Official Articles of Incorporation Document

Embarking on the journey of forming a corporation is a significant step for entrepreneurs, one that is paved with critical documentation, the cornerstone of which is the Articles of Incorporation. This essential document serves as the birth certificate for a corporation, marking its entry into the legal world. It outlines the fundamental aspects of a business, including its name, purpose, location, duration, and details about shares and stock distribution. Each state has its own specific requirements for what needs to be included, but the overarching aim is uniform: to officially register the corporation with the state's Secretary of State or similar authority. Additionally, this form plays a pivotal role in establishing the legal identity of the corporation, setting the stage for future operational and financial activities, such as opening bank accounts and securing loans. By meticulously crafting the Articles of Incorporation, entrepreneurs lay the foundational stone for their corporation's structure and governance, ensuring compliance with state laws and regulations.

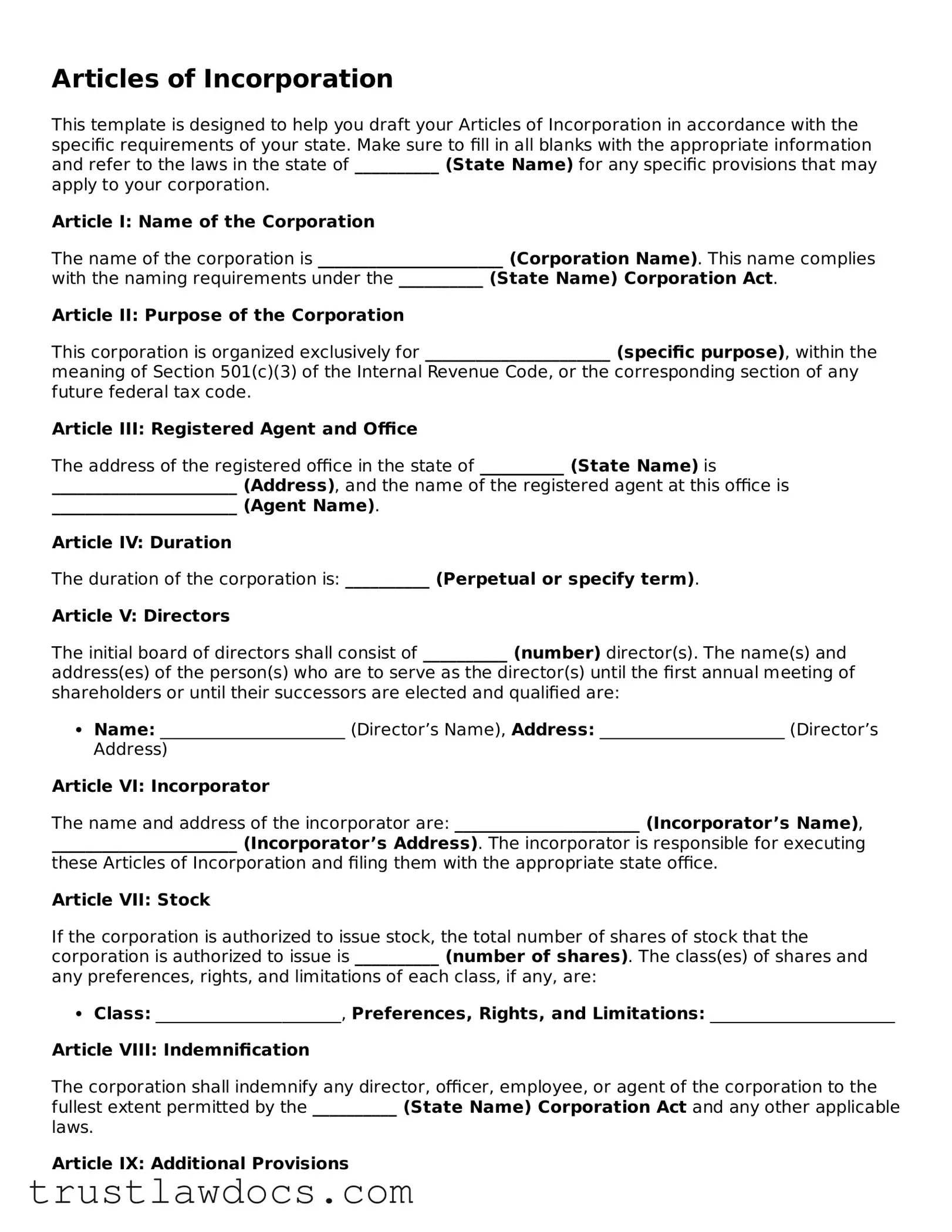

Form Example

Articles of Incorporation

This template is designed to help you draft your Articles of Incorporation in accordance with the specific requirements of your state. Make sure to fill in all blanks with the appropriate information and refer to the laws in the state of __________ (State Name) for any specific provisions that may apply to your corporation.

