Free Articles of Incorporation Form for New York

Embarking on the journey of starting a new company in the state of New York involves navigating through several important steps, with one of the key milestones being the completion of the Articles of Incorporation form. This vital document lays the groundwork for the legal identity of a corporation, detailing essential information such as the company's name, purpose, initial office location, and the corporation's duration. The form also requires specifying the number of shares the company is authorized to issue, and the information about the incorporator(s) implementing an indispensable legal structure for the business. Furthermore, it includes provisions for designating a registered agent, who will handle all legal and official documents on behalf of the corporation. Understanding the nuances of this form and ensuring its accurate completion is paramount for establishing a solid foundation for the corporation's operational and legal future in New York. Hence, attention to detail and comprehension of the requirements can aid prospective business owners in avoiding common pitfalls and setting the stage for their company's success.

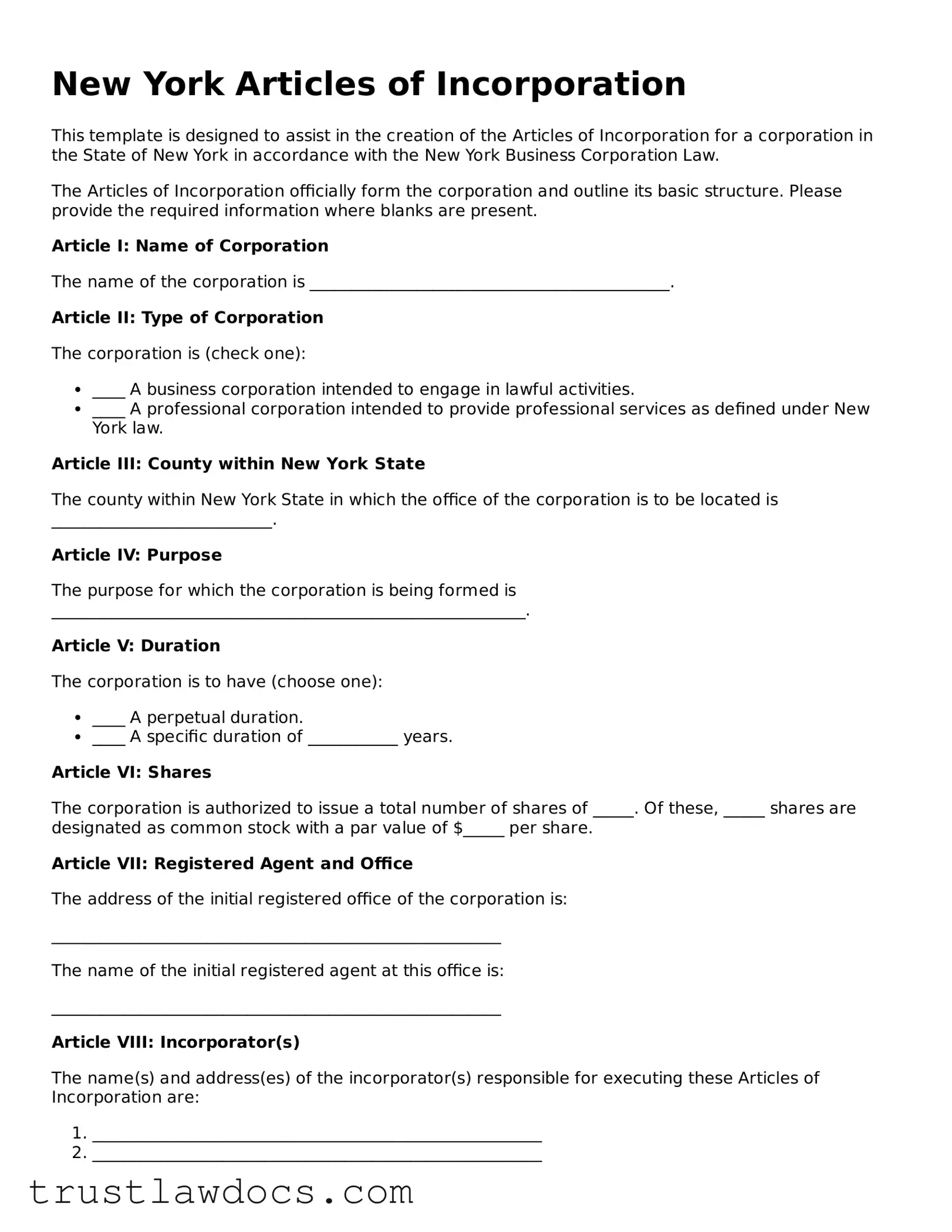

Form Example

New York Articles of Incorporation

This template is designed to assist in the creation of the Articles of Incorporation for a corporation in the State of New York in accordance with the New York Business Corporation Law.

The Articles of Incorporation officially form the corporation and outline its basic structure. Please provide the required information where blanks are present.

Article I: Name of Corporation

The name of the corporation is ____________________________________________.

Article II: Type of Corporation

The corporation is (check one):

- ____ A business corporation intended to engage in lawful activities.

- ____ A professional corporation intended to provide professional services as defined under New York law.

Article III: County within New York State

The county within New York State in which the office of the corporation is to be located is ___________________________.

Article IV: Purpose

The purpose for which the corporation is being formed is __________________________________________________________.

Article V: Duration

The corporation is to have (choose one):

- ____ A perpetual duration.

- ____ A specific duration of ___________ years.

Article VI: Shares

The corporation is authorized to issue a total number of shares of _____. Of these, _____ shares are designated as common stock with a par value of $_____ per share.

Article VII: Registered Agent and Office

The address of the initial registered office of the corporation is:

_______________________________________________________

The name of the initial registered agent at this office is:

_______________________________________________________

Article VIII: Incorporator(s)

The name(s) and address(es) of the incorporator(s) responsible for executing these Articles of Incorporation are:

- _______________________________________________________

- _______________________________________________________

Additional Provisions

If there are any additional provisions to be included in the Articles of Incorporation, please add them here:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

Add more lines as necessaryIn witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ______ day of _______________, _______.

_______________________________________________________

Signature of Incorporator

_______________________________________________________

Printed Name of Incorporator

Duplicate signature lines as necessary for additional incorporatorsPDF Form Details

| Fact | Description |

|---|---|

| Basic Requirement | The New York Articles of Incorporation form is a necessary document for establishing a corporation in New York State. |

| Governing Law | These documents are governed by the New York Business Corporation Law. |

| Form Usage | It is used to legally create a corporate entity in New York. |

| Information Required | The form requires information such as the corporation's name, purpose, office location, and information about directors and incorporators. |

| Filing Method | Articles can be filed online or by mail with the New York Department of State. |

| Fee Involved | There is a fee to file the Articles of Incorporation, which varies based on several factors including the corporation type and services selected. |

| Additional Requirements | Beyond the Articles of Incorporation, corporations may need to file additional documents or notices with the state or local government, depending on their activities and location. |

How to Write New York Articles of Incorporation

Filling out the New York Articles of Incorporation is an essential step for registering a corporation in New York. This legal formality is the foundation of your company's legal existence, defining its identity, purpose, and adherence to state regulations. Carefully completing this document ensures your corporation is compliant from the start, paving the way for a stable legal and operational structure. Below are the steps you need to follow to accurately fill out this form.

- Enter the proposed corporate name, ensuring it meets New York state requirements and includes an appropriate corporate designator such as "Inc." or "Corporation".

- Specify the county within New York where the corporation will be located. This helps determine the appropriate jurisdiction for legal and regulatory purposes.

- Describe the purpose for which the corporation is being formed. New York law requires a specific and lawful purpose to be stated.

- State the total number of shares the corporation is authorized to issue. This includes defining if there are different classes of shares and their characteristics.

- Provide the address of the corporation's initial registered office and the name of its initial registered agent at that office. This is necessary for receiving legal and official communications.

