller's Information:

- Name: ________________________________________

- Address: ______________________________________

- City: _______________ State: MI Zip: _________

- Phone Number: ________________________________

Buyer's Information:

- Name: ________________________________________

- Address: ______________________________________

- City: _______________ State: MI Zip: _________

- Phone Number: ________________________________

Tractor Information:

- Make: _________________________________________

- Model: ________________________________________

- Year: _________________________________________

- VIN: _________________________________________

- Odometer Reading: _____________________________

- Color: ________________________________________

- Condition: ____________________________________

- Additional Features/Comments: _________________

Sale Information:

- Date of Sale: _________________________________

- Sale Price: $_________________________________

- Method of Payment: ____________________________

- Other Terms and Conditions: ___________________

This Bill of Sale acknowledges that the Seller has received full payment for the tractor described above and conveys all ownership rights to the Buyer. This transaction is conducted and recognized under Michigan law, specifically adhering to any state-specific regulations pertaining to the sale of tractors.

Upon completion, it's highly recommended that both parties keep a copy of this document for their records and to serve as proof of transfer of ownership.

Signatures:

Seller's Signature: ___________________ Date: _____________

Buyer's Signature: ___________________ Date: _____________

This document does not in itself guarantee a clear title to the tractor. It is the buyer's responsibility to ensure that the vehicle is free from any liens or encumbrances before finalizing the purchase.

PDF Form Details

| Fact | Description |

|---|---|

| Purpose | The Michigan Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from a seller to a buyer in the state of Michigan. |

| Key Information Required | It typically includes details such as the make, model, year, serial number of the tractor, sale price, date of sale, and the names and signatures of the buyer and seller. |

| Governing Law | In Michigan, personal property sales, including tractors, are generally governed by Article 2 of the Uniform Commercial Code (UCC) as adopted by the state. |

| Additional Documentation | Proof of ownership, such as a title or registration, if applicable, may be required to accompany the Bill of Sale for a complete transfer of ownership. |

| Notarization | Not all Bill of Sale forms require notarization in Michigan, but having the document notarized can add an extra level of legal protection and verification. |

| Importance of Accuracy | Accuracy in the Bill of Sale is crucial for both the buyer and seller to ensure legal protection, accurate record-keeping, and to facilitate the registration process, if necessary. |

| Usage in Disputes | Should any disputes or questions regarding the tractor’s ownership arise, the Bill of Sale serves as a legally binding document that clarifies and confirms the details of the transaction. |

How to Write Michigan Tractor Bill of Sale

In the process of selling or buying a tractor in Michigan, the use of a bill of sale is crucial. This document acts as a formal record of the transaction, providing not only proof of the sale but also critical details about the transaction. The steps to fill out the Michigan Tractor Bill of Sale form are straightforward yet require attention to detail to ensure accuracy and legality. Following the steps correctly is essential to protect both the seller's and buyer's interests, making the transition of ownership smooth and legally binding.

- Date of Sale: At the top of the form, fill in the date the sale will take / has taken place.

- Seller's Information: Enter the full legal name, address (including city, state, and zip code), and phone number of the person selling the tractor.

- Buyer's Information: In this section, document the full legal name, address (including city, state, and zip code), and phone number of the purchaser of the tractor.

- Tractor Details: Here, it is essential to describe the tractor in detail. Include the make, model, year, color, identification number, and any additional details that accurately describe the tractor. This ensures there's no confusion about what is being sold.

- Sale Price: Clearly state the sale price of the tractor in US dollars. This confirms the financial aspect of the agreement.

- Odometer Disclosure: If applicable, include the tractor's current mileage. Although not always relevant for a tractor, if the tractor has an hour meter or odometer, documenting the reading can be beneficial for the buyer.

- Seller's Disclosure: This section is where the seller notes any known defects or problems with the tractor. Being honest and upfront about the condition of the tractor can prevent disputes in the future.

