Free Tractor Bill of Sale Form for Florida

When buying or selling a tractor in Florida, the Tractor Bill of Sale form plays a crucial role in the transaction, documenting the transfer of ownership from the seller to the buyer. This legal document, while not always mandatory, is highly recommended as it provides a written record of the sale, including details such as the sale price, description of the tractor, and the names and signatures of both parties involved. It serves not only as proof of purchase for the buyer but also as a release of liability for the seller, ensuring that any future issues or disputes can be resolved with clear, documented evidence. Furthermore, the form can be essential for the buyer when registering the tractor with state authorities or when required for insurance purposes. Understanding the importance and the correct way to complete this form can significantly streamline the buying or selling process, offering peace of mind to both parties involved in the transaction.

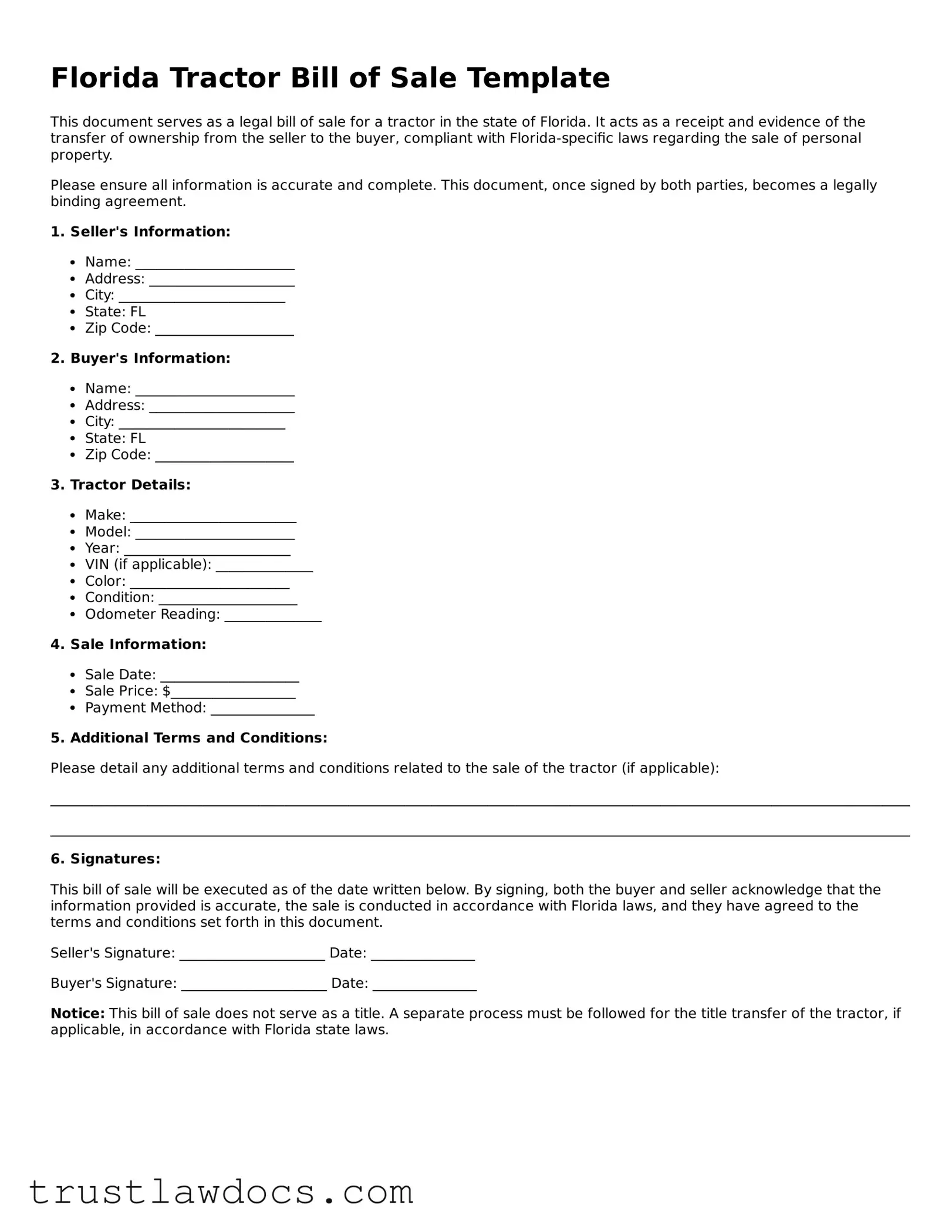

Form Example

Florida Tractor Bill of Sale Template

This document serves as a legal bill of sale for a tractor in the state of Florida. It acts as a receipt and evidence of the transfer of ownership from the seller to the buyer, compliant with Florida-specific laws regarding the sale of personal property.

