Free Motor Vehicle Bill of Sale Form for Texas

For anyone looking to buy or sell a vehicle in the Lone Star State, understanding and properly completing the Texas Motor Vehicle Bill of Sale form is crucial. This document serves as a formal record of the transaction, detailing the sale's specifics, including information about the buyer, seller, and the vehicle itself. It is not just a receipt but a legally binding agreement that verifies the transfer of ownership and helps both parties in the sale avoid future disputes. Additionally, the form provides essential data that aids in the registration process and may be required for tax assessment purposes. Whether you're a seasoned car dealer or a first-time buyer, familiarizing yourself with this form ensures that your vehicle transactions comply with Texas state law, offering peace of mind and legal protection for all involved.

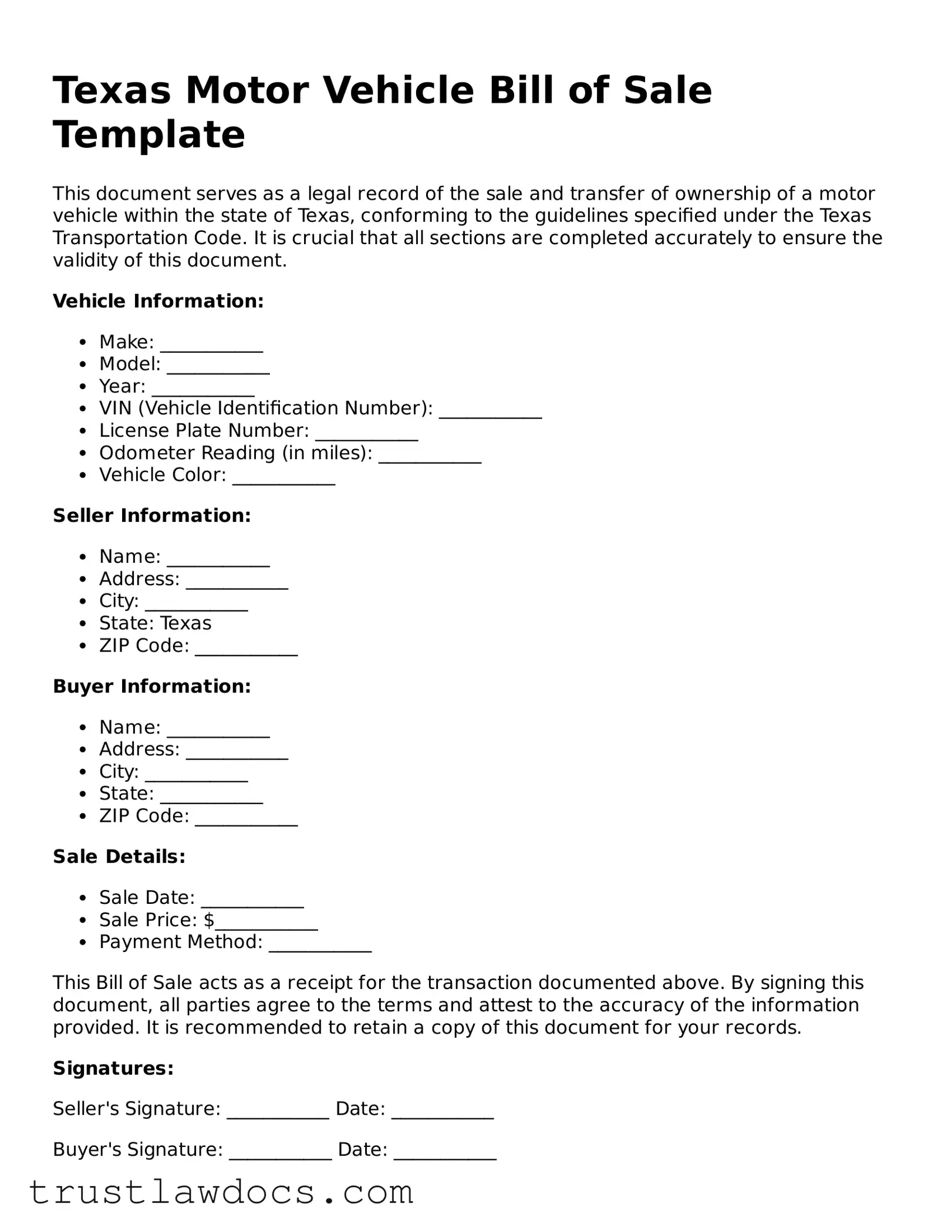

Form Example

Texas Motor Vehicle Bill of Sale Template

This document serves as a legal record of the sale and transfer of ownership of a motor vehicle within the state of Texas, conforming to the guidelines specified under the Texas Transportation Code. It is crucial that all sections are completed accurately to ensure the validity of this document.

