Official Business Bill of Sale Document

When embarking on the complex journey of selling or purchasing a business, the pivotal document that ensures a smooth transition and provides a clear record of the sale is the Business Bill of Sale form. This crucial piece of documentation not only validates the transaction between the buyer and the seller but also meticulously details the assets included in the sale, whether they are tangible or intangible. The form serves as a legally binding confirmation of the deal, safeguarding both parties' interests by specifying the terms and conditions, the agreed-upon price, and the transfer of ownership rights. Furthermore, this document plays a significant role in the financial and tax implications post-sale, making it indispensable for accurately recording the transaction in both parties' books. By encompassing all elements essential to the sale of a business, the Business Bill of Sale form stands as a testament to the agreement reached, providing a foundation for future operations under new ownership.

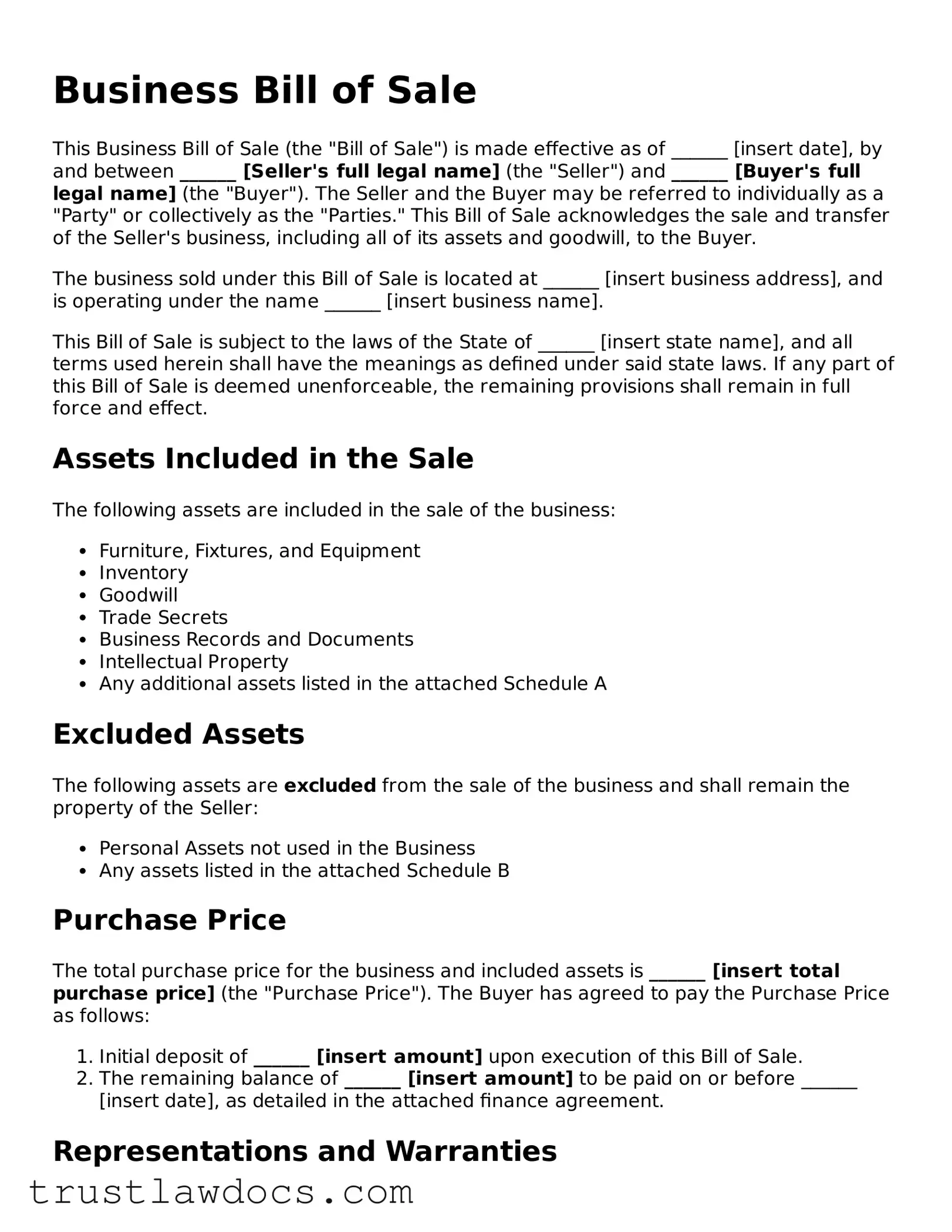

Form Example

Business Bill of Sale

This Business Bill of Sale (the "Bill of Sale") is made effective as of ______ [insert date], by and between ______ [Seller's full legal name] (the "Seller") and ______ [Buyer's full legal name] (the "Buyer"). The Seller and the Buyer may be referred to individually as a "Party" or collectively as the "Parties." This Bill of Sale acknowledges the sale and transfer of the Seller's business, including all of its assets and goodwill, to the Buyer.

The business sold under this Bill of Sale is located at ______ [insert business address], and is operating under the name ______ [insert business name].

This Bill of Sale is subject to the laws of the State of ______ [insert state name], and all terms used herein shall have the meanings as defined under said state laws. If any part of this Bill of Sale is deemed unenforceable, the remaining provisions shall remain in full force and effect.

Assets Included in the Sale

The following assets are included in the sale of the business:

- Furniture, Fixtures, and Equipment

- Inventory

- Goodwill

- Trade Secrets

- Business Records and Documents

- Intellectual Property

- Any additional assets listed in the attached Schedule A

Excluded Assets

The following assets are excluded from the sale of the business and shall remain the property of the Seller:

- Personal Assets not used in the Business

- Any assets listed in the attached Schedule B

Purchase Price

The total purchase price for the business and included assets is ______ [insert total purchase price] (the "Purchase Price"). The Buyer has agreed to pay the Purchase Price as follows:

- Initial deposit of ______ [insert amount] upon execution of this Bill of Sale.

- The remaining balance of ______ [insert amount] to be paid on or before ______ [insert date], as detailed in the attached finance agreement.

Representations and Warranties

The Seller represents and warrants that:

- They are the sole owner of the business and have the full authority to sell it.

- The business is free of all liens, charges, and encumbrances.

- All information related to the business provided to the Buyer is true and accurate to the best of their knowledge.

The Buyer represents and warrants that:

- They have the full authority to purchase the business.

- They have conducted due diligence to their satisfaction.

Signatures

By signing below, the Seller and Buyer agree to the terms set forth in this Business Bill of Sale.

__________________________________

Seller's Signature

______ [insert date]

__________________________________

Buyer's Signature

______ [insert date]

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The Business Bill of Sale form is a legal document that proves the transfer of ownership of a business from the seller to the buyer. |

| 2 | It lists the purchase price, date of sale, and details about the business being sold. |

| 3 | This form can include information about the assets being transferred, including physical and intellectual properties. |

| 4 | It often requires notarization to confirm the authenticity of the signatures of both parties involved. |

| 5 | A Business Bill of Sale serves as a receipt for the transaction for both the buyer and the seller. |

| 6 | This document may be required for tax purposes and to update business records at local or state agencies. |

| 7 | In states with specific requirements, the form must comply with local laws governing business sales. |

| 8 | Not all states have the same requirements for a Business Bill of Sale, so it's essential to check the laws in the state where the transaction occurs. |

| 9 | Using a state-specific form can help ensure that all legal bases are covered according to the governing law(s). |

How to Write Business Bill of Sale

When you're at the point of buying or selling a business, one crucial document you need is a Business Bill of Sale. This form serves as a legal record transferring ownership from the seller to the buyer, ensuring that the transaction is clear and undisputed. The process of filling it out correctly is straightforward but important for both parties involved. It involves providing detailed information about the sale, including the business being sold, the sale price, and the terms of the agreement. Here's how to fill out the Business Bill of Sale form step by step.

