Free Articles of Incorporation Form for Michigan

Starting a corporation in Michigan demands attention to several critical steps, with one of the most important being the completion of the Articles of Incorporation form. This document serves as the foundation for your business's legal structure, officially embedding your corporation's existence into state records. It asks for essential information about your corporation, including the name, purpose, registered agent, share structure, and incorporator details. Understanding each section is crucial to ensure compliance with state law and avoid common pitfalls that can delay your business launch. Additionally, filing this form correctly sets the stage for your corporation's future governance and operational procedures, laying down the groundwork for a smooth registration process with the Michigan Department of Licensing and Regulatory Affairs. Navigating this form can seem daunting, but with careful preparation, it marks the exciting start of your corporate journey.

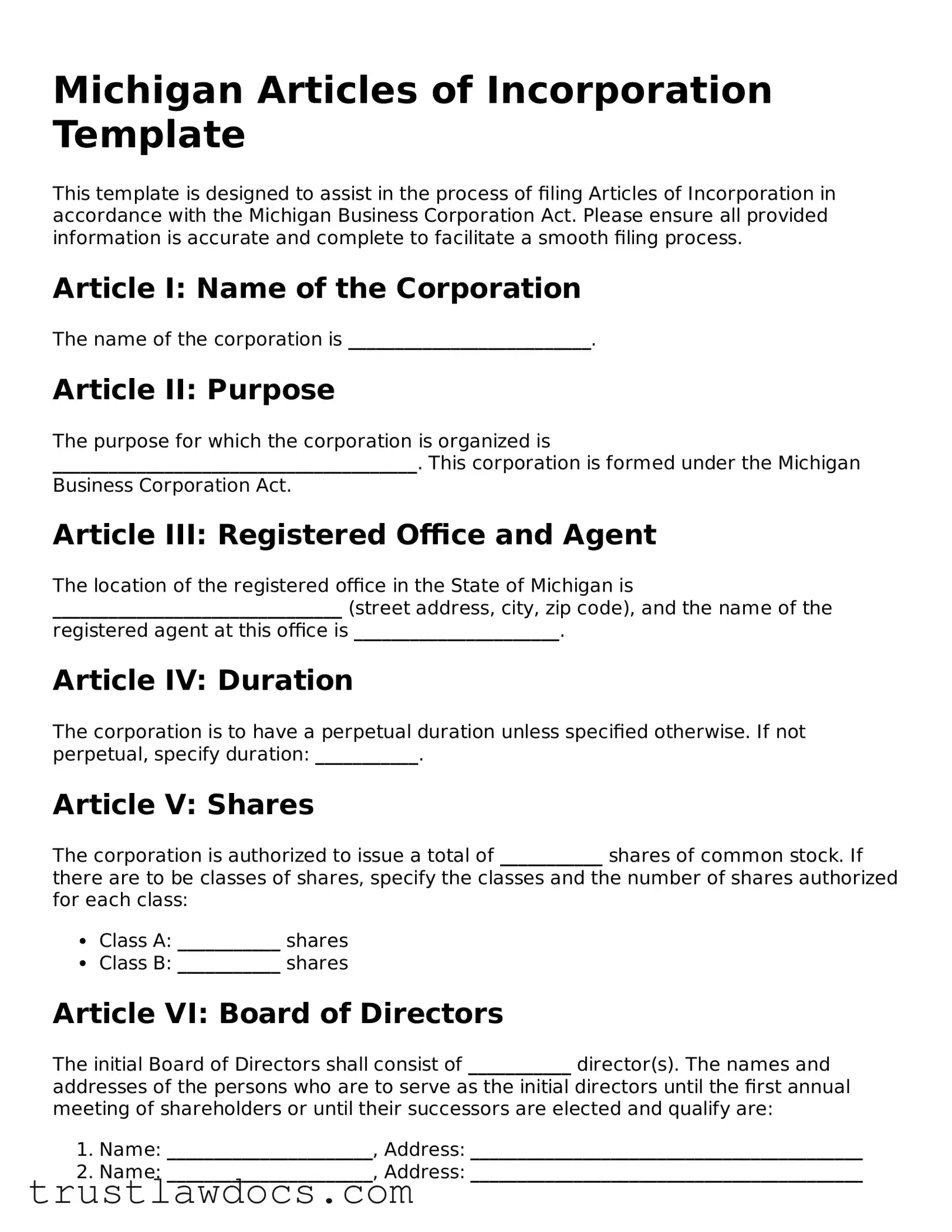

Form Example

Michigan Articles of Incorporation Template

This template is designed to assist in the process of filing Articles of Incorporation in accordance with the Michigan Business Corporation Act. Please ensure all provided information is accurate and complete to facilitate a smooth filing process.