- List the names and addresses of the incorporator(s) responsible for executing the Articles of Incorporation. Incorporators are typically the individuals initiating the corporation's formation.

- Indicate the duration of the corporation if it is not intended to be perpetual. This is optional and applies if the corporation is established for a limited time.

- Detail the names and addresses of the initial directors who will serve until the first annual meeting of shareholders or until their successors are elected and qualified.

- Include any additional provisions necessary for the operation of the corporation that are not inconsistent with New York law. This may cover internal governance rules, shareholder rights, or specific operational practices.

- Sign and date the form in the designated area. The incorporator(s) must sign the form, indicating their agreement to form the corporation under the laws of New York State.

After completing these steps, review the document for accuracy and completeness. Submit the Articles of Incorporation, along with any required filing fee, to the New York State Department of State. Following submission, await confirmation that the state has accepted and filed your Articles of Incorporation, recognizing your corporation's legal formation. Keep a copy of the filed Articles and any correspondence for your records, marking the beginning of your corporate entity's legal obligations and protections.

Get Answers on New York Articles of Incorporation

What are the Articles of Incorporation in New York?

The Articles of Incorporation, in the context of the state of New York, are a set of formal documents filed with the Department of State to legally establish a corporation. This document outlines key aspects of the corporation, such as its name, purpose, office location, duration, and information about shares and incorporators. It serves as a foundational charter for the corporation in New York State law.

Who needs to file the Articles of Incorporation in New York?

Any group of individuals who wish to form a corporation in New York must file the Articles of Incorporation. This applies to both for-profit businesses and non-profit organizations that seek to have a corporate structure. Filing this document is an essential step in legally recognizing the entity as a corporation under New York law.

Where do I file the Articles of Incorporation in New York?

The Articles of Incorporation for a New York-based corporation must be filed with the New York Department of State, Division of Corporations. Filers can submit their documents through mail, in person, or for certain filings, online. The Division of Corporations serves as the official record keeper for corporate filings in the state.

What is required to complete the Articles of Incorporation form?

To complete the Articles of Incorporation form for New York, several pieces of information are required: the corporation's name (which must be distinguishable from other entities registered in New York), its corporate purpose, the county within New York where the office will be located, the total number of shares the corporation is authorized to issue, and the names and addresses of the incorporators. Additionally, the registered agent's information, who will receive legal notices on behalf of the corporation, must be included.

How much does it cost to file the Articles of Incorporation in New York?

The filing fee for the Articles of Incorporation in New York varies depending on the type of corporation being established and the number of shares it is authorized to issue. Generally, the minimum filing fee starts at a certain amount for corporations with an authorization to issue stock up to an initial specified number of shares, with additional fees applied for corporations authorized to issue more than that number. It is advisable to consult the New York Department of State's current fee schedule for the most accurate and up-to-date information.

Common mistakes

One common mistake people make when filling out the New York Articles of Incorporation form is not providing the precise legal name of the corporation. The legal name must include a corporate designation such as "Inc.," "Incorporated," "Corporation," or an abbreviation of one of these. This is crucial because it legally distinguishes the corporation from other entities and individuals. Failing to correctly format the name can lead to issues with the state's acceptance of the filing.

Another error involves the corporate purpose clause. Often, individuals are either too vague or overly specific about the purpose of their corporation. New York law requires that the purpose be stated clearly enough to identify the business activities. However, being overly specific can unintentionally limit the corporation's activities. A well-crafted purpose clause provides flexibility while staying within legal boundaries.

The appointment of the registered agent is another step that is frequently mishandled. The registered agent acts as the corporation's legal representative for receiving official state correspondence, including legal documents. Some people mistakenly believe they can leave this section blank or nominate an entity without the legal capacity to serve in this role. A registered agent must be a resident of New York or a corporation authorized to conduct business in New York.

