Free Bill of Sale Form for Indiana

When engaging in the sale of a vehicle, watercraft, or any personal property within the state of Indiana, the use of a bill of sale form is a critical step for both the buyer and the seller. This document not only serves as proof of the transaction, securing the rights of both parties, but also plays a vital role in the official recording and registration processes that follow. It typically contains essential information such as the detailed description of the item sold, the sale price, and the personal details of the involved parties. Furthermore, the Indiana bill of sale form may be required for tax assessment purposes and is a key element in ensuring the legality of the transfer of ownership. Its significance extends beyond a mere receipt; it is a binding agreement that outlines the specifics of the sale, offering a layer of protection and clarity that benefits all parties involved.

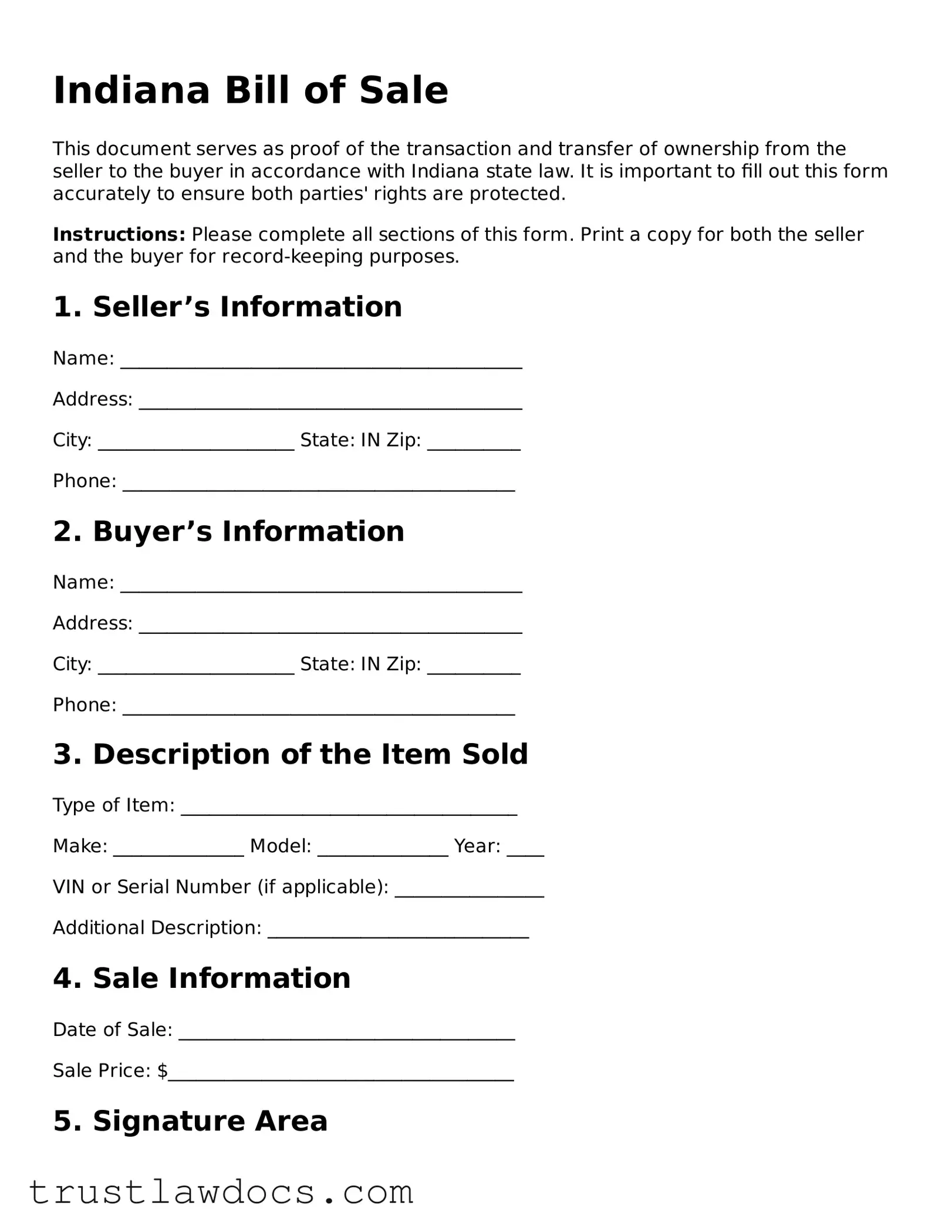

Form Example

Indiana Bill of Sale

This document serves as proof of the transaction and transfer of ownership from the seller to the buyer in accordance with Indiana state law. It is important to fill out this form accurately to ensure both parties' rights are protected.

Instructions: Please complete all sections of this form. Print a copy for both the seller and the buyer for record-keeping purposes.

1. Seller’s Information

Name: ___________________________________________

Address: _________________________________________

City: _____________________ State: IN Zip: __________

Phone: __________________________________________

2. Buyer’s Information

Name: ___________________________________________

Address: _________________________________________

City: _____________________ State: IN Zip: __________

Phone: __________________________________________

3. Description of the Item Sold

Type of Item: ____________________________________

Make: ______________ Model: ______________ Year: ____

VIN or Serial Number (if applicable): ________________

Additional Description: ____________________________

4. Sale Information

Date of Sale: ____________________________________

Sale Price: $_____________________________________

5. Signature Area

The undersigned seller and buyer acknowledge the sale of the item described above for the amount specified. Both parties confirm the accuracy of the information provided and agree to the transfer of ownership under the terms stated.

Seller’s Signature: ______________________ Date: _______

Buyer’s Signature: ______________________ Date: _______

Notice:

This Bill of Sale does not serve as a title transfer document. If required by Indiana state law, you must complete a separate title transfer with the Indiana Bureau of Motor Vehicles (BMV) or appropriate state agency.