Article I: Name of the Corporation

The name of the corporation is ______________________ (Corporation Name). This name complies with the naming requirements under the __________ (State Name) Corporation Act.

Article II: Purpose of the Corporation

This corporation is organized exclusively for ______________________ (specific purpose), within the meaning of Section 501(c)(3) of the Internal Revenue Code, or the corresponding section of any future federal tax code.

Article III: Registered Agent and Office

The address of the registered office in the state of __________ (State Name) is ______________________ (Address), and the name of the registered agent at this office is ______________________ (Agent Name).

Article IV: Duration

The duration of the corporation is: __________ (Perpetual or specify term).

Article V: Directors

The initial board of directors shall consist of __________ (number) director(s). The name(s) and address(es) of the person(s) who are to serve as the director(s) until the first annual meeting of shareholders or until their successors are elected and qualified are:

- Name: ______________________ (Director’s Name), Address: ______________________ (Director’s Address)

Article VI: Incorporator

The name and address of the incorporator are: ______________________ (Incorporator’s Name), ______________________ (Incorporator’s Address). The incorporator is responsible for executing these Articles of Incorporation and filing them with the appropriate state office.

Article VII: Stock

If the corporation is authorized to issue stock, the total number of shares of stock that the corporation is authorized to issue is __________ (number of shares). The class(es) of shares and any preferences, rights, and limitations of each class, if any, are:

- Class: ______________________, Preferences, Rights, and Limitations: ______________________

Article VIII: Indemnification

The corporation shall indemnify any director, officer, employee, or agent of the corporation to the fullest extent permitted by the __________ (State Name) Corporation Act and any other applicable laws.

Article IX: Additional Provisions

Additional provisions regarding the management of the corporation, the rights and obligations of shareholders, directors, and officers, and any other necessary information are as follows:

______________________________________________________________________________________________________

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation this __________ (date).

______________________________________

Incorporator’s Signature

______________________________________

Incorporator’s Printed Name

PDF Form Details

| Fact Number | Fact |

|---|---|

| 1 | The Articles of Incorporation is a document required to legally form a corporation in the United States. |

| 2 | This document is filed with a state's secretary of state or an equivalent department. |

| 3 | Contents of the Articles of Incorporation typically include the corporation’s name, purpose, duration, stock details, and information about the incorporator(s). |

| 4 | Each state has its own specific requirements and forms for the Articles of Incorporation, governed by state corporation statutes. |

| 5 | Filing fees for the Articles of Incorporation vary by state. |

| 6 | The document must be approved by the state for the corporation to be officially recognized. |

| 7 | Some states require the inclusion of a registered agent’s name and address in the document. A registered agent is responsible for receiving legal documents on behalf of the corporation. |

| 8 | After approval, the corporation is required to adhere to state laws regarding corporations, which may include annual report filings and tax obligations. |

| 9 | Amendments to the Articles of Incorporation can be filed if changes need to be made after the initial filing, subject to state laws. |

How to Write Articles of Incorporation

Once you've decided to formalize your business as a corporation, one of the first legal steps you'll need to take is filing the Articles of Incorporation. This document, essential for the creation of your corporation, is submitted to your state's business filing agency. It serves as a formal declaration of your business’s corporate structure, its purpose, and the details of its foundational governance. Completing this form accurately is crucial, as it lays down the legal groundwork for your endeavor. The following steps guide you through this process, simplifying the completion of your Articles of Incorporation.

- Identify the required information. Before filling out the form, gather necessary details such as the corporation's name, its purpose, the name and address of the registered agent, the number and type of shares the corporation is authorized to issue, and the names and addresses of the incorporators and initial directors.

- Determine the corporation's name. Ensure that the name complies with your state's requirements, often including a corporate designator like "Inc." or "Corporation" and is distinguishable from other business names already on file.

