Free Horse Bill of Sale Form for Texas

In the heart of Texas, where horses roam the vast expanses and form an integral part of the state's cultural and economic landscape, the Texas Horse Bill of Sale stands as a crucial document for both buyers and sellers engaged in the horse trade. This form is not just a receipt but a legally binding agreement that certifies the transfer of ownership of a horse from one party to another. It details essential information such as the description of the horse, the sale price, and both parties' contact information, providing clear proof of purchase and ensuring the authenticity of the transaction. Moreover, the form serves as a safeguard for all parties involved, delineating the terms and conditions of the sale, which can protect against future disputes or misunderstandings. Understanding and completing this form with the utmost care and attention is paramount for anyone looking to buy or sell a horse in Texas, as it solidifies the transaction in legal terms and contributes to a smoother, more transparent exchange.

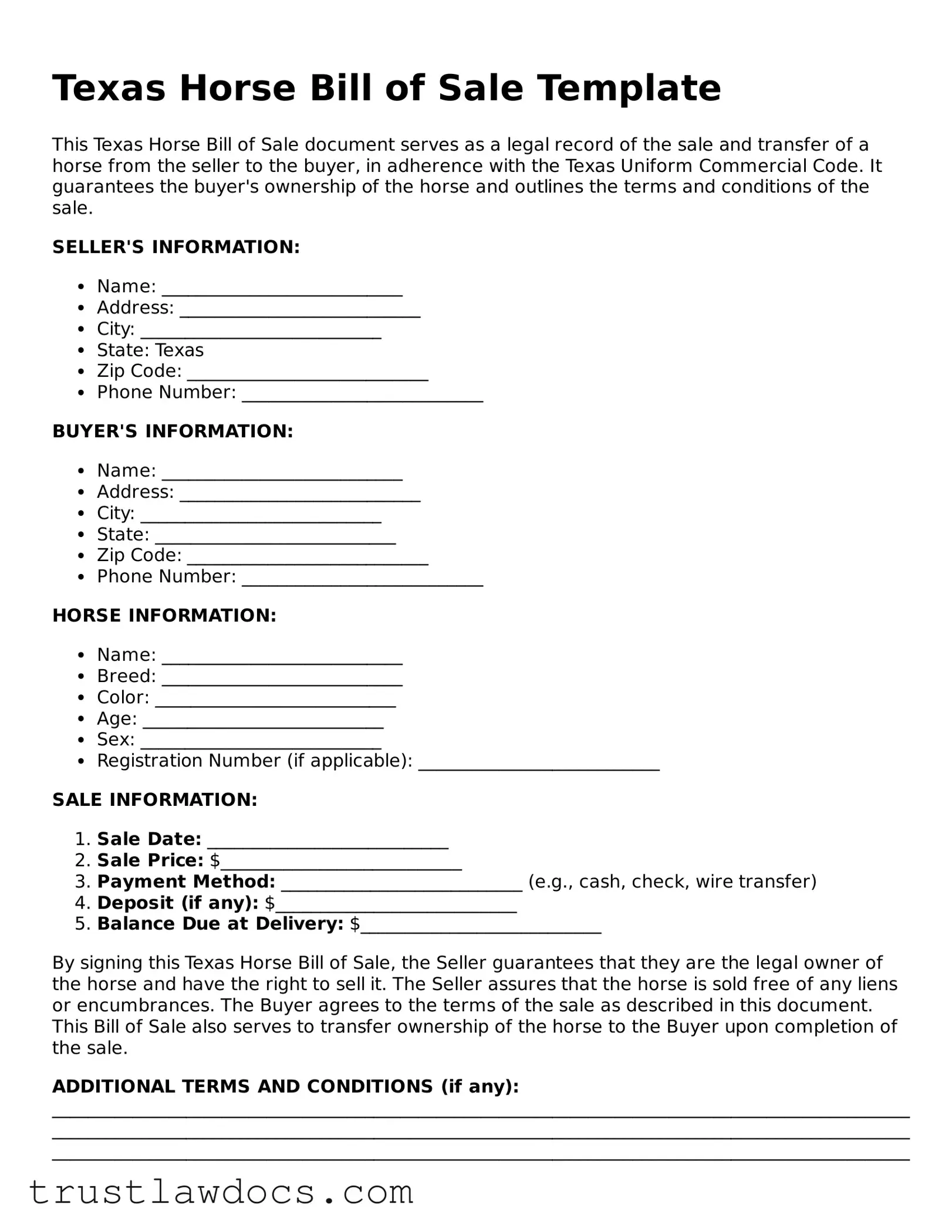

Form Example

Texas Horse Bill of Sale Template

This Texas Horse Bill of Sale document serves as a legal record of the sale and transfer of a horse from the seller to the buyer, in adherence with the Texas Uniform Commercial Code. It guarantees the buyer's ownership of the horse and outlines the terms and conditions of the sale.

SELLER'S INFORMATION:

- Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: Texas

- Zip Code: ___________________________

- Phone Number: ___________________________

BUYER'S INFORMATION:

- Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Phone Number: ___________________________

HORSE INFORMATION:

- Name: ___________________________

- Breed: ___________________________

- Color: ___________________________

- Age: ___________________________

- Sex: ___________________________

- Registration Number (if applicable): ___________________________

SALE INFORMATION:

- Sale Date: ___________________________

- Sale Price: $___________________________

- Payment Method: ___________________________ (e.g., cash, check, wire transfer)

- Deposit (if any): $___________________________

- Balance Due at Delivery: $___________________________

By signing this Texas Horse Bill of Sale, the Seller guarantees that they are the legal owner of the horse and have the right to sell it. The Seller assures that the horse is sold free of any liens or encumbrances. The Buyer agrees to the terms of the sale as described in this document. This Bill of Sale also serves to transfer ownership of the horse to the Buyer upon completion of the sale.

