Free Articles of Incorporation Form for Texas

Starting a business in Texas marks an exciting journey towards entrepreneurship, with the Texas Articles of Incorporation form standing as one of the first critical steps in legitimizing a corporation within the state. This essential document requires careful completion as it officially registers the corporation with the Texas Secretary of State. It captures fundamental details about the business, such as corporate name, purpose, duration, registered agent information, initial board of directors, and the share structure, among others. Its importance cannot be overstated, as it not only grants legal identity to the corporation but also provides benefits like liability protection for its owners and eligibility for certain taxes and incentives. Completing the form accurately ensures a smooth registration process, facilitating a stable foundation from which the business can grow and operate within the regulatory framework of Texas law. As such, understanding each section of the form and its implications is crucial for entrepreneurs aiming for a successful launch of their corporation.

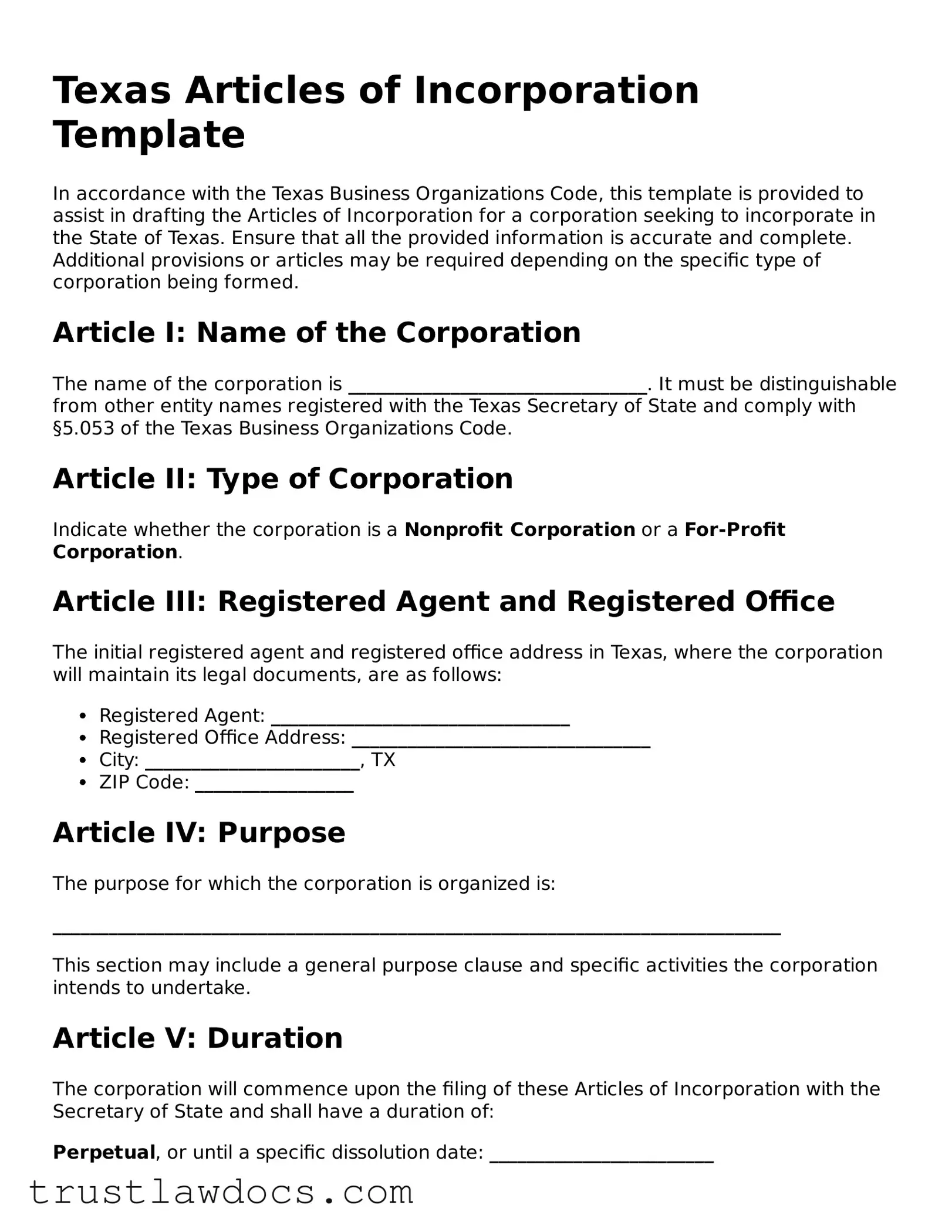

Form Example

Texas Articles of Incorporation Template

In accordance with the Texas Business Organizations Code, this template is provided to assist in drafting the Articles of Incorporation for a corporation seeking to incorporate in the State of Texas. Ensure that all the provided information is accurate and complete. Additional provisions or articles may be required depending on the specific type of corporation being formed.

Article I: Name of the Corporation

The name of the corporation is ________________________________. It must be distinguishable from other entity names registered with the Texas Secretary of State and comply with §5.053 of the Texas Business Organizations Code.

Article II: Type of Corporation

Indicate whether the corporation is a Nonprofit Corporation or a For-Profit Corporation.

Article III: Registered Agent and Registered Office

The initial registered agent and registered office address in Texas, where the corporation will maintain its legal documents, are as follows:

- Registered Agent: ________________________________

- Registered Office Address: ________________________________

- City: _______________________, TX

- ZIP Code: _________________

Article IV: Purpose

The purpose for which the corporation is organized is:

______________________________________________________________________________

This section may include a general purpose clause and specific activities the corporation intends to undertake.

Article V: Duration

The corporation will commence upon the filing of these Articles of Incorporation with the Secretary of State and shall have a duration of:

Perpetual, or until a specific dissolution date: ________________________

Article VI: Initial Directors

The initial board of directors shall consist of the following individuals, with their respective addresses:

- Name: ________________________________, Address: ________________________________

- Name: ________________________________, Address: ________________________________

- Name: ________________________________, Address: ________________________________