- Specify the purpose of the corporation. Some states require a detailed description of the business's intended activities, while others accept a general statement that the corporation engages in all lawful business.

- Detail the registered agent and office. The registered agent is the individual or corporation that will receive legal papers on behalf of your corporation. This section must include the agent's name and physical address within the state of incorporation.

- List the initial directors. If required by your state, provide the names and addresses of the individuals who will serve on the board of directors until the first annual meeting of shareholders.

- Define the share structure. Indicate the number of shares the corporation is authorized to issue, and if there are different classes of shares, provide details about each class.

- Include additional provisions. Some corporations choose to include provisions regarding director liability, indemnification of officers and directors, and other legal protections.

- Provide incorporator information. The incorporator, who signs and files the Articles of Incorporation, must include their name and address. If there are multiple incorporators, include details for each one.

- Review and verify the information. Before submission, double-check all entries for accuracy and completeness to prevent delays in the incorporation process.

- Submit the form. Follow the submission guidelines provided by your state's business filing agency, which may include online submission, mail, or in-person delivery, along with the appropriate filing fee.

After successfully filing the Articles of Incorporation, the next steps involve obtaining any necessary business licenses, applying for an Employer Identification Number (EIN), and preparing additional organizational documents like bylaws. Such preparations ensure the corporation not only starts on a firm legal foundation but also operates within the full compliance of state laws and regulations.

Get Answers on Articles of Incorporation

What are the Articles of Incorporation?

The Articles of Incorporation is a document that establishes the existence of a corporation in the United States. It’s filed with a state government, and it marks the corporation’s official birth. This document outlines the corporation's basic details, such as its name, purpose, and the amount and type of stock it is authorized to issue.

Who needs to file the Articles of Incorporation?

Any group wishing to form a corporation needs to file the Articles of Incorporation. This applies to both for-profit businesses and nonprofit organizations. Filing this document is one of the first steps toward establishing your entity as a legally recognized corporation in your state.

Where should the Articles of Incorporation be filed?

The Articles of Incorporation must be filed with the appropriate state agency that handles business incorporations. The specific agency varies by state, commonly being the Secretary of State's office. It's important to file in the state where your corporation will primarily operate, as each state has its own filing requirements and fees.

What information is typically required on the Articles of Incorporation form?

Though requirements can vary by state, the Articles of Incorporation typically include the corporation’s name, its purpose, the name and address of the registered agent, the number of shares the corporation is authorized to issue, and the names of the incorporators. It may also require details about the structure of the corporation, such as the composition of the board of directors.

How does one file the Articles of Incorporation?

Filing can usually be done online, by mail, or in person, depending on the state’s processes. You will need to complete the form according to your state’s requirements, pay any applicable filing fees, and submit it to the designated state agency. Some states provide templates or fillable forms to make the process easier.

Is there a fee to file the Articles of Incorporation?

Yes, there is typically a filing fee associated with the Articles of Incorporation. The fee can vary widely depending on the state where the corporation is being established. Some states have a flat fee, while others may base the fee on the number of authorized shares or the par value of those shares. It's crucial to check with the specific state agency for the exact fee structure.

Can the Articles of Incorporation be amended after they are filed?

Yes, corporations can amend their Articles of Incorporation. Amendments may be necessary to update the corporation’s name, change its purpose, increase or decrease the amount of authorized stock, or make other significant changes. The amendment process typically requires the preparation of an Articles of Amendment document and its submission to the same state agency where the original articles were filed, along with an amendment fee.

Common mistakes

When establishing a corporation, the Articles of Incorporation form plays a pivotal role. It serves as the foundation for the legal structure and recognition of the business. However, mistakes in filling out this document can lead to delays, additional expenses, or legal complications. Being aware of common pitfalls can streamline the process and set the stage for a corporation's successful future.

Not Checking Name Availability: One of the initial steps in the process that often gets overlooked is ensuring the chosen business name is available. States require that each corporation’s name be distinct from others already registered. Skipping this step may lead to the rejection of the Articles of Incorporation, necessitating a resubmission and, therefore, resulting in delays.

Incorrect Business Purpose Description: Another common mistake is providing an unclear or overly broad description of the business purpose. Some states have specific requirements about what this section should contain. A well-articulated business purpose can avoid confusion and potential legal issues down the line, especially in regulated industries.