- Begin by entering the date of the sale at the top of the form. This establishes when the transaction officially takes place.

- Write the full legal names and contact information of both the seller and the buyer. These details are crucial for identifying the parties involved in the sale.

- Describe the business being sold. Include the business name, location, and a detailed description of what is being included in the sale, such as assets, inventory, and client lists. Be as specific as possible to avoid any confusion or disputes later on.

- State the total purchase price of the business. This should be the agreed-upon amount between the buyer and seller.

- Detail the payment terms. Specify whether the payment is made in full at the time of sale or if there will be installment payments. If installment payments are agreed upon, include the schedule, amounts, and due dates.

- Include any representations and warranties the seller is making about the business. This could include statements about the business's financial condition, any debts or liabilities, or legal disputes the business is involved in.

- List any conditions that must be met before the sale can be finalized. These could be requirements such as the buyer securing financing or the seller clearing any outstanding debts.

- Specify the governing law. Indicate which state's laws will govern the interpretation and enforcement of the terms of the sale.

- Both the buyer and seller must sign and date the form. Their signatures officially validate the agreement and the transfer of ownership.

After filling out the Business Bill of Sale form, it's essential to keep a copy for your records. This document is not only a receipt of the sale but also serves as proof of ownership for the buyer. For the seller, it confirms the fulfillment of their agreement to transfer the business and can be crucial in resolving any post-sale disputes. Remember, this form is a significant step in the process of buying or selling a business, ensuring transparency and protecting the rights of both parties.

Get Answers on Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the sale of a business from one party (the seller) to another (the buyer), detailing the agreement that the business has been sold and transferred. It serves as definitive proof of the purchase, outlining what was sold, the sale price, and the date of the transaction.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial because it legally documents the transaction, helping to protect both the buyer and the seller. It clarifies the terms of the sale, reduces the likelihood of misunderstandings, and provides a record that can be used for tax and accounting purposes. It may also be required by related state laws or financial institutions.

What should be included in a Business Bill of Sale?

A comprehensive Business Bill of Sale should include the business name, a detailed description of assets being sold (such as equipment, inventory, and customer lists), the sale price, the date of sale, and the names and signatures of both the buyer and the seller. It may also include payment terms and any representations or warranties.

Is a Business Bill of Sale the same as a bill of sale for personal property?

No, a Business Bill of Sale differs from a bill of sale for personal property because it specifically relates to the sale of an entire business or a substantial part of a business, including various assets and, sometimes, liabilities. In contrast, a personal property bill of sale typically involves individual items or personal goods.

Do I need a lawyer to create a Business Bill of Sale?

While you can prepare a Business Bill of Sale on your own, consulting with a lawyer is advisable to ensure that the document accurately reflects the agreement and complies with local laws. A lawyer can also provide advice on the sale process and help identify any potential legal issues.

How does a Business Bill of Sale affect the employees of the business?

The impact on employees can vary depending on the terms of the sale and the decisions of the new owner. The Business Bill of Sale itself may not directly address the status of employees, but related agreements or negotiations might determine whether employees are retained, laid off, or offered new positions under the new ownership.

Can a Business Bill of Sale be used for tax purposes?

Yes, the Business Bill of Sale can be an important document for tax purposes. It provides a record of the sale price and date, which are necessary for calculating capital gains tax, and can also be used to substantiate the value of the acquired assets for depreciation and other tax deductions.

What happens if a Business Bill of Sale is not used in a business sale?

Not using a Business Bill of Sale can lead to significant legal and financial risks, including disputes over the terms of the sale, difficulties in proving ownership, and possible tax complications. Without this document, it can be challenging to enforce the agreement or protect the rights and interests of both the buyer and the seller.