- Signature of Seller(s): The seller(s) must sign the bill of sale to acknowledge the accuracy of the information provided and the agreement to sell the tractor under the listed conditions.

- Signature of Buyer(s): The buyer(s) must sign the bill of sale to acknowledge the purchase of the tractor under the given terms and conditions.

- Witnesses or Notarization: If required, the final step might involve having the bill of sale witnessed or notarized. This is dependent on local laws and requirements, so be sure to check whether this step is necessary in your area.

Once filled out, this document should be duplicated so that both the seller and the buyer each have a copy for their records. This protects both parties in case there are any future discrepancies or legal issues. Keep in mind, it’s not just a formality but a legal necessity that ensures the protection of rights for both the buyer and the seller. Ensuring every step is carefully followed and the information is accurate will pave the way for a successful and secure transaction.

Get Answers on Michigan Tractor Bill of Sale

What is a Tractor Bill of Sale form in Michigan?

A Tractor Bill of Sale form in Michigan is a legal document that serves as proof of purchase and sale of a tractor between a seller and a buyer. It outlines the transaction's details, including the names and addresses of both parties involved, a description of the tractor (make, model, year, and serial number), the sale price, and the date of sale. This document is important for the transfer of ownership and is often required for registration and tax purposes.

Do I need to notarize the Tractor Bill of Sale in Michigan?

In Michigan, notarization of a Tractor Bill of Sale is not strictly required by law for the sale to be considered valid. However, having the document notarized can add an extra layer of legal protection for both the buyer and the seller. It verifies the identity of the parties involved and can help prevent potential disputes in the future. While it is not a legal necessity, it is highly recommended.

What information should be included in a Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the tractor (including make, model, year, and serial number), the sale price, date of sale, and any other terms or conditions agreed upon by both parties. Additionally, it should also state that the seller confirms the tractor is free from any liens or encumbrances and that the seller legally owns the tractor and has the right to sell it.

How does a Tractor Bill of Sale protect the buyer?

A Tractor Bill of Sale protects the buyer by providing a legal document that evidences the transfer of ownership from the seller to the buyer. It confirms that the buyer has legally purchased the tractor and outlines the specific details of the transaction, which can be used to resolve any disputes, claim ownership, and register the tractor. Furthermore, it assures the buyer that the tractor was not previously stolen and is free from undisclosed liens.

Can I create a Tractor Bill of Sale myself, or do I need a lawyer?

Individuals can create a Tractor Bill of Sale themselves without the need for a lawyer. There are templates and forms available online that meet Michigan's requirements for such a document. However, it is important to ensure that all the necessary information is correctly included and that the form aligns with any specific local regulations. For complicated cases or for added legal assurance, consulting with a lawyer can be beneficial to ensure that all aspects of the transaction are legally sound and properly documented.

Common mistakes

One common error when filling out the Michigan Tractor Bill of Sale form is neglecting to check for accuracy in the vehicle identification number (VIN). This sequence of numbers and letters is crucial for the identification of the tractor. Mistakes in the VIN can lead to significant issues in the future, including legal ones, as it's the primary means by which a tractor is tracked and registered.

Another mistake often made is failing to provide a detailed description of the tractor. Beyond the make, model, and year, including information about the condition, modifications, or any unique features is essential. This detailed description can help avoid disputes about the tractor's condition at the time of sale.

A frequent oversight is not specifying the sale's terms clearly. It's vital to outline whether the sale is "as is" or if there are warranties or guarantees included. Without a clear statement, the seller may inadvertently imply a warranty, opening the door to potential legal challenges.

In addition, many people forget to include both the buyer's and the seller's full legal names and contact information. This oversight can complicate future communications or legal proceedings. Ensuring that this information is complete and accurate establishes a clear record of who was involved in the transaction.

Skipping the inclusion of the sale date is another common error. This date is important not only for record-keeping but also for any applicable warranty periods or for determining when the tractor officially changed hands.

