Free Articles of Incorporation Form for Indiana

Embarking on the journey of establishing a corporation in Indiana is a significant step towards bringing a business vision to life. At the heart of this process lies the Indiana Articles of Incorporation form, a crucial document that outlines the fundamental aspects of a corporation. This form serves as the official birth certificate for a corporation within the state, marking the commencement of its legal existence. With sections dedicated to detailing the corporation's name, its purpose, the number and types of shares it is authorized to issue, information about the registered agent, and the incorporator's details, this document encapsulates the essence of the corporation in legal terms. Completing and filing this form correctly is paramount, as it not only sets the corporation's legal framework but also determines the scope of its operations, governance structure, and complies with the Indiana state requirements for corporate formation. Navigating through the specifics of the form can seem daunting at first, but understanding its components is the first step in laying a strong foundation for any corporation aspiring to flourish in Indiana's dynamic business environment.

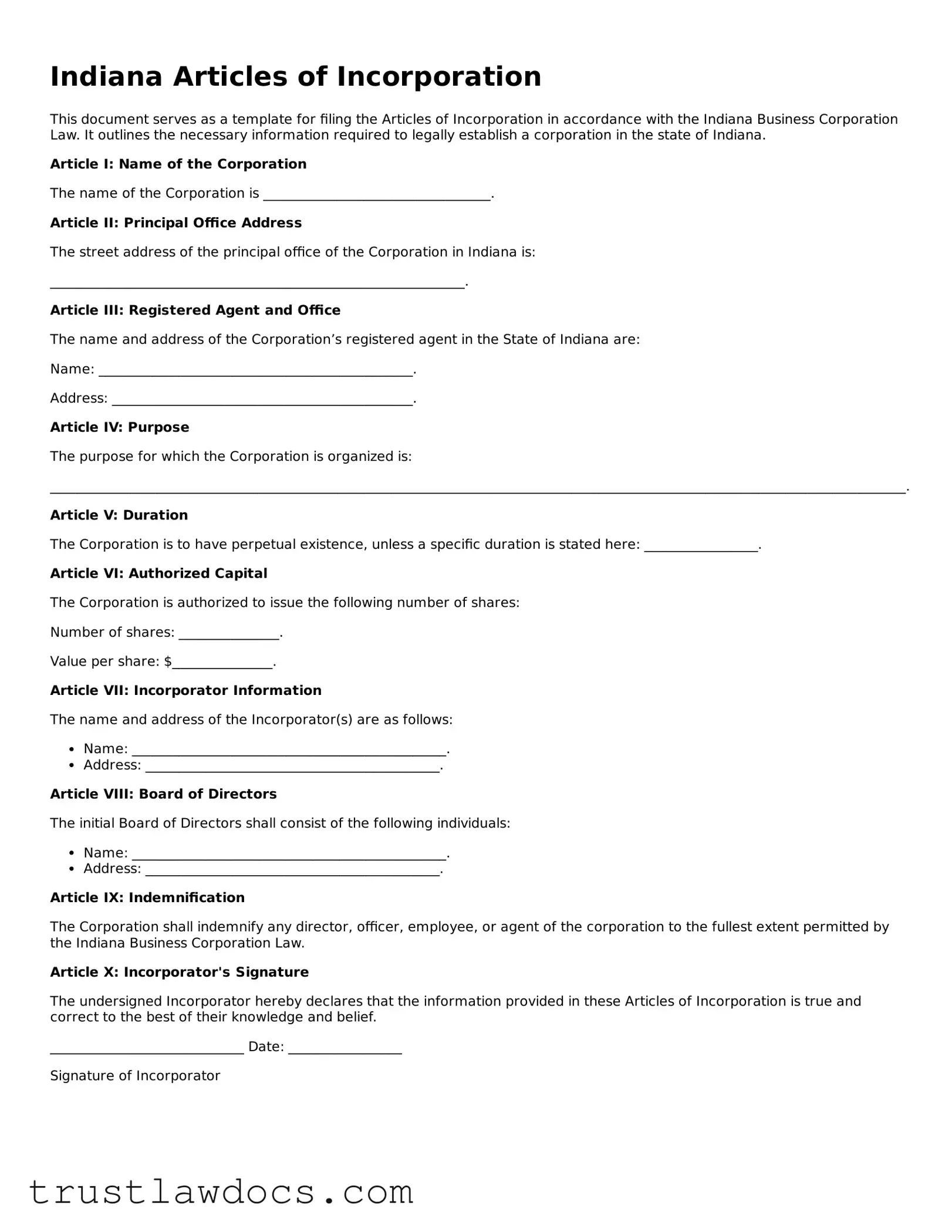

Form Example

Indiana Articles of Incorporation

This document serves as a template for filing the Articles of Incorporation in accordance with the Indiana Business Corporation Law. It outlines the necessary information required to legally establish a corporation in the state of Indiana.

