Free Affidavit of Death Form for Texas

When someone passes away, the ripple effects touch various aspects of legal and personal affairs, particularly concerning the deceased’s properties and assets. In Texas, handling these sensitive issues involves a significant document known as the Affidavit of Death form. This form plays a crucial role in the transfer of property titles and the execution of estate plans, ensuring that assets are distributed according to the deceased’s wishes or state laws if no will exists. Filled out by a surviving relative or an executor of the estate, it serves as an official declaration of death, providing needed proof to legal entities, financial institutions, and others. Understanding the Affidavit of Death form is key to navigating the post-loss legal landscape, making it essential for anyone involved in settling the affairs of someone who has passed away. It's a sobering task that requires attention to detail, accuracy, and a clear grasp of the legal requirements to facilitate the smooth transfer of assets and help bring closure to those affected.

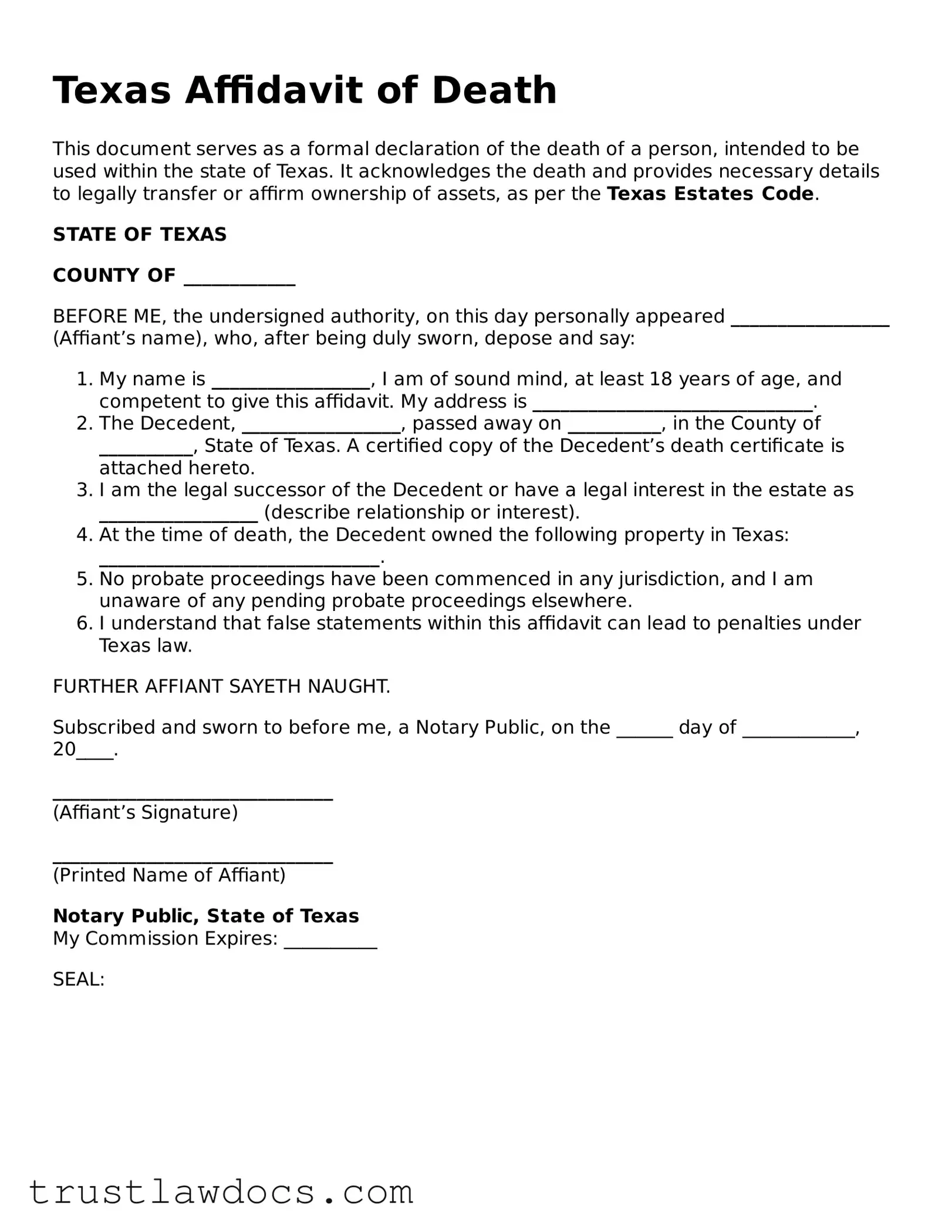

Form Example

Texas Affidavit of Death

This document serves as a formal declaration of the death of a person, intended to be used within the state of Texas. It acknowledges the death and provides necessary details to legally transfer or affirm ownership of assets, as per the Texas Estates Code.

STATE OF TEXAS

COUNTY OF ____________

BEFORE ME, the undersigned authority, on this day personally appeared _________________ (Affiant’s name), who, after being duly sworn, depose and say:

- My name is _________________, I am of sound mind, at least 18 years of age, and competent to give this affidavit. My address is ______________________________.

- The Decedent, _________________, passed away on __________, in the County of __________, State of Texas. A certified copy of the Decedent’s death certificate is attached hereto.

- I am the legal successor of the Decedent or have a legal interest in the estate as _________________ (describe relationship or interest).

- At the time of death, the Decedent owned the following property in Texas:

______________________________. - No probate proceedings have been commenced in any jurisdiction, and I am unaware of any pending probate proceedings elsewhere.

- I understand that false statements within this affidavit can lead to penalties under Texas law.

FURTHER AFFIANT SAYETH NAUGHT.

Subscribed and sworn to before me, a Notary Public, on the ______ day of ____________, 20____.

______________________________

(Affiant’s Signature)