The number of directors may be changed in accordance with the bylaws of the corporation but must always comply with the minimum and maximum numbers set forth in the Texas Business Organizations Code.

Article VII: Incorporator

The name and address of the incorporator responsible for executing these Articles of Incorporation are:

Name: ________________________________

Address: ________________________________

Article VIII: Capital Structure

The corporation is authorized to issue the following types and amounts of shares:

Number of Shares: __________________, Class: __________________, Par Value (if any): __________________

Provide details on the rights, preferences, privileges, and restrictions assigned to each class or series of shares, if applicable.

Article IX: Supplemental Provisions

Include any additional provisions here, including but not limited to indemnification of officers and directors, pre-emptive rights to purchase shares, and any restrictions on transferring shares.

______________________________________________________________________________

Execution

By signing below, the incorporator affirms that the information provided in these Articles of Incorporation is true and correct to the best of their knowledge and believes it to be in compliance with the Texas Business Organizations Code.

Signature: __________________________________ Date: __________________

Note: This template is for informational purposes only and should not be considered as legal advice. It is recommended that you consult with an attorney to ensure compliance with all applicable laws and regulations.

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Texas Articles of Incorporation must be filed by entities wishing to incorporate in the state of Texas. |

| 2 | This form is governed by the Texas Business Organizations Code. |

| 3 | The filing fee for the Articles of Incorporation varies based on the type of corporation being established. |

| 4 | Submission of the form can be done online through the Texas Secretary of State website or by mail. |

| 5 | Information required includes the corporation's name, its purpose, registered agent and office, initial board of directors, and organizer's information. |

| 6 | The corporation's name must be distinguishable from other entities already registered with the Texas Secretary of State. |

| 7 | Designating a registered agent who has a physical address in Texas is compulsory for accepting legal documents on behalf of the corporation. |

| 8 | Including a provision for the indemnification of directors and officers in the Articles is optional but commonly practiced. |

| 9 | Once filed and approved, the Articles of Incorporation officially create the corporation as a legal entity separate from its founders. |

How to Write Texas Articles of Incorporation

Creating a corporation in Texas marks a significant milestone for any business owner, paving the way towards legal recognition and myriad benefits. However, the initial step in this journey involves properly completing and submitting the Texas Articles of Incorporation form. This document is crucial, as it provides the state with vital information about your corporation, including its name, purpose, and the individuals steering its course. To ensure a seamless process, follow these step-by-step instructions carefully.

