Free Motor Vehicle Bill of Sale Form for California

The California Motor Vehicle Bill of Sale form serves as a pivotal document for both sellers and buyers involved in vehicle transactions within the state. It legally documents the transfer of ownership from one party to another and provides essential details about the vehicle, such as make, model, year, and the vehicle identification number (VIN). Additionally, this form outlines the terms of the sale, including the sale price and date, ensuring that both parties have a clear understanding of the agreement. It is also crucial for registration and tax purposes, as authorities may require this document to update their records. Furthermore, for both buyers and sellers, the Motor Vehicle Bill of Sale acts as a protective measure, offering proof of transfer and conditions of sale, thereby minimizing potential disputes. Understanding the importance and proper use of this form is essential for a smooth and legally compliant vehicle transaction process in California.

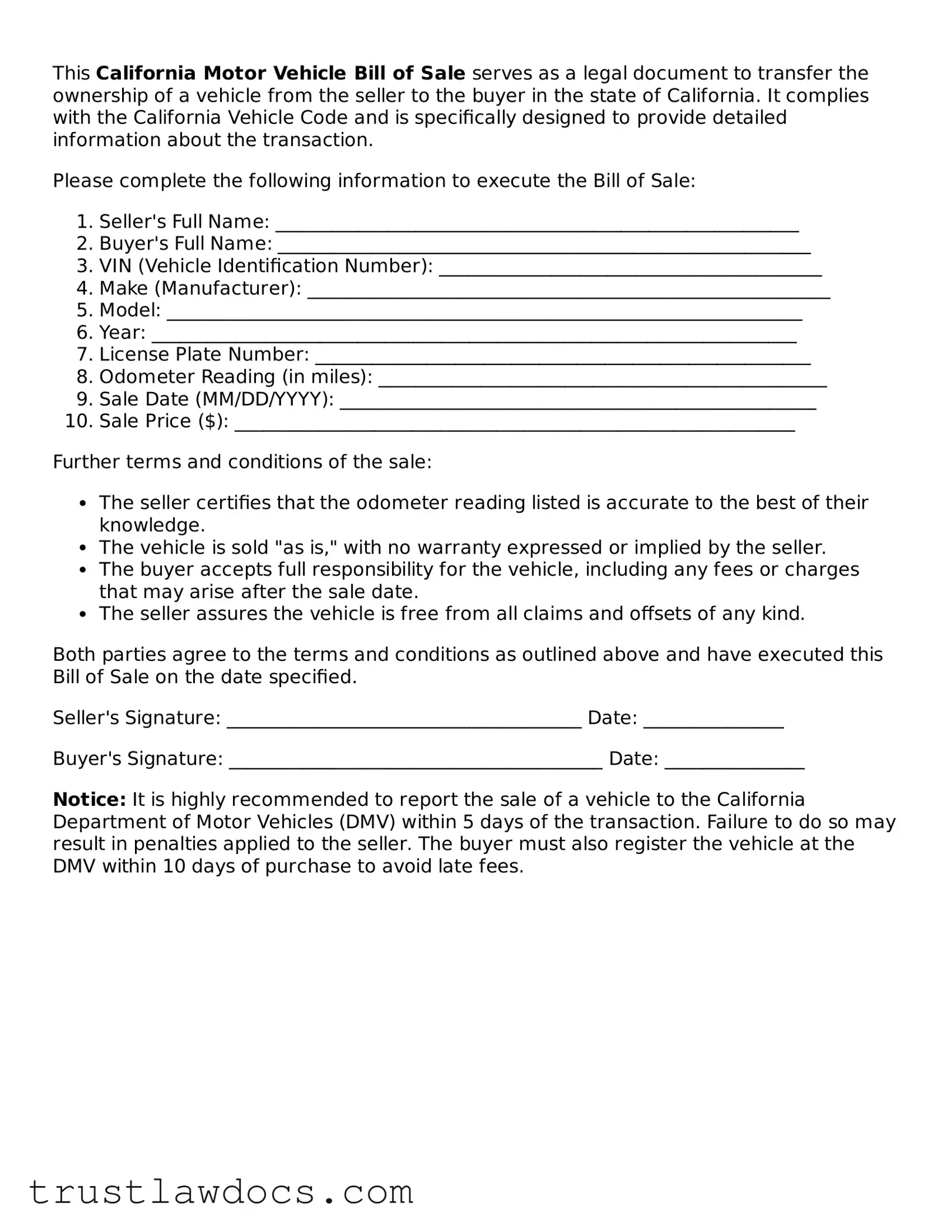

Form Example

This California Motor Vehicle Bill of Sale serves as a legal document to transfer the ownership of a vehicle from the seller to the buyer in the state of California. It complies with the California Vehicle Code and is specifically designed to provide detailed information about the transaction.

Please complete the following information to execute the Bill of Sale:

- Seller's Full Name: ________________________________________________________

- Buyer's Full Name: _________________________________________________________

- VIN (Vehicle Identification Number): _________________________________________

- Make (Manufacturer): ________________________________________________________

- Model: ____________________________________________________________________

- Year: _____________________________________________________________________

- License Plate Number: _____________________________________________________

- Odometer Reading (in miles): ________________________________________________

- Sale Date (MM/DD/YYYY): ___________________________________________________

- Sale Price ($): ____________________________________________________________

Further terms and conditions of the sale:

- The seller certifies that the odometer reading listed is accurate to the best of their knowledge.

- The vehicle is sold "as is," with no warranty expressed or implied by the seller.

- The buyer accepts full responsibility for the vehicle, including any fees or charges that may arise after the sale date.

- The seller assures the vehicle is free from all claims and offsets of any kind.

