Free Bill of Sale Form for California

In California, the process of buying or selling personal property can be made official and secure through the usage of a Bill of Sale form. This document serves as a critical record, confirming the transaction between the buyer and the seller. It outlines the specifics of the item being transferred, including its description and the agreed-upon price, thus providing legal protection should any disagreements or disputes arise post-sale. The Bill of Sale is particularly important in California for the registration and transfer of vehicles, but it is equally significant for a myriad of other transactions, such as furniture, electronics, or even pets. Its completion ensures a clear transfer of ownership, making it a necessary step for both parties to achieve peace of mind. Given its importance, understanding the form’s requirements, the details it must contain, and the legal implications it carries is crucial for anyone looking to engage in a private sale within the state.

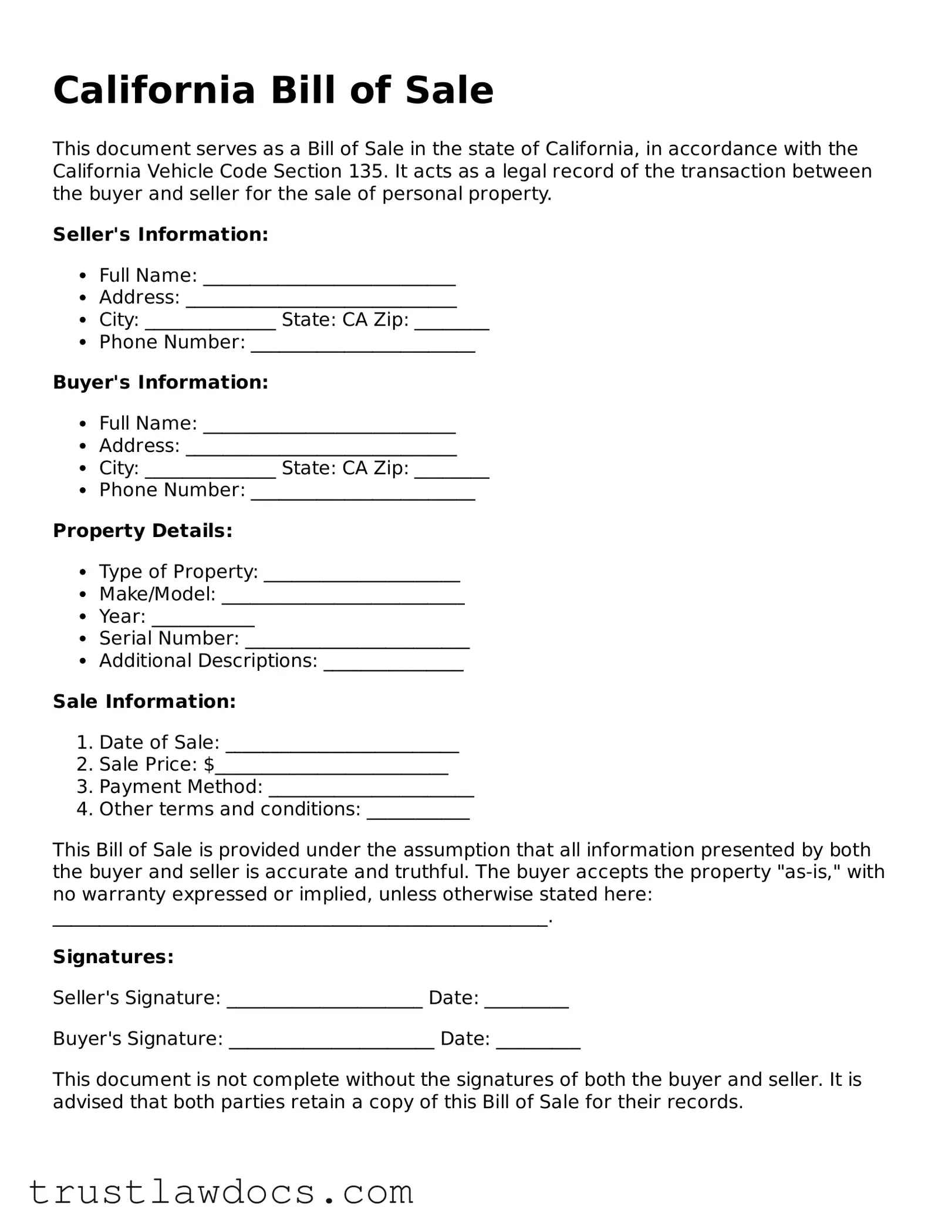

Form Example

California Bill of Sale

This document serves as a Bill of Sale in the state of California, in accordance with the California Vehicle Code Section 135. It acts as a legal record of the transaction between the buyer and seller for the sale of personal property.

