Free Tractor Bill of Sale Form for California

In the agricultural heartlands of California, the transfer of heavy equipment like tractors entails not just a handshake but a formal agreement to ensure both parties are protected and the transaction is clearly documented. The California Tractor Bill of Sale form serves this precise purpose, standing as an essential document for both buyers and sellers in the exchange of ownership of a tractor. It records the vital details of the transaction, including the description of the tractor, the agreed-upon price, and the personal details of both the buyer and seller. This document is not only a proof of sale but also acts as a protective measure against potential disputes, providing a clear trail of ownership transfer. In essence, it underpins the transaction with a legal foundation, ensuring that all aspects, from financial considerations to the acknowledgment of the tractor's condition, are transparent and agreed upon. With the agriculture sector's significant contribution to the state's economy, such formalization of equipment sales through the bill of sale is indispensable, reflecting the importance of clarity, legality, and fairness in these essential transactions.

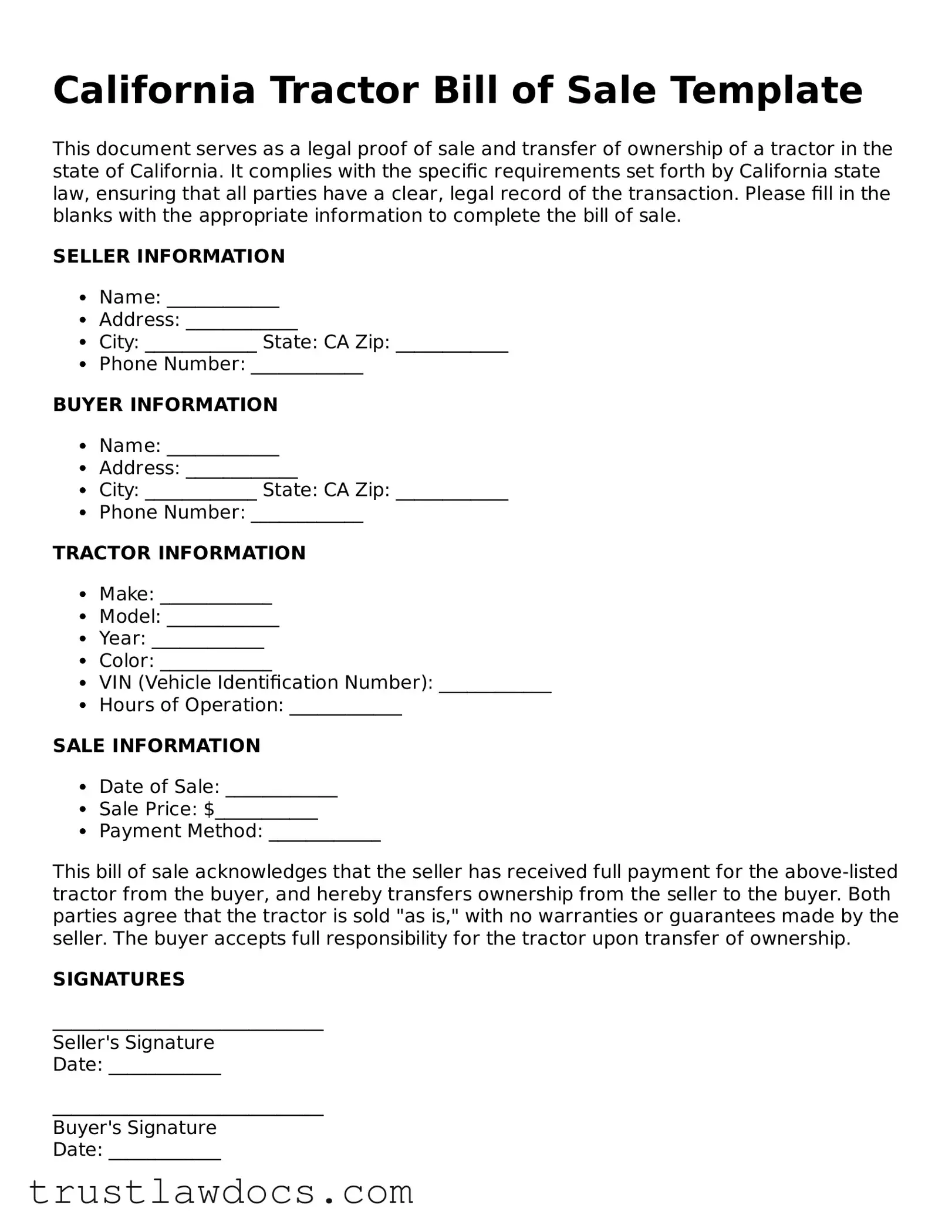

Form Example

California Tractor Bill of Sale Template

This document serves as a legal proof of sale and transfer of ownership of a tractor in the state of California. It complies with the specific requirements set forth by California state law, ensuring that all parties have a clear, legal record of the transaction. Please fill in the blanks with the appropriate information to complete the bill of sale.

SELLER INFORMATION

- Name: ____________

- Address: ____________

- City: ____________ State: CA Zip: ____________

- Phone Number: ____________

BUYER INFORMATION

- Name: ____________

- Address: ____________

- City: ____________ State: CA Zip: ____________

- Phone Number: ____________

TRACTOR INFORMATION

- Make: ____________

- Model: ____________

- Year: ____________

- Color: ____________

- VIN (Vehicle Identification Number): ____________

- Hours of Operation: ____________

SALE INFORMATION

- Date of Sale: ____________

- Sale Price: $___________

- Payment Method: ____________

This bill of sale acknowledges that the seller has received full payment for the above-listed tractor from the buyer, and hereby transfers ownership from the seller to the buyer. Both parties agree that the tractor is sold "as is," with no warranties or guarantees made by the seller. The buyer accepts full responsibility for the tractor upon transfer of ownership.

SIGNATURES

_____________________________

Seller's Signature

Date: ____________

_____________________________

Buyer's Signature

Date: ____________

NOTARY (if applicable)

This document was acknowledged before me on ____________ (date) by ____________ (name of seller) and ____________ (name of buyer).