Article I: Name of the Corporation

The name of the Corporation is __________________________________.

Article II: Principal Office Address

The street address of the principal office of the Corporation in Indiana is:

______________________________________________________________.

Article III: Registered Agent and Office

The name and address of the Corporation’s registered agent in the State of Indiana are:

Name: _______________________________________________.

Address: _____________________________________________.

Article IV: Purpose

The purpose for which the Corporation is organized is:

________________________________________________________________________________________________________________________________.

Article V: Duration

The Corporation is to have perpetual existence, unless a specific duration is stated here: _________________.

Article VI: Authorized Capital

The Corporation is authorized to issue the following number of shares:

Number of shares: _______________.

Value per share: $_______________.

Article VII: Incorporator Information

The name and address of the Incorporator(s) are as follows:

- Name: _______________________________________________.

- Address: ____________________________________________.

Article VIII: Board of Directors

The initial Board of Directors shall consist of the following individuals:

- Name: _______________________________________________.

- Address: ____________________________________________.

Article IX: Indemnification

The Corporation shall indemnify any director, officer, employee, or agent of the corporation to the fullest extent permitted by the Indiana Business Corporation Law.

Article X: Incorporator's Signature

The undersigned Incorporator hereby declares that the information provided in these Articles of Incorporation is true and correct to the best of their knowledge and belief.

_____________________________ Date: _________________

Signature of Incorporator

PDF Form Details

| Fact | Description |

|---|---|

| 1. Purpose | The Indiana Articles of Incorporation form is used to legally establish a corporation in the state of Indiana. |

| 2. Governing Body | Indiana Secretary of State is the governing body responsible for processing and maintaining the Articles of Incorporation. |

| 3. Online and Paper Filing | Forms for the Articles of Incorporation can be submitted either online through the Indiana Secretary of State's website or by mailing a paper form. |

| 4. Fee | There is a filing fee associated with the Articles of Incorporation, which varies depending on whether the filing is done online or by paper, and based on the type of corporation being established. |

| 5. Information Required | The form requires detailed information, including the corporation's name, principal office address, registered agent's name and address, incorporator's information, and the number of shares the corporation is authorized to issue. |

| 6. Naming Requirements | The corporation's name must be distinguishable from other names on record and must end with a corporate designator, such as "Corporation," "Incorporated," "Company," or an abbreviation of these. |

| 7. Registered Agent | A registered agent must be designated in the Articles of Incorporation, who will be responsible for receiving legal documents on behalf of the corporation. |

| 8. Annual Reports | Once incorporated, the corporation is required to file an annual report with the Indiana Secretary of State to maintain good standing. |

| 9. Amendments | The corporation can amend its Articles of Incorporation if needed, by filing an Articles of Amendment form with the Indiana Secretary of State. |

| 10. Governing Law | The Articles of Incorporation are governed by the Indiana Business Corporation Law. |

How to Write Indiana Articles of Incorporation

Filling out the Indiana Articles of Incorporation form is a crucial step in legally establishing your business within the state. This document lays the groundwork for your company's structure, responsibilities, and legal obligations. It's important to complete this form with accuracy and detail to ensure a smooth registration process. Below are the instructions to guide you through each section of the form, making it easier for you to get your business off the ground.

- Start by providing the name of the corporation. Ensure it meets Indiana's naming requirements and include an appropriate corporate identifier such as "Inc." or "Corporation".

- Specify the type of corporation you are registering – for-profit or nonprofit. This determines the tax and legal obligations of your entity.

- List the total number of shares the corporation is authorized to issue, if applicable. This is relevant for for-profit corporations planning to distribute stock.

- Provide the address of the corporation's registered office and the name of the registered agent at that address. This agent will receive legal documents on behalf of the corporation.