- Begin by gathering all necessary information about your corporation. This includes the proposed name, principal office address, the corporation's purpose, and details concerning the board of directors and incorporator(s).

- Locate the official Texas Articles of Incorporation form. It's available for download from the Texas Secretary of State's website.

- Read the instructions provided on the form thoroughly before filling it out. This will help avoid common errors.

- Fill in the corporate name in the designated section. Ensure that the name complies with Texas state laws regarding corporate names.

- Specify the duration of the corporation, if it is not perpetual. Note that in Texas, corporations are presumed to have a perpetual duration unless stated otherwise.

- Enter the street address of the corporation's initial registered office and the name of the initial registered agent at that office.

- Provide the number of shares the corporation is authorized to issue and any information about the classes of shares or series.

- List the names and addresses of the initial board of directors.

- Include the name and address of the incorporator(s) who is preparing the form.

- Attach any additional provisions or statements that are necessary for your particular corporation. These might relate to the management of corporate affairs, pre-emptive rights to purchase new shares, or any limitations on directors' liability.

- Ensure the incorporator signs and dates the form. If there are additional incorporators, they must also sign.

- Review the completed form for accuracy and completeness. Mistakes or omissions can delay the process.

- Submit the form along with the required filing fee to the Texas Secretary of State. This can usually be done by mail, in person, or online, depending on your preference.

Once submitted, the Texas Secretary of State's office will review your Articles of Incorporation. If approved, your corporation will be officially registered in Texas, marking the beginning of a new, exciting chapter for your business. Be sure to keep a copy of the filed form for your records and be prepared for the next steps, such as obtaining necessary permits and licenses, drafting bylaws, and holding your first board of directors meeting. Congratulations on taking this significant step towards building your corporation!

Get Answers on Texas Articles of Incorporation

What are the Articles of Incorporation in Texas?

The Articles of Incorporation in Texas serve as a formal document required to legally establish a corporation within the state. This crucial document outlines the corporation's basic structure, including its name, purpose, the number of shares it is authorized to issue, the name and address of its initial registered agent, and the names of the incorporators. Upon approval by the Texas Secretary of State, it officially brings the corporation into existence and allows it to begin operating under Texas law.

How do I file the Articles of Incorporation in Texas?

Filing the Articles of Incorporation in Texas involves several steps. Initially, you must ensure that your desired corporation name is available and complies with Texas naming requirements. Next, you can complete the Articles of Incorporation form, which requires information such as the corporation's name, its purpose, stock details, and the contact information for the registered agent and incorporators. This form can be submitted either online through the Texas Secretary of State's website or by mail. Accompanying your form should be the filing fee, which varies depending on the corporation type. After submission, await the state's review and approval to confirm your corporation's legal formation.

Who needs to sign the Texas Articles of Incorporation?

The Texas Articles of Incorporation must be signed by one or more incorporators. Incorporators are individuals or entities responsible for executing the incorporation process. They do not need to be part of the future corporation's management or shareholders. The main role of the incorporator(s) after signing the Articles of Incorporation is to appoint the initial board of directors unless they have already been named in the document. Once the initial board is in place, the incorporators' responsibilities are typically considered complete.

What happens after the Texas Articles of Incorporation are filed?

After the Texas Articles of Incorporation are filed and approved, the corporation officially exists as a legal entity separate from its owners. The newly formed corporation must then comply with several subsequent requirements, such as holding an initial meeting of the board of directors, issuing stock certificates to the initial shareholders, and obtaining any necessary business licenses and permits. Additionally, it is important to apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Keeping up with ongoing legal obligations, including annual reports and tax filings, is crucial for maintaining the corporation's good standing with the state.

Common mistakes

Filling out the Texas Articles of Incorporation form is a crucial step for those looking to establish a corporation within the state. However, it is a process fraught with potential missteps that can delay or derail the endeavor. A common mistake is neglecting to provide a distinctive name that complies with Texas state regulations. The chosen corporate name must not only be unique but also must not resemble too closely to existing names so as to avoid confusion. Moreover, it should end with a corporate designator, such as "Inc." or "Corporation," which people often forget to include.