Please ensure all information is accurate and complete. This document, once signed by both parties, becomes a legally binding agreement.

1. Seller's Information:

- Name: _______________________

- Address: _____________________

- City: ________________________

- State: FL

- Zip Code: ____________________

2. Buyer's Information:

- Name: _______________________

- Address: _____________________

- City: ________________________

- State: FL

- Zip Code: ____________________

3. Tractor Details:

- Make: ________________________

- Model: _______________________

- Year: ________________________

- VIN (if applicable): ______________

- Color: _______________________

- Condition: ____________________

- Odometer Reading: ______________

4. Sale Information:

- Sale Date: ____________________

- Sale Price: $__________________

- Payment Method: _______________

5. Additional Terms and Conditions:

Please detail any additional terms and conditions related to the sale of the tractor (if applicable):

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

6. Signatures:

This bill of sale will be executed as of the date written below. By signing, both the buyer and seller acknowledge that the information provided is accurate, the sale is conducted in accordance with Florida laws, and they have agreed to the terms and conditions set forth in this document.

Seller's Signature: _____________________ Date: _______________

Buyer's Signature: _____________________ Date: _______________

Notice: This bill of sale does not serve as a title. A separate process must be followed for the title transfer of the tractor, if applicable, in accordance with Florida state laws.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Florida Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from a seller to a buyer. |

| Legal Requirement | While Florida does not mandate a bill of sale for tractors specifically, it serves as a crucial record for proof of purchase and determination of sales tax. |

| Key Components | Essential information includes the make, model, year, serial number of the tractor, sale price, and the names and signatures of the buyer and seller. |

| Governing Laws | Primarily governed by Florida's general laws on personal property sales, found in the Florida Statutes, without specific statutes for tractors. |

How to Write Florida Tractor Bill of Sale

When you're ready to sell or purchase a tractor in Florida, completing the Tractor Bill of Sale form is an important step. This document serves as proof of the transaction, records the details of the sale, and provides peace of mind for both parties involved. It's a straightforward process, and by paying attention to detail, you can ensure the transaction goes smoothly. Here are the steps needed to fill out the form properly.

- Begin by documenting the date of the sale at the top of the form. This establishes when the transaction took place.

- Next, fill in the seller's full name and address. Make sure to include the city, state, and zip code to accurately identify the seller.

- Proceed by entering the buyer's full name and address, following the same format used for the seller to ensure clarity.

- Describe the tractor in detail. Include the make, model, year, and vehicle identification number (VIN). This information is critical for correctly identifying the vehicle being sold.

- Enter the sale price of the tractor. This should be the agreed amount between the buyer and seller.

- Both the buyer and the seller need to sign the form. Their signatures officially seal the deal, marking their agreement to the terms of the sale.

- Finally, for additional validation, it's wise to have the form notarized. While this step may not be mandatory, it adds an extra layer of authenticity to the transaction.

Once the Florida Tractor Bill of Sale form is filled out completely, both parties should keep a copy for their records. This document confirms the transfer of ownership and can serve as a valuable piece of evidence if any disputes arise in the future. Remember, attention to detail today can prevent headaches tomorrow. With the filled-out form, you're one step closer to successfully completing the tractor transaction.

Get Answers on Florida Tractor Bill of Sale

What is a Tractor Bill of Sale form in Florida?

A Tractor Bill of Sale in Florida is a legal document that records the sale and transfer of a tractor from a seller to a buyer. This document serves as proof of purchase and can be vital for registration, tax purposes, and to protect both parties in the event of any future disputes regarding the tractor's ownership.

Why do I need a Tractor Bill of Sale in Florida?

Having a Tractor Bill of Sale is crucial in Florida for a few reasons. It legally documents the transaction, helping to prevent potential misunderstandings or fraud. For the buyer, it provides evidence of ownership which is necessary for registration with local authorities. For sellers, it releases them from liability if the tractor is subsequently involved in an accident or incurs penalties.

What information should be included in a Tractor Bill of Sale form?

A comprehensive Tractor Bill of Sale should include the date of the sale, detailed information about the tractor (such as make, model, year, and serial number), the sale price, the names and addresses of both the buyer and seller, and the signatures of both parties. It is also recommended to have it notarized, though not mandatory in Florida.

