Official Affidavit of Domicile Document

When managing the estate of a loved one who has passed away, certain documents play crucial roles in ensuring a smooth transfer of assets. Among these, the Affidavit of Domicile form stands out as a pivotal document. This form is used to officially declare the residency of the deceased at the time of their death, a detail of paramount importance for the legal transfer of securities and other assets. It serves as a key piece of evidence in the probate process, helping executors and financial institutions verify the jurisdiction under which the estate will be settled. The information provided on the form, including the deceased's legal address, length of residence, and the executor's sworn statement, is instrumental in clarifying tax liabilities and facilitating the proper distribution of the estate's holdings. Preparing this affidavit demands attention to detail and an understanding of its impact on estate proceedings, making it an indispensable step for executors navigating the complexities of estate management.

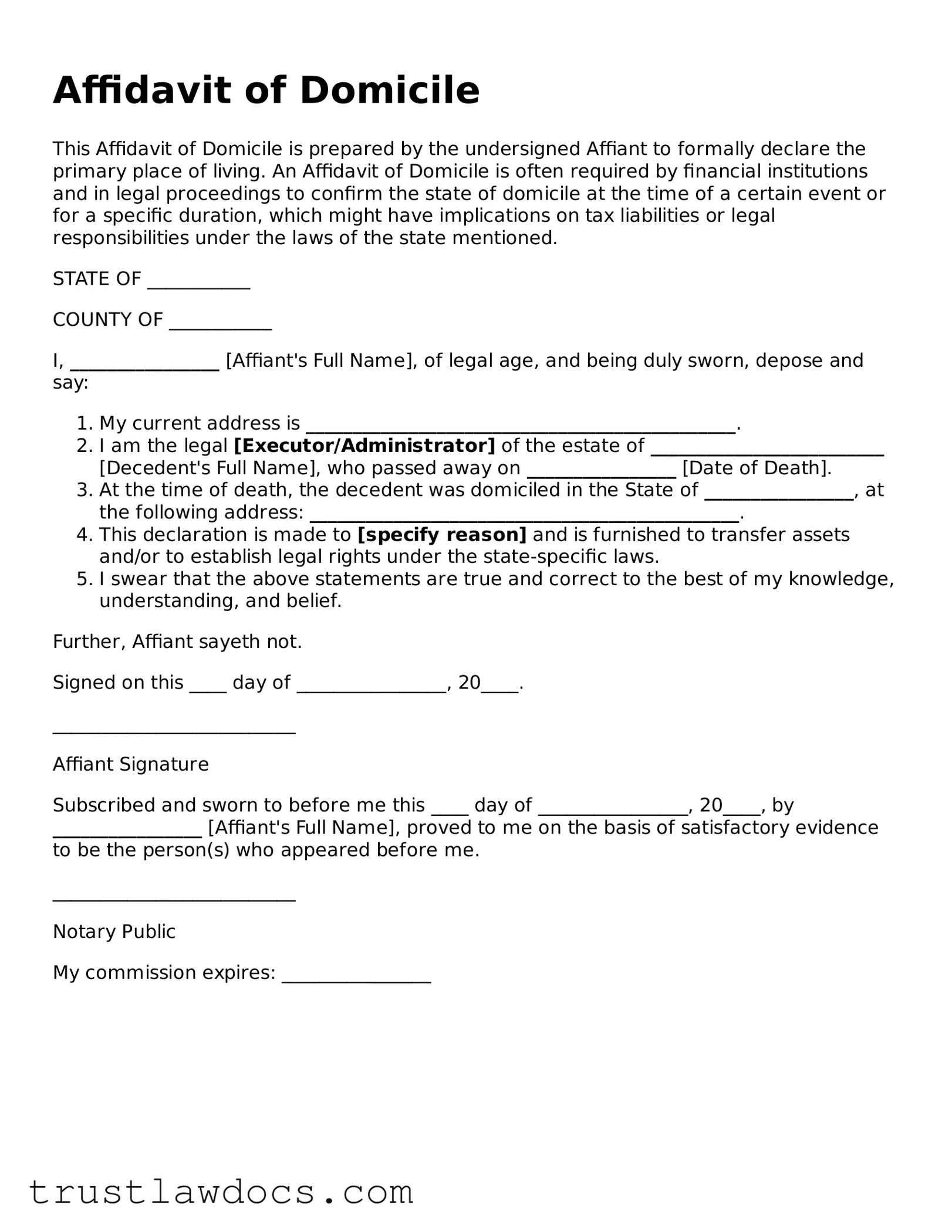

Form Example

Affidavit of Domicile

This Affidavit of Domicile is prepared by the undersigned Affiant to formally declare the primary place of living. An Affidavit of Domicile is often required by financial institutions and in legal proceedings to confirm the state of domicile at the time of a certain event or for a specific duration, which might have implications on tax liabilities or legal responsibilities under the laws of the state mentioned.

