Free Affidavit of Gift Form for Texas

In Texas, gifting a vehicle to a family member, charity, or any other individual without expecting anything in return involves a vital piece of documentation known as the Affidavit of Gift form. This legal document is essential not only for officially transferring ownership of the vehicle but also for ensuring that the process is recognized and accepted by the Texas Department of Motor Vehicles (DMV). It serves to clarify the relationship between the donor and recipient, stipulates that no money is exchanged for the vehicle, and ultimately, exempts the recipient from certain taxes that would otherwise apply to a standard vehicle purchase. Importantly, the form requires verification of the details provided, including the identities of both the giver and receiver, alongside the vehicle's information, thereby preventing potential fraud and misunderstandings during the transfer process. Understanding its components, requirements, and the precise steps for its completion and submission is crucial for anyone involved in the gifting of a vehicle in Texas.

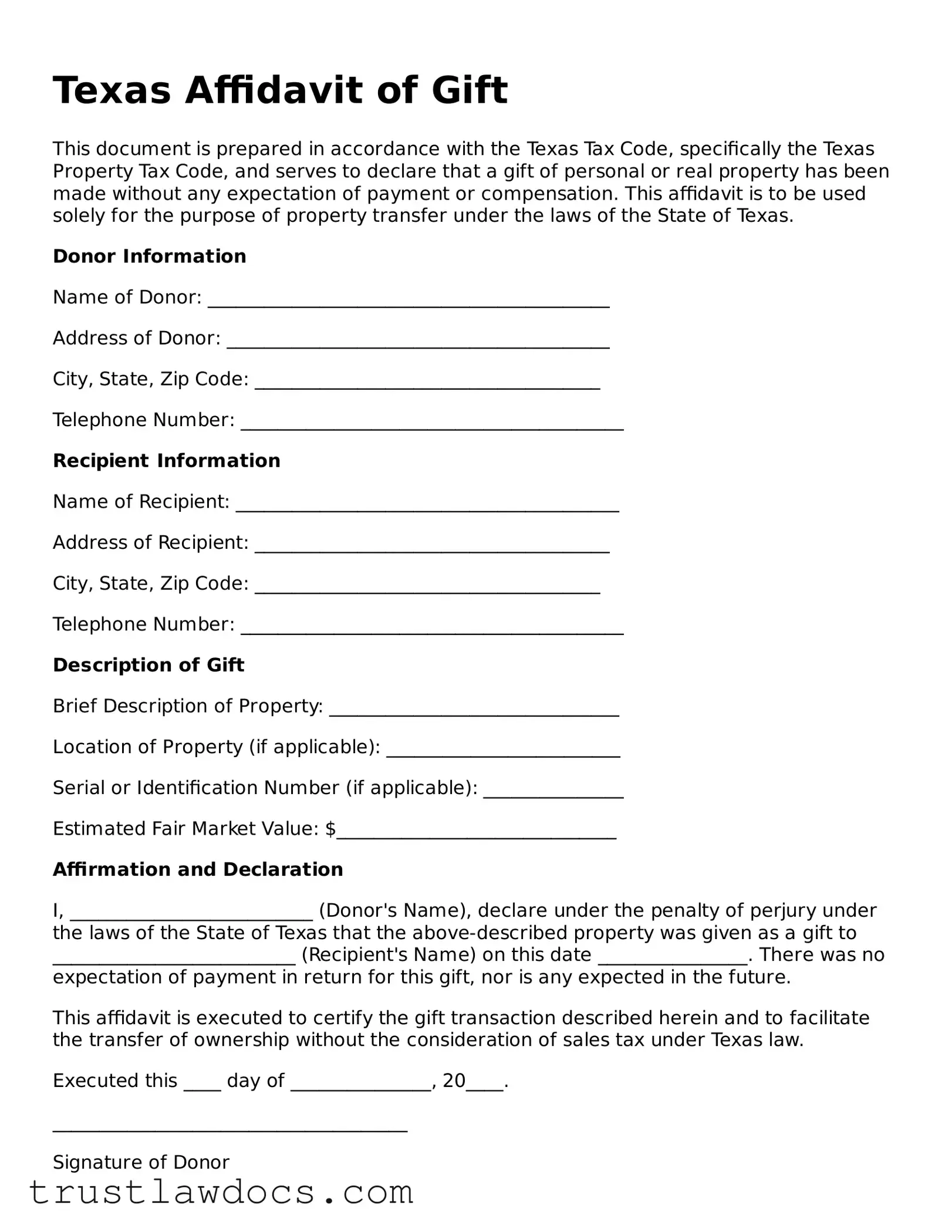

Form Example

Texas Affidavit of Gift

This document is prepared in accordance with the Texas Tax Code, specifically the Texas Property Tax Code, and serves to declare that a gift of personal or real property has been made without any expectation of payment or compensation. This affidavit is to be used solely for the purpose of property transfer under the laws of the State of Texas.