ADDITIONAL TERMS AND CONDITIONS (if any):

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

SIGNATURES:

___________________________ ___________________________

Seller's Signature Date

___________________________ ___________________________

Buyer's Signature Date

This document was created based on the current laws governing the sale of horses in Texas. It is advisable for both parties to retain a copy of this Bill of Sale for their records.

PDF Form Details

| Fact Name | Detail |

|---|---|

| Purpose | The Texas Horse Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a horse from a seller to a buyer. |

| Legally Binding | Once signed by both parties and, if applicable, a witness, the form becomes a legally binding agreement in the state of Texas. |

| Governing Law | The form is governed by Texas state laws, specifically the Property Code, which outlines the legal requirements for a bill of sale. |

| Key Components | The form typically includes details about the horse (such as breed, age, and markings), sale price, seller and buyer information, and any warranties or disclosures. |

| Witness Requirement | While not mandated by Texas law, having a witness sign the bill of sale can provide additional legal protection and verification of the transaction. |

| Notarization | Notarization of the form is not required under Texas law but is recommended to further authenticate the document. |

| Electronic Signatures | Under the Texas Uniform Electronic Transactions Act, electronic signatures are considered as legally valid as traditional handwritten signatures for a bill of sale. |

How to Write Texas Horse Bill of Sale

When preparing to transfer ownership of a horse in Texas, completing a Horse Bill of Sale is a necessary step. This document serves as a legal record of the transaction, providing protection and clarity for both the buyer and seller. Filling out this form accurately is crucial for ensuring the process goes smoothly. Below are the essential steps to guide you through filling out the Texas Horse Bill of Sale form correctly.

- Start by entering the date of the sale at the top of the form. This should be the actual date when the transaction is finalized.

- Write the full name and address of the seller in the designated section. If the seller is a business, include the business name along with the contact person's name.

- In the section provided, fill in the full name and address of the buyer. Similar to the seller's information, include any pertinent business names and contact details.