STATE OF ___________

COUNTY OF ___________

I, ________________ [Affiant's Full Name], of legal age, and being duly sworn, depose and say:

- My current address is ______________________________________________.

- I am the legal [Executor/Administrator] of the estate of _________________________ [Decedent's Full Name], who passed away on ________________ [Date of Death].

- At the time of death, the decedent was domiciled in the State of ________________, at the following address: ______________________________________________.

- This declaration is made to [specify reason] and is furnished to transfer assets and/or to establish legal rights under the state-specific laws.

- I swear that the above statements are true and correct to the best of my knowledge, understanding, and belief.

Further, Affiant sayeth not.

Signed on this ____ day of ________________, 20____.

__________________________

Affiant Signature

Subscribed and sworn to before me this ____ day of ________________, 20____, by ________________ [Affiant's Full Name], proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

__________________________

Notary Public

My commission expires: ________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Used to legally certify a deceased person's residency at the time of death. |

| Primary Use | Assists in the transfer of securities and assets by proving the decedent’s residence. |

| Who Prepares It | Typically prepared by the executor or administrator of the estate. |

| Required Signatures | Must be signed by the executor/administrator and notarized. |

| Notarization | Required to verify the authenticity of the executor/administrator’s signature. |

| Financial Institutions | Often requested by banks and financial institutions to release assets. |

| Legal Significance | Serves as an official declaration for estate and tax purposes. |

| Governing Laws | Vary by state, but generally governed by estate and probate laws where the decedent resided. |

How to Write Affidavit of Domicile

Once someone passes away, managing their assets requires detailed documentation. Among the necessary documents is the Affidavit of Domicile. This legal document verifies the deceased's primary place of residence at the time of death. It plays a critical role for executors and beneficiaries in the transfer of ownership of securities and other assets. Next, you will find a streamlined guide to accurately fill out this form, ensuring a smoother process in estate settlements.

Steps for Filling Out the Affidavit of Domicile Form:

- Start by entering the date at the top of the form. This should be the current date on which you’re filling out the affidavit.

- Write the full legal name of the deceased in the designated field. Ensure it matches the name as it appears on legal and financial documents.

- Include the full, legal last address of the deceased. This address should reflect the primary residence at the time of their death, not merely a temporary lodging.

- Enter the date of death exactly as it appears on the death certificate. Accuracy is paramount to avoid discrepancies with official records.

- If the form requests it, specify the length of time the deceased lived at the aforementioned address leading up to their death.

- Complete the section that inquiries about the deceased's legal domicile. Legal domicile refers to the place the deceased considered their permanent home, where they intended to return even if they lived elsewhere temporarily.

- In the designated spots, provide your full name and address. As the person completing the affidavit, your information verifies your association with the estate.

- State your relationship to the deceased to clarify your legal standing or interest in the estate.

- Some forms may require details about the executor or administrator of the estate. If applicable, include this individual's name and contact information.

- Review the affidavit to ensure all information provided is accurate and complete. Mistakes can lead to delays or legal complications.

- Sign the affidavit in the presence of a notary public. The notary will seal the document, lending it official credibility and legal acknowledgment.

Completing the Affidavit of Domicile with accuracy and care is a crucial step in managing the affairs of someone who has passed away. It not only helps in the smooth transfer of assets but also ensures compliance with legal requirements. By following these steps, you can confidently navigate this part of the estate settlement process.

Get Answers on Affidavit of Domicile

What is an Affidavit of Domicile and when do I need one?

An Affidavit of Domicile is a document that legally declares a deceased person's primary place of residence at the time of their death. This affidavit is often required by financial institutions and in legal matters to confirm the state laws that apply to the deceased's estate, especially for transferring or selling securities and stocks owned by the deceased. It is most commonly needed during the probate process, when a will is being executed, or when transferring ownership of assets.