Donor Information

Name of Donor: ___________________________________________

Address of Donor: _________________________________________

City, State, Zip Code: _____________________________________

Telephone Number: _________________________________________

Recipient Information

Name of Recipient: _________________________________________

Address of Recipient: ______________________________________

City, State, Zip Code: _____________________________________

Telephone Number: _________________________________________

Description of Gift

Brief Description of Property: _______________________________

Location of Property (if applicable): _________________________

Serial or Identification Number (if applicable): _______________

Estimated Fair Market Value: $______________________________

Affirmation and Declaration

I, __________________________ (Donor's Name), declare under the penalty of perjury under the laws of the State of Texas that the above-described property was given as a gift to __________________________ (Recipient's Name) on this date ________________. There was no expectation of payment in return for this gift, nor is any expected in the future.

This affidavit is executed to certify the gift transaction described herein and to facilitate the transfer of ownership without the consideration of sales tax under Texas law.

Executed this ____ day of _______________, 20____.

______________________________________

Signature of Donor

State of Texas

County of ____________________

Subscribed and sworn to (or affirmed) before me on this ____ day of _____________, 20____, by _________________________________, known to me (or proved to me on the oath of ________________________) to be the person whose name is subscribed to the foregoing instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Signature of Notary Public

My commission expires: __________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Texas Affidavit of Gift form is used to legally document the transfer of a vehicle from the donor (giver) to the recipient (receiver) without any exchange of money. |

| Governing Law | This form is governed by the laws of the State of Texas, specifically under the Texas Transportation Code. |

| Requirement for Validity | The form must be completed in its entirety, signed by both the donor and recipient, and notarized to be considered valid. |

| Additional Documentation | Along with the Affidavit of Gift form, a Title Application must also be submitted to the Texas Department of Motor Vehicles (TxDMV) to complete the transfer process. |

| No Monetary Exchange | The form is specifically used when the vehicle is gifted, implying that no payment is made between the two parties for the transfer of the vehicle. |

| Tax Implications | While there might not be a sale price, the recipient may still be responsible for paying gift tax as per the Internal Revenue Service (IRS) regulations and any applicable state tax. |

| Changing Ownership | Once filed, this form serves as legal evidence of the change in ownership, which is necessary for updating vehicle records and registration with the Texas DMV. |

How to Write Texas Affidavit of Gift

Filling out a Texas Affidavit of Gift form is an important step when transferring ownership of a vehicle or property without any exchange of money. Often used between family members, this document legally states that the item was indeed a gift. Making sure the form is completed accurately ensures a smoother transition of ownership, helping avoid any potential legal or tax implications. Here's a straightforward guide to help you through each step of filling out the form correctly.

- Begin by reading through the entire form carefully to understand all the required information. This will help you gather all necessary documents and details beforehand.

- In the first section, provide the recipient's (donee's) full legal name and address. Ensure this information matches their identification and other legal documents to avoid discrepancies.

- Next, input the donor's (the person giving the gift) full legal name and address in the designated section. Just like with the recipient's information, accuracy is critical to ensure the form's validity.

- Describe the gifted item accurately. If it's a vehicle, include the make, model, year, and Vehicle Identification Number (VIN). For other properties, provide a detailed description that clearly identifies the item.

- Specify the date of the gift. This is vital for both parties' records and any potential legal or tax assessments.

- For vehicle gifts, enter the vehicle's odometer reading at the time of the transaction. This step is crucial for registering the vehicle and may not apply to other types of property gifts.

- Both the donor and the recipient must sign and date the form in the presence of a notary public. The notarization process is essential, as it verifies the identities of both parties and the authenticity of their signatures.

- Finally, submit the completed and notarized Affidavit of Gift form along with any other requested documents to the appropriate Texas state department or agency. Be sure to check if any additional forms or fees are required for the particular type of gift transfer you're conducting.