Both parties agree to the terms and conditions as outlined above and have executed this Bill of Sale on the date specified.

Seller's Signature: ______________________________________ Date: _______________

Buyer's Signature: ________________________________________ Date: _______________

Notice: It is highly recommended to report the sale of a vehicle to the California Department of Motor Vehicles (DMV) within 5 days of the transaction. Failure to do so may result in penalties applied to the seller. The buyer must also register the vehicle at the DMV within 10 days of purchase to avoid late fees.

PDF Form Details

| # | Fact | Detail |

|---|---|---|

| 1 | Purpose | Used to document the sale and transfer of ownership of a motor vehicle in California. |

| 2 | Required by DMV | California Department of Motor Vehicles (DMV) requires a Bill of Sale for private vehicle transactions. |

| 3 | Governing Law | Regulated under California Vehicle Code. |

| 4 | Key Elements | Must include date of sale, sale price, vehicle description, and parties’ details. |

| 5 | Signing Requirement | Both the seller and buyer need to sign the form. |

| 6 | Notarization | Not required in California, but recommended for the protection of both parties. |

| 7 | Additional Documentation | Title transfer and odometer disclosure statement may be required for the sale to be finalized. |

| 8 | Electronic Submission | Not typically accepted; the original document may be required for registration or title transfer. |

| 9 | Effectiveness | The form is effective immediately upon completion and signature. |

| 10 | Public Record | The completed form is not public record, but must be presented to the DMV upon request. |

How to Write California Motor Vehicle Bill of Sale

When it's time to seal the deal on the sale of a motor vehicle in California, properly filling out the Motor Vehicle Bill of Sale form is a crucial step. This document is a straightforward, yet essential, piece of paperwork that records the transaction details, providing a legal record for both buyer and seller. It may seem a bit daunting at first, but worry not. By following these step-by-step instructions, you'll navigate through the process with ease and ensure all the necessary information is accurately captured.

Steps to Fill Out the California Motor Vehicle Bill of Sale Form:

- Begin by writing the date of the sale in the designated spot. Make sure to use the month, day, and year format.

- Enter the full name and address of the seller in the section provided. This includes street address, city, state, and zip code.