Who is authorized to sign the Affididavit of Domicile?

The executor or administrator of the estate is typically the person authorized to sign the Affidavit of Domicile. This individual is appointed as part of the probate process, responsible for managing and distributing the deceased's assets according to the will or state law if there is no will. In circumstances where an estate is not probated, legal advice may be necessary to determine who is eligible to sign.

What information do I need to fill out this form?

To complete an Affidavit of Domicile form, the following information is generally required: the date of death of the deceased, the full legal name of the deceased, the last address of residence, and a statement confirming the deceased's domicile at the time of death. Also, the form must be signed by the executor or administrator of the estate and notarized to verify its authenticity and the identity of the signer.

Where do I file the completed Affidavit of Domicile?

Once completed and notarized, the Affidavit of Domicile should be filed with the institution or entity requesting it, such as a brokerage firm, bank, or court. It is not typically filed with a government office but is kept on file by the requesting institution as part of their records and proof of compliance with legal requirements for transferring assets.

Is there a fee to obtain or file an Affidavit of Domicile?

There is no standard fee to obtain an Affidavit of Domicile form, as it is often available free of charge from legal forms websites, financial institutions, or an attorney's office. However, there may be a small notarization fee when getting the document officially notarized. This fee can vary by location and service provider. When filing the document with a financial institution or other entity, it's important to check if they require any filing fees.

Common mistakes

One common mistake made when filling out an Affidavit of Domicile form is overlooking the precise definition of domicile. People often confuse this with mere residence, where one lives at a certain point. However, domicile refers to the place an individual intends to maintain as their permanent home, where they plan to return even after periods of absence. This misunderstanding can lead to inaccuracies on the form, potentially complicating legal matters related to estate settlement or tax obligations.

Another error is the failure to update the form when circumstances change. Life events such as marriage, divorce, or even a significant relocation can alter one’s domicile. When these changes occur, the Affidavit of Domicile should be revised to reflect the current state of affairs. Continuing with outdated information can cast doubts on the document's validity, thus obstructing its intended purpose.

Incorrectly identifying legal documents that support the claim of domicile constitutes an additional pitfall. Specific items, like property deeds, voter registrations, and even driver’s licenses, bolster the claim of a domicile location. Nevertheless, individuals often neglect to reference or attach these crucial pieces of evidence, weakening their position and potentially rendering the affidavit less persuasive to financial institutions or courts.

In the process of executing the Affidavit of Domicile, there is also the mistake of improper witnessing or notarization. This document, like many legal declarations, may require a witness or notary public to attest to the signer's identity and their acknowledgment of the form's contents. Some individuals either skip this step altogether or complete it in a manner not compliant with their jurisdiction's laws, thereby risking the document's acceptability.

Last but certainly not least, is the error of overlooking or misunderstanding the need for detailed and specific information regarding the decedent's assets. The Affidavit of Domicile is often used to facilitate the transfer of securities and other asset types after someone passes away. Failing to provide precise information about these assets can delay the process, complicate transactions, and increase costs for the estate. It’s essential to include thorough and exact data about each asset for which the affidavit is being submitted.

Documents used along the form

When processing legal, financial, or estate-related matters, an Affidavit of Domicile often goes hand in hand with several other important forms and documents. This affidavit is a sworn statement used to confirm the primary legal residence of a deceased individual at the time of their death. It plays a crucial role in the transfer of assets, especially securities. However, to ensure a smooth process, this document is frequently accompanied by additional forms. Each of these forms serves its unique purpose, contributing to the comprehensive documentation needed during such proceedings.

- Certificate of Death: A government-issued document that officially records the date, location, and cause of a person's death. This certificate is essential for legally verifying the death, a prerequisite for many other processes, including the execution of the will and the transfer of assets.

- Last Will and Testament: This document outlines the deceased's wishes regarding the distribution of their estate and the care of any minor children. It is crucial for determining the distribution of assets in accordance with the deceased's wishes.

- Letters Testamentary or Letters of Administration: These documents are issued by a court to authorize an executor or administrator to settle the deceased's estate. Their presence confirms the individual's legal authority to act on behalf of the estate during the transaction of assets and other estate matters.