After completing these steps, it's a waiting game as the process of transferring ownership officially commences. Ensure to keep copies of all submitted documents for your records. Promptly addressing any inquiries from the state department or agency can help expedite the process. Remember, this form is a legal document, so filling it out accurately reflects the genuine intent and legitimacy of the gift, providing clear evidence that the transaction was not a sale and is exempt from certain taxes or fees.

Get Answers on Texas Affidavit of Gift

What is a Texas Affidavit of Gift form?

The Texas Affidavit of Gift form is a legal document that is used when a motor vehicle is given as a gift from one person to another without any exchange of money. It serves as proof that the vehicle's transfer is indeed a gift and not a sale, which has implications for taxes and ownership transfer.

Who needs to complete the Texas Affidavit of Gift form?

Both the giver (donor) and the receiver (donee) of the gifted vehicle need to complete and sign the Texas Affidavit of Gift form. This ensures that both parties acknowledge the gift transaction and agree to its terms, specifically that no money was exchanged for the vehicle.

When should the Texas Affidavit of Gift form be submitted?

This form should be submitted to the Texas Department of Motor Vehicles (TxDMV) at the time of title transfer. Ideally, it should be completed and ready to submit within 30 days of the vehicle being gifted to avoid penalties or late fees.

Are there any fees associated with submitting the Texas Affidavit of Gift form?

While there is no fee for submitting the affidavit itself, there may be other fees associated with transferring the vehicle's title, such as the new title fee or registration fees. It's important to consult the TxDMV for the most current fee schedule.

What information is required on the Texas Affidavit of Gift form?

The form requires detailed information about the donor, the donee, and the vehicle being gifted, including make, model, year, Vehicle Identification Number (VIN), and the odometer reading. Both the donor and donee's signatures are also required, sometimes in the presence of a notary public.

Do I need a notary to complete the Texas Affidavit of Gift form?

While not always required, having the form notarized can provide an additional layer of authenticity to the document and may help in the event of any discrepancies or disputes. It is advisable to check the most current requirements with the TxDMV or a legal advisor.

How does gifting a vehicle affect taxes?

When a vehicle is gifted, the recipient (donee) may be exempt from paying sales tax on the vehicle. However, they may still be responsible for other taxes or fees. It's crucial to consult with a tax professional or the TxDMV to understand the specific tax implications of receiving a gifted vehicle in Texas.

Can a Texas Affidavit of Gift form be used for vehicles coming from out of state?

Yes, the form can be used for vehicles being gifted from out of state, but it's important that all Texas-specific requirements are met, including having the vehicle inspected and meeting Texas emissions standards if applicable. Additional documentation may be required.

What happens if the Texas Affidavit of Gift form is filled out incorrectly?

If errors are found on the form, it may be rejected by the TxDMV, and you may be asked to complete a new form with the correct information. This can delay the title transfer process. Therefore, it's essential to carefully review the form for accuracy before submission.

Is the Texas Affidavit of Gift form available online?

Yes, the Texas Affidavit of Gift form is available online through the Texas Department of Motor Vehicles website. It can be downloaded, printed, filled out manually, and then submitted as part of the vehicle title transfer process.

Common mistakes

One common mistake individuals make when completing the Texas Affidavit of Gift form is not verifying the recipient's information thoroughly. It's crucial that the recipient's full legal name, address, and, if applicable, relationship to the giver are accurately recorded. Misinformation can lead to delays or rejection of the document during the title transfer process. This meticulous detail ensures the process progresses smoothly without unnecessary hindrances.

Another misstep often seen is neglecting to clearly specify the gift's details, including the make, model, and Vehicle Identification Number (VIN) of the vehicle being given. This lack of specificity can create confusion, potentially delaying the acceptance of the affidavit. The accuracy of these details directly impacts the effectiveness of the document in facilitating a seamless transfer of ownership.

Failure to properly execute the document in the presence of a notary public is a critical error. The Texas Affidavit of Gift form requires notarization for it to be considered valid and legally binding. Without this, the form lacks the necessary verification of the signatures, undermining its legitimacy and potentially voiding the document's intent.

Many individuals mistakenly believe that once the affidavit is completed, no further action is required. However, the form must be submitted to the Texas Department of Motor Vehicles (DMV) or an equivalent authority for the gift transaction to be officially recorded. Overlooking this step can result in legal complications for both the giver and the recipient regarding the vehicle's ownership and tax obligations.

