Free Motor Vehicle Bill of Sale Form for Indiana

In the bustling world of vehicle transactions in Indiana, the Motor Vehicle Bill of Sale form serves as an indispensable document, marking the transfer of ownership from seller to buyer. This comprehensive record, crucial for both parties, encapsulates essential details like the vehicle's description, purchase price, and the respective identities of the buyer and seller. Not only does it lay the groundwork for a transparent exchange, but it also paves the way for the buyer's ease in registration and titling processes. Furthermore, in disputes or discrepancies regarding the vehicle's condition or ownership, this document stands as a paramount piece of evidence. Its significance extends beyond mere formalities; it acts as a protective shield for the buyer and seller, ensuring a mutual understanding and agreement on the vehicle's sale. Thus, the Indiana Motor Vehicle Bill of Sale form is not just a piece of paper but a crucial instrument that fortifies trust and clarity in the vehicle trading process.

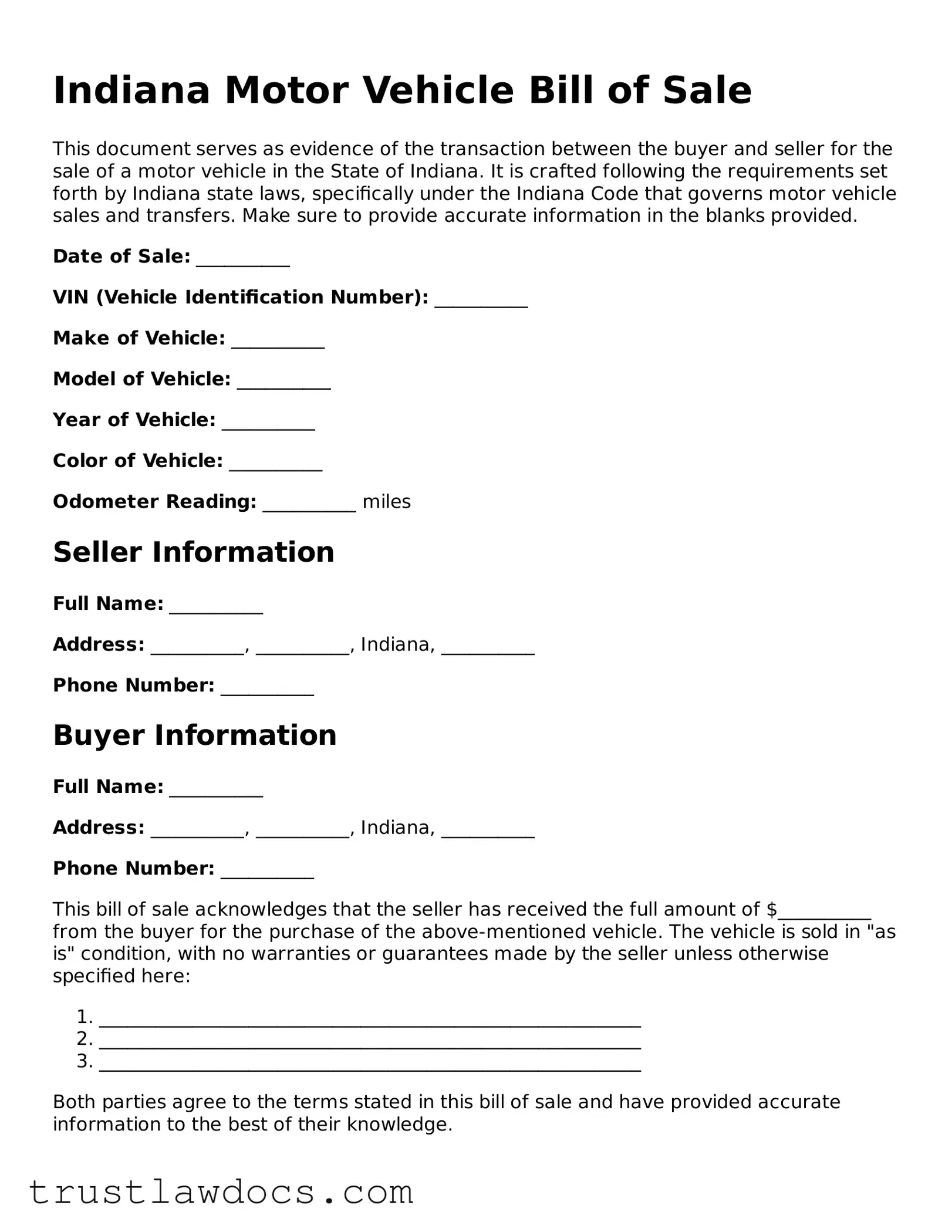

Form Example

Indiana Motor Vehicle Bill of Sale

This document serves as evidence of the transaction between the buyer and seller for the sale of a motor vehicle in the State of Indiana. It is crafted following the requirements set forth by Indiana state laws, specifically under the Indiana Code that governs motor vehicle sales and transfers. Make sure to provide accurate information in the blanks provided.

