Free Tractor Bill of Sale Form for Indiana

In Indiana, the tractor bill of sale form serves as a crucial document for the legal transfer of ownership from one party to another. This form, although not always mandatory, plays a significant role in protecting the rights and interests of both the buyer and the seller. It contains essential details such as the description of the tractor (make, model, year, and serial number), the sale price, and the personal information of the involved parties (names, addresses, and signatures). Moreover, the documentation acts as a reliable record for tax purposes and verifies the legitimacy of the sale, ensuring transparency and trust between the parties. The Indiana tractor bill of sale form also assists in the registration process, if required, and helps in resolving any future disputes or claims regarding the tractor's ownership. By providing a solid proof of purchase, this document fundamentally supports the smooth transition of ownership, instilling confidence in both parties regarding the legality of the transaction.

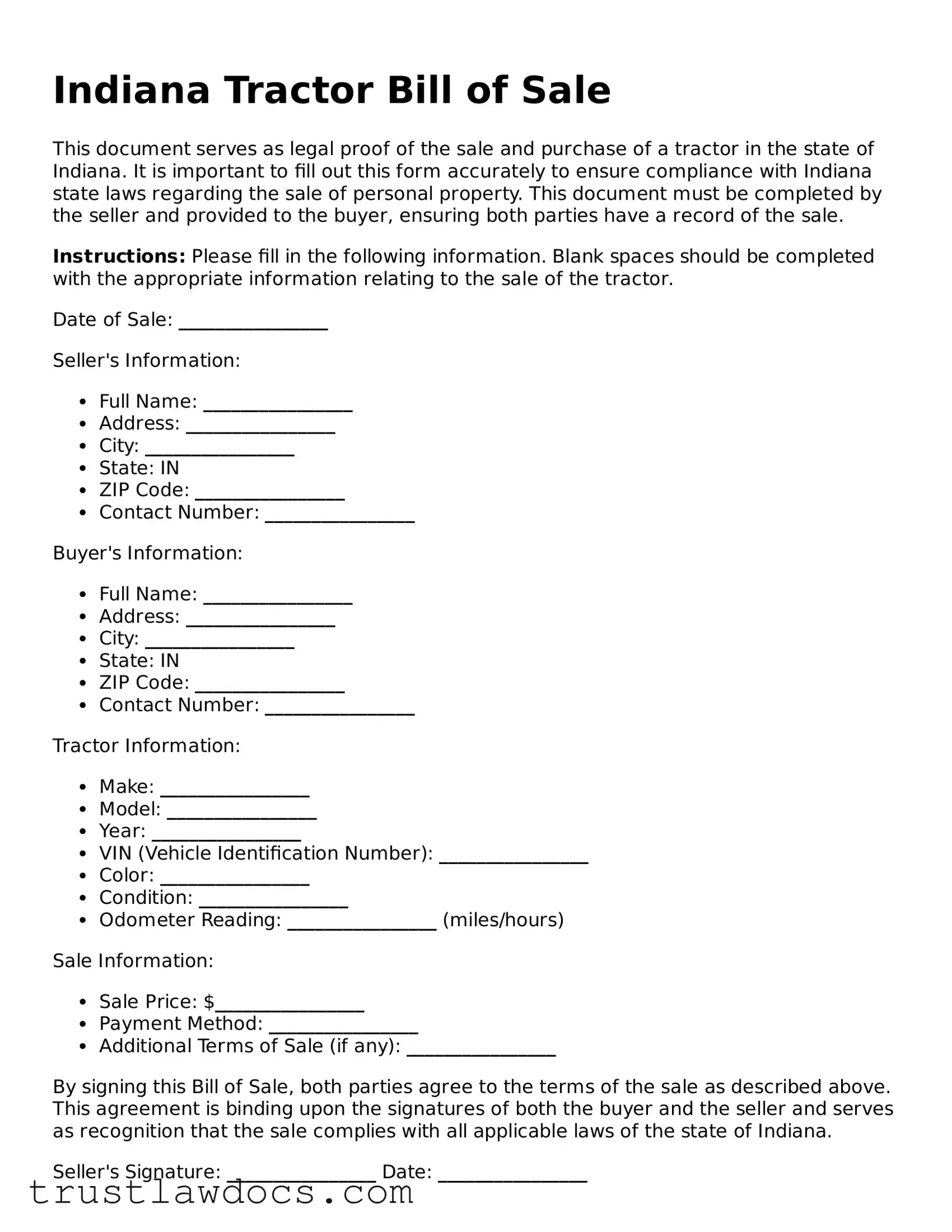

Form Example

Indiana Tractor Bill of Sale

This document serves as legal proof of the sale and purchase of a tractor in the state of Indiana. It is important to fill out this form accurately to ensure compliance with Indiana state laws regarding the sale of personal property. This document must be completed by the seller and provided to the buyer, ensuring both parties have a record of the sale.

Instructions: Please fill in the following information. Blank spaces should be completed with the appropriate information relating to the sale of the tractor.

Date of Sale: ________________

Seller's Information:

- Full Name: ________________

- Address: ________________

- City: ________________

- State: IN

- ZIP Code: ________________

- Contact Number: ________________

Buyer's Information:

- Full Name: ________________

- Address: ________________

- City: ________________

- State: IN

- ZIP Code: ________________

- Contact Number: ________________

Tractor Information:

- Make: ________________

- Model: ________________

- Year: ________________

- VIN (Vehicle Identification Number): ________________

- Color: ________________

- Condition: ________________

- Odometer Reading: ________________ (miles/hours)

Sale Information:

- Sale Price: $________________

- Payment Method: ________________

- Additional Terms of Sale (if any): ________________

By signing this Bill of Sale, both parties agree to the terms of the sale as described above. This agreement is binding upon the signatures of both the buyer and the seller and serves as recognition that the sale complies with all applicable laws of the state of Indiana.

Seller's Signature: ________________ Date: ________________

Buyer's Signature: ________________ Date: ________________

Witness (if any): ________________ Date: ________________

Notary Public (if required): ________________ Date: ________________

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Indiana Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from a seller to a buyer within the state of Indiana. |

