Free Articles of Incorporation Form for Florida

Embarking on the journey of establishing a corporation in Florida introduces business founders to a pivotal stage: filing the Articles of Incorporation. This strategic document, essential for the birth of any corporation within the state's jurisdiction, lays down the foundation for a company's legal existence under Florida law. While its completion and submission mark an important beginning, understanding its composition sheds light on the precision required to navigate this process effectively. The form comprises several key elements, each designed to detail critical aspects of the corporation being formed, such as the corporation’s name, principal address, purpose, the number of shares the corporation is authorized to issue, and information about the registered agent and initial officers or directors. Accuracy in the document is paramount, as it stands as the legal framework for the corporation's operations and governance. Accordingly, when approached with due diligence and thoughtfulness, the filing of the Articles of Incorporation becomes more than a mere procedural step; it is the cornerstone upon which the business identity is built and recognized by the state of Florida, paving the way for future endeavors and responsibilities.

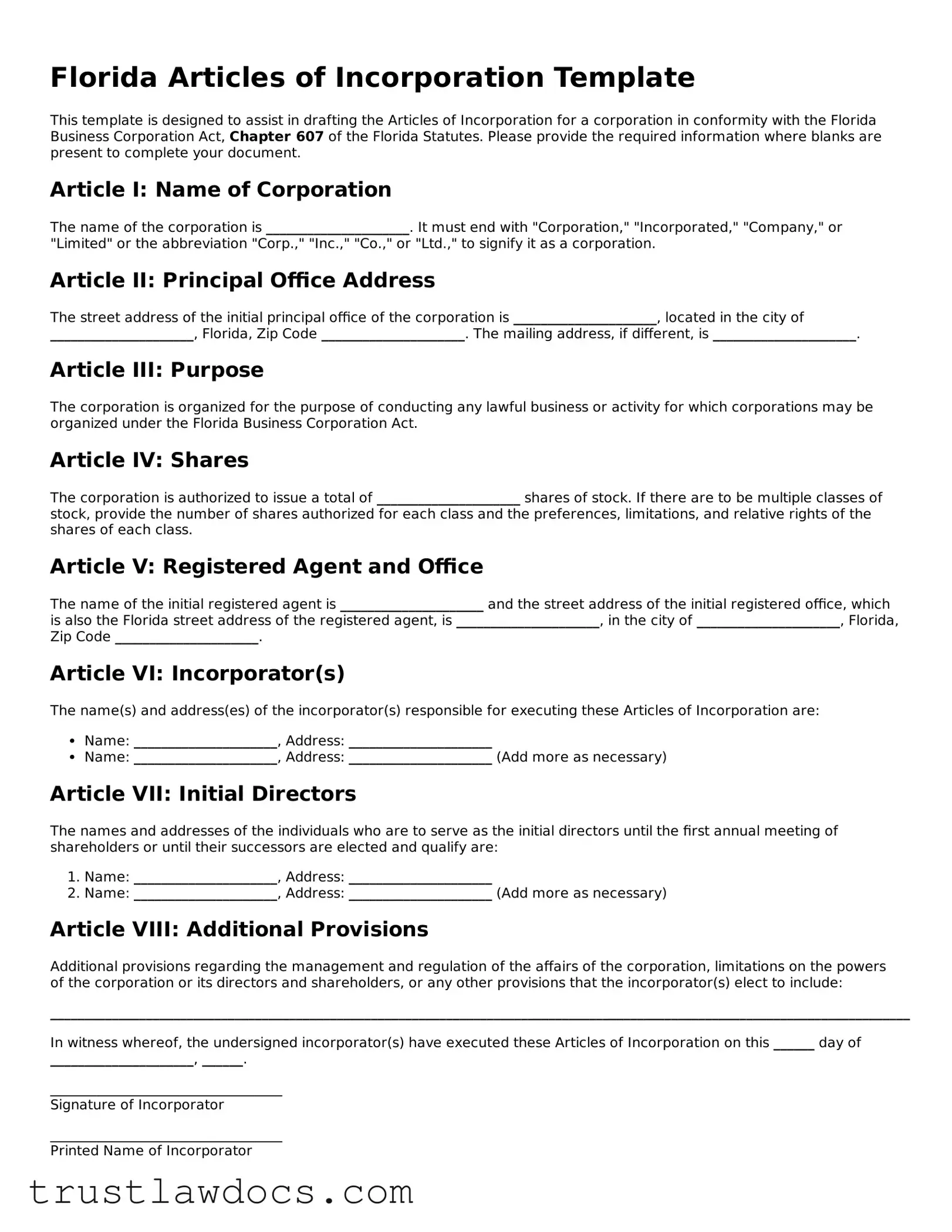

Form Example

Florida Articles of Incorporation Template

This template is designed to assist in drafting the Articles of Incorporation for a corporation in conformity with the Florida Business Corporation Act, Chapter 607 of the Florida Statutes. Please provide the required information where blanks are present to complete your document.

Article I: Name of Corporation

The name of the corporation is _____________________. It must end with "Corporation," "Incorporated," "Company," or "Limited" or the abbreviation "Corp.," "Inc.," "Co.," or "Ltd.," to signify it as a corporation.

Article II: Principal Office Address

The street address of the initial principal office of the corporation is _____________________, located in the city of _____________________, Florida, Zip Code _____________________. The mailing address, if different, is _____________________.

Article III: Purpose

The corporation is organized for the purpose of conducting any lawful business or activity for which corporations may be organized under the Florida Business Corporation Act.

Article IV: Shares

The corporation is authorized to issue a total of _____________________ shares of stock. If there are to be multiple classes of stock, provide the number of shares authorized for each class and the preferences, limitations, and relative rights of the shares of each class.

Article V: Registered Agent and Office

The name of the initial registered agent is _____________________ and the street address of the initial registered office, which is also the Florida street address of the registered agent, is _____________________, in the city of _____________________, Florida, Zip Code _____________________.

Article VI: Incorporator(s)

The name(s) and address(es) of the incorporator(s) responsible for executing these Articles of Incorporation are:

- Name: _____________________, Address: _____________________

- Name: _____________________, Address: _____________________ (Add more as necessary)

Article VII: Initial Directors

