Free Articles of Incorporation Form for California

Starting a corporation in California is an exciting step for any entrepreneur. It marks the beginning of a new business adventure, but it also comes with its fair share of legal requirements. One of the first and most important steps in this process is filling out the Articles of Incorporation form. This document is crucial as it officially registers your corporation with the State of California, allowing you to do business legally within the state. The form asks for various pieces of information about your corporation, including its name, purpose, the address of its principal office, the name and address of its registered agent, and information about its shares and stock structure. Completing this form accurately is essential for establishing your corporation's legal foundation, influencing everything from your ability to open bank accounts to your eligibility for certain types of loans and lines of credit. Understanding each section and what it requires can help ensure that the process goes smoothly, setting your business up for success from the start.

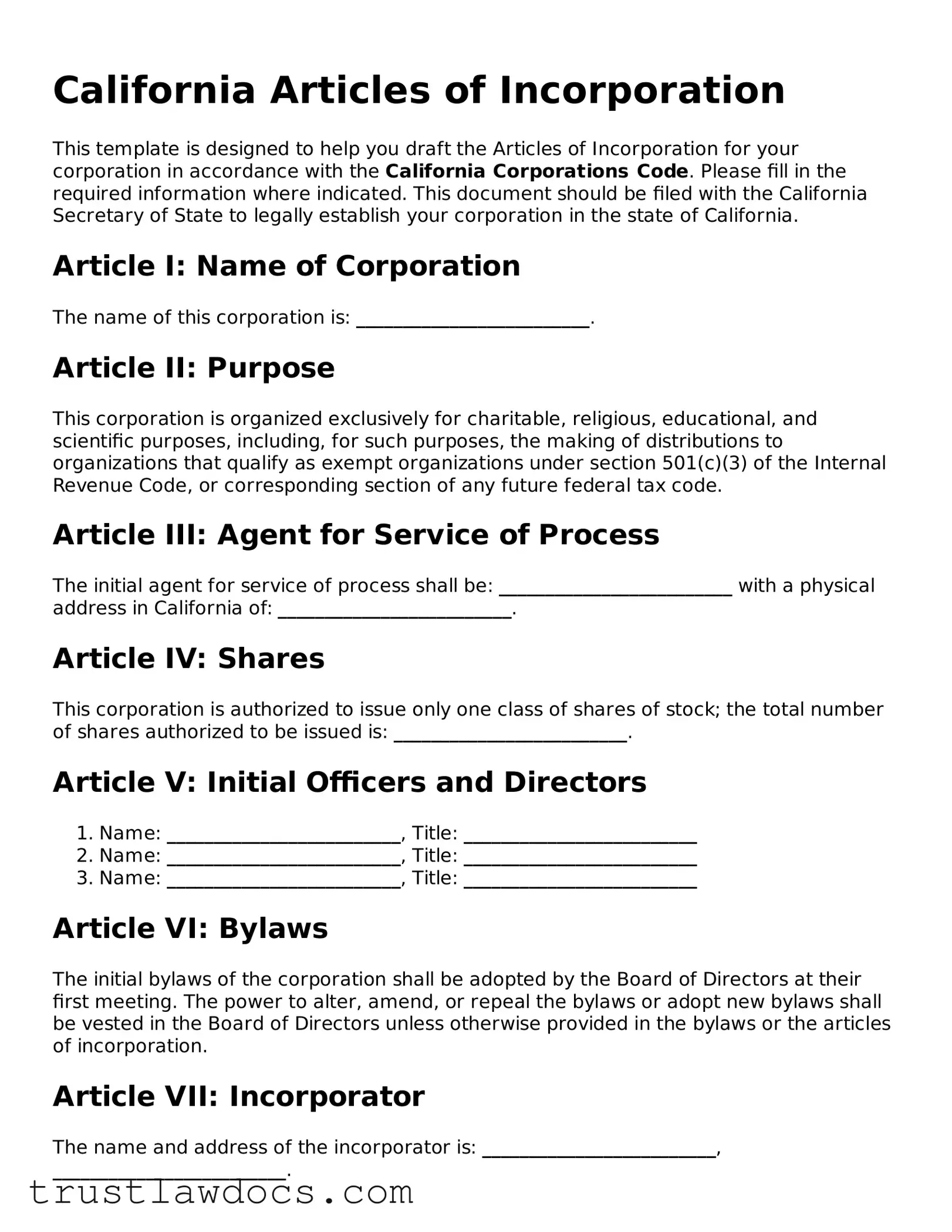

Form Example

California Articles of Incorporation

This template is designed to help you draft the Articles of Incorporation for your corporation in accordance with the California Corporations Code. Please fill in the required information where indicated. This document should be filed with the California Secretary of State to legally establish your corporation in the state of California.

Article I: Name of Corporation

The name of this corporation is: _________________________.

Article II: Purpose

This corporation is organized exclusively for charitable, religious, educational, and scientific purposes, including, for such purposes, the making of distributions to organizations that qualify as exempt organizations under section 501(c)(3) of the Internal Revenue Code, or corresponding section of any future federal tax code.

Article III: Agent for Service of Process

The initial agent for service of process shall be: _________________________ with a physical address in California of: _________________________.

Article IV: Shares

This corporation is authorized to issue only one class of shares of stock; the total number of shares authorized to be issued is: _________________________.

Article V: Initial Officers and Directors

- Name: _________________________, Title: _________________________

- Name: _________________________, Title: _________________________

- Name: _________________________, Title: _________________________

Article VI: Bylaws

The initial bylaws of the corporation shall be adopted by the Board of Directors at their first meeting. The power to alter, amend, or repeal the bylaws or adopt new bylaws shall be vested in the Board of Directors unless otherwise provided in the bylaws or the articles of incorporation.

Article VII: Incorporator