Another frequent oversight is not specifying the type of corporation intended. The form allows for the creation of both for-profit and nonprofit entities, and not clearly stating the selected type can lead to unexpected legal and tax implications. Additionally, failing to appoint a registered agent or not providing a valid physical address for this agent within Texas borders is a critical error. The registered agent acts as the corporation's legal representative in the state, and having an accurate address is essential for receiving important legal and tax documents.

Moreover, inaccuracies in stating the number of authorized shares can pose significant ramifications for the corporation’s structure and future funding. This figure represents the maximum amount of shares the corporation is allowed to issue, and miscalculating it can either limit the company’s growth or dilute ownership more than intended. Also, people often overlook the requirement to describe the corporation’s purpose, even though Texas law mandates that this information be clear and precise.

Additionally, the Articles of Incorporation form must be signed by an incorporator. However, it's not uncommon for individuals to mistakenly sign in the wrong section or use an unauthorized signature, such as that of a registered agent or director who has not been formally appointed as an incorporator. Relatedly, forgetting to include the necessary filing fee or submitting an incorrect amount can delay processing. The required fee is tied to the type of corporation being formed and must accompany the form submission.

Lastly, submitting the form without double-checking for completeness and accuracy is a prevalent error. Missing information, such as the effective date of incorporation or principal office address, can cause the form to be returned for corrections, further delaying the incorporation process. Similarly, disregarding the need for additional documents or approvals that may be required for specific types of corporations, like those intending to offer professional services, can obstruct the approval of the Articles of Incorporation.

Addressing these common mistakes during the preparation of the Texas Articles of Incorporation can streamline the process, prevent unnecessary delays, and ensure compliance with state requirements. Attention to detail and a thorough review of the form and supplementary materials are essential steps toward successful incorporation.

Documents used along the form

When starting a corporation in Texas, the process involves more than just the Articles of Incorporation. A range of other documents and forms are essential to ensure compliance with state requirements, facilitate the corporation's operations, and protect the interests of all parties involved. The following list gives an overview of some typical documents and forms that are frequently used alongside the Articles of Incorporation, providing a clearer picture for those navigating the incorporation process in Texas.

- Bylaws: A crucial document that outlines the corporation’s internal management structure, rules, and procedures. Bylaws govern how the corporation operates and lay out the rights and responsibilities of directors, officers, and shareholders.

- Initial Report: Some states require a newly incorporated entity to file an initial report after the Articles of Incorporation. This report typically includes basic information about the corporation, such as the names and addresses of directors.

- SS-4 Form: Used to apply for an Employer Identification Number (EIN) from the IRS. An EIN is necessary for tax purposes, opening a bank account, and hiring employees.

- Bank Resolution: A document needed to open a bank account in the name of the corporation. It authorizes specific individuals to act on behalf of the corporation in banking matters.

- Shareholder Agreement: Although not mandatory, this agreement among the shareholders outlines how the company will be operated and describes the shareholders’ rights and obligations.

- Stock Certificates: Physical evidence of ownership in the corporation. Each certificate indicates the number of shares owned by a shareholder.

- Operating Agreement: Mainly used for LLCs but sometimes relevant for corporations, especially if treated as an S-corp. This document details the operational and financial decisions of the business.

- Meeting Minutes: Written records of the discussions and decisions made during corporate meetings. Keeping minutes is a legal requirement and helps maintain corporate liability protections.

- DBA Registration Form: 'Doing Business As' (DBA) forms are required if the corporation operates under a name different from its legal name. It allows the public to identify the true owner of a business.

- State Tax Registration: Necessary for corporations to register for state taxes they are obligated to collect, such as sales tax or employer taxes.

These documents are foundational to a corporation's legal and operational framework in Texas. While the Articles of Incorporation establish the corporation, the accompanying forms and documents enable it to effectively operate, comply with legal obligations, and protect stakeholders' interests. As every corporation's situation is unique, it's advisable to consult with legal and financial professionals to determine which documents are required or recommended for your specific circumstances.