The names and addresses of the individuals who are to serve as the initial directors until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: _____________________, Address: _____________________

- Name: _____________________, Address: _____________________ (Add more as necessary)

Article VIII: Additional Provisions

Additional provisions regarding the management and regulation of the affairs of the corporation, limitations on the powers of the corporation or its directors and shareholders, or any other provisions that the incorporator(s) elect to include:

______________________________________________________________________________________________________________________________

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ______ day of _____________________, ______.

__________________________________

Signature of Incorporator

__________________________________

Printed Name of Incorporator

PDF Form Details

| Fact | Detail |

|---|---|

| 1. Governing Law | The Florida Articles of Incorporation are governed by Chapter 607 of the Florida Statutes, which outlines the requirements for the formation and operation of corporations within the state. |

| 2. Purpose Statement | A company must provide a specific purpose for its existence in the Florida Articles of Incorporation, though a general purpose clause is permissible for most corporations. |

| 3. Registered Agent Requirement | Corporations must designate a registered agent with a physical Florida address for service of process; post office boxes are not acceptable. |

| 4. Director Information | The names and addresses of the initial directors must be included in the Articles, ensuring there is a transparent line of accountability from the outset. |

| 5. Filings are Public Record | Once filed, the Articles of Incorporation become a public document, accessible by anyone seeking to understand the corporate structure or verify its legitimacy. |

| 6. Filing Fees | The state of Florida requires a fee to file the Articles of Incorporation; this fee is subject to change and additional charges may apply for expedited services. |

| 7. Electronic Filing | Florida offers electronic filing, making it convenient and efficient to submit the Articles of Incorporation online through the Division of Corporations' website. |

| 8. Duration Clause | While corporations can be set up to exist perpetually, a specific duration can also be stated within the Articles of Incorporation if desired. |

| 9. Amendment Provisions | The Articles of Incorporation can be amended as needed, but any changes must comply with existing laws and be filed appropriately with the state. |

| 10. Dissolution Process | The Articles must outline the process for dissolution, ensuring that there is a clear path for legally concluding the corporation's activities if necessary. |

How to Write Florida Articles of Incorporation

Starting a new business in Florida requires an important step of filing Articles of Incorporation with the state. These documents are the legal foundation of your corporation, formally marking its creation. They must be filled out carefully and accurately to ensure compliance with state laws and regulations. The process can seem daunting, but by breaking it down into manageable steps, you can complete your filing without overlooking essential details.

