Free Bill of Sale Form for Texas

In the heart of the Lone Star State, the transaction between buyers and sellers of various goods reaches its culmination through a pivotal document: the Texas Bill of Sale form. Serving as a concrete acknowledgment of the transfer of ownership, this document is not merely a formality but a necessary piece of the puzzle providing legal protection and clarity for both parties involved. Whether it’s for the sale of vehicles, boats, firearms, or even personal property, each Bill of Sale is designed to encapsulate all pertinent details of the transaction, including the identities of the buyer and seller, a comprehensive description of the item sold, the sale price, and the date of sale. The significance of this document extends beyond the immediate transaction, as it may be required for registration purposes or even to settle potential disputes that arise post-sale. Crafting such a document demands attention to detail and an understanding of its legal implications, ensuring that every transfer of ownership is transparent, binding, and recognized by the state of Texas.

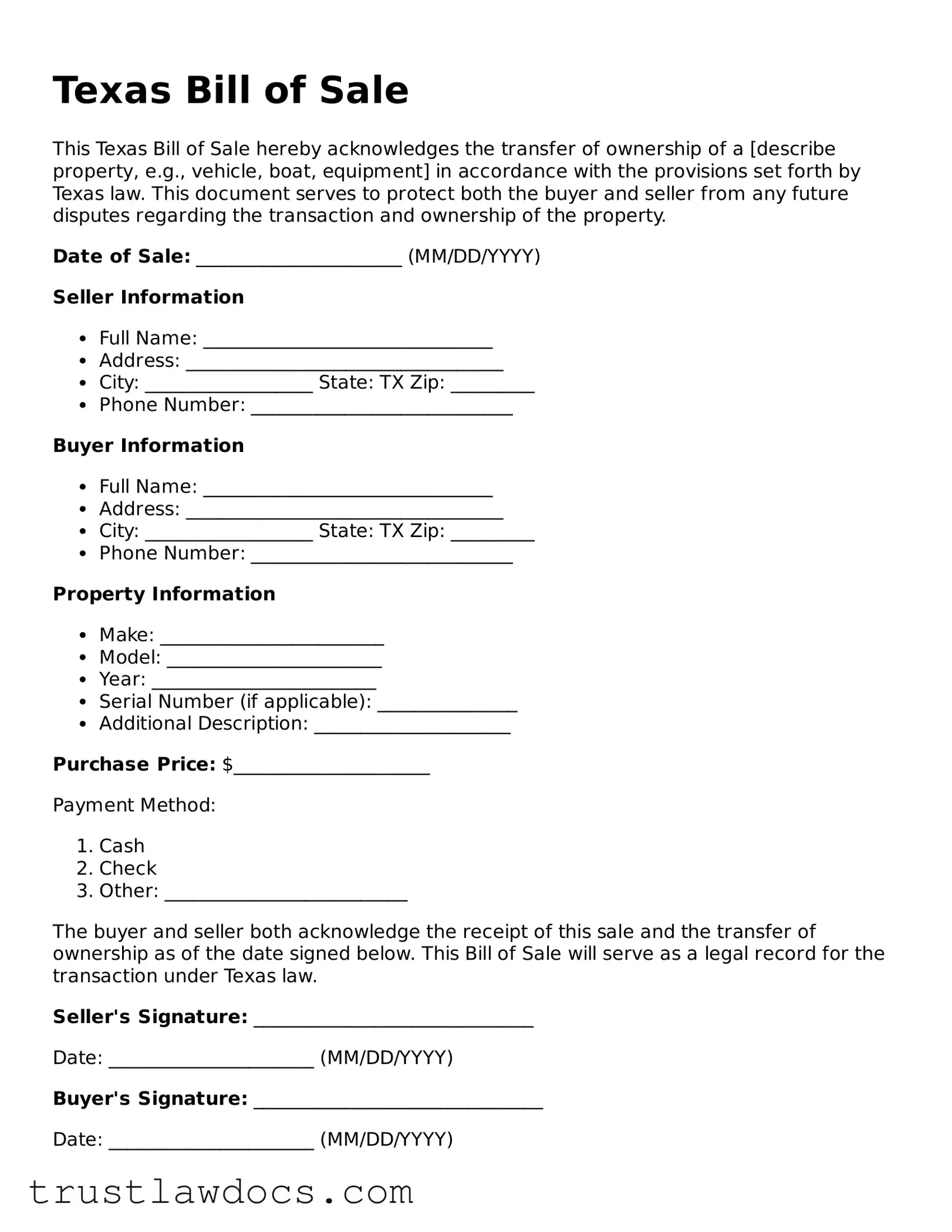

Form Example

Texas Bill of Sale

This Texas Bill of Sale hereby acknowledges the transfer of ownership of a [describe property, e.g., vehicle, boat, equipment] in accordance with the provisions set forth by Texas law. This document serves to protect both the buyer and seller from any future disputes regarding the transaction and ownership of the property.

Date of Sale: ______________________ (MM/DD/YYYY)

Seller Information

- Full Name: _______________________________

- Address: __________________________________

- City: __________________ State: TX Zip: _________

- Phone Number: ____________________________

Buyer Information

- Full Name: _______________________________

- Address: __________________________________

- City: __________________ State: TX Zip: _________

- Phone Number: ____________________________

Property Information

- Make: ________________________

- Model: _______________________

- Year: ________________________

- Serial Number (if applicable): _______________

- Additional Description: _____________________

Purchase Price: $_____________________

Payment Method:

- Cash

- Check

- Other: __________________________

The buyer and seller both acknowledge the receipt of this sale and the transfer of ownership as of the date signed below. This Bill of Sale will serve as a legal record for the transaction under Texas law.

Seller's Signature: ______________________________

Date: ______________________ (MM/DD/YYYY)

Buyer's Signature: _______________________________