Seller's Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ______________ State: CA Zip: ________

- Phone Number: ________________________

Buyer's Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ______________ State: CA Zip: ________

- Phone Number: ________________________

Property Details:

- Type of Property: _____________________

- Make/Model: __________________________

- Year: ___________

- Serial Number: ________________________

- Additional Descriptions: _______________

Sale Information:

- Date of Sale: _________________________

- Sale Price: $_________________________

- Payment Method: ______________________

- Other terms and conditions: ___________

This Bill of Sale is provided under the assumption that all information presented by both the buyer and seller is accurate and truthful. The buyer accepts the property "as-is," with no warranty expressed or implied, unless otherwise stated here: _____________________________________________________.

Signatures:

Seller's Signature: _____________________ Date: _________

Buyer's Signature: ______________________ Date: _________

This document is not complete without the signatures of both the buyer and seller. It is advised that both parties retain a copy of this Bill of Sale for their records.

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | It is a legal document that records the sale of an item between a seller and a buyer in California. |

| 2 | The California Bill of Sale form is often used for the sale of cars, boats, motorcycles, and other personal property. |

| 3 | It provides proof of purchase and can be used for registering and titling the sold item with the California Department of Motor Vehicles (DMV) if applicable. |

| 4 | The form typically includes details about the item sold, such as make, model, year, and identification number. |

| 5 | Both the buyer's and seller's names, addresses, and signatures must be included in the document. |

| 6 | It serves as a receipt for the transaction and may be important for tax purposes. |

| 7 | While not all sales may legally require a Bill of Sale in California, it's always recommended to complete one for records and legal protection. |

| 8 | Some counties in California may have specific requirements or forms for a Bill of Sale, so it's important to check local regulations. |

| 9 | There's no standard state-issued form for all types of personal property, but the California DMV provides a specific form for vehicle transactions (REG 135). |

| 10 | The California Bill of Sale must comply with all state laws, including the California Civil Code, for the sale to be recognized as valid. |

How to Write California Bill of Sale

When a private sale of an item takes place in California, both the seller and the buyer might want to complete a Bill of Sale. This document serves as a record of the transaction and can be helpful for both parties for record-keeping and tax purposes. It's important to fill out the Bill of Sale accurately to ensure that all the details of the transaction are correctly documented. The process is straightforward and requires both parties to provide specific information about the sale item, the transaction date, and their personal details.

- Gather all necessary information, including the full names and addresses of both the seller and the buyer, a detailed description of the item being sold (including make, model, year, and identification number, if applicable), and the sale price.

- Download a California Bill of Sale form from a reliable source. Make sure the form is current and tailored to the type of item you are selling.

- Enter the date of the sale at the top of the form. This ensures that the transaction is recorded with an accurate timestamp.

- Write down the seller's information, including their full name and address, in the specified section of the form.

- Fill in the buyer's details, such as their full name and address, in the designated area on the form.

- Provide a comprehensive description of the item being sold. Include any specific identifiers that can help prove the item's identity and condition.

- List the total sale price of the item. This should be the agreed amount between the buyer and the seller.

- Both the seller and the buyer must sign the Bill of Sale. Their signatures officially confirm the details of the transaction as recorded on the document.

- Date the form again next to the signatures to mark when the agreement was signed by both parties.

- Make copies of the completed Bill of Sale. Each party should keep a copy for their records.

Following these steps helps ensure the Bill of Sale is filled out thoroughly and accurately. This document serves as a key piece of evidence of the ownership transfer, which can be crucial for legal and tax purposes. Each step contributes to creating a clear and enforceable agreement between the buyer and the seller, establishing trust and safeguarding the interests of both parties.

Get Answers on California Bill of Sale

What is a California Bill of Sale form?