____________________________________

Notary Public's Signature

My commission expires: ____________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose | Facilitates the sale of a tractor between two parties in the state of California, providing a legal document that records the transaction details. |

| Governing Law | Primarily governed by the California Uniform Commercial Code (UCC) for personal property transactions. Local county regulations may also apply. |

| Key Components | Includes details such as the date of sale, identities of the seller and buyer, description of the tractor (make, model, year, and VIN), sale price, and any warranties or "as is" status. |

| Notarization | While not always required, having the bill of sale notarized can add legal credibility and is recommended in many instances. |

| Usage | Used as proof of ownership transfer, for registration purposes, and may be needed for taxation or insurance claims. |

| Additional Documentation | It may need to be accompanied by other documents such as a title transfer or clearance certificate, depending on local requirements or the tractor’s status. |

How to Write California Tractor Bill of Sale

After deciding to buy or sell a tractor in California, one of the key documents that will need to be completed is the Tractor Bill of Sale form. This form serves as a receipt for the transaction and provides proof of ownership transfer from the seller to the buyer. It is straightforward to fill out but requires attention to ensure all the details are accurately captured. Here are the steps to correctly complete this form.

- Date of Sale: Write the date when the sale of the tractor takes place.

- Seller’s Information: Fill in the full name, address, and contact details of the person selling the tractor.

- Buyer’s Information: Enter the full name, address, and contact details of the person buying the tractor.

- Tractor Details: Specify the make, model, year, and serial number (if available) of the tractor being sold. Include any additional identifying details.

- Sale Price: Indicate the total amount agreed upon for the purchase of the tractor.

- Odometer Disclosure: If applicable, include the tractor's current mileage. Note that this may not be relevant for all tractor sales, but it's important if the tractor tracks hours of operation similar to how a vehicle tracks mileage.

- Warranty Information: State whether the tractor is being sold "as is" or if there’s a warranty covering certain aspects of the tractor. If there's a warranty, provide details about what is covered and for how long.

- Signatures: Both the buyer and the seller must sign the form. Include the date of signing next to each signature.

Once the form is fully completed and signed by both parties, it’s recommended to make copies. Both the buyer and the seller should keep a copy for their records. This document will serve as a legal proof of the transaction and can be important for registration, tax, or warranty purposes.