Date of Sale: __________

VIN (Vehicle Identification Number): __________

Make of Vehicle: __________

Model of Vehicle: __________

Year of Vehicle: __________

Color of Vehicle: __________

Odometer Reading: __________ miles

Seller Information

Full Name: __________

Address: __________, __________, Indiana, __________

Phone Number: __________

Buyer Information

Full Name: __________

Address: __________, __________, Indiana, __________

Phone Number: __________

This bill of sale acknowledges that the seller has received the full amount of $__________ from the buyer for the purchase of the above-mentioned vehicle. The vehicle is sold in "as is" condition, with no warranties or guarantees made by the seller unless otherwise specified here:

- __________________________________________________________

- __________________________________________________________

- __________________________________________________________

Both parties agree to the terms stated in this bill of sale and have provided accurate information to the best of their knowledge.

Signatures

Seller's Signature: __________ Date: __________

Buyer's Signature: __________ Date: __________

Witness (if applicable): __________ Signature: __________ Date: __________

This document is not valid unless all required fields are completed and signed by both parties and, if applicable, a witness. It is recommended to keep copies of this bill of sale for records and future reference.

PDF Form Details

| Fact Number | Fact Details |

|---|---|

| 1 | The Indiana Motor Vehicle Bill of Sale is a document that records the sale and purchase of a motor vehicle in the state of Indiana. |

| 2 | It serves as legal proof of ownership transfer from the seller to the buyer. |

| 3 | This form typically includes information such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price. |

| 4 | Both the buyer and the seller are required to sign the document; it may also require notarization depending on the circumstances of the sale. |

| 5 | Governing Laws: The form and its use are governed by Indiana state law, specifically within the regulations that cover the sale of motor vehicles. |

How to Write Indiana Motor Vehicle Bill of Sale

Filling out the Indiana Motor Vehicle Bill of Sale form is a crucial step in the process of a vehicle transaction between a buyer and a seller. This legal document provides a record of the sale and is important for both parties’ personal records. It may also be required for registration and tax purposes. The accuracy and completeness of the information on this form are key to ensuring the transaction is recognized as valid by relevant authorities.

- Start by entering the date of the sale at the top of the form.

- Fill in the full name and address of the seller in the designated area.

- Enter the full name and address of the buyer in their respective section.

- Provide the vehicle’s details, including its make, model, year, color, and Vehicle Identification Number (VIN).

- List the vehicle’s mileage at the time of sale, and indicate whether the mileage is actual, not actual, or exceeds mechanical limits.

- Enter the sale price of the vehicle and the date of sale.

- If applicable, include any additional conditions or warranties related to the sale.

- Both the buyer and the seller must sign and print their names at the bottom of the form to validate the transaction.

- Make copies of the completed form. One copy should be given to the buyer, one to the seller, and an extra one should be kept safe for records.

Once the Indiana Motor Vehicle Bill of Sale form is properly filled out and signed by both parties, it serves as a binding document that confirms the transfer of ownership of the vehicle. It is advisable for both the seller and the buyer to keep their copies of the form in a safe place, as it may be required for future reference, such as for tax purposes or legal inquiries.

Get Answers on Indiana Motor Vehicle Bill of Sale

What is an Indiana Motor Vehicle Bill of Sale?

A Motor Vehicle Bill of Sale in Indiana is a legal document that records the sale and transfer of ownership of a motor vehicle from one party to another. It typically includes details about the seller, the buyer, the vehicle, and the sale itself, such as the purchase price and date.

Do I need a Bill of Sale to sell a car in Indiana?

While Indiana law may not explicitly require a Bill of Sale to sell a car, it is highly recommended. It provides a written record of the transaction, which is useful for tax, legal, and personal record-keeping purposes.

What information should be included on a Bill of Sale?

An Indiana Motor Vehicle Bill of Sale should include the full names and addresses of both the seller and buyer, a detailed description of the vehicle (make, model, year, VIN), the sale price, the sale date, and signatures from both parties confirming the transaction.

Is a notary required for a Bill of Sale in Indiana?