- Begin by gathering all necessary information, including the proposed name of the corporation, the principal place of business, and the names and addresses of the incorporators and initial directors.

- Download the Articles of Incorporation form from the Florida Division of Corporations website.

- Fill out the name of your corporation, ensuring it meets Florida naming requirements and is distinguishable from other business names already on file.

- Specify the purpose of the corporation. While some states allow for a broad, general purpose, it's important to check the current Florida requirements for specificity.

- Enter the principal place of business address, providing both street and mailing address if they differ.

- List the name and address of the Registered Agent who will accept legal papers on behalf of the corporation. The agent must have a physical address in Florida and consent to serve in this role.

- Detail the number of shares the corporation is authorized to issue, along with their par value if applicable. If the corporation will issue more than one class or series of shares, attach a provision outlining the rights and preferences of each class or series.

- Include the names and addresses of the initial directors who will serve until the first annual meeting or until successors are elected and qualified.

- If your corporation will have a specific duration rather than perpetuity, specify the length of time it intends to operate.

- Conclude by having an incorporator or authorized representative sign the form. Remember to print the name and title of the person signing the form.

- Review the form for accuracy. Double-check all information to ensure it is correct and complete.

- Submit the completed form along with the required filing fee to the Florida Division of Corporations. This can typically be done by mail, in person, or online, depending on the current options offered.

After submitting the Articles of Incorporation, the process for establishing your corporation in Florida does not end. The next steps include drafting bylaws, issuing stock certificates to the initial shareholders, and applying for any necessary licenses and permits. Additionally, an Employer Identification Number (EIN) must be obtained from the Internal Revenue Service (IRS) for tax purposes. These steps are critical for ensuring that your corporation is fully operational and compliant with both state and federal requirements.

Get Answers on Florida Articles of Incorporation

What are the Articles of Incorporation in Florida?

The Articles of Incorporation is a document that must be filed with the state of Florida to legally form a corporation. This document includes vital information such as the corporation’s name, address, purpose, and details regarding shares of stock, among other specifics. Filing this document with the Florida Department of State is a crucial step in establishing a corporation's legal identity.

How do I file the Florida Articles of Incorporation?

To file the Articles of Incorporation, you can submit the document online through the Florida Division of Corporations’ website or mail the completed form to the provided address. The process requires you to fill out the form with accurate and comprehensive information about your corporation, followed by paying the necessary filing fee.

Where do I get the form for the Florida Articles of Incorporation?

The form for the Articles of Incorporation can be downloaded from the Florida Division of Corporations’ official website. Additionally, you can request the form via mail or pick it up in person from their office, if preferred.

What is the filing fee for the Florida Articles of Incorporation?

The filing fee for the Articles of Incorporation in Florida varies depending on several factors, including the type of corporation being established. To get the most current fee information, it's best to consult the Florida Division of Corporations' website or contact their office directly.

Can I file the Florida Articles of Incorporation online?

Yes, you can file the Articles of Incorporation online through the Florida Division of Corporations’ website. This is often the fastest and most convenient method to get your corporation officially registered with the state.

What information do I need to provide in the Articles of Incorporation?

When completing the Articles of Incorporation, you'll need to provide specific details about your corporation, including its official name, principal office address, the nature of the business it will conduct, the number of shares of stock the corporation is authorized to issue, the names and addresses of the directors, and the name and address of the registered agent.

Who needs to sign the Florida Articles of Incorporation?

The Articles of Incorporation must be signed by the incorporator(s). If there are multiple incorporators, each must sign the document. The incorporator(s) are typically the individual(s) involved in the formation of the corporation.

