Free Motor Vehicle Bill of Sale Form for Michigan

In the state of Michigan, when individuals engage in the sale and purchase of a motor vehicle, documenting the transaction through a Motor Vehicle Bill of Sale form is an important step. This document serves as a legal record of the sale, providing proof that the vehicle has been transferred from the seller to the buyer. It includes essential information such as the vehicle's description, the sale price, and the identities of both the buyer and seller. Moreover, it plays a crucial role in the registration process, as it may be required by the Michigan Secretary of State when the new owner registers the vehicle. The completion of this form not only protects both parties in the event of future disputes but also ensures compliance with state laws regarding vehicle transactions. Additionally, it serves as a valuable tool for governmental agencies in tracking the ownership and sale of vehicles, aiding in the enforcement of laws and regulations pertaining to motor vehicle sales.

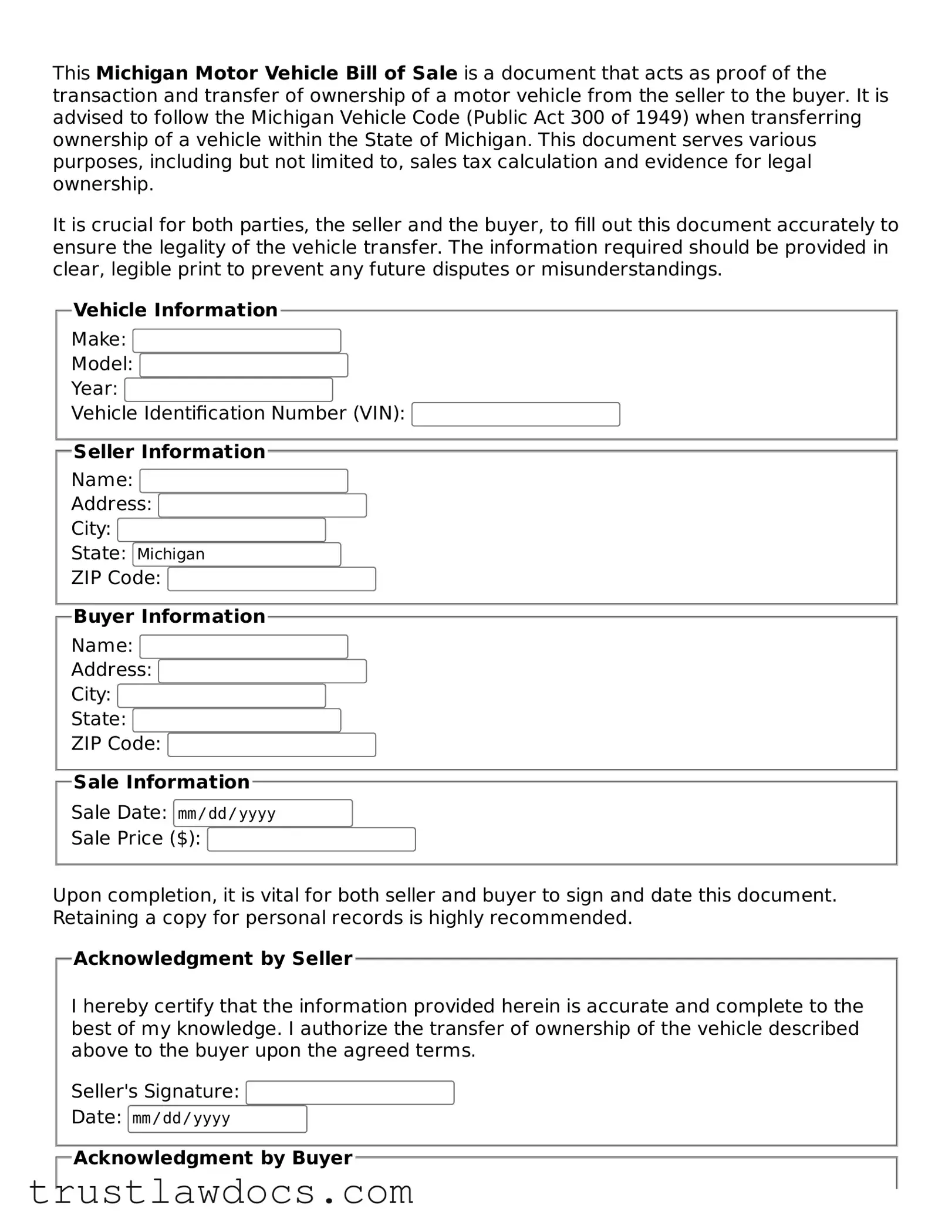

Form Example

This Michigan Motor Vehicle Bill of Sale is a document that acts as proof of the transaction and transfer of ownership of a motor vehicle from the seller to the buyer. It is advised to follow the Michigan Vehicle Code (Public Act 300 of 1949) when transferring ownership of a vehicle within the State of Michigan. This document serves various purposes, including but not limited to, sales tax calculation and evidence for legal ownership.