The name and address of the incorporator is: _________________________, _________________________.

Declaration

We, the undersigned, declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Executed on this __________ day of ________________, 20____ at ________________________, California.

Signature of Incorporator: __________________________

Print Name of Incorporator: __________________________

PDF Form Details

| Fact Name | Detail |

|---|---|

| Purpose | The California Articles of Incorporation form is used to legally establish a corporation in the state of California. |

| Governing Law | This form and the incorporation process it initiates are governed by the California Corporations Code. |

| Filing Body | The form is filed with the California Secretary of State. |

| Required Information | Information required includes the corporation name, principal executive office address, agent for service of process, and shares information. |

| Processing Time | Processing times can vary but expedited options are available for an additional fee. |

| Filing Fee | There is a filing fee associated with the Articles of Incorporation, subject to change; consult the Secretary of State's office for the current rate. |

| Online Filing | Certain types of corporations can file the Articles of Incorporation online through the California Secretary of State's website. |

| Benefit Corporations | California allows for the creation of benefit corporations, which are for-profit entities that aim to produce public benefits alongside financial profits. |

| Annual Requirements | After incorporation, corporations are required to file an annual Statement of Information with the California Secretary of State. |

How to Write California Articles of Incorporation

Filling out the California Articles of Incorporation form is a significant step for anyone looking to establish a corporation in the state. This document formally creates your corporation, so it's crucial to complete it accurately and thoroughly. After submission, the form undergoes a review by the California Secretary of State. If approved, your corporation becomes officially recognized. This recognition allows you to conduct business, enter into contracts, and fulfill various other legal capacities under your corporation’s name. Here's a step-by-step guide to help you complete the form with ease.

- Begin with the corporation's name: Ensure the name complies with California law, is distinguishable from other names registered with the Secretary of State, and includes a corporate designator such as "Inc.," "Corporation," or a similar abbreviation.

- Specify the purpose of the corporation: Clearly state the main business activity. Some types of corporations, like non-profits, are required to provide more detailed purpose descriptions.

- Appoint a registered agent: The agent must have a physical address in California (a P.O. Box is not sufficient) and be willing and able to receive legal documents on behalf of the corporation.

