Free RV Bill of Sale Form for Michigan

Preparing to buy or sell a recreational vehicle (RV) in Michigan involves several important steps, one of which is the completion of the RV Bill of Sale form. This document serves as a crucial piece of the transaction, ensuring that both parties have a clear understanding of the conditions of the sale, the details of the RV, and the responsibilities each party holds. It not only provides proof of the change in ownership but also includes specifics about the RV such as make, model, year, and identification number, helping to identify the vehicle accurately. Additionally, the form contains essential information about the buyer and seller, including their names and addresses, to establish the identities of the parties involved. The Michigan RV Bill of Sale form acts as a binding agreement between the buyer and seller, detailing the agreed-upon purchase price and confirming that the transaction is conducted willingly by both sides. Furthermore, this document can be an important asset for registration, tax, and legal purposes, marking its significance well beyond the initial purchase.

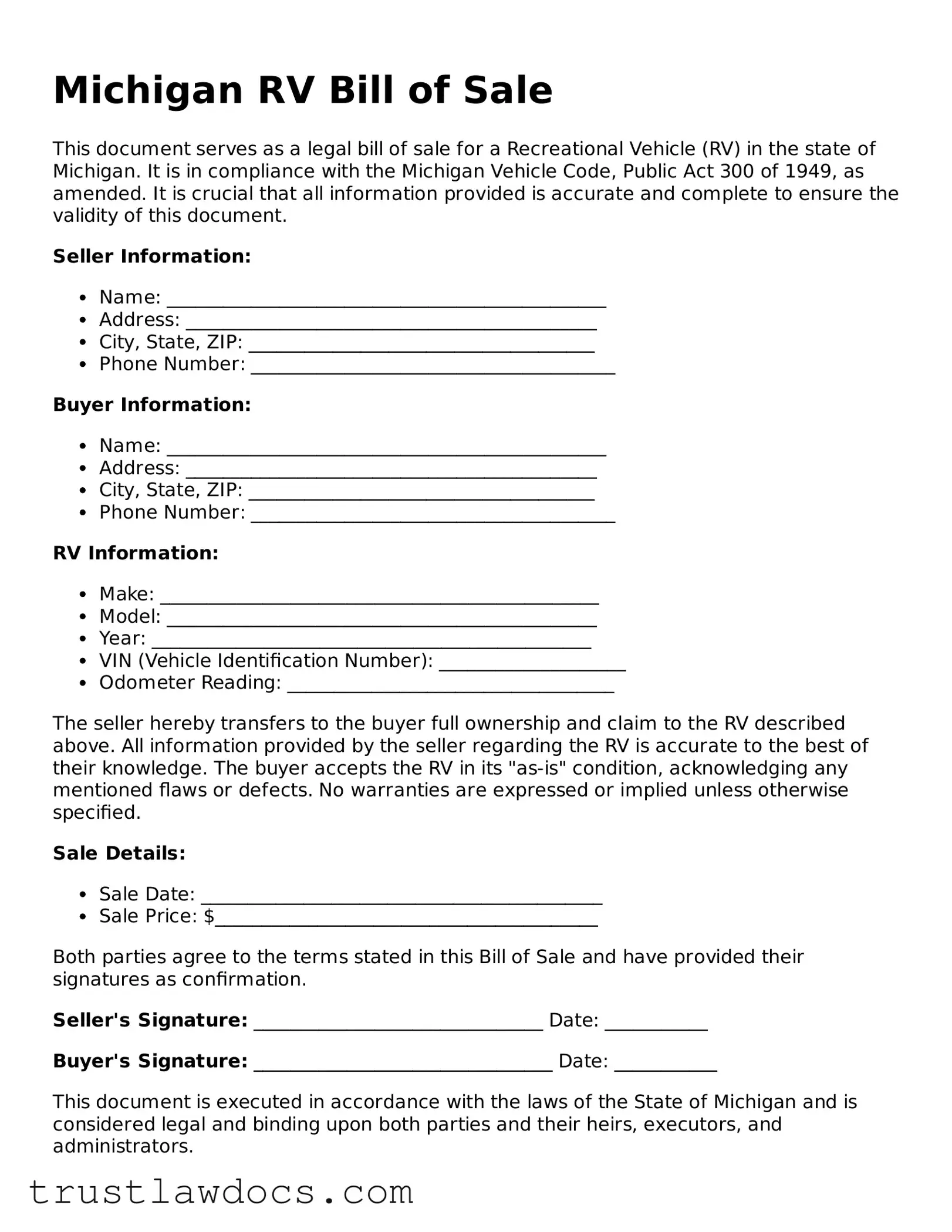

Form Example

Michigan RV Bill of Sale

This document serves as a legal bill of sale for a Recreational Vehicle (RV) in the state of Michigan. It is in compliance with the Michigan Vehicle Code, Public Act 300 of 1949, as amended. It is crucial that all information provided is accurate and complete to ensure the validity of this document.