| 2 | This form serves as a legal document for the transaction and provides proof of purchase for the buyer. |

| 3 | It is important for both parties, the buyer and the seller, to fill out the form accurately to ensure all details are correct and legally binding. |

| 4 | The form typically includes information such as the make, model, year, and serial number of the tractor, as well as the names and addresses of both the buyer and the seller. |

| 5 | The sale price of the tractor and the date of sale are also essential details that must be included on the form. |

| 6 | Signing the Indiana Tractor Bill of Sale form may need to be witnessed and/or notarized, depending on local regulations and requirements. |

| 7 | Once completed and signed, the form acts as a legal document that can be used for registration, tax, and title transfer purposes. |

| 8 | The Indiana Tractor Bill of Sale form does not replace the need for a clear title but accompanies it in the transfer of ownership process. |

| 9 | Keeping a copy of the completed form is crucial for both the seller and the buyer for record-keeping and in case any disputes arise regarding the transaction. |

| 10 | The use of this form is governed by Indiana state law, specifically those laws that relate to the sale, purchase, and ownership transfer of motor vehicles and machinery. |

How to Write Indiana Tractor Bill of Sale

Filling out a Tractor Bill of Sale form in Indiana is an essential step in the process of buying or selling a tractor. This form serves as a legal record of the transaction, offering protection for both parties involved. It documents the details of the sale, ensuring transparency and establishing a clear transfer of ownership. Completing this form accurately is crucial, as it provides evidence of the sale and can be used for registration, tax purposes, and more. Below are step-by-step instructions to guide you through the process of filling out the form properly.

- Gather all necessary information about the sale. This includes the seller's and buyer's full names, addresses, and contact information, as well as the tractor's make, model, year, and identification number.

- Enter the date of the sale at the top of the form.

- Write the full name, address (including city, state, and zip code), and contact number of the seller in the designated area.

- Provide the same information for the buyer in the corresponding section.

- Describe the tractor in detail. Include the make, model, year, and any identifying numbers or features that distinguish it. This part is crucial for the accuracy of the document.

- List any additional property or equipment being sold with the tractor, if applicable.

- Input the sale price of the tractor. Be sure to state the amount in numbers and then spell it out in words for clarity.

- Specify the terms of the sale, such as whether it's being sold "as is" or if there are any warranties or guarantees attached. This will help to manage expectations and legal responsibilities.