- Indicate the name and address of each incorporator. Incorporators are individuals involved in the formation of the corporation.

- Describe the purpose for which the corporation is being formed. Be specific, as this will outline the legal activities of your business.

- If there are specific provisions for the management of the corporation, include these details. This may cover how board meetings are conducted or voting rights.

- Include the duration of the corporation, if it is not perpetual. Some corporations are established for a specific period to complete a particular project.

- Sign and date the form. All incorporators should provide their signatures to legally validate the document.

- Submit the completed form along with the required filing fee to the Indiana Secretary of State. You can do this online, by mail, or in person, depending on your preference.

After submitting your Articles of Incorporation, the next steps include waiting for approval from the Indiana Secretary of State. Once approved, your corporation will be officially recognized by the state. You'll receive a certificate of incorporation, after which you can proceed with other necessary business setups, such as obtaining an Employer Identification Number (EIN), opening a bank account, and applying for any required licenses and permits. This marks a significant milestone in making your business vision a reality.

Get Answers on Indiana Articles of Incorporation

What is the purpose of the Indiana Articles of Incorporation?

The Indiana Articles of Incorporation form is used to officially create a corporation in the state of Indiana. It serves as a formal declaration of a business’s corporate structure, legal name, and fundamental operational characteristics to the Indiana Secretary of State, ensuring compliance with state laws and regulations.

Who needs to file the Indiana Articles of Incorporation?

Any individual or group wishing to establish a corporation in Indiana must file the Articles of Incorporation. This applies to both for-profit and nonprofit organizations planning to operate within the state.

What information is required on the Indiana Articles of Incorporation form?

Typically, the form requires detailed information including the corporation’s name, principal office address, registered agent’s name and address, the number and type of authorized shares (for corporations issuing stock), the corporation’s purpose, and the names and addresses of the incorporators.

How can one file the Indiana Articles of Incorporation?

Filing can be done either online through the Indiana Secretary of State’s website or by mailing a completed form to the appropriate office. Online filing is generally faster and allows for easier tracking of the submission’s status.

Is there a filing fee for the Indiana Articles of Incorporation?

Yes, filing the Indiana Articles of Incorporation requires a fee. The exact amount depends on whether the corporation is for-profit or nonprofit. The fee is subject to change, so it's important to check the current cost on the Secretary of State’s website or by contacting their office directly.

How long does it take to process the Indiana Articles of Incorporation?

The processing time can vary, but online submissions are typically processed quicker than mailed applications. Generally, one can expect a processing time from a few days to a few weeks. Expedited services may be available for an additional fee.

What happens after the Indiana Articles of Incorporation are filed?

Once filed and approved, the corporation officially exists as a legal entity in the state of Indiana. The business can then continue with other necessary legal and organizational steps, such as obtaining an Employer Identification Number (EIN), setting up a business bank account, and applying for any necessary licenses and permits.

Can the Indiana Articles of Incorporation be amended?

Yes, if a corporation needs to change any information submitted with the original Articles of Incorporation, it can file an amendment with the Indiana Secretary of State. There is a form and filing fee associated with this process.

Common mistakes

Filing Articles of Incorporation is a pivotal step for any individual looking to form a corporation in Indiana. This document lays the foundation of your corporation, making its accuracy and completeness non-negotiable. An error or oversight here can delay your filings, incur unnecessary fees, or even affect your legal standing. Knowledge of common mistakes can pave the way for a smoother journey to corporate formation.

One frequent error is not providing a specific enough purpose for the corporation. Indiana law requires that the corporation's purpose be clearly defined in the Articles of Incorporation. A broad or ambiguous statement may not suffice. This serves to inform the state, as well as potential creditors or litigants, of the nature of your business operations.

Another common oversight is failing to adhere to Indiana’s requirements for corporate names. Your corporation’s name must be distinguishable from other entities registered in the state and end with a corporate designator such as "Inc.," "Corporation," or an equivalent abbreviation. Erroneously assuming your desired name is available or not properly distinguishing it from existing names can lead to the rejection of your Articles of Incorporation.

Neglecting to appoint a registered agent or providing incomplete information about the agent is also a significant mistake. The registered agent serves as the corporation's official contact for legal correspondence. This role requires a physical address within Indiana, where the agent is available during normal business hours. One cannot simply list a P.O. Box or leave this section incomplete.