- Declare the stock structure: If your corporation will issue stock, specify the total number of shares authorized to be issued. Different classes of stock should also be delineated here if applicable.

- Detail the corporation's addresses: Provide the initial street address of the corporation's principal executive office and, if different, the mailing address.

- Name the incorporator(s): These are the individuals or entities responsible for executing the Articles of Incorporation. Include their names and addresses.

- Elect the initial directors: If the corporation will have a board of directors at the time of filing, list the names and addresses of each director.

- Add any additional provisions: These may relate to the management of the corporation, indemnification of directors and officers, or other relevant matters.

- Include the incorporator’s signature: The form must be signed by the incorporator(s), confirming the information on the form is accurate and in compliance with state law.

- Review the form for accuracy: Before submission, thoroughly check the form to ensure all information is correct and complete to avoid delays or rejection.

- File the form with the Secretary of State: Submit the form along with the required filing fee. Filing can be done by mail or, in some cases, online, depending on the services offered by the Secretary of State.

After filing, you will receive confirmation that the Secretary of State has accepted your Articles of Incorporation. This marks the beginning of your corporation's legal existence. It's now important to comply with any other regulatory requirements, such as obtaining business licenses and permits, setting up the appropriate tax accounts, and filing an initial Statement of Information. These steps are critical for operating your corporation in good standing within California.

Get Answers on California Articles of Incorporation

What are the Articles of Incorporation in California?

The Articles of Incorporation is a document required to legally establish a corporation in California. It outlines key details about the corporation such as its name, purpose, corporate structure, and the information about incorporators. Once filed with the California Secretary of State, the corporation becomes officially recognized.

How do I file my Articles of Incorporation in California?

To file the Articles of Incorporation in California, you need to complete the appropriate form, which can be obtained from the California Secretary of State’s website. After filling it out with the required information, you can submit it either by mail, in person, or online, along with the necessary filing fee. Ensure all information is accurate to avoid delays.

What information is needed to fill out the Articles of Incorporation?

You will need to provide the name of your corporation, its purpose, the name and address of the agent for service of process, the number of shares the corporation is authorized to issue, and the information about the incorporators. Specific details about stock and the corporation’s structure may also be required, depending on your corporation’s type.

Who can act as an agent for service of process in California?

An agent for service of process in California can be either an individual residing in California or a corporation registered with the California Secretary of State. This agent is responsible for receiving legal documents on behalf of the corporation.

Is there a filing fee for the Articles of Incorporation in California?

Yes, there is a filing fee for the Articles of Incorporation in California. The fee is subject to change, so it is recommended to check the most current fee schedule on the California Secretary of State’s website or contact them directly.

How long does it take to process the Articles of Incorporation in California?

The processing time can vary depending on the method of submission and the current workload of the California Secretary of State’s office. Filings done online or in person may be processed more quickly than those submitted by mail. It is advisable to check with the Secretary of State for current processing times.

Can I expedite the filing of my Articles of Incorporation in California?

Yes, California offers expedited filing options for an additional fee. These options can significantly reduce the processing time. Detailed information on expedited filing fees and the process can be found on the California Secretary of State's website.

What happens after my Articles of Incorporation are filed in California?

Once your Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation from the California Secretary of State. Afterward, your corporation will need to fulfill other legal requirements, such as holding an initial board of directors meeting, issuing stock, and applying for any necessary business licenses and permits.

Common mistakes

Filling out the California Articles of Incorporation is a critical step in formalizing your business structure, but it's easy to stumble over common pitfalls. One frequent mistake is not specifying the type of corporation correctly. California allows for different corporation types, such as general stock, no stock, and professional corporations. Each type has its own set of rules and tax implications, so it's crucial to choose the one that best fits your business's needs.

Another area where errors occur is in the naming of the corporation. The chosen name must comply with California law, meaning it cannot be the same as or too similar to an existing business name in the state. Additionally, certain words may require special permissions or be completely prohibited. Failing to perform a thorough name search or misunderstanding the naming guidelines can lead to rejection of the Articles of Incorporation.

