Free Affidavit of Correction Form for Texas

In the vast landscape of legal documentation, the Texas Affidavit of Correction stands out as a pivotal instrument for rectifying errors that inevitably crop up in public records or on other official documents. This document serves a critical function by providing individuals with a straightforward means to amend inaccuracies, ensuring that essential records accurately reflect the correct information. Typically utilized in scenarios involving vehicle titles, real estate deeds, and vital records, among others, the form requires the affiant to clearly state the specific error, provide the corrected information, and substantiate the correction with verifiable facts. The process mandates a notarization to confirm the affiant's identity and to legitimize the affidavit, thereby safeguarding against fraudulent claims and preserving the integrity of the public record. As such, the Texas Affidavit of Correction is an indispensable tool in the maintenance of accurate legal documentation, functioning to prevent potential complications arising from misinformation in official documents.

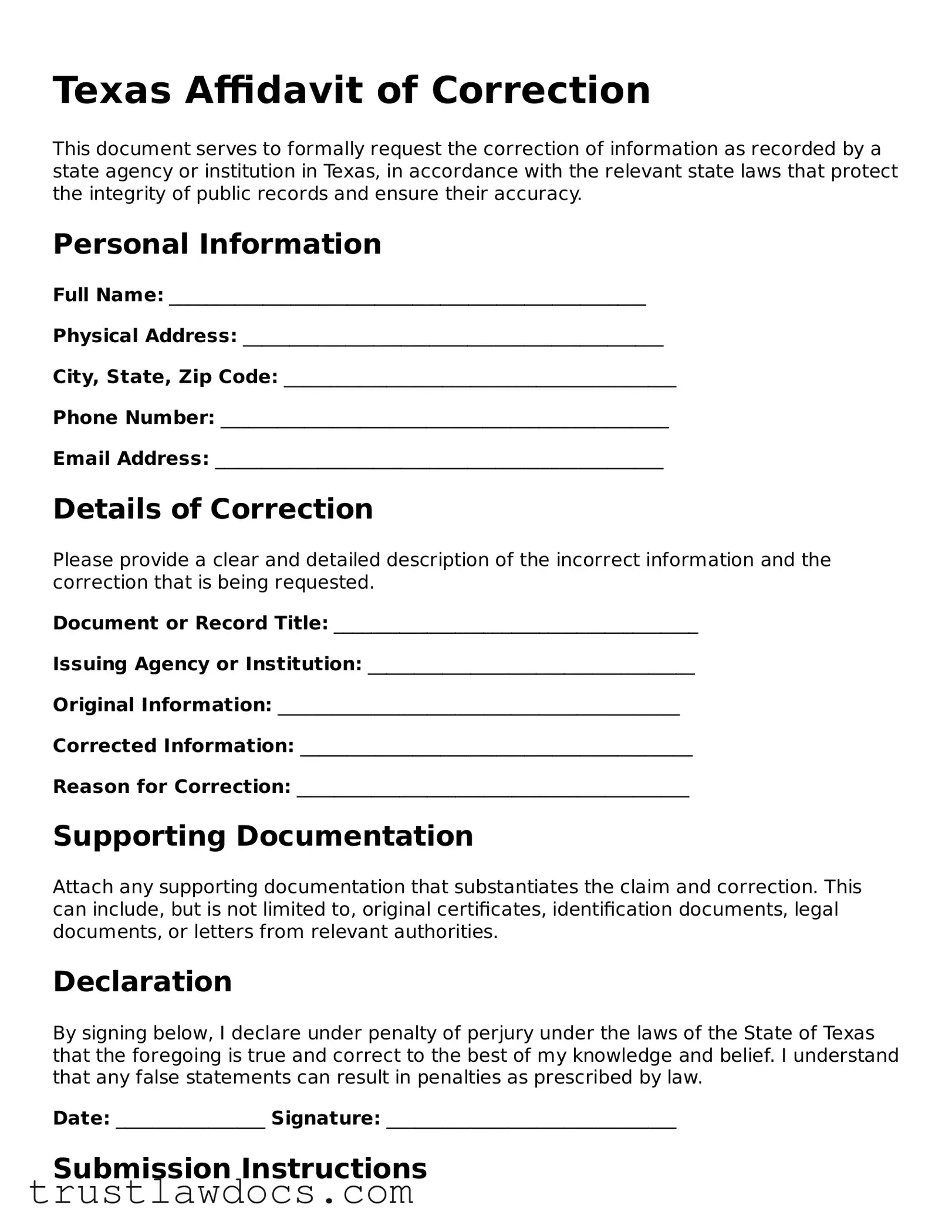

Form Example

Texas Affidavit of Correction

This document serves to formally request the correction of information as recorded by a state agency or institution in Texas, in accordance with the relevant state laws that protect the integrity of public records and ensure their accuracy.

Personal Information

Full Name: ___________________________________________________

Physical Address: _____________________________________________

City, State, Zip Code: __________________________________________

Phone Number: ________________________________________________

Email Address: ________________________________________________

Details of Correction

Please provide a clear and detailed description of the incorrect information and the correction that is being requested.

Document or Record Title: _______________________________________

Issuing Agency or Institution: ___________________________________

Original Information: ___________________________________________

Corrected Information: __________________________________________

Reason for Correction: __________________________________________

Supporting Documentation

Attach any supporting documentation that substantiates the claim and correction. This can include, but is not limited to, original certificates, identification documents, legal documents, or letters from relevant authorities.

Declaration

By signing below, I declare under penalty of perjury under the laws of the State of Texas that the foregoing is true and correct to the best of my knowledge and belief. I understand that any false statements can result in penalties as prescribed by law.

Date: ________________ Signature: _______________________________

Submission Instructions

To submit this affidavit, please send the completed form along with any supporting documentation to the appropriate state agency or institution at the address provided by them. It is recommended to keep a copy of the entire submission for your records.