- Describe the horse being sold. Include breed, color, age, sex, registration number (if applicable), and any distinguishing features or marks. The more detailed, the better for identification purposes.

- Enter the sale price of the horse in dollars, ensuring both parties agree on the amount.

- Specify any additional terms or conditions of the sale that both the buyer and seller have agreed upon. This could include payment plans, warranties regarding the horse's health, or other terms specific to this transaction.

- Both the buyer and seller must sign and date the form in the designated areas. If any witnesses are present, it’s advisable to have them sign the form as well.

- Finally, if a notary public is present, have them complete their section of the form, validating the signatures of both parties. While not always required, notarization adds an extra layer of legality and assurance to the document.

Once the Texas Horse Bill of Sale form is fully completed and signed by both parties, it's important to make copies. Each party should retain a copy for their records. This will serve as proof of ownership transfer and can be crucial in resolving any disputes or questions about the transaction in the future. Following these steps carefully will help ensure that the sale of your horse is legally documented and recognized in Texas.

Get Answers on Texas Horse Bill of Sale

What is a Texas Horse Bill of Sale form and why is it necessary?

The Texas Horse Bill of Sale form serves as a legal document to document the sale and transfer of a horse from one individual to another within the state of Texas. It's necessary because it provides proof of purchase, helps ensure the transparency of the transaction, and establishes a record of the horse's ownership change. This document can be crucial for registration, insurance, and in the event of any disputes regarding the horse's ownership.

What information should be included in a Texas Horse Bill of Sale?

A comprehensive Texas Horse Bill of Sale should include the full names and addresses of both the buyer and seller, a detailed description of the horse (such as breed, color, age, sex, and any identifying marks), the sale date, the purchase price, and any other terms or conditions of the sale. Signatures of both parties are also required to validate the document, and it may be beneficial to have the signatures notarized for added legal standing.

Is a witness or notarization required for a Texas Horse Bill of Sale?

While Texas law does not explicitly require a witness or notarization for a Horse Bill of Sale to be legally binding, having the document notarized or witnessed can provide additional legal protection and help prevent future disputes. A notarized document confirms the identity of the parties and helps ensure that the signatures are genuine.

How can one obtain a Texas Horse Bill of Sale form?

Individuals can obtain a Texas Horse Bill of Sale form through various means. This includes downloading templates from reputable legal forms websites, consulting with an attorney who can draft the form to suit specific needs, or purchasing forms from office supply stores that provide standardized legal documents. However, when using any template, verifying that it meets all legal requirements in Texas is important.

Does the Texas Horse Bill of Sale form need to be filed with any government agency?

No, the Texas Horse Bill of Sale form does not need to be filed with any government agency. It is a private agreement between the buyer and seller. However, retaining a copy for personal records is highly recommended. This document can be crucial for tax purposes, future sales, or as evidence in legal situations regarding the horse's ownership.

What are the legal implications of not using a Texas Horse Bill of Sale when selling or buying a horse?

Not using a Texas Horse Bill of Sale when selling or buying a horse can lead to significant risks. Without this document, there may be no formal record of the transaction, making it difficult to prove ownership or settle disputes. This could result in legal complications, financial loss, or issues with law enforcement if questions about the horse's ownership arise. Using a properly executed Horse Bill of Sale aids in protecting the rights and interests of both parties involved in the transaction.

Common mistakes

One common mistake made when filling out the Texas Horse Bill of Sale form is not providing complete information on the horse. Details such as the horse's age, breed, and registration number, if applicable, are critical. These specifics ensure a clear understanding of the exact animal being sold and can prevent disputes about the identity of the horse.

Another error that occurs is not clearly stating the sale price. The document should articulate the total amount agreed upon for the horse. Omitting this information or writing an unclear amount can lead to confusion or legal issues down the line regarding the transaction's financial terms.