Date: ______________________ (MM/DD/YYYY)

This document is provided “as is” without any kind of warranty. The legality of this document for other uses is not guaranteed. You are encouraged to consult with a knowledgeable legal professional before entering into any transaction.

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | A Texas Bill of Sale form is a legal document used to record the transfer of a variety of items from the seller to the buyer. |

| 2 | It serves as proof of purchase and documents the sale of personal property, vehicles, boats, and motorcycles. |

| 3 | The form typically includes detailed information about the item sold, the sale price, and the names and addresses of the seller and buyer. |

| 4 | In Texas, a Bill of Sale does not have to be notarized for most transactions, but it is recommended for legal protection and verification. |

| 5 | For motor vehicles, Texas law requires the seller to file a Vehicle Transfer Notification with the Texas Department of Motor Vehicles (TxDMV) to officially transfer ownership and liability. |

| 6 | A Bill of Sale for a motor vehicle must include the vehicle's make, model, year, VIN, and odometer reading at the time of sale. |

| 7 | The Texas Parks and Wildlife Department requires a Bill of Sale for boat transactions, along with the title and registration to transfer ownership. |

| 8 | When selling a gun in Texas, while not required, a Bill of Sale is advisable to document the transfer and details of the firearm, which helps in ensuring the seller's protection. |

| 9 | It is crucial for both buyer and seller to keep a signed copy of the Bill of Sale as a record of the transaction and for future reference. |

| 10 | Although the Texas Bill of Sale form is an important legal document, it alone does not prove ownership; the title transfer or registration documents must accompany it to complete the process. |

How to Write Texas Bill of Sale

When the time comes to document the sale of personal property in Texas, utilizing a Bill of Sale is a wise step to ensure both the buyer and seller have a record of the transaction. This document serves as a legal record, providing proof of transfer and details about the item sold. The process can seem daunting, but with careful attention to detail, filling out the Texas Bill of Sale can be straightforward. The following steps will help guide you through this process, ensuring all necessary information is accurately captured. Remember, completing this form is not the final step in the sales process, but it is a vital part of protecting the interests of both parties involved.