It is crucial for both parties, the seller and the buyer, to fill out this document accurately to ensure the legality of the vehicle transfer. The information required should be provided in clear, legible print to prevent any future disputes or misunderstandings.

PDF Form Details

| Fact | Description |

|---|---|

| Purpose | It serves as a legal record of the sale of a motor vehicle in the state of Michigan. |

| Governing Law | Michigan Vehicle Code, which outlines the requirements for the sale and transfer of motor vehicles. |

| Requirements | Includes details such as the date of sale, purchase price, and information about the buyer, seller, and the vehicle. |

| Necessity for Registration | A Bill of Sale is often required for the new owner to register the vehicle in their name. |

| Verification | Both seller and buyer signatures are required for the document to be considered valid. |

| Additional Documentation | It is typically used in conjunction with a title transfer to prove ownership of the vehicle. |

How to Write Michigan Motor Vehicle Bill of Sale

When selling or buying a motor vehicle in Michigan, completing a Motor Vehicle Bill of Sale form is a crucial step. This document serves as a record of the transaction, detailing the agreement between the buyer and the seller. It's a straightforward process, but filling out the form accurately is important to ensure both parties are protected and the transaction proceeds smoothly. Below are step-by-step instructions for filling out the Michigan Motor Vehicle Bill of Sale form.

- Date of Sale: Start by entering the date when the sale is to be completed. This should include the month, day, and year.

- Seller Information: Fill out the full legal name of the seller, their complete address including city, state, and ZIP code.

- Buyer Information: Next, enter the full legal name of the buyer along with their complete address, including city, state, and ZIP code.

- Vehicle Information: Provide detailed information about the vehicle being sold. This includes the make, model, year, color, VIN (Vehicle Identification Number), and the odometer reading at the time of sale.

- Purchase Price: Clearly state the sale price of the vehicle in dollars.

- Signatures: The form must be signed by both the buyer and the seller. Include the date next to each signature.

- Witnesses: If required, ensure the signatures are witnessed and that witnesses sign the form as well. This step may vary depending on local requirements, so it's worth checking if witnesses are needed.

After completing these steps, you'll have a fully executed Motor Vehicle Bill of Sale. It's recommended that both the buyer and the seller retain copies of the document for their records. This form serves as a legal record of the sale and can be important for title transfers, registration, or even tax purposes. Ensuring the form is filled out correctly and completely is vital for the protection of both parties involved in the transaction.

Get Answers on Michigan Motor Vehicle Bill of Sale

What is a Michigan Motor Vehicle Bill of Sale form?

A Michigan Motor Vehicle Bill of Sale form is a legal document that records the sale of a vehicle between a seller and a buyer within the state of Michigan. It provides important information such as the vehicle's description, the sale price, and the names and signatures of both parties. This document acts as proof of transfer of ownership and is crucial for the registration of the vehicle under the new owner's name.

Is a Bill of Sale legally required in Michigan for a private vehicle sale?

While Michigan does not strictly require a Bill of Sale for private vehicle sales, it is highly recommended to complete one. It serves as a valuable record of the transaction for both the seller and the buyer, especially for personal record-keeping, tax reporting, or if any legal issues arise regarding the vehicle’s ownership or history.

What specific information needs to be included in a Michigan Motor Vehicle Bill of Sale?

The document should include the date of the sale, comprehensive details of the vehicle (make, model, year, color, VIN), the sale price, and the names and signatures of both the buyer and the seller. Additionally, it is advisable to mention any warranties or "as-is" status of the sale to clarify the condition of the vehicle at the time of sale.

Does the Michigan Motor Vehicle Bill of Sale need to be notarized?

No, the Michigan Motor Vehicle Bill of Sale does not need to be notarized. However, having the document notarized can add a layer of authenticity and could be useful in resolving any future disputes about the sale or ownership of the vehicle.

How does a Bill of Sale benefit the buyer?

For the buyer, the Bill of Sale serves as evidence of the transaction and ownership transfer. It is essential for registering the vehicle in their name with the Michigan Secretary of State. The document also provides details about the vehicle, ensuring that the buyer has received the vehicle as agreed upon in the sale.

