Free Self-Proving Affidavit Form for California

In the state of California, the preparation for the inevitable involves not just drafting a will but also taking steps to ensure its smooth passage through probate. One tool in this process is the Self-Proving Affidavit, a document that, while not mandatory, significantly simplifies the probate proceedings. This affidavit serves as a testament to the authenticity of the will, attested by witnesses, thereby reducing the need for those witnesses to appear in court and testify to the will's validity. Designed to streamline the probate process, the Self-Proving Affidavit can be a critical component for individuals planning their estates. However, understanding its application, benefits, and the specific requirements in California is crucial, as the laws and acceptance of such affidavits can vary from one jurisdiction to another. This form underscores the importance of thorough estate planning and attention to detail, ensuring that a person’s final wishes are honored without unnecessary delay or legal hurdles.

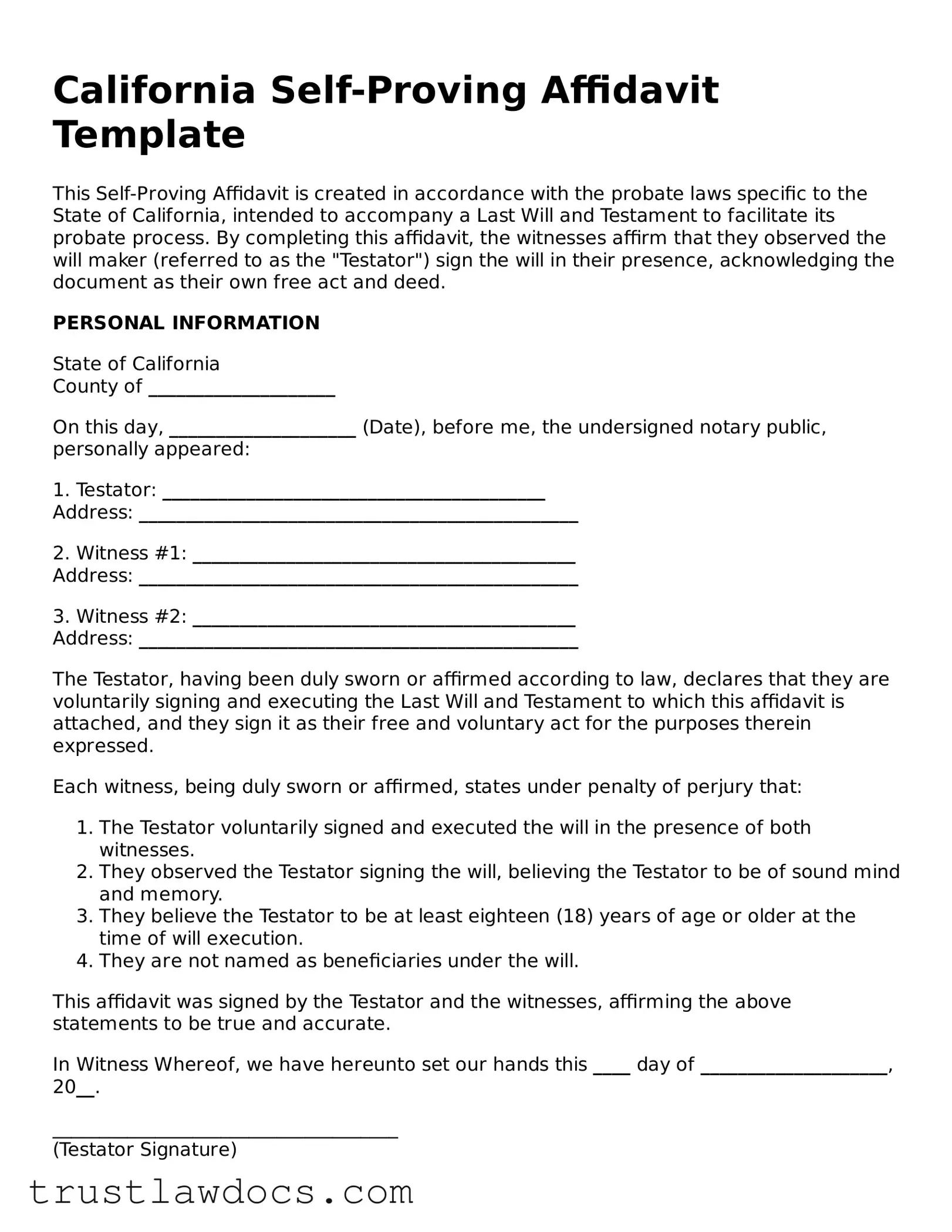

Form Example

California Self-Proving Affidavit Template

This Self-Proving Affidavit is created in accordance with the probate laws specific to the State of California, intended to accompany a Last Will and Testament to facilitate its probate process. By completing this affidavit, the witnesses affirm that they observed the will maker (referred to as the "Testator") sign the will in their presence, acknowledging the document as their own free act and deed.

PERSONAL INFORMATION

State of California

County of ____________________

On this day, ____________________ (Date), before me, the undersigned notary public, personally appeared:

1. Testator: _________________________________________

Address: _______________________________________________

2. Witness #1: _________________________________________

Address: _______________________________________________

3. Witness #2: _________________________________________

Address: _______________________________________________

The Testator, having been duly sworn or affirmed according to law, declares that they are voluntarily signing and executing the Last Will and Testament to which this affidavit is attached, and they sign it as their free and voluntary act for the purposes therein expressed.

Each witness, being duly sworn or affirmed, states under penalty of perjury that:

- The Testator voluntarily signed and executed the will in the presence of both witnesses.

- They observed the Testator signing the will, believing the Testator to be of sound mind and memory.

- They believe the Testator to be at least eighteen (18) years of age or older at the time of will execution.

- They are not named as beneficiaries under the will.

This affidavit was signed by the Testator and the witnesses, affirming the above statements to be true and accurate.

In Witness Whereof, we have hereunto set our hands this ____ day of ____________________, 20__.

_____________________________________

(Testator Signature)

_____________________________________

(Witness #1 Signature)

_____________________________________

(Witness #2 Signature)