- Date the Sale: At the top of the form, enter the date the sale is to take effect. Ensure that this date reflects when the transaction is actually made.

- Parties Involved: Fill in the full names and addresses of both the buyer and the seller. It's crucial to ensure these details are accurate for identification purposes.

- Description of the Item: Provide a detailed description of the item being sold. This may include make, model, year, color, and any other identifying characteristics or serial numbers.

- Sale Price: Clearly state the purchase price of the item in question. If the transaction is a gift, indicate this by writing "gift" in the appropriate section.

- Warranties or As-Is Condition: Indicate whether the item is being sold with any warranties or guarantees. If the sale is "as-is" (meaning no warranties are provided), make sure this is clearly stated.

- Signatures: The form must be signed by both the buyer and the seller. These signatures legally bind the agreement, showing that both parties agree to the terms as written.

- Date of Signatures: Lastly, ensure that both the buyer and the seller date their signatures alongside their names. This date should match or closely follow the sale date mentioned in the first step.

After correctly filling out the Texas Bill of Sale, it's recommended to make copies for both the buyer and seller, thereby ensuring both parties retain a record of the transaction. While this document is an important part of transferring ownership, remember to consult any additional state or local regulations that may affect the sale. This ensures not only the legality of the sale but also the peace of mind for both the seller and the buyer.

Get Answers on Texas Bill of Sale

What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document used during the sale of personal items such as cars, boats, motorcycles, and other property in Texas. It records the transaction between the buyer and the seller and provides proof of the change of ownership. The form typically includes details about the item sold, the sale price, and the parties involved.

Do I need a Texas Bill of Sale to sell my car?

While it's not always legally required to have a Texas Bill of Sale to sell your car, it's highly recommended. This document provides important evidence of the transaction and can protect both the seller and buyer in case of disagreements or disputes in the future. Moreover, it may be required by your local county tax-assessor collector’s office when the buyer goes to register the vehicle.

What information should be included in a Texas Bill of Sale form?

A comprehensive Texas Bill of Sale form should include the full names and addresses of both the buyer and the seller, a detailed description of the item being sold (including make, model, year, and VIN for vehicles), the sale price, the sale date, and signatures from both parties. Including an acknowledgment of the item's condition and any warranties or "as is" status is also advisable.

Is a Texas Bill of Sale form required for the sale of all items?

No, a Texas Bill of Sale form is not required for the sale of all items. However, for high-value items like vehicles, boats, and firearms, it's highly encouraged to complete this form to create a legal record of the sale. For everyday items or lower value goods, though still useful, the necessity for a bill of sale is less critical.

Do both parties need to sign the Texas Bill of Sale form?

Yes, for the Texas Bill of Sale form to be considered valid and effective, both the buyer and the seller must sign the document. These signatures acknowledge that both parties agree to the terms of the sale and verify the accuracy of the information provided on the form.

Does the Texas Bill of Sale form need to be notarized?

Generally, the Texas Bill of Sale form does not need to be notarized. However, for certain transactions or at the request of one of the parties, notarizing the document can add an extra level of legal validity and protection. It's best to check if any specific requirements exist for your particular situation or type of sale.

Can I create a Texas Bill of Sale form myself?

Yes, you can create a Texas Bill of Sale form yourself as long as it includes all the necessary information such as the details of the transaction, the parties involved, and their signatures. Templates and samples are available online to help guide you through the process. However, ensuring that the document complies with local laws and regulations is important.

What should I do after completing the Texas Bill of Sale form?

After completing the Texas Bill of Sale form, both the buyer and the seller should keep a copy for their records. The buyer may need the document for registration, insurance, or taxation purposes. It's also wise to record the transaction with any relevant government offices or agencies, depending on the item's nature.