A California Bill of Sale form is a legal document that records the transfer of ownership of a personal property from a seller to a buyer. It serves as evidence of the transaction and includes important details such as the description of the property, purchase price, and the names and signatures of both parties involved.

Is a California Bill of Sale form required for all sales transactions?

No, a California Bill of Sale form is not required for all sales transactions. However, it is highly recommended for the transfer of valuable items or when specifically required by law, such as for the sale of vehicles or boats. Having this document can provide legal proof of the transaction and can be useful for tax purposes or any potential disputes in the future.

What details should be included in a California Bill of Sale?

A California Bill of Sale should include the date of the transaction, a detailed description of the item being sold (including make, model, year, and serial number if applicable), the sale price, the names and addresses of the seller and buyer, and signatures of both parties. It's also a good idea to include any warranties or agreements regarding the condition of the item.

Do both parties need to sign the California Bill of Sale form?

Yes, for the California Bill of Sale form to be considered valid, both the seller and buyer must sign the document. These signatures serve as an acknowledgment of the terms of the transaction by both parties and can help in safeguarding the legal rights of everyone involved.

How can one ensure the validity of a California Bill of Sale?

To ensure the validity of a California Bill of Sale, it should be completed in full and contain accurate information about the transaction and the parties involved. Both the buyer and seller should have a copy of the signed document. Although not always required, it may be beneficial to have the Bill of Sale notarized to further authenticate the document.

Common mistakes

Filling out a California Bill of Sale form is a critical step in the process of buying or selling property, but it's also a process where many people make mistakes. These errors can range from minor oversights to major issues that affect the legality of the transaction. Understanding these common pitfalls can help parties avoid them, ensuring a smooth and lawful transfer of ownership.

The first mistake is not providing complete information about the seller and the buyer. The form requires full legal names, addresses, and, in some cases, identification numbers. Leaving these sections incomplete or inaccurately filled can lead to questions about the legitimacy of the document, potentially causing issues in the ownership transfer process.

Another error is failing to accurately describe the item being sold. This description should include make, model, year, color, size, and any identifying numbers or marks. An incomplete or vague description may lead to disputes or confusion about what was actually sold, especially in cases where the item is not immediately transferred or is one of multiple similar items.

A third common mistake is not specifying the sale date and price. The date of sale establishes when the ownership changeover takes place, and the price is crucial for tax purposes. Without these details, legal ownership and responsibility for the item can be ambiguous, potentially leading to disputes or complications in the future.

People often overlook the necessity of including any warranties or "as is" statements. Clearly stating the condition in which the item is sold protects both the buyer and the seller. Without this clarification, the seller could be liable for problems that arise after the sale that they did not anticipate being responsible for.

Another frequent oversight is not obtaining signatures from all parties, including witnesses or notaries, if applicable. Signatures provide proof of the agreement and its terms, making the document a binding legal agreement. Failing to have the form properly signed can render it useless in resolving disputes or proving ownership.

Additionally, some individuals make the mistake of not checking state-specific requirements. California, like many states, may have particular stipulations, such as requiring a notary or additional documentation for certain types of sales. Ignorance of these requirements can result in the bill of sale not being recognized as a legal document.

Last but not least, not keeping a copy of the signed bill of sale is a mistake that can have serious repercussions. This document serves as a receipt and a legal record of the transaction. Without it, proving ownership or the terms of the sale can become nearly impossible, particularly in legal or tax-related matters.

Documents used along the form

In California, transferring ownership of personal property or a vehicle necessitates several documents in addition to the Bill of Sale form. These documents are designed to ensure a smooth transaction between buyer and seller and to fulfill legal requirements set by the state. Below, we explore some of these essential forms and their functions.

- Certificate of Title: This document proves ownership of the vehicle. It must be signed by the seller and given to the buyer.

- Odometer Disclosure Statement: Required for vehicles less than 10 years old, this form records the vehicle's mileage at the time of sale and is aimed at preventing odometer fraud.

- Release of Liability (Notice of Transfer and Release of Liability form): Sellers use this form to notify the Department of Motor Vehicles (DMV) that the vehicle has been sold, protecting them from liability for tickets or other violations.

- Smog Certification: In California, sellers must provide proof that the vehicle meets the state's emission standards, except in certain exempt cases.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): This form is used to document the transfer of ownership if the Certificate of Title does not have enough space for all the required information or signatures.

