Free Affidavit of Gift Form for Florida

In Florida, when a vehicle or a piece of property is gifted, an essential document required is the Affidavit of Gift form. This legal instrument plays a pivotal role in formally documenting the transfer of ownership without any exchange of money between the giver and the recipient. It serves to clarify the relationship between the two parties, ensuring that the transaction is recognized as a genuine gift by the state. The form not only provides a record of the gift for both the donor and the recipient but also aids in the exemption of sales tax normally applicable to such transactions. Completing the form requires detailed information about the item being gifted, the parties involved, and the affirmation that no payment was made for the transfer. By submitting this affidavit, both donor and recipient confirm their understanding and agreement that the item is being transferred as a gift, thus providing a layer of protection and clarity to what might otherwise be a legally ambiguous situation.

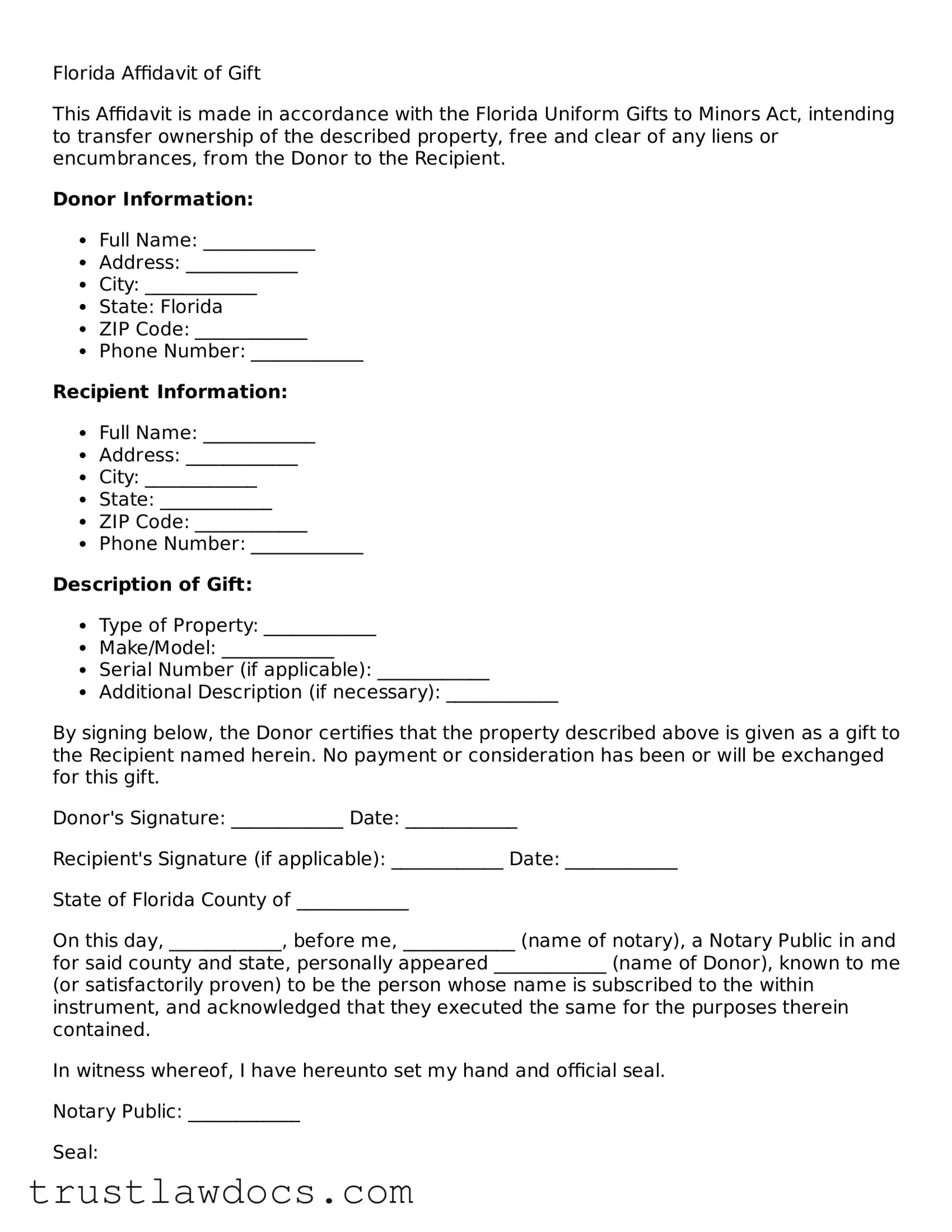

Form Example

Florida Affidavit of Gift

This Affidavit is made in accordance with the Florida Uniform Gifts to Minors Act, intending to transfer ownership of the described property, free and clear of any liens or encumbrances, from the Donor to the Recipient.