How long does it take to process the Florida Articles of Incorporation?

The processing time for the Articles of Incorporation can vary depending on the current workload of the Florida Division of Corporations and the filing method chosen. Online submissions are usually processed more quickly than mailed submissions. For the most accurate processing time estimates, it's advisable to check directly with the division's office or website.

Common mistakes

Filling out the Florida Articles of Incorporation is a vital step in establishing a corporation within the state. It lays the foundation for the legal structure of the business. However, errors in this process can lead to delays, additional fees, or even the denial of incorporation. Being aware of common mistakes can significantly streamline the process.

One of the primary errors involves incorrect or incomplete names. The name of the corporation must be unique and adhere to specific guidelines set by the state of Florida. It should not be easily confused with another business and must include a corporate suffix such as "Inc." or "Corp." Overlooking these requirements can cause the application to be rejected outright.

Another common mistake is not providing a proper principal place of business address. This address cannot be a P.O. Box and must be a physical location where the corporation's primary business activities take place. This ensures that legal and governmental correspondence reaches the corporation without delay.

The failure to appoint a registered agent or to provide incorrect information about the agent can also hinder the process. A registered agent acts as the corporation's official point of contact for legal documents. This agent must have a physical address within Florida and must be available during regular business hours to accept legal papers on behalf of the corporation.

Furthermore, neglecting to detail the specific purpose for which the corporation is being formed is another oversight. While some states allow for a general purpose statement, Florida requires a more detailed explanation. This helps in identifying the primary business activities and ensures compliance with state laws.

A common point of confusion is shares information. Failing to properly specify the number and type of shares the corporation is authorized to issue can lead to misunderstandings about the ownership structure and the rights of shareholders. This information is crucial for both the corporation's internal governance and for potential investors.

Not paying attention to the required signatures can also cause issues. The Articles of Incorporation must be signed by the incorporator or incorporators. If this step is overlooked or if the document is signed in the wrong place, it can be deemed incomplete.

Last but not least, a significant misstep is not checking for mandatory attachments that might be needed based on the type of business being registered. Certain types of corporations may need to attach additional documents that outline specific details about the corporation's structure or regulatory compliance. Missing these attachments can stall the incorporation process.

Overall, while the process of filling out the Florida Articles of Incorporation may seem straightforward, attention to detail is crucial. Avoiding these common mistakes can help ensure that the foundation of your corporation is solidly laid, paving the way for a smooth start and future success.

Documents used along the form

When incorporating a business in Florida, it's essential to understand that the Articles of Incorporation form is just the beginning. Several other documents play a critical role in the incorporation process, ensuring compliance with state regulations and setting the groundwork for the company's legal and operational structure. These documents vary in purpose, from specifying the business's internal governance to meeting tax obligations. Here, we explore five key documents often used in conjunction with the Florida Articles of Incorporation to provide a comprehensive framework for new businesses.

- Bylaws: Bylaws are an essential document for any corporation. They outline the company's internal management structure, including the roles of directors and officers, the procedures for holding meetings, and the process of making corporate decisions. Although they are not filed with the state, bylaws are crucial for establishing the operational guidelines of the corporation.

- Initial Report: In some states, newly incorporated businesses are required to file an initial report. This document typically includes information about the corporation’s officers and directors, and sometimes its shareholders, providing a snapshot of the company's leadership structure to the state. Even if it's not mandatory in Florida, it's often recommended as a matter of good practice.

- Employer Identification Number (EIN) Application: An EIN, also known as a Federal Tax Identification Number, is required for a corporation to legally hire employees, open a bank account, and properly file taxes. The IRS provides a form to apply for an EIN, and this step is crucial following the incorporation of the business.

- Share Certificate: A share certificate is a document that certifies ownership of a certain number of shares in the corporation. It serves as a physical representation of a shareholder’s stake in the company. Issuing share certificates is a way to document each shareholder's investment formally.

- DBA Filing: "Doing Business As" (DBA) filings are not necessary for every corporation but can be essential for those planning to operate under a name other than their legal corporate name. This document is filed with the state and allows the corporation to conduct business, open bank accounts, and advertise under its DBA name. It’s particularly useful for branding purposes and establishing a presence in the market.