Indiana does not require a Bill of Sale to be notarized for it to be considered legal. However, notarizing the document can add an extra level of fraud protection and authenticity to the transaction.

How does a Bill of Sale protect the seller?

A Bill of Sale protects the seller by providing proof that the vehicle was legally sold and transferred to the buyer. This can be important if there are any future disputes about the vehicle’s ownership or if the vehicle is involved in illegal activities after the sale.

How does a Bill of Sale protect the buyer?

For the buyer, a Bill of Sale is proof of ownership and confirms the details of the transaction, such as the purchase price. It’s an essential document for registering the vehicle in the buyer's name at the Indiana Bureau of Motor Vehicles (BMV).

Can I create a Motor Vehicle Bill of Sale by myself?

Yes, you can create a Motor Vehicle Bill of Sale by yourself. Ensure that it includes all the necessary information and that both the buyer and seller agree on the contents before signing.

What should I do after completing the Bill of Sale?

After completing a Motor Vehicle Bill of Sale in Indiana, both the buyer and seller should keep copies for their records. The buyer will need the document to register the vehicle in their name at the BMV.

Does a Bill of Sale need to be filed with any Indiana state agency?

No, a Bill of Sale does not need to be filed with any Indiana state agency. However, the buyer must present it at the BMV when registering the vehicle. Keeping a copy for your records is also recommended.

Common mistakes

One common mistake individuals make when completing the Indiana Motor Vehicle Bill of Sale form is neglecting to accurately describe the vehicle. This description should include the make, model, year, and Vehicle Identification Number (VIN). Ensuring these details are accurately recorded is crucial for the legal transfer of ownership. Missing or erroneous information can lead to issues with the vehicle's registration and even future legal challenges regarding ownership and responsibility.

Another oversight often encountered is failing to specify the sale price and the payment terms. It's important for both parties to have a clear understanding of the financial aspects of the transaction. This includes the total sale price, any deposit made, the balance due, and the agreed terms of payment. Omitting these details can result in misunderstandings or disputes after the sale, potentially complicating or nullifying the deal.

Not properly documenting the condition of the vehicle at the time of sale is also a frequent mistake. The bill of sale should clearly state the vehicle's condition, noting any known faults or damages. This transparency helps protect the seller from future claims by the buyer about the vehicle's condition that were known at the time of sale. For the buyer, it provides a clear record of the vehicle's state at the time of purchase, which is useful for insurance or warranty claims.

Individuals often forget to include both the buyer's and seller's full names and contact information. This is a significant oversight, as this information is essential for establishing the legal transfer of ownership. It also serves as a point of contact for any post-sale inquiries or necessary communications related to the vehicle. Without this information, tracing the history of ownership or resolving any future disputes becomes much more challenging.

A common error is not obtaining or failing to provide the necessary signatures on the bill of sale. The document must be signed by both the buyer and the seller to be legally binding. In some cases, a witness's signature may also be required. Without these signatures, the document's validity can be questioned, potentially leaving the transfer of ownership incomplete.

Overlooking the requirement to date the document is another mistake that can have significant consequences. The date of sale is crucial for several reasons, including tax obligations and the transfer of the title. An undated bill of sale can lead to uncertainties about when the transaction occurred, affecting both parties' responsibilities.

An additional common error is not specifying any warranties or the lack thereof. Clearly stating whether the vehicle is sold "as is" or with a warranty protects both the buyer and the seller. If the vehicle is sold "as is," the buyer accepts all future repairs and cannot hold the seller responsible for any issues. Conversely, explicitly stating any warranty details gives the buyer recourse if the terms of the warranty are not met.

Finally, a frequent oversight is not providing or incorrectly detailing information about the vehicle's title. The bill of sale should indicate whether the title is clear, meaning there are no liens or encumbrances against the vehicle. Failing to adequately address the status of the vehicle's title can lead to legal complications, impeding the buyer's ability to register the vehicle or the seller's ability to legally transfer ownership.

Documents used along the form

When completing a motor vehicle transaction in Indiana, the Motor Vehicle Bill of Sale form plays a pivotal role. However, it's often just one of several documents you need to ensure a seamless and legally compliant process. Below are six other essential forms and documents that are commonly used in conjunction with the Motor Vehicle Bill of Sale form for vehicle transactions in Indiana.

- Title Transfer Form: This is critical for legal ownership transfer. It ensures the buyer becomes the recognized owner in state records.

- Odometer Disclosure Statement: Required by federal law for vehicles less than ten years old, this statement records the vehicle's mileage at the time of sale, protecting the buyer from odometer tampering.