Donor Information:

- Full Name: ____________

- Address: ____________

- City: ____________

- State: Florida

- ZIP Code: ____________

- Phone Number: ____________

Recipient Information:

- Full Name: ____________

- Address: ____________

- City: ____________

- State: ____________

- ZIP Code: ____________

- Phone Number: ____________

Description of Gift:

- Type of Property: ____________

- Make/Model: ____________

- Serial Number (if applicable): ____________

- Additional Description (if necessary): ____________

By signing below, the Donor certifies that the property described above is given as a gift to the Recipient named herein. No payment or consideration has been or will be exchanged for this gift.

Donor's Signature: ____________ Date: ____________

Recipient's Signature (if applicable): ____________ Date: ____________

State of Florida County of ____________

On this day, ____________, before me, ____________ (name of notary), a Notary Public in and for said county and state, personally appeared ____________ (name of Donor), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

Notary Public: ____________

Seal:

My commission expires: ____________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to officially document the transfer of a gift from one individual to another without any consideration or payment. |

| Governing Law | It is governed by the laws of the State of Florida, including, but not limited to, the Florida Statutes that regulate the transfer of personal and real property. |

| Tax Implications | Depending on the value of the gift, it may be subject to federal gift tax regulations. However, Florida does not impose a state gift tax. |

| Required Information | The form requires detailed information about the donor and recipient, a description of the gift, and a statement declaring the item is given freely without coercion. |

How to Write Florida Affidavit of Gift

When transferring ownership of a vehicle in Florida as a gift, the process is streamlined but still requires the meticulous completion of the Affidavit of Gift form. This form serves to legally document that the vehicle is being transferred without any exchange of money or consideration, satisfying the requirement for tax exemption under state law. To ensure accuracy and compliance, follow these instructions closely. This will not only facilitate a smooth transition but also protect both parties involved in the transaction.

Steps for Filling Out the Florida Affidavit of Gift Form

- Gather Required Information: Before starting, ensure you have all necessary details such as the vehicle identification number (VIN), the make and model of the vehicle, and the personal information of both the donor and the recipient.

- Enter Donor and Recipient Details: Fill in the full legal names, addresses, and contact information of both the donor (the person giving the vehicle) and the recipient (the person receiving the vehicle).

- Describe the Vehicle: Accurately write in the vehicle's make, model, year, and VIN to correctly identify the vehicle being gifted.

- State the Relationship: Specify the relationship between the donor and the recipient if applicable, as certain tax exemptions might apply based on the nature of the relationship.

- Declare the Gift: This section is crucial. Clearly declare that the vehicle is being given as a gift and that no money, services, or other items of value are being exchanged for the vehicle.

- Sign and Date: Both the donor and the recipient must sign and date the form, affirming the accuracy of the information and the genuineness of the gift. It may also require notarization depending on local regulations, so check if this step is necessary in your area.

- Odometer Disclosure Statement: If the vehicle is less than ten years old, federal law requires completion of the odometer disclosure statement section by the donor, indicating the vehicle's current mileage. This is an important step for the recipient's awareness and for legal documentation.

- Submit the Form: Once completed and signed, the form must be submitted to the local county tax collector’s office or the Florida Department of Highway Safety and Motor Vehicles. This may require an appointment, so verify with the specific office.

Following these detailed steps ensures that your affidavit accurately reflects the transaction and complies with Florida's legal requirements. After submitting the form, the next steps primarily involve the recipient registering the vehicle in their name, which may include paying a nominal registration fee, despite the exemption from paying the sales tax thanks to the gift declaration. This sequence of actions safeguards the interests of both the giver and the receiver in the gift transaction of a vehicle.

Get Answers on Florida Affidavit of Gift

What is an Affidavit of Gift form in Florida?

An Affidavit of Gift form in Florida is a legal document that officially records the transfer of a gift from one person to another without any payment or consideration in return. It is often used to document the transfer of items like vehicles, to confirm that the gift is indeed free of any financial transactions.

When do I need to use an Affidavit of Gift form?

You need to use an Affidavit of Gift form when you are giving or receiving a significant gift in Florida, such as a car, and need to formally document the transfer for legal or tax purposes, or to prove ownership and clarify that the item was indeed received as a gift.