- In the next section, fill in the buyer's full name and address, following the same format as you did for the seller.

- Now, describe the vehicle. This includes the make, model, year, color, and Vehicle Identification Number (VIN).

- Next, you'll need to specify the vehicle's sale price. Write this amount in the space provided, ensuring accuracy.

- For the section regarding the odometer reading, enter the vehicle's current mileage. This confirms the actual mileage at the time of sale.

- If there are any terms and conditions associated with the sale, make sure to list them clearly. If there are no additional terms, it's helpful to write "none" to avoid any confusion.

- Both the buyer and seller must provide their signatures. There's a designated spot for each party to sign, indicating agreement to the sale's terms and the accuracy of the information provided.

- Lastly, for added verification, it's highly recommended that both parties print their names below their signatures. This ensures clarity on who has agreed to the transaction.

Once you've carefully followed these steps, you are all set. The completed California Motor Vehicle Bill of Sale form serves as an official record of the vehicle's sale, providing peace of mind and legal protection to both buyer and seller. Remember, it's always wise to keep a copy of this document for your records. Whether you're the buyer or the seller, having this document on hand is beneficial for future reference, especially if any questions or concerns arise after the sale.

Get Answers on California Motor Vehicle Bill of Sale

What is a California Motor Vehicle Bill of Sale?

A California Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of a vehicle from one person to another in the state of California. It includes details such as the make, model, year, and VIN of the vehicle, as well as the names and signatures of the seller and the buyer. This document serves as proof of purchase and can be used for registering the vehicle under the new owner's name.

Is a Motor Vehicle Bill of Sale required in California?

In California, a Motor Vehicle Bill of Sale is not a mandatory document for the sale process of a vehicle as the state has other forms that are required. However, having one can be very beneficial as it provides a written record of the transaction details, offering protection for both the seller and the buyer. It's particularly useful for personal record keeping and may be required by the Department of Motor Vehicles (DMV) for registration or title transfer in certain scenarios.

What information should be included in a California Motor Vehicle Bill of Sale?

The California Motor Vehicle Bill of Sale should include the date of the sale, the purchase price, and the full names and addresses of both the seller and the buyer. Crucial vehicle details such as the make, model, year, color, VIN (Vehicle Identification Number), and the odometer reading at the time of sale should also be detailed. Signatures of both the seller and the buyer are required to validate the document.

Do both the buyer and the seller need to sign the Motor Vehicle Bill of Sale in California?

Yes, for the document to be considered legal and valid, both the seller and the buyer must sign the California Motor Vehicle Bill of Sale. These signatures confirm that both parties agree to the terms of the sale and that the information provided is accurate to the best of their knowledge. It is recommended to also have the document notarized, although it is not a legal requirement.

How does one use a California Motor Vehicle Bill of Sale?

Once completed and signed, the Bill of Sale can be used as proof of ownership and to assist in the process of registering the vehicle in the buyer’s name. The buyer should submit a copy to the California DMV as part of the vehicle registration or title transfer process. It’s advisable for both parties to keep a copy of the document for their records to resolve any future disputes or discrepancies regarding the vehicle’s sale.

Common mistakes

When navigating the process of transferring vehicle ownership in California, a crucial step involves correctly filling out the Motor Vehicle Bill of Sale form. This document, essential for both buyer and seller, acts as a formal record of the transaction. Despite its importance, people often make mistakes while completing this form, leading to potential delays or complications in the sale process.

One common error is neglecting to provide complete information about the vehicle. This includes the make, model, year, Vehicle Identification Number (VIN), and accurate odometer reading. Each piece of data is vital for the accuracy and legitimacy of the Bill of Sale. Without this information, the document may not meet legal requirements, causing unnecessary setbacks for both parties involved in the transaction.