It is recommended that both parties retain a copy of this document for their records.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Used to document the sale or transfer of personal property from a seller to a buyer in Indiana. |

| Governing Law(s) | Regulated under Indiana state laws, specifically those that deal with the sale and transfer of personal property. |

| Requirements | Must include details such as a description of the item sold, sale price, and parties' information. |

| Notarization | Not required by Indiana law, but it's recommended to add credibility to the document. |

| Key Components | Buyer and seller information, detailed description of the item, sale date, and signatures. |

| Benefits | Provides legal protection for both parties and serves as a receipt for the transaction. |

| Limitations | Only covers the transfer of personal property, not real estate or automobiles, which require different forms. |

How to Write Indiana Bill of Sale

Once the decision has been made to buy or sell a piece of personal property in Indiana, the Indiana Bill of Sale form is a crucial document for recording the transaction. This form provides a written record of the sale, detailing the change in ownership of the item. It's important for both the buyer and seller to fill out this form accurately to ensure both parties have a record of the sale. Follow these steps to complete the Indiana Bill of Sale form.

- Begin by entering the date of the sale at the top of the form.

- Write the full names and addresses of both the seller and the buyer in the designated areas.

- Describe the item being sold. Include make, model, year, and any identifying numbers (like a VIN or serial number) if applicable.

- Enter the selling price of the item in the space provided.

- If the item is a gift, state the relationship between the buyer and seller and provide a detailed reason for the gift.

- Both the buyer and seller should provide signatures and printed names at the bottom of the form to validate the transaction.

- Finally, it is advisable to have the signatures notarized, although it is not mandatory, to further authenticate the document.

In the next steps, ensure that both parties receive a copy of the completed Bill of Sale for their records. This document may need to be presented for registration or tax purposes. Keeping a copy is essential for future reference or in case any disputes arise regarding the transaction.

Get Answers on Indiana Bill of Sale

What is an Indiana Bill of Sale form?

An Indiana Bill of Sale form is a legal document that records a transaction between two parties within the state of Indiana. It provides evidence that personal property has been legally transferred from one person to another. The form typically includes details about the item sold, the sale price, and the names and signatures of both the buyer and the seller.