Common mistakes

When transferring ownership of a business or its assets, a Business Bill of Sale is a quintessential document that must be filled out with accuracy and completeness. Nonetheless, this process is susceptible to a variety of mistakes, borne out of confusion, misunderstanding, or a simple lack of attention to detail. Among the most common errors, the failure to provide a detailed description of the business assets being sold tops the list. This oversight not only leads to ambiguity but may also result in legal disputes over what was actually included in the sale. A well-drafted Bill of Sale should list all tangible and intangible assets, including but not limited to inventory, equipment, and intellectual property, leaving no room for interpretation.

Another frequent mistake is neglecting to verify the accuracy of information provided by both parties. This step is about more than just getting the names and addresses right; it ensures that each party is legally authorized to participate in the transaction. Mistakes in this area can lead to the sale being deemed invalid. For instance, if a party is not legally permitted to sell certain assets due to previous contractual agreements or if the buyer does not have the legal capacity to purchase, the sale could be void. Therefore, double-checking the legal standing and authority of all involved parties is not just a precaution; it's a necessity.

Omitting the sale's terms and conditions is an error that can have far-reaching consequences. This critical section of the Business Bill of Sale outlines the agreement’s specifics, including payment terms, warranties, and the transfer of liabilities. Skipping or glossing over these details can lead to misunderstandings or even litigation if one party feels the terms were not honored. To ensure a smooth transition and clear expectations, all terms and conditions must be explicitly stated, understood, and agreed upon by both the buyer and the seller.

Lastly, many people underestimate the importance of obtaining the proper signatures and notarization where required. A Business Bill of Sale needs to be signed by both parties to be legally binding. Moreover, some jurisdictions require this document to be notarized to confirm the identity of the signatories and protect against fraud. Failing to fulfill these requirements can invalidate the document, complicating or even nullifying the sale. It is advisable to check local laws to confirm whether notarization is needed and ensure all signatures are in place before considering the transaction complete.

In sum, a vigilant approach to documenting the sale of business assets can prevent legal headaches and safeguard the interests of both buyer and seller. By avoiding these mistakes, the parties can ensure the transaction’s legality and pave the way for a smooth transition of ownership.

Documents used along the form

When a business is being sold, several important documents, in addition to the Business Bill of Sale, are often necessary to ensure the transfer is legally binding and comprehensively recorded. The Business Bill of Sale serves as a key piece in this puzzle, marking the agreement between buyer and seller on the sale of the business assets. However, this document does not stand alone. Let's look at other forms and documents that are commonly used alongside the Business Bill of Sale to complete the transaction.

- Asset Purchase Agreement: This comprehensive agreement outlines the specific assets and liabilities being bought or sold. It serves as the main contract for the sale of the business, covering terms and conditions, payment agreements, and warranties.

- Non-Disclosure Agreement (NDA): Often used during the negotiation phase, an NDA protects confidential information shared between the buyer and seller. It helps safeguard trade secrets and proprietary information.

- Non-Compete Agreement: This agreement restricts the seller from starting a new, competing business within a specified geographic area for a certain period. It aims to protect the buyer's investment in the business.

- Warranties and Representations: Included either within the Asset Purchase Agreement or as a separate document, this outlines the seller's guarantees about the business and its assets, such as being free from undisclosed liabilities.

- Bill of Sale for Each Asset: For transactions where individual assets of the business are sold separately, a separate bill of sale for each major asset might be required to document the transfer legally.

- Employment Agreement(s): If the new owner plans to retain any of the existing staff, new employment agreements or contracts may be needed to outline terms under the new ownership.

- Lease Agreements: If the business operates out of leased premises, transferring these leases or negotiating new ones is crucial. This includes agreements for any equipment or vehicles that are leased as well.

Together with the Business Bill of Sale, these documents create a framework for the smooth transition of business ownership. They not only secure the legal interests of both parties involved but also help in clarifying the specific terms of the sale, from the grand scale of the operation down to the minutiae of daily operations. It's always recommended to seek professional legal advice when preparing and reviewing these documents to ensure all legal requirements are met and interests are protected.