- VIN Inspection Form: In some cases, especially for out-of-state vehicles, a VIN (Vehicle Identification Number) inspection is required to verify the vehicle’s identity.

- Application for Registration: This form is used to apply for new registration of the vehicle under the buyer's name, allowing the vehicle to be legally operated on public roads.

- Notice of Sale or Transfer Form: This form notifies the state of the change of ownership and can protect the seller from liability for citations or violations incurred after the sale.

- Release of Liability Form: This document is important for the seller to complete, as it releases them from liability in case the vehicle is involved in an accident or incurs fines after the sale.

Together with the Indiana Motor Vehicle Bill of Sale form, these documents create a comprehensive package that facilitates the legal sale and transfer of a vehicle. They ensure that all aspects of the transaction are properly documented, protecting both the buyer and the seller under Indiana law.

Similar forms

The Vehicle Title Transfer Form plays a pivotal role akin to the Indiana Motor Vehicle Bill of Sale, primarily serving as official proof of the transfer of ownership of the vehicle. This document is essential for legalizing the change in ownership with the state’s Department of Motor Vehicles (DMV). It typically requires information similar to the bill of sale, such as details about the buyer, seller, and the vehicle itself, ensuring that all parties are clearly identified and the vehicle's history is transparent.

A Warranty Deed, while generally associated with real estate transactions, shares commonalities with the Indiana Motor Vehicle Bill of Sale in its function of guaranteeing the buyer’s legal ownership and rights to the property in question. It asserts that the seller holds clear title to the property (be it land or a house) and has the right to sell it, paralleling the bill of sale’s role in confirming the seller’s right to transfer a vehicle and ensuring the buyer’s protection from future claims against the vehicle.

The Promissory Note is another document closely related to the Indiana Motor Vehicle Bill of Sale. It outlines the terms under which one party promises to pay another party a predetermined sum of money, often used in conjunction with the sale of a vehicle to detail a payment plan for the purchase. While the bill of sale acknowledges the transfer of ownership, the promissory note ensures there is a legally binding agreement on the payment terms between the buyer and seller.

Similarly, the Loan Agreement bears resemblance to the Indiana Motor Vehicle Bill of Sale, as it outlines the specifics of a loan provided to the buyer to purchase the vehicle. This document specifies the loan amount, interest rate, repayment schedule, and any other terms and conditions. Like the bill of sale, it plays a critical role in ensuring both the lender and the buyer are on the same page and that the financial aspects of the vehicle purchase are clearly outlined and agreed upon.

The General Bill of Sale, much like its more specific counterpart for motor vehicles, is used to document the sale and transfer of personal property from one party to another. While applicable to a broad range of items beyond vehicles, its core function of providing evidence of a transaction, detailing the item sold, and protecting both buyer and seller rights mirrors that of the Indiana Motor Vehicle Bill of Sale.

The Receipt of Sale serves a similar, albeit simpler, purpose compared to the Indiana Motor Vehicle Bill of Sale. It acts as proof of transaction, often for smaller or less regulated sales than a vehicle. Despite its less formal nature, it still records the essential details: who sold what to whom, for how much, and when. This documentation is crucial for personal records and in cases where proof of purchase is needed.

A Release of Liability Form, closely related to the motor vehicle bill of sale, is specifically designed to protect the seller from any future liabilities arising from the vehicle after the sale is completed. This document clearly states that the buyer assumes all responsibility for the vehicle, including any accidents or violations, from the point of sale onwards. It's a critical complement to the bill of sale, ensuring the seller’s legal protection post-transaction.

Lastly, the Sales and Use Tax Form bears resemblance to the Indiana Motor Vehicle Bill of Sale by involving the financial aspect of the vehicle sale. This particular document is necessary for the buyer to report and pay any sales tax due on the purchase of the vehicle. While distinct in its purpose, focusing on the tax liability aspect, it is nonetheless integral to the completion of a lawful and transparent vehicle transaction, ensuring compliance with state tax laws.

Dos and Don'ts

When filling out the Indiana Motor Vehicle Bill of Sale form, it is essential to proceed carefully to ensure that the process is completed accurately. This document is a legal record of the sale and transfer of ownership of a vehicle between the seller and the buyer. Below are eight dos and don'ts to help guide you through this process:

- Do verify the accuracy of all vehicle information, including the make, model, year, and Vehicle Identification Number (VIN), to prevent any future disputes or legal issues.

- Do ensure both parties (buyer and seller) provide complete and legible information to maintain the integrity of the document.

- Do include the sale price of the vehicle in the document, as this information is crucial for tax assessment and other legal purposes.