Article I: Name of the Corporation

The name of the corporation is __________________________.

Article II: Purpose

The purpose for which the corporation is organized is _______________________________________. This corporation is formed under the Michigan Business Corporation Act.

Article III: Registered Office and Agent

The location of the registered office in the State of Michigan is _______________________________ (street address, city, zip code), and the name of the registered agent at this office is ______________________.

Article IV: Duration

The corporation is to have a perpetual duration unless specified otherwise. If not perpetual, specify duration: ___________.

Article V: Shares

The corporation is authorized to issue a total of ___________ shares of common stock. If there are to be classes of shares, specify the classes and the number of shares authorized for each class:

- Class A: ___________ shares

- Class B: ___________ shares

Article VI: Board of Directors

The initial Board of Directors shall consist of ___________ director(s). The names and addresses of the persons who are to serve as the initial directors until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: ______________________, Address: __________________________________________

- Name: ______________________, Address: __________________________________________

Article VII: Incorporator(s)

The name(s) and address(es) of the incorporator(s) responsible for executing these Articles of Incorporation are:

- Name: ______________________, Address: __________________________________________

Article VIII: Bylaws

The initial bylaws of the corporation shall be adopted by the Board of Directors at their first meeting. The power to alter, amend, or repeal the bylaws or adopt new bylaws, subject to repeal or change by action of the shareholders, is granted to the Board of Directors.

Article IX: Indemnification

The corporation may indemnify any officer, director, employee, or agent to the fullest extent permitted by the Michigan Business Corporation Act or any other applicable laws.

Statement of Acceptance

By signing below, the incorporator(s) acknowledge that all the information provided in these Articles of Incorporation is true and correct to the best of their knowledge and believe that they are in compliance with the Michigan Business Corporation Act.

Date: ______________________

Incorporator's Signature: ________________________________

Printed Name: ___________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Articles of Incorporation are governed by the Michigan Business Corporation Act, specifically Act 284 of 1972. |

| Purpose Declaration | The form requires specifying the corporation's purpose, though a general purpose clause is acceptable under Michigan law. |

| Share Information | Details about the classes and series of shares must be included, as well as the rights and preferences associated with each. |

| Registered Agent Requirement | A registered agent with a physical address in Michigan must be named on the form, acting as the corporation's official point of contact. |

How to Write Michigan Articles of Incorporation

Filing the Articles of Incorporation is a critical step in officially establishing a corporation in the state of Michigan. This document outlines the basic information about your corporation, such as its name, purpose, and structure, and is required to legally operate. The process may seem daunting at first, but breaking it down into manageable steps can make it more approachable. Following the steps closely ensures that your corporation complies with Michigan state law from the very start.

- Identify the Corporation Name: The name must be unique and adhere to Michigan's naming requirements. It typically must include an identifier such as "Corporation," "Incorporated," "Limited," or an abbreviation.

- Specify the Purpose: Clearly state the purpose for which the corporation is being formed. Michigan allows corporations to be formed for any lawful purpose.

- Name the Registered Agent: Designate a registered agent who has a physical address in Michigan. This agent will receive official and legal documents on behalf of the corporation.

- Detail the Share Structure: Indicate the number of shares the corporation is authorized to issue, and if there are multiple classes of shares, provide the rights and preferences of each class.

- Provide Incorporator Information: List the name and address of the incorporator(s) – the person(s) responsible for executing the Articles of Incorporation.

- Include Additional Provisions: If needed, add any other provisions that are not inconsistent with state law and are necessary for the corporation's operation and governance.

- Prepare and Sign the Document: Once all the necessary information has been filled in, review the document for accuracy. The incorporator(s) must sign the Articles of Incorporation, indicating their intention to form the corporation under state law.