Often, individuals neglect to describe the condition of the horse at the time of sale, including any health issues or special needs. This oversight can lead to misunderstandings about the horse's state and who is responsible for any immediate medical care or special accommodations the horse might need.

Failure to include a warranty or the lack thereof is also a mistake. Whether the horse is being sold "as is" or with certain guarantees about its health and soundness should be specified. This clarity protects both the buyer and seller, setting clear expectations about the animal's condition at sale time.

Skipping the inclusion of a return policy or trial period can be problematic. If the buyer is not satisfied or the horse does not fit their needs, a clear course of action should be outlined. Without this information, resolving disputes or misunderstandings about returning the horse becomes more complicated.

Leaving out signatures and dates from all parties involved in the sale leads to a lack of verifiability of the agreement. A signature confirms that all parties have agreed to the terms and conditions of the sale, and dating the document helps to establish the timeline of the sale, which is important for record-keeping and any potential legal issues that might arise.

Not having a witness or a third-party verify the transaction is a further mistake. A witness can lend credibility to the transaction and help resolve any disputes about the integrity of the bill of sale or the accuracy of what was agreed upon.

Last, a significant oversight is not keeping a copy of the bill of sale for personal records. Both the buyer and seller should retain a copy. This document serves as a receipt and a legal record of the transaction, which could be crucial for issues like future ownership disputes or taxation matters.

Documents used along the form

When buying or selling a horse in Texas, the Horse Bill of Sale form is a crucial document. However, to ensure a smooth and legally sound transaction, several other forms and documents are typically used alongside it. These supplementary documents help protect all parties involved, providing clear records and setting expectations and responsibilities. Let's explore some of these additional forms and documents often used with the Texas Horse Bill of Sale.

- Coggins Test Certificate: This certificate proves that the horse has been tested for Equine Infectious Anemia (EIA), a requirement in many states for sales, shows, and transport. The test helps ensure the health and safety of the horse population.

- Health Certificate: Issued by a certified veterinarian, this document certifies that the horse is in good health and free of contagious diseases at the time of examination. It's often required for travel and sale.

- Pre-Purchase Examination (PPE) Report: A comprehensive report by a veterinarian that assesses the horse's health and fitness prior to purchase. While not always mandatory, it's highly recommended to inform the buyer's decision.

- Transfer of Ownership Document: This document, which may be filed with breed registries, officially records the change of ownership. It's essential for maintaining the horse's pedigree and registration status.

- Warranty of Soundness: A statement or guarantee from the seller regarding the horse's health and soundness at the time of sale. It offers the buyer some protection against undisclosed health issues.

- Boarding Agreement: If the horse will be staying at a boarding facility immediately following the sale, this agreement outlines the terms and conditions of its care, including costs, services provided, and rules of the facility.

While the Texas Horse Bill of Sale form is the cornerstone of buying or selling a horse, the role of these additional documents can't be overstated. They collectively ensure the health, welfare, and legal standing of the horse, while also protecting the interests of the buyer, seller, and other stakeholders involved in the transaction. Always consider consulting with a professional to ensure that all necessary paperwork is completed accurately and in compliance with local laws.

Similar forms

The Texas Horse Bill of Sale is akin to the Vehicle Bill of Sale in several respects. Primarily, it serves as a documented agreement that records the transfer of ownership from one party to another. Much like when someone buys a car, the Horse Bill of Sale confirms that the buyer has agreed to purchase the horse for a specified amount and acknowledges the receipt of the payment. Both documents typically include details about the item being sold (a horse in one case, a vehicle in the other), the sale price, and the particulars of the buyer and seller, ensuring a smooth ownership transition.

Similarly, the Equipment Bill of Sale shares common ground with the Horse Bill of Sale. This document is utilized when selling or buying equipment, and it functions to legally document the transaction and transfer of ownership. It requires information about the equipment (make, model, condition), the sale amount, and the identities of the participating parties. Just as with the Horse Bill of Sale, this form acts as proof of purchase and protects both the buyer and the seller by detailing the agreed terms of the sale.