Seller Information:

- Name: _______________________________________________

- Address: ____________________________________________

- City, State, ZIP: _____________________________________

- Phone Number: _______________________________________

Buyer Information:

- Name: _______________________________________________

- Address: ____________________________________________

- City, State, ZIP: _____________________________________

- Phone Number: _______________________________________

RV Information:

- Make: _______________________________________________

- Model: ______________________________________________

- Year: _______________________________________________

- VIN (Vehicle Identification Number): ____________________

- Odometer Reading: ___________________________________

The seller hereby transfers to the buyer full ownership and claim to the RV described above. All information provided by the seller regarding the RV is accurate to the best of their knowledge. The buyer accepts the RV in its "as-is" condition, acknowledging any mentioned flaws or defects. No warranties are expressed or implied unless otherwise specified.

Sale Details:

- Sale Date: ___________________________________________

- Sale Price: $_________________________________________

Both parties agree to the terms stated in this Bill of Sale and have provided their signatures as confirmation.

Seller's Signature: _______________________________ Date: ___________

Buyer's Signature: ________________________________ Date: ___________

This document is executed in accordance with the laws of the State of Michigan and is considered legal and binding upon both parties and their heirs, executors, and administrators.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Michigan RV Bill of Sale form is used as a legal document to prove the sale and transfer of ownership of a recreational vehicle (RV) from a seller to a buyer. |

| Required Information | This form typically includes details such as the names and addresses of the seller and buyer, description of the RV (make, model, year, VIN), sale date, and purchase price. |

| Governing Law | In Michigan, RV Bill of Sale forms are governed by state laws pertaining to the sale of motor vehicles, which require proper documentation for the transfer of ownership. |

| Additional Requirements | Alongside the RV Bill of Sale, the state of Michigan may require a title transfer, and in some cases, an odometer disclosure statement, to fully document the change of ownership. |

How to Write Michigan RV Bill of Sale

When an RV (Recreational Vehicle) changes ownership in Michigan, a Bill of Sale serves as an essential record of the transaction. This document not only provides proof of purchase but also includes details like the sale price and the identities of the buyer and seller. Completing this form accurately is crucial for both parties involved to ensure a smooth transition of ownership. Below are the steps needed to fill out the Michigan RV Bill of Sale form properly.

- Start by writing the date of the sale at the top of the document.

- Next, fill in the full legal names and addresses of both the buyer and the seller in the designated spaces.

- In the section provided, describe the RV in detail, including its make, model, year, color, VIN (Vehicle Identification Number), and any other identifying features.

- Specify the sale price of the RV and the date when the payment was made or will be made.

- If there are any terms and conditions related to the sale (for example, warranties or “as is” condition), make sure to include these in the designated area.

- The next step is for both the buyer and the seller to carefully read the acknowledgment statement, which confirms their agreement to the terms of the sale and attests that the information provided is accurate.

- Both the buyer and the seller should then sign and print their names at the bottom of the form to make it legally binding. Don't forget to include the date of the signatures.

- Finally, if applicable, have a witness or notary public sign the form as well to verify the authenticity of the signatures.

After completing these steps, it's important for both parties to keep a copy of the Bill of Sale for their records. This document will serve as a receipt and may be required for registration and taxation purposes. Taking the time to fill out the form accurately and completely ensures that the sale is documented properly, providing peace of mind to both the buyer and seller.

Get Answers on Michigan RV Bill of Sale

What is a Michigan RV Bill of Sale form?

A Michigan RV Bill of Sale form is a legal document that records the sale of a recreational vehicle (RV) within the state of Michigan. It details the transaction between the buyer and seller, providing proof of transfer and ownership of the RV. This form captures essential information such as the purchase price, date of sale, and specifics about the RV, including its make, model, year, and Vehicle Identification Number (VIN).

Why do I need an RV Bill of Sale in Michigan?

In Michigan, an RV Bill of Sale is crucial for several reasons. It serves as evidence of the transaction, which is necessary for the buyer to register the RV with the state. Additionally, it protects both the buyer and seller in case of future disputes regarding the RV’s condition or terms of sale. For taxation purposes, the document provides proof of the sales price, which might be required by the tax authorities.