- File the Articles of Incorporation: Submit the completed form to the Michigan Department of Licensing and Regulatory Affairs. This can be done online, by mail, or in person. A filing fee will be required upon submission.

After submission, the Michigan Department of Licensing and Regulatory Affairs will review your Articles of Incorporation. If everything is in order, they will officially file the document, which marks the legal creation of your corporation in Michigan. You will then receive a certificate of incorporation, signaling that your business is officially recognized and ready to operate under the laws of the state. Keep in mind, this is just the beginning of your corporate journey. Following the incorporation, there are still ongoing requirements and responsibilities to maintain good standing with the state.

Get Answers on Michigan Articles of Incorporation

What are the Michigan Articles of Incorporation?

The Michigan Articles of Incorporation form a legal document required to officially register a corporation in the state of Michigan. This document outlines basic information about the corporation, including its name, purpose, registered agent, and shares of stock it is authorized to issue. Filing the Articles of Incorporation grants the corporation legal recognition by the state, allowing it to operate legally within Michigan and be recognized as an entity separate from its owners.

Who needs to file the Michigan Articles of Incorporation?

Any group intending to form a corporation in Michigan must file the Articles of Incorporation. This applies to both for-profit and nonprofit organizations seeking to establish a corporate structure under Michigan law. The process is a crucial step for businesses that wish to benefit from the legal protections and organizational framework provided to corporations, including limited liability for its owners.

Where can one find the form for the Michigan Articles of Incorporation?

The form for the Michigan Articles of Incorporation is available on the Michigan Department of Licensing and Regulatory Affairs (LARA) website. It can be downloaded from the Corporations Division section. Additionally, prospective filers can also choose to file online using the LARA's online filing system, which provides a streamlined process for submission.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation in Michigan, the following information must be provided: the corporation's name; the purpose for which it is formed; the address of the corporation's registered office; the name of the registered agent at that office; the number and types of shares the corporation is authorized to issue; and the names and addresses of the incorporators. Depending on the type of corporation being established, additional information may be required.

How does one file the Michigan Articles of Incorporation, and what is the cost?

Filing the Michigan Articles of Incorporation can be done either online through the LARA website, by mail, or in person. The online filing option typically offers the most convenience and fastest processing time. The filing fee for the Articles of Incorporation varies based on the type of corporation being established and the number of shares it is authorized to issue. Detailed fee information is available on the LARA website, ensuring filers can calculate the exact cost beforehand.

After filing, what are the next steps?

After the Michigan Articles of Incorporation are filed and approved, the corporation must take several steps to finalize its organization. This includes creating bylaws, issuing stock certificates to the initial shareholders, holding an initial meeting of the board of directors, and obtaining any necessary licenses or permits for its operations. It is also crucial for new corporations to comply with local, state, and federal tax requirements, including applying for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Common mistakes

Filing the Michigan Articles of Incorporation is a step many entrepreneurs take with excitement and a bit of trepidation. This document marks the legal starting point of a corporation's life. However, the process isn't always straight forward, leading to common pitfalls. One major mistake is the incorrect listing of the registered agent's name or address. An accurate registered agent is crucial as this is the entity or person designated to receive legal and government communications on behalf of the corporation.

Another area where errors occur is in defining the corporation's purpose too narrowly. Some individuals believe that being specific limits liability or crystallizes the business's scope. However, defining the purpose too narrowly can restrict the corporation's ability to evolve and grow beyond its initial goals. It’s often advisable to use a broader scope, within legal limits, to allow for future flexibility.

A frequently overlooked aspect is the allocation of shares. Prospective business owners often arbitrarily decide on the number of shares without understanding the implications. This decision impacts everything from the corporation's ability to raise capital to how it's viewed by potential investors. Failure to appropriately plan the share structure can lead to significant hurdles down the line, including unnecessary amendments to the articles.

There's also a tendency to neglect the details of incorporator information. An incorporator is the individual who signs and files the Articles of Incorporation. Sometimes, people fill in this section without realizing that the incorporator will be listed in the public record. Depending on the level of privacy desired, this might not be ideal for everyone involved in the corporation. Knowing the visibility of this information and planning accordingly can avoid unwanted exposure.

