Free Bill of Sale Form for Michigan

When engaging in private sales or transfers of property in Michigan, the Michigan Bill of Sale form plays a crucial role in ensuring that the transaction is legally documented and recognized. This form provides a written record of the sale, capturing details such as the date of transaction, information about the seller and buyer, and a description of the item or items being sold. Additionally, it includes the sale price and signatures from both parties, making it an essential piece of documentation for both legal protection and personal record-keeping. Whether you're buying or selling vehicles, boats, firearms, or any personal property, understanding and correctly utilizing this form can facilitate a smooth transaction process, offer legal safeguards, and reinforce the legitimacy of the transfer. It's particularly important in private sales where proof of ownership and the terms of the sale need to be explicitly documented to prevent future disputes or complications.

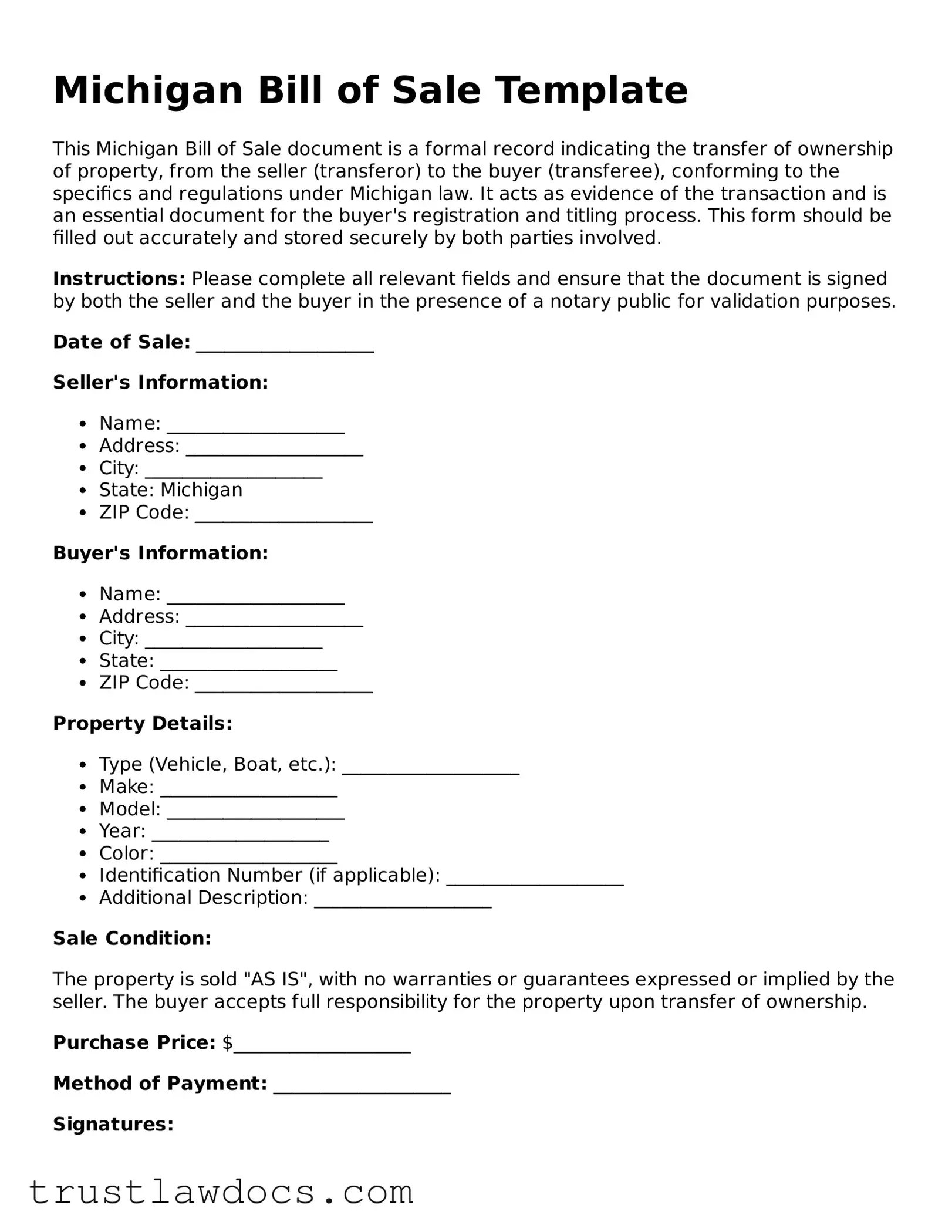

Form Example

Michigan Bill of Sale Template

This Michigan Bill of Sale document is a formal record indicating the transfer of ownership of property, from the seller (transferor) to the buyer (transferee), conforming to the specifics and regulations under Michigan law. It acts as evidence of the transaction and is an essential document for the buyer's registration and titling process. This form should be filled out accurately and stored securely by both parties involved.

