Free Self-Proving Affidavit Form for Texas

When it comes to ensuring a will is swiftly and efficiently processed through the legal system, the Texas Self-Proving Affidavit form plays a pivotal role. This essential document, often attached to a will, simplifies the probate process by verifying the authenticity of the will and the soundness of the signatories' mental state. Crafted with the intent to streamline the validation process, this affidavit is a testimony that the will was executed properly, in the presence of witnesses, thereby often eliminating the need for those witnesses to be present in court. As the significance of a well-orchestrated estate plan cannot be overstated, understanding the nuances of the Texas Self-Proving Affidavit form becomes imperative for anyone navigating the complexities of estate planning. Moreover, it reflects an intuitive approach to legal procedures, ensuring that the final wishes of individuals are respected and upheld with minimal judicial intervention.

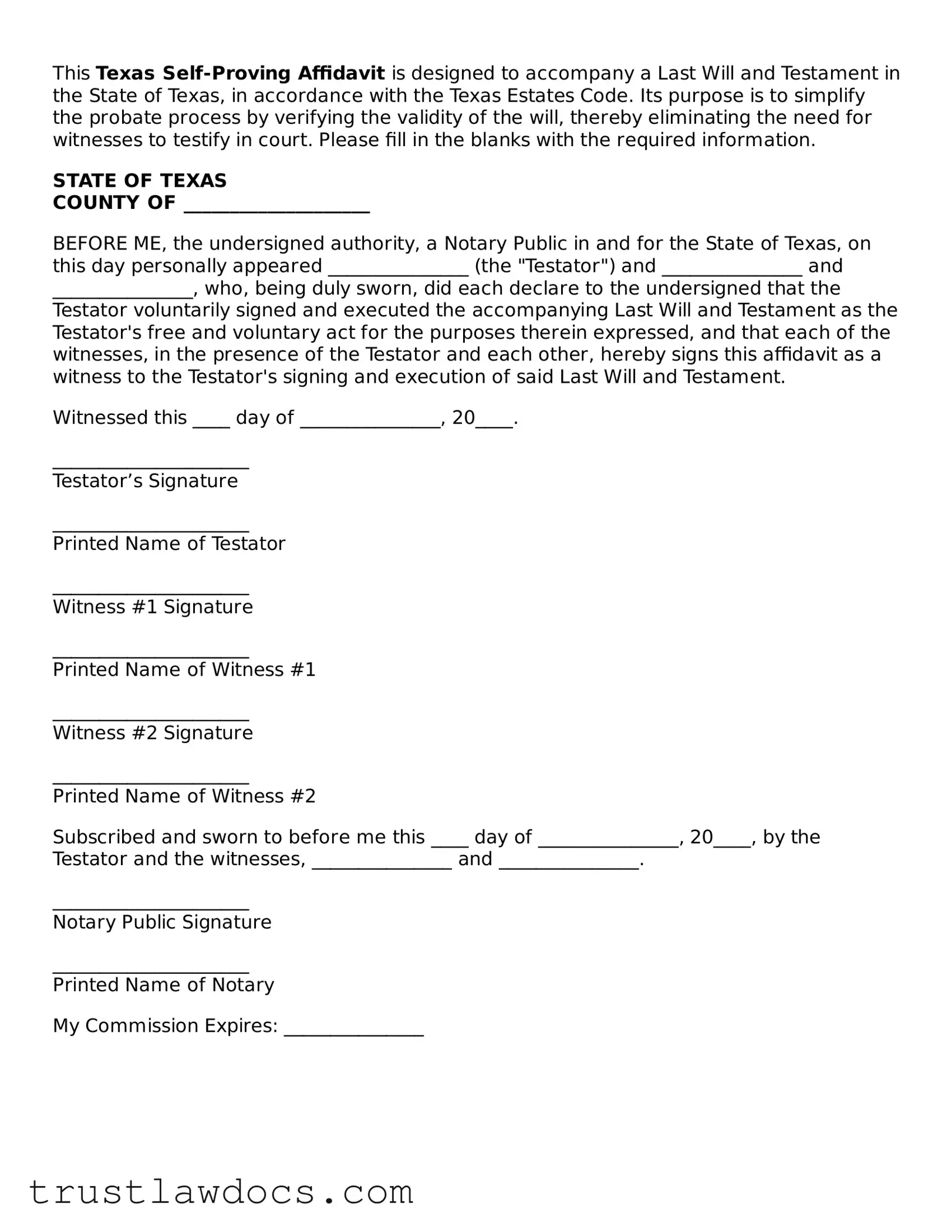

Form Example

This Texas Self-Proving Affidavit is designed to accompany a Last Will and Testament in the State of Texas, in accordance with the Texas Estates Code. Its purpose is to simplify the probate process by verifying the validity of the will, thereby eliminating the need for witnesses to testify in court. Please fill in the blanks with the required information.