Incomplete or incorrect designation of initial directors is yet another common error. The Articles of Incorporation must include the names and addresses of the initial directors who will serve until the first annual meeting of shareholders. Sometimes, individuals either omit this information or provide incomplete details, which can delay the processing of the form. The board of directors plays a fundamental role in the governance of the corporation, so this section is critical.

Failing to properly outline the share structure is also a frequent issue. The form requires specifics about the number and type of shares the corporation is authorized to issue. This part of the form sets the foundation for the corporation's ownership structure. Mistakes here, such as not designating different classes of shares when intended, can lead to future legal and operational complications.

Lastly, many overlook the importance of the incorporator’s statement. This section must be correctly filled out, with the incorporator(s) providing their signature(s) and date of signing. The incorporator, who may be an individual or a legal entity filing the Articles of Incorporation, must ensure that all information provided is accurate and complete. Overlooking or inaccurately completing this section can invalidate the entire document, leading to delays in the incorporation process.

Documents used along the form

When forming a corporation in New York, the Articles of Incorporation serve as a foundational document, but they are just one piece of the larger legal and compliance puzzle. To effectively establish and operate a corporation within this jurisdiction, several other forms and documents are often required throughout the process. Each document plays a critical role in ensuring that the corporation is legally compliant, structured according to the founders' wishes, and prepared for various business scenarios. Below is a list of documents commonly used alongside the New York Articles of Incorporation that help shape the broader framework of a corporation's legal identity and operational blueprint.

- Bylaws: These internal rules govern the corporation's operations, including procedures for meetings, electing officers and directors, and other corporate governance matters. Bylaws are essential for outlining the day-to-day rules that will guide the corporation.

- Operating Agreement: Although more commonly associated with Limited Liability Companies (LLCs), some corporations opt to draft an Operating Agreement to establish the financial and working relationships between business owners in more detail.

- Shareholder Agreement: This document outlines the rights and obligations of the shareholders, including transfer of shares, resolution of disputes, and processes for making major business decisions. It supplements the bylaws in governing the corporation’s affairs.

- Board Resolutions: Written records of decisions made by a corporation's board of directors are crucial for documenting the board's actions and providing evidence of authorized corporate actions.

- Stock Certificates: These certificates serve as a physical representation of share ownership in the corporation, detailing the number of shares owned by the shareholder.

- Employer Identification Number (EIN) Application Form (IRS Form SS-4): To hire employees, open a business bank account, and for various other purposes, corporations need an EIN, obtained by filing Form SS-4 with the Internal Revenue Service.

- Business Licenses and Permits: Depending on the nature and location of the business, various local, state, and federal licenses and permits may be required to lawfully operate the corporation.

- Foreign Qualification Documents: If a corporation formed in New York plans to do business in other states, it must file for foreign qualification in those states to be recognized as a legal entity there.

- Annual Reports: New York and most other states require corporations to file annual reports to maintain good standing within the state. This report typically updates the state on key information about the corporation.

- Minutes of Meetings: Keeping detailed records of what transpires during meetings of the corporation's shareholders and board of directors is critical for legal compliance and maintaining corporate formalities.

Collectively, these documents complement the Articles of Incorporation, providing a comprehensive framework for the operational, financial, and legal structure of the corporation. Together, they ensure that the corporation not only complies with all legal requirements but also operates smoothly and according to the specific intentions of its founders and stakeholders. It's important for individuals forming a corporation in New York to familiarize themselves with these documents to ensure a solid foundation for their business endeavors.

Similar forms

The New York Articles of Incorporation form shares similarities with the Certificate of Formation, commonly used in limited liability companies (LLCs) across various states. This document, like the Articles of Incorporation, establishes the legal existence of an LLC. It outlines fundamental information such as the company name, purpose, duration, and the address of its principal office. While differing in the entity type they create, both documents serve the primary function of registering the business with the state authorities, marking the legal beginning of the corporation or LLC.