- Stock Certificates: If the deceased owned shares in physical form, these certificates would need to be presented. They serve as proof of ownership and are necessary for the transfer of these assets to the rightful beneficiaries.

- Trust Documents: If assets were held in a trust, the relevant trust documents would be required. These detail the trust's terms and identify the trustees and beneficiaries, guiding the distribution of the trust assets.

- Power of Attorney (POA): Should the deceased have designated a POA, this document would be necessary for actions taken on behalf of the deceased prior to their death. Although a POA typically ends upon the death of the individual, it is still important for transactions or decisions made before death.

While the Affidavit of Domicile is significant in itself, it is the integration with these accompanying documents that ensures thoroughness in estate settlement or the transfer of assets. Collectively, they provide a comprehensive legal framework essential for the effective management and distribution of the deceased's estate, safeguarding their legacy and ensuring their final wishes are respected and followed accurately.

Similar forms

The Affidavit of Domicile shares similarities with a Death Certificate. Both documents are vital for the administration of estates and the transfer of assets following an individual's death. While the Affidavit of Domicile declares the legal residence of the deceased at the time of death, crucial for tax purposes and legal matters, the Death Certificate officially records the date, location, and cause of death. Each serves as a legal requirement in the settlement of the deceased's affairs, facilitating the execution of wills and the distribution of the estate to beneficiaries.

Comparable to the Affidavit of Domicile, a Will is a foundational document in estate planning and settlement. A Will outlines the deceased's wishes regarding the distribution of their assets and may specify the desired legal residence for estate administration purposes. Whereas the Affidavit of Domicile certifies an individual's legal domicile at death, influencing jurisdictional matters, a Will communicates the decedent's intentions for their estate, appointing executors and guardians as necessary.

A Trust Document also parallels the Affidavit of Domicile in its role within estate planning and execution. Trust Documents dictate terms for managing and distributing an individual’s assets, often bypassing the probate process, similar to how the affidavit determines the state laws applicable to the deceased's estate. The domicile stated in the affidavit can affect the administration of trusts, especially regarding state-specific tax implications and legal considerations.

The Power of Attorney (POA) form, while active during the grantor's lifetime, shares its legal importance with the Affidavit of Domicile. A POA grants an individual the authority to make decisions on behalf of another, potentially including declarations about domicile for various purposes. In contrast, the affidavit confirms the deceased's domicile posthumously, guiding estate settlement. Both documents hold significant sway in legal and financial arenas, impacting decisions related to assets, healthcare, and personal affairs.

Just like the Affidavit of Domicile, the Real Property Deed is crucial in confirming legal statuses tied to estate management. While the deed verifies the ownership and transfers of real estate -- specifying details about the property and its holders -- the affidavit asserts the decedent's domicile, affecting property succession laws and taxation. These documents collectively ensure that real estate and other assets are transferred in accordance with legal stipulations and the decedent's residency status.

Similarly, the Vehicle Title holds a comparable function to the Affidavit of Domicile but in the context of personal property. Vehicle titles document the legal owner of a vehicle, necessary for the sale or transfer of ownership. When an individual passes away, the affidavit's declaration of domicile can affect how vehicles and other personal property are distributed, based on the decedent’s state of residence and the corresponding laws. Both forms play integral roles in the proper allocation of personal and real assets following death.

The Tax Return Document, especially the final return filed after an individual's demise, works in tandem with the Affidavit of Domicile to ensure the accurate assessment and payment of taxes. While the tax return details income, deductions, and tax liabilities up to the point of death or for the deceased's estate, the affidavit establishes the legal domicile, which determines the state tax obligations. These documents together assist in wrapping up the financial responsibilities of the deceased, providing a clear understanding of the tax implications based on their domicile.

Dos and Don'ts

When filling out the Affidavit of Domicile form, attention to detail is crucial. This document plays a significant role in legal and financial matters, especially concerning the transfer of securities upon a person's death. Below are essential dos and don'ts to guide you through the process efficiently and accurately.

Do:

- Double-check the deceased's full legal name and any other identifying information to ensure it matches official documents like the death certificate.

- Verify the precise address and the length of time the deceased lived at their last domicile. This requires accurate recollection or research.

- Obtain and attach official death certificates or other legal documents if required by the form instructions or the financial institution.

- Ensure that the form is signed in front of a notary public to validate the affidavit’s authenticity. This step is often mandatory.