Similar forms

The Business Bill of Sale form shares similarities with a Vehicle Bill of Sale in that both serve as proof of a transaction. The Vehicle Bill of Sale documents the transfer of ownership of a vehicle from the seller to the buyer, mirroring the function of the Business Bill of Sale for business assets. Both forms typically include information about the seller and buyer, a description of the item or business being sold, the sale price, and the date of sale, making them crucial for legal and record-keeping purposes.

Similar to the Equipment Bill of Sale, the Business Bill of Sale details the transfer of ownership of items, but the former is specifically for equipment. Like the Business Bill of Sale, the Equipment Bill of Sale includes information about the transaction, such as a description of the equipment, the sale price, and the parties involved. These documents are important for both parties to safeguard their interests and provide a record that the item has been legally transferred.

Another document similar to the Business Bill of Sale is the Warranty Deed, which is used in real estate transactions to transfer ownership of property from the seller to the buyer. Although the Warranty Deed is specific to real estate, it serves a similar purpose by providing a legal guarantee about the clear title of the property, paralleling how the Business Bill of Sale signifies the transfer of ownership of a business or business assets. Both documents legalize the transfer and protect the buyer's interests.

The Promissory Note is akin to the Business Bill of Sale as it documents an agreement between two parties. However, instead of detailing the sale of goods or assets, a Promissory Note outlines the terms for the borrowing of money, including repayment schedule, interest rate, and consequences for non-repayment. Both serve as legally binding agreements but differ in their subject matter - one for the sale of assets, the other for money lending.

The Quitclaim Deed, like the Business Bill of Sale, is involved in the transfer of ownership, but it is specifically used in real estate transactions. It transfers any ownership interest the grantor may have in the property without guaranteeing a clear title, making it less comprehensive than a Warranty Deed. Both documents facilitate the transfer of ownership rights, but they apply to different kinds of assets and offer different levels of protection to the buyer.

Non-Disclosure Agreements (NDAs) share a similarity with the Business Bill of Sale in their role in business transactions. An NDA is designed to protect sensitive information from being disclosed to unauthorized parties, commonly used during negotiations for a business sale to keep details confidential. While the Business Bill of Sale finalizes the sale of a business or its assets, an NDA protects the confidentiality of the information exchanged during the process.

The Asset Purchase Agreement is closely related to the Business Bill of Sale as it covers the sale and transfer of specific assets of a business. Unlike the Business Bill of Sale, which might document a single transaction, an Asset Purchase Agreement can include various terms and conditions of the sale, including warranties, representations, and covenants regarding the business's assets. Both documents are pivotal in transactions involving the sale of business assets, but the latter offers a more detailed contractual agreement.

Finally, the Partnership Agreement parallels the Business Bill of Sale in its application to business operations, particularly in how it governs the relationship between business partners. This document outlines the terms of the partnership, including the distribution of profits and losses, roles, and responsibilities of each partner. While the Business Bill of Sale facilitates the transaction of selling business assets, the Partnership Agreement structures the ongoing operation and management of a business, contributing to its smooth and efficient operation post-sale.

Dos and Don'ts

Filling out a Business Bill of Sale form accurately is crucial in documenting the sale and transfer of a business between a seller and a buyer. Here are some essential dos and don'ts to consider:

- Do provide complete details of both the buyer and seller, including names, addresses, and contact information, to ensure both parties are correctly identified.

- Do clearly describe the business being sold, including its name, location, and any significant assets or inventory included in the sale, to avoid any misunderstandings.

- Do specify the sale price and the terms of payment. This includes whether it's a lump sum or installment payments, as well as the dates when the payments are due.

- Don't leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) to indicate that it has been reviewed but is not relevant to this particular sale.

- Don't forget to include any warranties or guarantees being made about the business, or specify that the business is being sold "as is" if no warranties are provided.

- Don't sign the form without ensuring that both parties fully understand and agree to the terms. It's often advisable to have the document reviewed by legal professionals before proceeding.