Instructions: Please complete all relevant fields and ensure that the document is signed by both the seller and the buyer in the presence of a notary public for validation purposes.

Date of Sale: ___________________

Seller's Information:

- Name: ___________________

- Address: ___________________

- City: ___________________

- State: Michigan

- ZIP Code: ___________________

Buyer's Information:

- Name: ___________________

- Address: ___________________

- City: ___________________

- State: ___________________

- ZIP Code: ___________________

Property Details:

- Type (Vehicle, Boat, etc.): ___________________

- Make: ___________________

- Model: ___________________

- Year: ___________________

- Color: ___________________

- Identification Number (if applicable): ___________________

- Additional Description: ___________________

Sale Condition:

The property is sold "AS IS", with no warranties or guarantees expressed or implied by the seller. The buyer accepts full responsibility for the property upon transfer of ownership.

Purchase Price: $___________________

Method of Payment: ___________________

Signatures:

___________________

Seller's Signature

Date: ___________________

___________________

Buyer's Signature

Date: ___________________

Notary Public:

The undersigned notary public confirms the identity of the seller and buyer and witnesses the signing of this document.

___________________

Notary's Signature

Date: ___________________

Commission Expires: ___________________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose | Used to document the sale of an item, typically personal property, from one party to another in the state of Michigan. |

| Governing Laws | Subject to Michigan Compiled Laws (MCL), particularly those regarding the sale of personal property and motor vehicles. |

| Required Information | Includes details like the names and addresses of the buyer and seller, a description of the item sold, sale date, and sale amount. |

| Optional Elements | May also contain warranties, payment method, and terms, which are not required but can provide extra protection and clarity. |

| Significance of Notarization | Not always required, but having the bill of sale notarized can add a layer of authenticity and can be helpful for certain transactions, such as in the sale of a vehicle. |

| Usage in Vehicle Sales | Especially important for the sale of motor vehicles, where it is often required for registering and titling the vehicle in the buyer's name. |

How to Write Michigan Bill of Sale

Completing a Michigan Bill of Sale form is a crucial step in the process of buying or selling a personal property item, such as a car or a boat, in the state of Michigan. This document serves as a record of the transaction and provides proof of transfer of ownership. The form should be filled out accurately and completely to ensure the legal protection of both parties. The following steps will guide individuals through the process of filling out the Michigan Bill of Sale form properly.

- Begin by entering the date of the sale in the format of month, day, and year.

- Next, write the full name and address (including the city, state, and ZIP code) of the seller.

- Repeat this process for the buyer's full name and address (including the city, state, and ZIP code).

- Describe the item being sold. Include detailed information such as make, model, year, color, size, and any identifying numbers (serial number, VIN, etc.).

- Enter the sale amount in dollars. If the item is being given as a gift, indicate this by writing "gift" in the appropriate space.

- If applicable, include any warranties or conditions of the sale. If the item is being sold "as is," specify this to make clear that the buyer accepts the item in its current condition.

- Both the seller and the buyer should sign and print their names to make the document legally binding. Include the date of signing next to the signatures.

- For added legal protection, it's recommended (though not required) that the signatures be notarized. If choosing to do so, leave space at the bottom of the form for the notary public's seal and signature.

Once the Michigan Bill of Sale form is fully completed and signed by both parties, it acts as evidence of the transaction and transfer of ownership. It is recommended that both the buyer and seller keep a copy of the document for their records. In certain cases, the buyer may need to present this form as part of the registration process of the item. Thus, ensuring the form is filled out accurately and retained is essential for a smooth transfer of ownership.

Get Answers on Michigan Bill of Sale

What is a Michigan Bill of Sale form?