Omitting details about any liens or encumbrances on the vehicle is also a common oversight. It's imperative to disclose if the vehicle is under any financial obligations. Failure to do so can transfer the responsibility of those liens to the recipient, creating unexpected burdens.

Some people inaccurately fill in the date of the gift, either by providing a future date or neglecting to provide one at all. For the document to have legal standing, the date when the vehicle was actually given must be clearly indicated. This date is important for various reasons, including taxation and the initiation of the recipient's ownership period.

Another error is not consulting or adhering to specific county requirements. While the Texas Affidavit of Gift form is broadly accepted, some counties may have additional stipulations or paperwork. Ignorance of these requirements can cause delays or necessitate the submission of supplementary documents, complicating the gifting process.

Lastly, a significant mistake is the failure to keep a copy of the affidavit for personal records. Both the giver and the recipient should retain a copy of the notarized document. This precaution ensures a backup is available in case the original is lost or questioned, providing a layer of security and peace of mind for all parties involved.

Documents used along the form

In conjunction with the Texas Affidavit of Gift form, which is primarily used to transfer ownership of a vehicle between family members without monetary considerations, several other documents may be required to ensure a smooth, lawful transfer. These additional forms and documents help to establish the legal parameters of the gift, verify the identities of the parties involved, and comply with state regulations. Understanding these documents can simplify the process for both the giver and the recipient.

- Title Application: This form is pivotal in the process of transferring vehicle ownership in Texas. It formally requests the issuance of a new title under the recipient’s name, acknowledging the change in ownership.

- Vehicle Transfer Notification: When a vehicle's ownership is transferred, this notification informs the Texas Department of Motor Vehicles (TxDMV) about the change. It helps protect the seller from liabilities if the vehicle is not yet re-titled or if any violations occur before the new title is issued.

- Bill of Sale: Although not mandatory in all cases, a Bill of Sale serves as a written record of the vehicle's transfer. It typically includes the vehicle’s details, the date of the transaction, and information about the buyer and seller.

- Odometer Disclosure Statement: Required for vehicles less than ten years old, this statement records the vehicle's mileage at the time of sale or gift. It’s crucial for preventing odometer fraud and ensuring fair assessment of the vehicle's value.

- Proof of Insurance: The new owner must provide proof of insurance to register the vehicle in their name. This document verifies that the vehicle meets the minimum insurance requirements mandated by Texas law.

- Inspection Certificate: Texas requires most vehicles to undergo a safety and emissions inspection before registration. The certificate from this inspection must be presented when transferring vehicle ownership.

- Government-issued Identification: Both parties involved in the transfer must present valid identification, such as a driver’s license or passport, to verify their identities during the transaction.

- Release of Lien: If there was a lien on the vehicle (meaning the vehicle was financed and the lender had a claim to it until the loan was paid off), a release of lien proves that the vehicle is now free from these financial obligations, allowing for a clear transfer of title.

The array of documents mentioned above ensures that the transfer of a vehicle as a gift is conducted transparently and in accordance with the law. Each document plays a unique role in recording the transaction, protecting the interests of both the giver and the recipient, and meeting the legal requirements set forth by Texas state law. When compiled together, these forms and documents create a comprehensive paper trail that validates the transfer and registration of the vehicle under the new owner's name.

Similar forms

The Texas Affidavit of Gift form is akin to the Gift Affidavit which is commonly used across various jurisdictions to formally declare that an item or sum of money has been freely given as a gift. Both documents serve the same essential purpose: to verify that no compensation is expected or required in return for the transferred property, thereby exempting the transaction from sales tax and other types of tax implications. Additionally, both affidavits are legal documents that may be required by financial institutions or government agencies to prove the nature of the transaction.

Similar to the Texas Affidavit of Gift, the Vehicle Transfer Notification form is another document used when ownership of a vehicle is transferred without a sale, typically between family members. This form alerts the Department of Motor Vehicles (DMV) about the change in ownership, ensuring the new owner is recorded in the official records. While the Affidavit of Gift confirms the lack of financial exchange, the Vehicle Transfer Notification provides specifics about the vehicle and the transfer, fulfilling state requirements for documentation of vehicle ownership changes.

The Quitclaim Deed is a document that resembles the Texas Affidavit of Gift in its purpose to transfer property rights without a traditional sale. However, unlike the Affidavit of Gift, which emphasizes the gift aspect, the Quitclaim Deed is used to convey real estate with no promises about the title's status, potentially including property as a gift. Both documents finalize the transfer of ownership without financial considerations, but the Quitclaim Deed is specifically tailored for real estate transactions.