Common mistakes

Filling out a Texas Bill of Sale form seems straightforward, but a surprising number of folks slip up on the details. This document is crucial when you're selling or buying a vehicle privately in the Lone Star State. It's the go-to proof of the transaction, securing rights for both parties. However, even the smallest mistake can lead to big headaches down the road. Let's dive into the six common errors people make, so you can steer clear of them.

Not checking for accuracy. The first mistake is not double-checking the accuracy of the information provided. This includes names, addresses, and especially the vehicle identification number (VIN). A typo in the VIN can cause significant issues, as it's the key to the vehicle's identity. It might seem like a minor oversight, but it can complicate ownership verification and even impact legal matters if the vehicle has been involved in controversies.

Skipping signatures or dates. Believe it or not, it's easy to forget to sign or date the document. Both the seller's and buyer's signatures are essential, as is dating the form at the time of the transaction. This oversight can invalidate the document, putting both parties at risk. A bill of sale without these elements is like a car without gas: it simply won't go anywhere if disputes arise.

Ignoring acknowledgment of the odometer disclosure. Under Texas law, acknowledging the vehicle's odometer reading at the time of sale is crucial. This step prevents odometer fraud, safeguarding the buyer's interests. Skipping this part not only misleads the buyer but also breaches Texas regulations, potentially leading to legal issues.

Omitting sale price or payment terms. Another common mistake is not being clear about the sale price or the payment terms. This detail is vital for tax purposes and future disputes. If the sale price is significantly lower than the market value or isn't specified, it could raise eyebrows at the tax office or, worse, be construed as an attempt to evade taxes or launder money.

Forgetting to include a detailed description of the item sold. Providing a generic description or omitting it entirely can lead to misunderstandings or disputes. It's crucial to include make, model, year, color, condition, and any included warranties or accessories. This not only solidifies the agreement but also gives the buyer clear expectations of what they are purchasing.

Not retaining a copy. Finally, a mistake that's easy to make but just as easy to avoid: not keeping a copy of the Bill of Sale. Both the buyer and seller should keep a copy for their records. This document is often required for registration, insurance, and in case any questions or disputes arise after the sale. It's your proof of purchase (or sale), so treat it with care!

By steering clear of these common errors, you can ensure your Texas Bill of Sale form is airtight. Whether you're buying your dream car or selling your old truck, taking a few extra moments for accuracy and completeness can save you from potential pitfalls down the road.

Documents used along the form

When conducting transactions in Texas, particularly those involving the sale of items such as vehicles, boats, or personal property, the Bill of Sale form is crucial. However, other forms and documents often accompany this form to ensure a seamless and legally sound process. Below is a list of up to 8 essential forms and documents that are typically used in conjunction with the Texas Bill of Sale form, each with a brief description.

- Title Transfer Forms: Necessary for transferring the title of vehicles or boats. This form officially changes the ownership on government records.

- Odometer Disclosure Statement: Required for the sale of vehicles, this document discloses the mileage of the vehicle at the time of sale and helps prevent odometer fraud.

- Vehicle Registration Forms: Used to register a vehicle in the buyer’s name. Registration must be updated when a vehicle changes ownership.

- Warranty Documents: These detail any warranties that are transferred with the sale of the item, or new warranties that the seller is providing to the buyer.

- As-Is Sale Agreement: Indicates that the item is sold in its current condition, and the buyer agrees that they are responsible for any repairs or issues that may arise post-sale.

- Loan Documents: If the item being sold is under financing, these documents outline the transfer of the loan to the new owner, or detail the seller's responsibility in paying off the loan before the sale.

- Release of Liability Form: Protects the seller from legal responsibility for any accidents or incidents that occur with the item after the sale.

- Proof of Insurance: For vehicles and boats, proof of insurance is often required to complete the sale, ensuring the new owner has coverage as mandated by law.