- Do keep a copy of the completed Bill of Sale for your records. It's important for both the buyer and the seller to retain a copy.

- Don't leave any sections of the form blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Don't forget to sign and date the form. The signatures of both the buyer and the seller are required to validate the document.

- Don't rely on verbal agreements. The Bill of Sale serves as a binding legal document and protects both parties if there are any future disputes.

- Don't ignore state-specific requirements. Each state may have different requirements for what needs to be included in the Bill of Sale. Make sure the form meets Indiana's specific requirements.

Taking the time to carefully complete the Indiana Motor Vehicle Bill of Sale form is a crucial step in ensuring a smooth and legally compliant transaction. By following these dos and don'ts, you can help protect your rights and interests during the sale or purchase of a vehicle.

Misconceptions

Many misconceptions exist regarding the Indiana Motor Vehicle Bill of Sale form. Clearing up these misunderstandings ensures that individuals can approach the sale or purchase of a vehicle with confidence.

Notary Public Stamp is Always Required: While having a notary public stamp can add a layer of authenticity, it's not always mandatory for a Motor Vehicle Bill of Sale in Indiana. Requirements can vary depending on local laws.

A Bill of Sale is the Same as a Title Transfer: This is incorrect. A Bill of Sale documents the transaction between buyer and seller, but the vehicle title transfer is a separate process that legally transfers ownership and is filed with the Indiana Bureau of Motor Vehicles.

Preparation by a Lawyer is Necessary: While legal guidance can be helpful, especially in complex situations, anyone can prepare a Motor Vehicle Bill of Sale as long as it includes the necessary information and both parties agree to the terms.

Only the Buyer Needs to Sign: Both the seller and the buyer need to sign the Bill of Sale. Their signatures confirm that they agree to the terms of the sale, including the sale price and the vehicle's condition.

It Must Be Filed with the Indiana BMV: The Bill of Sale does not need to be filed with the Indiana Bureau of Motor Vehicles. However, it's an important document to keep for your records and may be required for title transfer or registration.

All Sales are Final: While a Bill of Sale indicates a transfer of ownership, it does not necessarily mean that all sales are final. Issues discovered after the sale that were not disclosed may be subject to legal action or negotiations for return or compensation.

There's a Standard State-Issued Form: Indiana does not have a standardized state-issued Motor Vehicle Bill of Sale form. However, any document used should include specific information, such as the VIN, make, model, sale price, and parties' details, to be considered valid.

Understanding these key points ensures that both buyers and sellers are well-informed about the Indiana Motor Vehicle Bill of Sale process. This can help avoid potential legal issues and make the transaction smoother for all parties involved.

Key takeaways

When managing transactions involving vehicles in Indiana, using a Motor Vehicle Bill of Sale form is crucial for both buyers and sellers. This document not only serves as proof of purchase but also ensures that details about the transaction and the vehicle are accurately recorded for legal and registration purposes. Here are four key takeaways about filling out and using the Indiana Motor Vehicle Bill of Sale form:

- Ensure all information is complete and accurate. The form should include details such as the make, model, year, vehicle identification number (VIN), and the odometer reading of the vehicle. Both parties should double-check these details to prevent future disputes or issues with vehicle registration.

- Include both parties' full names and contact information. It is important to have the names, addresses, and signatures of both the seller and the buyer on the form. This not only confirms the identities of the parties involved but also provides a way to contact them should any questions or concerns arise after the sale.

- Price and payment terms should be clearly outlined. The document must specify the sale price of the vehicle and any agreed-upon payment arrangements. This is essential for financial records and can also serve as evidence in case of misunderstandings about the payment.

- Make multiple copies of the Bill of Sale. After both parties have signed the document, it’s advisable to make several copies. One copy should be kept by each party, and another should be used for the vehicle registration process with the Indiana Bureau of Motor Vehicles (BMV). This ensures that all parties have proof of the transaction and that the buyer can properly register the vehicle in their name.

By following these guidelines, individuals involved in the sale or purchase of a vehicle in Indiana can ensure their transaction is properly documented and legally sound. This not only provides peace of mind but also simplifies the process of transferring vehicle ownership.

Popular Motor Vehicle Bill of Sale State Forms

Michigan Bill of Sale Car - A form that simplifies the sale process and outlines responsibilities and rights.

Bill of Sale Florida Pdf - For collectors or buyers of vintage cars, the form serves as an essential record of the vehicle's provenance and ownership history.

California Dmv Forms - Signing this form typically necessitates a witness to validate the authenticity of the sale.