- Both the buyer and seller should sign and date the form. This act finalizes the agreement and confirms the accuracy of the information provided.

- Make copies of the completed form. Each party should keep a copy for their records, and an additional copy may be required for legal or registration purposes.

Once the Tractor Bill of Sale form is filled out and signed, the transaction is officially documented. This document will serve as a valuable asset in the case of disputes, taxation issues, or when proving ownership. It is recommended to keep the form in a safe place, easily accessible if needed for future reference.

Get Answers on Indiana Tractor Bill of Sale

What is a Tractor Bill of Sale form in Indiana?

A Tractor Bill of Sale form in Indiana is a legal document used to record the sale of a tractor from the seller to the buyer. It serves as proof of transaction and includes important details such as the purchase price, the description of the tractor, and the names and signatures of both the seller and the buyer. This form helps both parties to confirm the terms of the sale and protects their rights in the transaction.

Is a Tractor Bill of Sale form required in Indiana?

While Indiana law does not specifically require a Tractor Bill of Sale form for the private sale of a tractor, it is highly recommended to have one. This document serves as a receipt for the buyer and can be crucial for the seller in proving the transfer of ownership. It is also useful for registration or insurance purposes and can resolve any future disputes that may arise regarding the tractor’s ownership.

What information should be included in a Tractor Bill of Sale form?

A comprehensive Tractor Bill of Sale form should include the full names and addresses of both the seller and the buyer, the date of the sale, a detailed description of the tractor (including make, model, year, and serial number), the sale price, payment details, and conditions of the sale if any. Both the buyer and seller should sign and date the form, and it's beneficial to have the signatures notarized to verify the authenticity of the document.

Can I create my own Tractor Bill of Sale form in Indiana?

Yes, you can create your own Tractor Bill of Sale form in Indiana. It is important, however, to ensure that all the necessary information is included to make the document legally binding and effective. Following a template or guideline can help ensure that you do not miss any crucial details. Once completed, both the buyer and seller should keep a copy of the signed document for their records.

Common mistakes

When completing the Indiana Tractor Bill of Sale form, a common misstep many encounter is overlooking the need to provide a thorough description of the tractor. It's not just about the make and model. Including details such as the tractor's year, condition, any unique features, and the serial number can significantly enhance the clarity and enforceability of the bill of sale. This meticulousness helps prevent misunderstandings and ensures both parties are clear on what is being transacted.

Another frequent oversight is failing to verify and accurately record the personal information of both the buyer and the seller. It's crucial that names are spelled correctly and that contact information is current and precise. This information is vital, as it establishes the legal parties in the transaction. Any errors or outdated information can lead to complications in the event of disputes or when the need for future contact arises.

Many individuals also forget to stipulate the sale's terms and conditions. This includes, but is not limited to, the sale price, payment method, and any agreements regarding the tractor’s delivery or pick-up. By clearly defining these terms within the bill of sale, both parties gain a clear understanding of their obligations, thereby minimizing the potential for future conflicts.

In addition to the details of the transaction, ensuring that the bill of sale is duly signed and dated by both parties is a step often missed. This act of signing is not a mere formality; it legally binds the parties to the terms of the agreement as detailed in the document. Forgetting to include these signatures or the date can render the bill of sale incomplete or, worse, legally void.

Last but not least, neglecting to keep a copy of the bill of sale is a mistake that can lead to issues down the line. Both the buyer and the seller should keep a copy of the fully executed document for their records. This copy serves as a proof of purchase and ownership transfer, which can be invaluable in resolving any future disputes, for tax reporting purposes, or when registering the tractor with the Indiana Bureau of Motor Vehicles.

Documents used along the form

When involved in the sale or purchase of a tractor in Indiana, the Tractor Bill of Sale form is a pivotal document, certifying the transfer of ownership from the seller to the buyer. However, to ensure a comprehensive and legally-binding transaction, several other forms and documents are often utilized alongside the Tractor Bill of Sale. These additional forms serve a variety of purposes, from confirming the identity of the parties involved to ensuring the tractor is free from liens and encumbrances.

- Title Certificate: This document is crucial as it officially records the ownership of the tractor. It should be transferred from the seller to the buyer upon the sale, ensuring the buyer is recognized as the new legal owner.