Vehicle Information:

- Make: ___________

- Model: ___________

- Year: ___________

- VIN (Vehicle Identification Number): ___________

- License Plate Number: ___________

- Odometer Reading (in miles): ___________

- Vehicle Color: ___________

Seller Information:

- Name: ___________

- Address: ___________

- City: ___________

- State: Texas

- ZIP Code: ___________

Buyer Information:

- Name: ___________

- Address: ___________

- City: ___________

- State: ___________

- ZIP Code: ___________

Sale Details:

- Sale Date: ___________

- Sale Price: $___________

- Payment Method: ___________

This Bill of Sale acts as a receipt for the transaction documented above. By signing this document, all parties agree to the terms and attest to the accuracy of the information provided. It is recommended to retain a copy of this document for your records.

Signatures:

Seller's Signature: ___________ Date: ___________

Buyer's Signature: ___________ Date: ___________

This document does not serve as a title transfer. The buyer must submit this Bill of Sale along with the necessary documents to the Texas Department of Motor Vehicles (TxDMV) to record the change of ownership and apply for a new vehicle title.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | It serves as a legal document that records the sale of a vehicle in Texas, providing proof of the transaction. |

| Legal Requirement | In Texas, it's not legally required but highly recommended for personal record-keeping and tax purposes. |

| Governing Law | It is governed by the Texas Transportation Code, which outlines the requirements for motor vehicle sales and transfers. |

| Information Included | Typically includes the names and addresses of the buyer and seller, vehicle description, sale date, and sale price. |

| Importance of Accuracy | Accuracy is crucial to protect both parties and ensure the transfer of ownership is recognized by the state. |

| Notarization | Not required by Texas law, but having the form notarized can add a layer of legal protection and authenticity. |

| Use in Registration | The buyer needs this document to register the vehicle in Texas under their name. |

| Addendum | An addendum can be attached if additional details about the vehicle or sale need to be included. |

| Copies | Both the buyer and seller should keep a signed copy of the form for their records. |

| Online Availability | Templates for a Texas Motor Vehicle Bill of Sale can be found online or obtained from local DMV offices. |

How to Write Texas Motor Vehicle Bill of Sale

Completing the Texas Motor Vehicle Bill of Sale form is a practical step in the process of buying or selling a vehicle in Texas. This document serves as a record of the transaction between the buyer and the seller, detailing the exchange. It's important for both parties to accurately fill out this form to ensure a smooth transfer of ownership and to provide a legal record of the sale. The following steps are designed to guide you through this process, making sure all the necessary information is correctly documented.

- Gather the necessary information: Before you begin, make sure you have all the necessary details including the vehicle identification number (VIN), make, model, year, and the sale price.

- Enter the date of the sale: At the top of the form, write down the date on which the sale is being completed.

- Document the buyer's information: Fill in the full name and address of the person buying the vehicle. Ensure accuracy to avoid issues in the future.

- Record the seller's information: Similarly, enter the full name and address of the current owner (seller) of the vehicle.

- Describe the vehicle: Provide a detailed description of the vehicle being sold. This includes the make, model, year, VIN, and an odometer reading at the time of sale.

- State the sale price: Clearly mention the amount for which the vehicle is being sold. If the vehicle is a gift, indicate so by stating the value as $0.

- Signature of the seller: The seller must sign the form to officially transfer ownership of the vehicle to the buyer. This acts as a confirmation of the sale and the information provided.

- Signature of the buyer: The buyer also signs the form, acknowledging the receipt of the vehicle under the terms and conditions stated. This step is crucial for the sale to be legally binding.

- Notarization (if required): Some circumstances may necessitate the notarization of the bill of sale. While not always mandatory, it is advisable to check whether this step is required in your situation.

Once the Texas Motor Vehicle Bill of Sale form is fully completed and signed by both parties, it is recommended to make copies for each. Keeping a copy of this document is important for records, future reference, or any potential disputes that may arise. It not only formalizes the sale but also serves as a protective measure for both the buyer and the seller.

Get Answers on Texas Motor Vehicle Bill of Sale

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle in the state of Texas. It provides evidence that a transaction between a seller and a buyer has taken place, detailing the sale's specifics such as the date, price, and information about the vehicle including make, model, and VIN (Vehicle Identification Number). This document is crucial for the legal transfer of ownership.

Is a Motor Vehicle Bill of Sale required in Texas?