- Consult with a legal advisor or attorney if there are questions or uncertainties about the form or process. Legal advice can prevent costly mistakes.

Don't:

- Guess on dates or addresses; inaccuracies can lead to processing delays or rejection of the document.

- Omit any requested information. If unsure about a detail, seek clarification rather than leaving a section blank.

- Alter the form without authorization. Amendments may be necessary, but they should be done according to the instructions or legal advice.

- Forget to make a copy for personal records before submitting the original document. Having a copy can be crucial for future reference or in case the original is lost.

- Rush through the process without reviewing the document completely. Mistakes could be more troublesome to correct after submission.

By adhering to these guidelines, you can complete the Affidavit of Domicile form with confidence, ensuring a smoother transaction for all parties involved.

Misconceptions

When dealing with the legal document known as the Affidavit of Domicile, people often hold various misconceptions. This document is vital for various transactions, especially those involving the transfer of securities after someone has died. It's crucial to understand what this document is and what it is not. Let's debunk some common misunderstandings:

It can replace a will: Some believe that this affidavit can act as a substitute for a will. However, its sole purpose is to declare the deceased's legal residence at the time of their death, which can affect the transfer of securities. It does not distribute assets like a will.

It's only for real estate transactions: While the term domicile often relates to property, this document is crucial for the transfer of securities (stocks, bonds, etc.). It is not limited to transactions involving real estate.

It serves as proof of ownership: Another common error is thinking this affidavit establishes ownership of the assets. Instead, it certifies the deceased’s primary legal residence, influencing the legal and tax implications of the transfer of assets.

The document is complicated: People often anticipate a complex process. In reality, an Affidavit of Domicile is relatively straightforward, usually requiring basic information about the deceased, their last residence, and the signature of an executor or administrator, verified by a notary.

It’s only required in specific states: The necessity of this document is not confined to particular states. While requirements can vary, many financial institutions across the country request an Affidavit of Domicile to transfer securities owned by a deceased person.

Only family members can file it: It's often thought that only a family member of the deceased can file this affidavit. In reality, the executor or administrator of the estate, who may not be a relative, is authorized to complete and sign it.

Personal attendance is necessary to file it: Many people believe they must present the affidavit in person. However, it is commonly accepted through mail or electronic submission by most institutions requiring it.

It’s valid indefinitely: Unlike some legal documents, the Affidavit of Domicile has no indefinite validity. Financial institutions may require a recently dated affidavit, often within a specific time frame from the date of submission.

A lawyer must prepare it: There’s a misconception that legal expertise is necessary to create an Affidavit of Domicile. While seeking legal advice can be beneficial, especially in complex cases, the document itself is straightforward enough for individuals to complete on their own or with minimal guidance.

Clearing up these misconceptions is crucial for understanding the purpose and requirements of the Affidavit of Domicile, ensuring that the estates are handled properly and efficiently.

Key takeaways

When you're handling the estate of someone who has passed away, the Affidavit of Domicile becomes an important document. This form is crucial for transferring ownership of securities from the deceased to their beneficiaries. Here are some key points to remember when filling out and using this form:

- The form must be completed by the executor or administrator of the estate. It confirms the state in which the deceased primarily lived at the time of their death. This is essential for tax purposes and for transferring assets according to the laws of that state.

- Accuracy is key. Make sure all information on the Affidavit of Domicile is correct, including the full legal name of the deceased, their last address, and the date of death. Mistakes can delay the transfer of assets.

- A notary public must witness the signing of this document. This step adds a layer of legal validation, affirming that the person signing the form is indeed the executor or administrator of the estate.

- Once the form is notarized, it should be submitted alongside other required documents to the financial institutions holding the deceased's assets. It's wise to contact these institutions beforehand to understand their specific requirements, as some may need additional forms or documentation.

Remember, the Affidavit of Domicile is a legally binding document that plays a pivotal role in the estate settlement process. Taking the time to fill it out correctly can smooth the path for transferring assets to the rightful beneficiaries, ensuring that the deceased's final wishes are honored.

Consider More Types of Affidavit of Domicile Forms

Who Is the Petitioner in I-751 - An effective affidavit addresses the concerns that an immigration official might have about the marriage’s authenticity directly and convincingly.

Affidavit of Service Example - It is a key piece of documentation that supports the enforceability of court decisions by verifying service of process.