______________________________

(Printed Name of Affiant)

Notary Public, State of Texas

My Commission Expires: __________

SEAL:

PDF Form Details

| Fact | Description |

|---|---|

| 1. Purpose | The Texas Affidavit of Death is used to legally establish someone's death within the state, typically for matters of estate and property transfer when the deceased owned real estate. |

| 2. Governing Law | It is governed by the Texas Estates Code, which outlines how death certificates and affidavits of death are to be handled and recognized under Texas law. |

| 3. Required Information | This form requires detailed information including the deceased's full name, date of death, description of the property affected, and the legal claim of the person filing the affidavit. |

| 4. Recording Requirement | Once completed, the affidavit must be filed and recorded with the county clerk in the county where the property is located to be effective. |

| 5. Use in Estate Planning | It is often used in the absence of a will, or when the estate does not go through formal probate, to facilitate the transfer of property to heirs or beneficiaries. |

| 6. Non-Probate Tool | Considered a critical non-probate tool, it simplifies the transfer process of the deceased's assets without the need for a lengthy probate proceeding. |

| 7. Validation | The affidavit must be signed by a notary public to validate the identity of the filer and the truths of the statements made within. |

| 8. Timeframe | There's often a mandatory waiting period after death (commonly around 30 days in Texas) before the affidavit can be effectively filed to ensure all death-related matters are settled. |

How to Write Texas Affidavit of Death

Filling out a Texas Affidavit of Death form is a crucial step in managing the estate of someone who has passed away. It helps to officially document the death and facilitate the transfer of property and assets according to the decedent’s will or the state’s succession laws. The process can be straightforward if you know what information you need and where it should go on the form. Below, you'll find a simplified guide to help you navigate each section, ensuring that you complete the form accurately and comply with Texas legal requirements.

- Start by entering the full name of the deceased (referred to as the "Decedent") at the top of the form where indicated.

- Provide the Decedent's last known address, including the city, county, and state. This information is crucial for identifying the correct estate records.

- Fill in the date of death as recorded on the official death certificate. This date must be accurate for the affidavit to be valid.