Contact Information

For questions or additional information, please contact the issuing agency or institution directly. Their contact information can be typically found on the document in question or through a simple web search.

PDF Form Details

| Fact | Description |

|---|---|

| Purpose | Used to correct information on a previously filed document or record with Texas state agencies or departments. |

| Applicable Documents | Typically associated with vehicle titles, birth certificates, and other state records. |

| Governing Law(s) | Guided by the Texas Administrative Code and specific statutes related to the document needing correction. |

| Who May File | Individuals or entities who originally filed the document or have legal authority to request a correction. |

| Required Information | Varies by document but generally includes the incorrect information, the correct information, and justification for the change. |

| Filing Process | Completed forms must be submitted to the issuing or overseeing state department or agency. |

| Processing Time | Depends on the department and the complexity of the correction but can range from a few days to several weeks. |

How to Write Texas Affidavit of Correction

After completing the Texas Affidavit of Correction form, it will be used to correct information on important documents related to vehicle registration, titles, or other official records. The form ensures that errors are officially recognized and corrected in the respective records. This could involve correcting a name, vehicle identification number, or other key details. Accuracy is crucial in filling out this form to avoid further complications. The following steps will guide you through the process of completing the form correctly.

- Begin by reading the form thoroughly to understand what information is required and how it should be provided.

- Enter your full legal name as the affiant, ensuring it matches the name on your identification documents.

- Provide your full address, including the city, state, and zip code, to ensure any correspondence related to this affidavit can be directed to you.

- Identify the document or record needing correction, such as a vehicle title or registration form. Specify the document number if available.

- Clearly state the incorrect information as it currently appears on the document.

- Specify the correct information that should replace the incorrect entry. Provide documentation to support the correction if required.

- Include the date the original document was issued or filed, to help locate the record needing correction.

- Read the statement regarding perjury and the accuracy of the information provided in the affidavit. This section emphasizes the legal implications of submitting false or misleading information.

- Sign the affidavit in the presence of a notary public. This step formalizes your request and verifies your identity.

- Have the notary public complete their section, including their signature, commission expiration date, and seal. This step is essential for the document to be legally recognized.