Using the Texas Bill of Sale form alongside these documents ensures a comprehensive approach to the transfer of ownership. It protects all parties involved, solidifies the transaction, and complies with Texas state laws. Remember, the requirements may vary based on the specific item being sold and local regulations, so it's important to confirm what documents are necessary for your individual situation.

Similar forms

A Bill of Sale form in Texas serves as a formal document to record the transfer of ownership of personal property from a seller to a buyer. This document is similar to a Warranty Deed, which is used in real estate transactions to guarantee that the seller holds clear title to the property and has the right to sell it. Both documents act as legal proof of the transfer of ownership, but while a Bill of Sale typically covers personal property such as vehicles or equipment, a Warranty Deed is exclusive to real estate transactions.

Another document akin to the Texas Bill of Sale is the Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to another party under agreed-upon terms. Like a Bill of Sale, it spells out the specifics of a transaction between two parties. However, instead of documenting the sale and transfer of ownership of goods, it details the borrower's obligation to repay a debt. This note is legally binding and includes details like the repayment schedule, interest rate, and consequences of non-payment.

Additionally, a Texas Bill of Sale shares similarities with a Certificate of Title, particularly in the context of vehicle transactions. A Certificate of Title is a legal document that proves ownership of a vehicle. When a vehicle is sold, the Bill of Sale supplements the Certificate of Title by providing evidence of the transaction and the change of ownership, including details such as the sale price and date of sale. Both documents are crucial for the legal transfer of a vehicle in Texas, ensuring the buyer’s rights are protected.

Finally, the Texas Bill of Sale can be compared to a Sale and Purchase Agreement (SPA). An SPA is a comprehensive contract that outlines the terms and conditions of a sale between a buyer and a seller. This agreement encompasses a wide array of details about the transaction, including price, delivery and payment terms, and warranties, much like a Bill of Sale. However, the SPA is more detailed and is often used in more complex transactions, including those involving businesses or high-value assets, detailing conditions that must be met before the sale is finalized.

Dos and Don'ts

Filling out a Texas Bill of Sale form is an essential step in the process of buying or selling property within the state, such as vehicles, boats, or other valuable items. To ensure the process is completed accurately and legally, there are several important dos and don'ts to keep in mind:

- Do verify that all the information on the form is accurate. This includes the names of the buyer and seller, the description of the item being sold, and the sale price.

- Do make sure both the buyer and seller sign and date the form. In Texas, signatures may need to be notarized depending on the type of property being sold.

- Do include any identifying numbers or information related to the item being sold, such as a vehicle identification number (VIN) for cars or serial numbers for other types of property.

- Do keep a copy of the Bill of Sale for personal records. It's a good idea for both the buyer and seller to each keep a copy.

- Do use clear and concise language to avoid any ambiguity or confusion.

- Don't leave any fields blank. If a section does not apply, enter "N/A" (not applicable) to indicate this.

- Don't use guesswork for critical details like the sale price or item description. Ensure all data is precise and correct.

- Don't forget to include any additional terms or conditions of the sale that both parties have agreed upon.

- Don't ignore the requirement to report the sale to the Texas Department of Motor Vehicles (DMV) if the bill of sale is for a vehicle. This step is necessary for the official transfer of ownership and may require additional documentation.

By following these guidelines, both parties can ensure a smoother and more reliable transaction. Properly completing the Texas Bill of Sale form not only provides legal protection but also helps in personal record-keeping and compliance with state regulations.

Misconceptions

Many people hold misconceptions about the Texas Bill of Sale form, often due to a lack of specific knowledge or misunderstandings about legal documents in general. Below, we debunk some common myths to provide clearer insights into its use and significance.

The Bill of Sale is the only document you need to transfer ownership. This is not completely accurate. In Texas, a Bill of Sale serves as a proof of the transaction, but the official transfer of ownership for vehicles, for example, requires a signed title and the completion of additional state-specific forms.

A Texas Bill of Sale does not need to be notarized. Generally, Texas does not require notarization for a Bill of Sale to be legal. However, having it notarized adds a layer of authenticity and may be beneficial in disputes or as a part of specific agreements.