Is the Affidavit of Gift form required for vehicle registration in Florida?

Yes, if a vehicle is being given as a gift, the Affidavit of Gift form is required for the new owner to register the vehicle in Florida. It helps the Department of Motor Vehicles (DMV) to process the registration without considering the transaction as a sale, which would normally require sales tax to be paid.

Does the Affidavit of Gift affect my taxes?

The Affidavit of Gift may have tax implications for both the giver and the recipient. While it does not directly impose taxes, it serves as a record that may be relevant for federal gift tax purposes. It is advisable to consult with a tax professional to understand any potential tax liabilities or exclusions that may apply.

What information is needed to complete an Affidavit of Gift form?

To complete an Affidavit of Gift form in Florida, you will need specific details including the full names and addresses of both the giver and the recipient, a description of the gift being transferred, the date of the transfer, and a statement confirming that the item is a gift. It may also require notarization.

Where can I obtain an Affidavit of Gift form in Florida?

Affidavit of Gift forms can be obtained through the Florida Department of Highway Safety and Motor Vehicles (DHSMV) website, local DHSMV offices, or possibly through legal forms websites. It's important to ensure that the form is the most current one available.

Can I write my own Affidavit of Gift?

While it is possible to write your own Affidavit of Gift, it is important that the document meets all legal requirements in Florida. Using an official form or consulting with a legal professional can help ensure that your affidavit is valid and accepted by the DMV or other agencies.

Is notarization required for an Affidavit of Gift in Florida?

Yes, in most cases, the Affidavit of Gift form needs to be notarized in Florida. Notarization confirms the identity of the signatories and adds a level of legal authentication, ensuring that the document is more readily accepted by government agencies and other parties.

What happens after I submit the Affidavit of Gift?

After you submit the Affidavit of Gift, along with any other required documentation, to the appropriate Florida agency, the gift will be officially recorded, and the recipient can proceed with any necessary steps, such as vehicle registration, free of implications of a sale.

Can an Affidavit of Gift be revoked?

Once an Affidavit of Gift has been completed and submitted, and the gift has been transferred, the giver cannot revoke the affidavit or reclaim the gift without the recipient's consent. The transfer is considered final, making it important to be certain of your decision before completing the process.

Common mistakes

Filling out the Florida Affidavit of Gift form might seem straightforward, but it's easy to make mistakes that can create complications down the line. One common error is not accurately describing the gift. Every detail matters. If the document doesn't precisely identify the item being given, such as a car, including make, model, and serial number, it might not meet legal requirements.

Another frequent oversight is neglecting to include all necessary parties in the document. For a gift transfer to be recognized legally, information about both the giver and the recipient must be clearly stated. Leaving out or incorrectly entering anyone's full legal name or contact information can invalidate the affidavit.

It's also vital to ensure the form is signed in front of a notary public or other official authorized to witness affidavits in Florida. Some people mistakenly believe a signature alone suffices. However, without the formal acknowledgment by a notary, the affidavit may not be legally binding.

Evidence of the giver's intention to make the gift is another area often overlooked. The affidavit must clearly state that the gift is given freely, without any expectation of payment or compensation in return. A simple oversight in wording here can lead to disputes or challenges regarding the transfer's validity.

Incorrectly dating the document is a minor mistake with potentially major consequences. The date on the affidavit should be the actual date of signing. Misdating can cause issues with record-keeping or when trying to prove the timing of the gift transfer, especially if tax implications are involved.

Failure to attach necessary supporting documents is another pitfall. Depending on the nature of the gift, additional paperwork like a certificate of title for a vehicle might be required. Not attaching these documents can lead to delays or even a refusal to recognize the gift legally.

Not specifying any conditions attached to the gift can also be problematic. If there are specific terms under which the gift is given, failing to outline these conditions in the affidavit might lead to misunderstandings or legal disputes later on.

Many people don't realize that failing to follow up with the appropriate government or financial institutions is a crucial step. After completing the affidavit, certain entities must be notified for the transfer to be recognized officially. Overlooking this step can result in the gift not being legally transferred.

Lastly, a simple but common mistake is using an outdated form or one that doesn't comply with current Florida law. Legal documents and requirements can change, so it's important to ensure the affidavit reflects the most recent legal standards.

Documents used along the form

When transferring a vehicle or property as a gift in Florida, the Affidavit of Gift form is a critical document, but it’s rarely the only paperwork you'll need to complete the process. Several other forms and documents are frequently required to ensure the transfer is legally binding and recognized by the necessary authorities. Each of these documents plays its own role in the process, providing additional verification, proving ownership, or releasing liability.