- Application for Duplicate or Transfer of Title (REG 227): This form is needed if the original Certificate of Title is lost, stolen, or damaged.

- Bill of Sale (REG 135): While the general Bill of Sale is useful, California's DMV also provides its own form (REG 135) to document the sale of a vehicle between private parties.

- Power of Attorney (POA): If either the buyer or seller cannot be present to sign the necessary documents, a POA allows another individual to act on their behalf.

- Car Buyer's Bill of Rights (FFVR 35): Not a form per se, but a document that details the rights of consumers when purchasing used vehicles from dealers.

- Temporary Operating Permit: This permit may be required if the vehicle is not currently registered or if the tags have expired, allowing the new owner to legally drive while registration is pending.

Understanding the purpose and requirement for each of these documents can significantly simplify the process of buying or selling a vehicle in California. Ensuring that all necessary paperwork is correctly completed and filed not only complies with state laws but also provides both parties with peace of mind during and after the transaction.

Similar forms

The California Bill of Sale form shares similarities with the Warranty Deed. Both documents serve as vital pieces in transferring ownership, but they operate in different arenas. The Bill of Sale is prevalent in personal property transactions, like selling a car or a piece of equipment, ensuring that the transaction is recorded and the ownership is officially transferred. Conversely, a Warranty Deed is used in real estate transactions. It guarantees that the seller holds a clear title to the property and has the right to sell it, safeguarding the buyer against future claims on the property.

Another document resembling the California Bill of Sale is the Promissory Note. This similarity lies in their function of formalizing agreements between parties. The Bill of Sale confirms the sale and transfer of an item, making it the buyer's property. On the other hand, a Promissory Note is used when one party promises to pay another party a definite sum of money at a specified time or on demand. While their purposes differ—one for the sale of items and the other for the promise of payment—they both legally bind parties to their commitments.

The Quitclaim Deed also shares characteristics with the California Bill of Sale, primarily in transferring rights or interests from one person to another. However, the Quitclaim Deed specifically deals with the transfer of titles, interests, or claims in real estate without guaranteeing the title's validity. It's often used among family members or to clear up title issues. In contrast, the Bill of Sale transfers ownership of personal property with or without warranties, depending on the agreement between buyer and seller.

The Sales Agreement is quite akin to the California Bill of Sale, as both are used to outline the terms of a transaction. The Sales Agreement, however, is more comprehensive, covering every aspect of the sale including payment plans, delivery details, warranties, and the duties of each party. This document is used for both personal property and real estate transactions, making it a broader tool for outlining the terms of a sale before it is finalized, whereas the Bill of Sale serves as proof of the transaction after the exchange has occurred.

Finally, the Loan Agreement shares a resemblance with the California Bill of Sale in that they are both contractual documents binding two or more parties to specific conditions. The Loan Agreement is used when one party borrows money from another, detailing the repayment schedule, interest rate, and collateral, if any. Though its focus is on the terms of a loan rather than a sale, like the Bill of Sale, it ensures that both parties understand their obligations and the terms of their agreement, providing a legal framework for resolution in case of disputes.

Dos and Don'ts

When filling out the California Bill of Sale form, it's important to understand the steps you should follow to ensure the document is legally binding and reflects the sale accurately. This guidance will help you avoid common mistakes and make the process smoother for both the seller and the buyer.

Things You Should Do

- Verify the accuracy of all provided information, including the full names and addresses of both parties involved in the transaction, as well as the specific details of the item being sold (such as make, model, year, and VIN for vehicles).

- Ensure that the date of the sale is clearly and correctly documented. This date should reflect when the transaction actually takes place.

- Clearly specify the selling price of the item and ensure that both the seller and the buyer agree on this amount. If the item is given as a gift, this should also be clearly stated, along with the relationship between the seller and the buyer.

- Both the seller and the buyer should sign and print their names on the form to validate the transaction. If possible, obtain signatures in the presence of a notary public to add an extra layer of authenticity.

- Retain copies of the completed form for both the buyer and the seller. Keeping a record is crucial for future reference, especially for tax purposes or any legal disputes that may arise.

- If the item is a vehicle, both parties must inform the California Department of Motor Vehicles (DMV) about the transaction. Failure to do so could result in legal complications for both the seller and the buyer.