The Livestock Bill of Sale is another document that closely mirrors the Texas Horse Bill of Sale. It is used specifically in transactions involving animals such as cattle, pigs, sheep, and sometimes horses. This bill records the sale and transfer of ownership of any livestock, outlining details such as the animal's description, health condition, and any other pertinent particulars. The core similarity lies in its role in ensuring legal ownership transfer and protecting the rights of both the buyer and the seller in the transaction.

The Boat Bill of Sale is also related, emphasizing the importance of documenting transactions for different types of property. This document records the sale of a boat, including necessary specifics such as the make, length, type, and serial number of the boat, alongside the agreed sale price. Similar to the Horse Bill of Sale, it establishes the change of ownership and is often required for the registration of the boat under the new owner's name, serving both a legal and administrative purpose.

The Firearm Bill of Sale is essential for transactions involving guns and shares similar functions with the Horse Bill of Sale, despite the vastly different types of items being sold. It officially documents the sale and transfer of ownership of a firearm, detailing the make, model, caliber, and serial number, among other specifics. Both documents ensure the protection of legal rights and adherence to state regulations, making them indispensable for a smooth and lawful transfer.

The Business Bill of Sale stands in parallel to the Horse Bill of Sale, albeit in the context of selling business assets rather than animals. This document solidifies the sale of various business assets and includes detailed information about the assets, the sale amount, and the parties involved. The function of legitimizing the transfer and ensuring that both parties adhere to agreed terms is a critical aspect of both documents. They serve as valuable records of the transaction for future reference or in case of disputes.

Lastly, the Real Estate Bill of Sale, while distinct in its application to immovable property, aligns with the Horse Bill of Sale regarding its purpose and structure. It records the sale of property, including land or houses, and includes information on the property's location, the sale price, and the identities of the buyer and seller. Though the tangible items differ, both documents act as pivotal proof of ownership transfer, safeguarding the interests of all involved parties.

Dos and Don'ts

When embarking on the process of completing a Texas Horse Bill of Sale form, there are several important dos and don'ts to keep in mind. These guidelines ensure that the sale is documented correctly, protecting both the buyer and seller, and ensuring that the legal transfer of ownership is smooth. Here are nine crucial points to remember:

- Do ensure all the information is accurate. Double-check the horse's description, including its breed, age, and any identifying marks.

- Do include both the buyer's and seller's full names and contact information to avoid any confusion about the parties involved in the transaction.

- Do verify that the sale price is correct and has been agreed upon by both parties. This clarity can prevent disputes later on.

- Do obtain a witness or notary's signature if possible. While not mandatory, this can add an extra layer of legitimacy to your document.

- Do keep a copy of the bill of sale for your records. Having this document can be crucial for tax purposes or any future disputes.

- Don't forget to include any terms or conditions of the sale, such as a trial period or specific responsibilities each party agrees to.

- Don't leave any blank spaces on the form. If a section doesn't apply, mark it as "N/A" (not applicable) to show that it was considered but deemed not relevant.

- Don't rely on verbal agreements only. The horse bill of sale serves as your legal proof of purchase and sale, so make sure it is filled out comprehensively.

- Don't hesitate to consult a legal professional if you have any uncertainties about the bill of sale. Ensuring the document is properly filled out can save you from potential legal headaches in the future.

Following these guidelines can smooth the transition of ownership and help prevent any misunderstandings or legal issues down the road. Remember, a Bill of Sale not only serves as a receipt for your transaction but also as an important piece of evidence should disputes arise about the ownership of the horse.

Misconceptions

When it comes to the Texas Horse Bill of Sale form, there are several misconceptions that can create confusion. Understanding these mistaken beliefs will help ensure a smooth transaction for both the buyer and seller. Here is a list of common misconceptions:

It's only necessary for expensive horses: Every horse sale in Texas, regardless of the price or value of the horse, should have a Bill of Sale. This document provides proof of the transaction and protects both parties.