Another mistake frequently made is failing to include both the buyer's and seller's full legal names, contact information, and signatures. These details not only confirm the identities of the parties involved but also their agreement to the terms outlined in the document. Incomplete or missing signatures can invalidate the entire agreement, emphasizing the need for thorough review before finalizing the sale.

A significant oversight is not verifying or misunderstanding the form's requirements in relation to California law. Each state has specific stipulations regarding vehicle sales, and California is no exception. For instance, not recognizing that California may require additional documents or specific forms alongside the Bill of Sale can lead to legal discrepancies, affecting the transfer of ownership or even the vehicle's future registration.

Additionally, a common pitfall is not securing a lien release, if applicable. If the vehicle is being sold with a lien still attached, this must be clearly stated in the Bill of Sale, alongside the arrangement for its release. Failing to properly address any liens on the vehicle can complicate the title transfer process, potentially entangling the buyer in legal and financial issues they were unaware of.

Lastly, people often forget the importance of keeping a copy of the fully completed and signed Bill of Sale. For both buyer and seller, maintaining a copy of this document provides a record of the transaction, serving as a protective measure in the event of future disputes or discrepancies. This seemingly minor step is a critical one, ensuring both parties have proof of the sale's terms and conditions.

By avoiding these common mistakes, individuals participating in the sale of a vehicle in California can ensure a smoother, more secure transaction process. Paying attention to detail and understanding the specific requirements of the California Motor Vehicle Bill of Sale form are crucial steps towards a successful vehicle ownership transfer.

Documents used along the form

When transferring ownership of a vehicle in California, several essential documents accompany the Motor Vehicle Bill of Sale form to ensure a smooth and legal transaction. This paperwork supports the sale, verifies the details of the transaction, ensures compliance with state laws, and facilitates the transfer of ownership. Below is a list of up to 10 forms and documents that are often used together with the California Motor Vehicle Bill of Sale.

- Certificate of Title: This is the legal document that officially proves ownership of the vehicle. It must be signed by the seller and given to the buyer.

- Odometer Disclosure Statement: Required by federal law for the sale of vehicles less than 10 years old, this document records the vehicle’s mileage at the time of sale.

- Smog Certification: Required in California for most private party sales or transfers of vehicles, this certification must be obtained within 90 days prior to the transaction if the vehicle is more than four years old.

- Release of Liability: This form is submitted to the California Department of Motor Vehicles (DMV) to report the sale of the vehicle and releases the seller from liability for any tickets or violations involving the vehicle after the sale.

- Notice of Transfer and Release of Liability: A document that is filed with the DMV to officially record the change of ownership and to release the seller from future liability.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): A document used to document the transfer of ownership and to reassign the vehicle’s title to the new owner. It's a combination document that includes an odometer disclosure, bill of sale, and power of attorney.

- Application for Title or Registration (REG 343): This form is used by the new owner to apply for a new title and registration in their name with the California DMV.

- Bill of Sale (REG 135): While the Motor Vehicle Bill of Sale form documents the transaction, California’s DMV also provides its own Bill of Sale form as a simple way to document the details of the vehicle transaction.

- Power of Attorney (if applicable): This document grants someone else the authority to sign documents related to the sale or registration of the vehicle on behalf of the seller or buyer.

- Vehicle History Report: Though not required, it's often recommended. This report can provide a detailed history of the vehicle, including accidents, service records, and previous owners.

The combination of these documents with the California Motor Vehicle Bill of Sale form ensures that all aspects of the vehicle’s sale are well-documented and legal. Each document plays a unique role in ensuring the sale adheres to California law, conveying rights and responsibilities clearly to both buyer and seller, and providing peace of mind through the transparency and official record of the transaction.

Similar forms

The California Motor Vehicle Bill of Sale form shares similarities with a Warranty Deed in the realm of real estate. Both documents serve as proof of transfer of ownership, but their assets differ—vehicles for the former and real estate for the latter. Yet, each provides critical information including the details of both the seller and buyer, a description of what is being sold, and the terms of the agreement. These documents essentially offer peace of mind that the transaction has been formalized and recorded properly.