Things You Shouldn't Do

- Do not leave any sections of the form blank. If a section does not apply, it is recommended to write “N/A” (not applicable) to indicate that you have reviewed the section and determined it's not relevant to your transaction.

- Avoid providing false or misleading information. All the details in the bill of sale should be accurate and truthful to the best of your knowledge.

- Don't forget to confirm the legal ownership of the item being sold. Transferring an item you do not legally own can lead to legal complications and may be considered fraud.

- Do not rely solely on verbal agreements. The bill of sale serves as a written document that protects both the buyer and the seller. It's essential to include all agreed-upon terms and conditions in the form.

- Refrain from erasing or making illegible changes. If corrections are necessary, it's best to start over with a new form to avoids confusion or disputes about the contract terms.

- Do not fail to check for any additional requirements from the California DMV, especially for vehicle sales, which might include smog certification, odometer disclosure, and transfer notice completion.

Misconceptions

When dealing with the California Bill of Sale form, several misconceptions often arise. Understanding these misconceptions is key to ensuring that the process of selling or buying personal property in California is handled correctly. Here, four common misunderstandings are addressed to clarify the use and requirements of the California Bill of Sale form.

- A Bill of Sale is not required in California. This is a common misconception. While California does not mandate a Bill of Sale for all personal property transactions, it is highly recommended. A Bill of Sale provides legal proof of the transfer of ownership and can be invaluable in resolving disputes or for tax and record-keeping purposes.

- The California Bill of Sale form must be notarized to be valid. Unlike some states, California does not require that a Bill of Sale be notarized. However, having it notarized can add an extra layer of security and authenticity to the document, serving as reassurance for both the buyer and the seller.

- There is a standard, state-issued Bill of Sale form for all transactions. Many believe that California provides a specific, standard Bill of Sale form for all types of personal property transactions. The truth is, while there are recommended formats, individuals can create their own Bill of Sale as long as it includes certain key information such as the names of the buyer and seller, a description of the item(s) sold, the sale price, and the date of the transaction.

- A Bill of Sale alone is enough to transfer the title of a vehicle. This is a critical misunderstanding. In California, while a Bill of Sale is an important part of the process, the title of a vehicle cannot be transferred without completing additional paperwork with the Department of Motor Vehicles (DMV). A Bill of Sale does not replace the need for a transfer of title but complements it by providing a record of the sale.

Clarifying these misconceptions can help sellers and buyers navigate the process of property transactions more smoothly and ensure that all legal requirements are met. It’s always advisable to consider consulting with a legal professional or the DMV for guidance specific to your situation.

Key takeaways

When considering the transfer of ownership of property in California, the Bill of Sale form serves as a critical document to finalize this process. By understanding the essentials of filling out and utilizing this form, parties can ensure a smooth and legally binding transaction. Here are five key takeaways to keep in mind:

- The California Bill of Sale form must include accurate information about the seller and the buyer, including full names, addresses, and identification details. This ensures that both parties are correctly identified and can be contacted if any issues arise post-sale.

- Description of the item being sold is crucial. Details such as make, model, year, color, size, and the serial number, if applicable, should be clearly mentioned. This prevents any future disputes regarding the specifics of the item transferred.

- The form should clearly state the sale amount, ensuring that the agreed-upon price is documented. This is important for both taxation purposes and for the protection of both parties, should any disagreement about the payment arise later.

- Both the seller and the buyer must sign and date the Bill of Sale. These signatures legally bind the document, signifying both parties' agreement to the terms of sale. Occasionally, a witness or a notary public may also be required to sign, further authenticating the transaction.

- Retaining a copy of the completed Bill of Sale is advisable for both the seller and the buyer. This document serves as a receipt and a legal record, proving ownership transfer and protecting both parties if any legal or financial disputes surface regarding the transaction.

Adhering to these guidelines when filling out and utilizing the California Bill of Sale form can help ensure that the process of transferring ownership of property is conducted smoothly and with due regard for the legal considerations involved.

Popular Bill of Sale State Forms

Bill of Sale Template Michigan - This form can act as an official record for tax purposes, proving the value and specifics of personal property sold.

How to Sell My Truck - By signing the Bill of Sale, both parties legally acknowledge the accuracy of the information and agree to the terms of the transaction.