In Texas, a Motor Vehicle Bill of Sale is not strictly required to complete the transfer of ownership for a vehicle, as the state relies more heavily on the title transfer. However, it’s highly recommended as it provides a written record of the vehicle’s sale which can be beneficial for tax, legal, and personal record-keeping purposes.

What information should be included in a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale should include the full names and contact information of both the seller and the buyer, a detailed description of the vehicle (make, model, year, VIN), the sale price, the date of sale, and signatures of both parties involved. It’s also advised to include an odometer disclosure statement.

Do both parties need to sign the Texas Motor Vehicle Bill of Sale?

Yes, for a Texas Motor Vehicle Bill of Sale to be considered valid, it should be signed by both the seller and the buyer. These signatures do not necessarily have to be notarized in Texas, but having the document notarized can add an extra layer of legal protection and authenticity to the document.

How does a Texas Motor Vehicle Bill of Sale benefit the buyer?

For the buyer, a Motor Vehicle Bill of Sale serves as proof of the transaction and ownership until the title transfer is completed. It can also be useful for state registration purposes and may be needed to obtain vehicle insurance. Additionally, it provides detailed information about the vehicle's condition and terms of sale agreed upon by both parties.

Is it necessary to register a Bill of Sale with the state of Texas?

No, it is not necessary to register a Motor Vehicle Bill of Sale with the state of Texas. However, the buyer must ensure the vehicle is properly titled and registered in their name after the purchase. The Bill of Sale can be an important document in this process but is not the official record of ownership transfer.

Common mistakes

One common error that individuals often make when filling out the Texas Motor Vehicle Bill of Sale form is neglecting to check for accuracy in the vehicle's details, such as the make, model, year, and Vehicle Identification Number (VIN). This kind of oversight can lead to significant issues, potentially invalidating the sale or creating complications in the vehicle registration process.

Another mistake is overlooking the importance of including both the buyer's and seller's full names and addresses. This information is crucial for both parties, as it not only confirms the identities of the involved parties but also facilitates any future communication that may be necessary. Failing to include this information can put the legality of the transaction into question.

Many people also forget to specify the sale date on the form. This detail is more important than it might seem at first glance. The sale date can affect warranty, tax obligations, and even legal ownership disputes. Without this, you might struggle to prove when the transaction occurred, which can be especially problematic in cases of later disputes or challenges.

Not stating the purchase price on the Bill of Sale is another error that can lead to problems down the road, mainly because it can affect tax calculations and proof of the transaction's fairness. Sometimes, individuals intentionally omit this detail for various reasons; however, this can create suspicions of tax evasion or fraud.

Failure to include a detailed description of the condition of the vehicle is yet another oversight. This section serves to protect both the buyer and seller by clearly documenting any existing defects or issues at the time of sale, which can help avoid future disputes about the vehicle's condition.

A critical step that is often missed is not obtaining the signatures of both the buyer and the seller. Without these signatures, the document lacks the legal binding it requires to officially confirm the transfer of ownership. A signature serves as a personal certification that the information on the form is accurate and agreed upon by all parties.

Lastly, a common mistake involves not verifying or acknowledging the requirement for a notary's signature. While not always obligatory, having a notarized Bill of Sale can add an extra layer of legality and protection for both parties. It proves that the signatures were made by the individuals involved, further legitimizing the entire process.

Documents used along the form

When engaging in a vehicle transaction in Texas, the Motor Vehicle Bill of Sale form is pivotal. However, this document does not stand alone. To ensure a comprehensive and legally binding transaction, several other forms and documents should accompany it. Each of these plays a unique role in the process, safeguarding both buyer and seller and meeting legal requirements. Below is an outline of such documents, providing a clear view of their significance and utility.

- Odometer Disclosure Statement: Required for vehicles less than ten years old, this document records the vehicle's actual mileage at the time of sale, helping to ensure the buyer is aware of the vehicle's condition and value.

- Title Application: This form initiates the process of transferring the vehicle's title from the seller to the buyer, a necessary step to legitimize the ownership change in official records.

- Vehicle Title: The most crucial document in the transaction, indicating the vehicle's legal owner. Both parties need to sign and date the title for the transfer to be valid.

- Sales Tax Affidavit: In Texas, vehicle sales are subject to sales tax. This form is used to declare the amount paid for the vehicle, determining the tax owed.

- Release of Lien: If the vehicle was financed and the loan has been paid off, this document from the lender states that there are no outstanding claims against the vehicle.

- Buyer's Tag Receipt: This serves as a temporary registration for the buyer, allowing them to legally drive the vehicle while the title transfer is being processed.