- Odometer Disclosure Statement: Required for vehicles under ten years old, this document records the tractor’s mileage at the time of sale, providing a clear history of use and potentially guarding against odometer fraud.

- Release of Liability Form: This form protects the seller by notifying the state that the seller is no longer responsible for what happens with the tractor after the sale. It's a crucial step in mitigating any potential future liabilities.

- Lien Release: If the tractor was previously financed, this document is necessary to prove that the vehicle is free from any financial encumbrances, with all liens against it having been satisfied.

- Registration Application: For the buyer, a new registration application for the tractor must be completed and submitted to the Indiana Bureau of Motor Vehicles (BMV). This step is necessary for legally operating the tractor on public roads.

- As-Is Sale Acknowledgment: Often used in private sales, this document clarifies that the tractor is sold in its existing condition without any guarantees or warranties from the seller, putting the responsibility on the buyer to accept any future repairs and conditions.

In conclusion, while the Tractor Bill of Sale is essential for documenting the sale and transfer of ownership of a tractor in Indiana, it works best when accompanied by other forms and documents. Each document plays a role in protecting the interests of both the buyer and the seller, making the transaction not only legal but also secure for both parties involved. It is always recommended to consult with a specialist or legal professional to ensure all paperwork is properly completed and filed.

Similar forms

The Indiana Tractor Bill of Sale form shares similarities with the Vehicle Bill of Sale document found in many states. Both serve as legal records that document the sale and transfer of ownership from a seller to a buyer. They provide essential information such as the make, model, year, and identification numbers of the item being sold, alongside the names and signatures of both parties involved. These documents act as proof of transaction and are often required for registration purposes or tax declarations.

Another document resembling the Indiana Tractor Bill of Sale is the Equipment Bill of Sale. This document is used for the sale of machinery and equipment other than vehicles, such as construction equipment. Like the tractor bill of sale, it outlines the terms of the sale, identifies the item sold, and includes the price and parties' details. The primary purpose of both documents is to legally record the sale and transfer of personal property, providing a binding agreement that can help resolve any future disputes over ownership.

The Boat Bill of Sale is also akin to the Indiana Tractor Bill of Sale. Both documents serve the specific need of transferring ownership of a particular type of property—tractors in one case and boats in the other. They include similar details such as the description of the item being sold, the sale price, and the signatures of both the buyer and seller. These bills of sale are crucial for registration processes and may be required by state or local authorities to document the change in ownership.

Similarly, the Firearm Bill of Sale form parallels the Indiana Tractor Bill of Sale. This specialized document is used for the private sale of guns and weapons, detailing the make, model, caliber, and serial number of the firearm. Both forms act as preventive measures against legal issues, offering proof of ownership transfer and the terms of sale agreed upon by both parties. Additionally, they can offer protection for the seller by documenting the item's condition at the time of sale, which can be crucial for avoiding liability in certain situations.

Last but not least, the General Bill of Sale form shares common ground with the Tractor Bill of Sale. This more universal document can be used for the sale of various personal property items, from electronics to furniture, making it versatile for different transactions. Both types of bill of sale contain detailed information about the transaction, including the items sold, sale date, buyer and seller information, and agreed-upon price. This documentation is essential for the legal transfer of ownership and can also serve as evidence in disputes about the sale or condition of the items involved.

Dos and Don'ts

When completing the Indiana Tractor Bill of Sale form, certain practices should be followed to ensure the process is smooth and legally sound. Here are the do's and don'ts that can guide you through this process effectively.

Do:

- Provide clear and accurate details about the tractor, including the make, model, year, and serial number. This information is crucial for identifying the vehicle precisely.

- Include both the seller's and buyer's full names, addresses, and contact information. This establishes a clear record of who is involved in the transaction.

- Ensure the sale price is accurately listed and both parties agree on the amount. This clarity prevents future disputes regarding the transaction terms.

- Sign and date the bill of sale on the day of the sale. This documents the transaction's date, which is important for legal and registration purposes.

- Keep a copy of the bill of sale for your records. Both the seller and the buyer should have a copy to serve as proof of purchase and ownership transfer.

Don't:

- Leave any fields on the form blank. If a section does not apply, mark it as "N/A" (Not Applicable) instead of leaving it empty, to show that the information was considered but not needed.