Overlooking the requirement to list the incorporator's information is another error. The incorporator, who signs and files the Articles of Incorporation, must provide their name and address, confirming their role and responsibilities in the formation of the corporation. This ensures there is a clear point of contact and accountability should any issues with the documentation arise.

Incorrectly stating the number of authorized shares or the share structure can also lead to complications. This not only affects the corporation's ability to raise capital but may also have legal and tax implications. Understanding the different types of shares and their benefits is crucial before drafting this section of the Articles.

A less common but impactful mistake involves skipping the duration of the corporation, if it is not perpetual. While many opt for their corporation to exist indefinitely, some business models may call for a fixed term. Failing to specify this term can confuse or mislead stakeholders about the longevity of the corporation.

Failing to address the director's information and role within the company in accordance with Indiana law is a pitfall. The number of directors, their qualifications, and how they're elected or removed should be aligned with the company's bylaws but need not be detailed in the Articles unless specifically required by the state for certain types of corporations.

An underappreciated albeit crucial mistake is neglecting to keep a copy of the filed Articles of Incorporation for your records. Once the document is approved by the Indiana Secretary of State, having this document on hand is vital for opening bank accounts, applying for business licenses, and other legal processes.

Last but not least, rushing through the filing process without reviewing for errors or consulting with a legal professional can be the most detrimental error of all. Ensuring the accuracy and legality of your Articles of Incorporation is vital for a strong start and the long-term success of your corporation.

Each of these missteps can introduce delays, additional costs, or legal complications, but they are all avoidable with thorough preparation and due diligence. Understanding these common errors empowers future incorporators to navigate the process with confidence and precision.

Documents used along the form

When forming a corporation in Indiana, the Articles of Incorporation stand as a foundational document. However, this form does not exist in isolation. To fully establish a new corporation, a variety of other forms and documents are commonly used in conjunction with the Articles of Incorporation. These documents serve various purposes, from tax registration to organizational structure, and are essential for compliance, governance, finance, and other critical business operations. The following list provides an overview of other forms and documents frequently used alongside the Indiana Articles of Incorporation.

- Bylaws: Bylaws are internal documents that outline the governance structure and operational rules of the corporation. They cover topics such as the roles and responsibilities of directors and officers, meeting schedules, and voting procedures. While not filed with the state, bylaws are crucial for internal organization and administration.

- EIN Application (Form SS-4): The Employer Identification Number (EIN) is essential for tax purposes. Form SS-4 is used to apply for an EIN from the IRS. This number is required for filing federal taxes, opening business bank accounts, and hiring employees.

- Indiana Business Tax Application: To register for state taxes, including sales tax and employer withholding tax, corporations must submit a business tax application to the Indiana Department of Revenue. This ensures compliance with state tax obligations.

- Share Certificate: A share certificate is a document issued by the corporation to shareholders, evidencing ownership of shares in the corporation. It includes details such as the number of shares owned and the issuance date.

- Minutes of the First Board of Directors Meeting: This document records the proceedings of the initial meeting of the corporation's board of directors. Topics typically include the adoption of bylaws, the selection of officers, and the authorization of the issuance of shares.

- Stock Ledger: A stock ledger is a record keeping document that tracks the issuance and transfer of shares, including shareholder details and the number of shares owned. It is vital for maintaining accurate ownership records.

- Operating Agreement: Though more commonly associated with LLCs, corporations, especially closely held corporations, may also use an operating agreement to outline more detailed operational practices and agreements among shareholders that may not be fully covered in the bylaws.

- Indemnification Agreement: An indemnification agreement provides protection for directors and officers against personal liability, to the extent permitted by law, for actions taken in their capacity as directors or officers. This agreement is important for protecting the personal assets of those who serve in these roles.

Beginning with the Articles of Incorporation, filing the appropriate additional documents is crucial for the legal and efficient operation of a corporation in Indiana. These documents collectively contribute to the corporation's legal foundation, operational effectiveness, and compliance with state and federal laws. They should be prepared, filed, and maintained with the seriousness and precision they deserve, as they are not only important at the inception of a corporation but also throughout its operational lifecycle.