Submitting the form without the necessary filing fee, or with an incorrect amount, can lead to delays. The Michigan Department of Licensing and Regulatory Affairs won't process the Articles of Incorporation without the correct fee. This mistake can be especially frustrating because it’s entirely avoidable with a bit of attention to detail.

Assuming all required approvals have been obtained before filing is another common error. Depending on the type of corporation and the industry, there may be regulatory approvals needed before the corporation can legally operate. Moving forward without these approvals can invalidate the Articles of Incorporation, putting the entire operation in jeopardy.

Avoiding the input of a dissolution date can also be problematic. Some individuals might skip this part, thinking it's irrelevant at the start of a business. However, setting a dissolution date can be a strategic decision, especially for projects with a defined lifespan.

Minor mistakes, like spelling errors or incorrect abbreviations, might seem insignificant but can lead to substantial issues. These errors can cause confusion regarding the corporation's legal name, leading to difficulties with banks, contractors, and legal documents.

Finally, overlooking the signature and date at the end of the form invalidates the entire document. It's a simple step, but in the rush to complete the filing, it's surprisingly easy to miss. Without a signature, the state cannot verify the form's authenticity or the incorporator's intent to create the corporation.

While the Michigan Articles of Incorporation form is a legal document, the common mistakes made are often due to a lack of attention rather than legal complexity. By being thorough and seeking clarity on unclear sections, many of these errors can be avoided, paving the way for a smoother start to your corporation.

Documents used along the form

When establishing a corporation in Michigan, the Articles of Incorporation form is a crucial starting point. It officially registers the corporation with the state. However, this form is often just the beginning. To fully establish and operate a corporation within legal boundaries, several other forms and documents are typically needed in addition to the Articles of Incorporation. These documents vary depending on the corporation’s specific needs, such as its size, structure, and the nature of its business. Understanding these additional documents can help ensure a smoother setup and compliance with Michigan state laws.

- Bylaws: Bylaws are essential for outlining the corporation's internal governance rules. They specify how the corporation will be run, including the process for making major decisions, the roles and responsibilities of directors and officers, and how shareholder meetings are conducted. Although not filed with the state, bylaws are crucial for organizational clarity and operations.

- SS-4 Form: This form is used to apply for an Employer Identification Number (EIN) from the IRS. An EIN is necessary for tax purposes, opening bank accounts, and hiring employees. It's effectively the corporation's social security number and is used on all federal tax filings.

- Initial Report Form: Some states require corporations to file an initial report after incorporation, detailing essential information like the corporation’s address, directors, and officers. While Michigan does not currently mandate this report, it’s important to stay updated as regulations can change.

- Stock Certificates: For corporations that plan to issue stock, creating stock certificates is a step towards documenting ownership. Each certificate serves as a physical representation of what each shareholder owns in terms of the corporation's stock. These need to be carefully prepared to reflect accurately the ownership and rights attached to the shares.

Completing the Articles of Incorporation for a Michigan corporation is just the beginning. To fully establish the legal structure and ensure ongoing compliance, the additional documents listed above are often necessary. Bylaws set the operational framework, the SS-4 Form secures a tax ID, initial reports (where required) confirm operational readiness, and stock certificates document ownership. Together, these documents form the backbone of a corporation's legal and operational structure. Understanding and preparing these documents correctly is key to a corporation's success and legal compliance.

Similar forms

The Michigan Articles of Incorporation form shares similarities with the Delaware Certificate of Incorporation, primarily because both serve as the foundational legal document necessary for establishing a corporation within their respective states. They detail the corporation's basic structure, including its name, purpose, authorized stock, and the information about its incorporator(s). The primary function of these documents is to officially register the new entity with the state government, thereby granting it legal recognition.

Similarly, the California Articles of Incorporation also mirrors the Michigan form. This document, vital for establishing a corporation in California, outlines key details such as the corporation's name, address, agent for service of process, and the shares of stock it is authorized to issue. Like Michigan's version, this document is a required step in the formal creation of a corporation, ensuring compliance with state laws and regulations.