- Review the completed affidavit for any errors or omissions before submitting it to the appropriate department or agency for processing.

Once the form is properly filled out and submitted, the relevant department will review the information and make the necessary corrections to the official records. It is crucial to follow up if a confirmation of the correction is not received within a reasonable timeframe. This ensures that the error has been rectified and that all records are now accurate.

Get Answers on Texas Affidavit of Correction

What is the Texas Affidavit of Correction form used for?

The Texas Affidavit of Correction form is typically used to correct errors or inaccuracies on official documents related to vehicle titles, real estate deeds, and other public records. By completing this form, an individual is able to legally declare the correct information and ensure that public records are accurate, which is crucial for transactions or legal matters involving those documents.

Who can file a Texas Affidavit of Correction?

Generally, the person who originally provided the incorrect information on the official document is the one responsible for filing the Texas Affidavit of Correction. This ensures that the correction comes from a credible source, directly associated with the original error. In some cases, a legal representative or agent acting on behalf of that person may also be authorized to file the affidavit, provided they have legitimate authority to do so.

What information is required to complete the form?

To complete the form, specific information is necessary: the document's identification number or reference (such as a title number for vehicle documents or a deed volume and page number for real estate documents), the incorrect information as it currently appears, and the corrected information as it should legally be. The form must also include the filer's full legal name, contact information, and signature, often notarized to validate the correction legally.

Is there a fee to file the form?

Whether there is a fee to file the Texas Affidavit of Correction can vary depending on the agency or department where the affidavit is being submitted. Some agencies may require a nominal processing fee, while others might process the affidavit without charge. It's essential to check with the specific agency handling your document type for accurate fee information.

How long does it take for the correction to be reflected in official records?

The timeframe for a correction to be updated in official records can vary significantly depending on the department or agency's workload, the type of document being corrected, and the specific correction's complexity. It is advisable to inquire directly with the agency processing the affidavit for an estimated timeline, but it's reasonable to expect a wait of several weeks in many cases.

Common mistakes

Filling out the Texas Affidavit of Correction form is a task that often seems straightforward but can lead to significant headaches if not done correctly. One common mistake is neglecting to provide specific details about the error being corrected. The form is designed to rectify mistakes on legal documents related to vehicle titles or registration, but without clear, precise details of what the error is and what the correct information should be, processing the affidavit can become a complex and drawn-out process.

Another frequent oversight is failing to include supporting documentation. The Texas Department of Motor Vehicles (TxDMV) requires evidence to validate the correction being claimed. For instance, if a typographical error is made in the vehicle identification number (VIN), the correct VIN must be substantiated with official documents. Without these, the affidavit may be deemed incomplete and returned to the sender, delaying the correction.

Incorrectly signing or notarizing the document is also a prevalent error. For the affidavit to be legally binding, it must be signed in the presence of a notary. However, individuals often sign the document before showing up to the notary, rendering the affidavit invalid. The signature must be witnessed by the notary to satisfy legal requirements.

Forgetting to check or update related documents is another mistake that can complicate matters further. Once a correction is made, it’s crucial to ensure that all related documents reflect the change. This might include updating insurance policies, loan documents, or any other records that were affected by the original error. Failure to do this can lead to confusion and legal inconsistencies down the line.

Last but not least, leaving sections of the form blank because they seem irrelevant can also create problems. Every field in the Affidavit of Correction form serves a purpose, and if the information is not applicable, entering "N/A" is advisable rather than leaving it empty. An incomplete form might be misinterpreted as an oversight or misunderstanding of the requirements, potentially leading to the rejection of the affidavit.

Documents used along the form

When dealing with the correction of documents related to vehicle transactions, property deeds, or vital records in Texas, the Affidavit of Correction form is an essential tool to rectify inaccuracies. To ensure the process is complete and compliant with state requirements, various other forms may be required alongside the Affidavit of Correction. Each serves its unique purpose, contributing to the thoroughness and legality of the documentation process.

- Application for Texas Title and/or Registration (Form 130-U): This is often required for vehicle transactions to apply for a new title or registration when corrections have been made to a vehicle’s information.