Overlooking Shares Information: The Articles of Incorporation require information about the number and type of shares the corporation is authorized to issue. Businesses sometimes neglect to consider the long-term implications of their initial share structure. This omission can hinder the corporation’s ability to attract investors or alter its capital structure efficiently in the future.

Ignoring State-Specific Requirements: Each state has its unique set of requirements for the Articles of Incorporation. Failing to adhere to these can result in the document being returned for corrections. It is crucial for incorporators to familiarize themselves with these state-specific guidelines to prevent unnecessary setbacks.

Failing to Appoint a Registered Agent: The registered agent acts as the corporation’s official point of contact for legal documents. Omitting this information or not providing a reliable agent can have significant legal ramifications, including the inability to receive crucial legal and tax documents.

Misunderstanding Director and Officer Roles: Sometimes, there's confusion about the roles and responsibilities of directors and officers within the corporation. Clarifying these roles in the Articles of Incorporation, when required, ensures a clear governance structure and aids in the management of corporate affairs.

Ignoring Bylaws and Shareholder Agreements: While not always required to be submitted with the Articles of Incorporation, bylaws and shareholder agreements are essential for the internal governance of the corporation. Overlooking the need to prepare these documents can lead to operational and legal issues in the future.

Incorrect Filing Fee: The submission of the Articles of Incorporation often requires a filing fee. This fee can vary significantly from state to state. Submitting the incorrect amount can cause delays. Ensuring the correct fee is included with the submission can prevent this simple yet common mistake.

Incomplete Signatures: Finally, a critical yet frequently encountered oversight is not obtaining or including all required signatures. The Articles of Incorporation must be signed as dictated by state laws, and missing signatures can render the document incomplete, requiring resubmission.

Understanding and avoiding these common mistakes can aid in the smooth establishment of a corporation. It’s advisable to consult with legal professionals or use state-provided resources to ensure compliance and accuracy when completing the Articles of Incorporation.

Documents used along the form

When starting a corporation, filing the Articles of Incorporation is a critical first step. However, this document is only the beginning of a comprehensive process to legally establish and organize a corporation. To ensure a solid foundation and compliance with both federal and state laws, several other documents and forms are typically required or highly recommended. Each plays a unique role in defining the structure, governance, and operational guidelines of the corporation. Below is a list of documents commonly used in conjunction with the Articles of Incorporation, providing a more detailed framework for the newly formed entity.

- Bylaws - A crucial document that outlines the internal management structure and governance of the corporation. It specifies the rules for the board of directors, shareholder meetings, and other administrative procedures, playing a significant role in how decisions are made within the corporation.

- Operating Agreement - Especially relevant for a limited liability company (LLC), this document outlines the business' financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the needs of its owners.

- Shareholders' Agreement - An agreement among the shareholders of the corporation that specifies their rights, responsibilities, and obligations. It includes details on share ownership, distribution of profits and losses, and the procedures for handling the transfer of shares.

- Corporate Resolution - A formal statement of a decision passed by the board of directors of the corporation, providing official documentation that the board has authorized certain actions.

- Stock Certificates - Documents that certify ownership of a specific number of shares in the corporation. They serve as important legal evidence of stock ownership.

- Employment Agreement(s) - Contracts between the corporation and its employees, detailing the rights, responsibilities, and conditions of employment. This can include job descriptions, compensation, confidentiality agreements, and non-compete clauses.

- Annual Report - A comprehensive report on the corporation's activities throughout the preceding year, intended to provide shareholders and other interested parties with information about the company's financial performance and operations. Most states require corporations to file an annual report with the Secretary of State.

In addition to the Articles of Incorporation, these documents form the backbone of a corporation's legal and operational structure. Each serves a specific purpose and contributes to the overall organization, governance, and compliance of the business. It's important for corporations to prepare, maintain, and, where necessary, file these documents to ensure legal standing and operational efficiency. While the process may seem daunting, careful attention to these details can help secure the corporation's success and longevity.

Similar forms

The Articles of Organization share similarities with the Articles of Incorporation, as both are foundational documents filed with the state to legally form a new business entity. While the Articles of Incorporation are used to establish a corporation, the Articles of Organization serve the same purpose for limited liability companies (LLCs). Each document outlines essential details such as the business name, principal place of business, and the names of the initial directors or members, establishing the entity’s legal existence under state law.