- Enter your full name, address, and relationship to the Decedent in the section designated for the "Affiant," the person completing the affidavit.

- If the form requires details about the Decedent’s property, list each item clearly. Describe real estate with precise addresses or legal descriptions, and identify personal property with enough detail for clear identification.

- Some affidavits may ask for information on the Decedent’s next of kin or heirs. If so, list their names, addresses, and relationships to the Decedent accurately.

- Review all entered information for accuracy. Mistakes could delay the process or affect the transfer of assets.

- Sign and date the affidavit in the presence of a notary public. The notary will fill out their section, which may include a seal, verifying the authenticity of your signature.

After completing the affidavit, the next steps often involve submitting it to the appropriate county recorder or probate court, along with any required filing fees. This action officially records the death and can be a key part of settling the Decedent's estate, transferring property, and resolving other legal matters tied to the Decedent's assets. Remember, every situation is unique, so consider consulting with a legal professional if you encounter complexities or have specific questions about your case.

Get Answers on Texas Affidavit of Death

What is a Texas Affidavit of Death form?

An Affidavit of Death form in Texas is a legal document used to formally declare the death of an individual. It helps in the process of transferring assets to heirs or beneficiaries, particularly when the deceased person owned property in Texas. This affidavit serves as an official statement that can be recorded with county records to clarify the chain of title.

Who needs to file an Affidavit of Death in Texas?

Typically, the executor of the estate or the surviving heirs might need to file an Affidavit of Death. This is especially important if the deceased owned real estate or other significant assets that need to be legally transferred to the rightful heirs or beneficiaries.

What information is required on the Texas Affidavit of Death form?

The form requires detailed information including the full name of the deceased, their date of death, and the legal description of the property involved. It might also require the affiant's relationship to the deceased and their knowledge of the estate's handling.

Do I need a lawyer to complete the Texas Affidavit of Death form?

While not strictly necessary, consulting with a legal professional can be helpful in ensuring that the affidavit is completed correctly and in accordance with Texas law. This can be particularly important if the estate's affairs are complex.

Where do I file the Texas Affidavit of Death?

The completed affidavit should be filed with the county clerk’s office in the county where the property of the deceased is located. This action legally updates the property records to reflect the death.

Is there a filing fee for the Texas Affidavit of Death form?

Yes, there is typically a filing fee required when submitting the affidavit to the county clerk’s office. The amount can vary by county, so it's advisable to check with the specific office where you plan to file the document.

How long does it take for the Affidavit of Death to be processed in Texas?

The processing time can vary by county and depending on the specific circumstances. However, once filed, the document becomes a part of public record relatively quickly. It's best to contact the county clerk's office for an estimated timeframe.

Can the Texas Affidavit of Death form be used to transfer vehicle titles?

Yes, in some cases, it can be used to assist in transferring the title of a deceased person’s vehicle to their heirs or beneficiaries. However, additional documents might be required by the Texas Department of Motor Vehicles.

What happens if the Affidavit of Death is filled out incorrectly?

If errors are found in the affidavit, it might not be accepted for filing or could be challenged later, potentially complicating the estate process. If inaccuracies are identified after filing, it may be necessary to submit a corrected affidavit. For these reasons, accuracy and completeness are crucial.

Common mistakes

Filling out the Texas Affidavit of Death form is an important step in managing estate affairs after a loved one has passed away. Unfortunately, this task often comes during a time of grief, leading to mistakes that can complicate property matters. One common error is not properly verifying the deceased person's full legal name. This might seem like a minor oversight, but it can create discrepancies with official records, leading to delays in the process.

Another mistake involves the property description. A detailed and accurate description of the property is crucial. Some people provide insufficient details or, even worse, incorrect information about the property in question. This can lead to significant legal challenges, especially if the estate includes multiple assets or properties spread across different locations.