Similar forms

The Articles of Incorporation form in Indiana shares similarities with the Certificate of Formation used by LLCs in several states. Both documents serve as the foundational legal document required to formally establish a business entity, whether a corporation or LLC, in their respective states. They typically contain critical information about the business such as its name, purpose, office address, and information about its organizers or incorporators. The key point of similarity lies in their role in legitimizing the business in the eyes of the state government and serving as a public record of the business's legal existence.

Another similar document is the Corporate Charter, historically used to recognize the formation of a corporation. Like the Articles of Incorporation, a Corporate Charter formally documents the establishment of a corporation, detailing its governance, structure, and the rights of shareholders. It is issued by a governmental body, signifying the state's acknowledgment of the corporation's legal status. Both documents are crucial for delineating the corporate powers, duties, and limitations within legal frameworks.

The Articles of Organization also bear resemblance to the Articles of Incorporation but are specifically used for establishing a Limited Liability Company (LLC) rather than a corporation. These documents are fundamental in registering the business with the state, outlining its operational scope, and specifying its management structure. While serving a similar purpose, the distinction lies in the type of business entity they are associated with, reflecting the legal structure and compliance requirements unique to corporations and LLCs, respectively.

Business Licenses and Permits, while not solely focused on the entity's formation, are analogous to the Articles of Incorporation in their necessity for legal operation of a business within certain industries or jurisdictions. They represent official permissions for a business to undertake specific activities, complementing the Articles by ensuring the business adheres to local, state, and federal regulations. This parallel underscores the broader regulatory framework businesses must navigate beyond initial formation.

The Statement of Information, required by some states on a periodic basis after the corporation is established, continues the thread of legal documentation initiated by the Articles of Incorporation. It typically includes updated information about the corporation, such as current addresses and officers, ensuring the state maintains accurate records of the entity's structure and contact points. While the Articles of Incorporation mark the beginning of a corporation's legal existence, the Statement of Information ensures its continuity and compliance.

Lastly, the Operating Agreement of an LLC parallels the Articles of Incorporation, albeit it is an internal document rather than one filed with the state. It outlines the operating procedures, financial decisions, and member duties within the LLC, playing a similar foundational role for the internal governance of an LLC as the Articles do for a corporation. Despite not being a public document, its importance lies in structuring the entity’s operations and management, mirroring the Articles’ role in establishing the corporation’s legal and operational framework.

Dos and Don'ts

When it comes to filling out the Indiana Articles of Incorporation form, ensuring accuracy and completeness is crucial. This document lays the foundation for your corporation's legal identity, rights, and responsibilities. Here's a compiled list of dos and don'ts to guide you through the process:

Do:

Read the instructions carefully before you start filling out the form. Understanding each section will help prevent mistakes that could delay the processing of your form.

Use the full legal name of the business, including the appropriate corporate identifier (e.g., Inc., Corporation) as required by Indiana law.

Provide a complete and accurate address for the corporation’s principal office. This is necessary for official communications.

Appoint a registered agent who has a physical address in Indiana. This person or entity is authorized to receive legal documents on behalf of the corporation.

Clearly describe the purpose of your corporation. While Indiana law allows for a broad statement of purpose, providing specifics can be beneficial for clarity.

Sign and date the form. The incorporator(s) must sign the Articles of Incorporation to validate the document.

Review the completed form for errors before submitting. A double-check can save you time and hassle by catching mistakes early.

Don't:

Leave any required fields blank. Incomplete forms may be rejected, delaying the incorporation process.

Use a P.O. Box for the corporation's principal office or registered agent address. A physical address is required for these entries.

Neglect the filing fee. Ensure you know the correct amount and include it with your submission to avoid processing delays.

Assume the reservation of your business name means your Articles of Incorporation will automatically be accepted. The name reservation is a separate process from the incorporation filing.

Forget to specify the number of shares the corporation is authorized to issue, if applicable. This information is critical for defining the ownership structure of your corporation.

Overlook the need to comply with other regulatory requirements, such as obtaining business licenses or permits, after your Articles of Incorporation are filed.

Fail to keep a copy of the submitted form and any correspondences for your records. Maintaining a complete file can help address future legal or administrative needs.

Misconceptions

Navigating the process of incorporating a business in Indiana can sometimes feel like walking through a maze. Misunderstandings and misconceptions about the Articles of Incorporation are common, but with a bit of guidance, you can avoid these pitfalls. Below, we'll debunk five common myths to help you on your path to incorporating your business in Indiana.