What information should be included in the Michigan RV Bill of Sale?

A comprehensive Michigan RV Bill of Sale should include the full names and addresses of both the buyer and seller, the sales price, the date of sale, and detailed information about the RV such as make, model, year, VIN, and any other relevant characteristics or included items with the sale (like additional equipment or accessories). Signatures of both parties are also required to validate the document.

Is notarization required for an RV Bill of Sale in Michigan?

Notarization is not a mandatory requirement for an RV Bill of Sale to be legally binding in Michigan. However, getting the document notarized can add an extra layer of legal protection and authenticity, helping to confirm that the signatures on the form are genuine and willingly given.

How do I register an RV in Michigan using a Bill of Sale?

To register an RV in Michigan, the buyer must bring the completed RV Bill of Sale to their local Secretary of State office, along with any other required documentation, such as proof of insurance and a valid Michigan driver’s license or state identification. The Bill of Sale acts as proof of ownership and is necessary for the registration process. It’s recommended to call ahead or check online for specific document requirements as they can vary.

Can I use a generic Bill of Sale for an RV transaction in Michigan?

While a generic Bill of Sale can be used for an RV transaction in Michigan, it’s advisable to use a form that is specifically designed for RV sales. This ensures that all relevant details specific to the transaction of an RV are captured, which can prevent potential legal issues and make the registration process smoother.

What happens if I lose my RV Bill of Sale?

If you lose your RV Bill of Sale, it’s important to contact the seller for a duplicate, if possible. In cases where a duplicate cannot be obtained, having a notarized statement explaining the loss and the details of the RV sale, including the information that was on the original Bill of Sale, can serve as a substitute for the registration process. However, the acceptance of this substitute can vary based on the discretion of the local Secretary of State office.

Do both the buyer and seller need to keep a copy of the Bill of Sale?

Yes, it is highly recommended that both the buyer and seller retain a copy of the RV Bill of Sale. Keeping a record of the transaction is beneficial for personal recordkeeping, tax purposes, and as proof of the sale or purchase. It also can provide legal protection in the event of a dispute over the terms of the sale or the RV’s condition at the time of purchase.

Common mistakes

When people fill out the Michigan RV Bill of Sale form, one common mistake is overlooking the need to accurately describe the RV. This includes failing to mention specific details such as make, model, year, VIN (Vehicle Identification Number), and any distinguishing features. These details are crucial for the identification of the RV and ensuring the sale is legally binding.

Another frequent error is not specifying the sale terms clearly. It is essential to clearly state if there are any warranties or if the RV is being sold "as is." Without this clarification, misunderstandings can arise after the sale, potentially leading to legal disputes between the buyer and seller.

Often, individuals mistakenly leave the sale price off the form or do not write it in clearly. This can create confusion or disagreements later on. The sale price should be written in both words and numerals to ensure clarity and prevent any misinterpretation of the sale amount.

Some sellers forget to include both the buyer’s and seller’s full names and addresses. This information is fundamental for identifying both parties involved in the transaction and cannot be omitted from the document.

A crucial step that is sometimes skipped is having the document notarized. In many cases, the bill of sale must be notarized to validate the signatures of both parties involved. Skipping this step can question the authenticity of the document.

Failure to provide a thorough condition report of the RV is another mistake. Any existing damages or issues should be listed to ensure the buyer is fully aware of the condition of the RV at the time of purchase.

Not setting a clear date of sale can lead to potential legal issues. The date of sale verifies when the transaction was agreed upon and completed. Leaving this date ambiguous or not including it at all is a mistake.

Forgetting to sign and date the document is a surprisingly common oversight. The signatures of both the buyer and seller are necessary to execute the sale officially. Without them, the document may not be considered legally binding.

Lastly, neglecting to give a copy of the signed document to each party involved is a misstep. Both the buyer and seller should have a copy of the bill of sale for their records. This serves as proof of the transaction and can be important for tax and registration purposes.

Documents used along the form

In the process of buying or selling a recreational vehicle (RV) in Michigan, the Bill of Sale is a fundamental document that evidences the transaction. Besides the RV Bill of Sale, there are other essential forms and documents that parties typically require to ensure a smooth and legally sound transaction. These additional documents serve to protect the interests of both the buyer and the seller, ensuring compliance with local laws and regulations, providing proof of ownership, and facilitating the registration and transfer process.

- Title Transfer Forms: Needed to legally transfer ownership of the RV from the seller to the buyer. It must be submitted to the Michigan Secretary of State.