A pivotal area where errors occur is in the signatures section. The form requires the signature of the person filling it out, yet it's surprisingly common for individuals to forget this step. Additionally, these signatures often need to be notarized, a requirement that some may overlook or misunderstand. Without proper notarization, the affidavit might not be recognized as valid by certain institutions or in court.

The inclusion of the decedent's death certificate is another critical component that sometimes gets mishandled. People either forget to attach it or provide a copy that is not certified. Certified copies of the death certificate are usually required to establish the death legally, and not providing one can halt the entire process.

Incorrect details about the heirs or beneficiaries are also a frequent mistake. It's essential to accurately list everyone entitled to inherit from the decedent, including their full legal names and their relationship to the deceased. Misnaming or omitting an heir can lead to disputes among potential beneficiaries and might require legal intervention to resolve.

Many also fail to provide the necessary documentation that proves their right to file the affidavit. Depending on the case, various documents, such as a will or a trust, may need to be attached. Without these, proving authority to act on behalf of the deceased's estate can be difficult.

Confusion about filing the affidavit with the correct county office leads to another common mistake. The affidavit needs to be filed in the county where the property is located, not necessarily where the person lived or died. Filing in the wrong county office can delay the transfer of property ownership.

A significant error that can cause unnecessary complications is not consulting with a legal professional. While the Texas Affidavit of Death form may seem straightforward, estate laws are complex and vary widely. Professional advice can help avoid mistakes and ensure that the process goes smoothly.

Underestimating the importance of the affidavit's timing is another oversight. There are certain periods within which actions must be taken after a person's death, and missing these deadlines can affect the estate's legal proceedings. Knowing and adhering to these time frames is crucial.

Last but not least, many overlook the step of verifying that all information provided in the affidavit is correct and consistent with other documents. This includes double-checking the deceased's personal information, property details, and the list of heirs or beneficiaries. Inconsistencies can raise questions and lead to delays or legal challenges.

By avoiding these common pitfalls, individuals can ensure a smoother process in transferring property ownership after the death of a loved one.

Documents used along the form

When dealing with the loss of a loved one in Texas, handling their estate can often involve more than just an Affidavit of Death. This document is crucial as it serves to legally declare someone's death, typically for the purpose of transferring assets. However, navigating the administrative aftermath requires several other forms and documents, each serving its own unique role in the process. Below is a rundown of these documents and a brief description of what they are used for.

- Will: This is a legal document that outlines how the deceased person (the decedent) wishes their property and other assets to be distributed after their death. It may also specify guardianship preferences for any minor children.

- Death Certificate: Issued by a government official such as a registrar of vital statistics, this official document serves as proof of death. It is essential for various purposes, including arranging for a burial or cremation, settling estates, and claiming insurance benefits or social security.

- Certificate of Appointment of Executor or Administrator: This document is issued by the probate court and grants authority to the person named as executor (if there's a will) or administrator (if there's no will) to act on behalf of the deceased's estate.

- Notice to Creditors: This notice is published in local newspapers and is used to inform creditors of the decedent's death. It gives them a platform to come forward with any claims against the estate within a specified period.

- Inventory and Appraisement of Estate: An inventory and appraisal document lists all of the assets in the estate and their estimated value at the time of the decedent's death. It is often required by the probate court to ensure proper distribution of the estate according to the will or state law.

- Transfer on Death Deed: This form allows a property owner to name a beneficiary who will receive the property at the owner's death, without going through probate. It's a useful instrument for simplifying the transfer of real estate.

- Trust Documents: If the decedent had established a trust, these documents would be necessary to manage and distribute the trust's assets according to the terms set by the decedent.

In summary, while the Affidavit of Death is a pivotal step in the process, it is just one part of a broader suite of forms and documents needed to effectively manage and settle an estate in Texas. Understanding the purpose and requirement of each can provide clarity and streamline what is often an emotionally taxing time. Handling these documents properly ensures that the decedent's wishes are respected and that legal requirements are met, facilitating a smoother transition for all involved.