Some individuals also mistakenly believe they don't need to acknowledge receipt of payment in the bill of sale. However, confirming that the seller has received the agreed-upon amount in full and specifying the payment method (cash, check, etc.) is critical for financial clarity and legal protection.

Another misstep is not securing a witness or notary's signature when it's necessary. While not always legally required, having the bill of sale witnessed or notarized can add an additional layer of authenticity and may be beneficial for record-keeping purposes.

Failing to provide copies of the bill of sale to all parties involved is a mistake that can lead to future documentation issues. Both the buyer and the seller should retain a copy for their records to document ownership transfer and as proof of the transaction's terms.

Finally, a significant mistake is not verifying whether additional paperwork is required by Michigan law to complete the sale. In some cases, additional documents or steps may be needed to fully transfer ownership and comply with state regulations. Overlooking these requirements can invalidate the bill of sale or delay the legal transfer of the tractor.

Documents used along the form

When buying or selling a tractor in Michigan, utilizing a Tractor Bill of Sale is just the beginning of compiling necessary documentation for the transaction. This form is crucial as it officially records the sale and transfers ownership from seller to buyer, offering a legal safeguard for both parties. Along with this important document, several other forms and documents are often needed to ensure a smooth and fully compliant transition. These documents help in verifying identities, ensuring the tractor’s legal status, and fulfilling state regulations. Below is a description of other common documents that are frequently used alongside the Michigan Tractor Bill of Sale.

- Title Transfer Form: This document is essential for legally transferring the title of the tractor from the seller to the buyer. It verifies the change of ownership and is required for registration.

- Warranty Deed or Manufacturer’s Statement of Origin (MSO): New tractors usually come with an MSO, while used ones might come with a warranty deed if applicable, showing the tractor’s origin and ensuring it is not a stolen property.

- Odometer Disclosure Statement: Required for tractors with odometers, this statement certifies the accuracy of the mileage displayed, helping buyers know the exact use of the tractor.

- Proof of Insurance: While not always mandatory for tractors depending on their use, proof of insurance protects the buyer and seller from potential liabilities resulting from tractor use.

- Photo Identification: A valid photo ID, such as a driver’s license or state ID, for both the buyer and seller is often required to verify identities during the sale process.

- Loan Satisfaction Letter: If the tractor was under a lien or loan, this document from the lender states that the loan has been fully paid and the lien can be released.

- Bill of Sale: Alongside the Tractor Bill of Sale, a general Bill of Sale document can also be useful in providing additional legal protection and details about the sale.

- As-Is Sale Form: This form indicates that the tractor is sold in its current condition, and the seller will not be responsible for any future repairs or issues.

- Registration Forms: Depending on local regulations, the buyer may need to register the tractor with a state or local agency, requiring specific forms to be filled out and submitted.

Gathering and completing these documents alongside the Michigan Tractor Bill of Sale form is crucial for a legally compliant and secure sale or purchase of a tractor. Both the buyer and seller should ensure all relevant forms are accurately filled out and filed as needed to protect their interests and adhere to state and local laws. It's also advised to keep copies of all documents for personal records, providing a solid legal foundation for the transaction and ownership of the tractor.

Similar forms

The Michigan Tractor Bill of Sale form shares similarities with the Car Bill of Sale, which is another document proving the legal sale and purchase of a vehicle. Both forms act as pivotal pieces of evidence in transferring ownership, requiring details about the seller, buyer, and the item sold—in this case, a car instead of a tractor. Moreover, they both typically need to include the sale date and purchase price, essential for registration and tax purposes.

Similar to a Boat Bill of Sale, the Michigan Tractor Bill of Sale serves the same purpose but for different types of property. The Boat Bill of Sale documents the sale of a watercraft, requiring information such as hull identification numbers alongside buyer and seller details. Like the tractor bill, it stands as a legal record that ownership has been lawfully transferred and ensures that all necessary information is recorded for future reference.