Subscribed and sworn to before me on this ____ day of ____________________, 20__, by the above-named Testator and witnesses.

_____________________________________

(Notary Public)

My Commission Expires: ____________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The California Self-Proving Affidavit form is utilized to expedite the probate process by authenticating the validity of a will, without requiring witnesses to testify in court. |

| Governing Law | In California, self-proving affidavits are governed by California Probate Code, specifically sections 8220-8222. |

| Requirements | The affidavit must be signed by the will's witnesses, in the presence of a notary public, to certify that they observed the will maker sign the will or acknowledge it. |

| Notarization | The presence of a notary public is essential, as they must certify the affidavit by endorsing it with their seal, making the document legally binding. |

| Limitations | While beneficial, the absence of a self-proving affidavit does not invalidate a will, but it can make the probate process longer and more complex. |

How to Write California Self-Proving Affidavit

Filling out a Self-Proving Affidavit form in California is a critical step for individuals planning their estates. This affidavit, when properly executed, complements a will by authenticating it, which can significantly expedite the probate process. It negates the need for witnesses to physically appear in court to validate their signatures on the will, therefore ensuring a smoother execution of one's final wishes. Here is a step-by-step guide designed to assist in accurately completing the California Self-Proving Affidavit form.

- Begin by downloading the latest version of the Self-Proving Affidavit form specific to California. Ensure that it is the correct document as legal forms can vary significantly between jurisdictions.

- Enter the full legal name of the testator (the person making the will) at the top of the affidavit form where it is indicated.

- Fill in the date of the affidavit. This should be the same date the will is signed and witnessed.

- Provide the names of the testator and the witnesses in the designated areas. It is crucial that the names are spelled accurately and match the identification documents of all parties involved.

- The testator and witnesses must sign the affidavit in the presence of a notary public. The presence of all parties during the signing is mandatory to meet the requirements of a self-proving affidavit.

- The notary public will fill in their section, which includes documenting the location and date of the notarization. They will then seal or stamp the affidavit, which officially notarizes the document.

Once the form is filled out and notarized, it should be stored in a safe place alongside the will. Should the will go through probate, the Self-Proving Affidavit will serve as evidence that the will was executed properly, thus simplifying and expediting the process. Remember to consult with a legal professional if there are any uncertainties about filling out the form or the probate process in California. This guidance ensures the affidavit fulfills its role without any unforeseen complications.