How does a Bill of Sale protect the seller?

The seller benefits from a Bill of Sale as it provides proof that they have legally transferred the ownership of the vehicle to the buyer, releasing them from liability for any future issues or violations involving the vehicle. It also helps to confirm that payment has been received as per the agreed-upon sale price.

Where can I find a Michigan Motor Vehicle Bill of Sale form?

You can obtain a Michigan Motor Vehicle Bill of Sale form from the Michigan Secretary of State's office or their official website. Additionally, several online platforms offer customizable templates that are compliant with Michigan law, ensuring that all necessary details are captured accurately.

Common mistakes

Filling out a Michigan Motor Vehicle Bill of Sale form requires attention to detail, as inaccuracies or omissions may lead to complications in the transfer of ownership or legal disputes. One common mistake is neglecting to verify and include the accurate vehicle identification number (VIN). The VIN is a unique code that identifies each vehicle, and any discrepancy in this number can invalidate the document or delay the transfer process.

Another error frequently encountered is failing to precisely record the sale price. This detail is crucial not only for the purposes of taxation but also for legal documentation. Incorrect reporting of the sale price can result in tax discrepancies and might raise questions regarding the legality of the transaction. It's vital to report the actual amount exchanged for the vehicle to ensure a transparent and lawful sale.

People often overlook the requirement to include both the buyer's and seller's full names and addresses. This information is essential for establishing the identities of the parties involved in the transaction. Without it, establishing legal ownership and responsibility can become challenging, potentially leading to disputes or claims of fraud.

The date of the sale is another detail that, if incorrectly recorded, can lead to issues post-sale. This date marks when the ownership officially transfers, and any mistakes in this detail can affect the application of warranties, the commencement of insurance coverage, and other time-sensitive aspects of vehicle ownership.

Additionally, omitting signatures or the printed names of both the buyer and the seller renders the bill of sale incomplete and, therefore, legally non-binding. The signatures certify that both parties agree to the terms of the sale, acknowledge the accuracy of the information provided, and confirm the voluntary transfer of ownership. Lack of signatures can make enforcing the terms of the sale challenging.

Some sellers fail to include a description of the vehicle's condition. While this might seem irrelevant to some, providing a detailed account of the vehicle's current state, including any defects or damages, can protect the seller from future claims of misrepresentation and ensure the buyer is fully informed of their purchase.

Ignoring to specify the terms of the sale is yet another mistake. When applicable, details regarding payment plans, delivery agreements, or other specific conditions should be explicitly stated. Without these terms, misunderstandings about the expectations from both parties can arise, possibly leading to legal conflicts.

A significant oversight on the part of sellers is not retaining a copy of the completed form for their records. Keeping a copy is essential for documenting the transaction and can serve as evidence in case of disputes, claims, or for tax reporting purposes.

Finally, parties sometimes neglect to check whether additional documentation is required by Michigan law for a vehicle sale. Depending on the circumstances of the sale, additional forms or notices might need to be completed and submitted to the appropriate state department. Failing to adhere to these requirements can delay the legal transfer of the vehicle or result in penalties.

Documents used along the form

In the process of buying or selling a vehicle in Michigan, the Motor Vehicle Bill of Sale form serves as a pivotal document, recording the transaction details between the buyer and seller. However, this form does not stand alone. To ensure a thorough and legally sound transfer of ownership, several other forms and documents are commonly utilized alongside it. These documents can vary based on specific requirements but generally include those that verify the condition, history, and legal status of the vehicle, as well as those that facilitate the registration process in the new owner's name.

- Title Transfer Form: This crucial document officially transfers the vehicle's title from the seller to the buyer. It is submitted to the state's Department of Motor Vehicles (DMV) or equivalent. The form typically requires information about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN), as well as details about both the seller and the buyer.

- Odometer Disclosure Statement: Required by federal law for the sale of most vehicles, this statement records the vehicle's odometer reading at the time of sale. It serves to inform the buyer of the vehicle's actual mileage and helps to detect potential odometer fraud.

- Damage Disclosure Statement: This document is necessary for revealing any significant damage that the vehicle may have sustained in the past. It's a form of consumer protection that ensures transparency regarding the vehicle's condition.

- Vehicle Registration Application: To register the vehicle in the buyer's name, this application must be completed and submitted to the local DMV office. It requires personal information about the buyer and details about the vehicle. Proof of insurance may also be necessary to complete the registration process.