Nonprofit organizations use a variant of this form, known as the Articles of Incorporation for a Nonprofit. This document, while serving a similar purpose in officially forming an organization, includes specific provisions related to nonprofit governance, such as the organization's charitable purpose and conditions regarding the distribution of assets upon dissolution. These nuanced differences tailor the document to the unique regulatory environment and tax considerations facing nonprofits.

Another document with parallels is the LLC Operating Agreement, despite catering to a different business structure. Although it governs the operations of a Limited Liability Company (LLC) rather than incorporating a corporation, both documents establish the entity's operational framework, member roles, and management structure. This agreement differs in that it is more flexible and comprehensive, detailing policies for financial decisions, member duties, and profit sharing.

The Limited Partnership Agreement shares similarities with the Michigan Articles of Incorporation in the context of creating a formal business entity, though it pertains to limited partnerships. This document outlines the structure, objectives, and operational guidelines of the partnership, including the roles and responsibilities of the general and limited partners, similarly establishing a legal framework for the business.

The Corporate Bylaws document, while typically created post-incorporation, complements the Articles of Incorporation. It details the internal governance practices of the corporation, including procedures for meetings, elections of directors, and the roles of officers. Despite being a separate document, it's intrinsically linked to the Articles by guiding the day-to-day operations within the framework initially established upon incorporation.

Foreign Qualification Applications are required when a corporation formed in one state, like Michigan, wishes to operate in another. These applications are comparable because they require similar information about the business, such as its name, purpose, and details on directors or officers, ensuring the company is legally recognized and authorized to conduct business outside its state of incorporation.

Amendments to the Articles of Incorporation can be necessary over a corporation's lifetime to reflect changes in share structure, business purpose, or corporate governance. These amendments carry the same legal weight and requirement for state approval as the original Articles, maintaining the corporation's compliance and currency with state law. They exemplify the document's living nature, adapting to the corporation's evolving needs.

The Statement of Information, although not a foundational corporate document, has notable parallels to the Articles of Incorporation. Required annually or biannually, depending on the state, this document updates the state on key corporate details, including addresses, directors, and registered agent information. It ensures ongoing compliance and public availability of current organizational information, aligning with the transparency objectives initiated by the Articles of Incorporation.

In summary, while the Michigan Articles of Incorporation form is uniquely tailored to the incorporation process within Michigan, it shares foundational purposes and structural similarities with a variety of other documents used in both corporate and non-corporate settings. Each of these documents plays a vital role in the establishment, governance, operation, and compliance of business entities across different jurisdictions and forms.

Dos and Don'ts

When preparing to fill out the Michigan Articles of Incorporation form, careful attention to detail can prevent common mistakes and help ensure that the process goes smoothly. Incorporating a business is a significant step, marking the start of its legal life as an entity separate from its owners. Here’s a straightforward guide to assist with what you should and shouldn't do in this process.

What You Should Do

- Ensure the business name is unique and complies with Michigan’s naming requirements. The name should not be misleadingly similar to any existing business names registered in the state.

- Provide a detailed purpose for the corporation. While it can be beneficial to be broad to allow for business flexibility, it should still clearly indicate the nature of the business activities.

- Appoint a registered agent with a physical Michigan address. This agent acts as the corporation’s official contact for legal and state communications.

- Include the number of shares the corporation is authorized to issue. This is important for defining ownership and raising capital.

- Review the entire form for accuracy before submission. Any inaccuracies can delay the process and potentially complicate your business operations.

What You Shouldn't Do

- Do not leave required fields blank. Incomplete forms are likely to be rejected, causing delays in the incorporation process.

- Do not use a P.O. Box as the address for the registered agent. A physical, in-state address where the agent can be reached during regular business hours is required.

- Do not forget to sign the form. An unsigned form is considered incomplete and will be returned or rejected.

- Do not overlook the filing fee. Ensure you understand the correct amount and make the payment to avoid processing delays.

- Do not ignore the need for bylaws. Although not submitted with the Articles of Incorporation, bylaws are essential for outlining the corporation’s internal operations and procedures.

Misconceptions

Filing Articles of Incorporation is a crucial step in formalizing any corporation's operational and legal standing in Michigan. There are, however, several misconceptions about this form that need clarification to ensure a smooth and informed incorporation process:

- It's only about naming the corporation. Many people believe that the Articles of Incorporation are solely about registering the corporation's name. While naming the corporation is essential, the Articles of Incorporation cover much more, including the corporation’s purpose, duration, registered office and agent, incorporator information, and the number of shares the corporation is authorized to issue. This document lays down the foundation of the corporation's legal identity.