STATE OF TEXAS

COUNTY OF ____________________

BEFORE ME, the undersigned authority, a Notary Public in and for the State of Texas, on this day personally appeared _______________ (the "Testator") and _______________ and _______________, who, being duly sworn, did each declare to the undersigned that the Testator voluntarily signed and executed the accompanying Last Will and Testament as the Testator's free and voluntary act for the purposes therein expressed, and that each of the witnesses, in the presence of the Testator and each other, hereby signs this affidavit as a witness to the Testator's signing and execution of said Last Will and Testament.

Witnessed this ____ day of _______________, 20____.

_____________________

Testator’s Signature

_____________________

Printed Name of Testator

_____________________

Witness #1 Signature

_____________________

Printed Name of Witness #1

_____________________

Witness #2 Signature

_____________________

Printed Name of Witness #2

Subscribed and sworn to before me this ____ day of _______________, 20____, by the Testator and the witnesses, _______________ and _______________.

_____________________

Notary Public Signature

_____________________

Printed Name of Notary

My Commission Expires: _______________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose of the Form | A Texas Self-Proving Affidavit form is used to validate a will without requiring live testimony from witnesses during probate. |

| Governing Law | The form is governed by the Texas Estates Code, specifically sections 251.104 and 251.107. |

| Required Signatures | The affidavit must be signed by the testator (the person making the will) and two witnesses, all in the presence of a notary public. |

| Witness Qualifications | Witnesses must be competent individuals, generally at least 14 years old, and should not be beneficiaries of the will. |

| Notarization | The affidavit requires notarization to be considered legally valid and effectively self-prove the will. |

| Advantages | Utilizing a self-proving affidavit can significantly streamline the probate process, potentially saving time and reducing legal fees. |

| Attachment to Will | The completed affidavit is typically attached to the will, forming an integral part of the will's documentation. |

How to Write Texas Self-Proving Affidavit

In Texas, a Self-Proving Affidavit is a handy document typically attached to a will. It's designed to simplify the probate process after the will's author passes away. By having a Self-Proving Affidavit, it becomes unnecessary for witnesses to physically appear in court to validate the will. This could save a significant amount of time and effort during a period that's already challenging for many. Here's how to fill out this form efficiently and correctly.

- Start by locating the most current version of the Texas Self-Proving Affidavit form. Verify that you have the correct document that is recognized by Texas law.

- Enter the full legal name of the individual creating the will, known as the "Testator," in the designated space at the top of the form.

- Proceed to fill in the names and complete addresses of the two witnesses. These individuals will testify that they observed the Testator signing the will and that the Testator appeared to be of sound mind and not under any undue influence at the time of signing.

- The next step is for the Testator to sign the affidavit in the presence of a Notary Public. Ensure that this is done accurately and in accordance with Texas law, which may require the presence of the witnessing parties during the signing.

- Following the Testator's signature, both witnesses must sign the affidavit. Their signatures also need to be done in the presence of the Notary Public. This step confirms their participation and their attestations regarding the Testator’s mental state and voluntariness in signing the will.

- The final step involves the Notary Public. The Notary will verify the identities of the Testator and witnesses. After witnessing all signatures, the Notary will then sign the affidavit and seal it with an official stamp. This act formally notarizes the document, making it a Self-Proving Affidavit.

Once these steps are completed, the Self-Proving Affidavit is effectively appended to the will. It's wise to keep this document in a secure location along with the will. Remember, the primary purpose of this affidavit is to facilitate a smoother probate process by preemptively addressing potential legal requirements related to the will's authentication.

Get Answers on Texas Self-Proving Affidavit

What is a Texas Self-Proving Affidavit?

A Texas Self-Proving Affidavit is a legal document that accompanies a will, serving as a testament that the will was executed correctly and validates the identity of the signatories. It is signed by the person making the will (the testator), two witnesses, and a notary public. This affidavit can significantly streamline the probate process by providing a sworn statement that the will is genuine, thus eliminating the need for witnesses to testify in court about the legitimacy of the will after the testator's death.

Who needs to sign a Texas Self-Proving Affidavit?

The Texas Self-Proving Affidavit must be signed by the same two or more adult witnesses who were present at the signing of the will and observed the testator sign the will or acknowledge the will. Additionally, the testator himself or herself must also sign the affidavit. Finally, the entire document must be notarized, which means a notary public will also sign and seal the affidavit, confirming the identity of the signers and the fact that they signed the document in the notary's presence.