In summary, while the Articles of Incorporation form the basis of a corporate entity in Florida, the journey to establishing a fully functional and compliant business involves several other steps. Each document—from the internal bylaws to the public DBA filing—plays a unique role in building the corporation's legal and operational foundation. Handling these documents with care ensures the company's smooth sailing through the complexities of corporate governance and legal compliance, paving the way for future success.

Similar forms

The Florida Articles of Incorporation form shares similarities with the Certificate of Formation used in some states to establish a new business entity. The Certificate of Formation also serves as a formal declaration, outlining key elements such as the business name, purpose, and the details of its initial managers or directors. Both documents officially register the entity with the state, making it a legal business structure under state law.

Similar to the Articles of Incorporation, the Operating Agreement for an LLC structures the internal operations of the company. While the Florida Articles outline the corporation's foundational details for state records, an Operating Agreement dives deeper into the governance, member roles, and operational processes of an LLC. Though it's not always required by law, this document is crucial for outlining the expectations and responsibilities of the members involved.

The Bylaws of a corporation are akin to the Articles of Incorporation in that they provide a framework for the organization. However, Bylaws focus more on the internal management and administrative procedures, detailing processes for meetings, elections, and other corporate activities. Both documents are foundational to the legal and functional structure of the corporation but serve different focuses—external legitimacy vs. internal governance.

DBA (Doing Business As) filings, while distinct in purpose, have a resemblance to the Articles of Incorporation because they both relate to the identity and operation of a business. A DBA filing is needed when a business operates under a name different from its legal name. Like the Articles of Incorporation, a DBA filing is a public declaration, but it's specifically about the name under which the business will conduct its operations.

Similar in their legal function to the Articles of Incorporation, the Articles of Organization are used to establish an LLC. These documents share the objective of formally creating a business entity but differ in the type of business structure they create. While Articles of Incorporation are for corporations, Articles of Organization serve a similar purpose for limited liability companies, detailing the LLC’s operational outlines and compliance obligations.

Stock Certificates are issued by a corporation after it is formed with Articles of Incorporation. These documents are connected in that the Articles often detail the types of shares the corporation is authorized to issue, while Stock Certificates are the physical evidence of ownership in the corporation. Though they serve different purposes—creation versus evidence of ownership—both are integral to the incorporation and capital structure of the corporation.

The Employer Identification Number (EIN) application is another document related to the initiation process of a business. Like the Articles of Incorporation, applying for an EIN is a critical step in legitimizing a new business entity. The EIN is necessary for tax purposes, and while the Articles establish the corporation’s legal identity, the EIN is required for the IRS to identify the business for tax filings and other federal purposes.

Lastly, the Statement of Information is similar to the Articles of Incorporation in terms of updating and maintaining records with the state. Required on a periodic basis after a corporation is formed, this document keeps the state updated on vital details such as the corporation's address, directors, and agent for service of process. While the Articles of Incorporation initiate these records, the Statement of Information ensures they are current and accurate.

Dos and Don'ts

Filing the Florida Articles of Incorporation is a significant step in establishing a corporation in the state. It is a process that requires careful attention to ensure compliance with legal requirements. To assist with this, here are some guidelines on what to do and what not to do when completing the form.

Do:Verify the availability of your corporation name. Before filling out the form, ensure the name you wish to use is not already taken by another entity. This can usually be done through a search on the Florida Department of State's website.

Provide a specific purpose for the corporation, if required. Some types of corporations must state a specific purpose for their formation. Ensure this is clearly defined if applicable to your corporation type.

Include all required information. This includes the principal place of business address, the name and address of the registered agent, the corporation’s initial principal office address, and the names and addresses of the incorporators.

Designate a registered agent in Florida. The agent must have a physical Florida address (a P.O. Box is not acceptable) and must be available during regular business hours to accept legal documents on behalf of the corporation.

Specify the number of shares the corporation is authorized to issue, if applicable. This information is critical for defining the ownership structure of the corporation.