- Bill of Sale: Provides proof of purchase and details of the transaction between buyer and seller, often needed when correcting information related to a sale.

- Release of Lien: Necessary if the correction involves removing or updating lienholder information on a vehicle or property title.

- Odometer Disclosure Statement (Form VTR-40): Used to correct or verify mileage information for vehicles, ensuring accurate readings are reported to the Department of Motor Vehicles.

- Power of Attorney (Form VTR-271): Allows another person to handle certain transactions or corrections on behalf of the owner, useful in situations where the owner cannot be present.

- Residential Deed of Trust: Relevant in real estate transactions, this document may need updates or corrections to reflect accurate property information or ownership details.

- Warranty Deed: Used to guarantee that the property title is clear and to correct any errors in ownership or property descriptions previously reported.

- Quitclaim Deed: Often used alongside corrections to clear up any discrepancies in property ownership or to correct errors in the property title.

- Death Certificate Application (for Vital Records Correction): Necessary when correcting vital records, such as birth or death certificates, to ensure the accurate recording of personal information.

These documents are often used in conjunction with the Affidavit of Correction to provide a complete and lawful solution to correcting recorded information. It’s imperative to use the correct forms and follow Texas state guidelines closely to ensure that amendments are properly documented and legally recognized. This comprehensive approach helps maintain the integrity and accuracy of important records.

Similar forms

The Texas Affidavit of Correction form shares similarities with the Amendment to Certificate of Title. Both documents serve the purpose of correcting or updating information previously filed. For instance, if there's an error in the vehicle's title, such as a misspelled name or incorrect vehicle identification number, an Amendment to Certificate of Title would be used, similar to how an Affidavit of Correction amends information on official documents.

Comparable to an Affidavit of Correction is a Deed Correction Agreement. This document is specifically used in real estate to correct errors in previously recorded deeds, such as misspellings, incorrect property descriptions, or wrong legal names. It ensures that property records accurately reflect the true intentions of the parties involved, much like how the Affidavit of Correction rectifies inaccuracies in official records.

The Error Correction Affidavit is another document closely related to the Affidavit of Correction. Its primary use is for rectifying clerical or typographical errors in recorded documents. While an Error Correction Affidavit focuses mainly on mistakes rather than substantive changes, it, similar to an Affidavit of Correction, plays a crucial role in ensuring that official records are accurate and reflective of the true information.

Like the Affidavit of Correction, the Affidavit of Heirship is used to correct public records, particularly regarding the ownership and transfer of property following an individual's death. However, the Affidavit of Heirship specifically addresses the correction or clarification of heirs' identities and their rightful claim to an estate, ensuring that property is transferred according to the decedent's wishes or applicable laws.

The DMV Title Correction Form, much like the Affidavit of Correction, is employed to rectify errors on vehicle titles issued by the Department of Motor Vehicles. This might involve correcting the owner's name, address, or the vehicle's details. Both documents ensure that official registries maintain accurate and up-to-date information critical for legal ownership and accountability.

An Affidavit of Name Change is akin to the Affidavit of Correction in that it is used to officially update one's name across various records due to marriage, divorce, or any other reason. It serves to legal-proof one's identity and the change thereof, necessary for updating government records, bank accounts, and more, ensuring all personal records are consistent.

Last but not least, the Correction Statement is a document used in a business context to amend or correct previously submitted information. Whether it's for correcting company names, addresses, or financial information, its function mirrors that of the Affidavit of Correction by validating and rectifying errors to uphold the integrity of official records, similar to how corrective affidavits ensure accuracy and legality in personal and public documents.

Dos and Don'ts

When filling out the Texas Affidavit of Correction form, it's essential to ensure accuracy and completeness to avoid delays or rejection. Below are guidelines on what to do and what to avoid for a smooth process.

Do:

- Review the entire form before starting to ensure you understand all the requirements.

- Use black ink for clarity and legibility when completing the form.

- Provide detailed explanations for any corrections, making sure they're clear and concise.