Is a Texas Self-Proving Affidavit required for a will to be valid?

No, a Texas Self-Proving Affidavit is not required for a will to be considered valid. A will can still be legitimate without this affidavit, as long as it complies with Texas law requirements. However, having a self-proving affidavit is highly beneficial as it simplifies the probate process, making it easier, quicker, and less expensive to prove the validity of a will. Without it, witnesses might need to be located and brought to court to affirm the will's authenticity, which can be time-consuming and costly.

How do I create a Texas Self-Proving Affidavit?

Creating a Texas Self-Proving Affidavit involves drafting a statement that includes specific legally required language, which will affirm the validity of the will and its execution. This statement typically states that the testator, in the presence of witnesses, declared the document to be their will and that they signed it willingly. It should also include that the witnesses believe the testator to be of sound mind. All parties, including the testator, witnesses, and a notary public, must sign the affidavit. It's advisable to consult a legal professional to ensure the affidavit meets all legal requirements and is correctly executed. This extra step during the will-making process can save considerable time and effort during probate.

Common mistakes

When completing the Texas Self-Proving Affidavit form, a key step in streamlining the will validation process, individuals often stumble over a variety of common errors. A self-proving affidavit can significantly expedite the probate process by serving as evidence that a will is genuine and correctly executed, without necessitating the in-person testimony of witnesses. However, certain mistakes can undermine its effectiveness or even render it invalid, complicating what should be a straightforward procedure.

One frequent mistake is not having the affidavit notarized. In Texas, for a self-proving affidavit to be valid, it must be notarized. This means the individual making the will (the testator) and the witnesses must sign the document in the presence of a notary public. Neglecting this step renders the affidavit ineffective, forcing the probate court to rely on traditional methods to validate the will, such as locating and questioning witnesses.

Another common error occurs when individuals inadvertently use witnesses who are also beneficiaries of the will. Texas law stipulates that witnesses to the self-proving affidavit should not stand to benefit from the will to avoid any appearance of conflict of interest or undue influence. Utilizing impartial witnesses is essential for maintaining the document's integrity.

Incorrect or incomplete filling out of the form also leads to problems. Mistakes such as misspelled names, incorrect dates, or omitting necessary information can question the affidavit's validity. It is crucial to review the document carefully before signing to ensure all details are accurate and complete.

People often overlook the requirement for two witnesses. Texas law requires the presence of two competent witnesses over the age of 14 to sign the affidavit alongside the testator. Failing to meet this requirement could invalidate the affidavit, leaving the probate court to verify the will in a more traditional and time-consuming manner.

Failure to adhere to the specific format required by Texas law is yet another hurdle some encounter. The state provides a statutory form for the affidavit, and deviations from this format might cause acceptance issues in probate court. It's advisable to use the state-provided form or ensure any alternative format covers all statutory requirements.

Some individuals mistakenly believe that the self-proving affidavit serves as a substitute for a will, which is not the case. The affidavit is merely a testamentary instrument designed to authenticate the associated will, not replace it. This misunderstanding could lead to significant probate issues if the individual fails to properly execute a separate last will and testament.

Another pitfall is assuming the affidavit is automatically attached to the will. After completing the affidavit, it must be securely attached to the will to function as intended during the probate process. Separation of these documents can lead to delays, as the probate court may not recognize the will as self-proved.

Underestimating the importance of legal advice is a critical error. While filling out the affidavit might seem straightforward, the nuances of estate law and the potential for costly mistakes make consulting with a legal professional a wise decision. An attorney can provide guidance tailored to an individual's specific situation, ensuring all legal requirements are met efficiently.

Lastly, failing to update the affidavit following any changes to the will is a common oversight. If the will is altered in any way, a new self-proving affidavit must be executed. This requirement ensures that the affidavit accurately reflects the will's current state, preserving its integrity throughout the probate process.

Documents used along the form

When handling estate planning in Texas, a Self-Proving Affidavit is a document frequently utilized to streamline the probate process. This essential form is usually one of several critical documents required to ensure a person's wishes are honored and the transfer of assets happens smoothly after they're gone. Here's a look at up to 10 other forms and documents that are often used alongside the Texas Self-Proving Affidavit to provide a comprehensive and robust approach to estate planning.

- Will: A legal document that outlines how a person's assets and estate will be distributed upon their death. It names an executor who will manage the estate and can also appoint guardians for minor children.

- Durable Power of Attorney: This form allows an individual to appoint someone else to manage their financial affairs in case they become incapacitated.