- Power of Attorney for Vehicle Transactions: If either the buyer or seller cannot be present for the title transfer, this document grants another individual the authority to sign on their behalf.

- VIN Verification Form: Required for vehicles coming from out of state, this form verifies the Vehicle Identification Number (VIN) to prevent fraud and theft.

- Gift Affidavit: If the vehicle is being given as a gift, this form declares that fact, potentially exempting the transaction from sales tax.

- Emission Inspection Report: Required in many Texas counties, this report verifies that the vehicle meets the state's environmental standards.

These documents collectively ensure that the vehicle sale adheres to Texas law, providing protections for all parties involved. By understanding and utilizing these forms properly, buyers and sellers can navigate the legal landscape of vehicle transactions with confidence, ensuring a smooth and compliant transition of ownership.

Similar forms

The Texas Motor Vehicle Bill of Sale form shares similarities with a Vehicle Title. Both documents are crucial in the process of transferring ownership of a vehicle from the seller to the buyer. The Vehicle Title is the official document that certifies who legally owns the vehicle. Like the Bill of Sale, it contains important information including the make, model, year, and identification number of the vehicle, as well as the names and addresses of the buyer and seller. However, the Vehicle Title goes a step further by also including any lienholders and is required for registration and licensing purposes.

A Warranty Deed in real estate has its parallels with the Motor Vehicle Bill of Sale. It serves as a guaranteed proof of transfer of a clear and unencumbered title of property from one individual to another. Similar to the Bill of Sale, a Warranty Deed outlines detailed information about the property being transferred, and the parties involved, ensuring that the seller legally owns the property and has the right to sell it. This document acts as a crucial part of the documentation required in the sale and purchase of property, ensuring the buyer's rights are protected just as the Bill of Sale does for vehicle purchases.

The Promissory Note is another document akin to the Texas Motor Vehicle Bill of Sale. It is used in various transactions as a written promise to pay a specified sum of money to someone at a set time or on demand. In the context of purchasing a vehicle, a Promissory Note might be used alongside the Bill of Sale to document a loan between the buyer and seller for the vehicle's purchase price. While the Bill of Sale confirms the transaction and transfer of ownership, the Promissory Note details the terms of repayment, including any interest, demonstrating how these documents work together in financial transactions.

Similarly, the Boat Bill of Sale is comparable to the Motor Vehicle Bill of Sale but is specifically used for the transfer of ownership of a boat. Both these documents record the details of the sale, such as the purchase price, description of the item (a vehicle or a boat), and the parties' details. Furthermore, both require signatures from both buyer and seller to validate the agreement. The primary difference lies in the type of items they cover, yet their function in confirming the sale and acting as a receipt for the transaction remains the same.

Last but not least, the Sales Invoice shares its purpose with the Texas Motor Vehicle Bill of Sale. Typically used in all kinds of transactions, a Sales Invoice outlines the purchase transaction between a buyer and a seller, detailing the items sold, the amount charged, and the payment terms. While it acts as a request for payment from the buyer, in many ways, it serves as proof of the transaction, similar to the Bill of Sale. The key difference is that a Sales Invoice is commonly used post-sale to request payment, whereas the Bill of Sale confirms the agreement to sell and transfer ownership at the point of sale.

Dos and Don'ts

Filling out the Texas Motor Vehicle Bill of Sale form is an important step in the process of buying or selling a vehicle. It legally documents the transaction and provides essential details about the sale. To ensure this process is handled correctly, here are some dos and don'ts that should be followed:

Do:

- Ensure all information is accurate and matches the details on the vehicle’s title and registration.

- Include comprehensive contact information for both the buyer and seller, such as full names, addresses, and phone numbers.

- Verify the vehicle identification number (VIN) on the vehicle matches the one on the form.

- Sign and date the form in the presence of a notary public if required by your local jurisdiction.

Don't:

- Leave any sections of the form blank. If a section does not apply, write “N/A” (not applicable) to indicate this.

- Forget to disclose the odometer reading accurately to ensure the buyer is aware of the vehicle's actual mileage.

- Sign the document without verifying every detail. Once signed, it is considered legally binding.

- Fail to keep a copy of the completed bill of sale for your records. It is beneficial for both parties to have a copy for future reference.

Misconceptions

When it comes to transferring ownership of a vehicle in Texas, the Motor Vehicle Bill of Sale form plays a crucial role. However, several misconceptions surround its use and importance. Understanding these misconceptions can help ensure a smooth transaction for both the buyer and the seller. Here are nine common misconceptions about the Texas Motor Vehicle Bill of Sale form:

- It's the only document you need to transfer ownership.