- Odometer Disclosure Statement: This document records the RV's mileage at the time of sale, required for vehicles less than 10 years old, ensuring transparency in the transaction.

- Proof of Insurance: Buyers must provide proof of insurance for the RV. This document is necessary for registration and is a legal requirement for operating the vehicle on public roads.

- Loan Agreement: If the RV is being financed, a loan agreement spells out the terms of the loan, including interest rate, repayment schedule, and what happens in case of default.

- Release of Liability: Sellers may require a release of liability form to be signed by the buyer, freeing the seller from responsibility for accidents or tickets involving the RV after the sale.

- Registration Application: To legally operate the RV, the buyer must submit a registration application to the Michigan Secretary of State, along with the necessary fees.

- Warranty Documents: If the RV is still under warranty, transferring these documents to the new owner ensures that the warranty remains valid after the sale.

- RV Inspection Form: A professional inspection report that provides an in-depth look at the RV's condition, highlighting any issues or repairs that may be needed.

- Power of Attorney: In situations where the seller cannot be present to sign the required documents, a power of attorney may be required to authorize another person to act on their behalf.

- Receipt of Sale: In addition to the Bill of Sale, a detailed receipt that includes the final sale price, date of sale, and signatures of both parties can provide additional proof of the transaction.

Together, these documents form a comprehensive packet that ensures all legal, financial, and regulatory bases are covered. Both the buyer and the seller are advised to keep copies of all documents for their records. While the Michigan RV Bill of Sale is the cornerstone of the sale transaction, the supplementary documents listed play vital roles in safeguarding the interests of all parties involved and ensuring compliance with Michigan law.

Similar forms

The Michigan RV Bill of Sale form shares similarities with the Vehicle Bill of Sale. Both documents serve as legal records of the sale and transfer of ownership from one party to another. They contain essential information, such as the buyer's and seller's details, a description of the vehicle or RV in question, the sale price, and the transaction date. These forms are crucial for registration purposes and to establish the new ownership legally.

Comparable to a General Bill of Sale, the Michigan RV Bill of Sale is used for documenting the sale of personal property. The General Bill of Sale applies to a wide range of items, including electronics, equipment, and other personal possessions. Both documents function as evidence of a transaction and include information about the items sold, the sale amount, and both parties' details. These forms provide legal protection by recording the transfer of goods from seller to buyer.

Another document similar to the Michigan RV Bill of Sale is the Boat Bill of Sale. This document is specifically designed for the sale of boats and, like the RV Bill of Sale, records the details of the transaction, including the buyer and seller information, a description of the boat, the price, and the date of sale. Both forms are vital for the registration of the vehicle (RV or boat) in the buyer’s name and confirm the legal change of ownership.

Lastly, the Michigan RV Bill of Sale is akin to a Firearm Bill of Sale. While both documents are used for different types of property (an RV vs. a firearm), they share the purpose of documenting the sale and change of ownership of an item. Each includes specific details about the item sold, the parties involved, the sale price, and the date. These documents are important for legal and registration purposes, ensuring compliance with state laws surrounding the ownership transfer.

Dos and Don'ts

When it comes to completing a Michigan RV Bill of Sale form, certain practices should be followed to ensure the process is handled correctly and efficiently. This document serves as a legal record of the transaction between the buyer and seller, providing proof of ownership transfer. Below are lists of what to do and what not to do, ensuring the document is filled out accurately and effectively.

Do:

- Verify all information is accurate: Before finalizing the bill of sale, double-check all details, including the RV's make, model, year, and Vehicle Identification Number (VIN), along with the personal information of both parties.

- Include a detailed description of the RV: Clearly state the condition of the RV, including any existing damages or issues. This can help prevent disputes later on.

- Ensure the date of sale is correct: The date when the transaction takes place should be accurately recorded as this date is critical for legal and registration purposes.

- Have all parties sign the form: The buyer, seller, and a notary public (if required) must sign the bill of sale to validate the document.

- Keep a copy for personal records: Both the buyer and seller should retain a copy of the bill of sale for their records, as it provides proof of ownership and can be important for tax and registration purposes.

- Consult with a legal expert if unsure: If there are any uncertainties about the form or process, seeking advice from a legal professional can help clarify and ensure that the document complies with Michigan law.

Don't:

- Leave blank spaces: All fields in the bill of sale should be filled out. If a section does not apply, mark it as “N/A” (not applicable) instead of leaving it blank to avoid alterations.

- Use vague language: Be as specific as possible when describing the RV and the terms of the sale. Ambiguities could lead to misunderstandings or legal issues.