The Deed of Gift serves a similar purpose to the Texas Affidavit of Gift but is often more expansive in scope. It is used to transfer not only personal property but also real estate or financial assets as a gift. Both documents help individuals give substantial gifts without expecting anything in return, facilitating a smoother transition of ownership. However, the Deed of Gift is commonly used in estate planning and charitable donations, providing a legal framework for significant transfers.

Comparable to the Texas Affidavit of Gift is the Personal Property Bill of Sale when it comes to transferring ownership of property without a sale. This document, however, is usually utilized in transactions where property changes hands, possibly at a nominal cost or no cost, allowing for an exchange to be documented. While the Bill of Sale can imply a transaction or trade, the Affidavit of Gift strictly denotes the item was given freely, differentiating the intentions behind each document.

The Donation Receipt is a document that, like the Texas Affidavit of Gift, acknowledges the transfer of goods or money without expecting something in return. This form is essential for tax purposes as it can serve as proof of a charitable contribution, potentially qualifying the donor for a tax deduction. In contrast, the Affidavit of Gift primarily facilitates the gift process between private individuals or parties and is not solely used for charitable donations.

The General Warranty Deed is a document related to the Texas Affidavit of Gift, particularly in real estate transactions. It provides a comprehensive guarantee of clear ownership transfer from the grantor to the grantee, similar to how the Affidavit of Gift transfers ownership rights. However, the General Warranty Deed is used in sell-purchase agreements ensuring the property is free from liens or claims, contrasting with the Affidavit of Gift's role in non-commercial transfers.

The Trust Transfer Deed, much like the Texas Affidavit of Gift, is utilized in the transfer of property. This deed specifically facilitates the transfer of real property into a trust, rather than directly to an individual as a gift. While both documents are tools in estate planning, the Trust Transfer Deed focuses on protecting assets and managing estate taxes, differing from the Affidavit of Gift, which simply acknowledges a gift transfer without any monetary exchange.

The Conditional Gift Agreement is a document that shares similarities with the Texas Affidavit of Gift in terms of transferring personal or real property. However, it stipulates conditions that must be met for the transfer to be permanent, unlike the Affidavit of Gift, which is unconditional. Both agreements ensure that the giver's intentions are clear and legally documented but differ in the conditional nature of the former, which may require the return of the gifted item if conditions are not met.

The Release of Liability form is indirectly related to the Texas Affidavit of Gift, especially in scenarios where a vehicle is given as a gift. This document absolves the giver from future liability related to the item once it's transferred, an important step in vehicle transfers to protect the previous owner. While serving different functions, both the Release of Liability and the Affidavit of Gift are crucial to ensuring a smooth and legally sound transfer of ownership, safeguarding both parties' interests.

Dos and Don'ts

When completing the Texas Affidavit of Gift form, certain practices should be followed to ensure the process is handled correctly. Understanding what to do and what not to do can help in the smooth transition of ownership without legal hitches.

Do's:

- Verify that all the information entered on the form is accurate, including the vehicle identification number (VIN), the donor and recipient's full legal names, and their detailed addresses. Accuracy is vital to avoid delays or rejections.

- Ensure that both the donor and the recipient sign the form in the presence of a notary public. This step is crucial as it legitimizes the document and the transfer of the vehicle as a gift.

- Include the vehicle's current odometer reading if the vehicle is less than 10 years old. This information is required by law to prevent odometer fraud.

- Contact the Texas Department of Motor Vehicles (DMV) or visit their website for any updates or additional documents that may be required. Rules and requirements can change, so staying informed is necessary.

Don'ts:

- Do not leave any sections of the form incomplete. An incomplete form can cause delays or outright rejection of the transfer. If a section does not apply, mark it as "N/A" (not applicable).

- Avoid guessing or estimating information. If you are unsure about specific details, such as the exact odometer reading, verify before filling out the form. Incorrect information can void the affidavit.

- Do not sign the form without a notary public present. Unsigned or improperly notarized documents will not be accepted and are considered invalid for the purposes of transferring ownership.

- Do not delay in submitting the completed form and any other required documentation to the Texas DMV. There may be deadlines associated with the transfer of vehicle ownership as a gift. Delaying beyond these deadlines can complicate the transfer process.

Misconceptions

When it comes to transferring property in Texas, the Affidavit of Gift form is a common document that people use. However, there are several misunderstandings about how this form works and what it entails. Below are eight misconceptions about the Texas Affidavit of Gift form, explained in detail to provide clarity.