- Verify all information for accuracy before submission, including checking all dates and spellings.

Don't:

- Use correction fluid or tape; if you make a mistake, start with a fresh form.

- Submit the form without the necessary signatures, as they are required for validation.

- Overlook the requirement to attach supporting documentation for certain corrections.

- Rush through filling out the form, as errors can lead to processing delays.

Misconceptions

Many misconceptions surround the Texas Affidavit of Correction form. These misunderstandings can lead to confusion about its purpose, how it operates, and who can use it. Here, we'll clarify some of the common misconceptions to ensure you have the correct information.

It can correct any mistake on any document. A widespread misconception is that the Texas Affidavit of Correction form can be used to correct any mistake on any document. However, this form is primarily intended for correcting minor errors on specific public records or documents related to property, vehicle registration, or titles. It cannot be used to amend personal documents or legal contracts not related to these areas.

It's an immediate, all-in-one solution. Some people think that once you fill out and submit this form, the error is corrected immediately across all records. The truth is, after submission, the relevant Texas agency reviews the affidavit. The correction process may take some time and might require additional verification or documentation.

Anyone can file it on behalf of someone else. There is a belief that anyone can file an Affidavit of Correction for someone else. In reality, the person who has a direct interest in the correction of the record—typically the owner or holder of the document—must sign the affidavit. In some cases, a legal guardian, executor, or authorized agent may file, but they must provide proof of their authority to act on behalf of the primary individual.

No need for any supporting documents. Another common belief is that filling out the form is enough and no supporting documentation is necessary. However, to process the correction, the Texas Department of Motor Vehicles or the relevant agency often requires additional documentation supporting the claim made in the affidavit. This might include original documents that contain the error, identification to verify the person requesting the change, or other legal documents supporting the correction request.

Understanding the actual uses and limitations of the Texas Affidavit of Correction can steer you in the right direction and help avoid frustration. Always ensure you have the correct form for your specific needs and comply with all requirements to facilitate a smooth correction process.

Key takeaways

When you need to correct a mistake on an official document in Texas, using an Affidavit of Correction is a straightforward way to make things right. Whether it's a title, deed, or any other legal paperwork, understanding the correct way to fill out and utilize this form is crucial. Here are nine key takeaways to bear in mind:

- Ensure Accuracy: Before you submit an Affidavit of Correction, double-check the information you plan to correct. The purpose of this document is to rectify errors, so ensuring the corrected information is accurate is paramount.

- Complete All Required Sections: Fill out every required field on the form. Leaving sections incomplete can result in the rejection of your affidavit, delaying the correction process.

- Specify the Error Clearly: When describing the mistake, be as clear and specific as possible. Indicate where the error occurred and what the correct information should be.

- Provide Proof: If possible, attach evidence supporting the correction. This proof can be in the form of documents that verify the correct information.

- Sign in the Presence of a Notary Public: Your signature on the affidavit must be witnessed by a notary public. This step validates the document and your identity.

- File Promptly: Once the affidavit is correctly completed and notarized, file it with the appropriate Texas agency or office as soon as possible. Delays can complicate matters further.

- Keep a Copy for Your Records: Always retain a copy of the filed affidavit and any correspondences related to the correction. Keeping a record can be helpful if there are any disputes or misunderstandings in the future.

- Understand the Limitations: An Affidavit of Correction may not be suitable for all types of errors or documents. Understand the limitations of this form and seek legal advice if uncertain whether it's the appropriate method for your situation.

- Follow Up: After filing, follow up with the office or agency to ensure the correction has been made. Sometimes, documents can get misplaced, or additional information may be required.

Using an Affidavit of Correction in Texas is a responsible step towards maintaining the integrity of your legal documents. By paying close attention to details and following the correct procedures, you can ensure that necessary corrections are made efficiently and accurately.

Popular Affidavit of Correction State Forms

General Affidavit Form Florida - The form is often required by governmental agencies or institutions to acknowledge and record the correction of a document.

Indiana Title Correction Form - It’s beneficial in estate planning and probate to correct misstated information in wills or trusts.