Similar forms

The Texas Articles of Incorporation form shares similarities with the Articles of Organization used in forming a Limited Liability Company (LLC). Both documents serve as the foundational legal paperwork for registering a new business entity with the state. They outline the basic information about the business, such as the name, purpose, principal office address, and the details of the registered agent. However, while the Articles of Incorporation are specifically for corporations, the Articles of Organization are used to establish an LLC.

Comparable to the Articles of Incorporation, the Bylaws of a Corporation are fundamental in establishing the internal rules and procedures for the operation of the corporation. Although the Bylaws don't need to be filed with the state, like the Articles of Incorporation do, they are crucial for outlining the governance of the corporation, detailing the roles of directors and officers, and setting the framework for shareholder meetings and voting processes.

The Operating Agreement of an LLC is somewhat akin to the Articles of Incorporation, though it is more comparable to corporate bylaws. It doesn't need to be filed with the state but it's essential for the internal management of the LLC. This document spells out the operational guidelines, ownership proportions, profit distributions, and management structure of the LLC, providing clarity and structure to its functioning.

DBA (Doing Business As) Registration Forms, while not establishing a separate business entity, bear resemblance to the Articles of Incorporation in that they are also filed with the state. These forms allow a business to operate under a name different from its legally registered name. This is particularly useful for branding purposes and is a common step for both newly formed corporations and other business types seeking to diversify their market presence.

Another similar document is the EIN (Employer Identification Number) Application. Although primarily a tax document filed with the IRS, not the state, it's a critical step following the filing of Articles of Incorporation. The EIN is necessary for the corporation to legally hire employees, open business bank accounts, and properly file taxes. In essence, it serves as the Social Security number for the corporation.

The Statement of Information, required in some states on a regular basis after the corporation is formed, aligns with the purpose of maintaining up-to-date public records about the business, similar to the aim of the Articles of Incorporation. This document typically includes current information about the corporation's directors, officers, and sometimes shareholders, ensuring the state and the public have accurate information about the corporation's leadership and contact details.

Lastly, the Certificate of Good Standing resembles the Articles of Incorporation in that it is a critical state-issued document affirming the corporation's compliance with state regulations and confirming its legal status to operate. While the Articles of Incorporation signify the beginning of a corporation's legal existence, the Certificate of Good Standing proves that the corporation has maintained its legal status and adhered to necessary regulatory requirements since its inception.

Dos and Don'ts

Filling out the Texas Articles of Incorporation is a significant step in establishing a corporation in the state. To ensure a smooth filing process, certain guidelines should be followed. Here are key dos and don’ts to keep in mind:

Do:- Read the instructions carefully: Before starting, thoroughly review the form's instructions to understand the requirements and the information you need to provide.

- Use the correct form: Ensure you are using the correct version of the Articles of Incorporation for the type of corporation you wish to establish.

- Provide accurate information: Double-check all the data you enter for accuracy. Mistakes can lead to unnecessary delays or rejection of your filing.

- Sign and date the form: An authorized person must sign the form. The signature indicates that the information provided is accurate and the signatory is authorized to submit the form.

- Keep a copy for your records: After submitting the form, keep a copy for your records. This is important for future reference and proof of filing.

- Consult with a professional: If you have any questions or uncertainties, consider consulting with a legal professional or an accountant. They can provide valuable guidance specific to your situation.

- Follow up on your submission: After submitting your Articles of Incorporation, follow up to ensure they have been accepted and processed. This can help identify and resolve any issues promptly.

- Leave fields blank: Do not leave any fields blank. If a section does not apply, fill in "N/A" or "Not Applicable" to indicate that you have reviewed the section.

- Use informal language: Avoid using informal language or abbreviations. The information provided should be formal, clear, and precise.

- Forget to include the filing fee: The filing process requires a fee. Failing to include the correct amount can delay processing your application.

- Ignore state-specific requirements: Each state, including Texas, has specific requirements for incorporating a business. Make sure you comply with all Texas-specific regulations.

- Rush through the form: Take your time filling out the form to avoid errors. Rushing can lead to omissions or mistakes that complicate the filing process.