Is an Indiana Bill of Sale form required for all sales?

While not all sales in Indiana require a bill of sale, having one is highly recommended for the legal protection it offers. It is especially important for private sales of vehicles, boats, and firearms, where it may also be required for registration or licensing purposes.

What information should be included in an Indiana Bill of Sale?

The form should include the date of the sale, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale price, and the names and addresses of the buyer and seller. It should also include the signatures of both parties and, optionally, a witness or notary public for added legal validity.

Does an Indiana Bill of Sale need to be notarized?

Notarization is not a requirement for a bill of sale to be legal in Indiana. However, getting the document notarized can add an extra layer of authenticity and may help protect against any future disputes.

Who should keep a copy of the Indiana Bill of Sale?

Both the buyer and the seller should keep a copy of the bill of sale. This document serves as a receipt for the buyer and as proof of release of liability for the seller, in case any issues or disputes arise after the sale.

How is an Indiana Bill of Sale used in selling a vehicle?

For selling a vehicle, the bill of sale should include the vehicle’s make, model, year, vehicle identification number (VIN), and odometer reading at the time of sale. It acts as a proof of purchase and is often required by the Bureau of Motor Vehicles (BMV) for the new owner to complete the title transfer and vehicle registration.

Can an Indiana Bill of Sale be used for selling other types of property?

Yes, a bill of sale can be used for transactions involving a wide range of personal property in Indiana, including boats, motorcycles, firearms, and general items like furniture or electronics.

What if the item is given as a gift? Is an Indiana Bill of Sale still necessary?

While it is not required, creating a bill of sale even for items given as a gift can be beneficial. It should state that the item was gifted and list a sale price of $0, providing documentation that can be useful for tax purposes or to prove ownership.

Are there any specific forms I need to use?

Indiana does not mandate a specific form for a bill of sale. However, it's important that all essential information is included in the document. Templates can be found online or through legal service providers, which can ensure that the bill of sale meets all legal criteria.

Common mistakes

Filling out the Indiana Bill of Sale form is an essential step in the process of buying or selling a vehicle, but it's often rushed or overlooked by many. A common mistake is neglecting to ensure all the details are accurate and complete. This form serves as a legal document that confirms the transaction between the buyer and the seller, making accuracy paramount. Sometimes, people skip over necessary information or enter data incorrectly. This can lead to various issues, from difficulties in transferring the title to legal complications if disputes arise.

Another error that frequently occurs is failing to obtain all the necessary signatures. The Indiana Bill of Sale form requires the signatures of both the buyer and the seller to be legally binding. Occasionally, in the excitement or haste to complete the sale, one party might forget to sign the document, or the signatures might be placed in the wrong sections. This oversight can invalidate the document, complicating the ownership transfer process or even nullifying the sale in some cases.

Underestimating the importance of detailing the condition of the item being sold is also a mistake people often make. For vehicles, details about the make, model, year, mileage, and condition at the time of sale should be thoroughly documented. Some might provide vague or incomplete descriptions, which can lead to misunderstandings or disputes later on. Accurate, detailed descriptions help protect both parties by ensuring there is a clear understanding of what is being bought or sold. Without this information, it becomes challenging to verify the item if one party claims the condition was not as described.

Lastly, people sometimes forget to make or distribute copies of the completed form properly. After filling out the Bill of Sale, it's critical that both the buyer and the seller keep a copy for their records. This document is often required for title transfers, registration, or tax purposes. Not having a copy readily available can lead to delays or additional hassle when attempting to complete these necessary post-sale steps.

Documents used along the form

When transferring ownership of property in Indiana, a Bill of Sale form is often just the starting point. This crucial document is frequently accompanied by a variety of other forms and documents that help ensure the transaction is lawful, transparent, and agrees with state and local regulations. Understanding these additional documents can empower both the buyer and the seller, providing clarity and legal protection throughout the process.

- Title Transfer Forms: If the sale involves a vehicle, a title transfer form is necessary to officially change the ownership recorded on the vehicle title. This process is often completed at the DMV.