A Michigan Bill of Sale form is a legal document used to record the transfer of ownership of personal property from a seller to a buyer. It provides proof of purchase and includes important details such as the date of sale, a description of the item sold, and the price.

Is a Bill of Sale required in Michigan?

In Michigan, a Bill of Sale is not always legally required for private sales. However, it is strongly recommended as it provides evidence of the transaction and can be useful for tax and legal purposes.

What information should be included in a Michigan Bill of Sale?

A Michigan Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the item being sold, the sale date, the sale amount, and signatures from both parties. It may also include the item's serial number or VIN, if applicable.

Do both parties need to sign the Michigan Bill of Sale?

Yes, both the seller and the buyer must sign the Michigan Bill of Sale. This confirms that both parties agree to the terms of the sale and that the document accurately reflects the transaction.

Does a Michigan Bill of Sale need to be notarized?

No, a Michigan Bill of Sale does not typically need to be notarized. However, having it notarized can add an extra layer of legal protection and helps verify the authenticity of the signatures.

Can I use a Michigan Bill of Sale for selling a vehicle?

Yes, a Michigan Bill of Sale can be used for selling a vehicle. It should include specific vehicle information, such as the make, model, year, and VIN. Note that a Bill of Sale alone is not sufficient for the legal transfer of a vehicle's title or registration in Michigan.

How do I obtain a Michigan Bill of Sale?

A Michigan Bill of Sale can be obtained through online legal forms websites, from attorney offices, or by creating one yourself. Ensure that it includes all required information and complies with Michigan state laws.

Common mistakes

When individuals fill out the Michigan Bill of Sale form, one common mistake is neglecting to provide complete and accurate descriptions of the item or items being sold. This description should include make, model, year, and serial number when applicable. Without these details, establishing proof of ownership and the specifics of the item transferred can become problematic.

Another mistake often encountered is failing to include both parties' full legal names and addresses. This information is crucial for identifying the seller and the buyer in any future disputes or for legal documentation. Omitting or inaccurately recording this information compromises the document's validity and its function as a legal instrument.

Overlooking the requirement to detail the sale's terms and conditions is also a frequent error. This includes the sale price, payment method (such as cash, check, or digital transfer), and any other conditions agreed upon by the parties. Such details are essential for the bill of sale to serve as a binding agreement, reflecting the understanding and agreement between buyer and seller.

Many individuals mistakenly neglect to specify the date of sale on the form. This date is critical for several reasons, including tax purposes, ownership transfer documentation, and as a reference in case of disputes. An undated Bill of Sale can significantly complicate these matters.

Skipping the verification of the buyer’s and seller's information is another error. Before finalizing the document, both parties should ensure that all personal information is accurate. Errors in this information can lead to legal complications and difficulties in enforcing the bill of sale, should the need arise.

Failure to sign the document is a surprisingly common oversight. The signatures of both the seller and the buyer are mandatory for the Bill of Sale to be considered legally binding. Without these signatures, the document's effectiveness as a legal proof of sale and transfer of ownership is nullified.

Additionally, not having the Bill of Sale witnessed or notarized when necessary can be a critical mistake. While not always a requirement, having an impartial third party witness or notarize the document can add a layer of verification and legal credibility, making it harder to contest.

Finally, a significant mistake is not retaining a copy of the Bill of Sale for personal records. Both the buyer and the seller should keep a copy. This document serves as a critical record of the transaction and can be essential for tax purposes, future disputes, or as proof of ownership. Without a copy, it can be challenging to establish the details of the transaction at a later date.

Documents used along the form

When you're diving into the process of buying or selling a vehicle in Michigan, the Bill of Sale form is a crucial document. However, it's not the only paper that you'll need to ensure a smooth and legally binding transaction. To fully protect yourself and comply with state laws, there are several other forms and documents commonly used alongside the Bill of Sale. Let's explore some of these important documents to give you a clearer road map of the entire process.

- Odometer Disclosure Statement: This document is necessary for the sale of vehicles less than ten years old. It records the vehicle's actual mileage at the time of sale, ensuring that the buyer is aware of the vehicle's condition and history.

- Title Transfer: The vehicle's title must be legally transferred from the seller to the buyer. This document is a must for officially changing ownership and is often required when registering the vehicle in the buyer’s name.