Incorrectly listing the corporation's address is also a common mistake. The Articles of Incorporation require a physical street address, not a P.O. Box. This address is where legal documents can be delivered, so it must be accurate and reliable. Mistaking the mailing address for the physical address can delay legal processes and communications.

Many people forget to appoint or properly designate an agent for service of process. This agent acts as the corporation's representative for receiving legal documents. The designated agent must be willing and able to perform this role, and their information must be accurately listed in the Articles of Incorporation. Failure to correctly identify the agent can result in the inability to be properly notified of legal actions, which can have serious implications for the business.

The number of shares the corporation is authorized to issue is another aspect often filled out incorrectly. This number should reflect your business’s financial structure and future growth plans. Setting it too low can limit the company’s ability to attract investors or expand, while setting it too high might increase certain taxes or fees. Understanding how share authorization impacts both the present and future of the company is essential.

Detailing the initial directors incorrectly is yet another common mistake. Some incorporators fail to list all the initial directors or provide inaccurate information about them. This oversight can complicate governance and operational procedures until the error is rectified. As these initial directors will play crucial roles in the early stages of the corporation, their accurate identification is paramount.

Omission of the corporation's purpose can also pose issues. While some states allow for a broad, all-purpose clause, California requires a more defined statement of purpose, especially for certain specialized types of corporations. Leaving this section vague or incomplete can hinder your corporation's ability to operate as intended within the state.

Lastly, not adhering to the signature requirements often trips up many applicants. The Articles of Incorporation must be signed by the incorporator(s), and if any allegations need to be included, these documents must also be correctly signed and attached. Overlooking the significance of these formalities can invalidate the entire document, delaying the incorporation process unnecessarily.

Being attentive to these common mistakes and approaching the filing process with careful review can ensure your corporation's successful formation in California. Remember, consulting with a professional can provide further clarity and assistance, helping to navigate these and other potential hurdles.

Documents used along the form

When forming a corporation in California, the Articles of Incorporation form is just the beginning. Several other forms and documents are commonly required to fully establish and maintain the legal and operational framework of a new business. These materials vary in purpose, from detailing the structure of the company to ensuring compliance with state regulations.

- Bylaws: Bylaws are crucial for outlining the internal rules governing the management of the corporation. They specify the rights and responsibilities of directors, officers, and shareholders, including how decisions are made and how meetings are conducted.

- Statement of Information: This document must be filed with the California Secretary of State within 90 days of filing the Articles of Incorporation and biennially thereafter. It includes important information about the corporation, such as the names and addresses of directors, the chief executive officer, and the agent for service of process.

- Stock Certificates: Although not a formal filing, issuing stock certificates to the shareholders is an important step in establishing ownership interests in the corporation. These certificates provide evidence of each shareholder's investment in the company.

- Action by Written Consent of Incorporator: When a corporation is formed, the incorporator, who files the Articles of Incorporation, often takes initial actions by written consent. This document sets the foundation for the company by appointing the initial directors and adopting the bylaws.

- Employer Identification Number (EIN) Application: An EIN, obtained by filing Form SS-4 with the IRS, is required for tax purposes. This nine-digit number is used to identify the business entity for federal tax reporting.

- Business License Application: Depending on the type of business and its location, various local and state permits and licenses may be required. The application process varies by jurisdiction, but it's essential for operating legally within the state.

Together with the Articles of Incorporation, these documents form the backbone of a corporation's legal and operational structure. Not only do they ensure compliance with state and federal laws, but they also lay the groundwork for the day-to-day and strategic decision-making processes of the company. It is crucial for business owners to understand the purpose and requirements of each document in the context of their specific operations and legal obligations.