- Odometer Disclosure Statement: Federal law requires that an odometer disclosure statement be filled out for the sale of most vehicles. This statement ensures the buyer is aware of the vehicle's actual mileage at the time of sale.

- Registration Forms: For vehicles, boats, and some types of heavy machinery, new owners need to register their purchase with the state. This often requires filling out specific registration forms available through state agencies.

- Loan Agreement: If the purchase is being financed, a loan agreement may be necessary. This document outlines the terms of the loan, including the interest rate, repayment schedule, and actions upon default.

- Warranty Documents: When a sale includes a warranty, specific warranty documents detailing the terms, conditions, and limitations of the warranty should be provided and signed.

- Release of Liability: Sellers may require a release of liability to ensure that once the property is sold, they are not held responsible for what happens with the property thereafter.

- Bill of Sale for Trailer: If the transaction includes a trailer, a separate Bill of Sale for the trailer might be needed, especially if the trailer and the vehicle have separate titles.

- As-Is Sale Agreement: To make it clear that an item is being sold in its current condition, without warranties regarding its condition or functionality, an as-is sale agreement may be signed.

Each of these documents serves a unique purpose in the context of a sale, providing necessary information, fulfilling legal requirements, or protecting the interests of the buyer, seller, or both. While the Bill of Sale is a fundamental document marking the exchange of property, these additional documents complete the transaction, ensuring it is recognized legally and both parties are adequately informed and protected throughout the process.

Similar forms

The Indiana Bill of Sale form shares similarities with the Warranty Deed in the aspect of guaranteeing specific conditions during the transaction. A Warranty Deed not only transfers property ownership but guarantees the new owner that the property is free from any liens or claims. Similar to this, a Bill of Sale can offer guarantees about the item being sold, such as being free from debts or encumbrances, providing a sense of security to the buyer.

Comparable to a Promissory Note, the Indiana Bill of Sale sometimes outlines payment terms for the transaction. A Promissory Note is a detailed financial agreement, specifying how a debt will be repaid over time, including interest rates and payment schedules. When a Bill of Sale includes payment terms, it serves a similar function, laying out how and when payments for the item sold should be completed, ensuring both parties are clear on the financial obligations.

Like a Sales Agreement, the Indiana Bill of Sale documents the specifics of the transaction between a buyer and a seller. A Sales Agreement outlines the terms and conditions of a sale, detailing the goods or services exchanged, the agreed-upon price, and any warranties or guarantees. Similarly, a Bill of Sale serves as concrete evidence of the transaction, detailing the item sold, the sale price, and the date of the sale, offering protection and clarity for both parties involved.

Similarly, to a Certificate of Title, especially in the context of selling vehicles, the Indiana Bill of Sale is integral in the transfer process. A Certificate of Title is the official document proving ownership of a vehicle, boat, or another piece of property. While the Certificate of Title signifies ownership, a Bill of Sale is often required to document the transaction and may be necessary for the buyer to obtain a new title, representing a crucial step in the legal transfer of ownership rights.

Dos and Don'ts

Completing the Indiana Bill of Sale form requires care and attention to detail. This document is crucial for both the buyer and seller in the transaction, serving as proof of purchase and transferring ownership of property. To ensure that this process is conducted smoothly and effectively, here are essential dos and don'ts.

Do:

- Verify the accuracy of all information, including names, addresses, and identification numbers. Mistakes can invalidate the document or cause legal complications.

- Use black or blue ink to ensure the document is legible and can be photocopied or scanned without issue.

- Include a detailed description of the item being sold. For vehicles, this entails the make, model, year, and vehicle identification number (VIN). Similar detailed descriptions are required for other items.

- Ensure both the buyer and seller sign and date the bill of sale. Signatures are critical for validating the document.

- Keep a copy of the completed bill of sale for your records. Both parties should have a copy for legal and personal record-keeping purposes.

Don't:

- Rush through the process. Take your time to review all sections of the bill of sale to ensure completeness and accuracy.