- Forget to specify the sale price: Clearly state the selling price of the RV, ensuring that both parties agree on this amount. This is crucial for tax assessment purposes.

- Ignore lien information: If the RV has an existing lien, this information must be disclosed in the bill of sale. Failure to do so can cause complications for the buyer.

- Rely solely on verbal agreements: All agreements related to the sale should be included in the bill of sale. Verbal agreements are difficult to enforce and prove in legal disputes.

- Undervalue the RV: For tax purposes, accurately report the sale price of the RV. Intentionally undervaluing the vehicle can lead to penalties or legal action.

Misconceptions

When it comes to the Michigan RV Bill of Sale form, several misunderstandings commonly surface. Individuals often navigate through the complexities of buying or selling recreational vehicles (RVs) with certain preconceived notions that don't always align with legal realities or requirements. Below, some of these misconceptions are addressed to ensure clarity and smooth transactions.

The Michigan RV Bill of Sale form is universally required for all RV transactions. In reality, not all RV transactions in Michigan mandate the completion of an RV Bill of Sale. The necessity of this document can vary based on local jurisdiction requirements and the specific circumstances of the sale.

It's just a simple formality. Contrary to this belief, the RV Bill of Sale serves critical purposes. It not only records the transaction details for legal and tax purposes but also protects both the buyer and the seller by specifying the condition of the RV, the sale price, and the transfer of ownership.

Any template will work as long as it has the basic information. While basic details are important, using a generic template might omit specific details and legal declarations important in Michigan. It's crucial to use a form that complies with Michigan state laws to ensure the validity of the bill of sale.

There's no need for a witness or notarization. This assumption can lead to problems. Depending on the transaction's complexity and value, having the bill of sale witnessed or notarized can add an additional layer of legal protection and authenticity to the document.

The Bill of Sale is only about buying and selling. Beyond recording the sale, this document can also be important for registration, insurance, and loan purposes. The RV Bill of Sale is often required by institutions or agencies to verify the transaction and update records.

All information regarding the condition of the RV can be omitted. It's a common misconception that the RV's condition doesn't need to be thoroughly documented. Detailing the RV's current condition, including any existing damages or issues, is crucial for a transparent transaction and can prevent disputes or misunderstandings post-sale.

In summary, navigating the requirements and implications of a Michigan RV Bill of Sale with accurate information benefits both the seller and the buyer. It ensures that the transaction is conducted legally, transparently, and with mutual satisfaction.

Key takeaways

When dealing with the Michigan RV Bill of Sale form, several key takeaways ensure the process is smooth and compliant with state requirements. Understanding these will help both the seller and the buyer complete the transaction confidently and legally.

- Accurate Information: It's vital to provide accurate details about both the buyer and the seller, including full names, addresses, and contact information. This ensures that the bill of sale is legally binding and useful for registration purposes.

- Description of the RV: The form should contain a detailed description of the recreational vehicle (RV), including make, model, year, VIN (Vehicle Identification Number), and any other identifying information. This specificity helps avoid any disputes over what is being sold.

- Sale Price: Clearly state the sale price of the RV. This is important for tax purposes and serves as proof of the transaction's value.

- Date of Sale: The exact date of the sale should be included on the bill of sale. This date is crucial for legal and registration reasons, particularly if any issues arise post-sale.

- Signatures: Both the buyer and the seller must sign the form. Signatures are essential as they indicate that both parties agree to the terms of the sale, making the document legally binding.

- Witness or Notarization: Depending on local requirements, the document may need to be witnessed or notarized. This adds an extra layer of verification to the transaction.

- Odometer Disclosure: For vehicles that require it, an accurate odometer reading should be included. This is a federal requirement to prevent odometer fraud.

- “As-Is” Clause: Including an "as-is" clause can protect the seller from future claims if the RV has issues after the sale. It indicates that the buyer accepts the RV in its current condition.

- Additional Documents: Sometimes, additional documentation is necessary alongside the Michigan RV Bill of Sale. Check local regulations to see if insurance proof, title transfer, or other forms are needed.

- Multiple Copies: Make sure to create multiple copies of the completed bill of sale— one for the buyer, one for the seller, and possibly another for registration purposes.

Taking the time to accurately complete the Michigan RV Bill of Sale form and understanding these key takeaways can save both parties from potential legal and administrative headaches down the road. Always check the most current state requirements or consult with a professional when in doubt.

Popular RV Bill of Sale State Forms

Travel Trailer Bill of Sale - For financing purchases, the RV Bill of Sale may be required by lenders to finalize the loan documents.