Get Answers on California Self-Proving Affidavit

What is a Self-Proving Affidavit form in California?

A Self-Proving Affidavit form in California is a legal document that accompanies a will. It involves the testator (the person who has made the will) and two witnesses signing an affidavit in front of a notary public. This affidavit certifies that the witnesses saw the testator sign the will, or heard the testator acknowledge the will, and believe the testator to be of sound mind. This process helps streamline probate by verifying the validity of the will without the need for witnesses to be present in court.

Do I need a Self-Proving Affidavit to validate a will in California?

No, a Self-Proving Affidavit is not required to validate a will in California. However, having one can be very beneficial. It can significantly speed up the probate process since the court can accept the will without needing to call the witnesses to testify about its authenticity. This can be especially helpful if the will is contested, or if the witnesses are unavailable or have passed away.

How can I create a Self-Proving Affidavit in California?

To create a Self-Proving Affidavit in California, the testator and two witnesses must sign the affidavit in the presence of a notary public after presenting valid identification. The affidavit should state that the witnesses saw the testator sign the will or heard the testator acknowledge the will, and that they believe the testator to be of sound mind. It is often attached to the will itself. It's advisable to consult with a legal professional to ensure the affidavit meets all legal requirements.

Who can serve as a witness to a Self-Proving Affidavit in California?

In California, witnesses to a Self-Proving Affidavit must be individuals who are competent and at least 18 years old. They should not be beneficiaries of the will to avoid potential conflicts of interest. Ideally, witnesses should be individuals who would have no benefit from the will and can be impartial in their testimony about the validity of the will.

Can a Self-Proving Affidavit be added to an existing will?

Yes, a Self-Proving Affidavit can be added to an existing will. To do this, the testator and the two witnesses must follow the procedure of signing a new Self-Proving Affidavit in the presence of a notary public. This affidavit should then be attached to the existing will, making sure it is clearly identified as part of the will's documentation. It's a good idea to review the entire will when adding any new documents to ensure all sections are consistent and reflective of the testator's wishes.

Is a Self-Proving Affidavit valid in other states?

The validity of a Self-Proving Affidavit from California in other states depends on the laws of the specific state where the will is being probated. Many states have reciprocal recognition of such documents, meaning they will accept a Self-Proving Affidavit made in California as valid. However, there can be exceptions and specific requirements different from those in California. If the estate may be probated outside of California, it is wise to consult with a legal expert in the relevant state to ensure compliance with local laws.

Common mistakes

Filling out a California Self-Proving Affidavit form can streamline the probate process for a will, ensuring that the testamentary document is accepted as valid by the court without the need for witness testimonies. However, making errors on this form can lead to unnecessary delays or even jeopardize the affidavit's validity. Here are seven common mistakes people make when completing this document.

One prevalent mistake is neglecting to have the affidavit notarized. According to California law, for a self-proving affidavit to be recognized, it must be notarized. This means that the person creating the will (the testator) and their witnesses must sign the document in the presence of a notary public. Failing to do so invalidates the affidavit, as the notary's seal and signature provide essential verification of the document's authenticity.

Another error occurs with the misidentification of parties. The affidavit requires clear identification of the testator and the witnesses. Mistakenly swapping names, providing incomplete names, or using nicknames instead of legal names can create confusion and potentially invalidate the document. Accuracy in this area is crucial for the affidavit to serve its intended purpose.

Incorrect witness information is a further issue. The State of California mandates that witnesses to the signing of the will (and affidavit) be disinterested parties—meaning they do not stand to gain from the will. Sometimes, individuals mistakenly use witnesses who are beneficiaries of the will, which can lead to challenges during the probate process.

A common oversight is not adhering to the specific requirements of the form. Each jurisdiction may have slight variations in how a self-proving affidavit needs to be filled out. Assuming the form is generic and not paying attention to specific state or local laws can lead to errors. For example, ignoring or mistakenly completing sections due to misinterpretation of instructions compromises the document's validity.