- All gifts require an Affidavit of Gift form. In reality, this form is typically used for the transfer of personal property, like a vehicle, without a monetary exchange. Not every gift transaction in Texas requires it, especially for smaller or less formal gifts.

- The form substitutes for a formal property title. This is incorrect. The Affidavit of Gift is a document that supports the transfer process but does not replace the need for a formal title or deed when transferring ownership of property.

- Once signed, the gift is irreversible. While the intent of gifting is usually permanent, legal mechanisms can reverse the transfer in specific circumstances, such as fraud or undue influence. Therefore, saying it's entirely irreversible simplifies a more complex legal reality.

- Witnesses or notarization aren’t necessary. Depending on the nature of the gift and local requirements, having the document notarized or witnessed can be crucial for its legal standing and authenticity. This is often overlooked.

- Submitting the form to a governmental entity is always required. The necessity to submit the form to a government body depends on the type of gift and relevant state laws. For example, vehicle gifts typically require submission to the Texas Department of Motor Vehicles, but not all gifts necessitate such formalities.

- No tax implications exist for gifts transferred using this form. The reality is that both federal and state tax laws may apply to gifts, depending on their value and nature. It's essential to consult with a tax professional to understand any potential tax obligations.

- It’s only for use between family members. While often used to transfer property among family, the Affidavit of Gift form can also be used between non-family members. The key factor is the gift transaction, not the relationship of the parties.

- The form guarantees the recipient’s ownership rights are protected. Although the form is a critical step in transferring personal property without a sale, the recipient might need to take additional steps to protect their ownership rights fully, like registering the property in their name.

Understanding these misconceptions can help ensure that the use of an Affidavit of Gift form in Texas is both effective and complies with legal requirements. When in doubt, consulting a legal professional can provide guidance tailored to the specific circumstances of the gift.

Key takeaways

The Texas Affidavit of Gift form is an essential document used to transfer ownership of a vehicle or property from one person to another without any payment. The form is required by the Texas Department of Motor Vehicles (TxDMV) and helps in recording the gift transaction for legal and tax purposes. Understanding the correct way to fill out and use this form is vital for a smooth transfer process. Here are some key takeaways to guide you:

- An Affidavit of Gift must be completed for any vehicle being gifted to another person in Texas. This document proves that the vehicle is being transferred as a gift, eliminating the need for sales tax at the time of transfer.

- The form requires detailed information about the donor (person giving the gift) and the recipient (person receiving the gift). Ensure every section is completed accurately to avoid delays in processing.

- Both the donor and recipient must sign the affidavit, verifying that the vehicle is being given as a gift. These signatures often need to be witnessed and notarized, confirming the authenticity of the document and signatures.

- Include the Vehicle Identification Number (VIN) and a detailed description of the vehicle on the affidavit to assist in its identification and to ensure the correct vehicle is being transferred.

- There are specific situations where the affidavit cannot be used, such as when the vehicle is being traded or sold for a price, even if below market value. The form is strictly for gifts without any exchange of money.

- To file the Affidavit of Gift, the completed form, along with any other required documents, should be submitted to the county tax office or the TxDMV. It's essential to check with the local office for any additional paperwork or verification needed.

- The recipient of the vehicle must apply for a new title using the affidavit as part of the required documentation. Failing to properly title the vehicle in the new owner’s name may result in legal complications.

- If claiming an exemption from the sales tax, it's important to understand that the Texas Comptroller's office may require additional proof or documentation to validate the gift. Be prepared to provide this if asked.

- Keep a copy of the completed affidavit for your records. Both the donor and recipient should retain a copy in case of future disputes, questions from the TxDMV, or tax inquiries.

- Incorrectly filling out the affidavit or failing to submit the required documentation can lead to penalties, delays in the transfer process, or the invalidation of the vehicle gift transfer. When in doubt, seek advice from the TxDMV or a legal professional.

The Texas Affidavit of Gift form is a straightforward document, but it's essential to pay close attention to detail when filling it out and submitting it. Following these guidelines will help ensure a hassle-free transfer of vehicle ownership as a gift, without unexpected setbacks or liabilities.

Popular Affidavit of Gift State Forms

Affidavit for Gifting a Car Florida - For gifts of considerable value, this affidavit can be crucial for tax reporting purposes, helping to clearly define the nature of the transfer.