Is it mandatory to notarize the Tractor Bill of Sale in Florida?

In Florida, it is not mandatory for a Tractor Bill of Sale to be notarized. However, having it notarized can add an extra layer of legal protection and authenticity to the document, making it harder for either party to dispute the transaction's validity.

Can a Tractor Bill of Sale form be written by hand?

Yes, a Tractor Bill of Sale form can be written by hand in Florida, as long as it contains all the necessary information and is clear and legible. Nonetheless, using a typed or professionally drafted form may help ensure that all required details are included and easy to read.

What if the tractor is being sold "as is"?

If a tractor is sold "as is" in Florida, this means the seller is not offering any warranties, and the buyer accepts the tractor with all its current faults and conditions. This should be explicitly stated in the Tractor Bill of Sale, along with acknowledgment from the buyer that they accept these terms. This protects the seller from future claims if issues arise with the tractor.

How can I obtain a Tractor Bill of Sale form in Florida?

Tractor Bill of Sale forms for Florida can be obtained online through legal document services, at local DMV offices, or by consulting with an attorney. Ensure any form you use is compliant with Florida law and includes all necessary details.

Is a Tractor Bill of Sale the same as a title?

No, a Tractor Bill of Sale is not the same as a title. The Bill of Sale serves as evidence of the transaction between the buyer and seller. In contrast, the title is a legal document issued by the state that officially records the current owner. For many tractors, especially older models, titles may not be available, making the Bill of Sale even more important.

What should I do after receiving a Tractor Bill of Sale?

After receiving a Tractor Bill of Sale in Florida, the buyer should keep the document in a safe place. It may be required for registration, insurance, or tax purposes. Additionally, ensuring that the transfer of ownership is complete and that the seller has canceled any previous registration or insurance is wise.

Can I use a Tractor Bill of Sale for tax deductions?

In some cases, purchasing a tractor can be eligible for tax deductions in Florida, particularly if it is used for business or agricultural purposes. The Tractor Bill of Sale serves as a receipt for the purchase and may be required by tax authorities when claiming deductions. It is advisable to consult with a tax professional to understand your eligibility for such benefits.

Common mistakes

One common mistake made when filling out the Florida Tractor Bill of Sale form is neglecting to include all necessary details about the tractor, such as make, model, year, and serial number. These details are essential for identifying the tractor and validating the sale. Omitting any of these can lead to complications in the transaction and can even affect the legal standing of the document.

Another error often encountered is failing to accurately record the sale price. It's critical to clearly state the agreed-upon purchase price on the form. This not only ensures transparency between the buyer and seller but also serves as a record for tax purposes. Inaccurate reporting of the sale price can lead to discrepancies and potential legal issues down the line.

Not all parties involved may remember to sign and date the document, which is a crucial step in the process. The signatures of both the buyer and the seller along with the date of the transaction finalize the agreement and make it legally binding. A bill of sale without these signatures might as well be considered incomplete and can easily be disputed.

Overlooking the need to verify or notarize the document is another common oversight. While not always mandatory, having the bill of sale notarized can add an extra layer of legal protection and authenticity to the document. Skipping this step might leave one vulnerable in the event of a dispute.

A significant mistake is not making or keeping copies of the completed bill of sale for personal records. Each party should have a copy of the document for their records. This ensures that there is a backup available in case the original document is lost or damaged.

Failing to include a full description of the tractor’s condition in the bill of sale is also a misstep. Detailed information regarding the tractor's current state, including any known faults or damages, should be noted. This transparent disclosure helps protect the seller from future claims by the buyer about the tractor's condition.

Some individuals mistakenly use a generic bill of sale form that does not cater to the specific requirements or legal standards of Florida. It is important to use a form that is designed specifically for the state of Florida to ensure that it meets all local legal criteria.

Lastly, a common mishap is not verifying the identity of the buyer or seller. Each party should confirm the other’s identity to prevent fraud and ensure the legality of the transaction. Neglecting to do so can result in legal issues and complications long after the sale is completed.

Documents used along the form

When completing a tractor transaction in Florida, the Bill of Sale form is a crucial document that officially records the sale and transfer of ownership. Alongside this form, several other documents are commonly used to ensure that the sale complies with local laws and regulations, and to protect the interests of both the buyer and the seller. These documents help in establishing a clear, legally sound record of the sale and in fulfilling various other legal or procedural requirements.