Bylaws are closely related to the Articles of Incorporation, albeit serving a more internal function. While the Articles establish the corporation with the state, bylaws outline the rules and procedures for how the corporation will operate and make decisions. This document covers roles of officers, meeting protocols, and other operational guidelines, providing a framework for corporate governance after incorporation.

The Operating Agreement is to an LLC what bylaws are to a corporation, making these documents analogous in their respective entities. This legal document outlines the ownership structure, operational procedures, and financial arrangements among members of an LLC. Similar to bylaws, it provides detailed guidelines for internal management and decision-making processes, even though it is not filed with the state.

The DBA Declaration, or "Doing Business As" filing, although not exclusive to corporations, can be connected to the process of incorporating. It allows a business to operate under a trade name that differs from the legal name listed in its Articles of Incorporation. For businesses seeking to market themselves differently from their incorporated title, a DBA declaration is a necessary step, linking the alternate name legally to the established corporate entity.

Employer Identification Number (EIN) Application forms are essential for new corporations, similar to the need for filing Articles of Incorporation. The EIN, obtained through the IRS, is required for tax purposes and is used when opening business bank accounts, hiring employees, and filing tax returns. This form establishes the corporation’s tax identity, complementing its legal identity established by the Articles of Incorporation.

The Shareholder Agreement, particularly relevant for corporations with multiple owners, shares a relationship with the Articles of Incorporation through its focus on the ownership structure of the corporation. This agreement details the rights and obligations of shareholders, mechanisms for transferring shares, and how decisions are made. It supplements the Articles by outlining the practical implications of ownership and control, embodying the business's financial and operational agreements among shareholders.

Annual Reports, although filed after a corporation is established, relate to the ongoing compliance and operational status similarly outlined in the Articles of Incorporation. These reports provide current information about the corporation’s structure, activities, and financial status to the state, ensuring the company remains in good standing and adheres to regulatory requirements. This ongoing filing echoes the initial declaration of the corporation's purpose and structure as stated in the Articles.

The Certificate of Good Standing is another document that, while obtained after incorporation, is directly related to the proper filing and ongoing compliance with the stipulations originally set forth in the Articles of Incorporation. This certificate is proof from the state that a corporation is authorized to do business and is in compliance with all state regulations, including the submission of annual reports and other required filings. It reassures outsiders of the corporation's legitimacy and adherence to legal standards.

Lastly, the Foreign Qualification filings bear resemblance to the Articles of Incorporation when a corporation seeks to operate in states other than where it was originally incorporated. This process requires the corporation to obtain authorization from the other state(s) to do business, highlighting the corporation’s legal structure, directors, and purpose, much like the Articles of Incorporation. It extends the corporation's legal existence beyond its initial state, enabling interstate operations under acknowledged legal status.

Dos and Don'ts

When embarking on the exciting journey of forming a corporation, the completion of the Articles of Incorporation is a pivotal step. This document lays the foundation of your corporation, dictating its structure and governance. Below, find a comprehensive list of dos and don'ts to help guide you through filling out your Articles of Incorporation, ensuring accuracy and compliance with state laws.

- Do thoroughly research your state’s specific requirements. Each state has unique stipulations for incorporation, including differing fees, required information, and processing times. Understanding these nuances can significantly smooth your filing process.

- Do choose a distinctive and compliant name for your corporation. The name must not only resonate with your brand identity but also adhere to state regulations regarding name availability and restrictions. Typically, it must include a corporation identifier such as "Inc." or "Corporation."

- Do appoint a reliable Registered Agent. This role is crucial as it involves receiving legal documents on behalf of the corporation. The agent must have a physical address within the state of incorporation and be available during regular business hours.

- Do be precise in defining the purpose of your corporation. Although some states allow a general-purpose statement, detailing your corporation's specific objectives can be advantageous for legal clarity and operational direction.

- Don't overlook the importance of detailing the share structure. Clearly define the number and types of shares the corporation is authorized to issue, as this affects voting rights, dividends, and ownership distribution.

- Don't neglect to specify the duration of the corporation if it is not perpetual. Some corporations are created for a specific duration or project. This detail should be explicitly stated if applicable.

- Don't submit the document without a careful review. Errors or omissions can delay processing times and impact the legal standing of your corporation. Double-check every section for accuracy and completeness.

- Don't hesitate to seek professional advice. Whether from a legal advisor or an experienced mentor in your field, obtaining expert guidance can offer peace of mind and prevent potential missteps in the incorporation process.