- Once filed, no changes can be made. Another common misconception is that once the Articles of Incorporation are filed with the Michigan Department of Licensing and Regulatory Affairs, they are set in stone. In reality, corporations can amend these articles as needed to reflect changes in the company’s structure, purpose, or other essential details. This process ensures that the corporation remains compliant with state laws while accommodating growth and evolution.

- There's a one-size-fits-all form. Individuals might think there's a single, universal form that all corporations use for their Articles of Incorporation. However, the requirements can vary significantly based on the type of corporation being formed, such as a nonprofit, professional, or business corporation. Michigan provides different forms and filing instructions that cater to these variations, ensuring each corporation's unique needs are met.

- Filing ensures immediate legal operation. The belief that a corporation can operate legally in Michigan as soon as its Articles of Incorporation are filed is another misconception. While filing is a critical step, corporations might need to obtain relevant business licenses, permits, or adhere to other regulatory requirements before commencing operations. This ensures that all aspects of the business meet state legal standards.

- Articles of Incorporation protect personal assets. Lastly, there's a misunderstanding that filing the Articles of Incorporation alone provides complete protection against personal liability for the corporation’s debts and obligations. While incorporating does offer a degree of personal asset protection by establishing the corporation as a separate legal entity, there are circumstances under which individual liability might still arise. It's essential to maintain proper corporate formalities, separate personal and business finances, and understand the limits of liability protection offered.

Understanding these misconceptions can help ensure that entrepreneurs and business owners navigate the incorporation process in Michigan more effectively and avoid potential pitfalls. With accurate information and a clear grasp of the legal requirements, corporations can establish a solid foundation for their operations and future growth.

Key takeaways

Starting a corporation in Michigan is an exciting venture, and filling out the Articles of Incorporation is a critical step in laying the groundwork for your business's legal structure. Here are key takeaways to ensure that this process is done correctly and efficiently:

Know the Form: The Articles of Incorporation is the document required to legally register your corporation with the State of Michigan. It establishes your corporation's existence.

Understand the Requirements: Michigan has specific requirements for what information must be included in the Articles of Incorporation, such as the corporation's name, purpose, duration, registered agent information, and details about stock.

Select a Unique Name: Your corporation's name must be distinguishable from other business names already on file with the Michigan Department of Licensing and Regulatory Affairs (LARA). A name availability search is strongly recommended.

Designate a Registered Agent: A registered agent must be named in your Articles of Incorporation. This individual or company agrees to accept legal papers on behalf of the corporation.

Detailed Stock Information: If your corporation will issue stock, details such as the number of shares authorized to be issued and their par value, if any, must be included.

Include Required Signatures: The Articles must be signed by the incorporator(s), the individual(s) preparing the document. If pre-signed by the initial directors, their consent is necessary as well.

File with the State: Once completed, the Articles of Incorporation must be filed with LARA, either online or by mail, along with the required filing fee.

Understand the Fees: The filing fee for the Articles of Incorporation in Michigan must be paid upon submission. The amount is subject to change, so it's important to verify the current fee.

Consider Additional Requirements: After filing, there may be additional steps to fully establish your corporation, such as obtaining an EIN, applying for necessary licenses and permits, and drafting corporate bylaws.

Taking these steps carefully will ensure that your corporation in Michigan is set up properly from the start, providing a strong foundation for your business operations. Remember, consulting with a legal professional can provide personalized guidance tailored to your specific business needs.

Popular Articles of Incorporation State Forms

Certificate of Corporation Ny - The form identifies the number of shares the corporation is authorized to issue, detailing stock structure.

Texas Llc Yearly Fees - Filing fees for the Articles of Incorporation are mandatory and vary depending on the state, impacting the initial cost of establishing a corporation.

Article of Incorporation Indiana - Required to comply with state laws and regulations regarding corporation establishment.

How Do I Get an Llc - Articles of Incorporation can be swiftly filed online in many states, facilitating a quicker start to business operations.