Get Answers on California Tractor Bill of Sale

What is a Tractor Bill of Sale form in California?

A Tractor Bill of Sale form in California is a legal document that records the sale and transfer of ownership of a tractor from one party (the seller) to another (the buyer). It serves as evidence of the transaction and includes pertinent details such as the description of the tractor, sale price, and information about both parties involved.

Why do I need a Tractor Bill of Sale in California?

In California, a Tractor Bill of Sale is important for several reasons. It provides legal proof of the purchase and transfer of ownership, which is essential for registration and taxation purposes. Additionally, it can protect both the seller and the buyer in case of future disputes regarding the tractor's condition or ownership.

What information should be included in a Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should include the make, model, and year of the tractor, the Vehicle Identification Number (VIN), the sale price, the sale date, and the names and signatures of both the buyer and the seller. Including the odometer reading is also recommended to provide a record of the tractor's use.

Is notarization required for a Tractor Bill of Sale in California?

While notarization of a Tractor Bill of Sale is not a legal requirement in California, it is highly recommended. Notarization adds an extra level of authenticity and can help prevent potential legal issues by verifying the identities of the parties involved and their agreement to the sale terms.

Can I create my own Tractor Bill of Sale or do I need a lawyer?

Individuals can create their own Tractor Bill of Sale without the assistance of a lawyer. Templates are available online, or one can simply draft a document including all the required information. However, consulting a lawyer can ensure that the bill of sale meets all legal requirements and provides adequate protection for both parties.

How does a Tractor Bill of Sale protect the buyer?

For the buyer, a Tractor Bill of Sale acts as proof of ownership, which is necessary for registration and insurance purposes. It also ensures that the buyer has legal evidence of the condition and terms of sale of the tractor at the time of purchase, which can be useful in disputing any future claims made by the seller.

How does a Tractor Bill of Sale protect the seller?

From the seller's perspective, a Tractor Bill of Sale provides evidence that they have rightfully transferred ownership of the tractor to the buyer, releasing them from future liabilities related to it. It can also serve as proof of the terms agreed upon at the time of sale, which can be crucial in the event of a dispute.

What happens if I lose my Tractor Bill of Sale?

If the original Tractor Bill of Sale is lost, it is advisable to contact the other party involved in the transaction and request a duplicate. Keeping a digital copy of the document can also serve as a backup. If recreating the document, ensure that it contains all the original information and is signed by both parties.

Does a Tractor Bill of Sale need to be filed with any California state agency?

A Tractor Bill of Sale does not typically need to be filed with a state agency in California. However, when registering the tractor or reporting the sale for tax purposes, presenting the Bill of Sale may be required. It is best to retain a copy for your records and consult local regulations to ensure compliance.

Common mistakes

When filling out the California Tractor Bill of Sale form, a common mistake is overlooking the importance of detail, particularly in the description of the tractor. Purchasers and sellers often provide only the make and model, when including the year, condition, and any included accessories or attachments can prevent future disputes. Accurate descriptions ensure both parties have a clear understanding of what is being sold or bought.

Another area often mishandled is the financial aspect. Many people mistakenly leave out vital payment information such as the sale price, payment method (e.g., cash, check, transfer), and terms of payment (e.g., down payment, installment payments if applicable). It's crucial to record these details accurately to maintain financial clarity and legal protection for both parties. This oversight could lead to misunderstandings or legal issues about the sale price or payment terms.

Not properly recording the buyer and seller information is also a frequent error. It's necessary to include full names, addresses, and contact information. Some individuals may provide incomplete details, such as missing addresses or phone numbers, which can complicate future communication. This information is vital for creating a binding contract and for any future contact needed between the parties involved.

A significant oversight is failing to acknowledge the requirement for witness signatures or notarization, depending on the legal requirements in California. While not all states require a bill of sale to be witnessed or notarized, ensuring this step can add an additional layer of legality and authenticity to the document. Many people overlook this formality, potentially jeopardizing the enforceability of the bill of sale in case of disputes.