A Motorcycle Bill of Sale resembles the Michigan Tractor Bill of Sale, as it is also used for transferring ownership of a vehicle—this time, a motorcycle. Both documents necessitate the inclusion of specifics such as make, model, and identification number of the vehicle, in addition to the sale details and parties' information. This paperwork is fundamental in validating the sale and ensuring that the new owner can register the vehicle in their name.

Equally, the Equipment Bill of Sale is closely related to the Michigan Tractor Bill of Sale. It is involved in transactions concerning various equipment types, from construction to office machinery. Like its counterpart for tractors, it includes details on the equipment sold, the sale amount, and the parties involved, serving as a receipt of the transaction and establishing a clear transfer of ownership.

The Firearm Bill of Sale has similarities to the Michigan Tractor Bill of Sale in that it also documents the sale of personal property—in this case, a firearm. Specific details about the firearm, such as make, model, and serial number, are required, alongside information on the buyer and seller. This form is crucial for ensuring the legality of the sale and the proper transfer of ownership according to state laws.

The Pet Bill of Sale is another form with parallels to the Michigan Tractor Bill of Sale. It documents the sale and transfer of ownership of pets, typically including detailed information about the animal, such as breed, age, and health status, as well as the sale terms. Both documents serve to protect both parties by detailing the agreement and confirming the change of ownership.

Similar in nature is the Furniture Bill of Sale, which, like the tractor bill, provides a written record of the sale of personal property—furniture, in this instance. It lists the items sold, along with the purchase price and the buyer’s and seller’s information, functioning as proof of ownership transfer and as a safeguard for both parties involved in the transaction.

The General Bill of Sale is a broad document encompassing the sale of various items, similar to the specific function of the Michigan Tractor Bill of Sale for tractors. This form includes essential information about the item sold, sale details, and the identities of the buyer and seller, catering to numerous transactions across different item types. Its versatility makes it a catch-all for legal sales documentation where more specific forms do not apply.

The Mobile Home Bill of Sale is akin to the Tractor Bill of Sale, focusing on the sale of a mobile home. It captures comprehensive details about the mobile home, sale terms, and parties involved, providing a legal record of ownership transfer. Both documents are tailored to their specific sale items yet function similarly by recording transactions and protecting the interests of all parties.

Lastly, the Horse Bill of Sale compares to the Michigan Tractor Bill of Sale as it is used for the sale of horses, detailing the transaction and changing ownership. It includes specifics such as the horse's description, any warranties or agreements, and the sale's particulars, mirroring the tractor bill's purpose of documenting the sale and ensuring all parties have a clear understanding of the transaction.

Dos and Don'ts

When you're filling out the Michigan Tractor Bill of Sale form, it's crucial to get every detail right. This document serves as a legal proof of the transaction and ensures that the ownership transfer is recognized and recorded properly. To make sure you're on the right path, here are some essential dos and don'ts:

Do:- Verify the accuracy of all information, including the make, model, and year of the tractor, as well as the VIN (Vehicle Identification Number), if applicable.

- Clearly state the sale price. This should reflect the agreed amount between the buyer and the seller.

- Include the date of the sale. This is important for record-keeping and may be relevant for tax purposes.

- Print and sign your name if you're the seller. Have the buyer do the same. It's essential for both parties to acknowledge the sale officially.

- Keep a copy of the bill of sale for your records. It's a good practice for both the buyer and the seller to have a copy for their own documentation.

- Ensure that the contact information for both the buyer and the seller is up to date and accurate.

- Consult with a professional if you have any questions or concerns. Understanding the legal and financial implications is crucial.

- Forget to include any of the tractor's unique identifiers. These details are crucial for the identification of the tractor.

- Leave any fields blank. If a section does not apply, mark it with "N/A" (not applicable).

- Use pencil to fill out the form. All entries should be made in ink to ensure permanency and legibility.