Similar forms

The Texas Affidavit of Death form shares similarities with the Transfer on Death Deed (TODD). Both documents are pivotal in the context of estate planning and are used to manage the transfer of assets upon someone's death. The Affidavit of Death helps in validating the death of an individual for the legal process, whereas the TODD allows a property owner to name someone to inherit their property upon their death, bypassing the probate process. Each serves to streamline different parts of the asset transfer process efficiently, aiming to lessen the administrative burden on the deceased's estate.

Similar to the Affidavit of Death, a Last Will and Testament is a foundational document in estate planning. It specifies an individual's wishes regarding the distribution of their assets and the care of any dependents after death. While the Affidavit of Death certifies the death of an individual, the will outlines how the deceased's assets should be handled. Both documents are crucial post-death, with the affidavit often being a procedural step required to execute the instructions laid out in a will.

The Death Certificate is another document closely connected to the Affidavit of Death. Both serve as official confirmations of death, but they are issued by different authorities and serve distinct purposes. The death certificate is a formal record issued by a government body that officially declares a person's death, including the cause, date, and place. Meanwhile, the Affidavit of Death, usually signed by a close relative or witness, is used to inform courts or financial institutions of the individual’s passing. Each plays a vital role in the legal processes that follow a death, such as settling estates and accessing benefits.

Joint Tenancy with Right of Survivorship (JTWROS) Agreement documents are somewhat akin to the concepts within an Affidavit of Death. JTWROS pertains to the co-ownership of property, where upon the death of one owner, their interest in the property automatically transfers to the surviving owner(s), outside of the probate process. While this agreement designates the flow of property ownership, the Affidavit of Death is commonly needed to prove the death of a joint tenant so that the property's title can be cleared and transferred appropriately.

The Durable Power of Attorney for Healthcare is a document that appoints someone to make medical decisions on one’s behalf if they are incapacitated. It is slightly akin to the Affidavit of Death in that both deal with preparations for death or incapacity. However, while the Affidavit of Death is used after someone's death to help settle their affairs, the durable power of attorney is used before death to ensure their wishes regarding healthcare are respected.

The Beneficiary Designation forms, used for life insurance policies or retirement accounts, are also similar to the Affidavit of Death in their purposes of asset transfer upon death. Both documents help facilitate the process of transferring assets to the designated individuals without the need for probate. While beneficiary designations directly inform financial institutions whom to pay, the Affidavit of Death is necessary to confirm the death officially before the asset transfer can occur.

Lastly, the Living Trust document bears resemblance to the Affidavit of Death through its role in estate planning and the avoidance of probate. A living trust allows an individual to transfer assets into a trust during their lifetime, with instructions for distribution upon their death. The Affidavit of Death may be required to demonstrate the trustor's death before assets can be distributed to the beneficiaries. Both documents work together to ensure a smoother transition of assets, avoiding the probate process and minimizing administrative difficulties.

Dos and Don'ts

When handling the Texas Affidavit of Death form, it's important to proceed with care. This document plays a crucial role in legal matters following a person's death. Below are key dos and don'ts to guide you through the process accurately.

What you should do:

- Verify the form’s applicability: Ensure that the Texas Affidavit of Death form is the correct document required for your specific situation.

- Provide accurate information: Double-check all the details you provide, such as the deceased's full name, date of death, and any property descriptions, for accuracy.

- Include legal descriptions: If the affidavit pertains to property, ensure the legal description of the property is complete and accurate.

- Sign in front of a notary: The affidavit must be signed in the presence of a notary public to be legally valid.

What you shouldn’t do:

- Leave sections incomplete: Do not skip any sections. Incomplete forms may be returned or cause delays.

- Guess information: Avoid filling in details based on guesses or assumptions. If you’re unsure about specific information, seek clarification or verification before proceeding.

- Use informal language: Keep the language formal and professional. Refrain from using colloquial expressions or slang.

- Forget to keep a copy: Always keep a copy of the submitted affidavit for your records. It’s important to have your own copy for future reference or in case any issues arise.