Failure to use the correct form altogether is another significant error. Some may mistakenly use a generic self-proving affidavit form that does not meet California's specific requirements. It's essential to use a state-specific form designed to comply with California Probate Code to ensure the affidavit's acceptance.

Another mistake is not updating the affidavit to reflect changes in the law or personal circumstances. Laws governing wills and estates can evolve, and if an affidavit is based on outdated statutes, its effectiveness may be compromised. Similarly, changes in personal circumstances, such as a change in witnesses or marital status, necessitate updates to the document to maintain its validity.

Finally, a glaring mistake is the omission of the affidavit itself. Many individuals are unaware that a self-proving affidavit, while not mandatory, can significantly simplify the probate process. By omitting this document, executors may face a more complicated court process that requires witness testimonies to validate the will, leading to potential delays and increased legal fees.

In summary, careful attention to detail and adherence to California's specific requirements when completing a self-proving affidavit can prevent these common mistakes. Ensuring the document is notarized, accurately identifying all parties, choosing the proper witnesses, following specific form instructions, updating the document as needed, and including it with the will are crucial steps. By avoiding these pitfalls, individuals can help ensure their wills are easily validated through the probate process.

Documents used along the form

When handling legal matters in California, particularly those related to estate planning, the California Self-Proving Affidavit form is often only one component of an array of documents needed to ensure all matters are thoroughly and legally arranged. This affidavit is instrumental in simplifying the probate process by validating the will to which it is attached, but its effectiveness and applicability are greatly enhanced when used in conjunction with other essential forms and documents. Below is a brief overview of other crucial forms and documents often used alongside the California Self-Proving Affidavit form.

- Last Will and Testament: The core document that indicates how a person's estate should be managed and distributed after their death. The Self-Proving Affidavit is typically attached to this document to attest to its validity.

- Advance Health Care Directive: A legal document that outlines a person's preferences for medical treatment in situations where they are unable to make decisions for themselves.

- Durable Power of Attorney for Finances: This grants another individual the authority to manage the financial affairs of the person, often in preparation for potential incapacitation.

- Living Trust: A document creating a legal entity that holds property or assets for the benefit of another, typically used to avoid probate and manage the estate efficiently.

- Property Deed: Required when transferring property into a trust, affirming that the property's title is correctly vested according to the trust's terms.

- Marital Settlement Agreement: Outlines the division of assets and responsibilities if the individual is going through a divorce, potentially affecting the estate’s distribution.

- Beneficiary Designations: Forms that specify individuals or entities that will inherit specific assets, such as life insurance policies or retirement accounts, which pass outside of a will or trust.

- Transfer on Death Deeds: Allows individuals to name beneficiaries for real estate, enabling property transfer without the need for probate upon their death.

- Funeral Planning Declarations: Documents that outline arrangements and preferences for funerals, ensuring wishes are met and relieving the burden on loved ones.

Together, these documents form a comprehensive estate plan that safeguards an individual's wishes, both in life and after death, ensuring their assets are distributed as they desire and their healthcare preferences are honored. Utilizing the California Self-Proving Affidavit alongside these essential documents can provide peace of mind, knowing that the necessary legal measures are in place to support and protect one's final wishes and those they care about.

Similar forms

The California Self-Proving Affidavit form is similar to a Will in that both documents are used to streamline legal processes after someone's death. A Will outlines a person's wishes regarding how their assets should be distributed, while a Self-Proving Affidavit accompanies a Will, verifying its authenticity. This affidavit ensures the Will is recognized as valid without witnesses having to testify in court, mirroring a Will's purpose of facilitating estate planning and execution.

Similar to the Durable Power of Attorney, the California Self-Proving Affidavit form grants a level of authority and confirmation, but in a different context. A Durable Power of Attorney empowers someone to act on another's behalf, especially in financial or health matters, often effective during the grantor's lifetime. The Self-Proving Affidavit, conversely, affirms the validity of a Will’s execution, playing a critical role posthumously. Both documents serve to authenticate and expedite legal proceedings, albeit in varying circumstances.

A Living Will shares common ground with the Self-Proving Affidavit, as both pertain to an individual's preferences and legal preparations for their end-of-life scenario. While a Living Will specifies medical treatments an individual wishes to receive or avoid, the Self-Proving Affidavit ensures that a traditional Will's execution is unquestionable. This affidavit supports the Will's intentions, ensuring that the individual's estate planning wishes are respected and smoothly implemented.