Similar to a Quitclaim Deed, the Motor Vehicle Bill of Sale form ensures the transfer of ownership rights from one party to another. A Quitclaim Deed is typically used to transfer property rights without a traditional sale, often between family members or to clear up a title issue, while the Motor Vehicle Bill of Sale is used for the sale and purchase of a vehicle. Both, however, finalize the transaction and make it official, signifying the buyer's new rights to the property or vehicle in question.

The General Bill of Sale form is quite akin to the Motor Vehicle Bill of Sale, as both are used to transfer ownership of personal property. The difference lies in their specificity; while the Motor Vehicle Bill of Sale is exclusively for vehicles, the General Bill of Sale can pertain to any type of personal property like electronics, furniture, or other tangible goods. Nonetheless, they share the common purpose of documenting the transaction and safeguarding both parties against future disputes.

Negotiable Instruments, such as promissory notes, bear resemblance to the Motor Vehicle Bill of Sale in their functionality of guaranteeing certain rights and actions between parties involved in a transaction. A promissory note spells out the terms under which one party promises to pay another a specific sum of money, either on demand or at a future date. Like a bill of sale, it provides a legal framework that outlines the agreement's specifics, offering clarity and legal protection, though it focuses on payment rather than the transfer of ownership.

The Motor Vehicle Bill of Sale and a Receipt share a common basic function—they both acknowledge that a transaction has taken place. A receipt is a more general acknowledgment of payment received for goods or services, lacking the detailed terms of ownership transfer found in a bill of sale. However, both serve as important records of a transaction, providing evidence that can be critical for accounting purposes or in the event of a dispute.

Partnership Agreements, while focusing on the relationship and terms between business partners, echo the Motor Vehicle Bill of Sale in their establishment of terms between parties. Though the former outlines the operation of a partnership and the latter the sale of a vehicle, both set forth agreements that are intended to prevent misunderstandings and conflicts by clearly documenting the rights, responsibilities, and expectations of all parties involved.

Similarly, the Employment Contract parallels the Motor Vehicle Bill of Sale in its function of formalizing an agreement, but between an employer and an employee rather than a buyer and seller of a vehicle. This document outlines the terms of employment, including salary, benefits, and duties, offering a clear understanding and expectations for both parties. Just as the Bill of Sale helps to prevent disputes over the sale of a vehicle, the Employment Contract aims to minimize disagreements between employer and employee by having a mutually agreed-upon document.

Dos and Don'ts

When completing the California Motor Vehicle Bill of Sale form, some crucial guidelines must be followed to ensure the process is handled accurately and lawfully. Here's a list of what one should and shouldn't do:

Do's:- Provide accurate information: Ensure all details about the vehicle, including make, model, year, VIN (Vehicle Identification Number), and mileage, are correct.

- Include both parties' details: Full names and addresses of both the seller and the buyer should be clearly stated.

- Record the sale price: Clearly mention the sale amount in the form to avoid any future disputes.

- Sign and date the form: The form must be signed and dated by both the buyer and the seller to validate the transaction.

- Keep a copy: Both the buyer and seller should keep a copy of the completed form for their records.

- Check for any additional requirements: Depending on the county, additional documentation may be required. Always verify if there’s anything else needed to complete the sale legally.

- Leave blanks: Do not leave any fields blank. If certain information is not applicable, mark it as such (N/A).

- Guess on specifics: Avoid guessing vehicle information. If unsure, check the vehicle’s documentation to provide accurate data.

- Post-date or pre-date: The form should be dated with the actual date of the transaction to avoid any legal complications.

- Sign without the other party present: Ideally, both parties should sign together to ensure mutual agreement on the facts.

- Ignore lien release: If the vehicle is being sold with a lien, make sure the lien release is included, indicating that the seller has the right to sell the car.

- Forget to report the sale: Remember to report the sale to the California Department of Motor Vehicles (DMV) as part of the legal obligation of selling a vehicle.