- Myth #1: The process is too complex for anyone without a legal background. Quite the contrary, the state of Indiana has streamlined the filing process, making it accessible for entrepreneurs of all backgrounds. While legal terms can seem daunting, the forms come with instructions that are straightforward and easy to follow. Remember, resources are available to guide you, and seeking advice from a legal professional is always a sound idea if you're unsure.

- Myth #2: It doesn’t matter what name you choose for your corporation. In reality, the name of your corporation matters a lot. Indiana has specific naming requirements that must be adhered to, including the necessity for the name to be distinguishable from other businesses registered in the state. Additionally, it must end with a corporate designator such as "Incorporated," "Corporation," "Company," or an abbreviation of these. Ensuring your chosen name meets these criteria is essential.

- Myth #3: You only need to file Articles of Incorporation to start your business. While filing your Articles of Incorporation is a critical step, it's not the only one. You'll also need to obtain any necessary licenses and permits, register for state taxes, and if applicable, comply with other regulatory requirements specific to your type of business. Think of the Articles of Incorporation as the foundation, but remember, building a strong business requires more.

- Myth #4: Once filed, you never have to worry about the Articles of Incorporation again. This is not entirely true. Changes in your corporation, such as amendments to the corporate structure, changes in the number of authorized shares, or updates to the registered agent or office, require filing an amendment to the Articles of Incorporation with the Indiana Secretary of State. Keeping your corporation's articles current is just as important as filing them initially.

- Myth #5: The Articles of Incorporation protect the personal assets of the owners from business liabilities. Filing the Articles of Incorporation does provide a layer of protection, but it's not an all-encompassing shield. The corporate veil can be pierced if the company is found to not be operating as a separate entity from its owners, or if there’s evidence of fraud or negligence. It's important to follow corporate formalities closely to maintain this protection.

By understanding and navigating these misconceptions, you're better equipped to successfully incorporate your business in Indiana. Remember, the journey of incorporating a business is a marathon, not a sprint, and equipping yourself with correct information is key to a strong start.

Key takeaways

Filling out and using the Indiana Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in Indiana. This document serves as a formal declaration of the business's creation and outlines its fundamental aspects. Here are key takeaways to guide you through the process:

- Know Your Business Name: The name of your corporation should be unique and comply with Indiana's naming requirements. It must include an indicator of its corporate status, such as "Incorporated," "Corporation," "Company," or an abbreviation like "Inc.," "Corp.," or "Co."

- Designate a Registered Agent: Your corporation must have a registered agent with a physical address in Indiana. This agent is responsible for receiving legal and official documents on behalf of the corporation.

- Specify Incorporators: Incorporators are those filing the Articles of Incorporation. You must include the names and addresses of all incorporators, who must also sign the document.

- Determine the Corporation's Purpose: Clearly outline the purpose of your corporation. While some companies state a specific purpose, others opt for a broad description to allow for business evolution.

- Share Structure: The form requires you to define the number and type of shares your corporation is authorized to issue. This decision impacts your company's financing and ownership structure.

- Prepare Additional Provisions: If necessary, include any other items you want to be a part of your corporation’s legal foundation. This can cover a wide range of topics, from director liability to shareholder rights.

- Check for Compliance: Ensure that all information provided complies with state laws and regulations. Incorrect or missing information can lead to delays or rejection of your filing.

- File with the Indiana Secretary of State: Once all sections of the form are completed, submit it along with the required filing fee to the Indiana Secretary of State. The filing can typically be done online, by mail, or in person.

Completing the Indiana Articles of Incorporation accurately and thoughtfully lays a solid foundation for your corporate entity. It’s a significant step towards establishing your business's legal identity and protecting your personal and financial interests. Taking time to understand and correctly fill out this document can save you from potential legal complications down the road.

Popular Articles of Incorporation State Forms

Michigan Llc Online - The document may specify the initial board of directors who will govern the corporation until the first annual meeting of shareholders, at which new directors can be elected.

Certificate of Corporation Ny - Requirements for annual meetings and the procedures for calling special meetings are often included.

Texas Llc Yearly Fees - Incorporators have the responsibility to ensure that the corporation's name is distinguishable from those of other businesses already registered in the same state.

How Do I Get an Llc - This form acts as a public record of a corporation, including the names of the initial directors and the registered agent.