Documents used along the form

When selling or buying a tractor in California, the Tractor Bill of Sale form is a crucial document that provides proof of transaction and details about the buyer, seller, and the tractor itself. However, to ensure a smooth and legally sound sale process, several other forms and documents are often required alongside the Tractor Bill of Sale. These additional papers help to establish the history of the tractor, ensure there are no legal entanglements, and provide a clear transfer of ownership. Here are nine other forms and documents frequently used in conjunction with the California Tractor Bill of Sale.

- Title Transfer Form: This form is necessary for officially transferring the title of the tractor from the seller to the buyer, ensuring the buyer becomes the legal owner.

- Odometer Disclosure Statement: Required for tractors with odometers, this document records the tractor's mileage at the time of sale and helps to verify its condition.

- Sales Tax Form: Depending on local laws, a sales tax form may need to be completed to account for the tax applicable to the sale of the tractor.

- Release of Liability Form: The seller often submits this form to the state’s Department of Motor Vehicles (DMV) to release them from liability in case the tractor is involved in an incident after the sale.

- As-Is Sale Form: If the tractor is sold without any guarantees regarding its condition, an As-Is Sale Form specifies that the buyer accepts the tractor in its current state.

- Warranty Document: Conversely, if the sale includes a warranty, this document outlines the terms and conditions of the coverage provided by the seller.

- Loan Payoff Letter: If there is an existing lien on the tractor, a loan payoff letter from the lender is required to prove that the loan will be settled as part of the sale.

- Registration Documents: These are necessary to register the tractor under the new owner’s name with the California DMV.

- Inspection Records: Documenting any inspections the tractor has undergone, these records provide insights into its condition and maintenance history.

Together, these forms and documents create a comprehensive package that facilitates a transparent, lawful, and straightforward tractor sale process in California. They not only protect the interests of the buyer and the seller but also comply with local regulations, ensuring a valid and enforceable transaction. Employing these documents effectively represents due diligence and can significantly smooth the path to a successful transfer of ownership.

Similar forms

The California Tractor Bill of Sale form shares similarities with the Vehicle Bill of Sale form, primarily in its function to document the sale and transfer of ownership of a vehicle. Like the tractor bill of sale, the vehicle bill of sale captures essential information such as the make, model, year, and VIN of the vehicle, along with details about the buyer and seller, sale date, and purchase price. This document serves as a legal record that a vehicle transaction has occurred, and it is often required for registering the vehicle with the state's DMV.

Another document similar to the California Tractor Bill of Sale form is the Boat Bill of Sale. This document functions in a comparable manner by recording the sale and transfer of ownership of a boat. It includes detailed information on the boat such as its length, make, model, year, and hull identification number (HIN), as well as the sale price and details about the buyer and seller. Like the tractor bill of sale, the boat bill of sale is crucial for the buyer to register the boat in their name with the appropriate state agency.

The General Bill of Sale form also shares similarities with the Tractor Bill of Sale form. This more generic document is used for the purchase and sale of various types of personal property beyond vehicles or boats, such as electronics, furniture, or equipment. Despite the broader range of items it covers, it similarly records important transaction details: the item description, sale date, buyer and seller information, and the sale price. This form acts as proof of purchase and can be important for warranty and insurance purposes.

Lastly, the Firearm Bill of Sale form is akin to the California Tractor Bill of Sale form in terms of its purpose to legally document the sale and transfer of ownership, but specifically for firearms. It includes detailed information on the firearm being sold, such as make, model, caliber, and serial number, in addition to the personal details of the buyer and seller, the sale date, and the sale price. This document is critical in ensuring that the transfer of ownership of the firearm is conducted legally and is duly recorded.

Dos and Don'ts

When it comes to selling or buying a tractor in California, filling out a Tractor Bill of Sale form correctly is crucial. This document not only provides proof of transaction but also ensures the legality of the sale. To help you navigate the process smoothly, here's a list of things you should and shouldn't do:

Do:- Provide accurate information: Ensure all details about the tractor, such as make, model, year, and serial number, are correctly entered.

- Include personal details of both parties: Full names, addresses, and contact information of both the seller and buyer should be clearly written.

- Check for compliance with California laws: Make sure the bill of sale adheres to the specific requirements of California state law.

- Sign and date the document: Both the buyer and the seller must sign and date the bill of sale to validate the agreement.