- Medical Power of Attorney: Similar to the durable power of attorney, but specifically relates to making healthcare decisions on behalf of someone if they're unable to do so themselves.

- Directive to Physicians and Family or Surrogates: Often referred to as a living will, it outlines a person’s wishes regarding end-of-life medical treatment.

- Declaration of Guardian in the Event of Later Incapacity or Need: Identifies a preferred guardian for oneself and possibly for minor children in the event of incapacity.

- Appointment for Disposition of Remains: Lets individuals specify their wishes for the disposition of their remains and appoints someone to ensure those wishes are carried out.

- Transfer on Death Deed: Allows property owners to name a beneficiary to their real estate, effective upon their death, bypassing the probate process.

- Lady Bird Deed: A special kind of deed that provides the grantor retains control over the property until death, whereupon it passes to the designated beneficiary without the need for probate.

- Revocable Living Trust: Enables individuals to create a trust with assets that can be used for their benefit while they're alive but pass directly to beneficiaries upon death, avoiding probate.

- Inventory and Appraisement: A document that details all of the deceased person's assets and their value at the time of death, often required during the probate process.

Together with the Texas Self-Proving Affidavit, these documents form the backbone of a thorough estate plan. They ensure a person's wishes are clearly documented and can be executed without unnecessary delay or legal complication. It's important for individuals to consult with legal professionals to ensure these forms are accurately completed and reflect their intentions. Estate planning can be complex, but with the right set of documents, the process can be simplified significantly for the benefit of the individual and their loved ones.

Similar forms

The Texas Self-Proving Affidavit Form is similar to a Will, particularly because both documents are fundamental in the probate process. Just like a Will specifies how a person wants their assets distributed after death, a Self-Proving Affidavit complements this by providing a sworn statement from witnesses to the will's signing, streamlining the process by verifying its authenticity without requiring witnesses to testify in court.

It shares similarities with a Notarized Document, as both necessitate a notary public's validation to be considered legitimate and binding. This notarization serves as an official verification that the signers are indeed who they claim to be, based on identification and personal acknowledgment before the notary, which adds an extra layer of trust and legality to the document.

A Power of Attorney (POA) also bears resemblance due to its function of allowing one individual to make decisions on another's behalf. Much like how a Self-Proving Affidavit endorses the validity of a Will, a POA designates someone to act in various capacities (healthcare, financial) on behalf of the grantor, often requiring notarization to ensure its legal standing and prevent fraud.

Comparable to a Living Will, where individuals detail their wishes concerning medical treatments and life-sustaining measures in anticipatory healthcare scenarios, a Self-Proving Affidavit solidifies the testamentary intentions of an individual. Both documents aim to ensure that personal decisions are respected, even when the individual cannot express their preferences.

It is analogous to an Advance Healthcare Directive because it gives directions ahead of time regarding medical care preference, should the individual become incapable of making decisions. In the same way, a Self-Proving Affidavit certifies a Will, ensuring the deceased's wishes are honored without delay or the need for additional witness testimony, facilitating smooth legal transitions.

The Self-Proving Affidavit has similarities with a Trust document as well. Both serve to manage and distribute a person's assets, with a Trust specifically allowing for the bypass of the probate process, potentially reducing time and expense. The affidavit supports the Will's execution during probate by confirming its legitimacy, indirectly aiding in the asset distribution process.

Comparable to a Codicil, which is an amendment to a Will, a Self-Proving Affidavit also plays a part in the testamentary process. While a Codicil modifies a Will's contents, the affidavit simplifies the proving process of the Will as valid. Both documents, when appropriately executed, provide clear, legally sound directives regarding a person's estate post-mortem.

It also resembles a Declaration of Heirship, which is employed to establish legal heirs in the absence of a Will. While a Declaration of Heirship identifies rightful heirs and the distribution of assets, a Self-Proving Affidavit helps confirm the validity of a Will, thus supporting the explicit wishes of the deceased regarding asset distribution to their chosen beneficiaries.

Lastly, it bears semblance to a Marriage License, in that both require official authorization for their legitimacy. A Marriage License permits a couple to marry, necessitating validation by an authorized body. In contrast, a Self-Proving Affidavit helps authenticate a Will's signature process, making both crucial in their respective realms for legal recognition and execution of personal intentions.

Dos and Don'ts

When filling out the Texas Self-Proving Affidavit form, which accompanies a last will and testament, it's crucial to follow specific guidelines to ensure the document is valid and effectively speeds up the probate process. Here’s a list of do's and don'ts to consider:

What to Do:

- Ensure all parties required to sign the affidavit, including the testator (the person making the will) and two witnesses, are present together when signing. This is essential for the document to be legally binding.