By closely adhering to these guidelines, you can ensure a meticulous approach to filling out your Articles of Incorporation. This not only solidifies the legal foundation of your corporation but also sets a precedent for thoroughness and diligence that will benefit your business operations in the long term.

Misconceptions

When forming a corporation, the Articles of Incorporation is a critical document. However, several misconceptions surround its preparation and filing. Understanding these can help ensure the process is handled correctly.

The Articles of Incorporation are only required for large businesses. This is a common misconception. In fact, any entity seeking to form a corporation, regardless of size, must file these articles with the appropriate state authority to be legally recognized as a corporation.

They are complicated and require legal expertise to fill out. While it's beneficial to consult with a legal professional, especially for unique situations, many states provide templates or straightforward forms that can be completed by individuals without a legal background.

Articles of Incorporation are the same as Bylaws. This isn't true. The Articles of Incorporation are the initial document filed to create the corporation, whereas Bylaws are internal rules adopted by the corporation after it has been formed.

Filing Articles of Incorporation provides instant protection from personal liability. While incorporating can offer liability protection, this doesn't become effective until the corporation is fully formed and operational following all legal requirements.

Once filed, the Articles of Incorporation never need to be updated. In reality, any significant changes to the corporation, such as changes in address, corporate officers, or stock information, usually require an amendment to be filed with the state.

Any state's form can be used, regardless of where the business operates. It's vital to file the Articles of Incorporation in the state where the corporation intends to conduct business, using that state's specific form and following its unique procedures.

The only purpose of the Articles of Incorporation is to legally form the corporation. While this is a primary purpose, the articles also provide important information to the public, including the corporation’s name, address, and the names of its directors.

Articles of Incorporation can be filed without deciding on the corporation's management structure. Decisions regarding the governance of the corporation should be made before filing, as many states require information on the initial directors and stock structure in the articles.

Filing Articles of Incorporation automatically registers the business name. While the name is protected in the state of incorporation, this does not apply to other states and does not negate the need for a trademark if broader protection is desired.

Electronic filing is not as legitimate as paper filing. Most states have moved to electronic filing systems for efficiency and convenience. An electronically filed document carries the same legal weight as its paper counterpart.

Dispelling these misconceptions helps in understanding the pivotal role Articles of Incorporation play in forming a corporation. Accurate knowledge ensures that the process is approached with the necessary care and attention to detail.

Key takeaways

Filling out the Articles of Incorporation is a pivotal first step in legally establishing a corporation in the United States. This document is not just a formality; it's a foundational piece of your company's legal identity. To navigate this process smoothly and effectively, consider the following key takeaways:

- Details Matter: The Articles of Incorporation require precision. Each piece of information, from the corporation's name to the number of authorized shares, must be entered accurately. Errors or omissions can lead to delays or legal challenges down the road.

- Choosing a Name: The name of your corporation needs to comply with state regulations, including avoiding confusion with existing names and including a corporate designator such as "Inc." or "Corporation." Research thoroughly to ensure your chosen name is available in your state.

- Appointing a Registered Agent: Most states require the designation of a registered agent in the Articles of Incorporation. This agent acts as the corporation’s official contact for legal correspondence. Choose someone reliable, as missed communications can have serious legal consequences.

- Understanding Authorized Shares: When detailing the number of authorized shares, it’s crucial to consider the corporation’s future growth and investment needs. This number can be increased later, but it often requires additional paperwork and fees.

- State-Specific Requirements: The Articles of Incorporation vary significantly from state to state. Pay careful attention to local requirements, including any mandatory provisions or additional documents that need to be submitted alongside the form.

Properly completing and filing the Articles of Incorporation sets the legal foundation of your corporation. It's a task that demands attention to detail and an understanding of both your business goals and the legal landscape of your state. While online resources and templates can provide guidance, consulting with a legal professional is advisable to navigate any complexities and ensure compliance with all regulatory requirements.

Other Templates:

Florida Declaration of Domicile Requirements - The affidavit must be filled out by the executor or administrator of the estate, often with the assistance of a lawyer.

Promissory Note for Loan - Students may encounter promissory notes when taking out education loans, where the note lays out the conditions under which the money is borrowed and will be paid back.

Free Bill of Sale Template for Car - For businesses selling vehicles, this form is an important part of sales records, necessary for accounting and tax reporting.