Overlook the need for a registered agent’s consent. It's not enough to merely designate a registered agent; their written consent is required to ensure they agree to take on this important role.

Ignore the filing fee. A specific fee must accompany your Articles of Incorporation. Failure to include the correct amount can result in the rejection of your application.

When completed with the requisite care and attention to detail, the Florida Articles of Incorporation form is the first step toward establishing a legal corporate entity in the state. Adhering to these do's and don'ts can help streamline the process, avoiding common pitfalls that could delay or impact the successful formation of your corporation.

Misconceptions

Starting a business in Florida is an exciting venture. However, when it comes to the legal paperwork, specifically the Florida Articles of Incorporation, there are several misunderstandings. Here are four common misconceptions that need to be cleared up:

Filing Is Complicated and Time-Consuming: One common misconception is that the process of filing the Articles of Incorporation in Florida is complicated and will take a lot of time. In reality, Florida has streamlined the process. You can easily file online through the Division of Corporations' website, and the process can be completed quickly if you have all the required information ready.

You Need a Lawyer to File: Many people think they need to hire a lawyer to file the Articles of Incorporation. Although having legal advice can be beneficial, especially for complex business structures, it is not a requirement. The form itself is straightforward, and plenty of resources are available to help individuals understand and complete the process on their own.

It’s Expensive to File: Another misconception is that filing the Articles of Incorporation is expensive. The state filing fee is actually quite reasonable, and while there may be additional costs depending on your specific situation (such as hiring a professional to help with the filing or expedited processing fees), the base cost is not prohibitive for most new businesses.

Once Filed, There’s Nothing More to Do: Some believe that once the Articles of Incorporation are filed, there's nothing more to do. This isn't true. After filing, businesses must comply with ongoing requirements such as annual reports and taxes. Additionally, there may be other permits or licenses required depending on the type of business and its location.

Understanding these misconceptions can help smooth the process of starting a new business in Florida, ensuring you're well-prepared for the steps ahead.

Key takeaways

Starting a corporation in Florida is a significant step toward establishing a formal business presence. The Florida Articles of Incorporation form is central to this process, serving as the official document that brings a corporation into existence under state law. Understanding the importance of accurately completing and using this form cannot be overstated. Below are several key takeaways to guide individuals through this critical process.

- Accuracy is critical: Every piece of information provided on the Florida Articles of Incorporation needs to be accurate and up-to-date. Inaccurate information can lead to delays, legal issues, or the denial of the incorporation process.

- Name availability: Before submitting the Articles of Incorporation, it's imperative to ensure the desired corporation name is available and complies with Florida’s naming requirements. This includes distinctiveness from existing names in the state’s database.

- Principal office address: The form requires a principal office address, which will be part of the public record. This address must be a physical location where the corporation’s primary activities take place.

- Registered Agent: Appointing a registered agent is a necessity. This agent will be responsible for receiving important legal and tax documents on behalf of the corporation. The selected registered agent must have a physical address in Florida and be available during normal business hours.

- Shares authorization: The Articles of Incorporation must specify the number of shares the corporation is authorized to issue. This influences corporate structure, equity distribution, and taxation. Thoughtful consideration should be given to the amount and type of shares authorized.

- Filing fee: Submission of the Articles of Incorporation to the Florida Department of State requires a filing fee. The fee amount is subject to change, so it's advisable to verify the current cost at the time of filing.

- Professional assistance: Considering the legal and financial ramifications of incorporating, consulting with legal and financial professionals can provide invaluable guidance. They can offer insight into the implications of decisions made during the incorporation process.

Fulfilling the requirements of the Florida Articles of Incorporation is the first step in building a corporation that complies with state law. It represents a commitment to operational, legal, and financial responsibility. By paying close attention to the details and seeking appropriate assistance, this process can be navigated successfully, setting a solid foundation for the business's future endeavors.

Popular Articles of Incorporation State Forms

Texas Llc Yearly Fees - It’s advisable for businesses to consult legal counsel when drafting their Articles of Incorporation to ensure compliance with all regulatory requirements.

Certificate of Corporation Ny - It might contain clauses on indemnification of directors and officers, protecting them against certain liabilities.