Misconceptions

When it comes to transferring ownership of a business, the Business Bill of Sale form is central to the process. Despite its importance, there are several misconceptions surrounding its use and content. Below, these misunderstandings are addressed to ensure clarity and provide a significant grasp on the actual roles and implications of this document.

- It’s the Only Document Needed for Selling a Business: Many believe that a Business Bill of Sale is sufficient to finalize the transfer of a business. However, this form is just a piece of the puzzle. Transferring ownership typically requires additional documents, such as agreements on non-compete clauses, lease agreements, and more, to fully outline the sale’s terms and protect both parties.

- It Covers the Transfer of All Business Assets Automatically: A common misunderstanding lies in assuming that this form encompasses the transfer of all types of assets by default. The truth is, it specifically outlines the assets included in the sale, which can range from physical items to intellectual property. Each asset type to be transferred should be clearly specified to avoid future disputes.

- One Standard Form Fits All Businesses: There's no one-size-fits-all Business Bill of Sale. Each sale is unique, and the form should be tailored to fit the specific asset types, conditions, and agreements relevant to the transaction. Employing a generic form without customization can lead to significant legal vulnerabilities.

- No Need for Legal Assistance When Filling Out: While some might think they can navigate the paperwork alone, seeking legal advice is essential. Every business sale is complex, and the Bill of Sale is legally binding. Legal professionals can provide crucial insights, ensuring the document’s provisions protect all parties and comply with relevant laws.

- It Acts as Proof of Ownership: While serving as evidence of a transaction, the Business Bill of Sale by itself does not prove ownership. The complete transfer of rights often involves other forms and official documents. It's crucial for the new owner to secure and maintain these documents to comprehensively establish their ownership.

- Any Disputes Are Settled by the Bill of Sale Alone: Believing that this document can settle any dispute arising from the sale of a business is a mistake. While crucial, it's often just one piece of evidence among many in legal disputes. The terms outlined within, along with additional agreements and context, play critical roles in resolving conflicts.

Understanding these misconceptions can dramatically alter one’s approach to buying or selling a business, ensuring more secure and informed transactions. Always remember, the Business Bill of Sale is vital but it’s the accuracy, completeness, and legal integrity of all documents together that truly solidify a sales transaction.

Key takeaways

When it comes to buying or selling a business, the Business Bill of Sale form plays a crucial role. Here are several key takeaways to remember:

- A Business Bill of Sale serves as a legal document that records the sale of a business from one party to another, ensuring both the buyer and seller agree to the terms.

- It is essential to include detailed information about both parties involved in the transaction, including names, addresses, and contact information, to avoid any confusion.

- The form should thoroughly describe the business being sold. This includes not just the name and location, but also a detailed description of all assets and liabilities being transferred.

- Clear terms of the sale, including the sale price, payment method, and any other conditions or warranties, must be explicitly stated to protect both parties' interests.

- Both parties should agree on the closing date of the sale, which is when the ownership of the business officially changes hands. This date should be clearly indicated on the form.

- It's crucial to list any representations and warranties made by the seller to the buyer regarding the state of the business, ensuring the buyer knows exactly what they are purchasing.

- A Business Bill of Sale should also include any applicable non-compete clauses, preventing the seller from starting a new, competing business within a certain geographic area or time period.

- The signatures of both the buyer and the seller are required to validate the document. In some cases, witness signatures or a notary public may also be necessary.

- Finally, it's advisable to consult with legal counsel before the sale. They can provide invaluable guidance and ensure that all aspects of the sale comply with applicable laws and regulations.

By keeping these key takeaways in mind, both the buyer and seller can ensure a smooth transaction, securing their assets and interests in the process.

Consider More Types of Business Bill of Sale Forms

Free Bill of Sale Template for Car - Including the VIN (Vehicle Identification Number) on the form helps prevent fraud and confirms the vehicle's identity.

Cattle Bill of Sale Template - By detailing the transaction comprehensively, it ensures that all parties have a clear understanding of their commitments.

Mobile Home Clipart - Clarifies the condition of the mobile home at the time of sale, which can affect the final selling price and buyer's decision.