- Proof of Insurance: Although not a form, proof of insurance is often required to be presented with the other documents. It confirms that the vehicle is insured under the buyer's name, which is a legal requirement for operating the vehicle on public roads.

Each of these documents plays a vital role in the transfer of vehicle ownership in Michigan, complementing the Motor Vehicle Bill of Sale. Together, they ensure that the transaction is not only recorded but also adheres to legal standards and regulations. Ensuring proper documentation is presented and filed can help both the buyer and seller avoid potential legal issues and ensure the transaction process is as smooth as possible.

Similar forms

The Michigan Motor Vehicle Bill of Sale form shares similarities with a Promissory Note in several aspects. Both documents serve as written agreements between two parties. A Promissory Note outlines the terms under which one party promises to pay a specified sum to another, usually regarding a loan or financial transaction. Similarly, the Motor Vehicle Bill of Sale acts as an agreement that facilitates the sale of a vehicle from one party to another, detailing the transaction amount and conditions. Each document provides legal proof of the agreement, protecting the interests of both parties involved.

Comparable to a Warranty Deed, the Motor Vehicle Bill of Sale in Michigan serves to transfer ownership rights, but in this context, it is specific to vehicles rather than real estate. A Warranty Deed ensures that a property's title is clear and the seller holds full rights to sell it, offering protections to the buyer. Likewise, the Bill of Sale confirms the seller's right to sell the vehicle and transfers its ownership, ensuring the buyer receives the title free from liens or claims.

Similar to a Lease Agreement, which outlines the terms under which one party agrees to rent property owned by another party, the Michigan Motor Vehicle Bill of Sale formalizes the terms of sale for a vehicle. Both documents contain specific details about the transaction, such as payment terms, identification of the parties, and the property's description. However, the Bill of Sale concludes the transfer of ownership upon the transaction's completion, whereas a Lease Agreement pertains to the temporary use of a property.

The Michigan Motor Vehicle Bill of Sale bears resemblance to a Quitclaim Deed in the aspect of transferring interest in property, though their scopes differ. A Quitclaim Deed is used to transfer any interest in real property with no guarantee about the extent of the interest or clear title, often between family members or close associates. Conversely, the Bill of Sale transfers a clearly defined interest - that of a vehicle - from the seller to the buyer, including a declaration of the vehicle's condition and any warranties.

Reflecting aspects of a General Receipt, the Motor Vehicle Bill of Sale in Michigan acts as proof of transaction between the buyer and seller. A General Receipt is a simple acknowledgment that money has been received in a transaction. Similarly, the Bill of Sale confirms payment was made and received for the vehicle sale, detailing the transaction's specifics like the sale price and date. Both serve to legally document the transfer of value and can be used for record-keeping or tax purposes.

Lastly, the Motor Vehicle Bill of Sale is akin to a Non-disclosure Agreement (NDA) in the sense that it may contain clauses that protect the parties' privacy or proprietary information. An NDA is designed to prevent the sharing of confidential information disclosed during negotiations or discussions. While the primary purpose of a Bill of Sale is to document the sale and transfer of ownership of a vehicle, it can also include terms that require the buyer to refrain from disclosing certain information about the sale or the vehicle itself.

Dos and Don'ts

Filling out the Michigan Motor Vehicle Bill of Sale form correctly is crucial for ensuring the smooth transfer of ownership of a vehicle. Whether you are the buyer or the seller, paying attention to detail and being thorough is key. Here's a concise guide to help you navigate the process correctly.

What you should do:

Ensure all the details are accurate: Double-check the VIN (Vehicle Identification Number), make, model, year, and the sale price to prevent any future discrepancies.

Include both the buyer's and seller's complete information: Full names, addresses, and contact information should be clearly stated to avoid any confusion.

Sign and date the form in the presence of a notary: This step often verifies the authenticity of the document, making the sale legally binding.

Keep a copy of the completed form for your records: This serves as a legal document indicating proof of purchase or proof of sale.

Ensure the form is legible: Handwrite in clear and readable print to prevent any misunderstandings or processing delays.

What you shouldn't do:

Don't leave blank spaces: If a section doesn’t apply, clearly indicate with an "N/A" (Not Applicable) instead of leaving it blank, which could lead to fraudulent alterations.

Avoid providing incorrect information: Mistakes, especially on crucial elements like the VIN, can nullify the legality of the document or delay the transfer process.

Never skip including both parties' details: This omission can make the document void or unenforceable in disputes.