Similar forms

The Articles of Incorporation, a crucial document in the United States for registering a corporation, have parallels with various other legal documents necessary for different organizational and legal processes. One such similar document is the LLC Operating Agreement. While the Articles of Incorporation establish the existence of a corporation, the LLC Operating Agreement sets out the operations, governance, and ownership details of a limited liability company (LLC). Both are foundational documents that define the structure and rules governing their respective entities, although they serve different types of organizations.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation register the corporation with the state and outline its basic structure, the Bylaws delve into the detailed governance rules of the corporation. This includes the process for electing directors, holding meetings, and other operational details. Both documents work in concert to establish and detail the internal regulations that will guide the corporation.

Similarly, the Business Plan shares common goals with the Articles of Incorporation, albeit in a broader sense. A Business Plan outlines a company's objectives, strategies, market analysis, and financial forecasts. Although not a legal document like the Articles of Incorporation, the Business Plan serves as a roadmap for the business, necessary for seeking investments, just as the Articles of Incorporation are necessary for legal recognition.

The Partnership Agreement is akin to the Articles of Incorporation for businesses operated by two or more persons. This document outlines the responsibilities, profit share, and operational guidelines amongst partners, playing a similar role to the Articles for corporations by setting the foundational rules and structure for the business entity’s operation and governance.

The Certificate of Formation is closely related to the Articles of Incorporation but is used for forming LLCs in some states. It performs the equivalent role of registering the entity with the state, specifying its name, purpose, duration, and management structure. Both the Certificate of Formation and the Articles of Incorporation serve as the official birth certificates for their respective entities.

Nonprofit Articles of Incorporation mirror the for-profit version but are specifically tailored for nonprofit organizations. These documents establish a nonprofit corporation, detailing its name, purpose, initial directors, and operational statute adherence, similar to how for-profit Articles outline the structure and intent of a business corporation. The main difference lies in the entity’s purpose and the tax exemptions that nonprofits may qualify for.

Lastly, the Declaration of Trust shares a common goal with the Articles of Incorporation, as it establishes a trust. While the Articles organize a corporation, the Declaration of Trust outlines the terms, trustees, and operations of a trust. Both serve as primary documents that formally create and provide the operational framework for their respective entities, albeit in different legal contexts.

Dos and Don'ts

When preparing the California Articles of Incorporation, accuracy and completeness are crucial. These documents lay the foundation for your corporation, establishing its legal identity and governing principles. Below is a guide designed to help ensure that your filing process is both efficient and compliant.

5 Things You Should Do:Ensure all required information is complete and accurate. This includes the corporation's name, corporate purpose, agent for service of process, and the share structure. Omitting details or providing incorrect information can lead to processing delays or rejection.

Conduct a thorough name availability search before submitting your form to ensure the chosen corporate name is not already in use or too similar to an existing name, as this can lead to your application being denied.

Choose a registered agent wisely. The agent must be available during normal business hours to accept legal documents on behalf of the corporation. This role is critical in ensuring that you don’t miss any important legal notices.

Specify the type of corporation you are registering (e.g., general stock, no stock, close, professional). Clear identification helps in aligning your corporation with the right legal and tax frameworks.

Keep a copy of the documents for your records before submitting them. Having your own record of what was filed can assist in resolving any discrepancies that might arise with the state filing office.

Do not leave sections blank. If a section does not apply, indicate with “N/A” (not applicable) or “None,” as appropriate. Blank sections can cause confusion and delays.

Avoid using unauthorized or restricted words in your corporation's name unless you have the necessary licenses or permissions. This includes words like "bank," "trust," "insurance," which may require additional regulatory oversight.

Do not rush through the process without reviewing each section carefully for accuracy and completeness. Mistakes can be costly to correct later and may even require re-filing the form.

Don’t forget to sign and date the form. Unsigned documents are invalid and will be returned, causing unnecessary delays in your filing process.

Refrain from providing personal information such as Social Security Numbers unless specifically required. Minimizing the risk of identity theft is important, and personal information should be protected.

Following these dos and don'ts will help streamline your filing process, ensure compliance, and set your corporation up for a successful start in California.