- Damage Disclosure Statement: Required for certain transactions, this form discloses any significant damage to the vehicle that could affect its value or safety. It's a vital piece of information for a transparent sale.

- Seller's Registration: While not always transferred with the vehicle, the seller’s current registration document is useful for verifying that the seller is indeed the vehicle's legal owner.

- Buyer's Proof of Insurance: In Michigan, it's necessary for the buyer to provide proof of insurance upon taking ownership of the vehicle. This ensures that the vehicle is covered under the new owner's policy immediately upon purchase.

- Loan Documentation: If the vehicle is being purchased with a loan, or if there is an outstanding loan that needs to be cleared before the sale, relevant loan documents should be prepared and reviewed as part of the transaction.

Getting familiar with these documents will make the purchasing or selling experience in Michigan much smoother. While the Bill of Sale is the cornerstone document capturing the agreement's basics, these additional forms ensure that all aspects of the vehicle's condition, ownership, and legal responsibilities are transparent and properly managed. Always double-check with local laws and regulations to ensure you have all the necessary documentation for your vehicle transaction.

Similar forms

The Michigan Bill of Sale form shares similarities with a Vehicle Title Transfer form. Both documents serve to legally document the change of ownership of a vehicle. The Bill of Sale captures details about the transaction, including buyer and seller information, and the sale amount, similar to how the Vehicle Title Transfer requires vehicle details, and signatures from both parties to officially change ownership in government records.

Another document comparable to the Michigan Bill of Sale is the Warranty Deed used in real estate transactions. While a Bill of Sale covers personal property such as vehicles or boats, a Warranty Deed deals with the transfer of real estate ownership. Both documents assure the buyer of the seller's right to sell the property and guarantee that the property is free from previous encumbrances, providing a legal record of the transaction.

A Quitclaim Deed, while used for transferring ownership interest in real property, shares qualities with the Michigan Bill of Sale. Unlike the comprehensive guarantees in a Warranty Deed, a Quitclaim Deed and a Bill of Sale may not guarantee a clear title but still serve to transfer ownership from one party to another, with the documents providing proof of the transaction and terms agreed upon by both parties.

Similarly, a Promissory Note is akin to the Michigan Bill of Sale in that it outlines specific terms agreed upon between two parties. A Promissory Note details the terms under which one party promises to pay another a certain amount of money, often including payment schedules, interest, and consequences for non-payment, akin to how a Bill of Sale details the agreement terms of a sale, including the sale price and item description.

The Sales Agreement, much like the Michigan Bill of Sale, is a document that formalizes the sale of goods between a buyer and a seller. Both documents detail the specifics of the sale, including a description of the sold items, the sale price, and the agreement's terms and conditions. However, a Sales Agreement may include more comprehensive terms of sale, such as delivery details, warranties, and return policies.

A Receipt is another document similar to the Michigan Bill of Sale in its function to provide proof of a transaction. Both a Receipt and a Bill of Sale acknowledge that a seller has received payment from a buyer for the sale of goods or services. However, the Bill of Sale often serves a more formal purpose, providing more detailed information about the transaction and the transferred property.

The Gift Affidavit resembles the Michigan Bill of Sale by documenting the transfer of goods without a sale involved. It formally records the transfer of property as a gift, including identifying information about the giver and receiver, similar to how a Bill of Sale records the details of a sale transaction. Both serve as legal evidence of the ownership transfer.

Finally, a Loan Agreement shares similarities with the Michigan Bill of Sale, with the primary difference being that a Loan Agreement pertains to the borrowing of money rather than the sale of goods. Both documents set forth the terms of an agreement between two parties and include detailed information about the parties involved, the amount being loaned or sold, and the repayment or transaction terms, ensuring all conditions are clearly understood and legally documented.

Dos and Don'ts

Filling out the Michigan Bill of Sale form is a significant step in the process of buying or selling a vehicle, a boat, or other large items. This document serves as a legal record of the transaction, providing proof of the change in ownership. To ensure the process goes smoothly and legally, there are certain practices one should follow. Here are some guidelines to help you properly fill out the form:

Do's:- Verify the Details: Double-check all the information you enter, including the VIN (Vehicle Identification Number), make, model, and year of the vehicle, or identifying details for other items. Accuracy is crucial.