- Forget to verify the accuracy of all details entered on the form, especially the tractor's identification numbers and personal information of both parties.

- Overlook the requirement for witness signatures if applicable. Some jurisdictions may require the bill of sale to be witnessed to increase its legal standing.

- Fail to check if additional documentation is needed for the tractor's sale in Indiana. Sometimes, further paperwork is necessary for registration or for tax purposes.

- Assume the bill of sale alone is enough for the buyer to register the tractor. Often, other documents are also required by the state for registration.

Misconceptions

When discussing the Indiana Tractor Bill of Sale form, several misconceptions commonly arise. These misunderstandings can lead to confusion and potential legal issues for both buyers and sellers. It's important to clarify these points to ensure a smooth transaction and legal compliance.

- The form is optional. Many believe that completing a Tractor Bill of Sale form is optional in Indiana. However, this document is crucial for legal proof of the transaction, ensuring both parties have evidence of the sale and terms.

- Any form will work. Not all Bill of Sale forms are created equal. The Indiana Tractor Bill of Sale form is specific to the state and designed to include all necessary legal information. Using a generic form may not comply with state requirements.

- It only benefits the seller. Both the buyer and seller benefit from the Bill of Sale. For the seller, it provides proof that the item was legally sold and ownership transferred. For the buyer, it serves as proof of purchase and ownership - crucial for registration and insurance purposes.

- Verbal agreements are just as good. While verbal agreements may hold some weight, they are challenging to prove in legal disputes. A written Bill of Sale is a tangible, enforceable document that outlines the specifics of the sale, offering protection to both parties.

- It's complicated to complete. The Indiana Tractor Bill of Sale form is straightforward. It requires essential information about the buyer, seller, item sold, and transaction details. While it's legal documentation, it's designed to be completed without the need for professional legal assistance.

- Not necessary for family transactions. Even when selling or buying a tractor within a family, a Bill of Sale is recommended. It ensures clarity and legality of the ownership transfer, which can prevent future disputes and complications, especially in estate situations or for tax purposes.

Dispelling these misconceptions ensures that individuals entering into a tractor sale in Indiana can do so with the correct knowledge and documentation, safeguarding their interests and compliance with state laws.

Key takeaways

When dealing with the Indiana Tractor Bill of Sale form, it’s crucial to approach the process with care and attention to detail. This document is essential for both the seller and the buyer, serving as a legal record of the sale and transfer of ownership of a tractor. Here are key takeaways to ensure the process is handled correctly:

- Ensure all parties have a clear understanding of the form’s content. It's a straightforward legal document, but every section must be filled out accurately to avoid future disputes or misunderstandings.

- Complete the form with the tractor's detailed description, including make, model, year, and serial number, to unequivocally identify the machine.

- Include both the seller's and buyer's full names and addresses. This information is crucial for legal and contact purposes.

- Don't forget to state the sale price. This is essential for tax purposes and serves as a record of the transaction's value.

- Date of sale is another critical detail. This date marks when the ownership officially transfers from the seller to the buyer.

- Signatures are mandatory. Both the buyer and seller must sign the form to validate the sale legally. Their signatures are a testament to the accuracy of the information and agreement to the sale.

- Consider having the signatures notarized. While not always a requirement, notarization adds an extra layer of authenticity and legal protection.

- Keep copies of the filled-out form for both the buyer and seller. Having this document readily available helps resolve any potential issues or disputes in the future.

- Report the sale to relevant local authorities if required. Some localities might need you to report the sale for tax or regulatory reasons.

Adhering to these guidelines will facilitate a smoother transaction process, providing peace of mind for both parties involved in the sale of a tractor in Indiana. Remember, the bill of sale is not just a receipt; it is a binding document that affirms the legality of the sale and the change of ownership.

Popular Tractor Bill of Sale State Forms

Bill of Sale for a Tractor - For collectors or restorers of vintage tractors, the Bill of Sale is crucial for verifying the authenticity and provenance of their vehicles.

Bill of Sale for a Tractor - Includes crucial information such as buyer and seller names, contact details, and signatures.

Bill of Sale for Tractor - Effective in deterring potential fraud, the detailed transaction record helps authenticate the sale.