Misconceptions

When it comes to transferring ownership of a motor vehicle in California, the Motor Vehicle Bill of Sale form plays a crucial role. However, there are several misconceptions about this document that can lead to confusion. By addressing these misconceptions, buyers and sellers can navigate the process more smoothly and ensure all legal requirements are met. Here's a look at some common misunderstandings:

- It's the only document you need to transfer ownership: Many people think that a Bill of Sale is the sole document required to transfer ownership of a vehicle in California. However, the California Department of Motor Vehicles (DMV) requires additional documents, such as the title of the vehicle and a Notice of Release of Liability form, to officially transfer ownership.

- The form is issued by the DMV: Another misconception is that the California Motor Vehicle Bill of Sale form is issued by the DMV. While the DMV provides guidelines for what information should be included, there's no official form provided by the DMV. Parties can create their own bill of sale as long as it contains all the required information.

- It's only necessary for vehicles with a title: Some believe that a Bill of Sale is only required for vehicles that have a title. In truth, this document is important for all motor vehicle transactions, including those for vehicles that might not have a title due to their age or type.

- Notarization is required: A common misconception is that the Bill of Sale must be notarized to be valid. In California, notarization is not a requirement for the document to be legally binding. However, getting it notarized can add an extra level of verification.

- A Bill of Sale is sufficient proof of ownership: While a Bill of Sale is a key document in the process, it alone does not prove ownership. The official transfer of ownership is not complete until the DMV updates the vehicle's registration records.

- There's no need to report the sale to the DMV: Some people think once the Bill of Sale is signed, there's no further need to involve the DMV. However, in California, sellers are required to report the sale of a vehicle to the DMV within a specific timeframe using the Notice of Transfer and Release of Liability form.

- All bills of sale are the same: It's a common misconception that all Bills of Sale are identical, regardless of the state. Each state has its own requirements for what information needs to be included in a Bill of Sale for it to be considered valid.

- Electronic signatures aren't acceptable: With the rise of digital transactions, some might think that electronic signatures aren't valid on a Bill of Sale in California. However, electronic signatures are legally recognized and can be just as valid as handwritten ones, provided that all parties agree to their use.

- It determines the sales tax amount: Lastly, some believe that the amount stated on the Bill of Sale is what determines the sales tax due. In reality, the California DMV calculates the sales tax based on the vehicle's purchase price or its fair market value, whichever is higher.

Understanding these misconceptions can help individuals involved in the sale or purchase of a vehicle in California to better navigate the legal requirements and ensure a smooth transfer of ownership.

Key takeaways

When handling the California Motor Vehicle Bill of Sale form, several key points should be kept in mind to ensure its correct use and completion. This document plays a crucial role in the transfer of a vehicle between parties. Here are some important takeaways:

- Accurate Information is Crucial: Every detail filled out on the form must be precise and match official documents. This includes the make, model, year, and Vehicle Identification Number (VIN) of the car, as well as the personal information of both the buyer and the seller.

- Signatures are Necessary: Both the buyer and the seller need to sign the Bill of Sale to validate the agreement. In California, it's also recommended to have the signatures notarized, although not required by law, to add an extra layer of authenticity.

- Report of Sale to the DMV: It is the seller's responsibility to report the sale of the vehicle to the California Department of Motor Vehicles (DMV) within 5 days of the transaction. This process can usually be completed online or in person.

- Keep Copies for Records: Both parties should keep a copy of the Bill of Sale for their records. This document serves as a proof of transfer and can be important for future reference, such as for tax purposes or legal inquiries.

Popular Motor Vehicle Bill of Sale State Forms

Bill of Sale for Car Meaning - This form provides proof of purchase and sale, specifying the vehicle’s make, model, year, and VIN, along with the agreed-upon price.

Michigan Bill of Sale Car - A form that lays out the specifics of a vehicle sale, protecting all involved parties.