- Keep multiple copies: After completing the form, make copies for both the buyer and the seller to retain for their records.

- Leave blanks: Avoid leaving any fields empty. If certain sections don't apply, mark them with N/A (not applicable).

- Forget to specify the sale price: The total amount agreed upon for the sale of the tractor must be clearly stated.

- Overlook the need for a witness or notary: Depending on local requirements, the presence of a witness or notary public may be necessary for the document to be legally binding.

- Misrepresent the condition of the tractor: Be honest about the tractor's condition, including any known defects or issues.

- Ignore lien information: If the tractor is subject to any liens or encumbrances, these must be disclosed in the bill of sale.

By following these do's and don'ts, you can ensure a smooth and legally sound transaction. Always remember the importance of accuracy and completeness when filling out a Tractor Bill of Sale form in California.

Misconceptions

When it comes to completing a California Tractor Bill of Sale form, there are several misconceptions that can lead to confusion and complications. It is crucial to understand these misconceptions to ensure a smooth and legally sound transaction.

Only the buyer needs to keep a copy: Both the buyer and the seller should keep a copy of the Bill of Sale. It serves as a receipt for the buyer and proof of transfer for the seller.

The form needs to be notarized: In California, notarization is not a requirement for a Tractor Bill of Sale to be valid. However, having the document notarized can add an extra layer of protection against disputes.

A verbal agreement is just as good: Verbal agreements are difficult to prove and enforce. A written Bill of Sale is legally binding and clearly spells out the terms of the deal.

It's unnecessary if selling to a family member: Even when selling to a family member, a Bill of Sale is important. It documents the transaction and can prevent future disputes.

All that's needed is the tractor’s make and model: Along with the make and model, the Bill of Sale should include the serial number, purchase price, and date of sale, among other details.

There’s only one standard form: While there are templates available, there’s flexibility in the format as long as all required information is included. Different sources might offer different templates.

It automatically transfers the title: The Bill of Sale is part of the process but, if applicable, an official transfer of title must be completed with the state.

It’s too complicated to fill out: Despite requiring detailed information, a Bill of Sale is straightforward. Each party should include their information, details of the tractor, and any warranties or "as is" statements.

No witness signatures are required: While not always legally required, having a witness sign the Bill of Sale can provide additional evidence that the parties entered into the agreement.

A Bill of Sale is all you need for tax purposes: While useful, a Bill of Sale is part of the documentation required for tax purposes. Buyers and sellers may also need to prove the transaction's details to tax authorities.

Understanding these misconceptions is key to ensuring that the sale or purchase of a tractor in California is completed successfully and legally. Always ensure accuracy and completeness when filling out a Bill of Sale.

Key takeaways

A California Tractor Bill of Sale form is an essential document for both the seller and the buyer when transferring ownership of a tractor. This form serves as a legal record that verifies the transaction and details the condition, price, and specifics of the tractor. Here are key takeaways regarding filling out and using this form:

- The document must include the full names and contact information of both the buyer and the seller to ensure both parties are clearly identified.

- It is crucial to accurately describe the tractor, including its make, model, year, and identification number, to avoid any disputes about what is being sold.

- The sale price should be clearly stated on the form to solidify the agreement between the buyer and the seller regarding the financial transaction.

- Any additional terms of the sale, such as warranties or specific agreements about the tractor's condition, must be listed to protect both parties' interests.

- Both the seller and the buyer should sign and date the form to validate the transaction legally. In some cases, witness signatures may be required for additional verification.

- It's important to keep a copy of the Bill of Sale for personal records. Both the seller and the buyer should retain a copy in case any disputes arise after the sale.

- In California, the buyer may need to present the Bill of Sale when registering the tractor with the California Department of Motor Vehicles (DMV) to prove ownership and complete the registration process.

Ensuring that the California Tractor Bill of Sale form is filled out comprehensively and accurately will facilitate a smooth transfer of ownership and can prevent legal issues from arising in the future.

Popular Tractor Bill of Sale State Forms

Do Tractors Need to Be Registered - When selling or buying a used tractor, this document provides a level of trust and transparency between the parties, detailing the agreement in clear terms.

Bill of Sale for a Tractor - Allows for the inclusion of any additional accessories or attachments sold with the tractor.