- Certificate of Title: This is essential for proving ownership of the tractor. If the tractor is titled, a properly transferred title is necessary to complete the sale.

- Warranty Deed: When the tractor is part of a larger property sale, a Warranty Deed might be used to guarantee that the seller has the right to sell the property and that there are no liens against it.

- Release of Liability: This form protects the seller from future liabilities that may arise from the tractor's use after the sale. It’s a document that should be submitted to the DMV.

- Promissory Note: If the purchase involves installment payments, a Promissory Note outlines the payment plan, interest rate, and what happens in case of default.

- As-Is Sales Agreement: This document specifies that the tractor is sold in its current condition, releasing the seller from responsibility for any future repairs or problems.

- Loan Agreement: Should the purchase be financed, a Loan Agreement between the lender and the buyer details the loan's terms, including repayment schedule, interest rate, and collateral.

- Personal Property Security Agreement: In cases where the tractor is used as collateral for financing, this document secures the interest of the lender against the tractor.

- Odometer Disclosure Statement: Although typically associated with motor vehicles, if the tractor has an odometer, this statement might be necessary to confirm the accuracy of its recorded mileage.

Each of these documents plays a vital role in facilitating a smooth and legally compliant transaction. Buyers and sellers should gather and complete the necessary forms to ensure the sale meets all legal requirements. While the Florida Tractor Bill of Sale form is the cornerstone document recording the transaction, the associated documents provide additional legal protections and details regarding the sale, payment, and condition of the tractor. Being thorough in this process minimizes potential future disputes and legal complications.

Similar forms

The Vehicle Bill of Sale form represents a significant similarity to the Florida Tractor Bill of Sale, chiefly in its function and structure. This document serves as a legal record of the transaction between a seller and a buyer for the ownership transfer of a vehicle. Like the tractor bill of sale, it typically includes details such as the make, model, year, and VIN (Vehicle Identification Number), alongside the names and signatures of the involved parties. Its primary purpose is to protect both parties in the transaction by ensuring there's a formal record of the sale and the exchange of ownership.

Another document closely related to the Florida Tractor Bill of Sale is the General Bill of Sale. This versatile document is used for the purchase or sale of personal property ranging from electronics to furniture, essentially items other than vehicles or real estate. Similar to the tractor bill of sale, it outlines the transaction details, including the description of the item being sold, the sale price, and the particulars of the buyer and seller. It serves to legally document the transfer of ownership and to safeguard the rights of both parties.

The Equipment Bill of Sale document shares notable similarities with the Florida Tractor Bill of Sale, specifically designed for the sale of machinery and equipment. This document holds vital importance in transactions involving items such as construction equipment, heavy machinery, or any substantial equipment, similar to tractors. It records critical information like the equipment's description, the identification number, and the sale conditions, ensuring a clear transfer of ownership and protecting the transaction's legality.

The Boat Bill of Sale form also parallels the Florida Tractor Bill of Sale in its purpose and content, focusing instead on the sale and purchase of boats. It includes specifics such as the boat’s make, year, hull identification number, and any included accessories or trailers. This document ensures the smooth and legally binding transfer of ownership from the seller to the buyer, similar to how the tractor bill of sale functions for agricultural or construction vehicles.

Lastly, the Firearm Bill of Sale is akin to the tractor bill of sale in its aim to document the sale and transfer of ownership, though it specifically deals with firearms. This document includes detailed information about the firearm, such as make, model, caliber, and serial number, in addition to the personal details of the buyer and seller. By providing a legal proof of sale and transfer, this bill of sale plays a crucial role in ensuring the transaction adheres to legal standards, mirroring the essential protective function of the tractor bill of sale.

Dos and Don'ts

When filling out the Florida Tractor Bill of Sale form, it's important to approach the process with attention to detail and accuracy. This document is essential for both the seller and buyer as it verifies the sale and transfer of ownership of the tractor. Listed below are essential dos and don'ts to ensure the form is completed properly.

Do's:

- Ensure all information is accurate and reflects the details of the tractor and the sale. This includes the make, model, year, serial number, and any other distinguishing features or conditions of the tractor.

- Include both the seller's and buyer's full names, along with their addresses and contact information. This information is crucial for creating a record of who is involved in the transaction.

- Make sure the sale price is clearly stated and agreed upon by both parties. This should reflect the total amount that will be exchanged for the tractor.

- Sign and date the bill of sale. Both the buyer and the seller should provide their signatures on the document to validate the sale and transfer of ownership.