- Title Certificate: This document proves ownership of the vehicle or property. When gifting, the title must be legally transferred to the recipient’s name, indicating their new ownership status.

- Bill of Sale: Although not always required when a gift is involved, a bill of sale provides a written record of the transaction, including details about the giver and the recipient, as well as any monetary transaction or exchange value, even if nominal.

- Odometer Disclosure Statement: For vehicle gifts, this form reports the vehicle's actual mileage at the time of gifting. It's crucial for buyer protection and is mandated by federal law.

- Release of Liability Form: The donor should file this document with the state to inform that the vehicle or property is no longer under their ownership, limiting their liability in case of future issues with the item gifted.

- Vehicle Registration Application: The recipient must register the vehicle under their name. This application is necessary for vehicles and, in some cases, boats or large equipment, depending on state regulations.

- Sales Tax Exemption Certificate: To officially record the transfer as a gift and exempt the recipient from sales tax, this certificate is often required, depending on the state’s tax laws and exemptions for gift transactions.

- Proof of Insurance: For vehicle gifts, the new owner must provide evidence of insurance coverage. This requirement ensures that the vehicle is covered under the recipient's policy immediately upon transfer.

The process of gifting a vehicle or property involves careful documentation to protect all parties involved and comply with legal standards. By gathering and accurately completing the necessary forms and documents, donors can ensure a smooth and lawful transfer, establishing a clear and documented gift transaction. Understanding each document's purpose can significantly aid in navigating the complexities of legal transfers and ensuring the gift's rightful ownership is recognized without dispute.

Similar forms

The Florida Affidavit of Gift form is closely related to a Bill of Sale document, as both serve to transfer ownership of property from one person to another. The key distinction lies in the financial transaction involved in a Bill of Sale, where goods are sold for money or other compensation, while the Affidavit of Gift documents a transfer made as a gift without any consideration or payment received in return.

A similar document to the Affidavit of Gift is a Quitclaim Deed, commonly used in real estate transactions to transfer interest in property without guaranteeing the title's validity. Both documents facilitate the transfer of property rights, but the Affidavit of Gift applies to personal property, whereas a Quitclaim Deed is used for real estate.

The Warranty Deed, like the Affidavit of Gift, is another document used in real estate to transfer property. However, unlike the Affidavit of Gift, which makes no guarantees about the property's encumbrances, a Warranty Deed guarantees that the property is free from any liens or claims, providing the receiver with a greater level of protection.

Gift Letters are often used in financial transactions, particularly in mortgage processes, to prove that funds received by a homebuyer are indeed gifts and not loans. Both Gift Letters and Affidavits of Gift confirm the transfer of something of value without the expectation of repayment, although the latter is more formal and specific to personal property transfers.

Another related document is the Promissory Note, which outlines the terms for repaying a debt. Although it differs in purpose from the Affidavit of Gift, which involves no repayment, both documents establish an agreement under specific terms—either the terms of repayment or the terms under which a gift is given, respectively.

The Release of Liability form, while serving a different function, shares a commonality with the Affidavit of Gift, as both can signify relinquishment of rights. In a Release of Liability, one party waives the right to hold the other responsible for any damage or injury that might occur, whereas the Affidavit of Gift relinquishes the giver's right to the property, transferring it to the receiver.

Transfer-on-Death (TOD) forms are akin to Affidavits of Gift in that they allow for the transfer of assets upon the death of the owner. While TOD forms are specific to posthumous circumstances and typically used with securities and registrations, the Affidavit of Gift enables similar transfers to take place during the owner's lifetime without the exchange of money.

Power of Attorney documents empower someone to act on another's behalf in specific or broad circumstances. This is somewhat related to the Affidavit of Gift's purpose in that it sometimes requires a representative to sign and manage the gifting process, especially when the donor is unable to do so personally. However, the authority granted in a Power of Attorney is typically broader and involves ongoing duties beyond a single act of gifting.

The Declaration of Trust document outlines the management and distribution of assets held in trust, which can involve transferring property to beneficiaries, akin to how an Affidavit of Gift transfers ownership of personal property to someone else. While both involve transferring property, a Declaration of Trust is usually part of a broader estate planning strategy and involves a fiduciary duty.