Verbal agreements are just as good: While verbal agreements may seem convenient, they are difficult to enforce and prove in case of a dispute. A written Horse Bill of Sale is legally binding and clearly outlines the terms agreed upon by both parties.

The form is complicated and requires legal assistance: The Texas Horse Bill of Sale form is straightforward. It typically includes basic information about the sale, such as the names of the buyer and seller, description of the horse, sale price, and date. Completing it doesn’t usually require a lawyer’s help.

Any general Bill of Sale form will work: While a general Bill of Sale might be legally acceptable, using a form specifically designed for horse sales is better. These forms cater to the unique aspects of horse transactions, like breed, registration details, and health information.

Only the seller needs to sign the form: For the Bill of Sale to be fully effective, it should be signed by both the seller and the buyer. This confirms that both parties agree to the terms and conditions of the sale.

The form isn't necessary if selling to a friend or family member: Even when selling a horse to someone you trust, it's important to complete a Bill of Sale. This helps avoid any misunderstandings or disagreements in the future.

There’s no need to include a description of the horse: Including a detailed description of the horse (e.g., age, breed, color, and any identifying marks) in the Bill of Sale is crucial. This information helps confirm the identity of the horse being sold and can be especially important if disputes arise later.

It's unnecessary to keep a copy once the sale is complete: Both the buyer and seller should keep a copy of the completed Bill of Sale. This document serves as a receipt and may be needed for future reference, such as proving ownership or for tax purposes.

Key takeaways

When it comes to buying or selling a horse in Texas, utilizing a Horse Bill of Sale form is a crucial step to ensure the transaction is legally binding and accurately documented. This form not only serves as proof of purchase but also outlines the details of the sale, protecting both the buyer and seller. Here are five key takeaways to consider when filling out and using a Texas Horse Bill of Sale form:

- Accurate Details of the Horse: It is essential to include comprehensive information about the horse being sold. This should cover the horse's name, breed, color, age, sex, registration details (if applicable), and any identifying marks or health issues. Precise details help in avoiding any disputes or confusion regarding the horse's identity.

- Payment Information: Clearly state the sale price of the horse and the terms of the payment. Whether it's being paid in full, in installments, or through a trade, detailing the agreement helps in maintaining transparency. Also, specifying if a deposit has been made can clarify the financial obligations of the buyer.

- Warranties or Guarantees: The bill of sale should specify if the horse is being sold with any warranties or guarantees. If the seller is providing assurances regarding the horse's health or ability to perform certain tasks, these should be explicitly mentioned. Conversely, if the horse is being sold "as-is," this should also be clearly stated to avoid potential legal issues.

- Pre-Purchase Examination: It's advisable to mention whether a pre-purchase examination by a veterinarian was allowed or conducted. If an examination has taken place, including details about the findings can provide transparency and trust in the transaction. If no examination was allowed, stating this fact can help protect the seller from future complaints about the horse's health or condition.

- Signatures and Dates: For the Horse Bill of Sale to be legally binding in Texas, it must be signed and dated by both the buyer and seller. Including the printed names and addresses of both parties is also recommended. This formalizes the agreement and serves as a point of reference for the exact moment the ownership transfer took place.

Using a Texas Horse Bill of Sale form correctly can create a smooth transaction for both parties involved. It provides legal protection and ensures that everyone has a clear understanding of the sale's terms and conditions. Always ensure the information provided is accurate and complete to prevent any future disputes or misunderstandings.

Popular Horse Bill of Sale State Forms

Simple Horse Bill of Sale - This form reassures the buyer about the legitimacy of the purchase, providing a sense of security in the investment.

Horse Bill of Sale - Brings transparency to the horse sale, with detailed sections for the horse's condition and sale terms.