Any form downloaded online is acceptable for use as a Texas Bill of Sale. While downloadable forms can serve as a Bill of Sale, it is important to ensure that the form includes all necessary information to be considered valid under Texas law.

The Bill of Sale must be submitted to a government office. In Texas, the Bill of Sale does not need to be filed with any government agency for most private property sales. However, for vehicles, boats, or large transactions, other forms specific to those sales must often be filed with the appropriate Texas department.

Writing a Bill of Sale yourself is illegal. You can write your own Bill of Sale. As long as it contains all the required elements — such as a detailed description of the item sold, purchase price, and parties' information — it is legally valid in Texas.

There’s a statewide standard Bill of Sale form in Texas. There is no single, officially sanctioned Texas Bill of Sale form for all types of transactions. Different items and circumstances might call for different information, so the form should be tailored accordingly.

The Bill of Sale must include warranty information. While including warranty information can be beneficial and is often recommended, it is not a legal requirement for the validity of a Bill of Sale in Texas.

A Bill of Sale is sufficient proof to register a vehicle in Texas. To register a vehicle, Texas requires the vehicle title, a completed application for Texas title, and proof of insurance, in addition to the Bill of Sale. The Bill of Sale alone does not fulfill all requirements for registration.

If you buy from a dealer, a Bill of Sale is unnecessary. Even when purchasing from a dealer, a Bill of Sale can provide a clear record of the transaction and may be necessary for personal records, insurance, or tax purposes. Dealers typically provide this document as part of the sales paperwork.

The buyer is the only party that needs to keep a copy of the Bill of Sale. It's essential for both the buyer and the seller to retain copies of the Bill of Sale. For the seller, it can serve as proof of relinquishing ownership and, for the buyer, as proof of purchase and ownership.

Key takeaways

A Texas Bill of Sale form is a crucial document for buyers and sellers in private sales of property, such as vehicles, boats, or smaller items. It serves as a receipt and can also provide legal protection in the event of disputes. Understanding how to correctly fill out and use this document is essential. Here are key takeaways for navigating the process effectively:

- Verify the form's requirements: Texas may have specific requirements for what needs to be included in a Bill of Sale. Always check the most current guidelines from a reliable Texas state government or legal resource.

- Include detailed information about the item being sold: This includes make, model, year, and serial number or vehicle identification number (VIN) for items like vehicles or boats.

- State the sale price clearly: The document should clearly list the sale price of the item, which can be important for tax purposes.

- Include the date of the sale: This establishes the official transfer of ownership date, which can be important for both buyer and seller in the event of disputes or for record-keeping purposes.

- Provide detailed information about both the buyer and the seller: Full names, addresses, and contact information should be included to identify the parties involved clearly.

- Signatures are essential: Both the buyer and the seller must sign the Bill of Sale to make it legally binding. Depending on the item's nature and the sale's location, witness signatures or notarization may also be required.

- Keep copies of the document: Both parties should keep a copy of the Bill of Sale for their records. It serves as a receipt for the buyer and proof of transfer of ownership for the seller.

- Registration of the item: For items like vehicles and boats, the buyer may need to present the Bill of Sale as part of the registration process in Texas. Make sure the document meets all the state requirements to avoid delays.

Properly filling out and using a Bill of Sale in Texas ensures that all parties have a clear record of the transaction, which can protect legal rights and responsibilities. When in doubt, consulting with a legal professional can provide guidance tailored to your specific situation.

Popular Bill of Sale State Forms

Form 44237 - Individuals can quickly prove ownership of property when needed, thanks to this document.

How to Sell My Truck - This form acts as a legal receipt that details the transaction between the two parties, recording the sale's specifics including date, price, and item description.

As Is Vehicle Bill of Sale Template - It plays a crucial role in disputes over ownership or the condition of the item sold, offering a written record that can resolve conflicts or misunderstandings.