Lastly, a Donation Receipt is often used by non-profit organizations to acknowledge the receipt of a gift. Similar to an Affidavit of Gift, it serves as a record that an item or sum of money was willingly transferred to another party without expectation of payment. However, Donation Receipts are typically used for tax purposes to document charitable contributions.

Dos and Don'ts

When completing the Florida Affidavit of Gift form, adhering to specific guidelines ensures the process is smooth and valid. Below are lists of dos and don'ts to guide you through accurately filling out the form.

Do:

- Ensure all information is legible and written in ink to avoid any misunderstandings or processing delays.

- Include the full legal names and addresses of both the giver and the recipient to clearly identify the parties involved in the gift transaction.

- Describe the gifted item in detail, including make, model, year, and identification number if applicable, to ensure there's no ambiguity about what is being gifted.

- Sign and date the form in the presence of a notary to validate the document officially.

Don't:

- Leave any sections of the form blank; incomplete forms may be rejected or cause unnecessary delays in the processing of the gift affidavit.

- Alter any pre-printed text on the form; this can invalidate the document.

- Forget to check for specific county requirements in Florida as they may vary and could require additional documentation or steps.

- Delay in submitting the form after it is completed and notarized, as there may be time-sensitive requirements for the transfer to be recognized.

Misconceptions

There are several misconceptions about the Florida Affidavit of Gift form that can lead to confusion or errors in the process of transferring property without consideration. Understanding these misconceptions helps in accurately completing and using the form.

A Notary Public is not required to witness the signing. In Florida, the law requires that the Affidavit of Gift form be witnessed and notarized to ensure the authenticity of the document and the identity of the signers.

It can be used for any type of gift. The Affidavit of Gift form in Florida is specifically designed for the transfer of motor vehicles, mobile homes, and boats as gifts. It is not applicable for other types of personal or real property.

It exempts the recipient from all taxes. While the Affidavit of Gift might exempt the recipient from paying sales tax on the transferred property, it does not exempt them from other applicable taxes such as federal gift tax, depending on the value of the gift.

There's no need to report the gift to the IRS. Depending on the value of the gift, the donor may be required to file a federal gift tax return with the IRS. This form does not negate the donor's responsibility to adhere to federal tax laws.

It allows for conditional gifts. The Affidavit of Gift is intended for the unconditional transfer of property. Any conditions or expectations attached to the gift should be detailed in a separate agreement, as this form does not address contingencies.

The form automatically transfers the title. Completing and submitting the Affidavit of Gift is a necessary step in the gift transfer process, but the title to the property is not officially transferred until the relevant Florida state department processes and approves the change.

It serves as a legal document for estate planning. While the Affidavit of Gift can be used to transfer property as a gift, it should not be considered a substitute for comprehensive estate planning documents like wills or trusts.

Key takeaways

If you're planning to give a vehicle, vessel, or mobile home as a gift in Florida, the Affidavit of Gift form is an essential document to complete the process correctly. Understanding how to fill out and use this form properly is crucial for a smooth transfer. Here are some key takeaways to guide you:

- Verification is Key: The Florida Affidavit of Gift Form must be accurately completed to verify that an item is genuinely being given as a gift. This means no payment or consideration is expected or received by the giver. It's necessary to be truthful on this form to avoid potential penalties for fraud.

- Details Matter: Ensure all details are filled out correctly, including the full names of the giver and the recipient, the vehicle, vessel, or mobile home identification number, and the accurate description of the item being gifted. Inaccuracies can delay the process or invalidate the affidavit.

- Notarization is Required: For the affidavit to be legally binding, it must be notarized. This means that after completing the form, both the giver and the recipient must sign it in the presence of a notary public. The notary's role is to confirm the identity of the signers and ensure that they are signing willingly and under no duress.

- Keep a Copy: Both the giver and the recipient should keep a copy of the notarized affidavit for their records. This document can serve as proof of the gift for tax purposes or if any questions arise about the ownership of the item in the future.

- Follow Through with Title Transfer: Completing the affidavit is just one step in the gift process. The new owner must take the affidavit to the Florida Department of Highway Safety and Motor Vehicles (DHSMV) or its equivalent to complete the title transfer process. Without transferring the title, the vehicle, vessel, or mobile home legally remains in the name of the giver.

Always ensure the process is followed as per the Florida DHSMV or local tax collector's office guidelines for a seamless transfer. Missteps can lead to legal complications or delays in transferring the title.

Popular Affidavit of Gift State Forms

Texas Dept of Motor Vehicles - It can be an invaluable document in estate planning, ensuring that certain assets are distributed according to the giver's wishes.