- Ignore the requirement for witness signatures if applicable. Some jurisdictions may require this additional step.

- Omit relevant attachments that might be necessary, such as a disclosure about the tractor's condition.

- Rush the process. Taking the time to double-check details can save you a lot of trouble down the line.

- Assume the buyer’s copies suffice for your records. Having your own copies is vital for future reference.

Misconceptions

When it comes to transferring ownership of a tractor in Michigan, the Bill of Sale plays a crucial role. However, there are several misconceptions about this form that need to be cleared up to ensure the process goes smoothly for everyone involved. Here are four common misunderstandings:

- It's only a formal requirement and provides no real protection. This couldn't be further from the truth. A Bill of Sale is not just a formality; it serves as concrete evidence of the transaction. It details the agreement between the buyer and the seller, offering protection to both parties in case of future disputes.

- Any generic Bill of Sale will do. While it's tempting to use a one-size-fits-all document, the state of Michigan has specific requirements for what should be included in a Tractor Bill of Sale. This often includes identification details of the tractor, such as the make, model, year, and serial number, to ensure the document is legally binding and recognized.

- Only the buyer needs to worry about it. This myth leaves sellers vulnerable. Both the buyer and the seller should take the Bill of Sale seriously. For sellers, it’s proof that they’ve legally transferred their ownership and are no longer responsible for the tractor. This can help prevent potential legal issues down the road.

- A digital copy is enough for all parties. While keeping a digital copy is convenient and recommended for backup, having a hard copy is essential. When it comes to registrations or any legal verifications, a physical copy of the Bill of Sale is often required. It's advisable for both the buyer and the seller to keep a signed, hard copy for their records.

Understanding these nuances about the Michigan Tractor Bill of Sale can make the transfer of ownership an easier and safer process. Remember, this document is more than just paperwork; it's a record of a significant transaction that offers protection and peace of mind to both the buyer and the seller.

Key takeaways

When dealing with the transfer of ownership of a tractor in Michigan, the tractor bill of sale form is a crucial document that outlines the details of the transaction between the buyer and seller. This legal document serves not only as proof of the sale but also protects the rights of both parties. Here are key takeaways about filling out and using the Michigan Tractor Bill of Sale form:

- Complete Accuracy is Crucial: Ensure that all the information provided on the form is accurate and truthful. This includes details about the tractor such as make, model, year, serial number, and any other identifying features. Mistakes or inaccuracies can lead to potential legal issues down the line.

- Personal Information: Both the buyer and the seller must provide their full legal names, addresses, and contact information. This information is necessary for the proper registration of the tractor and serves as a point of contact for any future inquiries or issues.

- Sale Details: Clearly state the sale date and the total purchase price. If there are any conditions or warranties associated with the sale, such as "as is" condition, they should be explicitly mentioned to avoid any misunderstandings.

- Signatures Matter: The bill of sale must be signed by both the buyer and the seller. These signatures legally bind the document, making it a valid and enforceable agreement between the parties.

- Notarization May Be Required: While not always mandatory, having the bill of sale notarized can add an extra layer of legal protection. Notarization certifies that the document is genuine and that the signatures are legitimate.

- Keep Copies: It’s important for both the buyer and the seller to keep copies of the completed bill of sale. This document can be essential for registration, taxation, and personal record-keeping purposes.

Understanding and following these guidelines when filling out the Michigan Tractor Bill of Sale form can help ensure a smooth and legally sound transaction. It's an essential step in transferring ownership of a tractor, providing peace of mind to both the buyer and seller.

Popular Tractor Bill of Sale State Forms

Tractor Bill of Sale - A Tractor Bill of Sale is an indispensable tool in transferring ownership rights transparently and effectively.

Bill of Sale for a Tractor - A Tractor Bill of Sale form may be required for the registration of the tractor in the buyer’s name, depending on local laws.

Bill of Sale for Tractor - Customizable, allowing sellers to include specific terms and conditions tailored to the individual sale.