The Health Care Proxy, much like the Self-Proving Affidavit, designates someone’s authority in making crucial decisions. In the Health Care Proxy scenario, the authority pertains to health care decisions on behalf of the person if they become incapable of making such decisions themselves. The Self-Proving Affidavit, meanwhile, reinforces a Will's legitimacy to facilitate the intended distribution of the person's estate, posthumously ensuring their wishes are honored.

The Advance Directive is another document with parallels to the Self-Proving Affidavit. It typically outlines an individual’s wishes regarding medical treatment and end-of-life care. While it functions to guide healthcare providers and loved ones during critical moments, the Self-Proving Affidavit underlines the veracity of a Will, ensuring that an individual's estate-related decisions are recognized and implemented without delay in the court system.

Trust Documents share a functionality with the Self-Proving Affidavit by establishing clear instructions for managing and distributing an individual’s assets. Trusts can take effect during an individual’s lifetime or after their death, emphasizing planned, seamless asset distribution. The Self-Proving Affidavit complements a Will by certifying its authenticity, similarly aiming to streamline the legal formalities involved in distributing an individual's property and assets.

The Executor’s Oath is closely related to the Self-Proving Affidavit since both are pivotal in the probate process. The Executor’s Oath is a sworn statement by the executor of a Will, promising to fulfill the deceased's wishes as stated in the Will. The Self-Proving Affidavit, on the other hand, aids this process by confirming the Will’s legitimacy, thereby expediting its execution and the duties entrusted to the executor.

Beneficiary Designations, often found in insurance policies and retirement accounts, designate who will receive the assets upon the policyholder or account owner’s death. These designations bypass the probate process, similar to how a Self-Proving Affidavit streamlines the validation of a Will. Both mechanisms ensure that an individual’s wishes regarding asset distribution are honored without unnecessary legal delay.

A Codicil to a Will, which amends or revises parts of an existing Will, has similarities to a Self-Proving Affidavit in that it needs to be verified. While the codicil adjusts the Will’s terms, a Self-Proving Affidavit attests to the original Will’s validity, possibly including its amendments. Both documents are integral to ensuring that the current wishes of the deceased are acknowledged and faithfully executed.

Finally, the Financial Power of Attorney is akin to the Self-Proving Affidavit as it deals with the authorization of parties to act on one's behalf. The Financial Power of Attorney focuses on financial decisions during an individual's lifetime, allowing a designated person to manage financial affairs. In contrast, the Self-Proving Affidavit serves to authenticate a Will, ensuring that the deceased's financial wishes are realized efficiently and according to their documented intentions.

Dos and Don'ts

The California Self-Proving Affidavit form is an essential document that validates your will, streamlining the probate process. It's a declaration that your will was duly signed and witnessed. When filling out this form, adhering to specific dos and don’ts is crucial to ensure its legality and your peace of mind.

- Do gather all necessary information before you start, including the full names and addresses of witnesses.

- Do use ink that is blue or black to ensure legibility and durability over time.

- Do ensure that the witnesses you choose are not beneficiaries in your will to prevent conflicts of interest.

- Do have the affidavit notarized, as this step is crucial for the document to be considered "self-proving."

- Do keep the completed and notarized affidavit with your will, in a safe but accessible place.

- Don't fill out the form hastily. Take your time to ensure every detail is accurate and clearly written.

- Don't use witnesses who are minor-aged. Witnesses must be legal adults and mentally competent to understand the significance of the document they are witnessing.

- Don't forget to review the form for errors before finalizing it. Even small mistakes can raise questions about the document's validity.

- Don't lose track of the affidavit after it's completed. Ensuring it's stored safely with your will is key to avoiding complications during the probate process.

Misconceptions

When it comes to understanding the nuances of legal documents in estate planning, many individuals often find themselves sifting through misinformation and misconceptions. One document that frequently becomes a subject of confusion is the California Self-Proving Affidavit form. This important piece of documentation can significantly streamline the probate process for a will, yet misunderstandings persist regarding its usage and implications. Here, we aim to clarify some of the common misconceptions about this form, providing a clearer picture for those navigating estate planning in California.