- Keep a copy of the completed bill of sale for personal records. Both parties should retain a copy for legal and administrative purposes.

Don'ts:

- Do not leave any section blank. If a section does not apply, mark it with "N/A" (not applicable) instead of leaving it empty, to indicate you didn't overlook it.

- Avoid making any handwritten changes or corrections. If you make a mistake, it's best to start with a new form to keep the document neat and legible.

- Don't forget to check the form for completeness and accuracy before finalizing the sale. Overlooking details can lead to disputes or problems in the future.

- Do not rely solely on verbal agreements. The bill of sale should accurately reflect all agreed-upon terms and conditions of the sale, providing a legal record of the transaction.

- Refrain from providing false information. This includes exaggerating the condition or value of the tractor, as doing so can result in legal trouble.

Misconceptions

When dealing with the Florida Tractor Bill of Sale form, it's crucial to separate fact from fiction. This form is often misunderstood, leading to common misconceptions that could affect transactions and legal standing. Here, we aim to clarify some of these misconceptions.

- It's only needed for new tractors. Many assume that a Bill of Sale is necessary only for brand-new tractors. However, this document is crucial for both new and used tractor sales. It provides a record of sale and proves the transfer of ownership, regardless of the tractor's age.

- The form is the same across all states. Even though many states have similar requirements for a Bill of Sale, it's important to realize that each state has its nuances and specific requirements. The Florida Tractor Bill of Sale form includes details and disclosures that are necessary under Florida law and may not be the same as those required in other states.

- Signing the form transfers the title. Simply signing the Bill of Sale does not complete the transfer of the tractor’s title. While it is a crucial document in the process, the title transfer typically requires submitting the Bill of Sale along with other documents to the appropriate state department and paying any necessary fees.

- Any generic form will work. While generic Bill of Sale forms can sometimes serve basic needs, relying on them can be risky. The Florida-specific form ensures compliance with state laws, including any specific disclosures or information that must be included. Using a form tailored for Florida helps prevent potential legal issues.

- Legal assistance is not necessary. Although many tractor sales between individuals can be straightforward, seeking legal advice can help clarify obligations and rights under Florida law. Legal counsel can ensure that the Bill of Sale complies with all legal requirements and properly records the transaction's specifics.

- Electronic signatures aren't acceptable. With advancements in technology and changes in law, electronic signatures are becoming increasingly recognized for legal documents, including the Florida Tractor Bill of Sale. However, it's important to ensure that electronic signing processes meet state guidelines and that all parties agree to this method.

Understanding the true requirements and implications of the Florida Tractor Bill of Sale can help buyers and sellers navigate the transaction more effectively. Dispelling these misconceptions is a step towards more informed and legally sound tractor sales in Florida.

Key takeaways

When dealing with the sale of a tractor in Florida, the Bill of Sale form is a crucial document that confirms the transfer of ownership from the seller to the buyer. Here are several key takeaways to ensure the process is smooth and legally sound:

- Complete the form with accurate information. This includes the full names and addresses of both the buyer and the seller, along with the specific details of the tractor such as make, model, year, and serial number.

- Include the sale price. It's essential to state the exact amount agreed upon by both parties for the sale of the tractor. This amount should be written in both words and numbers to avoid any confusion.

- Document the date of sale. The form should clearly mention the date when the sale was finalized and the document was signed. This serves as the official transfer date of the tractor’s ownership.

- Signatures are mandatory. Both the buyer and the seller must sign the Bill of Sale to validate the document. Without these signatures, the form may not be legally binding.

- Verification of identity might be required. To further authenticate the transaction, it might be necessary for both parties to provide proof of identity, such as a valid driver’s license or state ID.

- Two copies should be made. After the Bill of Sale is completed and signed, both the buyer and the seller should keep a copy for their records. This is important for both tax purposes and for any future disputes that may arise.

- Notarization is not always necessary but recommended. While Florida law does not mandate that a tractor Bill of Sale be notarized, having it notarized adds an extra layer of legal protection and assures the document’s authenticity.

Following these guidelines when filling out and using the Florida Tractor Bill of Sale will help ensure that the sale process is conducted smoothly and effectively, protecting the interests of both the buyer and seller.

Popular Tractor Bill of Sale State Forms

Tractor Bill of Sale - It confirms the tractor's ownership status, crucial for legal operation or resale in the future.

Bill of Sale for Tractor - The form typically requires notarization to verify the authenticity of signatures and prevent fraudulent claims.