Another related document is the Bylaws or Operating Agreement, which, although not filed with the state, plays a vital role within the internal governance of corporations and LLCs, respectively. These documents outline the rules and procedures for conducting business, holding meetings, electing officers and directors, and other essential corporate governance matters. While the Articles of Incorporation register the business entity with the state, Bylaws and Operating Agreements govern its day-to-day operations and decision-making processes, establishing a clear framework within which the entity operates.

The DBA (Doing Business As) filing, also known as the Assumed Name Certificate, bears resemblance to the Articles of Incorporation in that both are formal documents filed with state or county agencies. A DBA filing is necessary for businesses intending to operate under a name different from the one registered with the state, which allows companies flexibility in branding and marketing. Similar to the Articles of Incorporation, a DBA filing provides legal recognition for the business under its chosen trade name, albeit without creating a separate legal entity.

Similarly, the Employer Identification Number (EIN) application form (IRS Form SS-4) is essential for new corporations and shares a functional similarity with the Articles of Incorporation. An EIN is a federal tax identification number for a business, necessary for tax filing, opening a bank account, and hiring employees among other activities. While the Articles of Incorporation establish the corporation's legal identity within the state, obtaining an EIN recognizes the corporation as a taxable entity at the federal level, making it a crucial step for operational legality in the United States.

The Statement of Information or Annual Report is another document akin to the Articles of Incorporation, required by many states on a periodic basis post-incorporation. This document updates or confirms the company's critical information, such as addresses, directors, and officers, ensuring that the state has current data on the corporation. Though it is filed after incorporation and on a recurring basis, it complements the Articles of Incorporation by keeping the corporation's public record accurate and up-to-date, facilitating transparency and compliance.

Lastly, the Application for Authority is a document similar to the Articles of Incorporation but is for corporations formed outside of New York that wish to do business within New York state. This foreign corporation application parallels the Articles of Incorporation in its purpose to grant legal recognition and operational permission within a new jurisdiction. The form typically requires information about the corporation, such as its name, home state, date of incorporation, and New York office location, solidifying the corporation’s legal footprint in multiple states.

Dos and Don'ts

When filing the Articles of Incorporation in New York, there are crucial steps to follow and common pitfalls to avoid ensuring the process goes smoothly. Here's a comprehensive guide to help individuals and businesses navigate this important document submission.

- Do double-check the availability of your business name in New York before filing to ensure it isn't already in use or too similar to an existing name.

- Don't overlook the requirement to specify the county within New York where your corporation will be based, as this detail is essential for legal and mailing purposes.

- Do provide a specific purpose for your corporation; vague descriptions may not meet New York State Department of State standards.

- Don't forget to include the number of authorized shares the corporation is allowed to issue, as this information is necessary for the state to process your incorporation properly.

- Do select a registered agent who has a physical address in New York. This agent will handle official documents and legal notices on behalf of your corporation.

- Don't assume all information is correct without reviewing your form for accuracy and completeness. Errors or omissions can delay the processing of your Articles of Incorporation.

- Do sign and date the form as instructed. An unauthorized or missing signature can invalidate your submission.

- Don't disregard the specific filing fees required by the New York State Department of State. Incorrect or incomplete payment can lead to a rejection of your filing.

- Do consider consulting with an attorney or a professional service familiar with New York corporate laws to ensure your Articles of Incorporation comply with all legal requirements.

- Don't submit your Articles of Incorporation without making copies for your records. Having a backup can be invaluable for reference or in case of disputes.

Filling out the New York Articles of Incorporation with care and attention to detail is vital for establishing your corporation legally and effectively. By following these guidelines, you can increase the likelihood of a smooth and successful filing process.

Misconceptions

There are several misconceptions surrounding the New York Articles of Incorporation form. It's important to have a clear understanding to ensure the process of incorporating a business in New York is smooth and accurate. Below are eight common misconceptions explained:

- Filing is optional for doing business. Many believe that filing the Articles of Incorporation is optional. In reality, it's a mandatory step for any corporation wanting to legally conduct business within New York State.