Don't forget to check if additional documentation is required: Sometimes, the state or financial institutions might require more than just the Bill of Sale for the vehicle transaction.

Avoid rushing through the process: Taking your time to review and ensure all the information is correct is better than making errors and facing consequences later.

Misconceptions

When it comes to buying or selling a vehicle in Michigan, having accurate information is crucial. The Michigan Motor Vehicle Bill of Sale form is a key document in this process, but there are several misconceptions about its use and requirements. Let's clear up some common misunderstandings:

- It's Not Legally Required: Many people think that the Michigan Motor Vehicle Bill of Sale form is a legal requirement for private sales, but it's actually not. While not mandated by state law, it's highly recommended as it provides a written record of the transaction details.

- One Size Fits All: A common misconception is that one standard form is used in every Michigan vehicle transaction. Though there's a general format, specifics can vary depending on the county or the parties involved. Customizing the form to fit the sale specifics is often necessary.

- Only the Buyer Needs a Copy: Both buyer and seller should keep a copy of the completed Bill of Sale. This misconception leaves sellers without proof of transfer, potentially leading to future liability for the vehicle.

- It Replaces a Title Transfer: Some people mistakenly believe that the Bill of Sale can be used in place of a title transfer. Although it documents the sale, a title transfer with the Michigan Secretary of State is necessary to legally change vehicle ownership.

- No Need to Notarize: Contrary to what some might think, Michigan does not require the Motor Vehicle Bill of Sale to be notarized. However, having it notarized can add an extra layer of legal protection and authenticity to the transaction.

- It Only Covers the Sale Price: The Motor Vehicle Bill of Sale serves a broader purpose than just stating the sale price. It includes important details like the vehicle's condition, odometer reading, and warranties, offering a complete view of the agreement terms.

- A Bill of Sale Is Sufficient for Registration: Buyers often think that presenting the Bill of Sale is enough to register the vehicle under their name. However, the Michigan Secretary of State requires additional documents, including the title, proof of insurance, and a valid ID, for vehicle registration.

Understanding the facts about the Michigan Motor Vehicle Bill of Sale can make the process of buying or selling a vehicle much smoother and protect all parties involved. Always ensure you're following the current guidelines and requirements by checking with local authorities or legal counsel.

Key takeaways

Completing and utilizing the Michigan Motor Vehicle Bill of Sale form is a crucial step in the process of buying or selling a vehicle in the state. This document serves as a legal record of the transaction, providing proof of change in ownership. The following are key takeaways to consider when filling out and using this form:

- Accurate Information: It's essential to ensure all information entered on the Michigan Motor Vehicle Bill of Sale is accurate and complete. This includes the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price.

- Seller and Buyer Information: Both the seller's and buyer's full names, addresses, and signatures must be included. This verifies the identity of the parties involved and the agreement to the terms of the sale.

- Witness Signatures: While not always a requirement, having the signatures of witnesses can provide an additional layer of authenticity and may be helpful in resolving potential disputes.

- Notarization: If required, getting the document notarized can further legitimize the bill of sale. This step may not be necessary for all transactions, but it’s advisable to check local regulations.

- Date of Sale: The exact date of the sale's completion must be documented. This is important for registration, tax purposes, and to establish the formal transfer of ownership.

- Odometer Disclosure: For vehicles that are less than ten years old, federal law requires the inclusion of an accurate odometer reading to prevent odometer fraud.

- Additional Terms and Conditions: Any additional terms or conditions relevant to the sale, such as warranties or the sale being “as is,” should be clearly outlined to protect both parties.

- Keep Copies: Both the buyer and the seller should keep a copy of the completed Bill of Sale for their records. This document serves as a receipt and might be needed for registration, tax purposes, or legal protection.

- Registration and Title Transfer: The completed Michigan Motor Vehicle Bill of Sale is an essential document for the registration of the vehicle and the formal transfer of the title. The buyer must submit this form, along with other necessary documents, to the Michigan Secretary of State.

Approaching the Michigan Motor Vehicle Bill of Sale with diligence and attention to detail ensures a smooth transfer of ownership that is legally binding and protected. Always consult current state requirements and consider professional advice to navigate the specifics of your situation effectively.

Popular Motor Vehicle Bill of Sale State Forms

Bill of Sale for Car Meaning - For classic or antique vehicles, this form documents the transaction and can be a valuable part of the vehicle’s provenance.

Bill of Sale Florida Pdf - Using a Motor Vehicle Bill of Sale form helps protect both the buyer and seller by documenting the condition and ownership of the vehicle.