Misconceptions

When preparing to file the California Articles of Incorporation, many individuals encounter misconceptions about the form and its requirements. Understanding these misconceptions can help in accurately completing and filing the form, ensuring a smoother process for establishing a corporation in California. Here are nine common misconceptions:

- Filing is the final step to start your business. While filing the Articles of Incorporation is a crucial step, it's not the only requirement. Businesses must also obtain the necessary licenses and permits, file for an Employer Identification Number (EIN), and fulfill other state-specific requirements.

- The Articles of Incorporation are the same in every state. Each state has its own set of rules and forms, including California. It's essential to use the California-specific form and adhere to the state's particular requirements.

- The process is too complicated for individuals to complete on their own. While the process can seem daunting, the California Secretary of State provides resources to help. Many individuals can complete the form without professional help, although consulting with a legal expert can provide added assurance.

- Only large businesses need to incorporate. Businesses of any size can benefit from incorporation, gaining legal protection, potential tax advantages, and increased credibility.

- Personal information must be provided for all shareholders. California requires the names and addresses of the corporation’s directors, not its shareholders, to be listed in the Articles of Incorporation.

- Once filed, the Articles cannot be changed. While it's important to be accurate, amendments can be filed if changes are needed later on, such as updating the corporation's address or changing its name.

- There’s only one type of corporation. California recognizes several types of corporations, including C corporations, S corporations, and non-profit corporations. Each has different implications for taxation and governance.

- Filing fees are prohibitively expensive. While there is a cost to file the Articles of Incorporation, it is generally considered reasonable. The exact fee can vary, so it's advisable to check the current rates on the California Secretary of State’s website.

- Approval is guaranteed upon filing. While most filings are approved, the California Secretary of State’s office reviews each submission. Approval is contingent upon the form being correctly filled out and the proposed corporation complying with all state regulations.

Dispelling these misconceptions ensures a more informed approach to incorporating in California. With a clear understanding of the process, requirements, and expectations, individuals can more effectively navigate the formation of their corporation, laying a solid foundation for their business ventures.

Key takeaways

The California Articles of Incorporation form is a crucial document for individuals looking to establish a corporation within the state. This process, while straightforward, requires attention to detail and an understanding of the specific requirements set forth by the state. Here are key takeaways to guide you through properly filling out and using the form:

- Complete All Required Sections Accurately: It is imperative that every section of the Articles of Incorporation form be filled out with accurate information. This includes the corporate name, which must be distinguishable from other entities registered in California, and must comply with state requirements regarding corporate designators. The form also requires the address of the corporation and the name and address of the agent for service of process, who will be authorized to receive legal documents on behalf of the corporation.

- Understand the Shares Structure: The form asks for details about the corporation's shares structure. This involves specifying the number of shares the corporation is authorized to issue, and if there are multiple classes of shares, each class must be described in detail. This is a critical step, as it affects the corporation's ability to raise capital and the rights of its shareholders.

- Include Additional Statements if Applicable: Depending on the nature of the corporation, additional statements may be required. For instance, if the corporation is a professional corporation, it must include a statement specifying the professional services it will provide. Similarly, if certain provisions related to directors' liability or corporate indemnification are to be included, they must be explicitly stated in the Articles of Incorporation.

- Ensure Proper Filing and Follow-Up: After completing the form, it must be filed with the California Secretary of State's office along with the appropriate filing fee. It is important to follow up to ensure that the filing has been processed and to obtain a certified copy of the Articles of Incorporation for your records. This document serves as a foundational legal document for your corporation, so keep it in a safe, accessible place.

By focusing on these key areas, individuals can navigate the complexities of creating a corporation in California, laying a strong foundation for their business's legal structure and compliance. It's always advisable to seek legal guidance when filling out and filing legal documents to ensure accuracy and adherence to all applicable laws and regulations.

Popular Articles of Incorporation State Forms

Certificate of Corporation Ny - It might ask for an assessment of the initial capital contributions of the shareholders.

Article of Incorporation Indiana - Enhances your business’s ability to enter into contracts and engage in legal transactions.