Misconceptions

Understanding the Texas Affidavit of Death form is crucial for those dealing with the estate of a deceased individual. However, several misconceptions often cloud its purpose and use. By clarifying these misconceptions, individuals can navigate their responsibilities with greater confidence and ensure that the estate is managed according to Texas law.

Misconception 1: The Affidavit of Death transfers property automatically. A common misunderstanding is that filling out and filing the Texas Affidavit of Death form with the appropriate county recorder's office immediately transfers property ownership from the deceased to their heirs or designated beneficiaries. In reality, this document serves as a legal statement verifying the death, which is necessary for the transfer process but does not itself effect the transfer of property. Further legal steps are required to officially transfer ownership.

Misconception 2: The Affidavit of Death is only for real estate matters. While it's often used in the context of transferring real estate, the scope of the Affidavit of Death is broader. It can also be used to facilitate the transfer of other types of assets or to help resolve issues related to the deceased's estate, such as claims against the estate or the release of certain assets to the rightful heirs.

Misconception 3: Any family member can prepare and file the Affidavit of Death. Although it might seem like a task any family member could complete, the preparation and filing of the Affidavit of Death require knowledge of specific legal details, including the accurate description of the property and the relationship of the heir(s) to the deceased. Typically, the executor of the estate or a person legally authorized to act on behalf of the deceased's estate is the most appropriate individual to handle this document.

Misconception 4: Once filed, the Affidavit of Death is the only document needed to prove ownership. Filing the Affidavit of Death is an important step in recognizing a person's death within the legal and estate process, but it is not the final step in proving ownership of the deceased's assets. Additional documents, such as a will, court orders, or specific transfer forms, might be required to establish legal ownership and complete the process of transferring assets to the heirs or beneficiaries.

Understanding these misconceptions can help individuals dealing with a Texas Affidavit of Death form execute their duties more effectively, ensuring that the deceased's estate is handled respectfully and according to legal standards. It's always advisable to consult with a legal professional experienced in estate matters to navigate the complexities of estate management and asset transfer.

Key takeaways

The Texas Affidavit of Death form is a crucial document used in the legal process to officially establish someone's death, often in matters relating to the transfer of property or inheritance. Understanding how to properly fill out and use this form can ensure that the process proceeds smoothly and without unnecessary delay. Here are key takeaways for anyone needing to utilize the Texas Affidavit of Death form:

- Accuracy is Key: Ensure all the information provided on the form is accurate. This includes the decedent's full name, date of death, and details about the property in question. Mistakes can lead to delays or issues in the property transfer process.

- Documentation is Required: Accompany the affidavit with a certified copy of the death certificate. This serves as the official proof of death and is needed to process the affidavit.

- Notarization is a Must: The form must be notarized to be legally valid. A notary public will verify the identity of the signer and ensure the document is signed freely and willingly.

- Know When to Use It: This form is often used when someone dies without a will (intestate) or when the estate does not go through probate. Its primary use is to facilitate the transfer of property to heirs or rightful beneficiaries.

- Public Filing: After notarization, the affidavit needs to be filed with the appropriate county clerk’s office. This makes the document a part of public record and officially notifies the local government of the death in relation to the property.

- Consult with Legal Professionals: While the form might seem straightforward, consulting with a lawyer or legal advisor can help navigate any potential complexities, especially if the estate or property matters are complex.

- Impact on Successors: Successfully filing this form can help clarify the legal standing of property and assists in the smooth transition of assets to successors, potentially avoiding disputes among heirs or between beneficiaries.

Handling the affairs of someone who has passed away can be a challenging process, but understanding and correctly utilizing the Texas Affidavit of Death form can aid in simplifying the legal steps involved. Being prepared and thorough in this task can help ensure that the decedent's property and assets are dealt with according to the law and their wishes.

Popular Affidavit of Death State Forms

Joint Tenancy in California - Completing an Affidavit of Death helps avoid legal complications by providing clear documentation of the individual's death.