- Forget to specify the sale price and the date of sale. This information is vital for tax purposes and future reference.

- Overlook the need for notarization, if applicable. While not always required, some transactions are best validated with a notary’s seal.

- Leave spaces blank. If a section does not apply, mark it with N/A (not applicable) to indicate that it was considered but found irrelevant.

- Use pencil or non-permanent ink that can easily be altered after the fact, potentially leading to disputes or fraudulent activities.

By following these guidelines, parties involved in filling out an Indiana Bill of Sale can avoid common pitfalls and ensure a valid and enforceable document. This fosters a smooth transfer of ownership and protects the interests of both the buyer and the seller.

Misconceptions

When it comes to the Indiana Bill of Sale form, several misconceptions can mislead people during its preparation and usage. Here, we address six common misunderstandings to provide clearer insight.

A Bill of Sale is required for every transaction in Indiana. This is not always the case. Although it's highly recommended for personal records and proof of purchase, Indiana law does not require a Bill of Sale for all transactions. It's crucial, however, for vehicle transactions to facilitate the transfer of ownership.

The Bill of Sale must be notarized in Indiana. While notarization adds a layer of authenticity, Indiana does not mandate notarization for the Bill of Sale to be considered valid. The primary requirement is that the document accurately details the transaction between the buyer and seller.

Only the buyer needs to sign the Bill of Sale. Contrary to this belief, both the buyer and the seller should sign the form to ensure its validity. This affirms that both parties agree to the terms of the sale and the accuracy of the information presented.

The Bill of Sale can substitute for a title during a vehicle sale. This is incorrect. The Bill of Sale supplements the vehicle title but cannot replace it. For vehicle transactions, the title is the official document proving ownership. The Bill of Sale serves as a receipt for the transaction.

Any template found online is suitable for use in Indiana. Not all templates are created equal. To ensure compliance with Indiana laws, it's recommended to use a template specifically designed for Indiana or one that meets all the necessary requirements outlined by the state.

There's no need to keep a copy of the Bill of Sale once the transaction is complete. Maintaining a copy of the Bill of Sale is crucial for both buyer and seller. It acts as a record of the transaction, useful for tax reporting, legal protections, and potential future disputes or registrations.

Key takeaways

When completing and utilizing the Indiana Bill of Sale form, several key points should be taken into consideration to ensure the process is handled accurately and effectively. Below are some of the pivotal takeaways:

- Both parties involved in the transaction, the seller and the buyer, need to provide accurate and complete information. This includes full names, addresses, and, if applicable, contact information.

- The detailed description of the item being sold is crucial. For vehicles, this means the make, model, year, VIN (Vehicle Identification Number), and mileage at the time of sale.

- The sale date and the total purchase price should be clearly stated on the form, to ensure there's no confusion about the terms of the sale.

- It’s essential to specify the payment method (cash, check, money order, etc.) and to state whether the sale is conditional upon any terms.

- The document must be signed by both the seller and the buyer. In some cases, witness signatures may also be required for additional validation.

- While not always mandatory, notarization of the bill of sale can add a layer of legal protection and authenticity to the document.

- Keeping a copy of the signed bill of sale is important for both parties. It serves as a receipt for the buyer and proof of release of liability for the seller.

By carefully adhering to these guidelines, individuals can ensure that the transaction process goes smoothly, and both parties have a clear understanding of the terms of sale. It not only facilitates a smoother transaction but also helps in protecting the rights of both the seller and the buyer.

Popular Bill of Sale State Forms

How to Sell My Truck - A Bill of Sale is a documented agreement for the purchase and sale of personal property, such as vehicles or electronics, formalizing the transfer of ownership from seller to buyer.

How Do I Notify Dmv That I Sold My Car in Florida - In transactions without immediate payment, the bill of sale may specify installment terms or other arrangements.

Dmv Forms - This form can be an important part of estate planning, documenting the distribution of personal property.

As Is Vehicle Bill of Sale Template - It serves as a safeguard against fraud, clearly documenting the buyer's and seller's identities and preventing the sale of stolen property.