-

Misconception 1: A Self-Proving Affidavit is Required for a Will to be Valid in California

Contrary to what many believe, a self-proving affidavit is not a requirement for a will to be considered valid in the state of California. A will can be deemed valid as long as it adheres to the state's legal requirements, such as being signed by the testator (the person who made the will) in the presence of two witnesses. The affidavit serves an additional purpose, primarily to simplify the probate process, but it is not a prerequisite for a will's validity. -

Misconception 2: The Self-Proving Affidavit Must Be Notarized in California

It is often assumed that for a self-proving affidavit to be effective in California, it must be notarized. However, the primary requirement is that it is signed by the testator and the witnesses, with their signatures serving to verify the authenticity of the will. While notarization can add a layer of verification, it is not legally required for the affidavit to serve its purpose in substantiating the will. -

Misconception 3: A Self-Proving Affidavit Can Be Added to a Will After Signing

Many hold the belief that a self-proving affidavit can be attached to a will after it has been signed. However, for the affidavit to be legally effective, it needs to be executed at the same time as the will. This ensures that the affidavit accurately reflects the circumstances under which the will was signed, preserving the integrity of the document and the testator's intentions. -

Misconception 4: The Affidavit Eliminates the Need for Witnesses During Probate

While a self-proving affidavit does streamline the probate process by pre-verifying the will's signatures, it does not eliminate the potential need for witnesses altogether. In certain situations, such as disputes over the will's validity or claims of undue influence, witnesses may still be required to testify. The affidavit significantly reduces this likelihood by providing a sworn statement of the will's execution but does not completely negate the need for witness testimony. -

Misconception 5: Every State Requires a Self-Proving Affidavit for a Will to be Self-Proved

The requirement and rules surrounding self-proving affidavits vary by state. While many states allow or encourage the use of such affidavits to make the probate process easier, not every state requires an affidavit for a will to be considered self-proved. In California, although it is beneficial and recommended to include a self-proving affidavit, it is not mandatory for the will's probate process.

Understanding these misconceptions can help individuals better prepare their estate documents, ensuring that their final wishes are honored and their loved ones are provided for with minimal legal complications. As always, consulting with a legal professional can provide guidance tailored to one's specific situation and needs.

Key takeaways

The California Self-Proving Affidavit form is a valuable document that can streamline the probate process after a person's death. By ensuring that all relevant information and procedures are correctly followed, individuals can save their loved ones time and reduce the burden during an already difficult period. Here are key takeaways to understand when filling out and using this form.

- Definition: A Self-Proving Affidavit is a legal document attached to a will, verifying that the will is genuine and that the signatures are authentic.

- Notarization Requirement: The affidavit must be signed in the presence of a notary public to confirm the identity of the signatories and the voluntary nature of their actions.

- Witnesses: Typically, two witnesses are required to sign the affidavit, asserting that they observed the signing of the will and believe the testator (the person making the will) to be of sound mind.

- Voluntary: Completing a Self-Proving Affidavit is voluntary but highly recommended to facilitate the probate process.

- State Specific: The requirements and acceptance of a Self-Proving Affidavit can vary by state, so it's important to ensure that the form meets California's specific regulations.

- Authentication Speed: A will with a Self-Proving Affidavit attached typically moves through the probate process more quickly, as less evidence is required to prove its validity.

- Reduced Legal Challenges: By providing clear evidence of the will's authenticity, a Self-Proving Affidavit can help reduce the likelihood of legal challenges against the will.

- Accuracy: It's crucial to fill out the form accurately, providing clear and correct information to avoid any complications during the probate process.

- Storage: Keep the affidavit in a safe place, preferably with the will, to ensure it can be easily found and submitted to probate court when needed.

- Professional Advice: Consulting with a legal professional when preparing a Self-Proving Affidavit can provide personalized guidance and help ensure that all legal requirements are met.

Popular Self-Proving Affidavit State Forms

Self Proving Affidavit for Will - An intelligent step for any individual serious about their estate planning and ensuring their legacy is preserved.

Self Proving Affidavit Texas - For those looking to ensure their estate is managed according to their wishes, incorporating this affidavit is a prudent choice.