This is a common misconception. While the Texas Motor Vehicle Bill of Sale form is an important part of the process, it's not the only document required. The vehicle title transfer is essential to legally change ownership, and in some cases, additional documents such as a Release of Lien or a Power of Attorney may be needed.

- The form is optional.

Many people think the Bill of Sale form is optional, but in Texas, it's a legal requirement for the buyer to obtain a valid form completed by the seller. This form not only serves as a receipt but also provides important details about the sale that can protect both parties in case of disputes.

- Any Bill of Sale form will work.

Not all Bill of Sale forms are created equal. The Texas Department of Motor Vehicles provides a specific form that should be used to ensure all state-required details are included. Using a generic form might omit important information and lead to issues with the transfer process.

- The form must be notarized.

Unlike in some states, Texas does not require the Motor Vehicle Bill of Sale form to be notarized. While having it notarized can add a layer of validation, it is not a legal requirement for the sale or purchase of a vehicle in Texas.

- Prices are fixed and non-negotiable.

Some believe that once a price is written on the Bill of Sale, it is final and cannot be negotiated. This is not true. The price can be negotiated up until the time the form is signed by both parties. The Bill of Sale should reflect the final agreed-upon price.

- Only the buyer needs to keep a copy.

It is often thought that only the buyer needs to keep a copy of the Bill of Sale. However, it's important for both the buyer and the seller to retain a copy. This document serves as proof of the transaction details and can be crucial in resolving any future disputes or for tax purposes.

- It serves as proof of ownership.

While the Bill of Sale is an essential document in the process of buying and selling a vehicle, it does not serve as legal proof of ownership by itself. The vehicle's title is the legal document that indicates the owner of the vehicle. The Bill of Sale supports the transfer of this title.

- Only cars require a Bill of Sale.

While cars are the most common vehicles to require a Bill of Sale, it is a misconception that they are the only ones. In Texas, motorcycles, boats, and even trailers often require a Bill of Sale for ownership transfer procedures.

- You can complete and submit the form online.

Many believe that in our digital age, the Texas Motor Vehicle Bill of Sale form can be completed and submitted online. However, the official process requires a physical copy of the form to be included with the other required documents when transferring vehicle ownership. Digital submissions are not currently accepted for this particular form.

Understanding these misconceptions about the Texas Motor Vehicle Bill of Sale form can eliminate potential issues and help ensure that the process of buying or selling a vehicle goes as smoothly as possible.

Key takeaways

When handling the transfer of ownership for a vehicle in Texas, the Motor Vehicle Bill of Sale form is an essential document that records the transaction details. Understanding how to fill out and use this form correctly ensures a smoother process for both the seller and the buyer. Here are eight key takeaways to keep in mind:

- Accurate Information: Ensure all details filled out on the form are accurate. This includes the make, model, year, vehicle identification number (VIN), and the sale price of the vehicle. Any error can invalidate the document.

- Complete All Required Sections: Both the seller and the buyer must fill in their respective information sections in full. This typically includes names, addresses, and signatures.

- Signatures: The form must be signed by both parties. In some cases, a witness or a notary public may also need to sign the document, adding an extra layer of authenticity.

- Date of Sale: The exact date when the sale takes place must be recorded. This date is crucial for both legal and registration purposes.

- Keep Copies: Both the seller and the buyer should retain a copy of the Bill of Sale for their records. It serves as a receipt and a legal document proving ownership transfer.

- Verification: It's advisable to verify the information on the form with the vehicle's title and registration to ensure everything matches, especially the VIN.

- Legal Requirements: Familiarize yourself with Texas-specific requirements for a motor vehicle bill of sale. Some localities may have additional stipulations or require specific forms.

- Additional Documents: The Bill of Sale is often used in conjunction with other documents, such as the vehicle's title transfer form, to complete the sale legally and update the vehicle's registration. Be prepared to procure or fill out these additional documents as needed.

Correctly filling out and using the Texas Motor Vehicle Bill of Sale form is a straightforward but critical part of the vehicle sale process. It not only provides a legal record of the sale but also helps ensure the transfer is recognized by both state authorities and financial institutions if required.

Popular Motor Vehicle Bill of Sale State Forms

Indiana Bmv Bill of Sale - It may include specific warranties or disclosures made by the seller regarding the vehicle's condition.

Bill of Sale for Car Meaning - This form is a critical step in the process of making the vehicle officially the property of the buyer, as recognized by law.

Bill of Sale Florida Pdf - The form's comprehensive nature allows for the inclusion of any special terms or conditions agreed upon by the buyer and seller.