- Use a notary public to authenticate the affidavit. This step is critical as the notary's seal and signature verify the identities of the signatories and the authenticity of the affidavit.

- Provide complete and accurate information in all fields of the form. Double-check names, addresses, and other details to prevent any discrepancies or errors that could challenge the affidavit's validity.

- Retain a copy of the notarized affidavit with the will. Make sure this copy is kept in a safe place, such as with the will or in another secure location where it can be easily accessed when needed.

What Not to Do:

- Do not leave any blanks on the form. If a section does not apply, fill it with "N/A" (not applicable) to confirm that the section was reviewed but is not relevant to your situation.

- Do not use a witness who is also a beneficiary of the will. This could potentially lead to conflicts of interest and challenges to the will's validity during the probate process.

- Do not forget to date the affidavit. The date is crucial for establishing the timeline of the will's execution and can affect its validity.

- Do not underestimate the importance of legible handwriting. If the affidavit is difficult to read, it could lead to misunderstandings or delays during the probate process.

Misconceptions

When preparing a will in Texas, many individuals are introduced to the concept of a Self-Proving Affidavit, yet there are several misconceptions about its purpose and requirements. A Self-Proving Affidavit, while not mandatory, can significantly streamline the probate process by verifying the authenticity of the will without necessitating in-person testimony from the witnesses during probate. Below are four common misconceptions about the Texas Self-Proving Affidavit form:

- It's only for complicated estates: Some might think a Self-Proving Affidavit is only necessary for those with extensive or complicated estates. In reality, it benefits estates of any size by simplifying the probate process, making it quicker and less cumbersome for executors and beneficiaries, regardless of the estate's size.

- It replaces the need for a will: Another misunderstanding is that having a Self-Proving Affidavit can replace the need for a will. This is not true. The affidavit acts as an accessory to a validly executed will, confirming the authenticity of the will and the signatures it bears. It does not substitute the will itself or its stipulations.

- Any notary public can notarize the form: While it's true that the affidavit needs to be notarized, it's a common misconception that any notary public can perform this duty. Texas law requires that the notarization be done by a notary public who does not have a conflict of interest—meaning they should not be a beneficiary or otherwise have a vested interest in the will.

- Witnesses don't need to understand the contents of the will: A persistent myth suggests that the witnesses of a Self-Proving Affidavit need not be aware of the will's contents. In truth, while witnesses are not required to know the specifics of the will's provisions, they must be aware that they are witnessing the execution of a will, understanding its significance, and that the testator (the person whose will is being confirmed) is signing it willingly and is of sound mind.

Dispelling these misconceptions is essential for anyone involved in planning their estate in Texas. A Self-Proving Affidavit simplifies the probate process but must be correctly understood and implemented to be effective.

Key takeaways

The Texas Self-Proving Affidavit form is a critical tool designed to streamline the probate process, adding a layer of validation to a will. Understanding its importance and the correct way to fill it out and use it is crucial. Here are key takeaways to consider:

- A self-proving affidavit can significantly speed up the probate process in Texas by providing a pre-verified testament to the authenticity of a will, eliminating the need for witnesses to testify in court about the will’s execution.

- To complete a Self-Proving Affidavit form in Texas, it must be signed by the testator—the person making the will—and the witnesses, in the presence of a notary public.

- The presence of a notary is mandatory; without notarization, the affidavit cannot serve its purpose of simplifying the validation of the will.

- Witnesses to the Self-Proving Affidavit must be disinterested parties, meaning they should not stand to benefit from the will to avoid any conflict of interest.

- The form requires basic information, including the names of the testator and witnesses, and must be attached to the will to be effective.

- There is no need to file this affidavit with a court before the testator's death. It should be safely stored with the will.

- Even though this affidavit adds credibility to a will, it is still subject to challenge in court under certain circumstances, such as allegations of fraud or undue influence.

- Using the Self-Proving Affidavit is not a substitute for complying with all other requirements for a valid will in Texas. Ensure the will itself is legally sound, clearly stating the testator’s wishes.

- Seeking legal counsel to ensure the will and Self-Proving Affidavit are properly executed is advisable. A professional can provide guidance tailored to individual situations, reducing the likelihood of future legal challenges.

Understanding and correctly utilizing the Texas Self-Proving Affidavit can save time and reduce complications during an already difficult period for decedents' families. Being well-prepared and informed is essential for effective estate planning.

Popular Self-Proving Affidavit State Forms

Self Proving Affidavit Florida - This legally binding document is tailored to comply with specific state laws, ensuring its acceptance in the probate court.