- Assume registration provides complete protection: While registering your corporation provides certain legal protections, it does not make you immune to all legal obligations and liabilities. Understand the extent and limitations of the protection it offers.

- Overlook the need for bylaws: Although not submitted with the Articles of Incorporation, bylaws are essential for outlining the corporation’s internal management structure. Preparing them in advance can be beneficial.

Misconceptions

When it comes to filing the Texas Articles of Incorporation, a variety of misunderstandings can complicate the process for many. Clearing up these misconceptions is crucial for business owners aiming to establish their companies properly in the state of Texas. Below, we delve into six common fallacies and provide the correct information to guide you.

All businesses must file Articles of Incorporation. Many assume that this document applies to all business types. However, it's specific to corporations. Other business structures, like sole proprietorships and limited liability companies (LLCs), have different filing requirements. Texas requires LLCs to file a Certificate of Formation, not Articles of Incorporation.

Once filed, no further action is required. It's a common mistake to think that once the Articles of Incorporation are filed, there's nothing more to do. Actually, corporations must meet ongoing requirements such as annual reports, tax filings, and maintaining proper records to stay in good standing.

Filling out the form is straightforward and requires no legal advice. While it's possible to complete the form without legal assistance, overlooking legal nuances can lead to problems. Misclassification, misunderstanding the extent of liability protection, or selecting the wrong corporate structure can have long-term repercussions. Seeking advice from a legal professional is often a wise step.

The same form is used for profit and nonprofit corporations. Texas distinguishes between these with separate forms. Profit corporations must file one set of articles, while nonprofit organizations are required to submit a different set. Each form addresses the specific needs and legal requirements of the entity type.

Electronic filing isn't an option. Actually, Texas encourages electronic filing due to its efficiency. The Secretary of State's website offers an online submission tool, making it easier and faster to file your Articles of Incorporation, with an immediate issuance of a filing acknowledgment.

Articles of Incorporation protect your business name. While filing does provide some level of name protection in the state of Texas, it's not absolute. To ensure comprehensive protection of your business name, trademark registration is recommended. This goes beyond just the state level, offering broader protection against unauthorized use.

Key takeaways

Filling out the Texas Articles of Incorporation is a critical step towards establishing a corporation in the state. It's a document that officially registers your business with the government, marking the beginning of its legal life. Here are five key takeaways to ensure the process goes smoothly and your business sets off on the right foot:

- Complete All Required Information Accurately: The form requires detailed information about your corporation, including its name, the type of corporation it will be, the address where it will conduct business, and details about the shares of stock it is authorized to issue. It's imperative to double-check all entries for accuracy to avoid delays.

- Name Must Be Unique: Your corporation’s name must be distinguishable from other business names already registered in Texas. Conduct a thorough search through the Texas Secretary of State’s office to ensure your chosen name is available. This prevents any issues related to trademark or name disputes down the line.

- Designate a Registered Agent: A crucial part of the process involves appointing a registered agent who will be responsible for receiving legal documents on behalf of the corporation. The agent can be an individual residing in Texas or a business entity authorized to do business in Texas. Accurate designation is crucial for legal notices and correspondences.

- Understand the Role of Directors and Officers: While not all details about the corporation's directors and officers may be required on the initial form, it’s important to understand their roles and responsibilities as they will govern the corporation. They play a crucial role in decision-making and in fulfilling the legal obligations of the corporation.

- Keep Records and Amendments Up-to-Date: After filing, it is vital to maintain records of your corporation and file any necessary amendments with the Secretary of State. Changes in the corporation, whether they are in address, business activities, directors, or officers, must be officially updated. Regular compliance ensures the corporation remains in good standing.

Remember, the Articles of Incorporation are just the beginning. Running a corporation requires continuous adherence to legal and regulatory obligations. Proper initial filing and ongoing diligence lay the foundation for a successful business venture in Texas.

Popular Articles of Incorporation State Forms

Certificate of Corporation Ny - It specifies the duration of the corporation, whether it's perpetual or for a fixed term.

How Do I Get an Llc - It is a fundamental step in building a strong legal and operational foundation for the corporation’s future growth.