- It's a one-time requirement. While filing the Articles of Incorporation is indeed a foundational step, it's not the only requirement. Corporations must also file annual reports and maintain compliance with state regulations to remain in good standing.

- The process is complicated and time-consuming. Many potential business owners are deterred, believing the process is overly complex. However, New York has streamlined the filing process, and assistance is available, making it more accessible than perceived.

- It's an immediate approval process. Some assume that once the Articles of Incorporation are submitted, the corporation is instantly recognized. The reality is that the approval process can take time, varying based on the current workload of the Secretary of State's office.

- Personal information is heavily exposed. Concerns often arise about the amount of personal information required on these forms. New York State requires specific details but also has measures in place to protect personal information from unnecessary exposure.

- A lawyer is required to file. While legal advice can be beneficial, especially in complex cases, it's not a requirement to have a lawyer to file the Articles of Incorporation. Many businesses successfully complete the process on their own or with minimal assistance.

- It guarantees trademark protection. Completing the Articles of Incorporation establishes a corporation in New York, but it does not inherently protect any trademarks. Trademark protection requires a separate process at the state or federal level.

- There are hidden fees involved. The concern about unexpected costs can be daunting. While there are filing fees associated with the Articles of Incorporation, New York State provides a schedule of these fees upfront, allowing companies to budget accordingly without fear of hidden charges.

Understanding these misconceptions helps in navigating the incorporation process with confidence, ensuring that businesses comply with New York State regulations and are set up for success from the start.

Key takeaways

When it comes to filing the Articles of Incorporation in New York, it's important to approach the process with care and diligence. Understanding the key takeaways can streamline the process, ensure compliance with state requirements, and lay a solid foundation for your corporation's legal structure. Here are eight key takeaways for anyone looking to navigate this crucial step in their business journey:

- Choose an appropriate name for your corporation. The name must be unique and not easily confused with any other business name already on file with the New York Department of State. It should also include a corporate designator such as "Inc.", "Corporation", "Incorporated", or an abbreviation of these terms.

- Designate a registered agent. The registered agent acts as the corporation's official liaison with the state, responsible for receiving legal documents on behalf of the corporation. This agent must have a physical address in New York State where they can be reached during normal business hours.

- Specify the corporation’s purpose. Clearly stating the primary business purpose is required for clarity and legal reasons. The purpose must comply with New York state law for the corporation to be approved.

- Determine the stock structure. If your corporation will have stock, you'll need to specify the number of shares the corporation is authorized to issue and, if applicable, the classes of stock and any preferences, rights, and limitations of each class.

- Identify the incorporators. The incorporator(s) sign and file the Articles of Incorporation. Information required includes names and addresses. They are responsible for ensuring the document is correctly executed according to New York State law.

- Include any additional necessary attachments. Depending on the nature of your business, additional attachments may be necessary. For example, specific businesses may need to attach approval from regulatory bodies relevant to their industry.

- File with the correct fee. There is a filing fee associated with the Articles of Incorporation in New York. Ensure that you are aware of the current fee and include it with your filing. Fees can vary based on the corporation type and other factors.

- Keep a copy for your records. After filing, ensure you keep a copy of the filed Articles of Incorporation for your records. This document is a fundamental part of your corporate records and will be needed for various legal and business processes in the future.

Following these guidelines will help to ensure that the process of filing your Articles of Incorporation in New York is as smooth and efficient as possible, setting your corporation up for success from the very beginning.

Popular Articles of Incorporation State Forms

Texas Llc Yearly Fees - Upon approval, the corporation receives a certificate of incorporation, officially marking its legal commencement of business activities.

Michigan Llc Online - This form is a declaration of a corporation's intent to comply with the laws and regulations of the state in which it is being incorporated, and possibly its operational footprint in other states or territories.

Fl Sunbiz - Provisions regarding recordkeeping requirements ensure the corporation maintains essential documents and meets reporting standards.

How Do I Get an Llc - Filing this form is the first step in establishing a corporate business structure, offering liability protection to owners.