- Complete All Required Sections: Make sure no required fields are left blank. If a section doesn’t apply, it’s better to mark it as 'N/A' (not applicable) than to leave it empty.

- Use Black or Blue Ink: Fill out the form using black or blue ink to ensure that the document is legible and photocopies well. This makes it easier for all parties to read and for official records.

- Keep Copies: After completing the form, make sure both the buyer and the seller keep a copy of the signed document. This is important for both parties' records and any future disputes or clarifications.

- Do Not Rush: Take your time when filling out the form to avoid mistakes. Errors can lead to complications or disputes later on.

- Avoid White-Outs or Cross-Outs: Mistakes happen, but instead of using white-out or crossing items out, it’s better to start over on a new form if errors are made. This ensures the document looks clean and is free from confusion.

- Skip the Signatures: The form is not legally binding without the signatures of both the buyer and the seller. Ensure that these are included on the document to finalize the sale.

- Estimate Details: Guessing or estimating details, especially about identification numbers or financial figures, can lead to legal issues. Always use actual figures and verified information.

Misconceptions

When it comes to transferring ownership of personal property in Michigan, the Bill of Sale form plays a crucial role. However, there are several common misconceptions about this document that can create confusion. Let’s shed some light on these to ensure transactions are smooth and legally sound.

It’s only for Vehicles: One of the most prevalent misconceptions about the Michigan Bill of Sale is that it is exclusively for vehicle transactions. While it is commonly used for buying or selling cars, motorcycles, boats, and other vehicles, this form is actually much more versatile. It can be used for a variety of personal property sales, such as furniture, electronics, or even livestock. Understanding its broad applicability can help in numerous types of transactions.

Not Legally Required: Another common misunderstanding is that the Bill of Sale is not a legally required document in Michigan. While it's true that Michigan law doesn't mandate a Bill of Sale for all transactions, having one can provide critical legal protection. It serves as proof of purchase and can establish the transfer of ownership, which can be invaluable during disputes or when proof of ownership is needed.

Any Format Will Do: Some believe that a Bill of Sale in Michigan can take any format, assuming that a quick note on a piece of paper is sufficient. Though a Bill of Sale does not have an absolute standard format, it must contain specific information to be legally viable. This includes details like the date of the sale, a description of the item sold, the sale price, and the names and signatures of both the buyer and seller.

No Need for Witnesses or Notarization: Many people assume there’s no need for a Bill of Sale to be witnessed or notarized in Michigan. While not always a legal requirement, having the document witnessed or notarized can add an extra layer of authenticity and may be required by certain institutions, like banks or when registering a vehicle. This practice can help safeguard against future legal troubles or disputes over the transaction.

Dispelling these misconceptions about the Michigan Bill of Sale ensures that both buyers and sellers can conduct their transactions with confidence, knowing their legal bases are covered.

Key takeaways

When handling the Michigan Bill of Sale form, it is vital to pay attention to the details to ensure the transaction is properly documented. This document plays a crucial role in both legal and personal records. Below are key takeaways to consider:

- Complete Information is Crucial: Both the seller and the buyer must provide complete information. This includes names, addresses, and contact details. For vehicle sales, include the make, model, year, VIN (Vehicle Identification Number), and the odometer reading at the time of sale.

- Accurate Details about the Transaction: The form should accurately reflect the sale details, including the sale date and the purchase price. Be precise to avoid any confusion or disputes in the future.

- Signatures are Mandatory: The Michigan Bill of Sale form requires the signatures of both the buyer and the seller. This act solidifies the transaction and provides a record that both parties agreed to the terms of the sale.

- Notarization May Be Required: While not always necessary, some situations may require the Bill of Sale to be notarized. Whether this is needed can depend on the type of property being sold or the preference of the parties involved. It’s recommended to check if this step is needed for your specific transaction.

Popular Bill of Sale State Forms

Dmv Forms - The document can be customized to include specific details relevant to the transaction, making it versatile.

As Is Vehicle Bill of Sale Template - For sellers, this document provides protection against future claims of liability, by clearly stating the transfer of ownership and condition of the item at the time of sale.

How to Sell My Truck - The document can also indicate if there is a lien on the property, providing the buyer with information on any existing claims or encumbrances.